Professional Documents

Culture Documents

CG2

CG2

Uploaded by

KAMWA IMCopyright:

Available Formats

You might also like

- Aurora Textile CompanyDocument16 pagesAurora Textile CompanyJesslin Ruslim0% (1)

- CFA Level 3 2012 Guideline AnswersDocument42 pagesCFA Level 3 2012 Guideline AnswersmerrylmorleyNo ratings yet

- Case Analysis: Murphy Stores, Capital ProjectDocument2 pagesCase Analysis: Murphy Stores, Capital Projectariba farrukhNo ratings yet

- Introduction To Corporate GovernanceDocument26 pagesIntroduction To Corporate GovernanceLeah BallesterosNo ratings yet

- Armour - Corporations - 2009F - Allen Kraakman Subramian 3rdDocument153 pagesArmour - Corporations - 2009F - Allen Kraakman Subramian 3rdSimon Hsien-Wen HsiaoNo ratings yet

- Corporate Finance: A Beginner's Guide: Investment series, #1From EverandCorporate Finance: A Beginner's Guide: Investment series, #1No ratings yet

- Chap 011Document44 pagesChap 011Jessica Cola50% (2)

- Agency Problems and Accountability of Corporate Managers and ShareholdersDocument29 pagesAgency Problems and Accountability of Corporate Managers and ShareholdersHarPearl Lie100% (3)

- Corporate Governance ModelsDocument31 pagesCorporate Governance ModelsEeshaa MalikNo ratings yet

- Ba 224 Module 4Document3 pagesBa 224 Module 4Honeylet PangasianNo ratings yet

- Lecture 4 Week 4: Shareholder Rights and Theories of Corporate GovernanceDocument37 pagesLecture 4 Week 4: Shareholder Rights and Theories of Corporate GovernanceDeelan AppaNo ratings yet

- Corporate GovernanceDocument8 pagesCorporate Governanceshaifali pandeyNo ratings yet

- Accounting 2 CorporationsDocument12 pagesAccounting 2 CorporationsAshraf AminNo ratings yet

- Acctg 9 Chap 3 TermsDocument9 pagesAcctg 9 Chap 3 TermsAnjelika ViescaNo ratings yet

- Bahr 1ST ReviewerDocument12 pagesBahr 1ST ReviewerTricia Nicole BahintingNo ratings yet

- Intoduction To Shareholders' Role in Corporate Governance in GeneralDocument15 pagesIntoduction To Shareholders' Role in Corporate Governance in GeneralDelil AhmedNo ratings yet

- New Blog Post Company LawDocument6 pagesNew Blog Post Company Lawbhavitha birdalaNo ratings yet

- Presented by - Parikshit Saha Pankaj Lokesh Randeep Garg Sahil Aggarwal Nishant AdlakhaDocument70 pagesPresented by - Parikshit Saha Pankaj Lokesh Randeep Garg Sahil Aggarwal Nishant AdlakhaRandeep Garg100% (1)

- Corporate Governance, StakeholdersDocument6 pagesCorporate Governance, StakeholdersIbra GrnNo ratings yet

- NotesDocument1 pageNotesBee ChunweiNo ratings yet

- Financial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120Document5 pagesFinancial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120wajid2345No ratings yet

- Acctg 9 Chap 1 TermsDocument8 pagesAcctg 9 Chap 1 TermsAnjelika ViescaNo ratings yet

- Individual Assignement Financial AccountingDocument4 pagesIndividual Assignement Financial AccountingkafilmohammedamineNo ratings yet

- MGMT203 Reviewer Chapter 1Document4 pagesMGMT203 Reviewer Chapter 1April Marie Abadilla CedillaNo ratings yet

- Rights of Shareholders FinalDocument12 pagesRights of Shareholders FinalNaing AungNo ratings yet

