Professional Documents

Culture Documents

Project Loan

Project Loan

Uploaded by

Gulam Ali KamdarCopyright:

Available Formats

You might also like

- Loan For Commercial PropertyDocument6 pagesLoan For Commercial PropertyAkshata AyreNo ratings yet

- SMEDocument24 pagesSMEKetan AhirNo ratings yet

- Traders Easy Loan Flexi Loan For Trade and ServicesDocument21 pagesTraders Easy Loan Flexi Loan For Trade and ServicesDebanjan DasNo ratings yet

- SME Finance Products: Sulabh Vyapar LoanDocument6 pagesSME Finance Products: Sulabh Vyapar LoangsupernaNo ratings yet

- Sme ProductDocument22 pagesSme ProductAnila BaburajanNo ratings yet

- Other Banks InfoDocument38 pagesOther Banks InfoVidhi GuptaNo ratings yet

- Bank of BarodaDocument28 pagesBank of BarodaElora NandyNo ratings yet

- SbiDocument17 pagesSbiSai PrintersNo ratings yet

- Types of LoansDocument8 pagesTypes of LoansFirdaus PanthakyNo ratings yet

- By R.Dinesh Kumar: Submitted To The Department ofDocument77 pagesBy R.Dinesh Kumar: Submitted To The Department ofDrRashmiranjan PanigrahiNo ratings yet

- Study On Credit Appraisal Methods in State Bank of IndiaDocument5 pagesStudy On Credit Appraisal Methods in State Bank of IndiamuktaNo ratings yet

- Project Report Under Mudra LoansDocument3 pagesProject Report Under Mudra Loanskpkdhar 36No ratings yet

- Credit AppraisalDocument6 pagesCredit Appraisalnhan thanhNo ratings yet

- Internship Report On Unsecured Personal Loan (UPL) of Brac BankDocument20 pagesInternship Report On Unsecured Personal Loan (UPL) of Brac BankSifat Shahriar Shakil100% (1)

- Policy Guidelines HDFCDocument3 pagesPolicy Guidelines HDFCkwangdidNo ratings yet

- Credit Management NOTESDocument7 pagesCredit Management NOTESAkshat SolankiNo ratings yet

- Micro Small & Medium EnterprisesDocument23 pagesMicro Small & Medium EnterprisesPurnima MahantaNo ratings yet

- Components of Credit Appraisal Process: Parameter Technical Feasibility Economic Viability BankabilityDocument4 pagesComponents of Credit Appraisal Process: Parameter Technical Feasibility Economic Viability Bankabilityrs9999No ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDocument4 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- Policies and Structure For Credit ManagementDocument41 pagesPolicies and Structure For Credit ManagementNeeRaz KunwarNo ratings yet

- Home Improvement Loans: FeaturesDocument6 pagesHome Improvement Loans: Featuresshailabanumh256No ratings yet

- Credit AppraisalDocument4 pagesCredit AppraisalAbhishek RanjanNo ratings yet

- Axis Bank Ltd. Policy For Lending To Micro Small & Medium Enterprises (Msmes)Document5 pagesAxis Bank Ltd. Policy For Lending To Micro Small & Medium Enterprises (Msmes)hiteshmohakar15No ratings yet

- Project Report On Bank Loan SystemDocument16 pagesProject Report On Bank Loan Systempranit bandkarNo ratings yet

- Loan Policy of Uco Bank For Retail SectorDocument22 pagesLoan Policy of Uco Bank For Retail SectorAnurag BohraNo ratings yet

- SME Credit: Loans at Low Interest To Fuel Your Sme BusinessDocument5 pagesSME Credit: Loans at Low Interest To Fuel Your Sme Businessnishaantdec13No ratings yet

- Fahana Najnin Rajib SirDocument24 pagesFahana Najnin Rajib Sirmrs solutionNo ratings yet

