Professional Documents

Culture Documents

AbacusShortTakes 08232022

AbacusShortTakes 08232022

Uploaded by

ignaciomannyCopyright:

Available Formats

You might also like

- RA Export 20230303-171712 (TEMPLATE-04 Haz) - ID230303164833 - Rev2023-03-03 - Cargo & Ballast Works - Ballast Water Treatment System FailureDocument3 pagesRA Export 20230303-171712 (TEMPLATE-04 Haz) - ID230303164833 - Rev2023-03-03 - Cargo & Ballast Works - Ballast Water Treatment System FailureHarman Sandhu100% (3)

- Brain Station Course CurriculumDocument21 pagesBrain Station Course CurriculumAliAbassi100% (1)

- AC17-602P-REGUNAYAN-End of Chapter 1 ExercisesDocument15 pagesAC17-602P-REGUNAYAN-End of Chapter 1 ExercisesMarco RegunayanNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- Axis Securities Equity Investment Strategy September 2022Document87 pagesAxis Securities Equity Investment Strategy September 2022Shriramkumar SinghNo ratings yet

- GS 2022 Macro Outlook - Nov21Document19 pagesGS 2022 Macro Outlook - Nov21gmehtaNo ratings yet

- S&P Report - 29 June 2020Document7 pagesS&P Report - 29 June 2020evans assanNo ratings yet

- SSBB Arsrapport 2022 ENGDocument49 pagesSSBB Arsrapport 2022 ENGFadillah WSNo ratings yet

- PVH Financial Analysis - Q1Document7 pagesPVH Financial Analysis - Q1Dulakshi RanadeeraNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- BudgetDocument23 pagesBudgetIron ManNo ratings yet

- Rashyu GuyinDocument1 pageRashyu GuyinChandra SegarNo ratings yet

- Monthly Gazette - October 2022Document5 pagesMonthly Gazette - October 2022bobbyardeaNo ratings yet

- Exercise Lecture 3Document3 pagesExercise Lecture 3ryanlee190502No ratings yet

- 12.10.10 Seven FY12 Results PresentationDocument43 pages12.10.10 Seven FY12 Results PresentationWilson WangmanNo ratings yet

- EquityInvestmentStrategy May2022Document85 pagesEquityInvestmentStrategy May2022varanasidineshNo ratings yet

- Economic Survey Descriptive QnaDocument64 pagesEconomic Survey Descriptive QnaKranti TejanNo ratings yet

- AngelTopPicks Sep 2022Document12 pagesAngelTopPicks Sep 2022Guru S SankarNo ratings yet

- Advisors Asset Management - Income Growth Fund OutlookDocument3 pagesAdvisors Asset Management - Income Growth Fund Outlookag rNo ratings yet

- Barclays WMG U.S. Media - DIS - Still Early in The Reset PhaseDocument27 pagesBarclays WMG U.S. Media - DIS - Still Early in The Reset PhaseraymanNo ratings yet

- CapitalGoods SectorUpdate2Mar23 ResearchDocument6 pagesCapitalGoods SectorUpdate2Mar23 Researchavinashpathak777No ratings yet

- Bank Stocks Swing Sharply After Another Big Fed Rate HikeDocument3 pagesBank Stocks Swing Sharply After Another Big Fed Rate HikeFatima NoorNo ratings yet

- CARE Ratings Limited Q2 FY22 & H1 FY22 Investors' Call 1 November 2021Document14 pagesCARE Ratings Limited Q2 FY22 & H1 FY22 Investors' Call 1 November 2021simmbNo ratings yet

- Directors Report 30 Sep 2020Document3 pagesDirectors Report 30 Sep 2020Muhammad SamiNo ratings yet

- Centrum Dabur India Company UpdateDocument7 pagesCentrum Dabur India Company UpdateprasaadrajputNo ratings yet

- PJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Document15 pagesPJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Neel DoshiNo ratings yet

- Consumer Discretionary Sector 3QFY22 Result Review 16 February 2022Document10 pagesConsumer Discretionary Sector 3QFY22 Result Review 16 February 2022Shinde Chaitanya Sharad C-DOT 5688No ratings yet

- AngelTopPicks N 2022Document12 pagesAngelTopPicks N 2022Venkatesh BudhaNo ratings yet

- World Bank 2023 India ReportDocument27 pagesWorld Bank 2023 India ReportMithilesh KumarNo ratings yet

- Market Outlook Samvat 2072: Low On Expectations, High On Returns Stock Update Aditya Birla Nuvo Stock Update Oil India Stock Update PTC India Financial ServicesDocument14 pagesMarket Outlook Samvat 2072: Low On Expectations, High On Returns Stock Update Aditya Birla Nuvo Stock Update Oil India Stock Update PTC India Financial ServicesrohitNo ratings yet

