Professional Documents

Culture Documents

PFForm 11

PFForm 11

Uploaded by

sanjith_shelly290Copyright:

Available Formats

You might also like

- Black & DeckerDocument28 pagesBlack & DeckerSunny ShresthaNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- PFForm 11Document1 pagePFForm 11mohan vamsiNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormRajeshNo ratings yet

- Employees' Provident Fund OrganisationDocument1 pageEmployees' Provident Fund Organisationvikas kunduNo ratings yet

- Employees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Document1 pageEmployees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Yash SellsNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- P.F. Form 11Document1 pageP.F. Form 11DattaNo ratings yet

- PF Form11 & Declaration FormDocument2 pagesPF Form11 & Declaration Formalapati NagalaxmiNo ratings yet

- (To Be Retained by The Employer For Future Reference) : Employees'Provident Fund OrganisationDocument3 pages(To Be Retained by The Employer For Future Reference) : Employees'Provident Fund Organisationshashi kiranNo ratings yet

- PF Membership Details in Form 11Document2 pagesPF Membership Details in Form 11AbhilashNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormPAINNo ratings yet

- Form No. - 11 - Declaration FormDocument1 pageForm No. - 11 - Declaration FormAditya GuptaNo ratings yet

- Form 11 (Download Here) - 54061825463895 - 54388549640084Document3 pagesForm 11 (Download Here) - 54061825463895 - 54388549640084Kishore NithyaNo ratings yet

- EPF - FormDocument1 pageEPF - FormBavithraNo ratings yet

- Form 11 - PF Declaration1Document2 pagesForm 11 - PF Declaration1ADITYA R P 1937302No ratings yet

- Employees' Provident Fund Organisation: New Form: 11 - Declaration FormDocument1 pageEmployees' Provident Fund Organisation: New Form: 11 - Declaration Formhareesh bathalaNo ratings yet

- New FormDocument2 pagesNew FormPondara Naveen BadatyaNo ratings yet

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamNo ratings yet

- QTPL Form 11Document2 pagesQTPL Form 11PreritNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormDharshan ChandrasekaranNo ratings yet

- 1 - EPF - Form No. 11 (Sample)Document1 page1 - EPF - Form No. 11 (Sample)Rajdeep GaharwarNo ratings yet

- PFForm 11Document1 pagePFForm 11chvsrajNo ratings yet

- 7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Document1 page7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Vakati HemasaiNo ratings yet

- Efp Form No 11Document1 pageEfp Form No 11likhithkumar. 411No ratings yet

- New Form No.11-Declaration Form: Employees Provident Fund OrganizationDocument2 pagesNew Form No.11-Declaration Form: Employees Provident Fund OrganizationbhargavaNo ratings yet

- .Ale - Onboarding Composite Declaration Form 11 - V1Document2 pages.Ale - Onboarding Composite Declaration Form 11 - V1Alex ShineNo ratings yet

- Print Form 11Document2 pagesPrint Form 11Andrew WinnerNo ratings yet

- Epf Form No 11Document1 pageEpf Form No 11Narayanprasad GhosalNo ratings yet

- Eram Shaikh - Onboarding KIT Template 23 May 2022Document97 pagesEram Shaikh - Onboarding KIT Template 23 May 2022Tariq ShaikhNo ratings yet

- IN Form 11Document1 pageIN Form 11Chetan DhuriNo ratings yet

- Click Here To Download EPF - Form No. 11Document1 pageClick Here To Download EPF - Form No. 11saichinni7036No ratings yet

- PF - Form 11Document2 pagesPF - Form 11Log SquareNo ratings yet

- EPF - New Form No. 11 - Declaration FormDocument2 pagesEPF - New Form No. 11 - Declaration FormNaveen SNo ratings yet

- PF Declaration Form No.-11Document2 pagesPF Declaration Form No.-11soumodip chakrabortyNo ratings yet

- Please Tick The Appropriate OptionDocument2 pagesPlease Tick The Appropriate OptionJayant ChorariaNo ratings yet

