Professional Documents

Culture Documents

Module 9-DIRECT FINANCING LEASE - LESSOR

Module 9-DIRECT FINANCING LEASE - LESSOR

Uploaded by

Jeanivyle CarmonaCopyright:

Available Formats

You might also like

- Members' Directory 2023 ICSB FinalDocument228 pagesMembers' Directory 2023 ICSB FinalJoynul Abedin100% (1)

- DTDC ReportDocument30 pagesDTDC ReportSujit_tdNo ratings yet

- Caps Floors CollarsDocument3 pagesCaps Floors CollarsNaga Mani MeruguNo ratings yet

- CSC 201-Leones, Mary Grace O. - IntermediateDocument28 pagesCSC 201-Leones, Mary Grace O. - IntermediateMary Grace Ocampo LeonesNo ratings yet

- AP Quiz Liab2Document4 pagesAP Quiz Liab2maurNo ratings yet

- Topic 3 - LeasesDocument29 pagesTopic 3 - LeasesTUAN NOR ATIKAH TUAN NOOR100% (1)

- Finance Lease - LessorDocument4 pagesFinance Lease - LessorRachel RiveraNo ratings yet

- Week 7 - ch21Document63 pagesWeek 7 - ch21bafsvideo4100% (1)

- Pcpar Insurance ContractDocument2 pagesPcpar Insurance Contractdoora keysNo ratings yet

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganNo ratings yet

- Chapter 2-Notes PayableDocument8 pagesChapter 2-Notes PayableMonique AlarcaNo ratings yet

- Compound Financial InstrumentDocument1 pageCompound Financial InstrumentMarissaNo ratings yet

- C8 (MC) - Cost Accounting by Carter (Part1)Document3 pagesC8 (MC) - Cost Accounting by Carter (Part1)AkiNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts FranchiseDocument12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts FranchiseJM Tomas Rubianes0% (2)

- Pfrs 16 LeasesDocument4 pagesPfrs 16 LeasesR.A.No ratings yet

- Accounting For LeasesDocument3 pagesAccounting For LeasesAsAd MaanNo ratings yet

- ProblemsDocument46 pagesProblemsDan Andrei BongoNo ratings yet

- Module1 - Foreign Currency Transaction and TranslationDocument3 pagesModule1 - Foreign Currency Transaction and TranslationGerome Echano0% (1)

- Provisions and Contingencies SlidesDocument28 pagesProvisions and Contingencies SlidesAinnur Arifah100% (1)

- HANDOUT - Bonds PayableDocument4 pagesHANDOUT - Bonds PayableMarian Augelio PolancoNo ratings yet

- FAR.0732 - Leases PDFDocument16 pagesFAR.0732 - Leases PDFMinie KimNo ratings yet

- Chapter 2-Determinants of Interest RatesDocument2 pagesChapter 2-Determinants of Interest RatesClaire VensueloNo ratings yet

- Chapter 4 LeaseDocument63 pagesChapter 4 Leasesamuel hailu100% (1)

- Practice Problems PPEDocument3 pagesPractice Problems PPEulquira grimamajowNo ratings yet

- Intacc 1 Notes - Financial Assets StartDocument8 pagesIntacc 1 Notes - Financial Assets StartKing BelicarioNo ratings yet

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNo ratings yet

- 2nd Year IntaccDocument14 pages2nd Year IntaccLeslie Faye CabigaoNo ratings yet

- Banking Laws (Atty. Laco)Document41 pagesBanking Laws (Atty. Laco)Neil GloriaNo ratings yet

- Diagnostic Exam Advanced AccountingDocument12 pagesDiagnostic Exam Advanced AccountingNhajNo ratings yet

- Current Liabilities, Provisions and Contingencies UPDATEDDocument82 pagesCurrent Liabilities, Provisions and Contingencies UPDATEDPaolo Perandos100% (2)

- Lease AccountingDocument19 pagesLease Accountinggregory george0% (1)

- Exercises 04 - Intangibles INTACC2 PDFDocument3 pagesExercises 04 - Intangibles INTACC2 PDFKhan TanNo ratings yet

- Lecture Notes On Trade and Other ReceivablesDocument5 pagesLecture Notes On Trade and Other Receivablesjudel ArielNo ratings yet

- Problem: Sorsogon State UniversityDocument3 pagesProblem: Sorsogon State UniversityHector OcampoNo ratings yet

- 16 Property Plant and EquipmentDocument2 pages16 Property Plant and EquipmentRex AdarmeNo ratings yet

- Chapter 8 Dividend Policy and Retained EarningsDocument5 pagesChapter 8 Dividend Policy and Retained EarningsYut YE50% (2)

- Foreign Currency Transactions and TranslationsDocument5 pagesForeign Currency Transactions and TranslationsKenneth PimentelNo ratings yet

- Chapter 12 Electronic Commerce Systems: Accounting Information Systems, 7eDocument50 pagesChapter 12 Electronic Commerce Systems: Accounting Information Systems, 7ecrissille100% (1)

- LTCC Exam PDF FreeDocument5 pagesLTCC Exam PDF FreeMichael Brian TorresNo ratings yet

- Revenue From LTCCDocument2 pagesRevenue From LTCCMarife RomeroNo ratings yet

- Quiz 1 Ia2Document4 pagesQuiz 1 Ia2Angelica NilloNo ratings yet

- Topic 1: Statement of Financial PositionDocument10 pagesTopic 1: Statement of Financial Positionemman neri100% (1)

- Installment Sales (1) aDVACDocument28 pagesInstallment Sales (1) aDVACAdrian Roxas100% (2)

