Professional Documents

Culture Documents

AbacusShortTakes 10262022

AbacusShortTakes 10262022

Uploaded by

ignaciomannyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AbacusShortTakes 10262022

AbacusShortTakes 10262022

Uploaded by

ignaciomannyCopyright:

Available Formats

Wednesday, October 26, 2022

*0

TODAY’S TOPICS

IN FOCUS Wilcon posted stellar earnings in Q3 wtih net income surging 78% YoY to

_____________

Php1.1B. This brought the YTD figure to Php2.96B, +58% YoY and already

84% of full year consensus.

According to Bloomberg, recent estimates place the Copper inventories at just

WLCON

P29.00, +1.75% 30,000 tons. The lack of inventory has seen spot prices for the red metal

climb to the highest premium over future deliveries in a long time.

The Hang Seng China Enterprises Index fell 7.3% last Monday with foreign

investors reportedly selling 17.9B yuan ($2.5B) worth of Chinese equities

through the Hong-Kong trading link.

the possibility that it will be slightly lower YoY. This will probably be a

negative surprise for the market. Stay UW.

: WLCON

Wilcon again posted stellar earnings in Q3 wtih net income surging 78% YoY to

Php1.1B. This brought the YTD figure to Php2.96B, +58% YoY and already 84% of

full year consensus. We discuss the details below and what this means for the share

price moving forward.

Wednesday, October 26, 2022

PAGE 1

Wednesday, October 26, 2022

Drivers. One reason for huge jump last quarter was that the corresponding period

IN FOCUS last year was a relatively low base as lockdowns were again imposed in Metro

_____________ Manila and surrounding areas. The impact of the lockdowns are evident in the same

store sales growth (sssg) figure for Q3 which was at a whopping +23.5%. More

WLCON -house

P29.00, +1.75% brands (see chart above). Management has made this a key part of their strategy

39.4%, the highest ever and 11 percentage points higher compared to the 28.4% in

4Q17. Third,

being buoyed by a backlog of construction projects that were delayed by the

pandemic for two years. As a result, officials expect home improvement sales to

ramp up until the first half of next year.

Upgrades.

could reach the median forecast for 2023. Analysts are thus likely to further

upgrade estimates for both this year and next which are already up 17% and 11%

year-to-

revenue of Php24.7B is 76% of full year consensus which is not a significant beat.

s outperformance can be traced to margins. The median

forecast for gross margin this year is 38.2% whereas the actual is likely to be above

39.0%. For next year, consensus GPM is at 38.5% but WLCON is already on track to

be at least 100 bps higher. One advantage it has over other listed consumer names

Wednesday, October 26, 2022

PAGE 2

Wednesday, October 26, 2022

IN FOCUS This is because overseas purchases are denominated in RMB which has been nearly

_____________ as weak against the dollar this year. Mor

be signalling that it will tolerate a weaker exchange rate and the peso has actually

appreciated against the RMB by 3.4% since late September. If the latter continues to

WLCON weaken, this could become a tailwind for earnings going into next year.

P29.00, +1.75%

Valuations. WLCON is one of the best performing index stocks since the start of

2020 and it shows. Its forward P/E of 29.2x is the highest in the PSEi and it is the

second most expensive home improvement play in the region. Upgrades are

imminent and this will help valuations but the stock will still be pricey. We do believe

the premium, especially over its regional peers (see chart), is partly justified by the

very strong YTD results and expanding margins. The Philippines is also the only

large SE Asian country that is at the beginning of its demographic transition and this

will be a key differentiator versus its peers over the long run. Nevertheless, we

would prefer to wait for dips before buying. The number of foreign owned shares as

of end-Q3 was actually down compared to a year ago (although higher versus end-

Q2) and there may be further selling pressure down the road. And not withstanding

-

developer) home construction over the next few quarters. Buy on weakness.