- BCC BR 98 320Document3 pagesBCC BR 98 320vijay435No ratings yet

- Fundamental Principles of LendingDocument8 pagesFundamental Principles of LendingSNo ratings yet

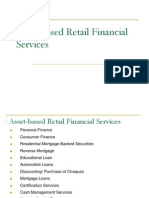

- Asset Based Retail Financial ServicesDocument37 pagesAsset Based Retail Financial Servicesjimi02100% (1)

- Sbi Smart Products For SmeDocument30 pagesSbi Smart Products For SmeRAJEEV THAKURNo ratings yet

- PNB Bank LoanDocument3 pagesPNB Bank Loanapi-3838281No ratings yet

- Term LoanDocument8 pagesTerm LoanDarshan PatilNo ratings yet

- Appraisal of Term LoanDocument13 pagesAppraisal of Term LoanAabhash ShrivastavNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument9 pagesProject Report "Banking System" in India Introduction of BankingmanishteensNo ratings yet

- Introduction of SmedaDocument5 pagesIntroduction of SmedaTƛyyƛb ƛliNo ratings yet

- SYNOPSIS VarshaDocument12 pagesSYNOPSIS VarshaVaibhav GawandeNo ratings yet

- Study On Credit PolicyDocument12 pagesStudy On Credit PolicyVaibhav GawandeNo ratings yet

- SYNOPSIS VarshaDocument12 pagesSYNOPSIS VarshaVaibhav GawandeNo ratings yet

- Ayushman and Sanjeevani Scheme DetailsDocument2 pagesAyushman and Sanjeevani Scheme Detailsdrmanojmsortho21No ratings yet

- Types of Loan Against PropertyDocument6 pagesTypes of Loan Against PropertyHimmanshu SabharwalNo ratings yet

- Loans To Smes and Msmes Collateral Free LoansDocument3 pagesLoans To Smes and Msmes Collateral Free LoansShatir LaundaNo ratings yet

- Luxury Hotels in JaipurDocument5 pagesLuxury Hotels in JaipurmayoonlyNo ratings yet

- Assignment 6EDEDocument5 pagesAssignment 6EDEKunal HarinkhedeNo ratings yet

- 3.BANKING SECTOR - Nishtha ChhabraDocument83 pages3.BANKING SECTOR - Nishtha ChhabraHarshal FuseNo ratings yet

- A Study On Financial Products Provided by My Money MantraDocument18 pagesA Study On Financial Products Provided by My Money Mantrasivagami100% (1)

- Factoring As An Important Tool For Working Capital ManagementDocument25 pagesFactoring As An Important Tool For Working Capital ManagementRupal HatkarNo ratings yet

- Real Estate FinancingDocument29 pagesReal Estate FinancingRaymon Prakash100% (1)

- General Banking - Credit OperationsDocument11 pagesGeneral Banking - Credit OperationsGnana SambandamNo ratings yet

- MSE Policy - Display Without Rating ScoreDocument17 pagesMSE Policy - Display Without Rating ScoreMahesh PatilNo ratings yet

- Mrunalini's Task 3Document4 pagesMrunalini's Task 3Pampana Bala Sai Saroj RamNo ratings yet

- Financial Management AssignmentDocument12 pagesFinancial Management AssignmentrohanpujariNo ratings yet

- ProjectDocument8 pagesProjectYograj PawarNo ratings yet

Project Loan

Project Loan

Uploaded by

Gulam Ali KamdarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Loan

Project Loan

Uploaded by

Gulam Ali KamdarCopyright:

