Professional Documents

Culture Documents

Ias & Ifrs

Ias & Ifrs

Uploaded by

Irfan Sahir0 ratings0% found this document useful (0 votes)

13 views6 pagesThis document outlines the objectives of 28 International Accounting Standards. The standards cover topics such as the presentation of financial statements, accounting for inventories, statement of cash flows, accounting policies and errors, events after the reporting period, construction contracts, income taxes, property, plant and equipment, leases, revenue, employee benefits, government grants, foreign exchange rates, borrowing costs, related party disclosures, retirement benefit plans, consolidated and separate financial statements, investments in associates, financial reporting in hyperinflationary economies, and interests in joint ventures. The objectives generally relate to prescribing the accounting treatment and disclosure requirements for transactions within each topic.

Original Description:

Original Title

IAS & IFRS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the objectives of 28 International Accounting Standards. The standards cover topics such as the presentation of financial statements, accounting for inventories, statement of cash flows, accounting policies and errors, events after the reporting period, construction contracts, income taxes, property, plant and equipment, leases, revenue, employee benefits, government grants, foreign exchange rates, borrowing costs, related party disclosures, retirement benefit plans, consolidated and separate financial statements, investments in associates, financial reporting in hyperinflationary economies, and interests in joint ventures. The objectives generally relate to prescribing the accounting treatment and disclosure requirements for transactions within each topic.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views6 pagesIas & Ifrs

Ias & Ifrs

Uploaded by

Irfan SahirThis document outlines the objectives of 28 International Accounting Standards. The standards cover topics such as the presentation of financial statements, accounting for inventories, statement of cash flows, accounting policies and errors, events after the reporting period, construction contracts, income taxes, property, plant and equipment, leases, revenue, employee benefits, government grants, foreign exchange rates, borrowing costs, related party disclosures, retirement benefit plans, consolidated and separate financial statements, investments in associates, financial reporting in hyperinflationary economies, and interests in joint ventures. The objectives generally relate to prescribing the accounting treatment and disclosure requirements for transactions within each topic.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

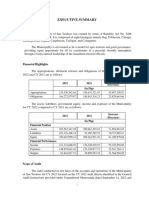

IAS International Accounting Standard Objective

This Standard sets out overall requirements for

the presentation of financial statements,

1 Presentation of Financial Statements

guidelines for their structure and minimum

requirements for their content.

The objective of this Standard is to prescribe the

accounting treatment for inventories. A primary

issue in accounting for inventories is the amount

of cost to be recognised as an asset and carried

forward until the related revenues are

2 Inventories recognised. This Standard provides guidance on

the determination of cost and its subsequent

recognition as an expense, including any write-

down to net realisable value. It also provides

guidance on the cost formulas that are used to

assign costs to inventories.

The objective of this Standard is to require the

provision of information about the historical

changes in cash and cash equivalents of an entity

7 Statement of Cash Flows

by means of a statement of cash flows which

classifies cash flows during the period from

operating, investing and financing activities.

The objective of this Standard is to prescribe the

criteria for selecting and changing accounting

Accounting Policies, Changes in policies, together with the accounting treatment

8

Accounting Estimates and Errors and disclosure of changes in accounting

policies, changes in accounting estimates and

corrections of errors.

The objective of this Standard is to prescribe:

(a) when an entity should adjust its financial

statements for events after the reporting period;

10 Events after the Reporting Period and (b) the disclosures that an entity should give

about the date when the financial statements

were authorised for issue and about events after

the reporting period.

The objective of this Standard is to prescribe the

11 Construction Contracts accounting treatment of revenue and costs

associated with construction contracts.

The objective of this Standard is to prescribe the

accounting treatment for income taxes. The

principal issue in accounting for income taxes is

12 Income Taxes how to account for the current and future tax

consequences of:

(a) the future recovery (settlement) of the

carrying amount of assets (liabilities) that are

recognised in an entity’s statement of financial

position; and (b) transactions and other events of

the current period that are recognised in an

entity’s financial statements.

The objective of this Standard is to prescribe the

accounting treatment for property, plant and

equipment so that users of the financial

16 Property, Plant & Equipment

statements can discern information about an

entity’s investment in its property, plant and

equipment and the changes in such investment.

This Standard sets out the principles for the

recognition, measurement, presentation and

disclosure of leases. The objective is to ensure

17 Leases

that lessees and lessors provide relevant

information in a manner that faithfully

represents those transactions.