- 15124-CardinalStone Research 2022 Macro Outlook Consolidating Recovery-ProshareDocument16 pages15124-CardinalStone Research 2022 Macro Outlook Consolidating Recovery-ProshareOladipo OlanyiNo ratings yet

- Diwali Muhurat Fundamental 2021Document22 pagesDiwali Muhurat Fundamental 2021Swasthyasudha AyurvedNo ratings yet

- Gic Weekly 080124Document14 pagesGic Weekly 080124eldime06No ratings yet

- DownloadDocument42 pagesDownloadRubi MunusamyNo ratings yet

- GS 2024 MacroDocument28 pagesGS 2024 Macroxiongfeng aiNo ratings yet

- PMS - SISOP Product Sheet - Oct 2020 - 1Document4 pagesPMS - SISOP Product Sheet - Oct 2020 - 1Swades DNo ratings yet

- Godrej Consumer: Investment Rationale IntactDocument24 pagesGodrej Consumer: Investment Rationale IntactbradburywillsNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- KICTalking Points 080608Document6 pagesKICTalking Points 080608russ8609No ratings yet

- Nirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Document11 pagesNirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Shinde Chaitanya Sharad C-DOT 5688No ratings yet

- Udita Wadhwa - 2019BB10060Document14 pagesUdita Wadhwa - 2019BB10060Khushii NaamdeoNo ratings yet

- Outlook - Energy-Cross-Region - 26apr21 MoodysDocument10 pagesOutlook - Energy-Cross-Region - 26apr21 MoodysPedro MentadoNo ratings yet

- BSP MonetaryPolicySummary August2022 QuizDocument2 pagesBSP MonetaryPolicySummary August2022 Quizcjpadin09No ratings yet

- ECM Quarterly Letter 2Q22Document14 pagesECM Quarterly Letter 2Q22cybereisNo ratings yet

- EdgeReport BRITANNIA CaseStudy 07 09 2022 994Document34 pagesEdgeReport BRITANNIA CaseStudy 07 09 2022 994aadil suhailNo ratings yet

- EY Economy Watch - November 2022Document29 pagesEY Economy Watch - November 2022Harsha BandarlaNo ratings yet

- Horizons Q1 2022 - v06 FinalDocument70 pagesHorizons Q1 2022 - v06 FinalwyowhokojzsvvyrbvaNo ratings yet

- Top Story:: WED 11 JAN 2023Document9 pagesTop Story:: WED 11 JAN 2023Elcano MirandaNo ratings yet

- Indivior PLC, Q3 2021 Earnings Call, Oct 28, 2021Document11 pagesIndivior PLC, Q3 2021 Earnings Call, Oct 28, 2021King KingssonNo ratings yet

- 3Q22 Earnings - Call FINAL Print - 2Document36 pages3Q22 Earnings - Call FINAL Print - 2vanessa karmadjayaNo ratings yet

- GQG Performance and PositioningDocument4 pagesGQG Performance and Positioningchicku76No ratings yet

- Market Strategy: February 2021Document19 pagesMarket Strategy: February 2021Harshvardhan SurekaNo ratings yet

- Schroders Outlook 2022 Macro Market Outlook FinalDocument24 pagesSchroders Outlook 2022 Macro Market Outlook FinalOkinawan P.SNo ratings yet

- PG and Tvs ReportDocument15 pagesPG and Tvs ReportSAYALEE MESHRAMNo ratings yet

- Pcomp Up On Gov't Stimulus Programs: Week in ReviewDocument2 pagesPcomp Up On Gov't Stimulus Programs: Week in ReviewJervie GacutanNo ratings yet

- GS - Macro Outlook 2024Document28 pagesGS - Macro Outlook 2024MadhurNo ratings yet

- Presales Recovery Expected in 2H, Earnings To Follow: Sector BriefDocument8 pagesPresales Recovery Expected in 2H, Earnings To Follow: Sector BrieftataxpNo ratings yet

- Goldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedDocument3 pagesGoldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedZerohedge100% (1)

- Accelerating Sustainable Development after COVID-19: The Role of SDG BondsFrom EverandAccelerating Sustainable Development after COVID-19: The Role of SDG BondsNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- First Quarterly Report of The Keepers Holdings, Inc. Cy 2022Document73 pagesFirst Quarterly Report of The Keepers Holdings, Inc. Cy 2022ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- AbacusShortTakes 10252022Document6 pagesAbacusShortTakes 10252022ignaciomannyNo ratings yet

