Professional Documents

Culture Documents

Trading Stock

Trading Stock

Uploaded by

k.c sedibeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trading Stock

Trading Stock

Uploaded by

k.c sedibeCopyright:

Available Formats

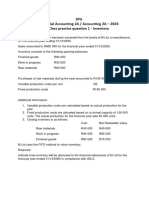

Trading Stock Movements: Year End 31 December

Donations of Stock

Case 01:

The taxpayer donated stock with a cost price of R2 000 and a market value of R4 000.

The taxpayer received a section 18A certificate.

Goods Donated s22(8): Recoupment at Cost 2 000

Final taxable income for the year before the s18A allowance was R50 000.

Taxable Income Before S18A Allowance 50 000

Less S18A Donation to PBO

Actual Donation 2 000 (2 000)

Limit: 10% of Taxable Income 5 000

Taxable Income: 48 000

Final taxable income for the year before the s18A allowance was R10 000.

Taxable Income Before S18A Allowance 10 000

Less S18A Donation to PBO

Actual Donation 2 000

Limit: 10% of Taxable Income 1 000 (1 000)

Taxable Income: 9 000

Case 02:

The taxpayer donated stock with a cost price of R2 000 and a market value of R4 000.

The taxpayer did not receive a section 18A certificate.

Goods Donated s22(8): Recoupment at MV 4 000

Final taxable income for the year before the s18A allowance was R50 000.

Taxable Income Before S18A Allowance 50 000

No Donation Deduction 0

Taxable Income: 50 000

Private or Domestic Use:

The owner of took stock with a cost price of R1 000 and a market value of R2 000 to use in renovations for

his home.

Goods Taken for Non-Trade Use: s22(8) Recoupment at Cost 1 000

The owner took stock that was damaged and the written down value was R500.

Goods Taken for Non-Trade Use: 500

s22(8) Recoup at Written-Down Value

Trading Stock Distributed as Dividend:

Paola decided to distribute hardware products as dividend to their shareholders.

The stock distributed had a market value of R10 000 and a cost of R5 000.

Dividend in Specie: S22(8) Recoup at MV 10 000

Trading Stock Used in Trade:

Paola used hardware stock with a cost of R750 and a market value of R1 500 to effect improvements on

some of their stores.

Goods Taken for Trade-Use: S22(8) Recoup at MV 1 500

Goods Taken for Trade-Use: S22(8) Deduction (1 500)

Trading Stock to Employees:

Stock with a market value of R3 000 was given to staff.

S22(8) Recoup at MV 3 000

S11(a) Employee Rations at MV (3 000)

Sold at Less Than the Market-Value:

Paola took stock with a market-value of R1 000 and a cost of R800 to sell to Carlito’s for R900

S22(8) Recoupment at Market-Value 1 000

S22(8) Deduction at Consideration (900)

Opening Stock:

The prior year closing stock was R2 250 000.

Stock with a value of R500 000 had decreased in value to R300 000.

Hannah’s Hardware a competitor of Paola had shut down to lack of business during COVID-19. They had sent

their left-over stock to Paola.

This stock cost R400 000 and a market-value of R800 00.

Opening Stock: S22(2)

At Cost: 2 250 000

Prior Year Write-Down to NRV: (200 000)

Stock Received for No Consideration: 800 000 (2 850 000)

Purchases:

Paola had purchased R1 000 000 worth of trading stock during the year of assessment.

70% of this stock was sold during the year of assessment.

Purchases: Section 11(a) (1 000 000)

Closing Stock:

Certain stock from a previous financial year still remained unsold. This stock cost R150 000.

The stock written down to R300 000 was a mistake its value should be R600 000.

Stock from Hannah’s Hardware remains unsold and was excluded from the R150 000 stock take.

Closing Stock: S22(1)

At Cost: 150 000

Write-Back Limited to Cost: 500 000 – 300 000 200 000

30% Unsold: 30% * 1 000 000 (Purchases) 300 000

Stock for No Consideration 800 000 1 450 000

Certain stock from a previous financial year still remained unsold. This stock cost R150 000.

The stock written down to R300 000 was a mistake its value should be R400 000.

Stock from Hannah’s Hardware remains unsold and was excluded from the R150 000 stock take.

