Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

27 viewsHomework Artsy Ceramics Solutions 2

Homework Artsy Ceramics Solutions 2

Uploaded by

Thi Van Anh VU1. Elvina deposited $120,000 into a bank account to start her business Artsy Ceramics.

2. She bought three vans for $100,000, paying $30,000 in cash and financing the rest with a bank loan.

3. Various operating expenses were paid throughout the month, including rent, equipment, wages, and vehicle maintenance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Solution Manual For Macroeconomics 16th Canadian Edition Christopher T S RaganDocument14 pagesSolution Manual For Macroeconomics 16th Canadian Edition Christopher T S RaganCharlesOrtizmryi100% (44)

- Vocabulary by Aytan IsmayilzadaDocument26 pagesVocabulary by Aytan Ismayilzadanazrinxalilova2000No ratings yet

- TK03 Aks Liana DamayantiDocument7 pagesTK03 Aks Liana DamayantiLiana DamayantiNo ratings yet

- Tan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMDocument6 pagesTan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMvanessaNo ratings yet

- CXC Principles of Accounts Past Papers May 2012Document8 pagesCXC Principles of Accounts Past Papers May 2012BrandySterlingNo ratings yet

- Motorola Communication StructureDocument25 pagesMotorola Communication Structureyo5208No ratings yet

- Sternberg Press - May 2018Document4 pagesSternberg Press - May 2018ArtdataNo ratings yet

- 1Document2 pages1Your MaterialsNo ratings yet

- Exercises Chapter 5 Group 4Document18 pagesExercises Chapter 5 Group 4Phạm Ngọc Uyên NhiNo ratings yet

- Solution 2.1: Indicate, by Circling The Correct Classification, Whether Each of The Following Are Assets or LiabilitiesDocument7 pagesSolution 2.1: Indicate, by Circling The Correct Classification, Whether Each of The Following Are Assets or Liabilitiesshafqat aliNo ratings yet

- Susquehanna Equipment RentalsDocument17 pagesSusquehanna Equipment RentalsFaiza SattiNo ratings yet

- Refresher Journal-Entries SundayDocument2 pagesRefresher Journal-Entries SundayAdolph Christian GonzalesNo ratings yet

- Answer FarDocument5 pagesAnswer Farpsvg4n8fbhNo ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- S. Roces Answer To Journal EntryDocument4 pagesS. Roces Answer To Journal EntryChoco LebbyNo ratings yet

- Fabm Sample Exercises With Answer KeyDocument7 pagesFabm Sample Exercises With Answer KeySg Dimz100% (1)

- Week 2 Tutorial Question 2 - Double Entry SolutionDocument2 pagesWeek 2 Tutorial Question 2 - Double Entry SolutionDragosNo ratings yet

- B Printer Limited Prepare Income Statement As Per The Schedule IV ofDocument1 pageB Printer Limited Prepare Income Statement As Per The Schedule IV ofYashi710100% (1)

- Partnership Dissolution: Accounting EntriesDocument4 pagesPartnership Dissolution: Accounting EntriesTawanda Tatenda HerbertNo ratings yet

- Piecemeal DistributionDocument5 pagesPiecemeal DistributionYashfeen HakimNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- S. Y. B Com - Accounts: Piecemeal Distribution 2016-17Document5 pagesS. Y. B Com - Accounts: Piecemeal Distribution 2016-17Aman VakhariaNo ratings yet

- Accounting Assignment & CATDocument14 pagesAccounting Assignment & CATMargaret IrunguNo ratings yet

- Postal Test Papers - P5 - Intermediate - Syllabus 2012Document27 pagesPostal Test Papers - P5 - Intermediate - Syllabus 2012Viswanathan SrkNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- ACC 1 Quiz No. 12 Answer KeyDocument17 pagesACC 1 Quiz No. 12 Answer Keynicole bancoroNo ratings yet

- MT2 Ch13Document7 pagesMT2 Ch13api-3725162100% (1)

- Tally New Assignment 2023Document14 pagesTally New Assignment 2023siddua204No ratings yet

- BAC 211 Assignment 2018Document4 pagesBAC 211 Assignment 2018vincentNo ratings yet

