Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsPR Advance 3

PR Advance 3

Uploaded by

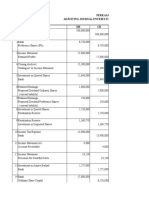

hy google1. The document records the purchase of shares in Jetjet Co. by Arafit over 3 dates from 2014-2016, with the total share acquired being 18,000 shares or 90% ownership.

2. It also includes journal entries recording the purchases, recognition of income/dividends, an investment revaluation, and the sale of 2,000 shares in 2017 reducing Arafit's ownership to 80%.

3. In 2017, Arafit sold 2,000 shares of Jetjet Co., recognizing a gain on sale of RP136,000 after considering its share of undistributed income from 2016-2017.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- ASAL Business Coursebook Answers PDFDocument242 pagesASAL Business Coursebook Answers PDFMatej Milosavljevic88% (25)

- KKTiwari - 18214263 - Worldwide Paper Company-2016Document5 pagesKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNo ratings yet

- Essays Sample Exam CAIA LEVEL 2Document31 pagesEssays Sample Exam CAIA LEVEL 2mirela2g100% (2)

- Stock Market and Indian EconomyDocument62 pagesStock Market and Indian Economyswapnilr85No ratings yet

- Expansion Project Example: Dr. C. Bulent AybarDocument10 pagesExpansion Project Example: Dr. C. Bulent AybarTricia Mae PetalverNo ratings yet

- Ak 2024-1Document7 pagesAk 2024-1kingaliisgreat.07860No ratings yet

- Cash Flow Statement Inv & Fin Activity (Mat 4) Iyhgblo8yugbjmnDocument3 pagesCash Flow Statement Inv & Fin Activity (Mat 4) Iyhgblo8yugbjmnPrashanth RNo ratings yet

- Short Term Credit Line ExampleDocument1 pageShort Term Credit Line ExampleNhư Hoài ThươngNo ratings yet

- Tugas Adv2Document13 pagesTugas Adv2Widodo MohammadNo ratings yet

- Statement - I Cost of Project Particulars Sl. No. Ref. Annex Total CostDocument15 pagesStatement - I Cost of Project Particulars Sl. No. Ref. Annex Total Costsohalsingh1No ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- The Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000Document5 pagesThe Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000RomerNo ratings yet

- Investment in Associate' 2Document9 pagesInvestment in Associate' 2Joefrey Pujadas BalumaNo ratings yet

- Peter5 QnADocument8 pagesPeter5 QnAAnsong KennedyNo ratings yet

- JournalDocument7 pagesJournalathierahNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- Master of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Document6 pagesMaster of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Namrata RamgadeNo ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Accounts CH 6 Cash FlowDocument11 pagesAccounts CH 6 Cash Flowapsonline8585No ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- In Other Words RE Increased by P250,000 (Income Less Dividends)Document6 pagesIn Other Words RE Increased by P250,000 (Income Less Dividends)Agatha de CastroNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- 2 Partnership - UpdatedDocument24 pages2 Partnership - UpdatedBorussian RamaNo ratings yet

- 21far460 Ss Set 1 Jun21 - StudentDocument9 pages21far460 Ss Set 1 Jun21 - StudentRuzaikha razaliNo ratings yet

- Jawaban Soal Latihan LKK1-BondsDocument21 pagesJawaban Soal Latihan LKK1-Bondszahra calista armansyahNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Assignment - Operating Lease & Direct Financing LeaseDocument8 pagesAssignment - Operating Lease & Direct Financing Leaseangelian bagadiongNo ratings yet

- Far460 Group Project 1Document3 pagesFar460 Group Project 1NURAMIRA AQILANo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- Module 3Document17 pagesModule 3Alpha RamoranNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- Advacc 3 Answer Key Set A 165pcsDocument3 pagesAdvacc 3 Answer Key Set A 165pcsPearl Mae De VeasNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- Revaluation Problems Part 2Document32 pagesRevaluation Problems Part 2XNo ratings yet

- Consolidated Working PaperDocument6 pagesConsolidated Working PaperChaCha Delos Reyes AguinidNo ratings yet