Available Formats

Project Loan : Overview Project Loan is given by the lending institution or banks to the borrower for the purpose

of business expansion, reconstruction etc. Project loan is also available to acquire the fixed assets like land & building, plant & machinery etc. Project Loans are available to the existing business or industrial houses for growth purpose and equally available to the new business entrants in form of seed or startup capital. Projects loans are generally mid or long term period loans but lending institutions may consider the short term loan applications depending upon the feasibility of the project. The short term Project Loan can be availed for one year whereas the mid and long term project loans can be obtained for up to 10 years. The rate of interest is quite competitive as the loan term is longer and may be affected by the periodic changes made by the lending institutes. Construction & Infrastructure, Engineering, Automobile, Power, Gas & Petrochemical industries are some of the business domains generally leverage on the Project Loans. The aspirants should have the detailed project report ready as it is the very basis of getting project loan sanctioned. The lending institutions seek good credit, strong solvency ratio, strong management systems, technology penetration etc. as granting criteria for project loans

Baroda Arogyadham Loan

PURPOSE To meet the financial requirements for setting up of new Nursing Home/Hospital including Pathological Laboratory, Expansion/renovation/modernization of existing Nursing Home/ Hospital including Pathological Laboratory, Purchase of medical diagnostic equipments as also office equipments, viz. computers, air conditioners, office furniture, Purchase of ambulance etc and to meet working capital requirements. ELIGIBILITY All entities, i.e. MSMEs, Enterprises other than individuals like Proprietorship, Partnership firms, Private Limited Companies and Trusts engaged in providing medical/pathological diagnostic services to the Society and with turnover uptoRs. 150/crores. Note : The Promoters should have requisite qualification in any branch of medical science from a recognized University and should have minimum 2 years of work experience. LIMIT

y y y

Notes :

Rural Centres - Rs. 0.50 crores Semi-Urban Centres - Rs. 6.00 crores Urban & Metro Centres - Rs. 12.00 crores

y y

Working Capital limits upto 10% of the annual sale or gross income, subject to 20% of the above ceiling limit in case of borrowers requiring both Term Loan and working capital facilities. In case of borrowers requiring only working capital limit, 20% of the above ceiling limit.

SECURITY

y y y y y

Equitable mortgage of Land & Building/premises of Nursing Home/Hospital Hypothecation of medical equipment/office equipment acquired out of loan amount. Personal guarantee of Promoter Directors in case of Limited Companies and Trustees in case of Trusts. Hypothecation of medicines, receivables and other chargeable current assets. Charge on unencumbered assets of Promoter Directors in case of Private Limited Companies, or any other collateral by way of FDR, mortgage of properties in the personal name of the relatives of Promoters, etc.

MARGIN : 25%. Higher margin if collaterals are inadequate RATE OF INTEREST : As per credit rating of the borrower. REPAYMENT PERIOD : 35 months to 84 months including moratorium depending upon the projected cash flow.

Amarpaisa.com

Project Loan

You can get projects loans like Educational projects (Management Schools, colleges), Hotel projects, Agriculture projects, diary firm projects, small scale industries loan, hospital project, nursing home project, medium scale industries loan etc. with a good term and low interest rates. For more details

just call +919051117231 and +919836632133. .

BANK LOANS FOR HOSPITALS AND HOTELS ARE NOT COMMERCIAL

Loans extended by banks to hotels and hospitals may no longer be treated as commercial real estate category. The Reserve Bank of India revised norms on real estate exposure where it included loans extended against security of future rent receivables from commercial real estate exposure. The revised norms will not immediately impact banks balance sheet. This is because standard provisioning for real estate companies were brought on a par with all other industries on November 15, 2008.