- Multi A SDN BHDDocument15 pagesMulti A SDN BHDMUHAMMAD AZIB ZAKHWAN BIN ZAKARIA (BG)No ratings yet

- 12 Comm QP AccountDocument2 pages12 Comm QP Accountvishal rahaneNo ratings yet

- Susquehanna Equipment Rentals General Journal: Date Description Debit CreditDocument2 pagesSusquehanna Equipment Rentals General Journal: Date Description Debit CreditMiles LinNo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- 2010 DR CR December 1 Cash: Journal EntriesDocument14 pages2010 DR CR December 1 Cash: Journal EntriesRafe Alexis MiravillaNo ratings yet

- Analysis of Notes Receivable and Related AccountsqDocument5 pagesAnalysis of Notes Receivable and Related AccountsqCJ alandyNo ratings yet

- TUTORIAL AccDocument12 pagesTUTORIAL Accizzat ikramNo ratings yet

- Accounting Model Paper - Final ExamDocument6 pagesAccounting Model Paper - Final ExamShenali NupehewaNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Chart of AccDocument9 pagesChart of Acccfo6779No ratings yet

- Dissolution of Partnership - Question 1Document16 pagesDissolution of Partnership - Question 1anthony hoNo ratings yet

- 1st Year - 3rd SheetDocument5 pages1st Year - 3rd SheetAhmed Ameen Nour EldinNo ratings yet

- Spring 2017 - MGT101 - 1Document11 pagesSpring 2017 - MGT101 - 1jaydee1000No ratings yet

- WorkDocument8 pagesWorkshifaanjum7172No ratings yet

- CAFF1 Topic 4 Practice Question SolutionsDocument16 pagesCAFF1 Topic 4 Practice Question SolutionsmusiciasansNo ratings yet

- (BUS-AC1) : Finbus2Document7 pages(BUS-AC1) : Finbus2mNo ratings yet

- Accounting 2Document17 pagesAccounting 2Arkar.myanmar 2018No ratings yet

- Model Question Paper - 2011 Class - XII Subject - AccountancyDocument6 pagesModel Question Paper - 2011 Class - XII Subject - AccountancyKunal AggarwalNo ratings yet

- 13,19 TH SumsDocument3 pages13,19 TH Sumsanky1555No ratings yet

- Accounting Course WorkDocument8 pagesAccounting Course Workanellebrown299No ratings yet

- Answer MahaDocument6 pagesAnswer Mahamohamadalsaygh232No ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Amalgamation - Example 1 To 4Document4 pagesAmalgamation - Example 1 To 4Zhong HanNo ratings yet

- Comprehensive ProblemDocument5 pagesComprehensive ProblemJedea Joy LactaoenNo ratings yet

- CHP 2 Exam Preparation ProblemsDocument3 pagesCHP 2 Exam Preparation ProblemsShawn JohnstonNo ratings yet

- Activity 1-BOTICARIO, D.Document2 pagesActivity 1-BOTICARIO, D.Dominic E. BoticarioNo ratings yet

- Tut 4 FinanceDocument7 pagesTut 4 FinanceJordan RixNo ratings yet

- 22i 2763Document3 pages22i 2763i222763 Asma JavaidNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- UntitledDocument3 pagesUntitledi222763 Asma JavaidNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- T Accounts Trial BalanceDocument7 pagesT Accounts Trial BalanceCamille Pasion100% (1)

- Week - 9 Workbook T1 2022Document6 pagesWeek - 9 Workbook T1 2022Thi Van Anh VUNo ratings yet

- CLWM4100 - T3 - 2021 - Questions - Week 03Document2 pagesCLWM4100 - T3 - 2021 - Questions - Week 03Thi Van Anh VUNo ratings yet

- FNDB020 Practice Exam Paper 1 SolutionDocument10 pagesFNDB020 Practice Exam Paper 1 SolutionThi Van Anh VUNo ratings yet

- Week - 10 Workbook - SolutionsDocument5 pagesWeek - 10 Workbook - SolutionsThi Van Anh VUNo ratings yet

- Workbook Week 7 SolutionsDocument11 pagesWorkbook Week 7 SolutionsThi Van Anh VUNo ratings yet

- Week 9 Special Journal PJ SJDocument21 pagesWeek 9 Special Journal PJ SJThi Van Anh VUNo ratings yet

