Professional Documents

Culture Documents

Wee

Wee

Uploaded by

rodrigo baltazarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wee

Wee

Uploaded by

rodrigo baltazarCopyright:

Available Formats

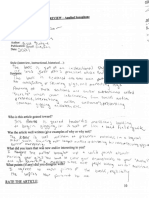

A.

Report the estimated monthly premium, estimated deductible, estimated out-of-pocket

maximum, and any copayments/coinsurance associated with the plan. What do these numbers

mean? How might these figures influence your decision to purchase a plan with similar

characteristics?

Monthly premium: 103.75

Deductible:500

Out of pocket maximum:6900

The first number is my monthly payment for insurance, the next number is the amount you pay

each visit and the third is the total amount you have to pay before insurance covers 100% of

expenses. When looking at plans this one made the most sense since these are the numbers

you want lowest and the other options had higher premiums, higher deductibles, and out of

pocket maximums so otherwise I’d be spending more money for worse benefits.

B. What other factors might be important in choosing a health plan (i.e. provider network,

covered drugs, etc.)? How does the plan you chose incorporate these factors?

My plan also incorporates $30 deductible for primary doctor and $10 drug deductibles so that

makes non urgent doctor visits more affordable for preventative measures and cheaper

medication costs.

C. Discuss what is most important to you in choosing a health insurance plan and how this

relates to this unit’s material regarding risk and your response to risk.

I think lower deductibles are more appealing to me because I’d rather not as much if I can avoid

it. I generally try to stay away from visiting hospitals but the lower deductible on primary doctors

also encourages me to visit my primary doctor to prevent long term health issues. But truthfully I

feel I could take lesser plan knowing at this stage in my life I’m not in as much risk but I tend to

air on the side of caution.

You might also like

- Health Insurance Activity Sheet - Spring 2022 1Document4 pagesHealth Insurance Activity Sheet - Spring 2022 1api-632711577No ratings yet

- Rapidcare Medical Billing ManualDocument93 pagesRapidcare Medical Billing Manualapi-19789919100% (3)

- Different Types of Health Plans: How They CompareDocument13 pagesDifferent Types of Health Plans: How They CompareWajid MalikNo ratings yet

- The Economics of HC - Week 2Document12 pagesThe Economics of HC - Week 2Fernanda CárcamoNo ratings yet

- Co-Pay vs. Deductible What's The DifferenceDocument3 pagesCo-Pay vs. Deductible What's The DifferenceKrîzèllê B. MëndòzâNo ratings yet

- Our Plans Fit Your Plans: Smartsense Plus Premier PlusDocument17 pagesOur Plans Fit Your Plans: Smartsense Plus Premier PlusKenton GreenNo ratings yet

- Your Pharmacy Benefit: Make It Work For You!Document16 pagesYour Pharmacy Benefit: Make It Work For You!sunnymeo786No ratings yet

- Questions and Answers About Health Insurance: A Consumer GuideDocument36 pagesQuestions and Answers About Health Insurance: A Consumer GuideVaibhav KapoorNo ratings yet

- Health InsuranceDocument13 pagesHealth InsuranceTroy MirandaNo ratings yet

- HR Health ConsumerDocument2 pagesHR Health ConsumerKia Jezzca ElarcosaNo ratings yet

- Healthy Care-Health Insurance Advice: EZ Internet Reference, #1From EverandHealthy Care-Health Insurance Advice: EZ Internet Reference, #1No ratings yet

- Horizon Presale Kit 2014off OnexchangeDocument18 pagesHorizon Presale Kit 2014off OnexchangewygneshNo ratings yet

- Health Insurance COMPANYDocument6 pagesHealth Insurance COMPANYWajid MalikNo ratings yet

- Plan 2 Gtqa W Hsa SummaryDocument11 pagesPlan 2 Gtqa W Hsa Summaryapi-247823065No ratings yet