- Chapter 1 Fin 2200Document7 pagesChapter 1 Fin 2200cheeseNo ratings yet

- Ba224 Chapter 1Document4 pagesBa224 Chapter 1kim zamoraNo ratings yet

- Corporate Finance SummaryDocument25 pagesCorporate Finance SummaryBrent Heiner100% (1)

- Governance, Risk, and EthicsDocument6 pagesGovernance, Risk, and EthicsbhoomailidNo ratings yet

- General Business Chapter 4Document5 pagesGeneral Business Chapter 4Александра ЖаловагаNo ratings yet

- Chapter 5 CorporationDocument12 pagesChapter 5 CorporationMamaru SewalemNo ratings yet

- Types of Business OwnershipDocument4 pagesTypes of Business OwnershipReillah DeluriaNo ratings yet

- Finance BasicsDocument48 pagesFinance BasicsLee ChiaNo ratings yet

- Joint Stock CompanyDocument12 pagesJoint Stock CompanyKainos GreyNo ratings yet

- Capital FinancingDocument33 pagesCapital FinancingRonell SolijonNo ratings yet

- Presentation On Corporate GovernanceDocument29 pagesPresentation On Corporate Governancesuren471988No ratings yet

- Rights of ShareholderDocument14 pagesRights of ShareholderArya SenNo ratings yet

- Answers To Review QuestionsDocument5 pagesAnswers To Review QuestionsMaria ArshadNo ratings yet

- Chapter 5 UpdatedDocument60 pagesChapter 5 UpdatedXi Bough Esce0% (1)

- Business EthicsDocument86 pagesBusiness EthicsSagar Parekh100% (1)

- Introduction To Corporate Governance: University of Languages and International StudiesDocument19 pagesIntroduction To Corporate Governance: University of Languages and International StudiesHM.No ratings yet

- Corporate GoveranceDocument35 pagesCorporate GoveranceEdomNo ratings yet

- Ordinary Share CapitalDocument7 pagesOrdinary Share CapitalKenneth RonoNo ratings yet

- Business 1.2Document44 pagesBusiness 1.2samerNo ratings yet

- Corporate Governance: By: 1. Kenneth A. Kim John R. Nofsinger and 2. A. C. FernandoDocument51 pagesCorporate Governance: By: 1. Kenneth A. Kim John R. Nofsinger and 2. A. C. FernandoKanganFatimaNo ratings yet

- Question Answered From Corporate Governance - A Book by Christine A. MallinDocument7 pagesQuestion Answered From Corporate Governance - A Book by Christine A. MallinUzzal Sarker - উজ্জ্বল সরকার100% (5)

- Fins3626 NotesDocument3 pagesFins3626 NotesMRML96No ratings yet

- Business Organization Structures, Strategies, and SuccessDocument3 pagesBusiness Organization Structures, Strategies, and SuccessSuhailShaikhNo ratings yet

- Corporations Law OutlineDocument33 pagesCorporations Law OutlineDeVaneyPageNo ratings yet

- Finals Activity No. 3 (LOMA)Document5 pagesFinals Activity No. 3 (LOMA)LOMA, ABIGAIL JOY C.No ratings yet

- Corporation Accounting - IntroductionDocument7 pagesCorporation Accounting - IntroductionErica Calzada50% (2)

- Ventura, Trisha Anne R. Ba2MaDocument5 pagesVentura, Trisha Anne R. Ba2MaTrisha Anne R. VenturaNo ratings yet

- Unit Ii Sources of FinanceDocument30 pagesUnit Ii Sources of FinanceSajal KhatriNo ratings yet

- StocksDocument9 pagesStocksHassan Tahir SialNo ratings yet

- ChatgptDocument17 pagesChatgptArushi PrasharNo ratings yet

- Intro To Corp GovDocument84 pagesIntro To Corp Govarun achariNo ratings yet

- Last ChapterDocument3 pagesLast ChapterCANAN HART REGO SDM COLLEGE OF BUSINESS MANAGEMENT POST GRADUATE CENTRENo ratings yet

