Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsPartnership Formation

Partnership Formation

Uploaded by

Shane Ivory ClaudioThe document provides guidelines for forming partnerships, including recording cash investments at fair value, non-cash investments at agreed value, services at agreed value, and liabilities at fair value. It also describes forming a partnership between individuals with no existing business and forming one between a sole proprietor and individual. The summary is:

1. Fernando and Java agreed to form a partnership, with Fernando contributing $700,000 cash and Java contributing land worth $1,300,000 with a $300,000 mortgage.

2. The journal entries record Fernando's $700,000 cash as an asset and Java's capital, the $1,300,000 land as an asset, and the $300,000 mortgage as

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Multi Choice Tech 1 AnswerDocument20 pagesMulti Choice Tech 1 AnswerquyennqNo ratings yet

- Exercise 1-1 To 1-5Document5 pagesExercise 1-1 To 1-5Jennette ToNo ratings yet

- CASINO by Nicholas PileggiDocument238 pagesCASINO by Nicholas PileggiPutipufNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- A. Partnership Formation and DissolutionDocument9 pagesA. Partnership Formation and DissolutionEricka MagatNo ratings yet

- Partnership Formation Activity 2Document4 pagesPartnership Formation Activity 2Shaira Untalan100% (1)

- Chapter 2 - Accounting For Partnership Formation2 (NO ILLUS)Document65 pagesChapter 2 - Accounting For Partnership Formation2 (NO ILLUS)PatOcampo50% (2)

- Part - Formation FATDocument2 pagesPart - Formation FATArian AmuraoNo ratings yet

- Partnership: Definition, Nature and FormationDocument19 pagesPartnership: Definition, Nature and FormationRuthchell CiriacoNo ratings yet

- Chapter 2Document35 pagesChapter 2Jerryline BerguiaNo ratings yet

- SAN BEDA COLLEGE Mendiola Manila Departm PDFDocument8 pagesSAN BEDA COLLEGE Mendiola Manila Departm PDFAlvaroNo ratings yet

- Partnership FormatDocument13 pagesPartnership FormatKenneth Ninalga100% (1)

- AFAR 1. PartnershipDocument8 pagesAFAR 1. PartnershipKristine May PeraltaNo ratings yet

- Advacc NotesDocument11 pagesAdvacc Notesthirdyear83No ratings yet

- PartnershipDocument18 pagesPartnershipMary Rica DublonNo ratings yet

- Acc 30 CorporationDocument8 pagesAcc 30 CorporationGerlie BonleonNo ratings yet

- Partnership Formation Partnership AccountingDocument14 pagesPartnership Formation Partnership AccountingJesseca JosafatNo ratings yet

- Concept Map Part FormationDocument4 pagesConcept Map Part FormationSamNo ratings yet

- Module-Partnership-and-Corporation-Accounting - Lesson 1Document6 pagesModule-Partnership-and-Corporation-Accounting - Lesson 1Jay Lord GallardoNo ratings yet

- PartnershipDocument9 pagesPartnershipChariz Audrey100% (1)

- Partnership Formation NotesDocument4 pagesPartnership Formation NotesMary Rica DublonNo ratings yet

- Partnership: Formation OperationDocument65 pagesPartnership: Formation OperationrickyjakezosaNo ratings yet

- Accounting For Partnerships: Basic Considerations and FormationDocument22 pagesAccounting For Partnerships: Basic Considerations and FormationAj CapungganNo ratings yet

- Partnership FormationDocument16 pagesPartnership FormationKian BarredoNo ratings yet

- Afar Partnerships Ms. Ellery D. de Leon: True or FalseDocument6 pagesAfar Partnerships Ms. Ellery D. de Leon: True or FalsePat DrezaNo ratings yet

- Partnership FormationDocument8 pagesPartnership FormationWithDoctorWu100% (1)

- 1 PartnershipDocument6 pages1 PartnershipJem Valmonte100% (3)

- Local Media1577402990991204520Document3 pagesLocal Media1577402990991204520KsUnlockerNo ratings yet

- Accounting 12Document4 pagesAccounting 12Breathe ArielleNo ratings yet

- Module 2Document6 pagesModule 2trixie mae0% (1)

- Module 2Document6 pagesModule 2Mary Joy CabilNo ratings yet

- 1 - Week Partnership FormationDocument24 pages1 - Week Partnership FormationAlrac Garcia100% (1)

