Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsIfos Part 2

Ifos Part 2

Uploaded by

kalyanikamineniThe document summarizes different types of income that are chargeable under the head "Income from Other Sources" in India. It discusses income such as interest from securities, interest from bank accounts, interest on certain government bonds, and income from renting of machinery. It also provides exemptions for interest income such as interest from postal savings accounts up to certain limits and interest on specific government bonds.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Gov Acc Quiz 4, BeltranDocument2 pagesGov Acc Quiz 4, Beltranbruuhhhh0% (2)

- The 1917 or Pio-Benedictine Code of Canon LawDocument660 pagesThe 1917 or Pio-Benedictine Code of Canon LawRoothNo ratings yet

- What Can A WES Evaluation Do For You?: Basic Evaluation Fees (7 Days)Document4 pagesWhat Can A WES Evaluation Do For You?: Basic Evaluation Fees (7 Days)BadshahNo ratings yet

- Theory of Health PromotionDocument3 pagesTheory of Health Promotionrocs De GuzmanNo ratings yet

- Income From Other SourcesDocument7 pagesIncome From Other SourcessristiNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other Sourcessanjul2008No ratings yet

- Lecture-5.Income From Salaries (Sec-21)Document16 pagesLecture-5.Income From Salaries (Sec-21)imdadul haqueNo ratings yet

- Chapter - 1: Page - 1Document7 pagesChapter - 1: Page - 1Arunangsu ChandaNo ratings yet

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- General Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UDocument67 pagesGeneral Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UVENKATESAN DNo ratings yet

- Module 3 Superannuation SlidesDocument68 pagesModule 3 Superannuation SlidesChua Rui TingNo ratings yet

- Presentation On Bank Dealings and Income Tax Returns: Presented By-Vandna Roll No. - 14401 YearDocument25 pagesPresentation On Bank Dealings and Income Tax Returns: Presented By-Vandna Roll No. - 14401 YearKhan'S updation.No ratings yet

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Document5 pages1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiNo ratings yet

- Tax and Estate PlanningDocument32 pagesTax and Estate PlanningVallabiNo ratings yet

- Income TaxDocument17 pagesIncome Taxericamaecarpila0520No ratings yet

- Business Income Tax (Schedule C)Document12 pagesBusiness Income Tax (Schedule C)Jichang HikNo ratings yet

- Income From Other Sources Notes and ProblemsDocument6 pagesIncome From Other Sources Notes and Problems20-UCO-517 AJAY KELVIN ANo ratings yet

- A Guide To Your Personal Income TaxDocument7 pagesA Guide To Your Personal Income TaxRekha SinghNo ratings yet

- Guideline For The Employers On Deducting Withholding Tax Paye From 01-01-2020 To 31-03-2020Document4 pagesGuideline For The Employers On Deducting Withholding Tax Paye From 01-01-2020 To 31-03-2020kNo ratings yet

- Income Taxation Module 2Document17 pagesIncome Taxation Module 2Regelene Selda TatadNo ratings yet

- Accounting PoliciesDocument4 pagesAccounting PoliciesShaiju MohammedNo ratings yet

- Residential Status of An IndividualDocument11 pagesResidential Status of An IndividualRevathy PrasannanNo ratings yet

- NPS Assignment WMDocument4 pagesNPS Assignment WMPaawandeep SinghNo ratings yet

- C8 Exclusion From Gross IncomeDocument16 pagesC8 Exclusion From Gross IncomeSUBA, Michagail D.No ratings yet

- Income TaxDocument21 pagesIncome Taxpayal sachdevNo ratings yet

- MRP 12th Plan GuidelinesDocument9 pagesMRP 12th Plan GuidelinesDeepanjali NigamNo ratings yet

- BSNL Benifit MedicalDocument4 pagesBSNL Benifit MedicalharishsatheNo ratings yet

- Presentation On Income Exempted From Income TaxDocument20 pagesPresentation On Income Exempted From Income Taxyatin rajputNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- Group Assignment Business Law: Prof. M. C. GuptaDocument13 pagesGroup Assignment Business Law: Prof. M. C. GuptaNishit GarwasisNo ratings yet

- Offaaer DocumentDocument137 pagesOffaaer DocumentsatishiitrNo ratings yet

- Annexure New Pension SchemeDocument3 pagesAnnexure New Pension SchemeAbhilasha MathurNo ratings yet

- KUPres 7 Nov 2010Document63 pagesKUPres 7 Nov 2010Hasan Irfan SiddiquiNo ratings yet

- Direct Tax SLE-1 Roll No KSPMCAA012 Dev Shah Mcom Part 1 Sem 3 2022-2023 Exemption Under Sec 10Document20 pagesDirect Tax SLE-1 Roll No KSPMCAA012 Dev Shah Mcom Part 1 Sem 3 2022-2023 Exemption Under Sec 10Dev ShahNo ratings yet