- Revew ExercisesDocument40 pagesRevew Exercisesjose amoresNo ratings yet

- Chapter 2: Introducing Money EssayDocument1 pageChapter 2: Introducing Money EssayhsjhsNo ratings yet

- Bank ReconciliationDocument3 pagesBank Reconciliationp12400No ratings yet

- Options Futures and DerivativesDocument33 pagesOptions Futures and DerivativesSudhir Kumar YadavNo ratings yet

- Finance Lease ReviewerDocument9 pagesFinance Lease Reviewerian_dazoNo ratings yet

- CHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeDocument2 pagesCHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeSeresa EstrellasNo ratings yet

- Accounting For Provisions and Contingent LiabilitiesDocument8 pagesAccounting For Provisions and Contingent LiabilitiesHenry Lister100% (1)

- 41 DepletionDocument5 pages41 DepletionjsemlpzNo ratings yet

- Chapter 4 - Accounting For Other LiabilitiesDocument21 pagesChapter 4 - Accounting For Other Liabilitiesjeanette lampitoc0% (1)

- Chapter 3Document5 pagesChapter 3Julie Neay AfableNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- Ias 24 Related Party DisclosuresDocument3 pagesIas 24 Related Party DisclosurescaarunjiNo ratings yet

- Long Term Construction Quiz PDF FreeDocument4 pagesLong Term Construction Quiz PDF FreeMichael Brian TorresNo ratings yet

- Module 9 - Nonfinancial Assets II - StudentsDocument9 pagesModule 9 - Nonfinancial Assets II - StudentsLuisito CorreaNo ratings yet

- Installment SalesDocument2 pagesInstallment SalesBusiness MatterNo ratings yet

- MAS-42N (Capital Budgeting With Investment Risks - Returns)Document16 pagesMAS-42N (Capital Budgeting With Investment Risks - Returns)saligumba mikeNo ratings yet

- Chapt 23 Current LiabilitiesDocument47 pagesChapt 23 Current LiabilitiesMikaela SamonteNo ratings yet

- Pas 32Document34 pagesPas 32Iris SarigumbaNo ratings yet

- Chapter 13 Ia2Document18 pagesChapter 13 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- Bonds Payable ActivityDocument2 pagesBonds Payable ActivityJeanivyle CarmonaNo ratings yet

- Module 10-SALES TYPE LEASE - LESSORDocument8 pagesModule 10-SALES TYPE LEASE - LESSORJeanivyle CarmonaNo ratings yet

- Module 11-SALE AND LEASEBACKDocument9 pagesModule 11-SALE AND LEASEBACKJeanivyle CarmonaNo ratings yet

- Module 8-OPERATING LESSEE-LESSORDocument5 pagesModule 8-OPERATING LESSEE-LESSORJeanivyle CarmonaNo ratings yet

- Module 2-WARRANTY LIABILITY and PROVISION AND CONTINGENT LIABILITYDocument12 pagesModule 2-WARRANTY LIABILITY and PROVISION AND CONTINGENT LIABILITYJeanivyle CarmonaNo ratings yet

- Module 4-COMPOUND FINANCIAL INSTRUMENTDocument8 pagesModule 4-COMPOUND FINANCIAL INSTRUMENTJeanivyle CarmonaNo ratings yet

- Module 5-NOTE PAYABLE AND DEBT RESTRUCTUREDocument13 pagesModule 5-NOTE PAYABLE AND DEBT RESTRUCTUREJeanivyle Carmona100% (1)

- Module 6-Lessee Accounting - (BASIC PRINCIPLES)Document14 pagesModule 6-Lessee Accounting - (BASIC PRINCIPLES)Jeanivyle CarmonaNo ratings yet

- Module 3-BONDS PAYABLEDocument24 pagesModule 3-BONDS PAYABLEJeanivyle CarmonaNo ratings yet

- Module 7-Lessee Accounting - (OTHER ACCTG ISSUES)Document10 pagesModule 7-Lessee Accounting - (OTHER ACCTG ISSUES)Jeanivyle CarmonaNo ratings yet

- Compound Financial Instrument ActivityDocument2 pagesCompound Financial Instrument ActivityJeanivyle CarmonaNo ratings yet

- Intrusion Detection Systems & HoneypotsDocument33 pagesIntrusion Detection Systems & HoneypotsmanahujaNo ratings yet

- Project Report On Customer Satisfaction Towards LGDocument52 pagesProject Report On Customer Satisfaction Towards LGrajasekar100% (2)

- Anatomia de Un Plan de Negocio - Linda Pinson PDFDocument282 pagesAnatomia de Un Plan de Negocio - Linda Pinson PDFCarolina RuizNo ratings yet

- Dan Webb Concealment GradeDocument2 pagesDan Webb Concealment Gradeapi-565691734No ratings yet

- Aonla Cultivation ProjectDocument6 pagesAonla Cultivation ProjectshrishivankarNo ratings yet

- Jamer Module 3 Foreignization and DomesticationDocument5 pagesJamer Module 3 Foreignization and DomesticationRenzo JamerNo ratings yet

- Ariston As 600 V DryerDocument40 pagesAriston As 600 V DryermmvdlpNo ratings yet

- Richfeel Spa: India, S First Certified TrichologistsDocument26 pagesRichfeel Spa: India, S First Certified TrichologistsArfaan XhAikhNo ratings yet

- Underwood C. P., "HVAC Control Systems, Modelling Analysis and Design" RoutledgeDocument2 pagesUnderwood C. P., "HVAC Control Systems, Modelling Analysis and Design" Routledgeatif shaikhNo ratings yet

- Soy Un Discipulo de JesucristoDocument27 pagesSoy Un Discipulo de JesucristoMaggySUDNo ratings yet