- Prelim PartnershipFormationSampleProblemDocument4 pagesPrelim PartnershipFormationSampleProblemLee SuarezNo ratings yet

- AFAR NotesDocument7 pagesAFAR NotesMay Grethel Joy PeranteNo ratings yet

- Partnership FormationDocument28 pagesPartnership Formationmarjorie magsinoNo ratings yet

- Accounting Quiz 1Document2 pagesAccounting Quiz 1Cjhay MarcosNo ratings yet

- Accounting For Special TransactionsDocument3 pagesAccounting For Special TransactionsJñelle Faith Herrera SaludaresNo ratings yet

- Partnerships PT 2 FormationDocument10 pagesPartnerships PT 2 FormationJohn Ashnaz DemaguilNo ratings yet

- PARCOR 1 and 2Document7 pagesPARCOR 1 and 2Kim Audrey Jalalain100% (1)

- FormationDocument31 pagesFormationBYRON DESEMBRANANo ratings yet

- The Teaching Hub Class Xii Accountancy Chapter 2: The Fundamental of Partnership FirmDocument3 pagesThe Teaching Hub Class Xii Accountancy Chapter 2: The Fundamental of Partnership FirmAthArvA .TNo ratings yet

- Accounting For PartnershipDocument46 pagesAccounting For PartnershipRejean Dela Cruz100% (1)

- Parcor FinalDocument6 pagesParcor FinalChris YuNo ratings yet

- Chapter 4 - Accounting For PartnershipsDocument34 pagesChapter 4 - Accounting For PartnershipsFasiko AsmaroNo ratings yet

- Parcoac Prelim Reviewer 2Document5 pagesParcoac Prelim Reviewer 2tokyoescotoNo ratings yet

- Partnership Formation Lecture NotesDocument3 pagesPartnership Formation Lecture Notesbum_24100% (5)

- PICPA - 1st Year QuestionsDocument1 pagePICPA - 1st Year QuestionsVincent Larrie MoldezNo ratings yet

- Acc ch-4 Lecture NoteDocument18 pagesAcc ch-4 Lecture NoteBlen tesfayeNo ratings yet

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- Accountancy Academic Organization: PartnershipDocument21 pagesAccountancy Academic Organization: Partnershipsehun ohNo ratings yet

- Forms of Business OrganizationDocument9 pagesForms of Business OrganizationKhim CortezNo ratings yet

- Problem 3 5 6 Special TransactionDocument5 pagesProblem 3 5 6 Special TransactionBabyann BallaNo ratings yet

- Week 6 Fundamentals of Partnership AnswersDocument6 pagesWeek 6 Fundamentals of Partnership AnswersHan ChinNo ratings yet

- Lesson 1 - Basic Consideration and FormationDocument3 pagesLesson 1 - Basic Consideration and FormationRynveeNo ratings yet

- Lesson 1 - Basic Consideration and FormationDocument3 pagesLesson 1 - Basic Consideration and FormationRynveeNo ratings yet

- BADVAC2X - MOD 1 Partnership FormationDocument4 pagesBADVAC2X - MOD 1 Partnership FormationAlice WuNo ratings yet

- Advacc 1Document11 pagesAdvacc 1Jasmine PeraltaNo ratings yet

- AC 1104 C-1 Ex, ProbDocument20 pagesAC 1104 C-1 Ex, ProbCharles LaspiñasNo ratings yet

- Partnership FormationDocument23 pagesPartnership FormationJOANNA ROSE MANALO100% (1)

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- PARTNERSHIPDocument4 pagesPARTNERSHIPShane Ivory Claudio100% (1)

- Partnership and CorporationDocument41 pagesPartnership and CorporationShane Ivory ClaudioNo ratings yet

- 1 Corporation Accounting IntroductionDocument6 pages1 Corporation Accounting IntroductionShane Ivory ClaudioNo ratings yet

- 1Document2 pages1Shane Ivory ClaudioNo ratings yet

- Abo 1Document3 pagesAbo 1Shane Ivory ClaudioNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- Chapter 27Document7 pagesChapter 27Shane Ivory ClaudioNo ratings yet