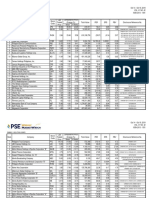

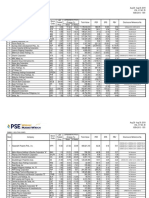

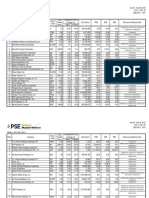

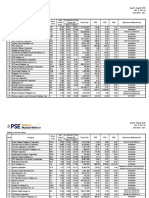

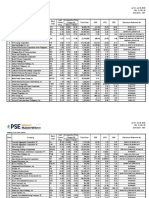

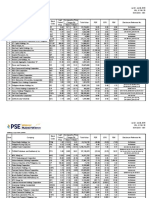

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- 2016 July Proficiency Session 2 A VersionDocument2 pages2016 July Proficiency Session 2 A VersionSanem Hazal TürkayNo ratings yet

- Fashion and ConsumerismDocument28 pagesFashion and ConsumerismAhmedNagyNo ratings yet

- American Scientific Research Journal For Engineering, Technology, and Sciences (Asrjets), Vol 6, No 1 (2013), Issn (Print) 2313-44106Document2 pagesAmerican Scientific Research Journal For Engineering, Technology, and Sciences (Asrjets), Vol 6, No 1 (2013), Issn (Print) 2313-44106atilaelciNo ratings yet

- MachinesDocument2 pagesMachinesShreyas YewaleNo ratings yet

- Veterinary Course WorkDocument5 pagesVeterinary Course Workbcnwhkha100% (2)

- HW 1Document4 pagesHW 1BillyLinNo ratings yet

- Premature Fatigue Failure of A Spring Due To Quench CracksDocument8 pagesPremature Fatigue Failure of A Spring Due To Quench CracksCamilo Rojas GómezNo ratings yet

- Magic Vision Tester by Ian Buckland DocumentDocument6 pagesMagic Vision Tester by Ian Buckland DocumentbrainechoNo ratings yet

- KGH Series Bellows CouplingDocument1 pageKGH Series Bellows CouplingServo2GoNo ratings yet

- Deploying C++Builder ApplicationsDocument11 pagesDeploying C++Builder ApplicationsalhadeedNo ratings yet

- Brooklyn College - Fieldwork ExperienceDocument6 pagesBrooklyn College - Fieldwork Experienceapi-547174770No ratings yet

- Tipi InstructionsDocument32 pagesTipi InstructionsZenrof100% (1)

- BillInvoice 2Document2 pagesBillInvoice 2gopim888No ratings yet

- Manual de Utilizare Sursa de Alimentare 27.6 V5 A Pulsar EN54-5A17 230 VAC50 HZ Montaj Aparent LEDDocument40 pagesManual de Utilizare Sursa de Alimentare 27.6 V5 A Pulsar EN54-5A17 230 VAC50 HZ Montaj Aparent LEDGabriel SerbanNo ratings yet

- Jan W. Gooch, Biosketch - Jan. 2015Document15 pagesJan W. Gooch, Biosketch - Jan. 2015jan w goochNo ratings yet

- CSEC IT Study GuideDocument21 pagesCSEC IT Study GuideNaje CampbellNo ratings yet

- Risk Management in Mental Health ServicesDocument54 pagesRisk Management in Mental Health Servicesjazz8181No ratings yet

- Desk Guide - Ag and Food Careers in Pennsylvania - FINALDocument121 pagesDesk Guide - Ag and Food Careers in Pennsylvania - FINALKuhnNo ratings yet

- Urban Floods in Bangalore and Chennai-Risk Management Challenges and Lessons For Sustainable Urban Ecology Current Science 2011 PDFDocument8 pagesUrban Floods in Bangalore and Chennai-Risk Management Challenges and Lessons For Sustainable Urban Ecology Current Science 2011 PDFSatishDeshmukhNo ratings yet

- Chapter 9.2 Process Costing - Average and FIFODocument14 pagesChapter 9.2 Process Costing - Average and FIFOdoomageddonsplinterlandNo ratings yet

- Adeshwar Nursing Institute Khamhargaon, Jagdalpur: Community Health Nursing Lesson Plan ON Wound DressingDocument8 pagesAdeshwar Nursing Institute Khamhargaon, Jagdalpur: Community Health Nursing Lesson Plan ON Wound DressingNitesh BhuraNo ratings yet

- 10 JMSCR PDFDocument5 pages10 JMSCR PDFSubi SureshNo ratings yet

- Scaling BenchmarkDocument7 pagesScaling BenchmarkJuan Pablo Henríquez ValenciaNo ratings yet