- Bangladesh IFRS Project Extended Question - SanganaDocument13 pagesBangladesh IFRS Project Extended Question - SanganaShakhawatNo ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Prelimexamacct1103withanswerandsolutiondocx PDF FreeDocument14 pagesPrelimexamacct1103withanswerandsolutiondocx PDF FreeBaby OREO0% (1)

- Quiz No 3Document5 pagesQuiz No 3KristiNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- Canyon Transport: Perform Financial CalculationsDocument7 pagesCanyon Transport: Perform Financial CalculationsManoj TeliNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- PSB Tk.2 d3 Pajak 2018Document93 pagesPSB Tk.2 d3 Pajak 2018Ardi PribadiNo ratings yet

- 7-3 PT Pandu Dan PT SadewaDocument2 pages7-3 PT Pandu Dan PT SadewaTeam 1No ratings yet

- FFS & CFSDocument9 pagesFFS & CFSHusain VagherNo ratings yet

- Acc 2 - AssignmentDocument8 pagesAcc 2 - AssignmentvincentNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Annual Report Avenue CapitalDocument44 pagesAnnual Report Avenue CapitalJoel CintrónNo ratings yet

- Executive SummaryDocument35 pagesExecutive SummaryAmit PasiNo ratings yet

- Has There Been A Decade of London PM Gold Fixing Manipulation?Document2 pagesHas There Been A Decade of London PM Gold Fixing Manipulation?Anvesh ReddyNo ratings yet

- Financial Accounting and Reporting Retained EarningsDocument68 pagesFinancial Accounting and Reporting Retained EarningsRic Cruz0% (1)

- 01Document106 pages01Tanya VermaNo ratings yet

- BAC 112 Final Departmental Exam (Answer Key) RevisedDocument12 pagesBAC 112 Final Departmental Exam (Answer Key) Revisedjanus lopezNo ratings yet

- 8 - Stock MarketsDocument78 pages8 - Stock MarketsDineAbs01No ratings yet

- Assignment 1 POF..Document3 pagesAssignment 1 POF..Anees RahmanNo ratings yet

- Outline: Valuation of Common StocksDocument8 pagesOutline: Valuation of Common StocksMadhuram SharmaNo ratings yet

- Shares: How It Works/ExampleDocument5 pagesShares: How It Works/ExampleSurendra VyasNo ratings yet

- Mentor & MRP Guide & Approved Title List-MBA-III (2012-14) - Consolidated (May 2014)Document31 pagesMentor & MRP Guide & Approved Title List-MBA-III (2012-14) - Consolidated (May 2014)hrishabhshuklaNo ratings yet

- NYSE & NASDAQ New 52 Week Highs and Lows - 20220506Document30 pagesNYSE & NASDAQ New 52 Week Highs and Lows - 20220506matrixitNo ratings yet

- A Comparative Analysis of Theperformance o FAfrican Capital Market Volume 2 2010Document81 pagesA Comparative Analysis of Theperformance o FAfrican Capital Market Volume 2 2010NiladriAcholNo ratings yet

- SAPM Course OutlinelDocument7 pagesSAPM Course OutlinelNimish KumarNo ratings yet

- An Empirical Analysis of The Quality of Corporate Financial DisclosureDocument11 pagesAn Empirical Analysis of The Quality of Corporate Financial Disclosurepriandhita asmoroNo ratings yet

- Valaution - ICAIDocument174 pagesValaution - ICAIhindustani888No ratings yet

- Woven Capital Associate ChallengeDocument2 pagesWoven Capital Associate ChallengeHaruka TakamoriNo ratings yet

- Nism 9Document19 pagesNism 9newbie1947No ratings yet

- Thelazypersonguidetoinvesting PDFDocument12 pagesThelazypersonguidetoinvesting PDFOussama ToumiNo ratings yet

- Management & Organization of Stock Exchange - Mukesh CarpenterDocument22 pagesManagement & Organization of Stock Exchange - Mukesh CarpenterMukesh CarpenterNo ratings yet

- Yamamoto 2012Document15 pagesYamamoto 2012Sultan AhmadNo ratings yet

- Sagar Patel - E1808240000410127Document124 pagesSagar Patel - E1808240000410127146. Singh SagarNo ratings yet