- Chapter 34Document8 pagesChapter 34Shane Ivory ClaudioNo ratings yet

- Chapter 33Document7 pagesChapter 33Shane Ivory ClaudioNo ratings yet

- Chapter 29Document6 pagesChapter 29Shane Ivory ClaudioNo ratings yet

- Chapter 26Document5 pagesChapter 26Shane Ivory ClaudioNo ratings yet

- Have Something Done EXERCISESDocument3 pagesHave Something Done EXERCISEScarlos laredoNo ratings yet

- Cleopatra Wall Tiles CatalogueDocument151 pagesCleopatra Wall Tiles CatalogueHussain ElarabiNo ratings yet

- Cores - TabelaDocument5 pagesCores - TabelahelberfuzerNo ratings yet

- Cost Audit RepairDocument7 pagesCost Audit RepairkayseNo ratings yet

- The Heat Transport System in Heavy Water Nuclear Reactor - Puci, ArberDocument42 pagesThe Heat Transport System in Heavy Water Nuclear Reactor - Puci, ArberDebye101No ratings yet

- Gen Bio 1 Le Week 1 - Quarter 2Document7 pagesGen Bio 1 Le Week 1 - Quarter 2Cassy Joy Rellama100% (1)

- A Comprehensive Review On Chanting of Sacred Sound Om (Aum) As A Healing PracticeDocument6 pagesA Comprehensive Review On Chanting of Sacred Sound Om (Aum) As A Healing Practicejayesh rajputNo ratings yet

- 11 Food Service Industry Commercial Vs NonCommercialDocument19 pages11 Food Service Industry Commercial Vs NonCommercialTum LamungNo ratings yet

- Written Theory Sample12Document1 pageWritten Theory Sample12John SmithNo ratings yet

- GeoseaDocument9 pagesGeoseaArthur WakashimasuNo ratings yet

- Leaf 2Document5 pagesLeaf 2Mannu GuptaNo ratings yet

- Maseno Universit1Document9 pagesMaseno Universit1Simon MutuaNo ratings yet

- Enrollment FormDocument1 pageEnrollment Formvalupadasu VishvasNo ratings yet

- Consultants/Contractors Confirmation Check List: Consultant/Contractor UndertakingDocument1 pageConsultants/Contractors Confirmation Check List: Consultant/Contractor Undertakingfishy18No ratings yet

- Music LP OrchestraDocument11 pagesMusic LP OrchestraCybi MethueneNo ratings yet

- 35 CPC Case Brief - Raj Sarogi v. American Express (Discovery of Documents) - Notes For FreeDocument2 pages35 CPC Case Brief - Raj Sarogi v. American Express (Discovery of Documents) - Notes For Freeabhishekp494No ratings yet

- CochinBase Tender E 13042021detailDocument27 pagesCochinBase Tender E 13042021detailisan.structural TjsvgalavanNo ratings yet

- Cam-Displacement DiagramDocument2 pagesCam-Displacement DiagramArvin VillanuevaNo ratings yet

- 15ec74 MMC Course ModulesDocument2 pages15ec74 MMC Course Modulesragavendra4No ratings yet

- DIY GREENHOUSE by KMS - ChangelogDocument4 pagesDIY GREENHOUSE by KMS - Changeloglm pronNo ratings yet

- Mooka's Pancha ShatiDocument16 pagesMooka's Pancha ShatiSudarsanan NesamonyNo ratings yet

- Sri Chaitanya IIT Academy, India: Grand Test-5Document31 pagesSri Chaitanya IIT Academy, India: Grand Test-5ashrithNo ratings yet

- Flygt Submersible Pumps: Water & WastewaterDocument2 pagesFlygt Submersible Pumps: Water & WastewaterRebeka ComercializadoraNo ratings yet

- HITO 2004 Annual ReportDocument15 pagesHITO 2004 Annual ReportHITONo ratings yet

- Medium - Voltage (Oman Cable)Document10 pagesMedium - Voltage (Oman Cable)jayhshah8No ratings yet

- Hydraulic Structure 1Document211 pagesHydraulic Structure 1tazebNo ratings yet

- No Tears For TiersDocument4 pagesNo Tears For Tiersapi-143406529No ratings yet

- (Oral Ana) Molars Gen CharacteristicsDocument24 pages(Oral Ana) Molars Gen CharacteristicsVT Superticioso Facto - TampusNo ratings yet

Partnership Formation

Partnership Formation

Uploaded by

Shane Ivory Claudio0 ratings0% found this document useful (0 votes)

12 views2 pagesThe document provides guidelines for forming partnerships, including recording cash investments at fair value, non-cash investments at agreed value, services at agreed value, and liabilities at fair value. It also describes forming a partnership between individuals with no existing business and forming one between a sole proprietor and individual. The summary is:

1. Fernando and Java agreed to form a partnership, with Fernando contributing $700,000 cash and Java contributing land worth $1,300,000 with a $300,000 mortgage.