Wednesday, October 26, 2022

PAGE 3

Wednesday, October 26, 2022

IN FOCUS SIGNIFICANT DIGITS

_____________

10 days

million tons a decade ago. According to Bloomberg, recent estimates place the

Copper figure at just 30,000 tons or a drop of 97%. Many factors have contributed to the

steady decline in

PX slump, higher interest rates, a stronger dollar and liquidity issues at top copper

P2.41, -1.63% trader Maike Metals. The lack of inventory has seen spot prices for the red metal

climb to the highest premiu

AT in China where physical copper is in short supply. Globally, it is estimated that there

P3.27, +0.62% are only 10 days worth of the material. Some traders are thus speculating that when

the global economy takes its eventual turn toward the better, there could be a huge

Foreign Flows spike in prices as demand recovers. It may therefore be a good idea to put a small

bet on PX or AT and hold for about a year as they are the most leveraged to the price

of copper.

RANDOM THOUGHTS

1. The Hang Seng China Enterprises Index fell 7.3% last Monday with foreign

investors reportedly selling 17.9B yuan ($2.5B) worth of Chinese equities

through the Hong-Kong trading link. This pushed the YTD foreign activity to a

small drop which, if it holds, will be the first annual outflow since the stock

connect program was launched in 2014. According to a Bloomberg article, many

were disappointed at the lack of supportive policies during China's recently

concluded party congress. Others cited concerns about the possibility of one-

man rule on the mainland. Whatever the reason, should foreign selling continue,

the freed up funds will have to end up (at some point) in other equity markets.

Hopefully, a trickle finds it way here which could help the seemingly

directionless trade in the local market.

Wednesday, October 26, 2022

PAGE 4

Wednesday, October 26, 2022

2. MER will hold its 3Q briefing this Friday. Last month, September 14, we gave our

IN FOCUS

_____________

quarter results. First, we said that Singapore-based Pacific Light contributed

MER

P299.60, +2.04% shrink significantly Qo

changing with less coming from households (which have higher tariffs) and

more from the commercial segment (lower). This means the average

now that 100%-

-rate power supply

agreements with its parent. This has led to Php1.2B in losses for the unit in H1

inc

that it will be slightly lower YoY. This will probably be a negative surprise for the

market. Stay UW.

Wednesday, October 26, 2022

PAGE 5

Wednesday, October 26, 2022

Unit 2904-AEast Tower, Philippine www.mytrade.com.ph asc.research@abacus-sec.com.ph 8667-8900 (63.2) 634-5206

Stock Exchange Centre, Exchange

Road, Ortigas Center, Pasig city 1600

Wednesday, October 26, 2022

PAGE 6

You might also like

- WorldExplorationTrends2023 ReportDocument16 pagesWorldExplorationTrends2023 ReportKrash King100% (1)

- Spanning The GlobeDocument3 pagesSpanning The GlobeAli Fasl69% (13)

- EE On Ikea and Its Marketing StrategiesDocument16 pagesEE On Ikea and Its Marketing StrategiesWilmore JulioNo ratings yet

- 01 PDFDocument2 pages01 PDFsamirarabello0% (2)

- Nirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Document11 pagesNirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Shinde Chaitanya Sharad C-DOT 5688No ratings yet

- Pcomp Up On Gov't Stimulus Programs: Week in ReviewDocument2 pagesPcomp Up On Gov't Stimulus Programs: Week in ReviewJervie GacutanNo ratings yet

- Presales Recovery Expected in 2H, Earnings To Follow: Sector BriefDocument8 pagesPresales Recovery Expected in 2H, Earnings To Follow: Sector BrieftataxpNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- Top Story:: WED 11 JAN 2023Document9 pagesTop Story:: WED 11 JAN 2023Elcano MirandaNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- Half-Year Construction Market View - FinalDocument19 pagesHalf-Year Construction Market View - FinalAdam DawsonNo ratings yet

- India Strategy Report - 28th Feb 2024Document20 pagesIndia Strategy Report - 28th Feb 2024MalolanRNo ratings yet

- Ey Pe VC Trend BookDocument80 pagesEy Pe VC Trend BookRama KumarNo ratings yet

- EquityInvestmentStrategy May2022Document85 pagesEquityInvestmentStrategy May2022varanasidineshNo ratings yet

- Infosys 140422 MotiDocument10 pagesInfosys 140422 MotiGrace StylesNo ratings yet