- Week - 1 Chapter 1 (Student)Document59 pagesWeek - 1 Chapter 1 (Student)Thi Van Anh VUNo ratings yet

- Week - 9 Workbook - SolutionsDocument6 pagesWeek - 9 Workbook - SolutionsThi Van Anh VUNo ratings yet

- Unit 3.4 CHP 1-4Document102 pagesUnit 3.4 CHP 1-4Thi Van Anh VUNo ratings yet

- Tikz TutorialDocument34 pagesTikz Tutorialmz_haq100% (1)

- Conservative Political TheoryDocument1 pageConservative Political TheoryOpenLearner0% (1)

- Ariesogeo BR Nse Ae - 0Document2 pagesAriesogeo BR Nse Ae - 0Martine OneNo ratings yet

- Variable Speed Drives Altivar Process ATV600Document125 pagesVariable Speed Drives Altivar Process ATV600Fabio CavalheiroNo ratings yet

- Share Capital Materials-1 (Theory and Framework)Document18 pagesShare Capital Materials-1 (Theory and Framework)Joydeep DuttaNo ratings yet

- TPA AbstractDocument2 pagesTPA AbstractDrishti TiwariNo ratings yet

- Stok InverterDocument8 pagesStok Inverterad01 kinNo ratings yet

- Problem 14 10Document2 pagesProblem 14 10indri retnoningtyasNo ratings yet

- A1 - Tabangin - FINAL GREENTECH SUMMIT 2023 Disclaimer v2Document39 pagesA1 - Tabangin - FINAL GREENTECH SUMMIT 2023 Disclaimer v2garthraymundo123No ratings yet

- Datadheet Del Regulador L78M00Document30 pagesDatadheet Del Regulador L78M00Eduardo MoralezNo ratings yet

- AFV - Modeller July-Aug 2016Document68 pagesAFV - Modeller July-Aug 2016Prplknite100% (5)

- Thinklite TTL Camera Flash: For FujiDocument14 pagesThinklite TTL Camera Flash: For Fujimmonteiro_5No ratings yet

- User Manual EG8245Q EG8247Q 4065149Document13 pagesUser Manual EG8245Q EG8247Q 4065149Claudio Carrasco NavarreteNo ratings yet

- Hardware Manual ACS800-01 Drives (0.55 To 200 KW) ACS800-U1 Drives (0.75 To 200 HP)Document174 pagesHardware Manual ACS800-01 Drives (0.55 To 200 KW) ACS800-U1 Drives (0.75 To 200 HP)virgil guimanNo ratings yet

- Economic MCQDocument7 pagesEconomic MCQKaran AroraNo ratings yet

- Device InfoDocument22 pagesDevice Infosimwa VictorNo ratings yet

- Summer Internship Report Arun KabraDocument53 pagesSummer Internship Report Arun KabraGuruNo ratings yet

- X40235D ChinookCompact ENDocument60 pagesX40235D ChinookCompact ENMartin Renner WallaceNo ratings yet

- Catalogo MartinDocument175 pagesCatalogo MartinLeonardo De la CruzNo ratings yet

- 2nd Year Civil Engineering Course Detail of IOE, TU NepalDocument20 pages2nd Year Civil Engineering Course Detail of IOE, TU NepalSunil Kharbuja100% (1)

- Food Beliefs and Food Supply Chains The Impact of Religion and Religiosity in IsraelDocument7 pagesFood Beliefs and Food Supply Chains The Impact of Religion and Religiosity in IsraelyssifzakiatuNo ratings yet

- Piramal Ar Full 2015 16Document292 pagesPiramal Ar Full 2015 16Naman TandonNo ratings yet

- NUST Business School: ECO 215 Fundamentals of Econometrics Assignment 2Document11 pagesNUST Business School: ECO 215 Fundamentals of Econometrics Assignment 2Asadullah SherNo ratings yet

- Surge Arrester - GIS ELK-04CDocument4 pagesSurge Arrester - GIS ELK-04CCbdtxd PcbtrNo ratings yet

Homework Artsy Ceramics Solutions 2

Homework Artsy Ceramics Solutions 2

Uploaded by

Thi Van Anh VU0 ratings0% found this document useful (0 votes)

27 views6 pages1. Elvina deposited $120,000 into a bank account to start her business Artsy Ceramics.

