Professional Documents

Culture Documents

BUDGETING BASICS MODULE1. Yuri Parra

BUDGETING BASICS MODULE1. Yuri Parra

Uploaded by

yuri cecilia parra suarezCopyright:

Available Formats

You might also like

- W04 Group Problem Solving Budgeting AssignmentDocument16 pagesW04 Group Problem Solving Budgeting AssignmentArmando Aroni BacaNo ratings yet

- Lesson 4 AClass ActivityDocument9 pagesLesson 4 AClass ActivitydodgeNo ratings yet

- Van Der Hoek - 2005 - From Cash To Accrual Budgeting and Accounting in The Public Sector The Dutch ExperienceDocument14 pagesVan Der Hoek - 2005 - From Cash To Accrual Budgeting and Accounting in The Public Sector The Dutch ExperiencesuwarjonoNo ratings yet

- Budgeting Basics Module1Document4 pagesBudgeting Basics Module1Jennifer HernandezNo ratings yet

- Budgeting Basics Module1Document24 pagesBudgeting Basics Module1Leidy HolguinNo ratings yet

- Budgeting Basics: A Companion Guide To Keeping It Real: How To Get The Support You Need For The Life You WantDocument20 pagesBudgeting Basics: A Companion Guide To Keeping It Real: How To Get The Support You Need For The Life You WantAngelo HuligangaNo ratings yet

- LifeSkillsReadingandMathBudgetsFREEBIE 1Document8 pagesLifeSkillsReadingandMathBudgetsFREEBIE 1Manu ManuelaNo ratings yet

- Math108x Document w04GroupAssignmentBudgeting ADocument16 pagesMath108x Document w04GroupAssignmentBudgeting AMatthew MacaballugNo ratings yet

- Benavidez Paul ExcelmasteryDocument12 pagesBenavidez Paul Excelmasteryapi-377088803No ratings yet

- Spin Premia NegocioDocument8 pagesSpin Premia Negociorobertozenteno771No ratings yet

- Budget DoneDocument6 pagesBudget Doneapi-695864872No ratings yet

- Budget Analysis Activity PDFDocument4 pagesBudget Analysis Activity PDFapi-685545642No ratings yet

- 02 02 Financial Strategy TemplateDocument6 pages02 02 Financial Strategy TemplateVISHAL PATILNo ratings yet

- State Income: Post College Budget WorksheetDocument4 pagesState Income: Post College Budget Worksheetapi-397100309No ratings yet

- Excel ApplicationDocument2 pagesExcel Applicationapi-381460003No ratings yet

- Youngadrianna ExcelmasteryDocument12 pagesYoungadrianna Excelmasteryapi-377243914No ratings yet

- Budget Analysis Activity-1 Kaitlyn NealDocument5 pagesBudget Analysis Activity-1 Kaitlyn Nealapi-627152429No ratings yet

- TF 00000012Document3 pagesTF 00000012henry.anthirayasNo ratings yet

- Building A Small Group BudgetDocument4 pagesBuilding A Small Group Budgetapi-508564949No ratings yet

- Budget Analysis ActivityDocument4 pagesBudget Analysis Activityapi-685760092No ratings yet

- Monthly Cash Flow EX Ercise: Use The Following Scenario Cards To Fill Out The Monthly Cash Flow Statement WorksheetDocument2 pagesMonthly Cash Flow EX Ercise: Use The Following Scenario Cards To Fill Out The Monthly Cash Flow Statement WorksheetNafa FadilaNo ratings yet

- Budget Sheet For Economics Project 2Document6 pagesBudget Sheet For Economics Project 2api-735280131No ratings yet

- Budget Worksheet: Number of Members in Your Household 2Document6 pagesBudget Worksheet: Number of Members in Your Household 2api-377088908No ratings yet

- 2022 23budgetproposalvoteDocument1 page2022 23budgetproposalvoteJethroNo ratings yet