- Axis Securities Equity Investment Strategy September 2022Document87 pagesAxis Securities Equity Investment Strategy September 2022Shriramkumar SinghNo ratings yet

- Colliers - Logistics - Report Q1 2023Document8 pagesColliers - Logistics - Report Q1 2023ANUSUA DASNo ratings yet

- Ciptadana Company Update MYOR 7 Mar 2024 Reiterate Buy Lower TPDocument7 pagesCiptadana Company Update MYOR 7 Mar 2024 Reiterate Buy Lower TPprima.brpNo ratings yet

- ORR BOSS Global Report WEBDocument2 pagesORR BOSS Global Report WEBasim.agueroNo ratings yet

- 2021 08 13 Dial - M - For - MarketDocument11 pages2021 08 13 Dial - M - For - MarketXavier StraussNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- Consumer: Commodity Cost Inflation Inflicts Earnings CutsDocument6 pagesConsumer: Commodity Cost Inflation Inflicts Earnings CutsktyNo ratings yet

- Consumer Durables: B2C and Small Ticket Items Lead RecoveryDocument5 pagesConsumer Durables: B2C and Small Ticket Items Lead RecoveryAnupam JainNo ratings yet

- Canada Cap Rate Report Q2 2023Document20 pagesCanada Cap Rate Report Q2 2023abahomed12No ratings yet

- Ki Unvr 20240212Document9 pagesKi Unvr 20240212muh.asad.amNo ratings yet

- Housing & Construction Review 2021Document17 pagesHousing & Construction Review 2021gutosaabNo ratings yet

- ComoDocument12 pagesComoLEKH021No ratings yet

- 2024 Market Outlook Sam 14 Des 2023 240116 124609Document26 pages2024 Market Outlook Sam 14 Des 2023 240116 124609marcellusdarrenNo ratings yet

- 7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Document5 pages7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Nicholas ChehNo ratings yet

- Through The Looking Glass Chinas 2023 GDP and The Year AheadDocument11 pagesThrough The Looking Glass Chinas 2023 GDP and The Year Aheadt8enedNo ratings yet

- Ey Ivca Monthly Pe VC Roundup December 2022Document77 pagesEy Ivca Monthly Pe VC Roundup December 2022Mehul GargNo ratings yet

- Flash - HM. Sampoerna: 2Q20 Volume and Key Forward-Looking StatementDocument3 pagesFlash - HM. Sampoerna: 2Q20 Volume and Key Forward-Looking Statementjnn sNo ratings yet

- 2QFY24 Results Recap - Good, Bad, Ugly - 231117Document58 pages2QFY24 Results Recap - Good, Bad, Ugly - 231117krishna_buntyNo ratings yet

- Asian Paints 18012024 MotiDocument12 pagesAsian Paints 18012024 Motigaurav24021990No ratings yet

- 2hcy22 Outlook Midf 010722Document56 pages2hcy22 Outlook Midf 010722jcw288No ratings yet

- FINAL - Capstone Headwaters Capital Markets Update Q2 2020Document30 pagesFINAL - Capstone Headwaters Capital Markets Update Q2 2020Ray CarpenterNo ratings yet

- Colliers Manila Q3 2022 Residential v2Document4 pagesColliers Manila Q3 2022 Residential v2bhandari_raviNo ratings yet

- Colliers Manila Q2 2022 Residential JB 07282022 BO Edits 2Document5 pagesColliers Manila Q2 2022 Residential JB 07282022 BO Edits 2Geodel CuarteroNo ratings yet

- 4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedDocument5 pages4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedbradburywillsNo ratings yet

- Still Challenging, Yet Promising Outlook: Quarterly - Office - Jakarta - 6 October 2021Document37 pagesStill Challenging, Yet Promising Outlook: Quarterly - Office - Jakarta - 6 October 2021Arko A.100% (1)

- Asian-Paints Broker ReportDocument7 pagesAsian-Paints Broker Reportsj singhNo ratings yet

- Kuwait Quarterly Brief 20230228 EDocument6 pagesKuwait Quarterly Brief 20230228 ERaven BlingNo ratings yet