- Sec eDocument2 pagesSec eVicter PaulNo ratings yet

- Springs Are Fundamental Mechanical Components Found in Many Mechanical SystemsDocument4 pagesSprings Are Fundamental Mechanical Components Found in Many Mechanical SystemsZandro GagoteNo ratings yet

- Placa Mãe HD7Document3 pagesPlaca Mãe HD7ALBANO2No ratings yet

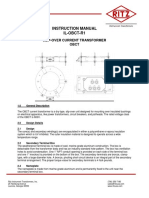

- Instruction Manual Il-Obct-R1: Slip-Over Current Transformer ObctDocument2 pagesInstruction Manual Il-Obct-R1: Slip-Over Current Transformer Obctبوحميدة كمالNo ratings yet

AbacusShortTakes 08232022

AbacusShortTakes 08232022

Uploaded by

ignaciomannyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AbacusShortTakes 08232022

AbacusShortTakes 08232022

Uploaded by

ignaciomannyCopyright:

Available Formats

Tuesday, August 23, 2022

*0

TODAY’S TOPICS

IN FOCUS

We provide our thoughts on the recent $PGOLD briefing and their outlook for

_____________

the rest of the year.

One global remittance company is reporting strong remittance growth for last

PGOLD month basically from all points of the globe. The company estimates that the

P35.75, +0.28% month-on-month increase from June to July was at least 10%.

We note down the changes in the FTSE Russell index and the impact to the

We reiterate our call to switch from $FLI to $MEG

occupancy rate is expected to further worsen from the current 68% to 55% by

end-2022.

FOCUS: PGOLD

Possibly the last company to hold its earnings call for the 2Q22 earnings season is

PGOLD which just occurred yesterday. While we have known about its earnings

results for the quarter in the past weeks, there are still some things to discuss that

would help give more visibility for its results and outlook for the rest of the year.

Tuesday, August 23, 2022

PAGE 1

Tuesday, August 23, 2022

IN FOCUS Improved sentiment. The last time we wrote about PGOLD was when the company

_____________ initially released its 2Q22 earnings on August 2. Since then, investors seem to have

liked what they saw with share price rising nearly 20% over the past three weeks

along of course, the improved sentiment of the market, in general. A part of the

PGOLD better sentiment may have to do with the better than expected US inflation data

P35.75, +0.28% which some may expect the toppish indicator to be true as well for the Philippines.

Should the latter be true, this may be a good indicator for PGOLD as high inflationary

periods tend to be less attractive for the consumer sector.

Margins and Strategy. We did mention margins the last time we wrote about

management took time to discuss. First, management acknowledged lower

consolidated margins which can be attributed to several factors such as higher input

costs, higher prices from suppliers, and the unfavorable foreign exchange rate

particularly for S&R. But the company is seeing consumer trends, given the high

inflationary environment, that customers are purchasing less per trip and are

beginning to trade down certain products. PGOLD's strategy remains to be the same

for both of its brands and that is to maintain its growth, which the company is doing

by absorbing some of its costs to retain its sales and will not fully pass on the costs.

relatively lower compared to the margins it showed in 1H22. Lastly, for its Puregold

brand, its expansion in the near term is mostly located outside of Metro Manila that

would give more importance to its pricing strategy for affordability but in turn could

slightly dampen margins.

Source: Company

Tuesday, August 23, 2022

PAGE 2

Tuesday, August 23, 2022

Traffic. The company attributed much of its topline growth to the returning foot

IN FOCUS traffic after the omicron wave in Q1. Despite the discussion above, topline and

_____________ bottom line growth have improved in 1H22 with the improved foot traffic that is

likely to be further boosted by the resumption of face-to-face classes and return to

office arrangements. Although traffic did appear better for S&R, same store net

PGOLD traffic was down and this was said to be caused by consumers preferring to go to

P35.75, +0.28% the newer stores that are closer to their homes. Nevertheless, we also expect foot

traffic to continue to improve in 2H22 as mobility restrictions remain to be at the

minimum and should be a positive development for Puregold and S&R.

Outlook. Management also provided a bit of color on early Q3 numbers in which they

are expecting better numbers compared to Q2. To recall, Q2 was actually a strong

quarter with topline growing 14% YoY and on a quarter-to-quarter basis. So what

this could mean is a much improved 2H22, with the return of face-to-face classes

and the holiday season, compared to the first half and likely to pose strong numbers

against 2H21. The higher costs for both its brands could dampen margins but its

strategy of pursuing growth could pay dividends for the company. Currently,

PGOLD is trading at around 12 - 13x forward P/E and its 1.5 - 2 standard deviation

below its 10-year mean P/E. In other words, the stock continues to be cheap relative

to its earnings that may even see a bump later on. Our recommendation remains to

accumulate especially if it sees some correction after its recent run.