- Income Tax Unit - 1Document13 pagesIncome Tax Unit - 1YuvrajNo ratings yet

- Regular Income TaxDocument5 pagesRegular Income TaxJulyanneErikaMigriñoMeñuza100% (1)

- Union Budget 2013-14 - Highlights of Direct Tax ProposalsDocument5 pagesUnion Budget 2013-14 - Highlights of Direct Tax Proposalsankit403No ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- Individual Income TaxDocument19 pagesIndividual Income TaxShopee PhilippinesNo ratings yet

- Gross Income: As A General Rules, Retirement Benefit, Pension, Gratuities, Separation Pay Are All TaxesDocument13 pagesGross Income: As A General Rules, Retirement Benefit, Pension, Gratuities, Separation Pay Are All TaxesXhien YeeNo ratings yet

- Gifts Distinguished From ExchangeDocument7 pagesGifts Distinguished From ExchangedailydoseoflawNo ratings yet

- General Financial Rules 2017Document62 pagesGeneral Financial Rules 2017ADITYA GAHLAUT0% (1)

- Gross Income From BusinessDocument13 pagesGross Income From BusinessAllan SantosNo ratings yet

- Gross Income: Module No. 3-4 Inclusive Week: August 23-27, 2021 Module Overview Reference / Research LinksDocument13 pagesGross Income: Module No. 3-4 Inclusive Week: August 23-27, 2021 Module Overview Reference / Research LinksHeigh Ven100% (1)

- Name: Dilip Kumar. G: Sikkim Manipal University 3 Semester Fall 2010Document11 pagesName: Dilip Kumar. G: Sikkim Manipal University 3 Semester Fall 2010Dilipk86No ratings yet

- Tax AmendmentDocument10 pagesTax AmendmentVinay BoradNo ratings yet

- Chapter 13a Regular Allowable Itemized DeductionsDocument6 pagesChapter 13a Regular Allowable Itemized DeductionsJason Mables100% (1)

- Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument32 pagesSection Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionanilpeddamalliNo ratings yet

- Exemptions Deductions Assessment: Principles of Taxation Income Tax Act 1961Document24 pagesExemptions Deductions Assessment: Principles of Taxation Income Tax Act 1961Presidency UniversityNo ratings yet

- Income Tax UpdatedDocument110 pagesIncome Tax UpdatedAldrich De VeraNo ratings yet

- BSNLDocument3 pagesBSNLPriyanshi AgarwalaNo ratings yet

- The Income Tax ActDocument15 pagesThe Income Tax ActfbuameNo ratings yet

- Chapter 8 9Document4 pagesChapter 8 9Jeciel Mae M. CalubaNo ratings yet

- Tax Planning For An NRI: Pratul JainDocument3 pagesTax Planning For An NRI: Pratul Jainjanardhan lalwaniNo ratings yet

- Exclusion of Gross IncomeDocument16 pagesExclusion of Gross IncomeAce ReytaNo ratings yet

- IC 83 - Compressed-4Document50 pagesIC 83 - Compressed-4purnachandrashee1No ratings yet

- Imprtant Points-IncomeTax 2015-16Document8 pagesImprtant Points-IncomeTax 2015-16Mansoor AliNo ratings yet

- Tgpala Aicte Income Tax Programme 2015 16 UPDATEDDocument27 pagesTgpala Aicte Income Tax Programme 2015 16 UPDATEDniranjannlgNo ratings yet

- II. INCOME TAXATION (RA 8242 Tax Reform Act of 1997) A. IndividualsDocument7 pagesII. INCOME TAXATION (RA 8242 Tax Reform Act of 1997) A. IndividualsRina TravelsNo ratings yet

- WWW - Fbr.gov - PK: Prepared by Azmat Shah (Dy. Director Finance)Document23 pagesWWW - Fbr.gov - PK: Prepared by Azmat Shah (Dy. Director Finance)arsalanssgNo ratings yet

- Provident FundsDocument70 pagesProvident FundsSpeed HRNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Vision - 2Document1 pageVision - 2kalyanikamineniNo ratings yet

- Money Market Instruments (Original Maturity Up To One Year)Document11 pagesMoney Market Instruments (Original Maturity Up To One Year)kalyanikamineniNo ratings yet

- FMS PPT Group5Document22 pagesFMS PPT Group5kalyanikamineniNo ratings yet

- Consignment Meaning of ConsignmentDocument1 pageConsignment Meaning of ConsignmentkalyanikamineniNo ratings yet

- Warner Bros. PicturesDocument8 pagesWarner Bros. PictureskalyanikamineniNo ratings yet