Closing Stock: S22(1)

At Cost: 150 000

Write-Back Limited to Cost: 400 000 – 300 000 100 000

30% Unsold: 30% * 1 000 000 300 000

Stock for No Consideration 800 000 1 350 000

Work-in-Progress and Consumables:

Opening Stock includes the following amounts:

Machines for Sale R2 000 000

Work-in-Progress R500 000

Consumables R20 000

Opening Stock: S22(2) (2 520 000)

At Cost: 2 000 000

Work-in-Progress 500 000

Consumables 20 000

Labour and Direct Overheads in respect of the manufacturing of the machines amounted to R4 000 000.

Labour and Direct Overheads: Section 11(a) (4 000 000)

Closing Stock consisted of the following:

o Stock on hand amounted to R 1 220 000.

o 2 machines with a cost of R50 000 each were considered obsolete and the commissioner deemed

them to be reflected at 50% of their cost.

o Consumables amounted to R150 000.

o Spare parts totalled to R30 000 that were not used during the current year of assessment.

o Work-in-Progress consists of labour used R22 000 and components used of R28 000.

Closing Stock: S22(1) 1 430 000

At Cost: 1 220 000

Write Down: 2 * 20 000 * 50% (20 000)

Work-in-Progress: 22 000 + 28 000 50 000

Consumables 150 000

Spare Parts 30 000

Change in Intention:

Paola has owned a company that purchases second hand vehicles and flips them.

She owns a vehicle that she uses to travel around the country to inspect potential vehicles at the customers’

premises. 01 June 2022: She decides to flip that vehicle as stock to sell it.

01 June 2022 the following values are applicable:

The original cost was R230 000.

The carrying value R110 000.

The capital allowances claimed so far have been R100 000.

The depreciation has been R120 000.

The market value would be R150 000.

Paola never managed to sell the asset during the year of assessment which ends on 31 May 2023.

01 June 2022

Tax Value = Cost – Total Capital Allowances

= 230 000 – 100 000

= 130 000

Recoupment = SP (Limit: to Cost) – Tax Value 20 000

= 150 000 – 130 000

= 20 000

Proceeds = Selling Price – Recoupment

= 150 000 – 20 000

= 130 000

Base Cost = Cost – Total Capital Allowances

= 230 000 – 100 000

= 130 000

Capital Gain = Proceeds – Base Cost

= 130 000 – 130 000

= 0

S12(2)(c) Deduction at MV (150 000)

31 May 2023

Closing Stock: S22(2) 150 000

01 June 2023:

Opening Stock: S22(1) (150 000)

Paola has owned a company that purchases second hand vehicles and flips them. She took a vehicle from

the yard to use as her new vehicle to travel to customers.

01 June 2022: She decides to take the vehicle out of trading stock and use it as a capital asset.

01 June 2022 the following values are applicable:

The market value would be R150 000.

Assume 4 years write off period.

01 June 2022

S22(8)(b) Recoupment Recoupment at MV 150 000

S11(e) Wear and Tear 150 000/4 years (37 500)

You might also like

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- PreSalarySlip JanDocument1 pagePreSalarySlip JanAnonymous fNNhXzTTyNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument82 pagesThis Paper Is Not To Be Removed From The Examination HallsPutin PhyNo ratings yet

- Financial Management: Page 1 of 7Document7 pagesFinancial Management: Page 1 of 7cima2k15No ratings yet

- Accounting Paper-Zoom 2Document7 pagesAccounting Paper-Zoom 2Sufyan SheikhNo ratings yet

- Structure of The Examination PaperDocument12 pagesStructure of The Examination PaperRaffa MukoonNo ratings yet

- Problems Chapter 7-1: RequiredDocument16 pagesProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- Cat Module 1 Answer KeysDocument27 pagesCat Module 1 Answer KeysLexden MendozaNo ratings yet

- Practice Question Taxable Income of A CompanyDocument3 pagesPractice Question Taxable Income of A CompanyNokubongaNo ratings yet

- Tanza EngDocument2 pagesTanza Engisabella.desa04No ratings yet

- ACC3201Document6 pagesACC3201natlyh100% (1)

- Acc3201 (F) Aug2014Document5 pagesAcc3201 (F) Aug2014natlyhNo ratings yet

- Inventory PracticeDocument3 pagesInventory PracticevutlhariclimatiaveeNo ratings yet

- MBAG-9 YR1 - ACCFI - 17 August 2021 - S1Document12 pagesMBAG-9 YR1 - ACCFI - 17 August 2021 - S1landu.connieNo ratings yet

- Project Question: Financial Management 1ADocument4 pagesProject Question: Financial Management 1AHashimRazaNo ratings yet

- HAC Intro To FInancial Management QuestionPaperDocument6 pagesHAC Intro To FInancial Management QuestionPaperfortune maviyaNo ratings yet