- Budget ReportDocument3 pagesBudget Reportapi-549327571No ratings yet

- Traditional College Student Budget WorksheetDocument20 pagesTraditional College Student Budget WorksheetManishTewaniNo ratings yet

- Master Monthly Master Monthly Variable Expenses Fixed ExpensesDocument32 pagesMaster Monthly Master Monthly Variable Expenses Fixed Expensesryan smithNo ratings yet

- Budget ProjectDocument6 pagesBudget Projectapi-698801018No ratings yet

- Budget Project CollegeDocument6 pagesBudget Project Collegeapi-735228076No ratings yet

- GWESPTA2023 24budgetDocument1 pageGWESPTA2023 24budgethisatan670No ratings yet

- Budget Analysis ActivityDocument4 pagesBudget Analysis Activityapi-627144387No ratings yet

- JA Budgeting Tool Activity SheetDocument2 pagesJA Budgeting Tool Activity Sheet162870No ratings yet

- Budget PlannerDocument3 pagesBudget PlannerRicardo Torres AndradeNo ratings yet

- McguireDocument6 pagesMcguireapi-735265682No ratings yet

- Traditional-College-Student 3Document6 pagesTraditional-College-Student 3api-659575922No ratings yet

- Monthly BudgetDocument4 pagesMonthly BudgetĐỗ Thị HiềnNo ratings yet

- Gabrielle's BudgetDocument3 pagesGabrielle's BudgetRH - 10PS 790469 Streetsville SSNo ratings yet

- Traditional-College-Student-1 1Document6 pagesTraditional-College-Student-1 1api-738759104No ratings yet

- Cheer Small Group BudgetDocument2 pagesCheer Small Group Budgetapi-646717483No ratings yet

- Summer Gala Event BudgetDocument3 pagesSummer Gala Event Budgetdhiraj shettyNo ratings yet

- Career BudgetDocument1 pageCareer Budgetapi-435326846No ratings yet

- Traditional-College-Student 3 - 2Document6 pagesTraditional-College-Student 3 - 2api-735179875No ratings yet

- Zero Based Budget Template 05Document15 pagesZero Based Budget Template 05ALI ASGHARNo ratings yet

- Traditional AdultDocument6 pagesTraditional Adultapi-699037645No ratings yet

- Household Monthly Budget1Document14 pagesHousehold Monthly Budget1Erman DurmazNo ratings yet

- Maguirre BDocument6 pagesMaguirre Bapi-735267339No ratings yet

- Traditional-College Budeget Project DoneDocument6 pagesTraditional-College Budeget Project Doneapi-659001513No ratings yet

- Traditional College StudentDocument6 pagesTraditional College Studentapi-637462343No ratings yet

- Sesion 09 RemovedDocument1 pageSesion 09 Removedalan WalkerNo ratings yet

- Traditional College Student 1 1Document6 pagesTraditional College Student 1 1api-734501927No ratings yet

- Long ProjectDocument6 pagesLong Projectapi-659491779No ratings yet

- PaulosDocument8 pagesPaulosapi-638325728No ratings yet

- Family Budget (Monthly) 1Document6 pagesFamily Budget (Monthly) 1Naddie DeoreNo ratings yet

- Traditional-College-Student 3 - 2 1 6Document6 pagesTraditional-College-Student 3 - 2 1 6api-735540493No ratings yet

- Budget Analysis PDFDocument5 pagesBudget Analysis PDFapi-626791287No ratings yet

- Household Monthly Budget1Document12 pagesHousehold Monthly Budget1Sujit ChauhanNo ratings yet

- Budget 2Document3 pagesBudget 2api-341259616No ratings yet

- Budget ReportDocument3 pagesBudget Reportapi-583576708No ratings yet

- Family Budget (Monthly) 1Document6 pagesFamily Budget (Monthly) 1ivan.breNo ratings yet

- Personal Budgeting Spreadsheet by NeilDocument14 pagesPersonal Budgeting Spreadsheet by NeilHarsh ShahNo ratings yet