Tuesday, August 23, 2022

PAGE 3

Tuesday, August 23, 2022

SIGNIFICANT DIGITS

IN FOCUS

_____________ +10%. Official BSP data for July remittances growth won't be out until almost four

weeks from now, but at least one global remittance company is reporting strong

remittance growth for last month. The Philippine Star quotes an official from World

Remittances Remit saying that the company has seen a spike in remittances to the Philippines

from all points of the globe. The company estimates that the month-on-month

Consumer increase from June to July was at least +10%, and that this is a rather fast m-o-m

Spending pace for the company. Indeed, total cash remittances based on BSP data during pre-

pandemic years typically rose m-o-m in May or June only by mid to high single

digits (this was before some schools moved their school opening date nearer to

August). The official goes on further to say that this spike started in June and only

peaked this August, whereas previous school expense-related remittance growth

increases typically last for only one month. This supports what we wrote last week

about how remittances is likely to prop up consumer spending in the 2H.

Additionally, the peso value of remittances in June was boosted to +16% (see chart

below) by the exchange rate depreciation that month, which was 11.3% year-on-year.

The exchange rate was just as weak in July, depreciating -11.9%, which means this

boost would most likely be repeated for July as well.

Tuesday, August 23, 2022

PAGE 4

Tuesday, August 23, 2022

RANDOM THOUGHTS

IN FOCUS

_____________ 1. for Q2

recently (see Short Takes dated August 18) but the briefing yesterday provided

more color on the company. As expected, malls led the growth on the back of

FLI improving foot traffic and gradual lifting of rental concessions, while residential

P0.93, 0.00% revenues was relatively more resilient than peers due to continuous

MEG segments should continue to improve in the second half, the drag would come

P2.57, -3.02% e deteriorated since end-2020

mostly due to POGO preterminations (see chart below). Its occupancy rate as of

55% by end-2022 due to expected preterminations from minor traditional

tenants, and new properties set to finish construction in the period. As of end-

June, POGOs still occupy 7% of office gross leasable area (GLA). The weak outing

Q2 indicate

are located. As we expect significant downgrades in full-year earnings estimates

for FLI, we thus reiterate our view to switch to MEG.

Tuesday, August 23, 2022

PAGE 5

Tuesday, August 23, 2022

IN FOCUS 2. FTSE Russell announced changes to their Global Equity Index Series. For

_____________ Philippine stocks, the most significant change was the addition of EMI to their

All-World Indices, the main ones that include large and mid cap companies, and

the deletion from the same category of FB, which failed their liquidity

EMI requirements. For their micro cap indices, ABA, ALLHC, CREIT, FILRT, MARC,

P21.50, +4.37% and WEB were added, while AB, MAXS, INFRA, and PNB were deleted. For the

deletions, we expect weakness from now until the implementation date on

FB September 19 (Monday). For the additions, the announcement enabled EMI to

P44.00, -2.65% buck the overall downward market trend yesterday, while it was more of a mixed

bag for the micro cap additions, as there is significantly less following for the

ABA smaller cap indices. We expect this same dynamic up to the implementation date.

P2.17, -1.36%

3. We invite you to our upcoming back-to-back live events happening this

ALLHC

Wednesday and Thursday, August 24 25, 2022, on the upcoming SPNEC SRO.

P3.66, -0.54%

Kindly register down below if you are interested to know more about the latest

updates and the offering:

CREIT

P2.39, 0.00%

FILRT

P6.48, +4.18%

MARC

P1.44, -2.70%

AB

P8.14, -0.12% Registration Link: https://bit.ly/3c8XpD0

MAXS

P5.70, -1.89%

INFRA

P1.04, -0.95%

PNB

P18.18, -1.73%

WEB

P3.23, +1.89%

Tuesday, August 23, 2022

PAGE 6

Tuesday, August 23, 2022

Unit 2904-AEast Tower, Philippine www.mytrade.com.ph asc.research@abacus-sec.com.ph 8667-8900 (63.2) 634-5206

Stock Exchange Centre, Exchange

Road, Ortigas Center, Pasig city 1600

Tuesday, August 23, 2022

PAGE 7

You might also like

- RA Export 20230303-171712 (TEMPLATE-04 Haz) - ID230303164833 - Rev2023-03-03 - Cargo & Ballast Works - Ballast Water Treatment System FailureDocument3 pagesRA Export 20230303-171712 (TEMPLATE-04 Haz) - ID230303164833 - Rev2023-03-03 - Cargo & Ballast Works - Ballast Water Treatment System FailureHarman Sandhu100% (3)

- Brain Station Course CurriculumDocument21 pagesBrain Station Course CurriculumAliAbassi100% (1)