- MS Excel Workshop - B 30Document26 pagesMS Excel Workshop - B 30kalyanikamineniNo ratings yet

- Assesment of Individuals Q-1Document4 pagesAssesment of Individuals Q-1kalyanikamineniNo ratings yet

- Sec 194 Ic, 194la, 194J (TDS)Document3 pagesSec 194 Ic, 194la, 194J (TDS)kalyanikamineniNo ratings yet

- Case Study - EV - 1Document5 pagesCase Study - EV - 1kalyanikamineniNo ratings yet

- Over SubscriptionDocument3 pagesOver SubscriptionkalyanikamineniNo ratings yet

- GAPs Model Survey QuestionsDocument3 pagesGAPs Model Survey QuestionskalyanikamineniNo ratings yet

- Intro To Company AccDocument6 pagesIntro To Company AcckalyanikamineniNo ratings yet

- As - 9Document1 pageAs - 9kalyanikamineniNo ratings yet

- Assesment of Individual Q-2Document4 pagesAssesment of Individual Q-2kalyanikamineniNo ratings yet

- Auditing BitsDocument48 pagesAuditing BitskalyanikamineniNo ratings yet

- Buy BackDocument5 pagesBuy BackkalyanikamineniNo ratings yet

- C2 - Human Resource Management-Class of 2024 - Trimester IIDocument8 pagesC2 - Human Resource Management-Class of 2024 - Trimester IIkalyanikamineniNo ratings yet

- SalaryDocument80 pagesSalarykalyanikamineniNo ratings yet

- BoS - Session 1Document37 pagesBoS - Session 1kalyanikamineni100% (1)

- Method 3 of GoodwillDocument3 pagesMethod 3 of GoodwillkalyanikamineniNo ratings yet

- Bna Article-8Document5 pagesBna Article-8kalyanikamineniNo ratings yet

- Calls in Arrers ND Calls in AdvanceDocument3 pagesCalls in Arrers ND Calls in AdvancekalyanikamineniNo ratings yet

- Accounting Standards 13. 47Document50 pagesAccounting Standards 13. 47kalyanikamineniNo ratings yet

- Exempt Income: Sec 10 (23D)Document5 pagesExempt Income: Sec 10 (23D)kalyanikamineniNo ratings yet

- CACell Intermediate Account Full Book-201-250Document50 pagesCACell Intermediate Account Full Book-201-250kalyanikamineniNo ratings yet

- Retirement of A Partner: Special Transactions in Case of Death: Joint Life PolicyDocument7 pagesRetirement of A Partner: Special Transactions in Case of Death: Joint Life PolicykalyanikamineniNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomekalyanikamineniNo ratings yet

- This Content Is Sourced From Past Years' CAT Exam Papers: DisclaimerDocument15 pagesThis Content Is Sourced From Past Years' CAT Exam Papers: DisclaimerkalyanikamineniNo ratings yet

- Assement of Individual Q - 5Document2 pagesAssement of Individual Q - 5kalyanikamineniNo ratings yet

- The Institute of Cost Accountants of India (Statutory Body Under An Act of Parliament)Document30 pagesThe Institute of Cost Accountants of India (Statutory Body Under An Act of Parliament)kalyanikamineniNo ratings yet

- CONSTI II - Echegaray v. Secretary and Lim v. PeopleDocument4 pagesCONSTI II - Echegaray v. Secretary and Lim v. PeopleMariaAyraCelinaBatacanNo ratings yet

- Transformations of The Indo Iranian Snake Man Myth Language Ethnoarcheology and Iranian IdentityDocument6 pagesTransformations of The Indo Iranian Snake Man Myth Language Ethnoarcheology and Iranian Identitysajad amiriNo ratings yet

- Debrahlee Lorenzana - A Hot Case StudyDocument3 pagesDebrahlee Lorenzana - A Hot Case StudyHarish SunderNo ratings yet

- Conclusions Concerning The Recurrent Discussion On Social Protection (Social Security)Document22 pagesConclusions Concerning The Recurrent Discussion On Social Protection (Social Security)Koustubh MohantyNo ratings yet

- Bhopal Gas TragedyDocument14 pagesBhopal Gas Tragedyhriday kumarNo ratings yet

- Jurisprudence First Semester AssignmentDocument17 pagesJurisprudence First Semester AssignmentAyinuola OpeyemiNo ratings yet

- RULE 110 Prosecution of Offenses I. Provisions and Notes: Vox Emissa Volat Litera Scripta Manet (The Spoken WordDocument5 pagesRULE 110 Prosecution of Offenses I. Provisions and Notes: Vox Emissa Volat Litera Scripta Manet (The Spoken WordEdward G-Boi DangilanNo ratings yet