- THE INDEPENDENT Issue 533 PDFDocument48 pagesTHE INDEPENDENT Issue 533 PDFThe Independent MagazineNo ratings yet

- 017-San Miguel Corporation v. CA, G.R. No. 146775, January 30, 2002Document5 pages017-San Miguel Corporation v. CA, G.R. No. 146775, January 30, 2002Jopan SJNo ratings yet

- Exercise of Human Rights in India and Its ViolationsDocument15 pagesExercise of Human Rights in India and Its ViolationsPriyamvada YadavNo ratings yet

- Spouses Jayme V ApostolDocument8 pagesSpouses Jayme V ApostolRafNo ratings yet

- S&SS Rules - 7 - 2 - 2012Document78 pagesS&SS Rules - 7 - 2 - 2012A2 Section CollectorateNo ratings yet

- RPH Module10 The Tejeros AssemblyDocument6 pagesRPH Module10 The Tejeros AssemblySandreiAngelFloresDuralNo ratings yet

- Unofficial Minutes of Saskatoon City CouncilDocument40 pagesUnofficial Minutes of Saskatoon City CouncilJonathan BishopNo ratings yet

- FMR NotesDocument2 pagesFMR NotesmathiesdavisNo ratings yet

- OCAMPO Vs REAR ADMIRAL ENRIQUEZ GR NO. 225973 NOVEMBER 8, 2016Document2 pagesOCAMPO Vs REAR ADMIRAL ENRIQUEZ GR NO. 225973 NOVEMBER 8, 2016Man HernandoNo ratings yet

- Easements Relating To WatersDocument27 pagesEasements Relating To WatersJaimie Paz Ang0% (1)

- Certified List of Candidates For Congressional and Provincial Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Provincial Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Public International LawDocument5 pagesPublic International LawDennise LozadaNo ratings yet

- JW V DOJ Rosenstein Docs 00481 PDFDocument147 pagesJW V DOJ Rosenstein Docs 00481 PDFAnonymous 5vBXwqx2No ratings yet

- 703 - 53.44.47 - Augusto Franco Siqueira CamposDocument3 pages703 - 53.44.47 - Augusto Franco Siqueira Camposayla gomesNo ratings yet

- Republic Act No. 9823 - Official Gazette of The Republic of The PhilippinesDocument4 pagesRepublic Act No. 9823 - Official Gazette of The Republic of The PhilippinesCOA nationalNo ratings yet

- Jurisdictionary - 2013-02!01!16k Declaration of Trust For Foundation - mp3Document9 pagesJurisdictionary - 2013-02!01!16k Declaration of Trust For Foundation - mp3jacque zidaneNo ratings yet

- What Is Democracy Why DemocracyDocument17 pagesWhat Is Democracy Why DemocracyBaljot SohiNo ratings yet

- Maceda v. Macaraig (1991) DigestDocument3 pagesMaceda v. Macaraig (1991) DigestEunice IgnacioNo ratings yet

- Against Women and The Example of The Mirabal Sisters SpeechDocument4 pagesAgainst Women and The Example of The Mirabal Sisters Speechapi-462985178No ratings yet

- Synfocity 347Document2 pagesSynfocity 347Mizoram Presbyterian Church SynodNo ratings yet

- Power and Function of Chief MinisterDocument2 pagesPower and Function of Chief MinisterShuvamNo ratings yet

- PWC PSAK 73 IFRS 16Document1 pagePWC PSAK 73 IFRS 16Ani Nalitayui LifityaNo ratings yet

- Divinagracia V Consolidated BroadcastingDocument2 pagesDivinagracia V Consolidated BroadcastingCamNo ratings yet

- Service LawDocument59 pagesService LawAir JordanNo ratings yet

- South End City Market - Art SoughtDocument6 pagesSouth End City Market - Art SoughtJoel Banner BairdNo ratings yet

- LegalEthicsDigest - Grace M. Anacta vs. Atty. Eduardo D. Resurreccion, AC 9074 (August 14, 2012)Document2 pagesLegalEthicsDigest - Grace M. Anacta vs. Atty. Eduardo D. Resurreccion, AC 9074 (August 14, 2012)Lu CasNo ratings yet