- 1604133570Document137 pages1604133570Rashmi HasrajaniNo ratings yet

- A Sideways View of The WorldDocument14 pagesA Sideways View of The Worldannawitkowski88No ratings yet

- Financial Accounting Theory Craig Deegan Chapter 7Document9 pagesFinancial Accounting Theory Craig Deegan Chapter 7Sylvia Al-a'maNo ratings yet

- IIFT ListDocument108 pagesIIFT ListAnonymous XMpsIw7Iz9No ratings yet

- Curriculum Vitae: Career ObjectiveDocument3 pagesCurriculum Vitae: Career ObjectivegujralsheenaNo ratings yet

PR Advance 3

PR Advance 3

Uploaded by

hy google0 ratings0% found this document useful (0 votes)

8 views2 pages1. The document records the purchase of shares in Jetjet Co. by Arafit over 3 dates from 2014-2016, with the total share acquired being 18,000 shares or 90% ownership.

2. It also includes journal entries recording the purchases, recognition of income/dividends, an investment revaluation, and the sale of 2,000 shares in 2017 reducing Arafit's ownership to 80%.

3. In 2017, Arafit sold 2,000 shares of Jetjet Co., recognizing a gain on sale of RP136,000 after considering its share of undistributed income from 2016-2017.

Original Description:

Original Title

PR ADVANCE 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document records the purchase of shares in Jetjet Co. by Arafit over 3 dates from 2014-2016, with the total share acquired being 18,000 shares or 90% ownership.

2. It also includes journal entries recording the purchases, recognition of income/dividends, an investment revaluation, and the sale of 2,000 shares in 2017 reducing Arafit's ownership to 80%.

3. In 2017, Arafit sold 2,000 shares of Jetjet Co., recognizing a gain on sale of RP136,000 after considering its share of undistributed income from 2016-2017.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views2 pagesPR Advance 3

PR Advance 3

Uploaded by

hy google1. The document records the purchase of shares in Jetjet Co. by Arafit over 3 dates from 2014-2016, with the total share acquired being 18,000 shares or 90% ownership.

2. It also includes journal entries recording the purchases, recognition of income/dividends, an investment revaluation, and the sale of 2,000 shares in 2017 reducing Arafit's ownership to 80%.

3. In 2017, Arafit sold 2,000 shares of Jetjet Co., recognizing a gain on sale of RP136,000 after considering its share of undistributed income from 2016-2017.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Jumlah lembar aham JETJET Co

20,000

Shares Cost/Sh Cost of

Date kepemilikan

Acquired ares Investment

3/1/2014 2,000 250 500,000 10%

2/1/2015 4,000 300 1,200,000 20%

4/1/2016 12,000 330 3,960,000 60% Date of Acquisiton

1.) Jurnal pembelian investasi

Investment In Jetjet Co. 500,000

3/1/2014

Cash 500,000

% Kepemilikan 10%

2.) Jurnal pengakuan Net Income Jetjet Co.

No

31/12/14

Entry

3.) Jurnal Pembagian Dividend dr Jetjet.co

No

31/12/14

Entry

4.) Jurnal Pembelian Investment

Investment in Jetjet Co. 1,200,000

2/1/2015

Cash 1,200,000

% Kepemilikan =2.000+4.000/20.000 30%

5.) Jurnal pengakuan Net Income Jetjet Co.

No

12/31/2015

Entry

6.) Jurnal Pembagian Dividend dr Jetjet.co

No

12/31/2015

Entry

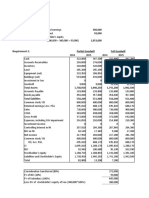

7.) Jurnal pembelian Investment CAD Schedule Parent(90%) NCI(10%) Total(100%)

Investment in Jetjet Co. 3,960,000 Date of Implied Value 5,940,000 660,000 6,600,000

1/4/2016

Cash 3,960,000 Acquisition Book Value of JETJET Co.