2. She bought three vans for $100,000, paying $30,000 in cash and financing the rest with a bank loan.

3. Various operating expenses were paid throughout the month, including rent, equipment, wages, and vehicle maintenance.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Elvina deposited $120,000 into a bank account to start her business Artsy Ceramics.

2. She bought three vans for $100,000, paying $30,000 in cash and financing the rest with a bank loan.

3. Various operating expenses were paid throughout the month, including rent, equipment, wages, and vehicle maintenance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

27 views6 pagesHomework Artsy Ceramics Solutions 2

Homework Artsy Ceramics Solutions 2

Uploaded by

Thi Van Anh VU1. Elvina deposited $120,000 into a bank account to start her business Artsy Ceramics.

2. She bought three vans for $100,000, paying $30,000 in cash and financing the rest with a bank loan.

3. Various operating expenses were paid throughout the month, including rent, equipment, wages, and vehicle maintenance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

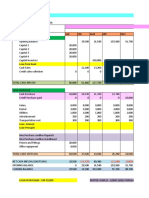

Homework Week 3

Part A. Transactions for the month of December,

2018.

1 1/12 Elvina, (sole owner of the business) deposited $120

000 in the bank to establish ‘Artsy Ceramics’ a craft

manufacturer and retail business in the eastern

suburbs.

2 3/12 Elvina bought three vans for $100 000; $30 000 paid

in cash and the balance with a bank loan.

3 4/12 Paid rent for December, January & February -

$6,000 in total

4 8/12 Purchased equipment for $5 000 cash.

5 12/12 Paid for petrol, oil and servicing of vans $1 000 cash.

6 16/12 Elvina used $800 from the business bank account to

pay insurance on her house ($400) and buy supplies

(all to be used in December) for her employees

($400).

7 20/12 Paid $70 000 owing on vans.

8 23/12 Paid wages of shop employees for the month of

December $2 500.

9 27/12 Sent an invoice to Gifts R Us t Ltd. for the delivery of

a range of craftwares at an agreed price of $12,000.

Gifts R Us Ltd are a retail organisation who intend to

sell these wares in a series of markets and stalls and

hope to generate in excess of $25 000.

10 Signed a contract to supply craftwares to the DJ Ltd.

stores throughout Australia for the next 5 years. The

agreed amount was $200 000.

Required:

a) Assess the above transactions and determine their effects on the

Transaction Analysis Table

b) Record the transactions in the General Journal of Artsy Ceramics.

c) Post journal entries to ledger accounts.

d) Prepare a trial balance.