- LIST To MPsDocument3 pagesLIST To MPsMohindra KaushalNo ratings yet

- Jinnah: India-Partition-Independence: Book ReviewDocument7 pagesJinnah: India-Partition-Independence: Book ReviewHassan MahmoodNo ratings yet

- Ang-Angco vs. Castillo-CONSTI Digest - AleahDocument2 pagesAng-Angco vs. Castillo-CONSTI Digest - AleahPrinsesaJuu75% (4)

BUDGETING BASICS MODULE1. Yuri Parra

BUDGETING BASICS MODULE1. Yuri Parra

Uploaded by

yuri cecilia parra suarezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BUDGETING BASICS MODULE1. Yuri Parra

BUDGETING BASICS MODULE1. Yuri Parra

Uploaded by

yuri cecilia parra suarezCopyright:

Available Formats

Earning and spending

It feels great to earn a paycheck. Whether you work part time at the mall, baby-sit on

weekends, or cut lawns in your neighborhood, having a job is a big step towards your

personal growth, independence, and buying things for yourself.

However, sometimes it seems that even when you have a job you still may find you

don’t have enough money to buy all the things you want. A new jacket, concert, ball

game ticket, or music player may be things you have wanted. Having a savings plan

and a budget can help you save for both purchases like buying a jacket and bigger

purchases like saving for new computer.

Budgeting is a very important step when it comes to successful money management.

It allows you to see how much money you earn and spend over a period of time, and

helps you to make good choices for both spending your money on what you need or

want now, and saving your money for what you think you’ll need or want in the

future.

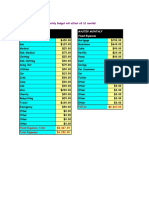

On the next page is an example of David’s income (the money he earns) and his

expenses (the money he spends) for a given month. Pay close attention to David’s

spending habits. Think about your own spending habits. Are they similar to David’s?

Do you sometimes spend more money on things that you want but do not really

need?

The Elizabeth M. Boggs Center on Developmental Disabilities/UMDNJ 1

David’s Income & Expenses For the Month of May

INCOME EARNED

Part-time job at the mall $240.00

Weekend work at Uncle Jim’s barber shop $110.00

Monthly allowance for doing chores at

$60.00

home

TOTAL INCOME: $410.00

EXPENSES THIS MONTH SPENT

Buying school lunch $60.00

Purchasing a new video game $65.00

YMCA club dues $15.00

Buying new pair of sneakers $75.00

Getting a haircut $15.00

Going to movies with friends $25.00

Paying for cell phone bill $75.00

Buying birthday present $40.00

Food for pet dog $20.00

Monthly savings goal $40.00

TOTAL EXPENSES : $430.00

DIFFERENCE

- ($20.00)

(Income minus Expenses, or Net Income)

The Elizabeth M. Boggs Center on Developmental Disabilities/UMDNJ 2

Activity:

What was David’s total income for the month?

What were David’s total expenses for the month?

What is David’s net income? (Net income is income minus expenses.)

Is David's net income more than, less than, or equal to his expenses for the month?

R/ Income is less than your expenses

If his expenses are greater than his income, what expenses do you think he can reduceor

eliminate? Why?

R/ The expenses that can be eliminated are the purchase of a new video game

for $65.00 and the purchase of a new pair of sneakers for $75.00, because they

may be unnecessary purchases that can be planned in savings.

What expense should David not reduce or eliminate? Why?