- Tutorial 9 Tax AccountingDocument7 pagesTutorial 9 Tax AccountingAhmed HeshamNo ratings yet

- ExercisesDocument20 pagesExercisesRolivhuwaNo ratings yet

- Questions - Financial AccountingDocument9 pagesQuestions - Financial AccountingMariamNo ratings yet

- Budgeting Review QuestionDocument5 pagesBudgeting Review QuestionFrankNo ratings yet

- Class Practice Question 1 - InventoryDocument1 pageClass Practice Question 1 - InventoryAmanda KatsioNo ratings yet

- Test 2 Question PaperDocument12 pagesTest 2 Question PapermikeNo ratings yet

- Assignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMDocument5 pagesAssignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMMarinella LosaNo ratings yet

- Hba 2401 Advanced Financial Reporting Cat March 2024Document5 pagesHba 2401 Advanced Financial Reporting Cat March 2024PhilipNo ratings yet

- Tutorial On Inventory and FSDocument3 pagesTutorial On Inventory and FSNcediswaNo ratings yet

- Home Quiz No 2Document3 pagesHome Quiz No 2Liew Chi ChiengNo ratings yet

- F2 Dept (N)Document3 pagesF2 Dept (N)aslamhamza949No ratings yet

- Problem SolutionsDocument5 pagesProblem Solutionsmd nayonNo ratings yet

- Midterm 5101Document4 pagesMidterm 5101MD Hafizul Islam HafizNo ratings yet

- Paper II Financial Accounting IIDocument7 pagesPaper II Financial Accounting IIPoonam JainNo ratings yet

- Lec3 - Chap3 - Class Exercise 3aDocument3 pagesLec3 - Chap3 - Class Exercise 3aMEGAKARTIKA MISRULNo ratings yet

- Tutorial 6 FA IVDocument8 pagesTutorial 6 FA IVZHUN HONG TANNo ratings yet

- HI5020 Final AssessmentDocument15 pagesHI5020 Final AssessmentTauseef AhmedNo ratings yet

- Acctg 202 Problems With SolutionsDocument7 pagesAcctg 202 Problems With SolutionsTray AhlNo ratings yet

- Acctg4a 02042017 Exam Quiz1aDocument5 pagesAcctg4a 02042017 Exam Quiz1aPatOcampoNo ratings yet

- Accounting and Financial Management-ProjectDocument8 pagesAccounting and Financial Management-ProjectMelokuhle MhlongoNo ratings yet

- FIA 324 - June 2013 - QuestionsDocument8 pagesFIA 324 - June 2013 - Questionspopla poplaNo ratings yet

- Assignment 1Document3 pagesAssignment 1pranaylanjewar644No ratings yet

- IAS 2 Inventory Questions-1Document8 pagesIAS 2 Inventory Questions-1lehlohonoloronaldinhoNo ratings yet

- AssessmentDocument1 pageAssessmentVhiena May EstrelladoNo ratings yet

- Question PackDocument44 pagesQuestion Packthando1.fadanaNo ratings yet

- The Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyDocument5 pagesThe Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyJel SanNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Term 3 Test Non Profit Organisations and Cost AccountingDocument9 pagesTerm 3 Test Non Profit Organisations and Cost Accountingjacobsjasmine937No ratings yet

- Financial ReportingDocument287 pagesFinancial ReportingAdebayo OlayinkaNo ratings yet

- All Aboard LTD QuestionDocument2 pagesAll Aboard LTD QuestionLesego BaneleNo ratings yet

- Bs 320 - 30th AprilDocument2 pagesBs 320 - 30th AprilPrince Daniels TutorNo ratings yet

- PPE QuestionsDocument10 pagesPPE QuestionsJohn Ibrahim James MohammadNo ratings yet

- CO517 - Financial AccountingDocument4 pagesCO517 - Financial Accountingmiciker416No ratings yet

- IDT CA FINAL Full Question Paper 20may 2016Document22 pagesIDT CA FINAL Full Question Paper 20may 2016Bhanu DangNo ratings yet

- Tax 86 09Document8 pagesTax 86 09Marinel FelipeNo ratings yet

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- Module 1Document391 pagesModule 1Nayab RasoolNo ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Multiple Choice Problems 9Document15 pagesMultiple Choice Problems 9Dieter LudwigNo ratings yet

- 3 - Cash Flow Statement - Indirect Method - QuestionsDocument3 pages3 - Cash Flow Statement - Indirect Method - Questionsmikheal beyber100% (1)