- AC17-602P-REGUNAYAN-End of Chapter 1 ExercisesDocument15 pagesAC17-602P-REGUNAYAN-End of Chapter 1 ExercisesMarco RegunayanNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- Axis Securities Equity Investment Strategy September 2022Document87 pagesAxis Securities Equity Investment Strategy September 2022Shriramkumar SinghNo ratings yet

- GS 2022 Macro Outlook - Nov21Document19 pagesGS 2022 Macro Outlook - Nov21gmehtaNo ratings yet

- S&P Report - 29 June 2020Document7 pagesS&P Report - 29 June 2020evans assanNo ratings yet

- SSBB Arsrapport 2022 ENGDocument49 pagesSSBB Arsrapport 2022 ENGFadillah WSNo ratings yet

- PVH Financial Analysis - Q1Document7 pagesPVH Financial Analysis - Q1Dulakshi RanadeeraNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- BudgetDocument23 pagesBudgetIron ManNo ratings yet

- Rashyu GuyinDocument1 pageRashyu GuyinChandra SegarNo ratings yet

- Monthly Gazette - October 2022Document5 pagesMonthly Gazette - October 2022bobbyardeaNo ratings yet

- Exercise Lecture 3Document3 pagesExercise Lecture 3ryanlee190502No ratings yet

- 12.10.10 Seven FY12 Results PresentationDocument43 pages12.10.10 Seven FY12 Results PresentationWilson WangmanNo ratings yet

- EquityInvestmentStrategy May2022Document85 pagesEquityInvestmentStrategy May2022varanasidineshNo ratings yet

- Economic Survey Descriptive QnaDocument64 pagesEconomic Survey Descriptive QnaKranti TejanNo ratings yet

- AngelTopPicks Sep 2022Document12 pagesAngelTopPicks Sep 2022Guru S SankarNo ratings yet

- Advisors Asset Management - Income Growth Fund OutlookDocument3 pagesAdvisors Asset Management - Income Growth Fund Outlookag rNo ratings yet

- Barclays WMG U.S. Media - DIS - Still Early in The Reset PhaseDocument27 pagesBarclays WMG U.S. Media - DIS - Still Early in The Reset PhaseraymanNo ratings yet

- CapitalGoods SectorUpdate2Mar23 ResearchDocument6 pagesCapitalGoods SectorUpdate2Mar23 Researchavinashpathak777No ratings yet

- Bank Stocks Swing Sharply After Another Big Fed Rate HikeDocument3 pagesBank Stocks Swing Sharply After Another Big Fed Rate HikeFatima NoorNo ratings yet

- CARE Ratings Limited Q2 FY22 & H1 FY22 Investors' Call 1 November 2021Document14 pagesCARE Ratings Limited Q2 FY22 & H1 FY22 Investors' Call 1 November 2021simmbNo ratings yet

- Directors Report 30 Sep 2020Document3 pagesDirectors Report 30 Sep 2020Muhammad SamiNo ratings yet

- Centrum Dabur India Company UpdateDocument7 pagesCentrum Dabur India Company UpdateprasaadrajputNo ratings yet

- PJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Document15 pagesPJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Neel DoshiNo ratings yet

- Consumer Discretionary Sector 3QFY22 Result Review 16 February 2022Document10 pagesConsumer Discretionary Sector 3QFY22 Result Review 16 February 2022Shinde Chaitanya Sharad C-DOT 5688No ratings yet

- AngelTopPicks N 2022Document12 pagesAngelTopPicks N 2022Venkatesh BudhaNo ratings yet

- World Bank 2023 India ReportDocument27 pagesWorld Bank 2023 India ReportMithilesh KumarNo ratings yet

- Market Outlook Samvat 2072: Low On Expectations, High On Returns Stock Update Aditya Birla Nuvo Stock Update Oil India Stock Update PTC India Financial ServicesDocument14 pagesMarket Outlook Samvat 2072: Low On Expectations, High On Returns Stock Update Aditya Birla Nuvo Stock Update Oil India Stock Update PTC India Financial ServicesrohitNo ratings yet

- 15124-CardinalStone Research 2022 Macro Outlook Consolidating Recovery-ProshareDocument16 pages15124-CardinalStone Research 2022 Macro Outlook Consolidating Recovery-ProshareOladipo OlanyiNo ratings yet

- Diwali Muhurat Fundamental 2021Document22 pagesDiwali Muhurat Fundamental 2021Swasthyasudha AyurvedNo ratings yet