- GroupM-DEC 2022Document34 pagesGroupM-DEC 2022nicholas.tan2810No ratings yet

- Pakistan Strategy 2020.Document60 pagesPakistan Strategy 2020.muddasir1980No ratings yet

- Morning Market Report 06-APR-2023Document2 pagesMorning Market Report 06-APR-2023Amit MittalNo ratings yet

- Can Fin Homes Ltd-4QFY23 Result UpdateDocument5 pagesCan Fin Homes Ltd-4QFY23 Result UpdateUjwal KumarNo ratings yet

- Nio - JesseDocument9 pagesNio - JessejayRNo ratings yet

- Insights Dim Light at The End of TunnelDocument37 pagesInsights Dim Light at The End of TunnelKelvin Narada GunawanNo ratings yet

- O/W: "You Only Sell The Dresses You Have ": City Chic Collective (CCX)Document5 pagesO/W: "You Only Sell The Dresses You Have ": City Chic Collective (CCX)Muhammad ImranNo ratings yet

- Nirmal Bang Voltas Management Meet Update 13 June 2022Document6 pagesNirmal Bang Voltas Management Meet Update 13 June 2022Anku YadavNo ratings yet

- GS Sales Trading - Good Morning Mail 27.03.2024Document6 pagesGS Sales Trading - Good Morning Mail 27.03.2024Franco CaraballoNo ratings yet

- Real Estate Outlook Global Edition March 2023Document6 pagesReal Estate Outlook Global Edition March 2023Saif MonajedNo ratings yet

- JLL - Singapore Property Market Monitor 1Q 2022Document2 pagesJLL - Singapore Property Market Monitor 1Q 2022WNo ratings yet

- Ashok Leyland Q3FY19 Result UpdateDocument4 pagesAshok Leyland Q3FY19 Result Updatekapil bahetiNo ratings yet

- JLL Global Real Estate Perspective November 2020Document7 pagesJLL Global Real Estate Perspective November 2020Trần Não EmailNo ratings yet

- CIMB Strategy Note 2 Aug 2023 2Q23, Mixed Results, Large Banks AheadDocument10 pagesCIMB Strategy Note 2 Aug 2023 2Q23, Mixed Results, Large Banks Aheadbotoy26No ratings yet

- Horizons Q3 Issue v4Document68 pagesHorizons Q3 Issue v4wyowhokojzsvvyrbvaNo ratings yet

- 15134-The Nigerian Financial Market 2021 Review and 2022 Outlook - A Mix of Boom and Gloom-ProshareDocument29 pages15134-The Nigerian Financial Market 2021 Review and 2022 Outlook - A Mix of Boom and Gloom-ProshareOladipo OlanyiNo ratings yet

- Pidilite Industries Limited: Eyeing Strong Post-Pandemic RecoveryDocument7 pagesPidilite Industries Limited: Eyeing Strong Post-Pandemic RecoveryIS group 7No ratings yet

- WilliamBlair - PCA 2024 Secondary Market Survey Report Mar 2024Document9 pagesWilliamBlair - PCA 2024 Secondary Market Survey Report Mar 2024Alexandre Da costaNo ratings yet

- Indian Mortgage Finance Market PDFDocument61 pagesIndian Mortgage Finance Market PDFmikecoreleonNo ratings yet

- Id 23062020 PDFDocument11 pagesId 23062020 PDFbala gamerNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- First Quarterly Report of The Keepers Holdings, Inc. Cy 2022Document73 pagesFirst Quarterly Report of The Keepers Holdings, Inc. Cy 2022ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- AbacusShortTakes 08232022Document7 pagesAbacusShortTakes 08232022ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

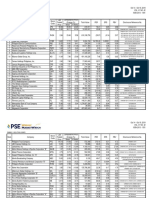

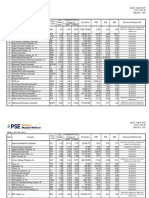

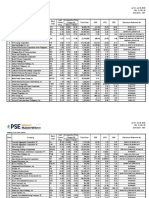

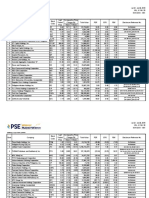

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- AbacusShortTakes 10252022Document6 pagesAbacusShortTakes 10252022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- 22 Dec 16 GNLMDocument16 pages22 Dec 16 GNLMmoe aungNo ratings yet