Date A L OE DR CR

1/12 Cash ↑ 120,000

Capital ↑ 120,000

3/12 Motor ↑ 100,000

Vehicles

Cash ↓ 30,000

Bank ↑ 70,000

Loan

4/12 Prepaid ↓ 6,000

Rent

Cash ↓ 6,000

8/12 Equipment ↑ 5,000

Cash ↓ 5,000

12/1 Vehicle ↓ 1,000

2 Maintenance

Expense

Cash ↓ 1,000

16/1 Drawings ↓ 400

2

Supplies ↑ 400

Cash ↓ 800

20/1 Bank Loan ↓ 70,000

2

Cash ↓ 70,000

23/1 Wages ↓ 2,500

2 Expense

Cash ↓ 2,500

27/1 Sales ↑ 12,000

2

Debtors 12,000

Bank / Cash at bank / Cash

1/12 Capital 120,000 3/12 Motor Vehicles 30,000

4/12 Rent Expense 6,000

8/12 Equipment 5,000

12/2 Vehicle Maintenance 1,000

Expenses

16/1 Drawings 400

2 Supplies 400

16/1 Bank Loan 70,000

2 Wages Expense 2,500

20/1

Balance 4,700 2

23/1

2

Capital

1/02 Opening Balance 120,000

Balance 120,000

Motor Vehicle

2/12 Cash/Bank Loan 100,000

Balance 100,000

Debtors

27/12 Sales 12,000

Balance 12,000

Equipment

8/12 Cash 5,000

Balance 5,000

Wages expense

23/12 Bank 2,500

Balance 2,500

Rent Expense

4/12 Bank 6000

Balance 6000

Sales revenue

27/12 Sales 12,000

Balance 12,000

Vehicle Maintenance Expense

5/12 Cash $1,000

Balance 1,000

Drawings

16/12 Bank 400

Balance 400

Supplies

23/12 Bank 400

Balance 400

Account Debit Credit

Bank 4,700

Motor Vehicles 100,000

Equipment 5,000

Debtors 12,000

Supplies 400

Capital 120,000

Sales Revenue 12,000

Drawings 400

Wages expense 2,500

Rent expense 6,000

Vehicle Maintenance 1,000

Expense

132,000 132,000

You might also like

- Solution Manual For Macroeconomics 16th Canadian Edition Christopher T S RaganDocument14 pagesSolution Manual For Macroeconomics 16th Canadian Edition Christopher T S RaganCharlesOrtizmryi100% (44)

- Vocabulary by Aytan IsmayilzadaDocument26 pagesVocabulary by Aytan Ismayilzadanazrinxalilova2000No ratings yet

- TK03 Aks Liana DamayantiDocument7 pagesTK03 Aks Liana DamayantiLiana DamayantiNo ratings yet

- Tan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMDocument6 pagesTan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMvanessaNo ratings yet

- CXC Principles of Accounts Past Papers May 2012Document8 pagesCXC Principles of Accounts Past Papers May 2012BrandySterlingNo ratings yet

- Motorola Communication StructureDocument25 pagesMotorola Communication Structureyo5208No ratings yet

- Sternberg Press - May 2018Document4 pagesSternberg Press - May 2018ArtdataNo ratings yet

- 1Document2 pages1Your MaterialsNo ratings yet

- Exercises Chapter 5 Group 4Document18 pagesExercises Chapter 5 Group 4Phạm Ngọc Uyên NhiNo ratings yet

- Solution 2.1: Indicate, by Circling The Correct Classification, Whether Each of The Following Are Assets or LiabilitiesDocument7 pagesSolution 2.1: Indicate, by Circling The Correct Classification, Whether Each of The Following Are Assets or Liabilitiesshafqat aliNo ratings yet

- Susquehanna Equipment RentalsDocument17 pagesSusquehanna Equipment RentalsFaiza SattiNo ratings yet

- Refresher Journal-Entries SundayDocument2 pagesRefresher Journal-Entries SundayAdolph Christian GonzalesNo ratings yet

- Answer FarDocument5 pagesAnswer Farpsvg4n8fbhNo ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- S. Roces Answer To Journal EntryDocument4 pagesS. Roces Answer To Journal EntryChoco LebbyNo ratings yet

- Fabm Sample Exercises With Answer KeyDocument7 pagesFabm Sample Exercises With Answer KeySg Dimz100% (1)

- Week 2 Tutorial Question 2 - Double Entry SolutionDocument2 pagesWeek 2 Tutorial Question 2 - Double Entry SolutionDragosNo ratings yet

- B Printer Limited Prepare Income Statement As Per The Schedule IV ofDocument1 pageB Printer Limited Prepare Income Statement As Per The Schedule IV ofYashi710100% (1)

- Partnership Dissolution: Accounting EntriesDocument4 pagesPartnership Dissolution: Accounting EntriesTawanda Tatenda HerbertNo ratings yet

- Piecemeal DistributionDocument5 pagesPiecemeal DistributionYashfeen HakimNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- S. Y. B Com - Accounts: Piecemeal Distribution 2016-17Document5 pagesS. Y. B Com - Accounts: Piecemeal Distribution 2016-17Aman VakhariaNo ratings yet

- Accounting Assignment & CATDocument14 pagesAccounting Assignment & CATMargaret IrunguNo ratings yet

- Postal Test Papers - P5 - Intermediate - Syllabus 2012Document27 pagesPostal Test Papers - P5 - Intermediate - Syllabus 2012Viswanathan SrkNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- ACC 1 Quiz No. 12 Answer KeyDocument17 pagesACC 1 Quiz No. 12 Answer Keynicole bancoroNo ratings yet

- MT2 Ch13Document7 pagesMT2 Ch13api-3725162100% (1)

- Tally New Assignment 2023Document14 pagesTally New Assignment 2023siddua204No ratings yet