- Corporate Governance LawDocument13 pagesCorporate Governance LawNzovwa Mwela ChombaNo ratings yet

- New Blog Post Company LawDocument6 pagesNew Blog Post Company Lawbhavitha birdalaNo ratings yet

- Corporate Governance Part 1Document55 pagesCorporate Governance Part 1swasat duttaNo ratings yet

- Sources of FinanceDocument39 pagesSources of Financenomanameer324No ratings yet

- Fin220 ch1Document22 pagesFin220 ch1अंजनी श्रीवास्तवNo ratings yet

- Lecture 5 - The Law of Associations 3 - Incorporations CTDDocument10 pagesLecture 5 - The Law of Associations 3 - Incorporations CTDShannan RichardsNo ratings yet

- Europa Science & Commerce Academy: Advantages of Joint Stock CompanyDocument4 pagesEuropa Science & Commerce Academy: Advantages of Joint Stock CompanyFaisi PrinceNo ratings yet

- Education: Vineet NagpalDocument1 pageEducation: Vineet NagpalNhật LinhNo ratings yet

- International Financial MarketsDocument13 pagesInternational Financial Marketsmanojpatel5150% (4)

- Petrochemical Margins Chemicals Pta Margins Up by 7% Mom in Mar'18Document3 pagesPetrochemical Margins Chemicals Pta Margins Up by 7% Mom in Mar'18adeelngNo ratings yet

- 120113-DCCBs in Maharashtra by SunilDocument7 pages120113-DCCBs in Maharashtra by SunilGauresh NaikNo ratings yet

- Financial Reporting Week 4Document9 pagesFinancial Reporting Week 4islam hamdyNo ratings yet

- Fixed DepositsDocument1 pageFixed DepositsTiso Blackstar GroupNo ratings yet

- MGT1022 - LSM - Final Project Report - Format - 27.11.2020Document7 pagesMGT1022 - LSM - Final Project Report - Format - 27.11.2020Gokul SrinathNo ratings yet

- FZ5000 Solución Tarea 3 AJ2020Document2 pagesFZ5000 Solución Tarea 3 AJ2020gerardoNo ratings yet

- PHD Thesis On Financial AnalysisDocument10 pagesPHD Thesis On Financial Analysisaliciastoddardprovo100% (2)

- Income Taxation 2023 DiscussionsDocument16 pagesIncome Taxation 2023 DiscussionsKenjay SarcoNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- Investment in AssociateDocument29 pagesInvestment in AssociateAngela RuedasNo ratings yet

- Essential Guide To Stock InvestingDocument19 pagesEssential Guide To Stock Investingleorbalaguru100% (1)

- Kristjan Kullamägi's Streams Mid Nov 2020-8Document13 pagesKristjan Kullamägi's Streams Mid Nov 2020-8Sairam ChandrasekharNo ratings yet

- GTB - Uti Bank Merger StoryDocument15 pagesGTB - Uti Bank Merger StoryAvanti MulayNo ratings yet

- Aurobindo Pharma LTDDocument13 pagesAurobindo Pharma LTDcrazyman2009No ratings yet

- Introduction To International Financial Management: Powerpoint® Lecture PresentationDocument34 pagesIntroduction To International Financial Management: Powerpoint® Lecture PresentationRafiqul Islam100% (2)

- Lucas - Econometric Policy Evaluation, A CritiqueDocument28 pagesLucas - Econometric Policy Evaluation, A CritiqueFederico Perez CusseNo ratings yet

- WEEK 1 Agribusiness and EntrepreneurshipDocument33 pagesWEEK 1 Agribusiness and EntrepreneurshipSITI NUR RASYIDAH BINTI MAZUKINo ratings yet

- Nse-Ncfm-Financial Markets A Beginners ModuleDocument99 pagesNse-Ncfm-Financial Markets A Beginners ModuleJyoti SukhijaNo ratings yet