- Nur Suraya Idayu Binti Abd Aziz CS244B1 2018401946 B2C QuestionsDocument5 pagesNur Suraya Idayu Binti Abd Aziz CS244B1 2018401946 B2C QuestionsNur Suraya AazizNo ratings yet

- Electrotel Spectracell WRFDocument41 pagesElectrotel Spectracell WRFLaurentiu CatalinNo ratings yet

- FL20240125111616552Document1 pageFL20240125111616552mayukh.baraiNo ratings yet

- Kmip Ug v1.2 cnd01Document84 pagesKmip Ug v1.2 cnd01Nandhini HaribabuNo ratings yet

- L/epublic of Tue Flbilippine.s': $upreme (!j:ourtDocument31 pagesL/epublic of Tue Flbilippine.s': $upreme (!j:ourtKarl Rigo AndrinoNo ratings yet

- Fiasco Fallout 2013Document14 pagesFiasco Fallout 2013G. Mac AoidhNo ratings yet

- Istilah Akuntansi EnglishDocument2 pagesIstilah Akuntansi Englishpramesari dinarNo ratings yet

- Domalsin v. Valenciano (G.R. No. 158687)Document2 pagesDomalsin v. Valenciano (G.R. No. 158687)Rache Gutierrez0% (1)

- Is 9259 1979 PDFDocument15 pagesIs 9259 1979 PDFsagarNo ratings yet

- Group 4 - The Rizal Law OutlineDocument3 pagesGroup 4 - The Rizal Law OutlineBaculio Janine G.No ratings yet

- The Great HackDocument4 pagesThe Great HackKeith Marcel MenezesNo ratings yet

- Gmail - .Net Interview Confirmation - Cognizant Technology Solutions (Interview Date - 20th July 2019, Saturday - ICC Trade 4th Floor (B Wing), S B Road, Pune (Above Star Bazaar) Pune - 4119016 PDFDocument4 pagesGmail - .Net Interview Confirmation - Cognizant Technology Solutions (Interview Date - 20th July 2019, Saturday - ICC Trade 4th Floor (B Wing), S B Road, Pune (Above Star Bazaar) Pune - 4119016 PDFmahesh pawarNo ratings yet

- Sha DM 0910Document2 pagesSha DM 0910shashank guptaNo ratings yet

- Witness To SplendourDocument89 pagesWitness To SplendourSani Panhwar100% (3)

- 04 AcknowledgementDocument3 pages04 AcknowledgementvigneshNo ratings yet

- Certificate of Appreciation: Curly Jane B. MadredijoDocument9 pagesCertificate of Appreciation: Curly Jane B. MadredijoIrene caberNo ratings yet

- Design & Fashion - October 2020Document12 pagesDesign & Fashion - October 2020ArtdataNo ratings yet

- Security Affairs - North KoreaDocument15 pagesSecurity Affairs - North KoreaAdriana CantonNo ratings yet

- Department of Education: Republic of The PhilippinesDocument48 pagesDepartment of Education: Republic of The PhilippinesSophy SophyNo ratings yet

- FedEx Vs DHL ReportDocument59 pagesFedEx Vs DHL Reportyu yanNo ratings yet

Ifos Part 2

Ifos Part 2

Uploaded by

kalyanikamineni0 ratings0% found this document useful (0 votes)

12 views2 pagesThe document summarizes different types of income that are chargeable under the head "Income from Other Sources" in India. It discusses income such as interest from securities, interest from bank accounts, interest on certain government bonds, and income from renting of machinery. It also provides exemptions for interest income such as interest from postal savings accounts up to certain limits and interest on specific government bonds.

Original Description:

Original Title

IFOS PART 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes different types of income that are chargeable under the head "Income from Other Sources" in India. It discusses income such as interest from securities, interest from bank accounts, interest on certain government bonds, and income from renting of machinery. It also provides exemptions for interest income such as interest from postal savings accounts up to certain limits and interest on specific government bonds.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesIfos Part 2

Ifos Part 2

Uploaded by

kalyanikamineniThe document summarizes different types of income that are chargeable under the head "Income from Other Sources" in India. It discusses income such as interest from securities, interest from bank accounts, interest on certain government bonds, and income from renting of machinery. It also provides exemptions for interest income such as interest from postal savings accounts up to certain limits and interest on specific government bonds.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

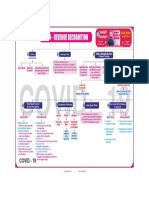

Income from other sources

Income Chargeable to IFOS only if not Chargeable under PGBP

1. Any sum received by an employer-assessee from his employees as

contributions to any provident fund, superannuation fund or any

other fund for the welfare of the employees.

2. Income from letting out on hire, machinery, plant or furniture.

3. Where letting out of buildings is inseparable from the letting out of

machinery, plant or furniture, the income from such letting.