- Gic Weekly 080124Document14 pagesGic Weekly 080124eldime06No ratings yet

- DownloadDocument42 pagesDownloadRubi MunusamyNo ratings yet

- GS 2024 MacroDocument28 pagesGS 2024 Macroxiongfeng aiNo ratings yet

- PMS - SISOP Product Sheet - Oct 2020 - 1Document4 pagesPMS - SISOP Product Sheet - Oct 2020 - 1Swades DNo ratings yet

- Godrej Consumer: Investment Rationale IntactDocument24 pagesGodrej Consumer: Investment Rationale IntactbradburywillsNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- KICTalking Points 080608Document6 pagesKICTalking Points 080608russ8609No ratings yet

- Nirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Document11 pagesNirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Shinde Chaitanya Sharad C-DOT 5688No ratings yet

- Udita Wadhwa - 2019BB10060Document14 pagesUdita Wadhwa - 2019BB10060Khushii NaamdeoNo ratings yet

- Outlook - Energy-Cross-Region - 26apr21 MoodysDocument10 pagesOutlook - Energy-Cross-Region - 26apr21 MoodysPedro MentadoNo ratings yet

- BSP MonetaryPolicySummary August2022 QuizDocument2 pagesBSP MonetaryPolicySummary August2022 Quizcjpadin09No ratings yet

- ECM Quarterly Letter 2Q22Document14 pagesECM Quarterly Letter 2Q22cybereisNo ratings yet

- EdgeReport BRITANNIA CaseStudy 07 09 2022 994Document34 pagesEdgeReport BRITANNIA CaseStudy 07 09 2022 994aadil suhailNo ratings yet

- EY Economy Watch - November 2022Document29 pagesEY Economy Watch - November 2022Harsha BandarlaNo ratings yet

- Horizons Q1 2022 - v06 FinalDocument70 pagesHorizons Q1 2022 - v06 FinalwyowhokojzsvvyrbvaNo ratings yet

- Top Story:: WED 11 JAN 2023Document9 pagesTop Story:: WED 11 JAN 2023Elcano MirandaNo ratings yet

- Indivior PLC, Q3 2021 Earnings Call, Oct 28, 2021Document11 pagesIndivior PLC, Q3 2021 Earnings Call, Oct 28, 2021King KingssonNo ratings yet

- 3Q22 Earnings - Call FINAL Print - 2Document36 pages3Q22 Earnings - Call FINAL Print - 2vanessa karmadjayaNo ratings yet

- GQG Performance and PositioningDocument4 pagesGQG Performance and Positioningchicku76No ratings yet

- Market Strategy: February 2021Document19 pagesMarket Strategy: February 2021Harshvardhan SurekaNo ratings yet

- Schroders Outlook 2022 Macro Market Outlook FinalDocument24 pagesSchroders Outlook 2022 Macro Market Outlook FinalOkinawan P.SNo ratings yet

- PG and Tvs ReportDocument15 pagesPG and Tvs ReportSAYALEE MESHRAMNo ratings yet

- Pcomp Up On Gov't Stimulus Programs: Week in ReviewDocument2 pagesPcomp Up On Gov't Stimulus Programs: Week in ReviewJervie GacutanNo ratings yet

- GS - Macro Outlook 2024Document28 pagesGS - Macro Outlook 2024MadhurNo ratings yet

- Presales Recovery Expected in 2H, Earnings To Follow: Sector BriefDocument8 pagesPresales Recovery Expected in 2H, Earnings To Follow: Sector BrieftataxpNo ratings yet

- Goldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedDocument3 pagesGoldman - China Two Sessions Comment 1 Government Work Report More Dovish Than ExpectedZerohedge100% (1)

- Accelerating Sustainable Development after COVID-19: The Role of SDG BondsFrom EverandAccelerating Sustainable Development after COVID-19: The Role of SDG BondsNo ratings yet

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Document201 pagesAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyNo ratings yet

- LRWC-SEC 17C - Financial Highlights of Q1 2022Document4 pagesLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyNo ratings yet

- First Quarterly Report of The Keepers Holdings, Inc. Cy 2022Document73 pagesFirst Quarterly Report of The Keepers Holdings, Inc. Cy 2022ignaciomannyNo ratings yet

- Response To PSE Query 07 September 2022Document1 pageResponse To PSE Query 07 September 2022ignaciomannyNo ratings yet

- AbacusShortTakes 09212022Document5 pagesAbacusShortTakes 09212022ignaciomannyNo ratings yet

- AbacusShortTakes 08312022Document7 pagesAbacusShortTakes 08312022ignaciomannyNo ratings yet

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Document3 pagesDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyNo ratings yet

- AbacusShortTakes 09092022Document6 pagesAbacusShortTakes 09092022ignaciomannyNo ratings yet