- Tutorial Unit 2 Relevant Costing SolutionsDocument3 pagesTutorial Unit 2 Relevant Costing SolutionsNdivho MavhethaNo ratings yet

- Mock Exam QuestionsDocument8 pagesMock Exam QuestionsDeva LinaNo ratings yet

- PROJ Jul22 BBAHONS AFM8 Final 20221205090359Document10 pagesPROJ Jul22 BBAHONS AFM8 Final 20221205090359Melokuhle MhlongoNo ratings yet

- Gatchalian v. Collector, 67 Phil 666Document2 pagesGatchalian v. Collector, 67 Phil 666Kharol EdeaNo ratings yet

- 1 Principles of TaxationDocument11 pages1 Principles of TaxationDiana SheineNo ratings yet

- Filed Dakota Patriot PAC 2022 Year End AmendedDocument6 pagesFiled Dakota Patriot PAC 2022 Year End AmendedRob PortNo ratings yet

- BIR RULING NO. 214-12: Greenstone Resources CorporationDocument6 pagesBIR RULING NO. 214-12: Greenstone Resources CorporationThe GiverNo ratings yet

- October Pay SlipDocument2 pagesOctober Pay SlipanakinpowersNo ratings yet

- CSSM 0605 2023Document1 pageCSSM 0605 2023PAULA TVNo ratings yet

- 1601 EQ3 RD QTRDocument2 pages1601 EQ3 RD QTRJM SombreNo ratings yet

- Vat Tax Invoice: Cure-Tech Civil ServicesDocument1 pageVat Tax Invoice: Cure-Tech Civil ServicesyadavameNo ratings yet

- Invoice Letter 11 Nov 2021Document8 pagesInvoice Letter 11 Nov 2021Suvi AzkaNo ratings yet

- What Are The Corporations Exempt From Taxation?Document3 pagesWhat Are The Corporations Exempt From Taxation?ANGEL MAE LINABAN GONGOBNo ratings yet

- eFPS Home - Efiling and Payment System AprilDocument2 pageseFPS Home - Efiling and Payment System AprilRenalynNo ratings yet

- EE Wages Bessie CoelloDocument6 pagesEE Wages Bessie Coelloapi-3728670100% (2)

- Tax 1 Midterm Exam 2019Document4 pagesTax 1 Midterm Exam 2019Lindbergh SyNo ratings yet

- Payslip Nov 18Document1 pagePayslip Nov 18gowda RaghuNo ratings yet

- DV Consulting Inc Summary of ServicesDocument5 pagesDV Consulting Inc Summary of ServicesDv AccountingNo ratings yet

- Accounting For Income Taxes: About This Chapter!Document9 pagesAccounting For Income Taxes: About This Chapter!Frylle Kanz Harani PocsonNo ratings yet

- Assignment No. 3 Income Taxation 2nd Sem AY 2020 2021Document12 pagesAssignment No. 3 Income Taxation 2nd Sem AY 2020 2021Gabrielle Marie RiveraNo ratings yet

- INCOME TAX VALUE ADDED TAX ACTIVITY SolutionDocument6 pagesINCOME TAX VALUE ADDED TAX ACTIVITY SolutionMarco Alejandro IbayNo ratings yet

- Public Revenue: Md. Nahiduzzaman Roll: 2016941011Document5 pagesPublic Revenue: Md. Nahiduzzaman Roll: 2016941011nahiduzzaman akashNo ratings yet

- Deduction of Tax Paid by Indian Resident Person in NepalDocument6 pagesDeduction of Tax Paid by Indian Resident Person in NepalRoshan PoudelNo ratings yet

- Taxation SyllabusDocument5 pagesTaxation SyllabusJenalyn Sarmiento MacawiliNo ratings yet

- TBT CH1Document10 pagesTBT CH1darkNo ratings yet

- H01 - Principles of TaxationDocument9 pagesH01 - Principles of TaxationRachel FuentesNo ratings yet

- SodaPDF-converted-PAYSLIP - Umashankar VDocument1 pageSodaPDF-converted-PAYSLIP - Umashankar VCyriac JoseNo ratings yet

- CHED Memorandum Order No. 3 s.2012 (Tuition and Other Fee Increase)Document10 pagesCHED Memorandum Order No. 3 s.2012 (Tuition and Other Fee Increase)Imperator Furiosa100% (2)

- Filers, July 14th MorningDocument191 pagesFilers, July 14th MorningrkarlinNo ratings yet

- Latar Belakang GST Di MalaysiaDocument49 pagesLatar Belakang GST Di MalaysiaBenny WeeNo ratings yet