The Elizabeth M. Boggs Center on Developmental Disabilities/UMDNJ 3

You might also like

- W04 Group Problem Solving Budgeting AssignmentDocument16 pagesW04 Group Problem Solving Budgeting AssignmentArmando Aroni BacaNo ratings yet

- Lesson 4 AClass ActivityDocument9 pagesLesson 4 AClass ActivitydodgeNo ratings yet

- Van Der Hoek - 2005 - From Cash To Accrual Budgeting and Accounting in The Public Sector The Dutch ExperienceDocument14 pagesVan Der Hoek - 2005 - From Cash To Accrual Budgeting and Accounting in The Public Sector The Dutch ExperiencesuwarjonoNo ratings yet

- Budgeting Basics Module1Document4 pagesBudgeting Basics Module1Jennifer HernandezNo ratings yet

- Budgeting Basics Module1Document24 pagesBudgeting Basics Module1Leidy HolguinNo ratings yet

- Budgeting Basics: A Companion Guide To Keeping It Real: How To Get The Support You Need For The Life You WantDocument20 pagesBudgeting Basics: A Companion Guide To Keeping It Real: How To Get The Support You Need For The Life You WantAngelo HuligangaNo ratings yet

- LifeSkillsReadingandMathBudgetsFREEBIE 1Document8 pagesLifeSkillsReadingandMathBudgetsFREEBIE 1Manu ManuelaNo ratings yet

- Math108x Document w04GroupAssignmentBudgeting ADocument16 pagesMath108x Document w04GroupAssignmentBudgeting AMatthew MacaballugNo ratings yet

- Benavidez Paul ExcelmasteryDocument12 pagesBenavidez Paul Excelmasteryapi-377088803No ratings yet

- Spin Premia NegocioDocument8 pagesSpin Premia Negociorobertozenteno771No ratings yet

- Budget DoneDocument6 pagesBudget Doneapi-695864872No ratings yet

- Budget Analysis Activity PDFDocument4 pagesBudget Analysis Activity PDFapi-685545642No ratings yet

- 02 02 Financial Strategy TemplateDocument6 pages02 02 Financial Strategy TemplateVISHAL PATILNo ratings yet

- State Income: Post College Budget WorksheetDocument4 pagesState Income: Post College Budget Worksheetapi-397100309No ratings yet

- Excel ApplicationDocument2 pagesExcel Applicationapi-381460003No ratings yet

- Youngadrianna ExcelmasteryDocument12 pagesYoungadrianna Excelmasteryapi-377243914No ratings yet

- Budget Analysis Activity-1 Kaitlyn NealDocument5 pagesBudget Analysis Activity-1 Kaitlyn Nealapi-627152429No ratings yet

- TF 00000012Document3 pagesTF 00000012henry.anthirayasNo ratings yet

- Building A Small Group BudgetDocument4 pagesBuilding A Small Group Budgetapi-508564949No ratings yet

- Budget Analysis ActivityDocument4 pagesBudget Analysis Activityapi-685760092No ratings yet

- Monthly Cash Flow EX Ercise: Use The Following Scenario Cards To Fill Out The Monthly Cash Flow Statement WorksheetDocument2 pagesMonthly Cash Flow EX Ercise: Use The Following Scenario Cards To Fill Out The Monthly Cash Flow Statement WorksheetNafa FadilaNo ratings yet

- Budget Sheet For Economics Project 2Document6 pagesBudget Sheet For Economics Project 2api-735280131No ratings yet

- Budget Worksheet: Number of Members in Your Household 2Document6 pagesBudget Worksheet: Number of Members in Your Household 2api-377088908No ratings yet

- 2022 23budgetproposalvoteDocument1 page2022 23budgetproposalvoteJethroNo ratings yet

- Budget ReportDocument3 pagesBudget Reportapi-549327571No ratings yet

- Traditional College Student Budget WorksheetDocument20 pagesTraditional College Student Budget WorksheetManishTewaniNo ratings yet

- Master Monthly Master Monthly Variable Expenses Fixed ExpensesDocument32 pagesMaster Monthly Master Monthly Variable Expenses Fixed Expensesryan smithNo ratings yet

- Budget ProjectDocument6 pagesBudget Projectapi-698801018No ratings yet

- Budget Project CollegeDocument6 pagesBudget Project Collegeapi-735228076No ratings yet