- EPF Form-11Document1 pageEPF Form-11PulkKit SharMaNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- PF Declaration Form 11 New-Ayesha KhanDocument3 pagesPF Declaration Form 11 New-Ayesha KhanMalik PrintNo ratings yet

- Employee Provident Fund Form11Document1 pageEmployee Provident Fund Form11Shaik RasulNo ratings yet

- FORM No 11 (NEW)Document2 pagesFORM No 11 (NEW)selvampanneer121No ratings yet

- Composite Declaration Form: Employees'Document2 pagesComposite Declaration Form: Employees'Keshav SarafNo ratings yet

- EPF Declaration FormDocument2 pagesEPF Declaration Formvishalkavi18No ratings yet

- Form 11Document2 pagesForm 11Arpit VermaNo ratings yet

- Form11 - 111018740Document2 pagesForm11 - 111018740muskan davidNo ratings yet

- Employees' Provident Fund Organisation: Composite Declaration Form - 11Document5 pagesEmployees' Provident Fund Organisation: Composite Declaration Form - 11Yashveer Pratap SinghNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormsarveshNo ratings yet

- PF Membership Details in Form 11 TemplateDocument2 pagesPF Membership Details in Form 11 TemplateNisumba SoodhaniNo ratings yet

- Lei C4 - 392-E.5-: - 4-6B Plat' I. S c.4Document4 pagesLei C4 - 392-E.5-: - 4-6B Plat' I. S c.4jasdeep singhNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Yash JainNo ratings yet

- Composite Declaration Form-11 Employees' Provident Fund OrganisationDocument2 pagesComposite Declaration Form-11 Employees' Provident Fund OrganisationHarshit SuriNo ratings yet

- Composite Declaration FORM 11Document4 pagesComposite Declaration FORM 11Yaswanth ChallaNo ratings yet

- Joining Docket DocumentsDocument9 pagesJoining Docket Documentsgh75zs5m4dNo ratings yet

- PF Form AgreementDocument2 pagesPF Form AgreementbindusNo ratings yet

- Employees' Provident Fund OrganisationDocument2 pagesEmployees' Provident Fund OrganisationMuthiah ManiNo ratings yet

- New Form 11Document2 pagesNew Form 11నీలం మధు సూధన్ రెడ్డిNo ratings yet

- Sample Filled EPF Composite Declaration Form 11Document2 pagesSample Filled EPF Composite Declaration Form 11Varalakshmi Sharan100% (1)

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11naresh2891No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Mob Bill 2023yttftDocument2 pagesMob Bill 2023yttftsanjith_shelly290No ratings yet

- DSL Bill 044102975329 TFGFGFN HT2233I001552283Document4 pagesDSL Bill 044102975329 TFGFGFN HT2233I001552283sanjith_shelly290No ratings yet

- Cell Phone Bill For The Mosfdfdfnth SepDocument2 pagesCell Phone Bill For The Mosfdfdfnth Sepsanjith_shelly290No ratings yet

- Dec Broadbanfdfdfd BillDocument3 pagesDec Broadbanfdfdfd Billsanjith_shelly290No ratings yet

- Oct NetDocument4 pagesOct Netsanjith_shelly290No ratings yet

- PF - Nomination FormDocument2 pagesPF - Nomination Formsanjith_shelly290No ratings yet

- Sanjith Medical Devices 2022Document3 pagesSanjith Medical Devices 2022sanjith_shelly290No ratings yet

- H H HH H H H H H H H H H H H H Class Notes PPT PresentationDocument1 pageH H HH H H H H H H H H H H H H Class Notes PPT Presentationsanjith_shelly290No ratings yet

- Dec BilDocument9 pagesDec Bilsanjith_shelly290No ratings yet

- Admixtures 2Document34 pagesAdmixtures 2MudduKrishna shettyNo ratings yet

- Travclan - Business Development Associate: About UsDocument3 pagesTravclan - Business Development Associate: About Uscharu bishtNo ratings yet