4. Interest on securities.

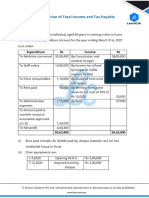

Sec 10(15) Exemption of Interest Income

1. Interest on Post Office Savings Bank Account would be exempt from

tax to the extent of:

a. Rs. 3,500 in case of an individual account.

b. Rs.7,000 in case of a joint account.

2. Interest payable by public sector companies on certain specified

bonds and debentures subject to the conditions which the Central

Government may specify by notification.

Notified tax free, secured, redeemable, non- convertible Bonds of

the

• IRFCL,

• NHAI,

• RECL,

• Housing and Urban Development Corporation,

• Power Finance Corporation (PFC),

• Jawaharlal Nehru Port Trust,

• Dredging Corporation of India Limited,

• Ennore Port Limited

• The Indian Renewable Energy Development Agency Limited

3. Interest payable by Government of India on deposit made by an

employee of the Central or State Government or a public sector

company in accordance with the scheme as may be notified of the

moneys due to him on account of his retirement while on

superannuation or otherwise.

Note: It is significant that this scheme is not applicable to non-

Government employees.

4. Interest on Gold Deposit Bond issued under the Gold Deposit

Scheme, 1999 or deposit certificates issued under the Gold

Monetization Scheme, 2015 notified by the Central Government.

5. Interest on bonds, issued by –

a. A local authority; or

A State Pooled Finance Entity

Taxable Interest

1. Interest on Employee contribution to URPF

2. Interest on delayed Enhanced Compensation (Std deduction u/s 57)

3. Interest on Govt. Securities

4. Interest on Income Tax Refund

5. Interest on Saving Bank Account (subject to sec 80TTA)

6. Interest on Other Bank Deposits (subject to sec 80TTB)

PREPARED BY: CA RAM PATIL

You might also like

- Gov Acc Quiz 4, BeltranDocument2 pagesGov Acc Quiz 4, Beltranbruuhhhh0% (2)

- The 1917 or Pio-Benedictine Code of Canon LawDocument660 pagesThe 1917 or Pio-Benedictine Code of Canon LawRoothNo ratings yet

- What Can A WES Evaluation Do For You?: Basic Evaluation Fees (7 Days)Document4 pagesWhat Can A WES Evaluation Do For You?: Basic Evaluation Fees (7 Days)BadshahNo ratings yet

- Theory of Health PromotionDocument3 pagesTheory of Health Promotionrocs De GuzmanNo ratings yet

- Income From Other SourcesDocument7 pagesIncome From Other SourcessristiNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other Sourcessanjul2008No ratings yet

- Lecture-5.Income From Salaries (Sec-21)Document16 pagesLecture-5.Income From Salaries (Sec-21)imdadul haqueNo ratings yet

- Chapter - 1: Page - 1Document7 pagesChapter - 1: Page - 1Arunangsu ChandaNo ratings yet

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- General Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UDocument67 pagesGeneral Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UVENKATESAN DNo ratings yet

- Module 3 Superannuation SlidesDocument68 pagesModule 3 Superannuation SlidesChua Rui TingNo ratings yet

- Presentation On Bank Dealings and Income Tax Returns: Presented By-Vandna Roll No. - 14401 YearDocument25 pagesPresentation On Bank Dealings and Income Tax Returns: Presented By-Vandna Roll No. - 14401 YearKhan'S updation.No ratings yet

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Document5 pages1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiNo ratings yet

- Tax and Estate PlanningDocument32 pagesTax and Estate PlanningVallabiNo ratings yet

- Income TaxDocument17 pagesIncome Taxericamaecarpila0520No ratings yet

- Business Income Tax (Schedule C)Document12 pagesBusiness Income Tax (Schedule C)Jichang HikNo ratings yet

- Income From Other Sources Notes and ProblemsDocument6 pagesIncome From Other Sources Notes and Problems20-UCO-517 AJAY KELVIN ANo ratings yet

- A Guide To Your Personal Income TaxDocument7 pagesA Guide To Your Personal Income TaxRekha SinghNo ratings yet

- Guideline For The Employers On Deducting Withholding Tax Paye From 01-01-2020 To 31-03-2020Document4 pagesGuideline For The Employers On Deducting Withholding Tax Paye From 01-01-2020 To 31-03-2020kNo ratings yet

- Income Taxation Module 2Document17 pagesIncome Taxation Module 2Regelene Selda TatadNo ratings yet

- Accounting PoliciesDocument4 pagesAccounting PoliciesShaiju MohammedNo ratings yet

- Residential Status of An IndividualDocument11 pagesResidential Status of An IndividualRevathy PrasannanNo ratings yet