- Britannia News Issue 47 PDFDocument28 pagesBritannia News Issue 47 PDFBill KelsoNo ratings yet

- Media ManagementDocument37 pagesMedia ManagementRizwan Khan100% (4)

- Sumit MRPDocument95 pagesSumit MRPANIL YADAVNo ratings yet

- Dabur India: Valuations Turn Attractive Upgrade To BuyDocument6 pagesDabur India: Valuations Turn Attractive Upgrade To BuyanirbanmNo ratings yet

- 2020 06b FI Core-Concepts IPSAS 29 PPDocument27 pages2020 06b FI Core-Concepts IPSAS 29 PPFebby Grace SabinoNo ratings yet

- MTP (TVM Questikon)Document11 pagesMTP (TVM Questikon)prashanttiwari155282No ratings yet

CG2

CG2

Uploaded by

KAMWA IMOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CG2

CG2

Uploaded by

KAMWA IMCopyright:

Available Formats

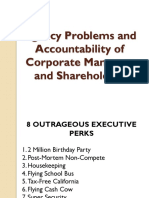

Company: owners (stockholders) & management (self-interested

executives)

Agency problem: self-interested executives take actions benefit

for themselves at shareholders/stockholders’ cost

Agency cost: costs resulting from agency problem

Moral salience: varying degrees of moral salience, depending on

personality, religious convictions, etc.

Corporate Governance: A control mechanism aimed at the

behavior of corporate managers that harm shareholders and

other stakeholders for their own interests.

Shareholder perspective: the primary obligation of organization is

to maximize shareholder value

Stakeholder perspective: organization has a societal obligation

beyond increasing shareholder value

Activist investors: institutional investors, hedge funds and

pension funds become more active to influence management and

board through public campaigns and annual proxy voting process

Private equity firms: low level of independence-board members

have relationships to the company and have interest in

operations. Offer high compensation to senior executives

Proxy advisory firm: increased attention on voting process.

Common Law: a system of jurisprudence based on judicial

precedents rather than statutory laws; originated in the unwritten

laws of England and was later applied in the United States

case law

Civil Law: the legal code of ancient Rome; the body of laws

established by a state or nation for its own regulation

Say-on-pay: shareholders vote on executive compensation

Disclosure: companies disclose executive compensation

Comply or explain: stating reasons for noncompliance is

acceptable

Preference shares: In terms of the order of repayment in the

bankruptcy liquidation of the company’s assets, it ranks after the

debts and has priority over ordinary shares, and secondly, it has

priority over ordinary shares in the order of dividend distribution,

and is usually paid at the pre-arranged dividend rate.

Plurality voting system: directors receive the most votes win,

regardless of majority of votes

Dual-class shares: different shares with different voting rights

(more insider control, public influence weakened)

Majority voting: directors required to receive a majority of votes

to be elected

Cumulative voting: allows shareholder to concentrate votes on a

single board candidate

Corporate Strategy: how a company expects to create long-term

value for shareholders and stakeholders.

Explain Risks to the Business Model

Operational risk – how exposed the company is to disruptions in

its operations

Financial risk – how much the company relies on external

financing

Reputational risk – how much the company protects the value of

its intangible assets, including corporate reputation

Compliance risk – how much the company complies with laws &

regulations that otherwise would damage the firm

You might also like

- Aurora Textile CompanyDocument16 pagesAurora Textile CompanyJesslin Ruslim0% (1)

- CFA Level 3 2012 Guideline AnswersDocument42 pagesCFA Level 3 2012 Guideline AnswersmerrylmorleyNo ratings yet

- Case Analysis: Murphy Stores, Capital ProjectDocument2 pagesCase Analysis: Murphy Stores, Capital Projectariba farrukhNo ratings yet

- Introduction To Corporate GovernanceDocument26 pagesIntroduction To Corporate GovernanceLeah BallesterosNo ratings yet