- Automating Inequality - Virginia EubanksDocument223 pagesAutomating Inequality - Virginia EubanksTanmay100% (1)

- IBM Company ProfileDocument2 pagesIBM Company ProfileKalyan SagarNo ratings yet

- Cookie Mining LabDocument5 pagesCookie Mining Labn_johnsenNo ratings yet

- 15A01510 Fluid Mechanics & Hydraulic MachinesDocument2 pages15A01510 Fluid Mechanics & Hydraulic MachinesarunNo ratings yet

- Collins Sentence MemoDocument17 pagesCollins Sentence MemoRoy S. JohnsonNo ratings yet

- Notice No. 320 (B) (Regarding Online Classes)Document2 pagesNotice No. 320 (B) (Regarding Online Classes)Ayush DubeyNo ratings yet

- Fiber Post Vs Metal PostDocument13 pagesFiber Post Vs Metal PostOdontología UnibeNo ratings yet

- Leon Battista Alberti - Sebastino Serlio - Giacomo Barozzi Da Vignola - Andrea Palladio - Philibert de L'ormeDocument32 pagesLeon Battista Alberti - Sebastino Serlio - Giacomo Barozzi Da Vignola - Andrea Palladio - Philibert de L'ormeYsabelle Marie FuentesNo ratings yet

- Koontz, Dean - Fear That ManDocument73 pagesKoontz, Dean - Fear That Mancbirleanu1963No ratings yet

- Learning Agreement During The MobilityDocument3 pagesLearning Agreement During The MobilityVictoria GrosuNo ratings yet

- Pienaar Savic Accepted MsDocument32 pagesPienaar Savic Accepted MsEl LuchoNo ratings yet

- Utilization of Space PDFDocument426 pagesUtilization of Space PDFDiksha DubeyNo ratings yet

- SK Z3 2022 BudgetDocument2 pagesSK Z3 2022 Budgetgenesis tolibasNo ratings yet

- 723PLUS Digital Control - WoodwardDocument40 pages723PLUS Digital Control - WoodwardMichael TanNo ratings yet

- Self WorthDocument5 pagesSelf WorthSav chan123No ratings yet

- Essentials of Comparative Politics 4th Edition Oneil Test BankDocument8 pagesEssentials of Comparative Politics 4th Edition Oneil Test Bankrobertjarvismdqarpsxdjnc100% (16)

- Messianic Theology and Christian Faith - G. A. RigganDocument206 pagesMessianic Theology and Christian Faith - G. A. RigganLucianaNo ratings yet

- Annotated BibliographyDocument4 pagesAnnotated Bibliographyapi-302549909No ratings yet

Module 9-DIRECT FINANCING LEASE - LESSOR

Module 9-DIRECT FINANCING LEASE - LESSOR

Uploaded by

Jeanivyle CarmonaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 9-DIRECT FINANCING LEASE - LESSOR

Module 9-DIRECT FINANCING LEASE - LESSOR

Uploaded by

Jeanivyle CarmonaCopyright:

Available Formats

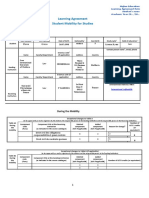

NEW BRIGHTON SCHOOL OF THE PHILIPPINES, Inx`C.

Module No. 9

Subject: Intermediate Accounting 2 Date of Submission: ____________

Name of Student: __________________________________________________

Course and Year: __________________________________________________

Semester and School Year: __________________________________________

FINANCE LEASE CLASSIFICATION

On the part of the lessor, a finance lease is either:

a. Direct financing

b. Sales type lease

The main distinction between the two is the presence or absence of manufacturer or dealer profit or loss. A direct

financing lease recognizes only interest income. A sales type lease recognizes interest income and gross profit on sale.

Direct financing lease

The lessor in a direct financing lease is actually engaged in the financing business. Thus, a direct financing lease is an

arrangement between a financing entity and a lessee. The income of the lessor is only in the form of interest income.

No dealer profit is recognized because the fair value and the cost of the asset are equal.

Accounting consideration

a. Gross investment – this is equal to the gross rentals for the entire lease term plus the absolute amount of the

residual value, whether guaranteed or unguaranteed.

b. Net investment in the lease – This is equal to the cost of the asset plus any initial direct cost paid by the lessor.

c. Unearned interest income – This is the difference between the gross investment and net investment in the lease.

d. Initial direct cost – in a direct financing lease, the initial direct cost paid by the lessor is added to the cost of the

asset to get the net investment in the lease.

The initial direct cost would effectively spread the initial direct cost over the lease term and reduce the amount of

interest income.

Illustration – Direct financing lease

On January 1, 2020, Lessor Company leased a machinery to another entity with the following details:

Cost of machinery 1,518,650

Annual rental payable at the end of each year 500,000

Lease term 4 years

Useful life of machinery 4 years

Implicit interest rate 12%

Present value of annuity of 1 for 4 years at 12% 3.0373

The initial problem is the determination of the annual rental which will give the lessor a fair rate of return on the net

investment in the lease.

The procedure is to divide the “net investment in the lease to be recorded from rental” by present value factor of an

annuity of 1 for a number of periods using a desired rate of return to get annual rental.

Computation

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 1

By the present value factor, The annual rate is computed by dividing the amount of P1,5,18,650 by the present value

factor, 3.0373, of an annuity of 1 for 4 years at 12%, or P500,000.

Gross rentals or lease receivable (500,000 x 4 years) 2,000,000

Present value of gross rentals (equal to the net investment in the lease of

Cost of the machinery) 1,518,650

Unearned interest income 481,350

Lease liability 2,000,000

Machinery 1,518,650

Unearned interest income 481,350

The annual collection of the rental is recorded as follows:

Cash 500,000

Lease receivable 500,000

Table of amortization

The unearned interest income of P481,350 is recognized over the lease term following the effective interest method.