- BAC 211 Assignment 2018Document4 pagesBAC 211 Assignment 2018vincentNo ratings yet

- Multi A SDN BHDDocument15 pagesMulti A SDN BHDMUHAMMAD AZIB ZAKHWAN BIN ZAKARIA (BG)No ratings yet

- 12 Comm QP AccountDocument2 pages12 Comm QP Accountvishal rahaneNo ratings yet

- Susquehanna Equipment Rentals General Journal: Date Description Debit CreditDocument2 pagesSusquehanna Equipment Rentals General Journal: Date Description Debit CreditMiles LinNo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- 2010 DR CR December 1 Cash: Journal EntriesDocument14 pages2010 DR CR December 1 Cash: Journal EntriesRafe Alexis MiravillaNo ratings yet

- Analysis of Notes Receivable and Related AccountsqDocument5 pagesAnalysis of Notes Receivable and Related AccountsqCJ alandyNo ratings yet

- TUTORIAL AccDocument12 pagesTUTORIAL Accizzat ikramNo ratings yet

- Accounting Model Paper - Final ExamDocument6 pagesAccounting Model Paper - Final ExamShenali NupehewaNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Chart of AccDocument9 pagesChart of Acccfo6779No ratings yet

- Dissolution of Partnership - Question 1Document16 pagesDissolution of Partnership - Question 1anthony hoNo ratings yet

- 1st Year - 3rd SheetDocument5 pages1st Year - 3rd SheetAhmed Ameen Nour EldinNo ratings yet

- Spring 2017 - MGT101 - 1Document11 pagesSpring 2017 - MGT101 - 1jaydee1000No ratings yet

- WorkDocument8 pagesWorkshifaanjum7172No ratings yet

- CAFF1 Topic 4 Practice Question SolutionsDocument16 pagesCAFF1 Topic 4 Practice Question SolutionsmusiciasansNo ratings yet

- (BUS-AC1) : Finbus2Document7 pages(BUS-AC1) : Finbus2mNo ratings yet

- Accounting 2Document17 pagesAccounting 2Arkar.myanmar 2018No ratings yet

- Model Question Paper - 2011 Class - XII Subject - AccountancyDocument6 pagesModel Question Paper - 2011 Class - XII Subject - AccountancyKunal AggarwalNo ratings yet

- 13,19 TH SumsDocument3 pages13,19 TH Sumsanky1555No ratings yet

- Accounting Course WorkDocument8 pagesAccounting Course Workanellebrown299No ratings yet

- Answer MahaDocument6 pagesAnswer Mahamohamadalsaygh232No ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Amalgamation - Example 1 To 4Document4 pagesAmalgamation - Example 1 To 4Zhong HanNo ratings yet

- Comprehensive ProblemDocument5 pagesComprehensive ProblemJedea Joy LactaoenNo ratings yet

- CHP 2 Exam Preparation ProblemsDocument3 pagesCHP 2 Exam Preparation ProblemsShawn JohnstonNo ratings yet

- Activity 1-BOTICARIO, D.Document2 pagesActivity 1-BOTICARIO, D.Dominic E. BoticarioNo ratings yet

- Tut 4 FinanceDocument7 pagesTut 4 FinanceJordan RixNo ratings yet

- 22i 2763Document3 pages22i 2763i222763 Asma JavaidNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- UntitledDocument3 pagesUntitledi222763 Asma JavaidNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- T Accounts Trial BalanceDocument7 pagesT Accounts Trial BalanceCamille Pasion100% (1)

- Week - 9 Workbook T1 2022Document6 pagesWeek - 9 Workbook T1 2022Thi Van Anh VUNo ratings yet

- CLWM4100 - T3 - 2021 - Questions - Week 03Document2 pagesCLWM4100 - T3 - 2021 - Questions - Week 03Thi Van Anh VUNo ratings yet

- FNDB020 Practice Exam Paper 1 SolutionDocument10 pagesFNDB020 Practice Exam Paper 1 SolutionThi Van Anh VUNo ratings yet

- Week - 10 Workbook - SolutionsDocument5 pagesWeek - 10 Workbook - SolutionsThi Van Anh VUNo ratings yet