- Armour - Corporations - 2009F - Allen Kraakman Subramian 3rdDocument153 pagesArmour - Corporations - 2009F - Allen Kraakman Subramian 3rdSimon Hsien-Wen HsiaoNo ratings yet

- Corporate Finance: A Beginner's Guide: Investment series, #1From EverandCorporate Finance: A Beginner's Guide: Investment series, #1No ratings yet

- Chap 011Document44 pagesChap 011Jessica Cola50% (2)

- Agency Problems and Accountability of Corporate Managers and ShareholdersDocument29 pagesAgency Problems and Accountability of Corporate Managers and ShareholdersHarPearl Lie100% (3)

- Corporate Governance ModelsDocument31 pagesCorporate Governance ModelsEeshaa MalikNo ratings yet

- Ba 224 Module 4Document3 pagesBa 224 Module 4Honeylet PangasianNo ratings yet

- Lecture 4 Week 4: Shareholder Rights and Theories of Corporate GovernanceDocument37 pagesLecture 4 Week 4: Shareholder Rights and Theories of Corporate GovernanceDeelan AppaNo ratings yet

- Corporate GovernanceDocument8 pagesCorporate Governanceshaifali pandeyNo ratings yet

- Accounting 2 CorporationsDocument12 pagesAccounting 2 CorporationsAshraf AminNo ratings yet

- Acctg 9 Chap 3 TermsDocument9 pagesAcctg 9 Chap 3 TermsAnjelika ViescaNo ratings yet

- Bahr 1ST ReviewerDocument12 pagesBahr 1ST ReviewerTricia Nicole BahintingNo ratings yet

- Intoduction To Shareholders' Role in Corporate Governance in GeneralDocument15 pagesIntoduction To Shareholders' Role in Corporate Governance in GeneralDelil AhmedNo ratings yet

- New Blog Post Company LawDocument6 pagesNew Blog Post Company Lawbhavitha birdalaNo ratings yet

- Presented by - Parikshit Saha Pankaj Lokesh Randeep Garg Sahil Aggarwal Nishant AdlakhaDocument70 pagesPresented by - Parikshit Saha Pankaj Lokesh Randeep Garg Sahil Aggarwal Nishant AdlakhaRandeep Garg100% (1)

- Corporate Governance, StakeholdersDocument6 pagesCorporate Governance, StakeholdersIbra GrnNo ratings yet

- NotesDocument1 pageNotesBee ChunweiNo ratings yet

- Financial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120Document5 pagesFinancial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120wajid2345No ratings yet

- Acctg 9 Chap 1 TermsDocument8 pagesAcctg 9 Chap 1 TermsAnjelika ViescaNo ratings yet

- Individual Assignement Financial AccountingDocument4 pagesIndividual Assignement Financial AccountingkafilmohammedamineNo ratings yet

- MGMT203 Reviewer Chapter 1Document4 pagesMGMT203 Reviewer Chapter 1April Marie Abadilla CedillaNo ratings yet

- Rights of Shareholders FinalDocument12 pagesRights of Shareholders FinalNaing AungNo ratings yet

- Chapter 1 Fin 2200Document7 pagesChapter 1 Fin 2200cheeseNo ratings yet

- Ba224 Chapter 1Document4 pagesBa224 Chapter 1kim zamoraNo ratings yet

- Corporate Finance SummaryDocument25 pagesCorporate Finance SummaryBrent Heiner100% (1)

- Governance, Risk, and EthicsDocument6 pagesGovernance, Risk, and EthicsbhoomailidNo ratings yet

- General Business Chapter 4Document5 pagesGeneral Business Chapter 4Александра ЖаловагаNo ratings yet

- Chapter 5 CorporationDocument12 pagesChapter 5 CorporationMamaru SewalemNo ratings yet

- Types of Business OwnershipDocument4 pagesTypes of Business OwnershipReillah DeluriaNo ratings yet