- Values and Ethics BBA Unit 1Document23 pagesValues and Ethics BBA Unit 1Gayatri ChopraNo ratings yet

- BH42SH60 0854PL 46kgcmDocument1 pageBH42SH60 0854PL 46kgcmYash PanchalNo ratings yet

- BRM AssignmentDocument26 pagesBRM AssignmentVivek GuptaNo ratings yet

- 1St Business Strategy Assignment Brief 2018Document9 pages1St Business Strategy Assignment Brief 2018Quyên VũNo ratings yet

- BME Capstone Report TemplateDocument2 pagesBME Capstone Report TemplatehahahaNo ratings yet

- Amortization On A Simple Interest MortgageDocument470 pagesAmortization On A Simple Interest Mortgagesaxophonist42No ratings yet

- Revised-Manuscript (Sec 1 and 2) Plant DesignDocument332 pagesRevised-Manuscript (Sec 1 and 2) Plant DesignJose Daniel AsuncionNo ratings yet

- ACR-Brigada Eskwela 2022Document4 pagesACR-Brigada Eskwela 2022C Ferrer100% (2)

- Ge - Carescape Monitor b650 v2 - User ManualDocument536 pagesGe - Carescape Monitor b650 v2 - User ManualrichsalgadoNo ratings yet

- ELCOMA Diractory 2021 2022Document28 pagesELCOMA Diractory 2021 2022Neeraj KumarNo ratings yet

- Section I1: Boiler Selection ConsiderationsDocument28 pagesSection I1: Boiler Selection Considerationsfructora100% (1)

- Statements Download - 20230723070046Document6 pagesStatements Download - 20230723070046AyoNo ratings yet

- Nursing Care Plan AGNDocument2 pagesNursing Care Plan AGNAlexis Coronado50% (2)

- CPAT Reviewer - Key Audit MattersDocument3 pagesCPAT Reviewer - Key Audit MattersZaaavnn VannnnnNo ratings yet

- Mortgage Loan Disclosure Statement - GFEDocument3 pagesMortgage Loan Disclosure Statement - GFEafncorpNo ratings yet

- Memory Hierarchy Design-AcaDocument15 pagesMemory Hierarchy Design-AcaGuruCharan SinghNo ratings yet

- An Introduction To DC Generator Using Matlab/Simulink: Debabrata PalDocument4 pagesAn Introduction To DC Generator Using Matlab/Simulink: Debabrata PalMohammad H Al-QaisiNo ratings yet

- Abbas - Firoozabadi - Fractured Petroleum Reserviors PDFDocument284 pagesAbbas - Firoozabadi - Fractured Petroleum Reserviors PDFHugoNo ratings yet

- CS540 Assig NmentDocument12 pagesCS540 Assig NmentSajid AbbasNo ratings yet

- A Study On Employee Retention Strategies in Indian Manufacturing Industries - International Journal of Management Research and Social ScienceDocument5 pagesA Study On Employee Retention Strategies in Indian Manufacturing Industries - International Journal of Management Research and Social Sciencenandi durga98No ratings yet

- Inflection Points and Bar Cut OffDocument8 pagesInflection Points and Bar Cut Offjohn sorianoNo ratings yet

- Planetary Mixer TK2Document2 pagesPlanetary Mixer TK2waad mellitiNo ratings yet

- The Rediscovered Benjamin Graham Lectures From 1946 - 47Document73 pagesThe Rediscovered Benjamin Graham Lectures From 1946 - 47Ludger MoraesNo ratings yet

- Final 2Document72 pagesFinal 2VM MittalNo ratings yet

- Ansell Annual Report 2018 FINAL For Website PDFDocument128 pagesAnsell Annual Report 2018 FINAL For Website PDFWilliam Veloz DiazNo ratings yet

- Design & Detailing of Bolts & Welds To BS5950-2000Document26 pagesDesign & Detailing of Bolts & Welds To BS5950-2000sitehab100% (4)

- Manual de Parte Bulldozer d8t Volumne 3Document28 pagesManual de Parte Bulldozer d8t Volumne 3henotharenasNo ratings yet

PFForm 11

PFForm 11

Uploaded by

sanjith_shelly290Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PFForm 11

PFForm 11

Uploaded by

sanjith_shelly290Copyright:

Available Formats

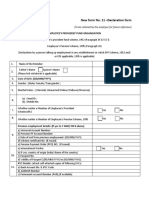

New Form No.