The objective of this Standard is to prescribe the

accounting treatment of revenue arising from

18 Revenue certain types of transactions and events. The

primary issue in accounting for revenue is

determining when to recognise revenue.

The objective of this Standard is to prescribe the

19 Employee Benefits accounting and disclosure for employee

benefits.

This Standard shall be applied in accounting for,

Accounting for Government Grants

and in the disclosure of, government grants and

20 and Disclosure of Government

in the disclosure of other forms of government

Assistance

assistance.

The objective of this Standard is to prescribe

how to include foreign currency transactions and

The Effect of Change in Foreign

21 foreign operations in the financial statements of

Exchange Rates

an entity and how to translate financial

statements into a presentation currency.

An entity shall apply this Standard in accounting

23 Borrowing Costs

for borrowing costs.

The objective of this Standard is to ensure that

an entity’s financial statements contain the

disclosures necessary to draw attention to the

possibility that its financial position and profit

24 Related Party Disclosures

or loss may have been affected by the existence

of related parties and by transactions and

outstanding balances, including commitments,

with such parties.

This Standard shall be applied in the financial

Accounting and Reporting by

26 statements of retirement benefit plans where

Retirement Benefit Plans

such financial statements are prepared.

The objective of this Standard is to prescribe the

accounting and disclosure requirements for

Consolidated and Separate Financial

27 investments in subsidiaries, joint ventures and

Statements

associates when an entity prepares separate

financial statements.

The objective of this Standard is to prescribe the

accounting for investments in associates and to

28 Investment in Associates set out the requirements for the application of

the equity method when accounting for

investments in associates and joint ventures.

This Standard shall be applied to the financial

statements, including the consolidated financial

Financial Reporting in Hyperinflatory

29 statements, of any entity whose functional

Economies

currency is the currency of a hyperinflationary

economy.

This Standard shall be applied in accounting for

interests in joint ventures and the reporting of

joint venture assets, liabilities, income and

Interests in Accounts and Joint

31 expenses in the financial statements of venturers

Ventures

and investors, regardless of the structures or

forms under which the joint venture activities

take place.

The objective of this Standard is to establish

principles for presenting financial instruments

32 Financial Instruments: Presentation

as liabilities or equity and for offsetting financial

assets and financial liabilities.

The objective of this Standard is to prescribe

principles for the determination and presentation

of earnings per share, so as to improve

33 Earnings Per Share performance comparisons between different

entities in the same reporting period and

between different reporting periods for the same

entity.

The objective of this Standard is to prescribe the

minimum content of an interim financial report

34 Interim Financial Reports and to prescribe the principles for recognition

and measurement in complete or condensed

financial statements for an interim period.

The objective of this Standard is to prescribe the

procedures that an entity applies to ensure that

36 Impairment of Assets

its assets are carried at no more than their

recoverable amount.

The objective of this Standard is to ensure that

Provisions, Contingent Liabilities and appropriate recognition criteria and

37

Contingent Assets measurement bases are applied to provisions,

contingent liabilities and contingent assets and

that sufficient information is disclosed in the

notes to enable users to understand their nature,

timing and amount.

The objective of this Standard is to prescribe the

accounting treatment for intangible assets that

38 Intangible Assets

are not dealt with specifically in another

Standard.

This Standard shall be applied by all entities to

all financial instruments within the scope of

IFRS 9 Financial Instruments if, and to the

extent that:

Financial Instruments: Recognition

39 (a) IFRS 9 permits the hedge accounting

and Measurement

requirements of this Standard to be applied; and

(b) the financial instrument is part of a hedging

relationship that qualifies for hedge accounting

in accordance with this Standard.

The objective of this Standard is to prescribe the

40 Investment Property accounting treatment for investment property

and related disclosure requirements.

The objective of this Standard is to prescribe the

41 Agriculture accounting treatment and disclosures related to

agricultural activity.

International Financial Reporting

IFRS Objective

Standard

The objective of this IFRS is to specify the

2 Share Based Payment financial reporting by an entity when it

undertakes a share-based payment transaction.

The objective of this IFRS is to improve the

relevance, reliability and comparability of the

3 Business Combinations information that a reporting entity provides in its

financial statements about a business

combination and its effects.

The objective of this IFRS is to specify the

4 Insurance Contracts financial reporting for insurance contracts by

any entity that issues such contracts

The objective of this IFRS is to specify the

Non-Current Assets Held for Sale accounting for assets held for sale, and the

5

and Discontinued Operations presentation and disclosure of discontinued

operations.