- Finance BasicsDocument48 pagesFinance BasicsLee ChiaNo ratings yet

- Joint Stock CompanyDocument12 pagesJoint Stock CompanyKainos GreyNo ratings yet

- Capital FinancingDocument33 pagesCapital FinancingRonell SolijonNo ratings yet

- Presentation On Corporate GovernanceDocument29 pagesPresentation On Corporate Governancesuren471988No ratings yet

- Rights of ShareholderDocument14 pagesRights of ShareholderArya SenNo ratings yet

- Answers To Review QuestionsDocument5 pagesAnswers To Review QuestionsMaria ArshadNo ratings yet

- Chapter 5 UpdatedDocument60 pagesChapter 5 UpdatedXi Bough Esce0% (1)

- Business EthicsDocument86 pagesBusiness EthicsSagar Parekh100% (1)

- Introduction To Corporate Governance: University of Languages and International StudiesDocument19 pagesIntroduction To Corporate Governance: University of Languages and International StudiesHM.No ratings yet

- Corporate GoveranceDocument35 pagesCorporate GoveranceEdomNo ratings yet

- Ordinary Share CapitalDocument7 pagesOrdinary Share CapitalKenneth RonoNo ratings yet

- Business 1.2Document44 pagesBusiness 1.2samerNo ratings yet

- Corporate Governance: By: 1. Kenneth A. Kim John R. Nofsinger and 2. A. C. FernandoDocument51 pagesCorporate Governance: By: 1. Kenneth A. Kim John R. Nofsinger and 2. A. C. FernandoKanganFatimaNo ratings yet

- Question Answered From Corporate Governance - A Book by Christine A. MallinDocument7 pagesQuestion Answered From Corporate Governance - A Book by Christine A. MallinUzzal Sarker - উজ্জ্বল সরকার100% (5)

- Fins3626 NotesDocument3 pagesFins3626 NotesMRML96No ratings yet

- Business Organization Structures, Strategies, and SuccessDocument3 pagesBusiness Organization Structures, Strategies, and SuccessSuhailShaikhNo ratings yet

- Corporations Law OutlineDocument33 pagesCorporations Law OutlineDeVaneyPageNo ratings yet

- Finals Activity No. 3 (LOMA)Document5 pagesFinals Activity No. 3 (LOMA)LOMA, ABIGAIL JOY C.No ratings yet

- Corporation Accounting - IntroductionDocument7 pagesCorporation Accounting - IntroductionErica Calzada50% (2)

- Ventura, Trisha Anne R. Ba2MaDocument5 pagesVentura, Trisha Anne R. Ba2MaTrisha Anne R. VenturaNo ratings yet

- Unit Ii Sources of FinanceDocument30 pagesUnit Ii Sources of FinanceSajal KhatriNo ratings yet

- StocksDocument9 pagesStocksHassan Tahir SialNo ratings yet

- ChatgptDocument17 pagesChatgptArushi PrasharNo ratings yet

- Intro To Corp GovDocument84 pagesIntro To Corp Govarun achariNo ratings yet

- Last ChapterDocument3 pagesLast ChapterCANAN HART REGO SDM COLLEGE OF BUSINESS MANAGEMENT POST GRADUATE CENTRENo ratings yet

- Corporate Governance LawDocument13 pagesCorporate Governance LawNzovwa Mwela ChombaNo ratings yet

- New Blog Post Company LawDocument6 pagesNew Blog Post Company Lawbhavitha birdalaNo ratings yet

- Corporate Governance Part 1Document55 pagesCorporate Governance Part 1swasat duttaNo ratings yet

- Sources of FinanceDocument39 pagesSources of Financenomanameer324No ratings yet

- Fin220 ch1Document22 pagesFin220 ch1अंजनी श्रीवास्तवNo ratings yet

- Lecture 5 - The Law of Associations 3 - Incorporations CTDDocument10 pagesLecture 5 - The Law of Associations 3 - Incorporations CTDShannan RichardsNo ratings yet