11- Declaration Form

(To be retained by the employer for future reference)

EMPLOYEES PROVIDENT FUND ORGANIZATION EmpCode:

Employees provident funds scheme, 1952 (paragraph 34 & 57) &

Employees pension scheme 1995 (paragraph 24) Company:

(Declaration by a person taking up employment in any establishment on which EPF Scheme, 1952 end /of EPS1995 is applicable)

1 Name of the member S DINESH KUMAR

2 Father’s Name ( ) Spouse’s Name () G SHANKAR

(Please Tick Whichever Is Applicable)

3 Date of Birth (DD/MM/YYYY) 08 05 1995

4 Gender: ( male / Female /Transgender ) MALE

5 Marital Status (married /Unmarried /widow/divorce) SINGLE

6 (a) EmailID: iamdineshkumarshankar@gmail.com

7448851995

(b) Mobile No:

7* Whether earlier a member of Employees ‘provident Fund Scheme 1952 Yes No

8* Whether earlier a member of Employees ‘Pension Scheme ,1995 Yes No

If response to any or both of (7) & (8) above is yes. MANDATORY FILL UP THE (COLUMN 9)

a) Universal Account Number(UAN) N/A

b) Previous PF a/c No AP HYD EST.CODE EXTN PF NO.

9 c) Date of exit from previous employment(DD/MM/YYY)

d) Scheme Certificate No (if Issued )

e) Pension Payment Order (PPO)No (ifIssued)

a) International Worker: Yes No

b) If Yes , State Country Of Origin (India /Name of Other Country)

10 c) PassportNo

d) Validity Of Passport (DD/MM/YYY) to(DD/MM/YYY)

KYC Details: (attach Self attested copies of following KYCs) **

a) Bank Account No .& IFScode 50100208848220 HDFC0001869

11 b) AADHAR Number (12 Digit) 617848020159

c) Permanent Account Number (PAN),Ifavailable CHOPD8180M

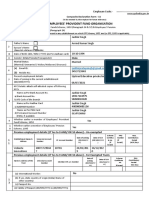

UNDERTAKING

1) Certified that the Particulars are true to the best of myKnowledge

2) I authorize EPFO to use my Aadhar for verification / e KYC purpose for servicedelivery

3) Kindly transfer the funds and service details, if applicable if applicable, from the previous PF account as declared above to the

present P.F Account(The Transfer Would be possible only if the identified KYC details approved by previous employer has

been verified by presentemployer

4) In case of changes In above details the same Will be intimate to employer at the earliest

Date: 29/6/2022

Place : BENGALUR Signature of member

DECLARATION BY PRESENT EMPLOYER

A) The member Mr./Ms./Mrs ………………..has joined on …………….and has been allotted PFNumber……………………………….

B) In case person was earlier not a member of EPF Scheme ,1952 andEPS,1995

(Post allotment of UAN ) The UAN Allotted for the memberis…………..

Please tick the AppropriateOption:

The KYC details of the above member in the UANdatabase

Have not been uploaded

Have been uploaded but not approved

Have been uploaded and approved withDSC

C) In case the person was earlier a member of EPF Scheme ,1952 and EPS,1995:

The above PF account number /UAN of the member as mentioned in (a) above has been tagged with his /her UAN/previous member ID as

declared by member

Please Tick the AppropriateOption

The KYC details of the above member in the UAN database have been approved with digital signature Certificate and transfer request

has been generated onportal.

As the DSC of establishment are not registered With EPFO the member has been informed to file physical claim (Form13) for transfer

of funds from his previousestablishment.