- GWESPTA2023 24budgetDocument1 pageGWESPTA2023 24budgethisatan670No ratings yet

- Budget Analysis ActivityDocument4 pagesBudget Analysis Activityapi-627144387No ratings yet

- JA Budgeting Tool Activity SheetDocument2 pagesJA Budgeting Tool Activity Sheet162870No ratings yet

- Budget PlannerDocument3 pagesBudget PlannerRicardo Torres AndradeNo ratings yet

- McguireDocument6 pagesMcguireapi-735265682No ratings yet

- Traditional-College-Student 3Document6 pagesTraditional-College-Student 3api-659575922No ratings yet

- Monthly BudgetDocument4 pagesMonthly BudgetĐỗ Thị HiềnNo ratings yet

- Gabrielle's BudgetDocument3 pagesGabrielle's BudgetRH - 10PS 790469 Streetsville SSNo ratings yet

- Traditional-College-Student-1 1Document6 pagesTraditional-College-Student-1 1api-738759104No ratings yet

- Cheer Small Group BudgetDocument2 pagesCheer Small Group Budgetapi-646717483No ratings yet

- Summer Gala Event BudgetDocument3 pagesSummer Gala Event Budgetdhiraj shettyNo ratings yet

- Career BudgetDocument1 pageCareer Budgetapi-435326846No ratings yet

- Traditional-College-Student 3 - 2Document6 pagesTraditional-College-Student 3 - 2api-735179875No ratings yet

- Zero Based Budget Template 05Document15 pagesZero Based Budget Template 05ALI ASGHARNo ratings yet

- Traditional AdultDocument6 pagesTraditional Adultapi-699037645No ratings yet

- Household Monthly Budget1Document14 pagesHousehold Monthly Budget1Erman DurmazNo ratings yet

- Maguirre BDocument6 pagesMaguirre Bapi-735267339No ratings yet

- Traditional-College Budeget Project DoneDocument6 pagesTraditional-College Budeget Project Doneapi-659001513No ratings yet

- Traditional College StudentDocument6 pagesTraditional College Studentapi-637462343No ratings yet

- Sesion 09 RemovedDocument1 pageSesion 09 Removedalan WalkerNo ratings yet

- Traditional College Student 1 1Document6 pagesTraditional College Student 1 1api-734501927No ratings yet

- Long ProjectDocument6 pagesLong Projectapi-659491779No ratings yet

- PaulosDocument8 pagesPaulosapi-638325728No ratings yet

- Family Budget (Monthly) 1Document6 pagesFamily Budget (Monthly) 1Naddie DeoreNo ratings yet

- Traditional-College-Student 3 - 2 1 6Document6 pagesTraditional-College-Student 3 - 2 1 6api-735540493No ratings yet

- Budget Analysis PDFDocument5 pagesBudget Analysis PDFapi-626791287No ratings yet

- Household Monthly Budget1Document12 pagesHousehold Monthly Budget1Sujit ChauhanNo ratings yet

- Budget 2Document3 pagesBudget 2api-341259616No ratings yet

- Budget ReportDocument3 pagesBudget Reportapi-583576708No ratings yet

- Family Budget (Monthly) 1Document6 pagesFamily Budget (Monthly) 1ivan.breNo ratings yet

- Personal Budgeting Spreadsheet by NeilDocument14 pagesPersonal Budgeting Spreadsheet by NeilHarsh ShahNo ratings yet

- THE INDEPENDENT Issue 533 PDFDocument48 pagesTHE INDEPENDENT Issue 533 PDFThe Independent MagazineNo ratings yet

- 017-San Miguel Corporation v. CA, G.R. No. 146775, January 30, 2002Document5 pages017-San Miguel Corporation v. CA, G.R. No. 146775, January 30, 2002Jopan SJNo ratings yet

- Exercise of Human Rights in India and Its ViolationsDocument15 pagesExercise of Human Rights in India and Its ViolationsPriyamvada YadavNo ratings yet