- Europa Science & Commerce Academy: Advantages of Joint Stock CompanyDocument4 pagesEuropa Science & Commerce Academy: Advantages of Joint Stock CompanyFaisi PrinceNo ratings yet

- Education: Vineet NagpalDocument1 pageEducation: Vineet NagpalNhật LinhNo ratings yet

- International Financial MarketsDocument13 pagesInternational Financial Marketsmanojpatel5150% (4)

- Petrochemical Margins Chemicals Pta Margins Up by 7% Mom in Mar'18Document3 pagesPetrochemical Margins Chemicals Pta Margins Up by 7% Mom in Mar'18adeelngNo ratings yet

- 120113-DCCBs in Maharashtra by SunilDocument7 pages120113-DCCBs in Maharashtra by SunilGauresh NaikNo ratings yet

- Financial Reporting Week 4Document9 pagesFinancial Reporting Week 4islam hamdyNo ratings yet

- Fixed DepositsDocument1 pageFixed DepositsTiso Blackstar GroupNo ratings yet

- MGT1022 - LSM - Final Project Report - Format - 27.11.2020Document7 pagesMGT1022 - LSM - Final Project Report - Format - 27.11.2020Gokul SrinathNo ratings yet

- FZ5000 Solución Tarea 3 AJ2020Document2 pagesFZ5000 Solución Tarea 3 AJ2020gerardoNo ratings yet

- PHD Thesis On Financial AnalysisDocument10 pagesPHD Thesis On Financial Analysisaliciastoddardprovo100% (2)

- Income Taxation 2023 DiscussionsDocument16 pagesIncome Taxation 2023 DiscussionsKenjay SarcoNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- Investment in AssociateDocument29 pagesInvestment in AssociateAngela RuedasNo ratings yet

- Essential Guide To Stock InvestingDocument19 pagesEssential Guide To Stock Investingleorbalaguru100% (1)

- Kristjan Kullamägi's Streams Mid Nov 2020-8Document13 pagesKristjan Kullamägi's Streams Mid Nov 2020-8Sairam ChandrasekharNo ratings yet

- GTB - Uti Bank Merger StoryDocument15 pagesGTB - Uti Bank Merger StoryAvanti MulayNo ratings yet

- Aurobindo Pharma LTDDocument13 pagesAurobindo Pharma LTDcrazyman2009No ratings yet

- Introduction To International Financial Management: Powerpoint® Lecture PresentationDocument34 pagesIntroduction To International Financial Management: Powerpoint® Lecture PresentationRafiqul Islam100% (2)

- Lucas - Econometric Policy Evaluation, A CritiqueDocument28 pagesLucas - Econometric Policy Evaluation, A CritiqueFederico Perez CusseNo ratings yet

- WEEK 1 Agribusiness and EntrepreneurshipDocument33 pagesWEEK 1 Agribusiness and EntrepreneurshipSITI NUR RASYIDAH BINTI MAZUKINo ratings yet

- Nse-Ncfm-Financial Markets A Beginners ModuleDocument99 pagesNse-Ncfm-Financial Markets A Beginners ModuleJyoti SukhijaNo ratings yet

- Britannia News Issue 47 PDFDocument28 pagesBritannia News Issue 47 PDFBill KelsoNo ratings yet

- Media ManagementDocument37 pagesMedia ManagementRizwan Khan100% (4)

- Sumit MRPDocument95 pagesSumit MRPANIL YADAVNo ratings yet

- Dabur India: Valuations Turn Attractive Upgrade To BuyDocument6 pagesDabur India: Valuations Turn Attractive Upgrade To BuyanirbanmNo ratings yet

- 2020 06b FI Core-Concepts IPSAS 29 PPDocument27 pages2020 06b FI Core-Concepts IPSAS 29 PPFebby Grace SabinoNo ratings yet

- MTP (TVM Questikon)Document11 pagesMTP (TVM Questikon)prashanttiwari155282No ratings yet