Date

Signature of Employer With seal of Establishment

You might also like

- Black & DeckerDocument28 pagesBlack & DeckerSunny ShresthaNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- PFForm 11Document1 pagePFForm 11mohan vamsiNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormRajeshNo ratings yet

- Employees' Provident Fund OrganisationDocument1 pageEmployees' Provident Fund Organisationvikas kunduNo ratings yet

- Employees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Document1 pageEmployees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Yash SellsNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- P.F. Form 11Document1 pageP.F. Form 11DattaNo ratings yet

- PF Form11 & Declaration FormDocument2 pagesPF Form11 & Declaration Formalapati NagalaxmiNo ratings yet

- (To Be Retained by The Employer For Future Reference) : Employees'Provident Fund OrganisationDocument3 pages(To Be Retained by The Employer For Future Reference) : Employees'Provident Fund Organisationshashi kiranNo ratings yet

- PF Membership Details in Form 11Document2 pagesPF Membership Details in Form 11AbhilashNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormPAINNo ratings yet

- Form No. - 11 - Declaration FormDocument1 pageForm No. - 11 - Declaration FormAditya GuptaNo ratings yet

- Form 11 (Download Here) - 54061825463895 - 54388549640084Document3 pagesForm 11 (Download Here) - 54061825463895 - 54388549640084Kishore NithyaNo ratings yet

- EPF - FormDocument1 pageEPF - FormBavithraNo ratings yet

- Form 11 - PF Declaration1Document2 pagesForm 11 - PF Declaration1ADITYA R P 1937302No ratings yet

- Employees' Provident Fund Organisation: New Form: 11 - Declaration FormDocument1 pageEmployees' Provident Fund Organisation: New Form: 11 - Declaration Formhareesh bathalaNo ratings yet

- New FormDocument2 pagesNew FormPondara Naveen BadatyaNo ratings yet

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamNo ratings yet

- QTPL Form 11Document2 pagesQTPL Form 11PreritNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormDharshan ChandrasekaranNo ratings yet

- 1 - EPF - Form No. 11 (Sample)Document1 page1 - EPF - Form No. 11 (Sample)Rajdeep GaharwarNo ratings yet

- PFForm 11Document1 pagePFForm 11chvsrajNo ratings yet

- 7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Document1 page7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Vakati HemasaiNo ratings yet

- Efp Form No 11Document1 pageEfp Form No 11likhithkumar. 411No ratings yet

- New Form No.11-Declaration Form: Employees Provident Fund OrganizationDocument2 pagesNew Form No.11-Declaration Form: Employees Provident Fund OrganizationbhargavaNo ratings yet

- .Ale - Onboarding Composite Declaration Form 11 - V1Document2 pages.Ale - Onboarding Composite Declaration Form 11 - V1Alex ShineNo ratings yet

- Print Form 11Document2 pagesPrint Form 11Andrew WinnerNo ratings yet

- Epf Form No 11Document1 pageEpf Form No 11Narayanprasad GhosalNo ratings yet

- Eram Shaikh - Onboarding KIT Template 23 May 2022Document97 pagesEram Shaikh - Onboarding KIT Template 23 May 2022Tariq ShaikhNo ratings yet

- IN Form 11Document1 pageIN Form 11Chetan DhuriNo ratings yet

- Click Here To Download EPF - Form No. 11Document1 pageClick Here To Download EPF - Form No. 11saichinni7036No ratings yet

- PF - Form 11Document2 pagesPF - Form 11Log SquareNo ratings yet

- EPF - New Form No. 11 - Declaration FormDocument2 pagesEPF - New Form No. 11 - Declaration FormNaveen SNo ratings yet

- PF Declaration Form No.-11Document2 pagesPF Declaration Form No.-11soumodip chakrabortyNo ratings yet

- Please Tick The Appropriate OptionDocument2 pagesPlease Tick The Appropriate OptionJayant ChorariaNo ratings yet

- EPF Form-11Document1 pageEPF Form-11PulkKit SharMaNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- PF Declaration Form 11 New-Ayesha KhanDocument3 pagesPF Declaration Form 11 New-Ayesha KhanMalik PrintNo ratings yet