The objective of this IFRS is to specify the

Exploration for and Evaluation of

6 financial reporting for the exploration for and

Mineral Resources

evaluation of mineral resources.

The objective of this IFRS is to require entities

to provide disclosures in their financial

statements that enable users to evaluate:

(a) the significance of financial instruments for

the entity’s financial position and performance;

7 Financial Instruments: Disclosures

and (b) the nature and extent of risks arising

from financial instruments to which the entity is

exposed during the period and at the end of the

reporting period, and how the entity manages

those risks.

An entity shall disclose information to enable

users of its financial statements to evaluate the

8 Operating Segments nature and financial effects of the business

activities in which it engages and the economic

environments in which it operates.

The objective of this IFRS is to establish

principles for the presentation and preparation of

10 Consolidated Financial Statements

consolidated financial statements when an entity

controls one or more other entities.

The objective of this IFRS is to establish

principles for financial reporting by entities that

11 Joint Arrangements

have an interest in arrangements that are

controlled jointly.

The objective of this IFRS is to require an entity

Disclosure of Interest in Other

12 to disclose information that enables users of its

Entities

financial statements to evaluate:

(a) the nature of, and risks associated with, its

interests in other entities; and

(b) the effects of those interests on its financial

position, financial performance and cash flows.

This IFRS:

(a) defines fair value;

(b) sets out in a single IFRS a framework for

13 Fair Value Measurement

measuring fair value; and

(c) requires disclosures about fair value

measurements.

You might also like

- Solution Manual For Financial and Managerial Accounting Williams Haka Bettner Carcello 16th EditionDocument13 pagesSolution Manual For Financial and Managerial Accounting Williams Haka Bettner Carcello 16th EditionToni Johnston100% (41)

- Seagate CaseDocument1 pageSeagate Casepexao87No ratings yet

- SL NO Principles Name of IAS Details About IAS Principles Status of ACI With IAS Complied Not CompliedDocument6 pagesSL NO Principles Name of IAS Details About IAS Principles Status of ACI With IAS Complied Not CompliedNaimmul FahimNo ratings yet

- CFASDocument3 pagesCFASMeybilene BernardoNo ratings yet

- Financial Reporting: Its Conceptual Framework: HapterDocument44 pagesFinancial Reporting: Its Conceptual Framework: HapterMarym MalikNo ratings yet

- Review of Conceptual Framework and Accounting RulesDocument18 pagesReview of Conceptual Framework and Accounting RulesIvory ClaudioNo ratings yet

- Interm Chap 1 (1)Document13 pagesInterm Chap 1 (1)Dere GurandaNo ratings yet

- 1 - Financial AccountingDocument92 pages1 - Financial Accountingajbebera1999No ratings yet

- Acc Cap1 PresentationDocument30 pagesAcc Cap1 PresentationtafsirmhinNo ratings yet

- Overview Of: Regulatory FrameworkDocument43 pagesOverview Of: Regulatory FrameworkMohit BoralkarNo ratings yet

- Regulatory FrameworkDocument31 pagesRegulatory FrameworkMOHIT BORALKARNo ratings yet

- Lecture 1 - Concepts and EthicsDocument10 pagesLecture 1 - Concepts and EthicsNikki MathysNo ratings yet

- SM ch04Document59 pagesSM ch04Sukirman SukirmanNo ratings yet

- Annexure - Module IDocument38 pagesAnnexure - Module ISatyam Kumar AryaNo ratings yet

- Topic 1 To 17Document85 pagesTopic 1 To 17Ava JohnNo ratings yet

- c1 Intro To AsDocument34 pagesc1 Intro To AsSkumar SnmvNo ratings yet

- Advanced Accounting Module 1Document256 pagesAdvanced Accounting Module 1itsmetuesday28No ratings yet

- SFAC 1-DikonversiDocument30 pagesSFAC 1-DikonversiEL FIRANo ratings yet

- Module 1 p1 Development of Financial Reporting FrameworkDocument5 pagesModule 1 p1 Development of Financial Reporting FrameworkluxasuhiNo ratings yet

- 76887cajournal Nov2023 9Document3 pages76887cajournal Nov2023 9tejveersingh7137No ratings yet

- Conceptual Framework and Accounting StandardsDocument7 pagesConceptual Framework and Accounting StandardsJumel Alejandre DelunaNo ratings yet

