Professional Documents

Culture Documents

Ashwani Kumar

Ashwani Kumar

Uploaded by

TarunCopyright:

Available Formats

You might also like

- 80D CertificateDocument2 pages80D CertificateYogy YNo ratings yet

- LTA Bill Template 1 PDFDocument1 pageLTA Bill Template 1 PDF9816494828No ratings yet

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- In - Gov.transport RVCER TN01BK9115Document1 pageIn - Gov.transport RVCER TN01BK9115Dr. Ezaykiyel PTNo ratings yet

- Religare PDFDocument5 pagesReligare PDFsomnathNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Health Policy SiddharthDocument9 pagesHealth Policy SiddharthSiddharth DasNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Parents Insurance TaxDocument1 pageParents Insurance Taxdev77729100% (1)

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- PolicyDocument55 pagesPolicyBaneNo ratings yet

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- LIC Premium Paid Statement Swapnil Nage 1Document1 pageLIC Premium Paid Statement Swapnil Nage 1Swapnil NageNo ratings yet

- Mr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Document7 pagesMr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Bhanu Pratap Simgh YadavNo ratings yet

- FeeReceipt Sep2019Document1 pageFeeReceipt Sep2019KavitaNo ratings yet

- Reliance Individual Mediclaim Policy ScheduleDocument1 pageReliance Individual Mediclaim Policy ScheduleParthiban K100% (1)

- 30515407628522max Bupa Premium Reeipt Parents PDFDocument1 page30515407628522max Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- Gym FeesDocument1 pageGym FeesMrityunjay AryanNo ratings yet

- Invoice 408 4521932 Balaji Book House Madhu Kumar KetteDocument2 pagesInvoice 408 4521932 Balaji Book House Madhu Kumar Kettemr pirateNo ratings yet

- Policy ParentsDocument6 pagesPolicy Parentsaniket goyalNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument4 pagesHDFC ERGO General Insurance Company LimitedTESTERPERSONNo ratings yet

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!ankit vermaNo ratings yet

- FDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115Document4 pagesFDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115arjunNo ratings yet

- Your Vi Bill: Mr. Rubal SrivastavDocument4 pagesYour Vi Bill: Mr. Rubal SrivastavRubal SrivastavaNo ratings yet

- BA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanDocument2 pagesBA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanSudesh ChauhanNo ratings yet

- Veeravenkata Mallikarjuna Rao KarriDocument1 pageVeeravenkata Mallikarjuna Rao KarriArjunNo ratings yet

- Health InsuranceDocument1 pageHealth InsuranceGaurav SaxenaNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementArpit SinghalNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailschanam bedantaNo ratings yet

- Gym Bill JuneDocument1 pageGym Bill Junemaheshwari.neeraj1No ratings yet

- Pooja Policy Self 80 DDocument2 pagesPooja Policy Self 80 Dcagopalofficebackup100% (1)

- Vivek LicDocument1 pageVivek Licranjeet kumarNo ratings yet

- AugDocument1 pageAugsrikanth0483287No ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Policy Doc PDFDocument4 pagesPolicy Doc PDFGajen SinghNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Bording PassDocument3 pagesBording PassSunder NingombamNo ratings yet

- LIC Aug 2020 PDFDocument1 pageLIC Aug 2020 PDFShantanu MetayNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Product Name: Max Bupa Health Recharge, Product UIN: MAXHLIP18129V011718Document51 pagesProduct Name: Max Bupa Health Recharge, Product UIN: MAXHLIP18129V011718906rahulNo ratings yet

- FPPack PDFDocument34 pagesFPPack PDFmeet1996No ratings yet

- Premium Paid Certificate: Date: 14-DEC-2017Document1 pagePremium Paid Certificate: Date: 14-DEC-2017zuhebNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood AhmadNo ratings yet

- Sunil Jain ResumeDocument4 pagesSunil Jain Resumesunilmalpura5768100% (5)

- Paymentof STTTDocument1 pagePaymentof STTTMustafaüç PolatNo ratings yet

- COC LEVEL-3 PracticalDocument81 pagesCOC LEVEL-3 PracticalMohammed AbduramanNo ratings yet

- HL Basic Savings A - C 042022Document2 pagesHL Basic Savings A - C 042022Taufiq AriffinNo ratings yet

- Professional Biography TemplateDocument2 pagesProfessional Biography TemplateRocelle MarbellaNo ratings yet

- Internship Report On MCBDocument37 pagesInternship Report On MCBbbaahmad89No ratings yet