- Workbook Week 7 SolutionsDocument11 pagesWorkbook Week 7 SolutionsThi Van Anh VUNo ratings yet

- Week 9 Special Journal PJ SJDocument21 pagesWeek 9 Special Journal PJ SJThi Van Anh VUNo ratings yet

- Week - 1 Chapter 1 (Student)Document59 pagesWeek - 1 Chapter 1 (Student)Thi Van Anh VUNo ratings yet

- Week - 9 Workbook - SolutionsDocument6 pagesWeek - 9 Workbook - SolutionsThi Van Anh VUNo ratings yet

- Unit 3.4 CHP 1-4Document102 pagesUnit 3.4 CHP 1-4Thi Van Anh VUNo ratings yet

- Tikz TutorialDocument34 pagesTikz Tutorialmz_haq100% (1)

- Conservative Political TheoryDocument1 pageConservative Political TheoryOpenLearner0% (1)

- Ariesogeo BR Nse Ae - 0Document2 pagesAriesogeo BR Nse Ae - 0Martine OneNo ratings yet

- Variable Speed Drives Altivar Process ATV600Document125 pagesVariable Speed Drives Altivar Process ATV600Fabio CavalheiroNo ratings yet

- Share Capital Materials-1 (Theory and Framework)Document18 pagesShare Capital Materials-1 (Theory and Framework)Joydeep DuttaNo ratings yet

- TPA AbstractDocument2 pagesTPA AbstractDrishti TiwariNo ratings yet

- Stok InverterDocument8 pagesStok Inverterad01 kinNo ratings yet

- Problem 14 10Document2 pagesProblem 14 10indri retnoningtyasNo ratings yet

- A1 - Tabangin - FINAL GREENTECH SUMMIT 2023 Disclaimer v2Document39 pagesA1 - Tabangin - FINAL GREENTECH SUMMIT 2023 Disclaimer v2garthraymundo123No ratings yet

- Datadheet Del Regulador L78M00Document30 pagesDatadheet Del Regulador L78M00Eduardo MoralezNo ratings yet

- AFV - Modeller July-Aug 2016Document68 pagesAFV - Modeller July-Aug 2016Prplknite100% (5)

- Thinklite TTL Camera Flash: For FujiDocument14 pagesThinklite TTL Camera Flash: For Fujimmonteiro_5No ratings yet

- User Manual EG8245Q EG8247Q 4065149Document13 pagesUser Manual EG8245Q EG8247Q 4065149Claudio Carrasco NavarreteNo ratings yet

- Hardware Manual ACS800-01 Drives (0.55 To 200 KW) ACS800-U1 Drives (0.75 To 200 HP)Document174 pagesHardware Manual ACS800-01 Drives (0.55 To 200 KW) ACS800-U1 Drives (0.75 To 200 HP)virgil guimanNo ratings yet

- Economic MCQDocument7 pagesEconomic MCQKaran AroraNo ratings yet

- Device InfoDocument22 pagesDevice Infosimwa VictorNo ratings yet

- Summer Internship Report Arun KabraDocument53 pagesSummer Internship Report Arun KabraGuruNo ratings yet

- X40235D ChinookCompact ENDocument60 pagesX40235D ChinookCompact ENMartin Renner WallaceNo ratings yet

- Catalogo MartinDocument175 pagesCatalogo MartinLeonardo De la CruzNo ratings yet

- 2nd Year Civil Engineering Course Detail of IOE, TU NepalDocument20 pages2nd Year Civil Engineering Course Detail of IOE, TU NepalSunil Kharbuja100% (1)

- Food Beliefs and Food Supply Chains The Impact of Religion and Religiosity in IsraelDocument7 pagesFood Beliefs and Food Supply Chains The Impact of Religion and Religiosity in IsraelyssifzakiatuNo ratings yet

- Piramal Ar Full 2015 16Document292 pagesPiramal Ar Full 2015 16Naman TandonNo ratings yet

- NUST Business School: ECO 215 Fundamentals of Econometrics Assignment 2Document11 pagesNUST Business School: ECO 215 Fundamentals of Econometrics Assignment 2Asadullah SherNo ratings yet

- Surge Arrester - GIS ELK-04CDocument4 pagesSurge Arrester - GIS ELK-04CCbdtxd PcbtrNo ratings yet