2. The journal entries record Fernando's $700,000 cash as an asset and Java's capital, the $1,300,000 land as an asset, and the $300,000 mortgage as

Original Description:

xcdvddcdvggsregwsthywrhyw4rtf34rfae3qt

Original Title

PARTNERSHIP FORMATION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides guidelines for forming partnerships, including recording cash investments at fair value, non-cash investments at agreed value, services at agreed value, and liabilities at fair value. It also describes forming a partnership between individuals with no existing business and forming one between a sole proprietor and individual. The summary is:

1. Fernando and Java agreed to form a partnership, with Fernando contributing $700,000 cash and Java contributing land worth $1,300,000 with a $300,000 mortgage.

2. The journal entries record Fernando's $700,000 cash as an asset and Java's capital, the $1,300,000 land as an asset, and the $300,000 mortgage as

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesPartnership Formation

Partnership Formation

Uploaded by

Shane Ivory ClaudioThe document provides guidelines for forming partnerships, including recording cash investments at fair value, non-cash investments at agreed value, services at agreed value, and liabilities at fair value. It also describes forming a partnership between individuals with no existing business and forming one between a sole proprietor and individual. The summary is:

1. Fernando and Java agreed to form a partnership, with Fernando contributing $700,000 cash and Java contributing land worth $1,300,000 with a $300,000 mortgage.

2. The journal entries record Fernando's $700,000 cash as an asset and Java's capital, the $1,300,000 land as an asset, and the $300,000 mortgage as

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

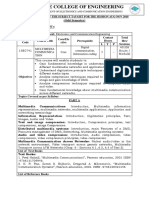

PARTNERSHIP FORMATION Guidelines in Partnership

CASH INVESTMENT 1. Adjust

- Recorded at Fair Value most often known 2. Close

as Face Value as far as cash valuation is 3. Investment

concerned 4. Balance Sheet

Note: If it is a Foreign Currency, it will be valued at

the current exchange rate Valuation:

Cash – Fair Value

NONCASH INVESTMENT Noncash – Agreed Value

- Recorded at the agreed value which is Service - Agreed Value

normally the fair value of the property at Liabilities – Fair Value

the time of investment.

Note: In case of conflict between agreed value and INDIVIDUALS WITH NO EXISTING BUSINESS

fair value, agreed value prevails FORMED A PARTNERSHIP

SERVICES On July 1, 2019, Gerry Fernando and Joanne Jave

- If this is contributed to the partnership a agreed to form a partnership. The partnership

memorandum entry is essential if it wero agreement specified that Fernando is to invest cash

no value agreed upon, otherwise a journal of 700,000 and Java is to contribute land with fair

entry would be required market value of 1,300,000 with 300,00 mortgages

to be assumed by the partnership

LIABILITIES

- assumed by the partnership should be valued at Required: Prepare the journal entries to record the

the present value (fair value) of the remaining cash formation of the partnership.

flow

Journal Entries:

A partnership may be formed in any of the

following ways: Cash 700,000

1. Individuals with no existing business formed Fernando Capital 700,000

a partnership

2. A sole proprietor and an individual without Land 1,300,000

existing business form a partnership Java Capital 1,000,000

3. Two or more sole proprietorship formed a Mortgage Payable 300,000

partnership

4. Admission or retirement of a partner (there

is an existing partnership already) A SOLE PROPRIETOR AND AN INDIVIDUAL W/O

EXISITNG BUSINESS FORM A PARTNERSHIP

STEPS IN PARTNERSHIP FORMATION

Book of Proprietor The statement of financial position of Leopoldo

1. Adjust assets and liabilities in accordance with Medina on October 1, 2019, before accepting

the agreement Challoner Matero as partners is shown below

2. Close the books

Leopoldo Medina

Books of Partnership Statement of Financial Position

1. Open the books of partnership October 1, 2019

Note: Gains, losses, income and expense ASSETS

adjustment will be reflected directly to "Capital Cash 60,000

account" Notes Receivable 30,000

Accounts Receivable 240,000

Allowance for Bad Debts (10,000)