- Spouses Jayme V ApostolDocument8 pagesSpouses Jayme V ApostolRafNo ratings yet

- S&SS Rules - 7 - 2 - 2012Document78 pagesS&SS Rules - 7 - 2 - 2012A2 Section CollectorateNo ratings yet

- RPH Module10 The Tejeros AssemblyDocument6 pagesRPH Module10 The Tejeros AssemblySandreiAngelFloresDuralNo ratings yet

- Unofficial Minutes of Saskatoon City CouncilDocument40 pagesUnofficial Minutes of Saskatoon City CouncilJonathan BishopNo ratings yet

- FMR NotesDocument2 pagesFMR NotesmathiesdavisNo ratings yet

- OCAMPO Vs REAR ADMIRAL ENRIQUEZ GR NO. 225973 NOVEMBER 8, 2016Document2 pagesOCAMPO Vs REAR ADMIRAL ENRIQUEZ GR NO. 225973 NOVEMBER 8, 2016Man HernandoNo ratings yet

- Easements Relating To WatersDocument27 pagesEasements Relating To WatersJaimie Paz Ang0% (1)

- Certified List of Candidates For Congressional and Provincial Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Provincial Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Public International LawDocument5 pagesPublic International LawDennise LozadaNo ratings yet

- JW V DOJ Rosenstein Docs 00481 PDFDocument147 pagesJW V DOJ Rosenstein Docs 00481 PDFAnonymous 5vBXwqx2No ratings yet

- 703 - 53.44.47 - Augusto Franco Siqueira CamposDocument3 pages703 - 53.44.47 - Augusto Franco Siqueira Camposayla gomesNo ratings yet

- Republic Act No. 9823 - Official Gazette of The Republic of The PhilippinesDocument4 pagesRepublic Act No. 9823 - Official Gazette of The Republic of The PhilippinesCOA nationalNo ratings yet

- Jurisdictionary - 2013-02!01!16k Declaration of Trust For Foundation - mp3Document9 pagesJurisdictionary - 2013-02!01!16k Declaration of Trust For Foundation - mp3jacque zidaneNo ratings yet

- What Is Democracy Why DemocracyDocument17 pagesWhat Is Democracy Why DemocracyBaljot SohiNo ratings yet

- Maceda v. Macaraig (1991) DigestDocument3 pagesMaceda v. Macaraig (1991) DigestEunice IgnacioNo ratings yet

- Against Women and The Example of The Mirabal Sisters SpeechDocument4 pagesAgainst Women and The Example of The Mirabal Sisters Speechapi-462985178No ratings yet

- Synfocity 347Document2 pagesSynfocity 347Mizoram Presbyterian Church SynodNo ratings yet

- Power and Function of Chief MinisterDocument2 pagesPower and Function of Chief MinisterShuvamNo ratings yet

- PWC PSAK 73 IFRS 16Document1 pagePWC PSAK 73 IFRS 16Ani Nalitayui LifityaNo ratings yet

- Divinagracia V Consolidated BroadcastingDocument2 pagesDivinagracia V Consolidated BroadcastingCamNo ratings yet

- Service LawDocument59 pagesService LawAir JordanNo ratings yet

- South End City Market - Art SoughtDocument6 pagesSouth End City Market - Art SoughtJoel Banner BairdNo ratings yet

- LegalEthicsDigest - Grace M. Anacta vs. Atty. Eduardo D. Resurreccion, AC 9074 (August 14, 2012)Document2 pagesLegalEthicsDigest - Grace M. Anacta vs. Atty. Eduardo D. Resurreccion, AC 9074 (August 14, 2012)Lu CasNo ratings yet

- LIST To MPsDocument3 pagesLIST To MPsMohindra KaushalNo ratings yet

- Jinnah: India-Partition-Independence: Book ReviewDocument7 pagesJinnah: India-Partition-Independence: Book ReviewHassan MahmoodNo ratings yet

- Ang-Angco vs. Castillo-CONSTI Digest - AleahDocument2 pagesAng-Angco vs. Castillo-CONSTI Digest - AleahPrinsesaJuu75% (4)