- How Insurance WorksDocument8 pagesHow Insurance WorksKing4RealNo ratings yet

- Healthcare Is Making Me Sick: Learn the Rules to Regain Control and Fight for Your HealthcareFrom EverandHealthcare Is Making Me Sick: Learn the Rules to Regain Control and Fight for Your HealthcareNo ratings yet

- Topic 11 6 Course 2017-18Document10 pagesTopic 11 6 Course 2017-18Hikufe JesayaNo ratings yet

- UHC Description of BenefitsDocument9 pagesUHC Description of BenefitsSebastián GuevaraNo ratings yet

- Blue Shield of California Choosing Your Health Plan A16646 2011Document54 pagesBlue Shield of California Choosing Your Health Plan A16646 2011DennisNo ratings yet

- What Is An HMO Plan?Document8 pagesWhat Is An HMO Plan?fahhad lashariNo ratings yet

- Introduction DekaDocument6 pagesIntroduction Dekaidil2023No ratings yet

- 3.3.1 Medical Care and Administration: Charges vs. CostsDocument5 pages3.3.1 Medical Care and Administration: Charges vs. CostsmarlinNo ratings yet

- 1) Coverage Amount/Sum Insured (SI)Document4 pages1) Coverage Amount/Sum Insured (SI)shaileshNo ratings yet

- If You Are Well: Health and Wellness Tips for the Empowered Health Care ConsumerFrom EverandIf You Are Well: Health and Wellness Tips for the Empowered Health Care ConsumerNo ratings yet

- Health InsuranceDocument1 pageHealth Insuranceapi-473034142No ratings yet

- Acknowledgement: Prof.B.P.Sharma Sir For Giving Me This Precious and Useful Opportunity To Improve MyDocument57 pagesAcknowledgement: Prof.B.P.Sharma Sir For Giving Me This Precious and Useful Opportunity To Improve MyDivyaroop HarshwalNo ratings yet

- The Health CareDocument2 pagesThe Health CareTe DuNo ratings yet

- What Everybody Ought To Know About Health Benefit Cards: Lawsuits GuidelineDocument3 pagesWhat Everybody Ought To Know About Health Benefit Cards: Lawsuits Guidelineapi-77613236No ratings yet

- Tanya Amon Assignment 2 HSA500Document5 pagesTanya Amon Assignment 2 HSA500Tanya Delaine AmonNo ratings yet

- On Health InsuranceDocument33 pagesOn Health InsuranceVenkat Reddy Arrabiri0% (1)

- How Are Doctors' Fees Set? How Much of The Doctor's Bill Will Medicare Cover?Document4 pagesHow Are Doctors' Fees Set? How Much of The Doctor's Bill Will Medicare Cover?GirishNo ratings yet

- Health Insurance 12 Points Check ListDocument3 pagesHealth Insurance 12 Points Check ListmcsrNo ratings yet

- Health Insurance Inforamtion, Individual Health Insurance, Family Health Insurance InformationDocument7 pagesHealth Insurance Inforamtion, Individual Health Insurance, Family Health Insurance Informationdjohnson418No ratings yet

- Consumer Driven Health CareDocument9 pagesConsumer Driven Health CareKevin VarnerNo ratings yet

- BluePreferred HSA MDDocument10 pagesBluePreferred HSA MDjeff303No ratings yet

- This Is Only A Summary.: Premier PlanDocument8 pagesThis Is Only A Summary.: Premier Planmandeep2610No ratings yet

- 4-Demand For HealthcareDocument24 pages4-Demand For HealthcareVaishali UzzielNo ratings yet

- Health Insurance 2Document32 pagesHealth Insurance 2roquiemayursaizNo ratings yet

- Sisc Q ADocument7 pagesSisc Q Aapi-204910805No ratings yet

- Dental Insurance: Types of Dental PlansDocument5 pagesDental Insurance: Types of Dental PlansVishal ThakkarNo ratings yet

- Uhc Hsa 2000-80 1 17Document22 pagesUhc Hsa 2000-80 1 17api-252555369No ratings yet