Merchandise Inventory 80,000

Furniture and Fixtures 60,000

Accum. Depreciation F&F (6,000)

Total assets 454,000

LIABILITIES AND EQUITY

Notes Payable 40,000

Accounts Payable 100,000

Medina, Capital 314,000

Total Liab and equity 454,000

Adjustments:

1. Merchandise inventory is to be valued at

74,000

2. The accounts receivable is 95% collectible

3. Interest accrued on the note’s receivable will

be recognized: 10,000, 12% dated July 1, 2019

and 20,000, 12% dated August 1, 2019

4. Interest on notes payable to be accrued at 14%

annually from April 1, 2019

5. The furniture and fixtures are to be valued at

46,000

6. Office supplies on hand that have been

charged to expense in the past amounted to

4,000. These will be used by the partnership

Recognized: Prepare the journal entries to record

the formation of the partnership

You might also like

- Multi Choice Tech 1 AnswerDocument20 pagesMulti Choice Tech 1 AnswerquyennqNo ratings yet

- Exercise 1-1 To 1-5Document5 pagesExercise 1-1 To 1-5Jennette ToNo ratings yet

- CASINO by Nicholas PileggiDocument238 pagesCASINO by Nicholas PileggiPutipufNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- A. Partnership Formation and DissolutionDocument9 pagesA. Partnership Formation and DissolutionEricka MagatNo ratings yet

- Partnership Formation Activity 2Document4 pagesPartnership Formation Activity 2Shaira Untalan100% (1)

- Chapter 2 - Accounting For Partnership Formation2 (NO ILLUS)Document65 pagesChapter 2 - Accounting For Partnership Formation2 (NO ILLUS)PatOcampo50% (2)

- Part - Formation FATDocument2 pagesPart - Formation FATArian AmuraoNo ratings yet

- Partnership: Definition, Nature and FormationDocument19 pagesPartnership: Definition, Nature and FormationRuthchell CiriacoNo ratings yet

- Chapter 2Document35 pagesChapter 2Jerryline BerguiaNo ratings yet

- SAN BEDA COLLEGE Mendiola Manila Departm PDFDocument8 pagesSAN BEDA COLLEGE Mendiola Manila Departm PDFAlvaroNo ratings yet

- Partnership FormatDocument13 pagesPartnership FormatKenneth Ninalga100% (1)

- AFAR 1. PartnershipDocument8 pagesAFAR 1. PartnershipKristine May PeraltaNo ratings yet

- Advacc NotesDocument11 pagesAdvacc Notesthirdyear83No ratings yet

- PartnershipDocument18 pagesPartnershipMary Rica DublonNo ratings yet

- Acc 30 CorporationDocument8 pagesAcc 30 CorporationGerlie BonleonNo ratings yet

- Partnership Formation Partnership AccountingDocument14 pagesPartnership Formation Partnership AccountingJesseca JosafatNo ratings yet

- Concept Map Part FormationDocument4 pagesConcept Map Part FormationSamNo ratings yet

- Module-Partnership-and-Corporation-Accounting - Lesson 1Document6 pagesModule-Partnership-and-Corporation-Accounting - Lesson 1Jay Lord GallardoNo ratings yet

- PartnershipDocument9 pagesPartnershipChariz Audrey100% (1)

- Partnership Formation NotesDocument4 pagesPartnership Formation NotesMary Rica DublonNo ratings yet

- Partnership: Formation OperationDocument65 pagesPartnership: Formation OperationrickyjakezosaNo ratings yet

- Accounting For Partnerships: Basic Considerations and FormationDocument22 pagesAccounting For Partnerships: Basic Considerations and FormationAj CapungganNo ratings yet

- Partnership FormationDocument16 pagesPartnership FormationKian BarredoNo ratings yet

- Afar Partnerships Ms. Ellery D. de Leon: True or FalseDocument6 pagesAfar Partnerships Ms. Ellery D. de Leon: True or FalsePat DrezaNo ratings yet

- Partnership FormationDocument8 pagesPartnership FormationWithDoctorWu100% (1)

- 1 PartnershipDocument6 pages1 PartnershipJem Valmonte100% (3)

- Local Media1577402990991204520Document3 pagesLocal Media1577402990991204520KsUnlockerNo ratings yet

- Accounting 12Document4 pagesAccounting 12Breathe ArielleNo ratings yet

- Module 2Document6 pagesModule 2trixie mae0% (1)