Date Payment Interest Principal Present value

Jan. 1, 2020 1,518,650

Dec. 31, 2020 500,000 182,238 317,762 1,200,888

Dec. 31, 2021 500,000 144,107 355,893 844,995

Dec. 31, 2022 500,000 101,399 398,601 446,394

Dec. 31, 2023 500,000 53,606 446,394 -

Payment represents the annual rental.

Interest is equal to the preceding present value times the interest rate. Thus, for 2020, P1,518,650 times 12% equals

P317,762.

Principal is the portion of the rental payment after deducting the interest. Thus, for 2020, P500,000 minus P182,238

equals P317,762.

Present value is the balance of the present value after deducting the principal payment.

Thus, on December 31,2020, P1,518,650 minus P317,762 equals P1,200,888.

Recognition of interest income

The effective interest method is used in recognizing interest income. IFRS 16, paragraph 75, states that the lessor shall

recognize finance income over the lease term based on a pattern reflecting a constant periodic rate of return on the

lessor’s net investment in the lease.

2020

Dec. 31 Unearned interest income 182,238

Interest income 182,238

2021

Dec. 31 Unearned interest income 144,107

Interest income 144,107

Direct financing lease – with initial direct cost

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 2

On January 1. 2020, Lessor Company leased a machinery to another entity with the following details:

Cost of machinery 1,518,650

Annual rental payable at the end of each year 500,000

Lease term 4 years

Useful life of machinery 4 years

Implicit interest rate 12%

Present value of annuity of 1 for 4 years at 12% 3.0373

On January 1, 2020, Lessor Company paid initial direct cost of P66,300.

The initial direct cost is added to the cost of the machinery to determine the net investment in the lease.

Cost of machinery 1,518,650

Initial direct cost 66,300

Net investment in the lease 1,584,950

The conclusion of initial direct cost in the net investment in lease will have the effect of spreading the initial direct cost

over the lease term and reduced the interest income from the finance lease.

Gross rentals 2,000,000

Net investment in the lease 1,584,950

Unearned interest income 415,050

Consequently, the initial direct cost would decrease implicit interest rate in the lease.

The problem therefore is the determination of the reduced implicit interest rate.

The original implicit interest rate of 12% cannot be applied anymore because of the added initial direct cost.

Computation of new implicit rate

The new implicit rate is computed by trial and error or through the interpolation process.

The new interest rate is definitely lower than 12% and it could be 11%, 10% or 9%.

The procedure is determine the present value of gross rentals that would equate the net investment in the lease of

P1,584,950 using a particular rate.

Using 11% the present value of an ordinary of 1 at 11% for 4 periods is 3.1024.

Thus, the present value of gross rentals is equal to P500,000 multiplied by 3.1024 or P 1,551,200.

This amount is not the same as the net investment in the lease. The new interest rate is not 11%.

Using 10%, the present value of an ordinary annuity of 1 at 10% for 4 periods is 3.1699.

Thus, the present value of gross rentals is equal to P500,000 multiplied by 3.1699 or P1,584,950.

Coincidentally, this amount is the same as the net investment in the lease.

In conclusion, the new interest rate is 10%.

Accordingly, the reduce interest rate of 10% is used in determining the annual interest income.

Journal entries

Machinery (initial direct cost) 66,300

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 3

Cash 66,300

Lease receivable 2,000,000

Machinery 1,584,950

Unearned interest income 415,050

The annual collection of the rental is recorded as:

Cash 500,000

Lease receivable 500,000

The unearned interest income of P415,050 is recognized as income over the lease term following the effective interest

method of amortization.

Table of amortization

Date Payment Interest Principal Present Value

Jan. 1, 2020 1,584,950

Dec. 31, 2020 500,000 158,495 341,505 1,243,445

Dec. 31, 2021 500,000 124,344 375,656 867,789

Dec. 31, 2022 500,000 86,779 413,221 454,568

Dec. 31, 2023 500,000 45,432 454,568 -

Payment represent the annual rental.

Interest is equal to the preceding present value times the interest rate.

Thus, for 2020, P1,584,950 times 10% equals P158,495.

Principal is the portion of the rental payment after deducting the interest.

Thus, for 2020, P500,000 minus P518,495 equals P341,505.

Present value is the balance of the preceding value after deducting the principal payment.

Thus, on December 31,2020 P1,584,950 minus P341,505 equals P1,243,445.

Journal entries

The recognition of interest income for the first two years is recorded as:

2020

December 31 Unearned interest income 158,495

Interest income 158,495

2021

December 31 Unearned interest income 124,334

Interest income 124,334

If a statement of financial position is prepared by the lessor on December 31, 2020, the lease receivable of P1,500,000

would be reported as partly current and partly noncurrent.

Current portion

Lease receivable 500,000

Unearned interest income (124,344)

Carrying amount 375,656

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 4

Noncurrent portion

Lease receivable 1,000,000

Unearned interest income (132,211)

Carrying amount 867,789

IFRS 16, paragraph 67, states that lessor shall recognize assets held under a finance lease as a receivable at an amount

equal to the net investment in the lease.

Note that the unearned interest income which is realizable within one year from December 31, 2020 is deducted from

the current lease receivable.

The remaining portion is deducted from the concurrent lease receivable.