- A Study On Financial Derivatives With Reference To Tata Motors Limited, Chittoor District of Ap, IndiaDocument5 pagesA Study On Financial Derivatives With Reference To Tata Motors Limited, Chittoor District of Ap, IndiaAbdullah HashimNo ratings yet

- Islamic Capital-Evren HosgorDocument19 pagesIslamic Capital-Evren HosgorDerya GültekinNo ratings yet

- Karnataka Bank AR 2020-21 10.08.2021Document255 pagesKarnataka Bank AR 2020-21 10.08.2021Karthik KarthikNo ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountArnav JoshiNo ratings yet

- New Central Bank Act ReviewerDocument10 pagesNew Central Bank Act ReviewernoorlawNo ratings yet

- Activity 4 Bank Reconciliation PDFDocument4 pagesActivity 4 Bank Reconciliation PDFSharmin ReulaNo ratings yet

- Alpha Beta Risk and Stock Returns-A DecompositionDocument11 pagesAlpha Beta Risk and Stock Returns-A Decompositionzan BobNo ratings yet

- PI 19190 M - Updated USD (25kg)Document1 pagePI 19190 M - Updated USD (25kg)Mukhammadnur XusniddinovichNo ratings yet

- R12 CE How To Reconcile Multiple Statement Lines To One Receipt or Payment or Journal Lines and Related QA (Doc ID 420940.1)Document2 pagesR12 CE How To Reconcile Multiple Statement Lines To One Receipt or Payment or Journal Lines and Related QA (Doc ID 420940.1)anind_1980No ratings yet

- Click To Edit Master Title Style: Receivables 9Document26 pagesClick To Edit Master Title Style: Receivables 9rina.asmara asmaraNo ratings yet

- InvoiceDocument1 pageInvoicetanya.prasadNo ratings yet

- Banking Awareness ImportantDocument30 pagesBanking Awareness ImportantThirrunavukkarasu R RNo ratings yet

- Estate Planning Basics732Document7 pagesEstate Planning Basics732anon_909251819No ratings yet

- BOBDocument39 pagesBOBpayal22octNo ratings yet

- Chapter 13 IAS 20 Govt GrantDocument11 pagesChapter 13 IAS 20 Govt GrantKelvin Chu JYNo ratings yet

- Access To Financial Services in Developing Countries: The Rabobank ViewDocument32 pagesAccess To Financial Services in Developing Countries: The Rabobank ViewAsniNo ratings yet

- Invoice Annexure 571171 04102022 1664883771056Document56 pagesInvoice Annexure 571171 04102022 1664883771056Roopa MNo ratings yet

- Boston BeerDocument23 pagesBoston BeerarnabpramanikNo ratings yet

- EXAMPLE - Worksheet: War On Debt™Document1 pageEXAMPLE - Worksheet: War On Debt™TriniMocha100% (1)

- Case1 SecC GroupJDocument7 pagesCase1 SecC GroupJNimish JoshiNo ratings yet

- Polands A2Document8 pagesPolands A2aanya17No ratings yet

- THE INDEPENDENT Issue 533 PDFDocument48 pagesTHE INDEPENDENT Issue 533 PDFThe Independent MagazineNo ratings yet

- PrefaceDocument98 pagesPrefaceviralNo ratings yet

- Non-Medical Chart For Lic AgentsDocument3 pagesNon-Medical Chart For Lic AgentsTarun GoyalNo ratings yet

Ashwani Kumar

Ashwani Kumar

Uploaded by

TarunOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ashwani Kumar

Ashwani Kumar

Uploaded by

TarunCopyright:

Available Formats

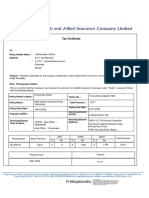

Premium Acknowledgement

Policy No. 13338343

Client ID 91371837

Policyholder Mr. Divyanshu Singla

Flat No. E-45,

Address Adarsh Nagar

Delhi - 110033

Policy Period 15-April-2022 to 14-April-2023

Premium Details

Particulars Amount (in Rs.) S.No. Receipt Number Amount Mode of Payment

1 32287758 30085 INTERNET PAYMENT GATEWAY (IPG)

Gross Premium

Care 25495.76

Goods & Services Tax (GST) 4589.23

Total 30,084.99

The Premium is rounded off to the nearest rupee.

Eligibility of Premium for Deduction u/s 80D of the Income Tax Act, 1961

The premium paid through any mode other than cash for this policy is eligible for Income tax benefits to the person making the payment subject to the

provisions of section 80D of the Income Tax Act, 1961 and amendments thereof. Effective from Assessment year 2023-24, in cases where health insur-

ance premium for multiple years is paid in one year, it will be eligible for proportionate deduction in the years in which the health insurance continues

to be effective.