- NPS Assignment WMDocument4 pagesNPS Assignment WMPaawandeep SinghNo ratings yet

- C8 Exclusion From Gross IncomeDocument16 pagesC8 Exclusion From Gross IncomeSUBA, Michagail D.No ratings yet

- Income TaxDocument21 pagesIncome Taxpayal sachdevNo ratings yet

- MRP 12th Plan GuidelinesDocument9 pagesMRP 12th Plan GuidelinesDeepanjali NigamNo ratings yet

- BSNL Benifit MedicalDocument4 pagesBSNL Benifit MedicalharishsatheNo ratings yet

- Presentation On Income Exempted From Income TaxDocument20 pagesPresentation On Income Exempted From Income Taxyatin rajputNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- Group Assignment Business Law: Prof. M. C. GuptaDocument13 pagesGroup Assignment Business Law: Prof. M. C. GuptaNishit GarwasisNo ratings yet

- Offaaer DocumentDocument137 pagesOffaaer DocumentsatishiitrNo ratings yet

- Annexure New Pension SchemeDocument3 pagesAnnexure New Pension SchemeAbhilasha MathurNo ratings yet

- KUPres 7 Nov 2010Document63 pagesKUPres 7 Nov 2010Hasan Irfan SiddiquiNo ratings yet

- Direct Tax SLE-1 Roll No KSPMCAA012 Dev Shah Mcom Part 1 Sem 3 2022-2023 Exemption Under Sec 10Document20 pagesDirect Tax SLE-1 Roll No KSPMCAA012 Dev Shah Mcom Part 1 Sem 3 2022-2023 Exemption Under Sec 10Dev ShahNo ratings yet

- Income Tax Unit - 1Document13 pagesIncome Tax Unit - 1YuvrajNo ratings yet

- Regular Income TaxDocument5 pagesRegular Income TaxJulyanneErikaMigriñoMeñuza100% (1)

- Union Budget 2013-14 - Highlights of Direct Tax ProposalsDocument5 pagesUnion Budget 2013-14 - Highlights of Direct Tax Proposalsankit403No ratings yet

- DTC ProvisionsDocument3 pagesDTC ProvisionsrajdeeppawarNo ratings yet

- Individual Income TaxDocument19 pagesIndividual Income TaxShopee PhilippinesNo ratings yet

- Gross Income: As A General Rules, Retirement Benefit, Pension, Gratuities, Separation Pay Are All TaxesDocument13 pagesGross Income: As A General Rules, Retirement Benefit, Pension, Gratuities, Separation Pay Are All TaxesXhien YeeNo ratings yet

- Gifts Distinguished From ExchangeDocument7 pagesGifts Distinguished From ExchangedailydoseoflawNo ratings yet

- General Financial Rules 2017Document62 pagesGeneral Financial Rules 2017ADITYA GAHLAUT0% (1)

- Gross Income From BusinessDocument13 pagesGross Income From BusinessAllan SantosNo ratings yet

- Gross Income: Module No. 3-4 Inclusive Week: August 23-27, 2021 Module Overview Reference / Research LinksDocument13 pagesGross Income: Module No. 3-4 Inclusive Week: August 23-27, 2021 Module Overview Reference / Research LinksHeigh Ven100% (1)

- Name: Dilip Kumar. G: Sikkim Manipal University 3 Semester Fall 2010Document11 pagesName: Dilip Kumar. G: Sikkim Manipal University 3 Semester Fall 2010Dilipk86No ratings yet

- Tax AmendmentDocument10 pagesTax AmendmentVinay BoradNo ratings yet

- Chapter 13a Regular Allowable Itemized DeductionsDocument6 pagesChapter 13a Regular Allowable Itemized DeductionsJason Mables100% (1)

- Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument32 pagesSection Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionanilpeddamalliNo ratings yet

- Exemptions Deductions Assessment: Principles of Taxation Income Tax Act 1961Document24 pagesExemptions Deductions Assessment: Principles of Taxation Income Tax Act 1961Presidency UniversityNo ratings yet

- Income Tax UpdatedDocument110 pagesIncome Tax UpdatedAldrich De VeraNo ratings yet

- BSNLDocument3 pagesBSNLPriyanshi AgarwalaNo ratings yet

- The Income Tax ActDocument15 pagesThe Income Tax ActfbuameNo ratings yet

- Chapter 8 9Document4 pagesChapter 8 9Jeciel Mae M. CalubaNo ratings yet

- Tax Planning For An NRI: Pratul JainDocument3 pagesTax Planning For An NRI: Pratul Jainjanardhan lalwaniNo ratings yet

- Exclusion of Gross IncomeDocument16 pagesExclusion of Gross IncomeAce ReytaNo ratings yet