% = 2.000+4.000+12.000/20.000 90% Common Stock 3,600,000 400,000 4,000,000

Additional PIC 1,080,000 120,000 1,200,000

8.) Retroactive Adjustment Retained Earnings 1,350,000 150,000 1,500,000

1/4/2016 No Total Book Value of Equity 6,030,000 670,000 6,700,000

Entry Difference between IV & BV (90,000) (10,000) (100,000)

p.s : dibuat di reciprocity Allocation to Land 90000 10000 100000

Balance - - -

Initial Purchase Price 1,700,000

Change In S R/E since Acquisition 55,000

Carrying Value Investment in Jetjet Co 1,755,000

Implied Value 1,980,000

Gain on Revaluation 225,000

9.) Jurnal Pengakuan Gain on Revaluation

Investment in Jetjet Co. 225,000

1/4/2016

Gain on Revaluation 225,000

10.) Jurnal Pengakuan Net Income

No

12/31/2016

Entry

11.) Jurnal Pengakuan Dividend

Cash 180,000

12/31/2016

Dividend Income 180,000

= (500.000*40%) * 90%

Investment in Jetjet Co. 31/12/16

Investment in Jetjet Co. 01/01/16 (30%) 1,700,000

Revaluation 04/01/16 225,000

Additional Investment 04/01/16 3,960,000

Investment in Jetjet Co 31/12/16 (90%) 5,885,000

Elimination Entries 2016

a.) Reciprocity Entries (10% ->30%)

Investment in Jetjet Co. 55,000

31/12/16

Beginning R/E - P 55,000

b.)Eliminasi Dividend

Dividend Income 180,000

31/12/16

Dividend Declared 180,000

c.)Eliminasi Investasi & BV

Common Stock 4,000,000

Additional PIC 1,200,000

Retained Earnings 1,500,000

31/12/16

Difference between IV&BV 100,000

Investment in Jetjet Co. 5,940,000

NCI in Equity 660,000

d.)Allocation Difference to Land

Difference Between IV&BV 100,000

3/12/2016

Land 100,000

Tahun 2017

Arafit jual 2000 lembar saham Jetjet Co.

Before 90% 10%

After 80% 20%

Cost of Investment Sold 594,000

Undistributed Income

Change in R/E - Jetjet Co (4/1/16-1/1/17) 30,000

RE 2017 1,500,000

RE 2018 1,800,000

Net Income Jetjet Co (1/1/17-1/7/17) 40,000 70,000

Adjusted Cost of Investment 664,000

Selling Price 800,000

Gain (Adjust to PIC P) 136,000

PIC Recorded 206,000

Reduced in PIC - Arafit Co. 70,000

12.) Jurnal penjualan Saham

Cash 800,000

1/7/2017 Investment in Jetjet Co. 594,000

PIC - Arafit Co, 206,000

13.) Jurnal Dividend Income 2017

Cash 160,000

31/12/2017

Dividend Income 160,000

Investment in Jetjet Co. 31/12/17

Investment in Jetjet Co. 01/01/17 (90%) 5,885,000

Cost of Investment (10%) (594,000)

Investment in Jetjet Co (80%) 5,291,000

Elimintion Entries 2017

a.) Reciprocity Adjustment

Investment in Jetjet Co 295,000

31/12/17

Beginning R/E - P 295,000

b.) Elimination Change in R/E

31/12/17 PIC - Arafit Co. 30,000

R/E Arafit Co. 30,000

c.) Elimination Income Sold

31/12/17 PIC - Arafit Co. 40,000

Beginning R/E - P 40,000

d.)Eliminasi Dividend

Dividend Income 160,000

31/12/17

Dividend Declared 160,000

e.)Eliminasi Investasi & BV

Common Stock 4,000,000

Additional PIC 1,200,000

Retained Earnings 1,500,000

31/12/17

Difference between IV&BV 100,000

Investment in Jetjet Co. 5,940,000

NCI in Equity 660,000

f.)Allocation Difference to Land

Difference Between IV&BV 100,000

3/12/2017

Land 100,000

You might also like

- ASAL Business Coursebook Answers PDFDocument242 pagesASAL Business Coursebook Answers PDFMatej Milosavljevic88% (25)

- KKTiwari - 18214263 - Worldwide Paper Company-2016Document5 pagesKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNo ratings yet