- Therapist Client Confidentiality AgreementDocument5 pagesTherapist Client Confidentiality AgreementJoshua GonsherNo ratings yet

- Techniques of Risk MGTDocument2 pagesTechniques of Risk MGTtage008No ratings yet

- What Is Managed CareDocument18 pagesWhat Is Managed CareYOGESHNo ratings yet

- Lesson 9 Managing Health ExpenseDocument3 pagesLesson 9 Managing Health ExpenseFrancisco Cherry BeNo ratings yet

- August 2015 MTB TDocument24 pagesAugust 2015 MTB TcarboncountynewsNo ratings yet

- What's The Best Way To Find A Drug Detox Center?: Image SourceDocument4 pagesWhat's The Best Way To Find A Drug Detox Center?: Image SourceAleem Ahmad RindekharabatNo ratings yet

- Why Should Health Insurance Be Given Due Consideration?Document4 pagesWhy Should Health Insurance Be Given Due Consideration?iqbalNo ratings yet

- NoSurpriseActFactsheet-Health Insurance Terms You Should Know - 508CDocument3 pagesNoSurpriseActFactsheet-Health Insurance Terms You Should Know - 508C848magnoliaNo ratings yet

- Comparative Health SystemsDocument2 pagesComparative Health SystemsShannon WuNo ratings yet

- Assignment 4 - Health Care InsuranceDocument4 pagesAssignment 4 - Health Care Insuranceapi-535313728No ratings yet

- HSA Choice Plus Plan AIQM/02V: Important Questions Answers Why This MattersDocument8 pagesHSA Choice Plus Plan AIQM/02V: Important Questions Answers Why This MattersAnonymous PWVeGM5n9gNo ratings yet

- Insurance Verification SlidesDocument19 pagesInsurance Verification Slidesjoxoplasma.gondiiNo ratings yet

- Insurance Health Care Health SystemDocument7 pagesInsurance Health Care Health SystemSrinivas LaishettyNo ratings yet

- Health Insurance GlossaryDocument13 pagesHealth Insurance GlossaryvivekNo ratings yet

- Quick Guide To Managing BillsDocument4 pagesQuick Guide To Managing Billsbalaaditya2020No ratings yet

- Banking LawDocument7 pagesBanking LawElsa ShaikhNo ratings yet

- 2nd Suite in F 1234 Sax Quartet-PartsDocument22 pages2nd Suite in F 1234 Sax Quartet-Partsrodrigo baltazarNo ratings yet

- El Galan IncognitoDocument7 pagesEl Galan Incognitorodrigo baltazarNo ratings yet

- WeDocument1 pageWerodrigo baltazarNo ratings yet

- Voxman - Selected Duets Vol 1Document74 pagesVoxman - Selected Duets Vol 1rodrigo baltazar100% (1)

- Week2 Ol Balance SheetDocument2 pagesWeek2 Ol Balance Sheetrodrigo baltazarNo ratings yet

- WyDocument2 pagesWyrodrigo baltazarNo ratings yet

- The Mystery of Edwin DDocument3 pagesThe Mystery of Edwin Drodrigo baltazarNo ratings yet

- Week2 Ol Cash Flows SimpleDocument2 pagesWeek2 Ol Cash Flows Simplerodrigo baltazarNo ratings yet

- Small Triangle Outline: ImagesDocument1 pageSmall Triangle Outline: Imagesrodrigo baltazarNo ratings yet

- Chap 28Document3 pagesChap 28rodrigo baltazarNo ratings yet

- 2020-10-20 20-43Document2 pages2020-10-20 20-43rodrigo baltazarNo ratings yet

- 3 :31Document1 page3 :31rodrigo baltazarNo ratings yet

- Book ReviewDocument2 pagesBook Reviewrodrigo baltazarNo ratings yet

- CD ReviewDocument12 pagesCD Reviewrodrigo baltazarNo ratings yet

- Half Dimished TriadDocument1 pageHalf Dimished Triadrodrigo baltazarNo ratings yet