- IC 83 - Compressed-4Document50 pagesIC 83 - Compressed-4purnachandrashee1No ratings yet

- Imprtant Points-IncomeTax 2015-16Document8 pagesImprtant Points-IncomeTax 2015-16Mansoor AliNo ratings yet

- Tgpala Aicte Income Tax Programme 2015 16 UPDATEDDocument27 pagesTgpala Aicte Income Tax Programme 2015 16 UPDATEDniranjannlgNo ratings yet

- II. INCOME TAXATION (RA 8242 Tax Reform Act of 1997) A. IndividualsDocument7 pagesII. INCOME TAXATION (RA 8242 Tax Reform Act of 1997) A. IndividualsRina TravelsNo ratings yet

- WWW - Fbr.gov - PK: Prepared by Azmat Shah (Dy. Director Finance)Document23 pagesWWW - Fbr.gov - PK: Prepared by Azmat Shah (Dy. Director Finance)arsalanssgNo ratings yet

- Provident FundsDocument70 pagesProvident FundsSpeed HRNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Vision - 2Document1 pageVision - 2kalyanikamineniNo ratings yet

- Money Market Instruments (Original Maturity Up To One Year)Document11 pagesMoney Market Instruments (Original Maturity Up To One Year)kalyanikamineniNo ratings yet

- FMS PPT Group5Document22 pagesFMS PPT Group5kalyanikamineniNo ratings yet

- Consignment Meaning of ConsignmentDocument1 pageConsignment Meaning of ConsignmentkalyanikamineniNo ratings yet

- Warner Bros. PicturesDocument8 pagesWarner Bros. PictureskalyanikamineniNo ratings yet

- MS Excel Workshop - B 30Document26 pagesMS Excel Workshop - B 30kalyanikamineniNo ratings yet

- Assesment of Individuals Q-1Document4 pagesAssesment of Individuals Q-1kalyanikamineniNo ratings yet

- Sec 194 Ic, 194la, 194J (TDS)Document3 pagesSec 194 Ic, 194la, 194J (TDS)kalyanikamineniNo ratings yet

- Case Study - EV - 1Document5 pagesCase Study - EV - 1kalyanikamineniNo ratings yet

- Over SubscriptionDocument3 pagesOver SubscriptionkalyanikamineniNo ratings yet

- GAPs Model Survey QuestionsDocument3 pagesGAPs Model Survey QuestionskalyanikamineniNo ratings yet

- Intro To Company AccDocument6 pagesIntro To Company AcckalyanikamineniNo ratings yet

- As - 9Document1 pageAs - 9kalyanikamineniNo ratings yet

- Assesment of Individual Q-2Document4 pagesAssesment of Individual Q-2kalyanikamineniNo ratings yet

- Auditing BitsDocument48 pagesAuditing BitskalyanikamineniNo ratings yet

- Buy BackDocument5 pagesBuy BackkalyanikamineniNo ratings yet

- C2 - Human Resource Management-Class of 2024 - Trimester IIDocument8 pagesC2 - Human Resource Management-Class of 2024 - Trimester IIkalyanikamineniNo ratings yet

- SalaryDocument80 pagesSalarykalyanikamineniNo ratings yet

- BoS - Session 1Document37 pagesBoS - Session 1kalyanikamineni100% (1)

- Method 3 of GoodwillDocument3 pagesMethod 3 of GoodwillkalyanikamineniNo ratings yet

- Bna Article-8Document5 pagesBna Article-8kalyanikamineniNo ratings yet

- Calls in Arrers ND Calls in AdvanceDocument3 pagesCalls in Arrers ND Calls in AdvancekalyanikamineniNo ratings yet

- Accounting Standards 13. 47Document50 pagesAccounting Standards 13. 47kalyanikamineniNo ratings yet

- Exempt Income: Sec 10 (23D)Document5 pagesExempt Income: Sec 10 (23D)kalyanikamineniNo ratings yet

- CACell Intermediate Account Full Book-201-250Document50 pagesCACell Intermediate Account Full Book-201-250kalyanikamineniNo ratings yet

- Retirement of A Partner: Special Transactions in Case of Death: Joint Life PolicyDocument7 pagesRetirement of A Partner: Special Transactions in Case of Death: Joint Life PolicykalyanikamineniNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomekalyanikamineniNo ratings yet

- This Content Is Sourced From Past Years' CAT Exam Papers: DisclaimerDocument15 pagesThis Content Is Sourced From Past Years' CAT Exam Papers: DisclaimerkalyanikamineniNo ratings yet

- Assement of Individual Q - 5Document2 pagesAssement of Individual Q - 5kalyanikamineniNo ratings yet

- The Institute of Cost Accountants of India (Statutory Body Under An Act of Parliament)Document30 pagesThe Institute of Cost Accountants of India (Statutory Body Under An Act of Parliament)kalyanikamineniNo ratings yet