Unearned interest income 415,050

Realized in 2020 (see table) 158,495

Balance, December 31, 2020 256,555

Realizable in 2021 124,344

Realizable beyond 2021 132,211

Direct financing lease – with residual value

On January 1, 2020, Lessor Company leased a machinery to another entity with the following details:

Cost of machinery 3,194,410

Residual value 500,000

Useful life and lease term 4 years

Implicit interest rate 10%

The machinery will revert to the lessor at the end of the lease term because there is neither a transfer of title nor a

purchase option.

The problem is the determination of the annual rental. The annual rental is payable at the end of each year with the first

payment on December 31, 2020. The relevant present value factors are:

PV of at 10% for 4 periods .683

PV of an ordinary annuity of at 10% for 4 periods 3.1699

Cost of machinery 3,194,410

Present value of residual value (500,000 x .683) ( 341,500)

Net investment to be recovered from rental 2,852,910

Divide by PV of an ordinary annuity of at 1 at 10% for 4 periods 3.1699

Annual rental 900,000

Note that the present value of the residual is deducted from the cost of the asset if the machinery will revert to the

lessor at the end of the lease term.

Otherwise, if the machinery will not revert to the lessor at the end of the lease term, the residual value is completely

ignored.

Gross rental (900,000 x 4) 3,600,000

Residual value (whether guaranteed or unguaranteed) 500,000

Gross investment 4,100,000

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 5

Cost of machinery- net investment (3,194,410)

Unearned interest income 905,590

Table of amortization

Date Payment Interest Principal Present Value

1/1/2020 3,194,410

12/31/2020 900,000 319,441 580,559 2,613,851

12/31/2021 900,000 261,385 638,615 1,975,236

12/31/2022 900,000 197,524 702,476 1,272,760

12/31/2023 900,000 127,240 772,760 500,000

Interest is equal to the preceding present value times the interest rate. Thus, for 2020, P3,194,410 times 10% equals

P319,441.

Principal is the portion of the rental asset after deducting interest.

Thus, for 2020, P900,000 minus P319,441 equals P580,559.

Present value equals the balance of the present value minus the principal payment.

Thus, on December 31, 2020, P3,194,410 minus P580,559 equals P2,613,851.

Journal entries for 2020

1. To record the direct financing lease:

Lease receivable 4,100,000

Machinery 3,194,410

Unearned interest income 905,590

2. To record the collection of annual rental:

Cash 900,000

Lease receivable 900,000

3. To record interest income:

Unearned interest income 319,441

Interest income 319,441

When the lease expires on December 31, 2023, the machinery will revert to the lessor.

Whether “guaranteed” or “unguaranteed”, the entry on the book of the lessor will be the same.

Machinery 500,000

Lease receivable 500,000

Accounting problem

The accounting problem is when the fair value of the machinery is P400,000 which is Lower than the residual value of

P500,000.

Under the guaranteed scenario, the lessee will pay the difference. The journal entry of the lessor is:

Cash 100,000

Machinery 400,000

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 6

Lease Receivable 500,000

Direct financing lease – with residual value

On January 1, 2020, Lessor Company leased a machinery to another entity with the following details:

Cost of machinery 3,700,100

Residual value guarantee 400,000

Useful life and lease term 4 years

Implicit interest rate 10%

The annual rental is payable in advance on January 1 of each year starting January 1, 2020.

Since the residual value is guaranteed, the machinery will revert to the lessor at the end of the lease term.

The relevant present value factors are:

Present value of 1 at 10% for 4 periods 0.6830

Present value of an annuity of 1 in advance at 10% for 4 periods 3.4869

Computation of annual rental

Cost of machinery 3,760,100

Present value of residual value(400,000 x .683) (273,200)

Net investment to be recovered from rental 3,486,900

Divide by PV of annuity of 1 in advance at 10% for 4 periods 3.4869

Annual rental 1,000,000

Note that the rental is payable in advance at the beginning of each year. Thus, the “annuity of 1 in advance factor” is

used in the computation.

Gross rentals (1,000,000 x 4 years ) 4,000,000

Residual value – guaranteed 400,000

Gross investment 4,400,000

Net investment – cost of machinery 3,760,100

Unearned interest income 639,900

Date Payment Interest Principal Present Value

1/1/2020 3,760,100

1/1/2020 1,000,000 - 1,000,000 2,760,100

1/1/2021 1,000,000 276,010 723,990 2,036,110

1/1/2022 1,000,000 203,611 796,389 1,239,721

1/1/2023 1,000,000 123,972 876,028 363,693

1/1/2024 400,000 36,307 363,693 -

Interest is equal to the preceding present value times the interest rate. The first rental payment on January 1, 2020

pertains to principal only.

Thus, on January 1, 2021, the interest is equal to P2,760,100 times 10% or P276,010. This interest income pertains to

2020.

Principal is the portion of rental payment minus the interest. Thus on January 1, 2021, P1,000,000 minus P276,010

equals P723,990.

Present value is the balance of the present value minus the principal payment.

Thus, on January 1, 2021 P2,760,100 minus P723,990 equals 2,036,110.

Journal entries

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 7

2020

Jan. 1 Lease receivable 4,400,000

Machinery 3,760,100

Unearned interest income 639,900

1 Cash 1,000,000

Lease receivable 1,000,000

Dec. 31 Unearned interest income 276,010

Interest income 276,010

2021

Jan. 1 Cash 1,000,000

Lease receivable 1,000,000

Dec. 31 Unearned interest income 203,611

Interest income 203,611

2022

Jan. 1 Cash 1,000,000

Lease receivable 1,000,000

Dec. 31 Unearned interest income 123,972

Interest income 123,972

2023

Jan. 1 Cash 1,000,000

Lease receivable 1,000,000

Dec. 31 Unearned interest income 36,307

Interest income 36,307

2024

Jan. 1 On this date, deferred value of the machinery is P300,000 only. Since

the guaranteed residual value is P400,000, the lessee will pay for the

differences of P100,000.