- Essays Sample Exam CAIA LEVEL 2Document31 pagesEssays Sample Exam CAIA LEVEL 2mirela2g100% (2)

- Stock Market and Indian EconomyDocument62 pagesStock Market and Indian Economyswapnilr85No ratings yet

- Expansion Project Example: Dr. C. Bulent AybarDocument10 pagesExpansion Project Example: Dr. C. Bulent AybarTricia Mae PetalverNo ratings yet

- Ak 2024-1Document7 pagesAk 2024-1kingaliisgreat.07860No ratings yet

- Cash Flow Statement Inv & Fin Activity (Mat 4) Iyhgblo8yugbjmnDocument3 pagesCash Flow Statement Inv & Fin Activity (Mat 4) Iyhgblo8yugbjmnPrashanth RNo ratings yet

- Short Term Credit Line ExampleDocument1 pageShort Term Credit Line ExampleNhư Hoài ThươngNo ratings yet

- Tugas Adv2Document13 pagesTugas Adv2Widodo MohammadNo ratings yet

- Statement - I Cost of Project Particulars Sl. No. Ref. Annex Total CostDocument15 pagesStatement - I Cost of Project Particulars Sl. No. Ref. Annex Total Costsohalsingh1No ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- The Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000Document5 pagesThe Remaining Percent of The Sea-Breeze Shares Traded Near A Total Value of 200,000RomerNo ratings yet

- Investment in Associate' 2Document9 pagesInvestment in Associate' 2Joefrey Pujadas BalumaNo ratings yet

- Peter5 QnADocument8 pagesPeter5 QnAAnsong KennedyNo ratings yet

- JournalDocument7 pagesJournalathierahNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- Master of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Document6 pagesMaster of Business Administration (M.B.A.) Semester-I (C.B.C.S.) Examination Accounting For Managers Compulsory Paper-3 (Elective)Namrata RamgadeNo ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Accounts CH 6 Cash FlowDocument11 pagesAccounts CH 6 Cash Flowapsonline8585No ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- In Other Words RE Increased by P250,000 (Income Less Dividends)Document6 pagesIn Other Words RE Increased by P250,000 (Income Less Dividends)Agatha de CastroNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- 2 Partnership - UpdatedDocument24 pages2 Partnership - UpdatedBorussian RamaNo ratings yet

- 21far460 Ss Set 1 Jun21 - StudentDocument9 pages21far460 Ss Set 1 Jun21 - StudentRuzaikha razaliNo ratings yet

- Jawaban Soal Latihan LKK1-BondsDocument21 pagesJawaban Soal Latihan LKK1-Bondszahra calista armansyahNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Assignment - Operating Lease & Direct Financing LeaseDocument8 pagesAssignment - Operating Lease & Direct Financing Leaseangelian bagadiongNo ratings yet

- Far460 Group Project 1Document3 pagesFar460 Group Project 1NURAMIRA AQILANo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- Module 3Document17 pagesModule 3Alpha RamoranNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- Advacc 3 Answer Key Set A 165pcsDocument3 pagesAdvacc 3 Answer Key Set A 165pcsPearl Mae De VeasNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- Revaluation Problems Part 2Document32 pagesRevaluation Problems Part 2XNo ratings yet

- Consolidated Working PaperDocument6 pagesConsolidated Working PaperChaCha Delos Reyes AguinidNo ratings yet

- Bangladesh IFRS Project Extended Question - SanganaDocument13 pagesBangladesh IFRS Project Extended Question - SanganaShakhawatNo ratings yet

- Jawaban Latihan Soal AklDocument11 pagesJawaban Latihan Soal AklFauzi AbdillahNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Prelimexamacct1103withanswerandsolutiondocx PDF FreeDocument14 pagesPrelimexamacct1103withanswerandsolutiondocx PDF FreeBaby OREO0% (1)

- Quiz No 3Document5 pagesQuiz No 3KristiNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- Canyon Transport: Perform Financial CalculationsDocument7 pagesCanyon Transport: Perform Financial CalculationsManoj TeliNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- PSB Tk.2 d3 Pajak 2018Document93 pagesPSB Tk.2 d3 Pajak 2018Ardi PribadiNo ratings yet