- CONSTI II - Echegaray v. Secretary and Lim v. PeopleDocument4 pagesCONSTI II - Echegaray v. Secretary and Lim v. PeopleMariaAyraCelinaBatacanNo ratings yet

- Transformations of The Indo Iranian Snake Man Myth Language Ethnoarcheology and Iranian IdentityDocument6 pagesTransformations of The Indo Iranian Snake Man Myth Language Ethnoarcheology and Iranian Identitysajad amiriNo ratings yet

- Debrahlee Lorenzana - A Hot Case StudyDocument3 pagesDebrahlee Lorenzana - A Hot Case StudyHarish SunderNo ratings yet

- Conclusions Concerning The Recurrent Discussion On Social Protection (Social Security)Document22 pagesConclusions Concerning The Recurrent Discussion On Social Protection (Social Security)Koustubh MohantyNo ratings yet

- Bhopal Gas TragedyDocument14 pagesBhopal Gas Tragedyhriday kumarNo ratings yet

- Jurisprudence First Semester AssignmentDocument17 pagesJurisprudence First Semester AssignmentAyinuola OpeyemiNo ratings yet

- RULE 110 Prosecution of Offenses I. Provisions and Notes: Vox Emissa Volat Litera Scripta Manet (The Spoken WordDocument5 pagesRULE 110 Prosecution of Offenses I. Provisions and Notes: Vox Emissa Volat Litera Scripta Manet (The Spoken WordEdward G-Boi DangilanNo ratings yet

- Nur Suraya Idayu Binti Abd Aziz CS244B1 2018401946 B2C QuestionsDocument5 pagesNur Suraya Idayu Binti Abd Aziz CS244B1 2018401946 B2C QuestionsNur Suraya AazizNo ratings yet

- Electrotel Spectracell WRFDocument41 pagesElectrotel Spectracell WRFLaurentiu CatalinNo ratings yet

- FL20240125111616552Document1 pageFL20240125111616552mayukh.baraiNo ratings yet

- Kmip Ug v1.2 cnd01Document84 pagesKmip Ug v1.2 cnd01Nandhini HaribabuNo ratings yet

- L/epublic of Tue Flbilippine.s': $upreme (!j:ourtDocument31 pagesL/epublic of Tue Flbilippine.s': $upreme (!j:ourtKarl Rigo AndrinoNo ratings yet

- Fiasco Fallout 2013Document14 pagesFiasco Fallout 2013G. Mac AoidhNo ratings yet

- Istilah Akuntansi EnglishDocument2 pagesIstilah Akuntansi Englishpramesari dinarNo ratings yet

- Domalsin v. Valenciano (G.R. No. 158687)Document2 pagesDomalsin v. Valenciano (G.R. No. 158687)Rache Gutierrez0% (1)

- Is 9259 1979 PDFDocument15 pagesIs 9259 1979 PDFsagarNo ratings yet

- Group 4 - The Rizal Law OutlineDocument3 pagesGroup 4 - The Rizal Law OutlineBaculio Janine G.No ratings yet

- The Great HackDocument4 pagesThe Great HackKeith Marcel MenezesNo ratings yet

- Gmail - .Net Interview Confirmation - Cognizant Technology Solutions (Interview Date - 20th July 2019, Saturday - ICC Trade 4th Floor (B Wing), S B Road, Pune (Above Star Bazaar) Pune - 4119016 PDFDocument4 pagesGmail - .Net Interview Confirmation - Cognizant Technology Solutions (Interview Date - 20th July 2019, Saturday - ICC Trade 4th Floor (B Wing), S B Road, Pune (Above Star Bazaar) Pune - 4119016 PDFmahesh pawarNo ratings yet

- Sha DM 0910Document2 pagesSha DM 0910shashank guptaNo ratings yet

- Witness To SplendourDocument89 pagesWitness To SplendourSani Panhwar100% (3)

- 04 AcknowledgementDocument3 pages04 AcknowledgementvigneshNo ratings yet

- Certificate of Appreciation: Curly Jane B. MadredijoDocument9 pagesCertificate of Appreciation: Curly Jane B. MadredijoIrene caberNo ratings yet

- Design & Fashion - October 2020Document12 pagesDesign & Fashion - October 2020ArtdataNo ratings yet

- Security Affairs - North KoreaDocument15 pagesSecurity Affairs - North KoreaAdriana CantonNo ratings yet

- Department of Education: Republic of The PhilippinesDocument48 pagesDepartment of Education: Republic of The PhilippinesSophy SophyNo ratings yet

- FedEx Vs DHL ReportDocument59 pagesFedEx Vs DHL Reportyu yanNo ratings yet