As a part of the stimulus package, the general provisioning requirement on standard advances for commercial real estate sector has come down from 2% to 0.04%. However, under reducing the standard provisioning for commercial real estate, RBI had said that they were counter cyclical prudential measures. This means that as and when the economic cycle changes, RBI may increase provisioning norms on commercial real estate sector. Meanwhile, on Thursday, RBI has continued to maintain that SEZs will be treated as commercial real estate. In case of hotels, the cash flows would be mainly sensitive to the flow of tourism, not directly to the fluctuations in the real estate prices. In the case of a hospital, the cash flows in normal course would be sensitive to the quality of doctors and other diagnostic services provided by the hospital. In these cases, the source of repayment might also depend upon the real estate prices to the extent that the fluctuation in prices influences the room rents, but it will be a minor factor in determining the overall cash flows. In these two cases, the recovery in case of default may partly depend upon the sale price of the hotel or hospital. Considering that repayment is not dependent on real estate prices, recovery is only partly dependent on the real estate prices, RBI decided not to treat them as real estate exposures. Justifying its stand on treating loan against future rent receivable as real estate, RBI pointed out that a few banks have formulated schemes where the owners of existing real estate such as shopping malls, office premises agree to repay loans from the income that is generated from the rentals by these properties. Such finance may or may not be secured by the mortgage of the underlying properties. In case it is unsecured, the repayment will be sensitive to fall in real estate rentals and there would be no source of recovery in case of default. In case the loan is secured by mortgage of the underlying property, both the repayment and recovery would depend upon property prices.

You might also like

- Loan For Commercial PropertyDocument6 pagesLoan For Commercial PropertyAkshata AyreNo ratings yet

- SMEDocument24 pagesSMEKetan AhirNo ratings yet

- Traders Easy Loan Flexi Loan For Trade and ServicesDocument21 pagesTraders Easy Loan Flexi Loan For Trade and ServicesDebanjan DasNo ratings yet

- SME Finance Products: Sulabh Vyapar LoanDocument6 pagesSME Finance Products: Sulabh Vyapar LoangsupernaNo ratings yet

- Sme ProductDocument22 pagesSme ProductAnila BaburajanNo ratings yet

- Other Banks InfoDocument38 pagesOther Banks InfoVidhi GuptaNo ratings yet

- Bank of BarodaDocument28 pagesBank of BarodaElora NandyNo ratings yet

- SbiDocument17 pagesSbiSai PrintersNo ratings yet

- Types of LoansDocument8 pagesTypes of LoansFirdaus PanthakyNo ratings yet

- By R.Dinesh Kumar: Submitted To The Department ofDocument77 pagesBy R.Dinesh Kumar: Submitted To The Department ofDrRashmiranjan PanigrahiNo ratings yet

- Study On Credit Appraisal Methods in State Bank of IndiaDocument5 pagesStudy On Credit Appraisal Methods in State Bank of IndiamuktaNo ratings yet

- Project Report Under Mudra LoansDocument3 pagesProject Report Under Mudra Loanskpkdhar 36No ratings yet

- Credit AppraisalDocument6 pagesCredit Appraisalnhan thanhNo ratings yet

- Internship Report On Unsecured Personal Loan (UPL) of Brac BankDocument20 pagesInternship Report On Unsecured Personal Loan (UPL) of Brac BankSifat Shahriar Shakil100% (1)

- Policy Guidelines HDFCDocument3 pagesPolicy Guidelines HDFCkwangdidNo ratings yet

- Credit Management NOTESDocument7 pagesCredit Management NOTESAkshat SolankiNo ratings yet

- Micro Small & Medium EnterprisesDocument23 pagesMicro Small & Medium EnterprisesPurnima MahantaNo ratings yet

- Components of Credit Appraisal Process: Parameter Technical Feasibility Economic Viability BankabilityDocument4 pagesComponents of Credit Appraisal Process: Parameter Technical Feasibility Economic Viability Bankabilityrs9999No ratings yet

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDocument4 pagesInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNo ratings yet

- Policies and Structure For Credit ManagementDocument41 pagesPolicies and Structure For Credit ManagementNeeRaz KunwarNo ratings yet

- Home Improvement Loans: FeaturesDocument6 pagesHome Improvement Loans: Featuresshailabanumh256No ratings yet

- Credit AppraisalDocument4 pagesCredit AppraisalAbhishek RanjanNo ratings yet

- Axis Bank Ltd. Policy For Lending To Micro Small & Medium Enterprises (Msmes)Document5 pagesAxis Bank Ltd. Policy For Lending To Micro Small & Medium Enterprises (Msmes)hiteshmohakar15No ratings yet