Cash 100,000

Machinery 300,000

Lease receivable 400,000

Direct financing lease – transfer of title to lessee

On January 1, 2020, Lessor Company leased a machinery to another entity with the following details:

Cost of machinery 3,449,600

Residual value 500,000

Useful life and lease term 5 years

Implicit interest rate 8%

The annual rental payable in advance on January 1 of each year starting January 1, 2020. The lease provides for a

transfer of title to the lessee at the end of the lease term.

The present value of an annuity of 1 in advance at 8% for 5 periods is 4.312.

Cost of machinery to be recovered from rental 3,449,600

Divide by PV of annuity of 1 in advance at 8% for 5 periods 4,312

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 8

Annual rental 800,000

Note well that if the machinery will not revert to the lessor at the of the lease term because the lease provide for a

transfer of title to the lessee, the residual value is completely ignored in the computation of the annual rental and the

unearned interest income.

Note also that the rental is payable in advance.

Thus, the annuity of 1 in advance or annuity due factor is used in the computation.

Gross rental (800,000 x 5 years) 4,000,000

Net investment – cost of machinery 3,449,600

Unearned interest income 550,400

Table of amortization

Date Payment Interest Principal Present Value

1/1/2020 3,449,600

1/1/2020 800,000 - 800,000 2,649,600

1/1/2021 800,000 211,968 588,032 2,061,568

1/1/2022 800,000 164,925 635,075 1,426,493

1/1/2023 800,000 114,119 685,881 740,612

1/1/2024 800,000 59,388 740,612 -

Interest is equal to the preceding present value times the interest rate. The first rental payment on January 1,2020

pertains to principal only. Thus, on January 1, 2021 the interest is equal to P2,649,600 times 8% or P211,968. This

interest income pertains to 2020/

Principal is the portion of the rental payment minus the interest. Thus, on January 1, 2021, P800,000 minus P211,968

equals P588,032.

Present value is the balance of the present value minus the principal payment. Thus, January 2021, P2,649,600 minus

P588,032 equals P2,061,568.

2020

Jan. 1 Lease receivable 4,000,000

Machinery 3,449,600

Unearned interest income 550,400

1 Cash 800,000

Lease receivable 800,000

Dec. 31 Unearned interest income 211,968

Interest income 211,968

2021

Jan. 1 Cash 800,000

Lease receivable 800,000

Dec. 31 Unearned interest income 164,925

Interest income 164,925

References

Valix, C. & Valix, C.A. (2018). Practical Accounting 1 vol 2. GIC Enterprises and Co., Inc. Manila, Philippines

Valix, C. & Valix, C.A. (2013). Theory of Accounts 2013 edition. GIC Enterprises and Co., Inc. Manila, Philippines

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 9

Valix, C. Valix, C.A. (2019). Financial Accounting and Reporting vol 2. GIC Enterprises and Co., Inc. Manila,

Philippines

Robles, N. & Empleo P. (2016). The Intermediate Accounting Series Vol 2. Millenium Books, Inc., Mandaluyong City

Uberita, C. (2012). Practical Accounting 1 2013 Edition. GIC Enterprises and Co, Inc. Manila, Philippines

Testbanks and CPA Examination Reviewers

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 10

You might also like

- Members' Directory 2023 ICSB FinalDocument228 pagesMembers' Directory 2023 ICSB FinalJoynul Abedin100% (1)

- DTDC ReportDocument30 pagesDTDC ReportSujit_tdNo ratings yet

- Caps Floors CollarsDocument3 pagesCaps Floors CollarsNaga Mani MeruguNo ratings yet

- CSC 201-Leones, Mary Grace O. - IntermediateDocument28 pagesCSC 201-Leones, Mary Grace O. - IntermediateMary Grace Ocampo LeonesNo ratings yet

- AP Quiz Liab2Document4 pagesAP Quiz Liab2maurNo ratings yet

- Topic 3 - LeasesDocument29 pagesTopic 3 - LeasesTUAN NOR ATIKAH TUAN NOOR100% (1)

- Finance Lease - LessorDocument4 pagesFinance Lease - LessorRachel RiveraNo ratings yet

- Week 7 - ch21Document63 pagesWeek 7 - ch21bafsvideo4100% (1)

- Pcpar Insurance ContractDocument2 pagesPcpar Insurance Contractdoora keysNo ratings yet

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganNo ratings yet

- Chapter 2-Notes PayableDocument8 pagesChapter 2-Notes PayableMonique AlarcaNo ratings yet

- Compound Financial InstrumentDocument1 pageCompound Financial InstrumentMarissaNo ratings yet

- C8 (MC) - Cost Accounting by Carter (Part1)Document3 pagesC8 (MC) - Cost Accounting by Carter (Part1)AkiNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts FranchiseDocument12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts FranchiseJM Tomas Rubianes0% (2)

- Pfrs 16 LeasesDocument4 pagesPfrs 16 LeasesR.A.No ratings yet

- Accounting For LeasesDocument3 pagesAccounting For LeasesAsAd MaanNo ratings yet

- ProblemsDocument46 pagesProblemsDan Andrei BongoNo ratings yet

- Module1 - Foreign Currency Transaction and TranslationDocument3 pagesModule1 - Foreign Currency Transaction and TranslationGerome Echano0% (1)

- Provisions and Contingencies SlidesDocument28 pagesProvisions and Contingencies SlidesAinnur Arifah100% (1)

- HANDOUT - Bonds PayableDocument4 pagesHANDOUT - Bonds PayableMarian Augelio PolancoNo ratings yet