For Care Health Insurance Limited

(Formerly known as Religare Health Insurance Company Limited)

Authorized Signatory Date of Issue: 15-April-2022 Place of Issue: Gurgaon, Haryana

IRDA Registration Number - 148

Registered office address: 5th Floor, 19 Chawla House, Nehru Place, New Delhi - 110019

CIN : U66000DL2007PLC161503

Note

1) In case of any discrepancy, the Policyholder is requested to contact the Company immediately.

2) Any amount paid in cash towards the premium would not qualify for tax benefits as mentioned above.

3) This document must be surrendered to the Company in case of Cancellation of the Policy or for the issuance of a fresh certificate in the case of any alteration in the Policy.

You might also like

- 80D CertificateDocument2 pages80D CertificateYogy YNo ratings yet

- LTA Bill Template 1 PDFDocument1 pageLTA Bill Template 1 PDF9816494828No ratings yet

- 80D.pdf-Piyush - Copy 3Document1 page80D.pdf-Piyush - Copy 3Saurabh RaghuvanshiNo ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- In - Gov.transport RVCER TN01BK9115Document1 pageIn - Gov.transport RVCER TN01BK9115Dr. Ezaykiyel PTNo ratings yet

- Religare PDFDocument5 pagesReligare PDFsomnathNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Health Policy SiddharthDocument9 pagesHealth Policy SiddharthSiddharth DasNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2952 2007 9281 0602 001Deena DayalanNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Parents Insurance TaxDocument1 pageParents Insurance Taxdev77729100% (1)

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- PolicyDocument55 pagesPolicyBaneNo ratings yet

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- LIC Premium Paid Statement Swapnil Nage 1Document1 pageLIC Premium Paid Statement Swapnil Nage 1Swapnil NageNo ratings yet

- Mr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Document7 pagesMr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Bhanu Pratap Simgh YadavNo ratings yet

- FeeReceipt Sep2019Document1 pageFeeReceipt Sep2019KavitaNo ratings yet

- Reliance Individual Mediclaim Policy ScheduleDocument1 pageReliance Individual Mediclaim Policy ScheduleParthiban K100% (1)

- 30515407628522max Bupa Premium Reeipt Parents PDFDocument1 page30515407628522max Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- Gym FeesDocument1 pageGym FeesMrityunjay AryanNo ratings yet

- Invoice 408 4521932 Balaji Book House Madhu Kumar KetteDocument2 pagesInvoice 408 4521932 Balaji Book House Madhu Kumar Kettemr pirateNo ratings yet

- Policy ParentsDocument6 pagesPolicy Parentsaniket goyalNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument4 pagesHDFC ERGO General Insurance Company LimitedTESTERPERSONNo ratings yet

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!ankit vermaNo ratings yet

- FDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115Document4 pagesFDGSDFGSDFGSDF: ICICI Lombard General Insurance Company Limited, IRDA Regn - No.115arjunNo ratings yet

- Your Vi Bill: Mr. Rubal SrivastavDocument4 pagesYour Vi Bill: Mr. Rubal SrivastavRubal SrivastavaNo ratings yet

- BA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanDocument2 pagesBA0000135190 Intermediary Code Name MR - Sandeep Chauhan: Family Health Optima Insurance PlanSudesh ChauhanNo ratings yet

- Veeravenkata Mallikarjuna Rao KarriDocument1 pageVeeravenkata Mallikarjuna Rao KarriArjunNo ratings yet

- Health InsuranceDocument1 pageHealth InsuranceGaurav SaxenaNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementArpit SinghalNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailschanam bedantaNo ratings yet

- Gym Bill JuneDocument1 pageGym Bill Junemaheshwari.neeraj1No ratings yet

- Pooja Policy Self 80 DDocument2 pagesPooja Policy Self 80 Dcagopalofficebackup100% (1)

- Vivek LicDocument1 pageVivek Licranjeet kumarNo ratings yet

- AugDocument1 pageAugsrikanth0483287No ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Policy Doc PDFDocument4 pagesPolicy Doc PDFGajen SinghNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Bording PassDocument3 pagesBording PassSunder NingombamNo ratings yet

- LIC Aug 2020 PDFDocument1 pageLIC Aug 2020 PDFShantanu MetayNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Product Name: Max Bupa Health Recharge, Product UIN: MAXHLIP18129V011718Document51 pagesProduct Name: Max Bupa Health Recharge, Product UIN: MAXHLIP18129V011718906rahulNo ratings yet