- Employee Provident Fund Form11Document1 pageEmployee Provident Fund Form11Shaik RasulNo ratings yet

- FORM No 11 (NEW)Document2 pagesFORM No 11 (NEW)selvampanneer121No ratings yet

- Composite Declaration Form: Employees'Document2 pagesComposite Declaration Form: Employees'Keshav SarafNo ratings yet

- EPF Declaration FormDocument2 pagesEPF Declaration Formvishalkavi18No ratings yet

- Form 11Document2 pagesForm 11Arpit VermaNo ratings yet

- Form11 - 111018740Document2 pagesForm11 - 111018740muskan davidNo ratings yet

- Employees' Provident Fund Organisation: Composite Declaration Form - 11Document5 pagesEmployees' Provident Fund Organisation: Composite Declaration Form - 11Yashveer Pratap SinghNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormsarveshNo ratings yet

- PF Membership Details in Form 11 TemplateDocument2 pagesPF Membership Details in Form 11 TemplateNisumba SoodhaniNo ratings yet

- Lei C4 - 392-E.5-: - 4-6B Plat' I. S c.4Document4 pagesLei C4 - 392-E.5-: - 4-6B Plat' I. S c.4jasdeep singhNo ratings yet

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11Yash JainNo ratings yet

- Composite Declaration Form-11 Employees' Provident Fund OrganisationDocument2 pagesComposite Declaration Form-11 Employees' Provident Fund OrganisationHarshit SuriNo ratings yet

- Composite Declaration FORM 11Document4 pagesComposite Declaration FORM 11Yaswanth ChallaNo ratings yet

- Joining Docket DocumentsDocument9 pagesJoining Docket Documentsgh75zs5m4dNo ratings yet

- PF Form AgreementDocument2 pagesPF Form AgreementbindusNo ratings yet

- Employees' Provident Fund OrganisationDocument2 pagesEmployees' Provident Fund OrganisationMuthiah ManiNo ratings yet

- New Form 11Document2 pagesNew Form 11నీలం మధు సూధన్ రెడ్డిNo ratings yet

- Sample Filled EPF Composite Declaration Form 11Document2 pagesSample Filled EPF Composite Declaration Form 11Varalakshmi Sharan100% (1)

- Employees' Provident Fund Organ Isation: Composite Declaration Form - 11Document2 pagesEmployees' Provident Fund Organ Isation: Composite Declaration Form - 11naresh2891No ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Mob Bill 2023yttftDocument2 pagesMob Bill 2023yttftsanjith_shelly290No ratings yet

- DSL Bill 044102975329 TFGFGFN HT2233I001552283Document4 pagesDSL Bill 044102975329 TFGFGFN HT2233I001552283sanjith_shelly290No ratings yet

- Cell Phone Bill For The Mosfdfdfnth SepDocument2 pagesCell Phone Bill For The Mosfdfdfnth Sepsanjith_shelly290No ratings yet

- Dec Broadbanfdfdfd BillDocument3 pagesDec Broadbanfdfdfd Billsanjith_shelly290No ratings yet

- Oct NetDocument4 pagesOct Netsanjith_shelly290No ratings yet

- PF - Nomination FormDocument2 pagesPF - Nomination Formsanjith_shelly290No ratings yet

- Sanjith Medical Devices 2022Document3 pagesSanjith Medical Devices 2022sanjith_shelly290No ratings yet

- H H HH H H H H H H H H H H H H Class Notes PPT PresentationDocument1 pageH H HH H H H H H H H H H H H H Class Notes PPT Presentationsanjith_shelly290No ratings yet

- Dec BilDocument9 pagesDec Bilsanjith_shelly290No ratings yet

- Admixtures 2Document34 pagesAdmixtures 2MudduKrishna shettyNo ratings yet

- Travclan - Business Development Associate: About UsDocument3 pagesTravclan - Business Development Associate: About Uscharu bishtNo ratings yet

- Values and Ethics BBA Unit 1Document23 pagesValues and Ethics BBA Unit 1Gayatri ChopraNo ratings yet