- FAR.0732 - Leases PDFDocument16 pagesFAR.0732 - Leases PDFMinie KimNo ratings yet

- Chapter 2-Determinants of Interest RatesDocument2 pagesChapter 2-Determinants of Interest RatesClaire VensueloNo ratings yet

- Chapter 4 LeaseDocument63 pagesChapter 4 Leasesamuel hailu100% (1)

- Practice Problems PPEDocument3 pagesPractice Problems PPEulquira grimamajowNo ratings yet

- Intacc 1 Notes - Financial Assets StartDocument8 pagesIntacc 1 Notes - Financial Assets StartKing BelicarioNo ratings yet

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNo ratings yet

- 2nd Year IntaccDocument14 pages2nd Year IntaccLeslie Faye CabigaoNo ratings yet

- Banking Laws (Atty. Laco)Document41 pagesBanking Laws (Atty. Laco)Neil GloriaNo ratings yet

- Diagnostic Exam Advanced AccountingDocument12 pagesDiagnostic Exam Advanced AccountingNhajNo ratings yet

- Current Liabilities, Provisions and Contingencies UPDATEDDocument82 pagesCurrent Liabilities, Provisions and Contingencies UPDATEDPaolo Perandos100% (2)

- Lease AccountingDocument19 pagesLease Accountinggregory george0% (1)

- Exercises 04 - Intangibles INTACC2 PDFDocument3 pagesExercises 04 - Intangibles INTACC2 PDFKhan TanNo ratings yet

- Lecture Notes On Trade and Other ReceivablesDocument5 pagesLecture Notes On Trade and Other Receivablesjudel ArielNo ratings yet

- Problem: Sorsogon State UniversityDocument3 pagesProblem: Sorsogon State UniversityHector OcampoNo ratings yet

- 16 Property Plant and EquipmentDocument2 pages16 Property Plant and EquipmentRex AdarmeNo ratings yet

- Chapter 8 Dividend Policy and Retained EarningsDocument5 pagesChapter 8 Dividend Policy and Retained EarningsYut YE50% (2)

- Foreign Currency Transactions and TranslationsDocument5 pagesForeign Currency Transactions and TranslationsKenneth PimentelNo ratings yet

- Chapter 12 Electronic Commerce Systems: Accounting Information Systems, 7eDocument50 pagesChapter 12 Electronic Commerce Systems: Accounting Information Systems, 7ecrissille100% (1)

- LTCC Exam PDF FreeDocument5 pagesLTCC Exam PDF FreeMichael Brian TorresNo ratings yet

- Revenue From LTCCDocument2 pagesRevenue From LTCCMarife RomeroNo ratings yet

- Quiz 1 Ia2Document4 pagesQuiz 1 Ia2Angelica NilloNo ratings yet

- Topic 1: Statement of Financial PositionDocument10 pagesTopic 1: Statement of Financial Positionemman neri100% (1)

- Installment Sales (1) aDVACDocument28 pagesInstallment Sales (1) aDVACAdrian Roxas100% (2)

- Revew ExercisesDocument40 pagesRevew Exercisesjose amoresNo ratings yet

- Chapter 2: Introducing Money EssayDocument1 pageChapter 2: Introducing Money EssayhsjhsNo ratings yet

- Bank ReconciliationDocument3 pagesBank Reconciliationp12400No ratings yet

- Options Futures and DerivativesDocument33 pagesOptions Futures and DerivativesSudhir Kumar YadavNo ratings yet

- Finance Lease ReviewerDocument9 pagesFinance Lease Reviewerian_dazoNo ratings yet

- CHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeDocument2 pagesCHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeSeresa EstrellasNo ratings yet

- Accounting For Provisions and Contingent LiabilitiesDocument8 pagesAccounting For Provisions and Contingent LiabilitiesHenry Lister100% (1)

- 41 DepletionDocument5 pages41 DepletionjsemlpzNo ratings yet

- Chapter 4 - Accounting For Other LiabilitiesDocument21 pagesChapter 4 - Accounting For Other Liabilitiesjeanette lampitoc0% (1)

- Chapter 3Document5 pagesChapter 3Julie Neay AfableNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- Ias 24 Related Party DisclosuresDocument3 pagesIas 24 Related Party DisclosurescaarunjiNo ratings yet

- Long Term Construction Quiz PDF FreeDocument4 pagesLong Term Construction Quiz PDF FreeMichael Brian TorresNo ratings yet

- Module 9 - Nonfinancial Assets II - StudentsDocument9 pagesModule 9 - Nonfinancial Assets II - StudentsLuisito CorreaNo ratings yet

- Installment SalesDocument2 pagesInstallment SalesBusiness MatterNo ratings yet

- MAS-42N (Capital Budgeting With Investment Risks - Returns)Document16 pagesMAS-42N (Capital Budgeting With Investment Risks - Returns)saligumba mikeNo ratings yet

- Chapt 23 Current LiabilitiesDocument47 pagesChapt 23 Current LiabilitiesMikaela SamonteNo ratings yet

- Pas 32Document34 pagesPas 32Iris SarigumbaNo ratings yet

- Chapter 13 Ia2Document18 pagesChapter 13 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- Bonds Payable ActivityDocument2 pagesBonds Payable ActivityJeanivyle CarmonaNo ratings yet

- Module 10-SALES TYPE LEASE - LESSORDocument8 pagesModule 10-SALES TYPE LEASE - LESSORJeanivyle CarmonaNo ratings yet

- Module 11-SALE AND LEASEBACKDocument9 pagesModule 11-SALE AND LEASEBACKJeanivyle CarmonaNo ratings yet