- Module 2Document6 pagesModule 2Mary Joy CabilNo ratings yet

- 1 - Week Partnership FormationDocument24 pages1 - Week Partnership FormationAlrac Garcia100% (1)

- Prelim PartnershipFormationSampleProblemDocument4 pagesPrelim PartnershipFormationSampleProblemLee SuarezNo ratings yet

- AFAR NotesDocument7 pagesAFAR NotesMay Grethel Joy PeranteNo ratings yet

- Partnership FormationDocument28 pagesPartnership Formationmarjorie magsinoNo ratings yet

- Accounting Quiz 1Document2 pagesAccounting Quiz 1Cjhay MarcosNo ratings yet

- Accounting For Special TransactionsDocument3 pagesAccounting For Special TransactionsJñelle Faith Herrera SaludaresNo ratings yet

- Partnerships PT 2 FormationDocument10 pagesPartnerships PT 2 FormationJohn Ashnaz DemaguilNo ratings yet

- PARCOR 1 and 2Document7 pagesPARCOR 1 and 2Kim Audrey Jalalain100% (1)

- FormationDocument31 pagesFormationBYRON DESEMBRANANo ratings yet

- The Teaching Hub Class Xii Accountancy Chapter 2: The Fundamental of Partnership FirmDocument3 pagesThe Teaching Hub Class Xii Accountancy Chapter 2: The Fundamental of Partnership FirmAthArvA .TNo ratings yet

- Accounting For PartnershipDocument46 pagesAccounting For PartnershipRejean Dela Cruz100% (1)

- Parcor FinalDocument6 pagesParcor FinalChris YuNo ratings yet

- Chapter 4 - Accounting For PartnershipsDocument34 pagesChapter 4 - Accounting For PartnershipsFasiko AsmaroNo ratings yet

- Parcoac Prelim Reviewer 2Document5 pagesParcoac Prelim Reviewer 2tokyoescotoNo ratings yet

- Partnership Formation Lecture NotesDocument3 pagesPartnership Formation Lecture Notesbum_24100% (5)

- PICPA - 1st Year QuestionsDocument1 pagePICPA - 1st Year QuestionsVincent Larrie MoldezNo ratings yet

- Acc ch-4 Lecture NoteDocument18 pagesAcc ch-4 Lecture NoteBlen tesfayeNo ratings yet

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- Accountancy Academic Organization: PartnershipDocument21 pagesAccountancy Academic Organization: Partnershipsehun ohNo ratings yet

- Forms of Business OrganizationDocument9 pagesForms of Business OrganizationKhim CortezNo ratings yet

- Problem 3 5 6 Special TransactionDocument5 pagesProblem 3 5 6 Special TransactionBabyann BallaNo ratings yet

- Week 6 Fundamentals of Partnership AnswersDocument6 pagesWeek 6 Fundamentals of Partnership AnswersHan ChinNo ratings yet

- Lesson 1 - Basic Consideration and FormationDocument3 pagesLesson 1 - Basic Consideration and FormationRynveeNo ratings yet

- Lesson 1 - Basic Consideration and FormationDocument3 pagesLesson 1 - Basic Consideration and FormationRynveeNo ratings yet

- BADVAC2X - MOD 1 Partnership FormationDocument4 pagesBADVAC2X - MOD 1 Partnership FormationAlice WuNo ratings yet

- Advacc 1Document11 pagesAdvacc 1Jasmine PeraltaNo ratings yet

- AC 1104 C-1 Ex, ProbDocument20 pagesAC 1104 C-1 Ex, ProbCharles LaspiñasNo ratings yet

- Partnership FormationDocument23 pagesPartnership FormationJOANNA ROSE MANALO100% (1)

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- PARTNERSHIPDocument4 pagesPARTNERSHIPShane Ivory Claudio100% (1)

- Partnership and CorporationDocument41 pagesPartnership and CorporationShane Ivory ClaudioNo ratings yet

- 1 Corporation Accounting IntroductionDocument6 pages1 Corporation Accounting IntroductionShane Ivory ClaudioNo ratings yet

- 1Document2 pages1Shane Ivory ClaudioNo ratings yet

- Abo 1Document3 pagesAbo 1Shane Ivory ClaudioNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- Chapter 27Document7 pagesChapter 27Shane Ivory ClaudioNo ratings yet