- AbacusShortTakes 10252022Document6 pagesAbacusShortTakes 10252022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- AbacusShortTakes 09082022Document7 pagesAbacusShortTakes 09082022ignaciomannyNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument5 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument4 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Document3 pagesWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyNo ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- 2016 July Proficiency Session 2 A VersionDocument2 pages2016 July Proficiency Session 2 A VersionSanem Hazal TürkayNo ratings yet

- Fashion and ConsumerismDocument28 pagesFashion and ConsumerismAhmedNagyNo ratings yet

- American Scientific Research Journal For Engineering, Technology, and Sciences (Asrjets), Vol 6, No 1 (2013), Issn (Print) 2313-44106Document2 pagesAmerican Scientific Research Journal For Engineering, Technology, and Sciences (Asrjets), Vol 6, No 1 (2013), Issn (Print) 2313-44106atilaelciNo ratings yet

- MachinesDocument2 pagesMachinesShreyas YewaleNo ratings yet

- Veterinary Course WorkDocument5 pagesVeterinary Course Workbcnwhkha100% (2)

- HW 1Document4 pagesHW 1BillyLinNo ratings yet

- Premature Fatigue Failure of A Spring Due To Quench CracksDocument8 pagesPremature Fatigue Failure of A Spring Due To Quench CracksCamilo Rojas GómezNo ratings yet

- Magic Vision Tester by Ian Buckland DocumentDocument6 pagesMagic Vision Tester by Ian Buckland DocumentbrainechoNo ratings yet

- KGH Series Bellows CouplingDocument1 pageKGH Series Bellows CouplingServo2GoNo ratings yet

- Deploying C++Builder ApplicationsDocument11 pagesDeploying C++Builder ApplicationsalhadeedNo ratings yet

- Brooklyn College - Fieldwork ExperienceDocument6 pagesBrooklyn College - Fieldwork Experienceapi-547174770No ratings yet

- Tipi InstructionsDocument32 pagesTipi InstructionsZenrof100% (1)

- BillInvoice 2Document2 pagesBillInvoice 2gopim888No ratings yet

- Manual de Utilizare Sursa de Alimentare 27.6 V5 A Pulsar EN54-5A17 230 VAC50 HZ Montaj Aparent LEDDocument40 pagesManual de Utilizare Sursa de Alimentare 27.6 V5 A Pulsar EN54-5A17 230 VAC50 HZ Montaj Aparent LEDGabriel SerbanNo ratings yet

- Jan W. Gooch, Biosketch - Jan. 2015Document15 pagesJan W. Gooch, Biosketch - Jan. 2015jan w goochNo ratings yet

- CSEC IT Study GuideDocument21 pagesCSEC IT Study GuideNaje CampbellNo ratings yet

- Risk Management in Mental Health ServicesDocument54 pagesRisk Management in Mental Health Servicesjazz8181No ratings yet

- Desk Guide - Ag and Food Careers in Pennsylvania - FINALDocument121 pagesDesk Guide - Ag and Food Careers in Pennsylvania - FINALKuhnNo ratings yet

- Urban Floods in Bangalore and Chennai-Risk Management Challenges and Lessons For Sustainable Urban Ecology Current Science 2011 PDFDocument8 pagesUrban Floods in Bangalore and Chennai-Risk Management Challenges and Lessons For Sustainable Urban Ecology Current Science 2011 PDFSatishDeshmukhNo ratings yet

- Chapter 9.2 Process Costing - Average and FIFODocument14 pagesChapter 9.2 Process Costing - Average and FIFOdoomageddonsplinterlandNo ratings yet

- Adeshwar Nursing Institute Khamhargaon, Jagdalpur: Community Health Nursing Lesson Plan ON Wound DressingDocument8 pagesAdeshwar Nursing Institute Khamhargaon, Jagdalpur: Community Health Nursing Lesson Plan ON Wound DressingNitesh BhuraNo ratings yet

- 10 JMSCR PDFDocument5 pages10 JMSCR PDFSubi SureshNo ratings yet

- Scaling BenchmarkDocument7 pagesScaling BenchmarkJuan Pablo Henríquez ValenciaNo ratings yet

- Sec eDocument2 pagesSec eVicter PaulNo ratings yet

- Springs Are Fundamental Mechanical Components Found in Many Mechanical SystemsDocument4 pagesSprings Are Fundamental Mechanical Components Found in Many Mechanical SystemsZandro GagoteNo ratings yet

- Placa Mãe HD7Document3 pagesPlaca Mãe HD7ALBANO2No ratings yet

- Instruction Manual Il-Obct-R1: Slip-Over Current Transformer ObctDocument2 pagesInstruction Manual Il-Obct-R1: Slip-Over Current Transformer Obctبوحميدة كمالNo ratings yet