- Module 8-OPERATING LESSEE-LESSORDocument5 pagesModule 8-OPERATING LESSEE-LESSORJeanivyle CarmonaNo ratings yet

- Module 2-WARRANTY LIABILITY and PROVISION AND CONTINGENT LIABILITYDocument12 pagesModule 2-WARRANTY LIABILITY and PROVISION AND CONTINGENT LIABILITYJeanivyle CarmonaNo ratings yet

- Module 4-COMPOUND FINANCIAL INSTRUMENTDocument8 pagesModule 4-COMPOUND FINANCIAL INSTRUMENTJeanivyle CarmonaNo ratings yet

- Module 5-NOTE PAYABLE AND DEBT RESTRUCTUREDocument13 pagesModule 5-NOTE PAYABLE AND DEBT RESTRUCTUREJeanivyle Carmona100% (1)

- Module 6-Lessee Accounting - (BASIC PRINCIPLES)Document14 pagesModule 6-Lessee Accounting - (BASIC PRINCIPLES)Jeanivyle CarmonaNo ratings yet

- Module 3-BONDS PAYABLEDocument24 pagesModule 3-BONDS PAYABLEJeanivyle CarmonaNo ratings yet

- Module 7-Lessee Accounting - (OTHER ACCTG ISSUES)Document10 pagesModule 7-Lessee Accounting - (OTHER ACCTG ISSUES)Jeanivyle CarmonaNo ratings yet

- Compound Financial Instrument ActivityDocument2 pagesCompound Financial Instrument ActivityJeanivyle CarmonaNo ratings yet

- Intrusion Detection Systems & HoneypotsDocument33 pagesIntrusion Detection Systems & HoneypotsmanahujaNo ratings yet

- Project Report On Customer Satisfaction Towards LGDocument52 pagesProject Report On Customer Satisfaction Towards LGrajasekar100% (2)

- Anatomia de Un Plan de Negocio - Linda Pinson PDFDocument282 pagesAnatomia de Un Plan de Negocio - Linda Pinson PDFCarolina RuizNo ratings yet

- Dan Webb Concealment GradeDocument2 pagesDan Webb Concealment Gradeapi-565691734No ratings yet

- Aonla Cultivation ProjectDocument6 pagesAonla Cultivation ProjectshrishivankarNo ratings yet

- Jamer Module 3 Foreignization and DomesticationDocument5 pagesJamer Module 3 Foreignization and DomesticationRenzo JamerNo ratings yet

- Ariston As 600 V DryerDocument40 pagesAriston As 600 V DryermmvdlpNo ratings yet

- Richfeel Spa: India, S First Certified TrichologistsDocument26 pagesRichfeel Spa: India, S First Certified TrichologistsArfaan XhAikhNo ratings yet

- Underwood C. P., "HVAC Control Systems, Modelling Analysis and Design" RoutledgeDocument2 pagesUnderwood C. P., "HVAC Control Systems, Modelling Analysis and Design" Routledgeatif shaikhNo ratings yet

- Soy Un Discipulo de JesucristoDocument27 pagesSoy Un Discipulo de JesucristoMaggySUDNo ratings yet

- Automating Inequality - Virginia EubanksDocument223 pagesAutomating Inequality - Virginia EubanksTanmay100% (1)

- IBM Company ProfileDocument2 pagesIBM Company ProfileKalyan SagarNo ratings yet

- Cookie Mining LabDocument5 pagesCookie Mining Labn_johnsenNo ratings yet

- 15A01510 Fluid Mechanics & Hydraulic MachinesDocument2 pages15A01510 Fluid Mechanics & Hydraulic MachinesarunNo ratings yet

- Collins Sentence MemoDocument17 pagesCollins Sentence MemoRoy S. JohnsonNo ratings yet

- Notice No. 320 (B) (Regarding Online Classes)Document2 pagesNotice No. 320 (B) (Regarding Online Classes)Ayush DubeyNo ratings yet

- Fiber Post Vs Metal PostDocument13 pagesFiber Post Vs Metal PostOdontología UnibeNo ratings yet

- Leon Battista Alberti - Sebastino Serlio - Giacomo Barozzi Da Vignola - Andrea Palladio - Philibert de L'ormeDocument32 pagesLeon Battista Alberti - Sebastino Serlio - Giacomo Barozzi Da Vignola - Andrea Palladio - Philibert de L'ormeYsabelle Marie FuentesNo ratings yet

- Koontz, Dean - Fear That ManDocument73 pagesKoontz, Dean - Fear That Mancbirleanu1963No ratings yet

- Learning Agreement During The MobilityDocument3 pagesLearning Agreement During The MobilityVictoria GrosuNo ratings yet

- Pienaar Savic Accepted MsDocument32 pagesPienaar Savic Accepted MsEl LuchoNo ratings yet

- Utilization of Space PDFDocument426 pagesUtilization of Space PDFDiksha DubeyNo ratings yet

- SK Z3 2022 BudgetDocument2 pagesSK Z3 2022 Budgetgenesis tolibasNo ratings yet

- 723PLUS Digital Control - WoodwardDocument40 pages723PLUS Digital Control - WoodwardMichael TanNo ratings yet

- Self WorthDocument5 pagesSelf WorthSav chan123No ratings yet

- Essentials of Comparative Politics 4th Edition Oneil Test BankDocument8 pagesEssentials of Comparative Politics 4th Edition Oneil Test Bankrobertjarvismdqarpsxdjnc100% (16)

- Messianic Theology and Christian Faith - G. A. RigganDocument206 pagesMessianic Theology and Christian Faith - G. A. RigganLucianaNo ratings yet

- Annotated BibliographyDocument4 pagesAnnotated Bibliographyapi-302549909No ratings yet