- Project Report On Bank Loan SystemDocument16 pagesProject Report On Bank Loan Systempranit bandkarNo ratings yet

- Loan Policy of Uco Bank For Retail SectorDocument22 pagesLoan Policy of Uco Bank For Retail SectorAnurag BohraNo ratings yet

- SME Credit: Loans at Low Interest To Fuel Your Sme BusinessDocument5 pagesSME Credit: Loans at Low Interest To Fuel Your Sme Businessnishaantdec13No ratings yet

- Fahana Najnin Rajib SirDocument24 pagesFahana Najnin Rajib Sirmrs solutionNo ratings yet

- BCC BR 98 320Document3 pagesBCC BR 98 320vijay435No ratings yet

- Fundamental Principles of LendingDocument8 pagesFundamental Principles of LendingSNo ratings yet

- Asset Based Retail Financial ServicesDocument37 pagesAsset Based Retail Financial Servicesjimi02100% (1)

- Sbi Smart Products For SmeDocument30 pagesSbi Smart Products For SmeRAJEEV THAKURNo ratings yet

- PNB Bank LoanDocument3 pagesPNB Bank Loanapi-3838281No ratings yet

- Term LoanDocument8 pagesTerm LoanDarshan PatilNo ratings yet

- Appraisal of Term LoanDocument13 pagesAppraisal of Term LoanAabhash ShrivastavNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument9 pagesProject Report "Banking System" in India Introduction of BankingmanishteensNo ratings yet

- Introduction of SmedaDocument5 pagesIntroduction of SmedaTƛyyƛb ƛliNo ratings yet

- SYNOPSIS VarshaDocument12 pagesSYNOPSIS VarshaVaibhav GawandeNo ratings yet

- Study On Credit PolicyDocument12 pagesStudy On Credit PolicyVaibhav GawandeNo ratings yet

- SYNOPSIS VarshaDocument12 pagesSYNOPSIS VarshaVaibhav GawandeNo ratings yet

- Ayushman and Sanjeevani Scheme DetailsDocument2 pagesAyushman and Sanjeevani Scheme Detailsdrmanojmsortho21No ratings yet

- Types of Loan Against PropertyDocument6 pagesTypes of Loan Against PropertyHimmanshu SabharwalNo ratings yet

- Loans To Smes and Msmes Collateral Free LoansDocument3 pagesLoans To Smes and Msmes Collateral Free LoansShatir LaundaNo ratings yet

- Luxury Hotels in JaipurDocument5 pagesLuxury Hotels in JaipurmayoonlyNo ratings yet

- Assignment 6EDEDocument5 pagesAssignment 6EDEKunal HarinkhedeNo ratings yet

- 3.BANKING SECTOR - Nishtha ChhabraDocument83 pages3.BANKING SECTOR - Nishtha ChhabraHarshal FuseNo ratings yet

- A Study On Financial Products Provided by My Money MantraDocument18 pagesA Study On Financial Products Provided by My Money Mantrasivagami100% (1)

- Factoring As An Important Tool For Working Capital ManagementDocument25 pagesFactoring As An Important Tool For Working Capital ManagementRupal HatkarNo ratings yet

- Real Estate FinancingDocument29 pagesReal Estate FinancingRaymon Prakash100% (1)

- General Banking - Credit OperationsDocument11 pagesGeneral Banking - Credit OperationsGnana SambandamNo ratings yet

- MSE Policy - Display Without Rating ScoreDocument17 pagesMSE Policy - Display Without Rating ScoreMahesh PatilNo ratings yet

- Mrunalini's Task 3Document4 pagesMrunalini's Task 3Pampana Bala Sai Saroj RamNo ratings yet

- Financial Management AssignmentDocument12 pagesFinancial Management AssignmentrohanpujariNo ratings yet

- ProjectDocument8 pagesProjectYograj PawarNo ratings yet