- Kevin Werbach - Chinas Social Credit SystemDocument57 pagesKevin Werbach - Chinas Social Credit SystemHellenNo ratings yet

- Strategic Management Case Study Group ReportDocument21 pagesStrategic Management Case Study Group ReportDevi Savira AlyshiaNo ratings yet

- 2012 International Arbitration Report Issue 1Document36 pages2012 International Arbitration Report Issue 1Khaled ChilwanNo ratings yet

- China's Ghost CitiesDocument46 pagesChina's Ghost CitiesasiafinancenewsNo ratings yet

- The Analects of ConfuciusDocument7 pagesThe Analects of ConfuciusAnonymous w5cOOIHNo ratings yet

- Drama 1105Document17 pagesDrama 1105EmpressMay ThetNo ratings yet

- On His Innovative Thought From The Book of Sangetsuki by Nakajima AtsushiDocument4 pagesOn His Innovative Thought From The Book of Sangetsuki by Nakajima AtsushiPseudo FiintaNo ratings yet

- China On Plastic WastesDocument3 pagesChina On Plastic WastesNica TemajoNo ratings yet

- XuetongDocument6 pagesXuetongVasil V. HristovNo ratings yet

- Boxer ProtocolDocument7 pagesBoxer ProtocolKeon Woo OhNo ratings yet

- China Facts For Kids China For Kids Cool Kid FactsDocument10 pagesChina Facts For Kids China For Kids Cool Kid Factsexfireex1No ratings yet

- Pak and Its Ties With CARsDocument12 pagesPak and Its Ties With CARsSaffiNo ratings yet

- Letter of Complaint (English)Document5 pagesLetter of Complaint (English)anyseeNo ratings yet

- RS Global Hotel Investment OutlookDocument17 pagesRS Global Hotel Investment OutlookGanesh LadNo ratings yet

- Tangram InstructionsDocument2 pagesTangram InstructionsJune SabatinNo ratings yet

- Dimensions of Cyber-Attacks: Cultural, Social, Economic, and PoliticalDocument11 pagesDimensions of Cyber-Attacks: Cultural, Social, Economic, and Politicalndaru_No ratings yet

- Unit 4 Writing AssignmentDocument6 pagesUnit 4 Writing AssignmentDan100% (2)

- Chapter 5 Global Customers: Global Marketing Management, 8e (Keegan)Document11 pagesChapter 5 Global Customers: Global Marketing Management, 8e (Keegan)prateek707199No ratings yet

- Feng Shui m2Document6 pagesFeng Shui m2Unicornio Azul0% (3)

- National Transport & Logistics Public Information Platform (MOT CHINA)Document36 pagesNational Transport & Logistics Public Information Platform (MOT CHINA)Lau MungNo ratings yet

- China Going Global: Between Ambition and CapacityDocument12 pagesChina Going Global: Between Ambition and CapacityOmar David Ramos VásquezNo ratings yet

- Zhang - Wang and Wang China 2012Document36 pagesZhang - Wang and Wang China 2012Karla VenegasNo ratings yet

- Jay Abraham The CEO Who Sees Around CornersDocument304 pagesJay Abraham The CEO Who Sees Around Cornersmichael3laterzaNo ratings yet

- Primary Source and Reading Guide - Rapid Development in China and IndiaDocument2 pagesPrimary Source and Reading Guide - Rapid Development in China and Indiajahran9194No ratings yet

- China Water Purifier Production: 4.2.2 by SegmentDocument3 pagesChina Water Purifier Production: 4.2.2 by SegmentWendell MerrillNo ratings yet

- China-Kyrgyzstan-Uzbekistan Railway - Opportunities and Challenges For ChinaDocument3 pagesChina-Kyrgyzstan-Uzbekistan Railway - Opportunities and Challenges For ChinaYunis ŞerifliNo ratings yet