- FPPack PDFDocument34 pagesFPPack PDFmeet1996No ratings yet

- Premium Paid Certificate: Date: 14-DEC-2017Document1 pagePremium Paid Certificate: Date: 14-DEC-2017zuhebNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood AhmadNo ratings yet

- Sunil Jain ResumeDocument4 pagesSunil Jain Resumesunilmalpura5768100% (5)

- Paymentof STTTDocument1 pagePaymentof STTTMustafaüç PolatNo ratings yet

- COC LEVEL-3 PracticalDocument81 pagesCOC LEVEL-3 PracticalMohammed AbduramanNo ratings yet

- HL Basic Savings A - C 042022Document2 pagesHL Basic Savings A - C 042022Taufiq AriffinNo ratings yet

- Professional Biography TemplateDocument2 pagesProfessional Biography TemplateRocelle MarbellaNo ratings yet

- Internship Report On MCBDocument37 pagesInternship Report On MCBbbaahmad89No ratings yet

- A Study On Financial Derivatives With Reference To Tata Motors Limited, Chittoor District of Ap, IndiaDocument5 pagesA Study On Financial Derivatives With Reference To Tata Motors Limited, Chittoor District of Ap, IndiaAbdullah HashimNo ratings yet

- Islamic Capital-Evren HosgorDocument19 pagesIslamic Capital-Evren HosgorDerya GültekinNo ratings yet

- Karnataka Bank AR 2020-21 10.08.2021Document255 pagesKarnataka Bank AR 2020-21 10.08.2021Karthik KarthikNo ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountArnav JoshiNo ratings yet

- New Central Bank Act ReviewerDocument10 pagesNew Central Bank Act ReviewernoorlawNo ratings yet

- Activity 4 Bank Reconciliation PDFDocument4 pagesActivity 4 Bank Reconciliation PDFSharmin ReulaNo ratings yet

- Alpha Beta Risk and Stock Returns-A DecompositionDocument11 pagesAlpha Beta Risk and Stock Returns-A Decompositionzan BobNo ratings yet

- PI 19190 M - Updated USD (25kg)Document1 pagePI 19190 M - Updated USD (25kg)Mukhammadnur XusniddinovichNo ratings yet

- R12 CE How To Reconcile Multiple Statement Lines To One Receipt or Payment or Journal Lines and Related QA (Doc ID 420940.1)Document2 pagesR12 CE How To Reconcile Multiple Statement Lines To One Receipt or Payment or Journal Lines and Related QA (Doc ID 420940.1)anind_1980No ratings yet

- Click To Edit Master Title Style: Receivables 9Document26 pagesClick To Edit Master Title Style: Receivables 9rina.asmara asmaraNo ratings yet

- InvoiceDocument1 pageInvoicetanya.prasadNo ratings yet

- Banking Awareness ImportantDocument30 pagesBanking Awareness ImportantThirrunavukkarasu R RNo ratings yet

- Estate Planning Basics732Document7 pagesEstate Planning Basics732anon_909251819No ratings yet

- BOBDocument39 pagesBOBpayal22octNo ratings yet

- Chapter 13 IAS 20 Govt GrantDocument11 pagesChapter 13 IAS 20 Govt GrantKelvin Chu JYNo ratings yet

- Access To Financial Services in Developing Countries: The Rabobank ViewDocument32 pagesAccess To Financial Services in Developing Countries: The Rabobank ViewAsniNo ratings yet

- Invoice Annexure 571171 04102022 1664883771056Document56 pagesInvoice Annexure 571171 04102022 1664883771056Roopa MNo ratings yet

- Boston BeerDocument23 pagesBoston BeerarnabpramanikNo ratings yet

- EXAMPLE - Worksheet: War On Debt™Document1 pageEXAMPLE - Worksheet: War On Debt™TriniMocha100% (1)

- Case1 SecC GroupJDocument7 pagesCase1 SecC GroupJNimish JoshiNo ratings yet

- Polands A2Document8 pagesPolands A2aanya17No ratings yet

- THE INDEPENDENT Issue 533 PDFDocument48 pagesTHE INDEPENDENT Issue 533 PDFThe Independent MagazineNo ratings yet

- PrefaceDocument98 pagesPrefaceviralNo ratings yet

- Non-Medical Chart For Lic AgentsDocument3 pagesNon-Medical Chart For Lic AgentsTarun GoyalNo ratings yet