- BH42SH60 0854PL 46kgcmDocument1 pageBH42SH60 0854PL 46kgcmYash PanchalNo ratings yet

- BRM AssignmentDocument26 pagesBRM AssignmentVivek GuptaNo ratings yet

- 1St Business Strategy Assignment Brief 2018Document9 pages1St Business Strategy Assignment Brief 2018Quyên VũNo ratings yet

- BME Capstone Report TemplateDocument2 pagesBME Capstone Report TemplatehahahaNo ratings yet

- Amortization On A Simple Interest MortgageDocument470 pagesAmortization On A Simple Interest Mortgagesaxophonist42No ratings yet

- Revised-Manuscript (Sec 1 and 2) Plant DesignDocument332 pagesRevised-Manuscript (Sec 1 and 2) Plant DesignJose Daniel AsuncionNo ratings yet

- ACR-Brigada Eskwela 2022Document4 pagesACR-Brigada Eskwela 2022C Ferrer100% (2)

- Ge - Carescape Monitor b650 v2 - User ManualDocument536 pagesGe - Carescape Monitor b650 v2 - User ManualrichsalgadoNo ratings yet

- ELCOMA Diractory 2021 2022Document28 pagesELCOMA Diractory 2021 2022Neeraj KumarNo ratings yet

- Section I1: Boiler Selection ConsiderationsDocument28 pagesSection I1: Boiler Selection Considerationsfructora100% (1)

- Statements Download - 20230723070046Document6 pagesStatements Download - 20230723070046AyoNo ratings yet

- Nursing Care Plan AGNDocument2 pagesNursing Care Plan AGNAlexis Coronado50% (2)

- CPAT Reviewer - Key Audit MattersDocument3 pagesCPAT Reviewer - Key Audit MattersZaaavnn VannnnnNo ratings yet

- Mortgage Loan Disclosure Statement - GFEDocument3 pagesMortgage Loan Disclosure Statement - GFEafncorpNo ratings yet

- Memory Hierarchy Design-AcaDocument15 pagesMemory Hierarchy Design-AcaGuruCharan SinghNo ratings yet

- An Introduction To DC Generator Using Matlab/Simulink: Debabrata PalDocument4 pagesAn Introduction To DC Generator Using Matlab/Simulink: Debabrata PalMohammad H Al-QaisiNo ratings yet

- Abbas - Firoozabadi - Fractured Petroleum Reserviors PDFDocument284 pagesAbbas - Firoozabadi - Fractured Petroleum Reserviors PDFHugoNo ratings yet

- CS540 Assig NmentDocument12 pagesCS540 Assig NmentSajid AbbasNo ratings yet

- A Study On Employee Retention Strategies in Indian Manufacturing Industries - International Journal of Management Research and Social ScienceDocument5 pagesA Study On Employee Retention Strategies in Indian Manufacturing Industries - International Journal of Management Research and Social Sciencenandi durga98No ratings yet

- Inflection Points and Bar Cut OffDocument8 pagesInflection Points and Bar Cut Offjohn sorianoNo ratings yet

- Planetary Mixer TK2Document2 pagesPlanetary Mixer TK2waad mellitiNo ratings yet

- The Rediscovered Benjamin Graham Lectures From 1946 - 47Document73 pagesThe Rediscovered Benjamin Graham Lectures From 1946 - 47Ludger MoraesNo ratings yet

- Final 2Document72 pagesFinal 2VM MittalNo ratings yet

- Ansell Annual Report 2018 FINAL For Website PDFDocument128 pagesAnsell Annual Report 2018 FINAL For Website PDFWilliam Veloz DiazNo ratings yet

- Design & Detailing of Bolts & Welds To BS5950-2000Document26 pagesDesign & Detailing of Bolts & Welds To BS5950-2000sitehab100% (4)

- Manual de Parte Bulldozer d8t Volumne 3Document28 pagesManual de Parte Bulldozer d8t Volumne 3henotharenasNo ratings yet