- Chapter 34Document8 pagesChapter 34Shane Ivory ClaudioNo ratings yet

- Chapter 33Document7 pagesChapter 33Shane Ivory ClaudioNo ratings yet

- Chapter 29Document6 pagesChapter 29Shane Ivory ClaudioNo ratings yet

- Chapter 26Document5 pagesChapter 26Shane Ivory ClaudioNo ratings yet

- Have Something Done EXERCISESDocument3 pagesHave Something Done EXERCISEScarlos laredoNo ratings yet

- Cleopatra Wall Tiles CatalogueDocument151 pagesCleopatra Wall Tiles CatalogueHussain ElarabiNo ratings yet

- Cores - TabelaDocument5 pagesCores - TabelahelberfuzerNo ratings yet

- Cost Audit RepairDocument7 pagesCost Audit RepairkayseNo ratings yet

- The Heat Transport System in Heavy Water Nuclear Reactor - Puci, ArberDocument42 pagesThe Heat Transport System in Heavy Water Nuclear Reactor - Puci, ArberDebye101No ratings yet

- Gen Bio 1 Le Week 1 - Quarter 2Document7 pagesGen Bio 1 Le Week 1 - Quarter 2Cassy Joy Rellama100% (1)

- A Comprehensive Review On Chanting of Sacred Sound Om (Aum) As A Healing PracticeDocument6 pagesA Comprehensive Review On Chanting of Sacred Sound Om (Aum) As A Healing Practicejayesh rajputNo ratings yet

- 11 Food Service Industry Commercial Vs NonCommercialDocument19 pages11 Food Service Industry Commercial Vs NonCommercialTum LamungNo ratings yet

- Written Theory Sample12Document1 pageWritten Theory Sample12John SmithNo ratings yet

- GeoseaDocument9 pagesGeoseaArthur WakashimasuNo ratings yet

- Leaf 2Document5 pagesLeaf 2Mannu GuptaNo ratings yet

- Maseno Universit1Document9 pagesMaseno Universit1Simon MutuaNo ratings yet

- Enrollment FormDocument1 pageEnrollment Formvalupadasu VishvasNo ratings yet

- Consultants/Contractors Confirmation Check List: Consultant/Contractor UndertakingDocument1 pageConsultants/Contractors Confirmation Check List: Consultant/Contractor Undertakingfishy18No ratings yet

- Music LP OrchestraDocument11 pagesMusic LP OrchestraCybi MethueneNo ratings yet

- 35 CPC Case Brief - Raj Sarogi v. American Express (Discovery of Documents) - Notes For FreeDocument2 pages35 CPC Case Brief - Raj Sarogi v. American Express (Discovery of Documents) - Notes For Freeabhishekp494No ratings yet

- CochinBase Tender E 13042021detailDocument27 pagesCochinBase Tender E 13042021detailisan.structural TjsvgalavanNo ratings yet

- Cam-Displacement DiagramDocument2 pagesCam-Displacement DiagramArvin VillanuevaNo ratings yet

- 15ec74 MMC Course ModulesDocument2 pages15ec74 MMC Course Modulesragavendra4No ratings yet

- DIY GREENHOUSE by KMS - ChangelogDocument4 pagesDIY GREENHOUSE by KMS - Changeloglm pronNo ratings yet

- Mooka's Pancha ShatiDocument16 pagesMooka's Pancha ShatiSudarsanan NesamonyNo ratings yet

- Sri Chaitanya IIT Academy, India: Grand Test-5Document31 pagesSri Chaitanya IIT Academy, India: Grand Test-5ashrithNo ratings yet

- Flygt Submersible Pumps: Water & WastewaterDocument2 pagesFlygt Submersible Pumps: Water & WastewaterRebeka ComercializadoraNo ratings yet

- HITO 2004 Annual ReportDocument15 pagesHITO 2004 Annual ReportHITONo ratings yet

- Medium - Voltage (Oman Cable)Document10 pagesMedium - Voltage (Oman Cable)jayhshah8No ratings yet

- Hydraulic Structure 1Document211 pagesHydraulic Structure 1tazebNo ratings yet

- No Tears For TiersDocument4 pagesNo Tears For Tiersapi-143406529No ratings yet

- (Oral Ana) Molars Gen CharacteristicsDocument24 pages(Oral Ana) Molars Gen CharacteristicsVT Superticioso Facto - TampusNo ratings yet