- 7-3 PT Pandu Dan PT SadewaDocument2 pages7-3 PT Pandu Dan PT SadewaTeam 1No ratings yet

- FFS & CFSDocument9 pagesFFS & CFSHusain VagherNo ratings yet

- Acc 2 - AssignmentDocument8 pagesAcc 2 - AssignmentvincentNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Annual Report Avenue CapitalDocument44 pagesAnnual Report Avenue CapitalJoel CintrónNo ratings yet

- Executive SummaryDocument35 pagesExecutive SummaryAmit PasiNo ratings yet

- Has There Been A Decade of London PM Gold Fixing Manipulation?Document2 pagesHas There Been A Decade of London PM Gold Fixing Manipulation?Anvesh ReddyNo ratings yet

- Financial Accounting and Reporting Retained EarningsDocument68 pagesFinancial Accounting and Reporting Retained EarningsRic Cruz0% (1)

- 01Document106 pages01Tanya VermaNo ratings yet

- BAC 112 Final Departmental Exam (Answer Key) RevisedDocument12 pagesBAC 112 Final Departmental Exam (Answer Key) Revisedjanus lopezNo ratings yet

- 8 - Stock MarketsDocument78 pages8 - Stock MarketsDineAbs01No ratings yet

- Assignment 1 POF..Document3 pagesAssignment 1 POF..Anees RahmanNo ratings yet

- Outline: Valuation of Common StocksDocument8 pagesOutline: Valuation of Common StocksMadhuram SharmaNo ratings yet

- Shares: How It Works/ExampleDocument5 pagesShares: How It Works/ExampleSurendra VyasNo ratings yet

- Mentor & MRP Guide & Approved Title List-MBA-III (2012-14) - Consolidated (May 2014)Document31 pagesMentor & MRP Guide & Approved Title List-MBA-III (2012-14) - Consolidated (May 2014)hrishabhshuklaNo ratings yet

- NYSE & NASDAQ New 52 Week Highs and Lows - 20220506Document30 pagesNYSE & NASDAQ New 52 Week Highs and Lows - 20220506matrixitNo ratings yet

- A Comparative Analysis of Theperformance o FAfrican Capital Market Volume 2 2010Document81 pagesA Comparative Analysis of Theperformance o FAfrican Capital Market Volume 2 2010NiladriAcholNo ratings yet

- SAPM Course OutlinelDocument7 pagesSAPM Course OutlinelNimish KumarNo ratings yet

- An Empirical Analysis of The Quality of Corporate Financial DisclosureDocument11 pagesAn Empirical Analysis of The Quality of Corporate Financial Disclosurepriandhita asmoroNo ratings yet

- Valaution - ICAIDocument174 pagesValaution - ICAIhindustani888No ratings yet

- Woven Capital Associate ChallengeDocument2 pagesWoven Capital Associate ChallengeHaruka TakamoriNo ratings yet

- Nism 9Document19 pagesNism 9newbie1947No ratings yet

- Thelazypersonguidetoinvesting PDFDocument12 pagesThelazypersonguidetoinvesting PDFOussama ToumiNo ratings yet

- Management & Organization of Stock Exchange - Mukesh CarpenterDocument22 pagesManagement & Organization of Stock Exchange - Mukesh CarpenterMukesh CarpenterNo ratings yet

- Yamamoto 2012Document15 pagesYamamoto 2012Sultan AhmadNo ratings yet

- Sagar Patel - E1808240000410127Document124 pagesSagar Patel - E1808240000410127146. Singh SagarNo ratings yet

- 1604133570Document137 pages1604133570Rashmi HasrajaniNo ratings yet

- A Sideways View of The WorldDocument14 pagesA Sideways View of The Worldannawitkowski88No ratings yet

- Financial Accounting Theory Craig Deegan Chapter 7Document9 pagesFinancial Accounting Theory Craig Deegan Chapter 7Sylvia Al-a'maNo ratings yet

- IIFT ListDocument108 pagesIIFT ListAnonymous XMpsIw7Iz9No ratings yet

- Curriculum Vitae: Career ObjectiveDocument3 pagesCurriculum Vitae: Career ObjectivegujralsheenaNo ratings yet