- Week 2Document11 pagesWeek 2Criselito EnigrihoNo ratings yet

- Intermediate AccountingDocument48 pagesIntermediate AccountingRachelle BulawanNo ratings yet

- Chapter 1 - Financial StatementsDocument2 pagesChapter 1 - Financial StatementsclarizaNo ratings yet

- F7 Notes 2Document4 pagesF7 Notes 2Ahmed IqbalNo ratings yet

- Accounting StandardsDocument12 pagesAccounting StandardsShalini TiwariNo ratings yet

- Financial Reporting 1 BACT 303Document33 pagesFinancial Reporting 1 BACT 303emeraldNo ratings yet

- Far 02 Conceptual Framework For Financial Reporting CompressDocument11 pagesFar 02 Conceptual Framework For Financial Reporting CompressDaphnie Loise CalderonNo ratings yet

- Reviewer For Cfas PDFDocument17 pagesReviewer For Cfas PDFPatrick Jayson VillademosaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument67 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsDafrosa HonorNo ratings yet

- Institute of Chartered Accountant of India (ICAI) Are As FollowsDocument8 pagesInstitute of Chartered Accountant of India (ICAI) Are As Followsarchana_anuragiNo ratings yet

- Kunci Jawaban Intermediate AccountingDocument41 pagesKunci Jawaban Intermediate AccountingbelindaNo ratings yet

- Accounting STDDocument168 pagesAccounting STDChandra ShekharNo ratings yet

- Advanced Financial Reporting ModuleDocument15 pagesAdvanced Financial Reporting ModuleMax MasiyaNo ratings yet

- Ias 8 EnglezaDocument9 pagesIas 8 EnglezaTatiana LupuNo ratings yet

- VCM Chap 1Document9 pagesVCM Chap 1Ivory ClaudioNo ratings yet

- Accounting Standards For Non Going Concern Entities 1709923353Document36 pagesAccounting Standards For Non Going Concern Entities 1709923353Bilal Ahmed KhanNo ratings yet

- Encoded Finacc2 Topic 2Document14 pagesEncoded Finacc2 Topic 2MARY MARGARETTE ROANo ratings yet

- Conceptual and Regulatory Frameworks For Financial ReportingDocument20 pagesConceptual and Regulatory Frameworks For Financial ReportingDhanushika SamarawickramaNo ratings yet

- AccReview Part 3 of 5Document3 pagesAccReview Part 3 of 5Jenny ManalastasNo ratings yet

- Cost Accounting: Study Material St. Joseph's Degree & PG College Hyderabad. Bba V SemDocument188 pagesCost Accounting: Study Material St. Joseph's Degree & PG College Hyderabad. Bba V Sempdd801852No ratings yet

- CFAS ReviewerDocument11 pagesCFAS Reviewerbertochristine10No ratings yet

- Interm Chap 1 NewDocument10 pagesInterm Chap 1 NewDere GurandaNo ratings yet

- FAR 02 Conceptual Framework For Financial ReportingDocument11 pagesFAR 02 Conceptual Framework For Financial ReportingKimberly NuñezNo ratings yet

- Planning Working Capital ManagementDocument39 pagesPlanning Working Capital ManagementRonn RaymundoNo ratings yet

- Accounts Theory Q&A - CA Zubair KhanDocument16 pagesAccounts Theory Q&A - CA Zubair KhanAnanya SharmaNo ratings yet

- IndAS8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument19 pagesIndAS8 Accounting Policies, Changes in Accounting Estimates and Errorsajayaju005No ratings yet

- Branches of Accounting and Users of Accounting InformationDocument5 pagesBranches of Accounting and Users of Accounting InformationSirvie FersifaeNo ratings yet

- Ca - Unit 1Document22 pagesCa - Unit 1SHANMUGHA SHETTY S SNo ratings yet

- L3 Financial Analysis and ReportingDocument1 pageL3 Financial Analysis and ReportingSacramento Mercy D.No ratings yet

- 2.1 Components and General Features of Financial Statements (3114AFE)Document19 pages2.1 Components and General Features of Financial Statements (3114AFE)WilsonNo ratings yet

- Chapter 1 - Introduction To Financial AccountingDocument28 pagesChapter 1 - Introduction To Financial AccountingTaehyung KimNo ratings yet

- Valuation in Ifrs IasDocument24 pagesValuation in Ifrs IashjhjkjNo ratings yet

- Indian and International Accounting StandardsDocument13 pagesIndian and International Accounting StandardsBhanu PrakashNo ratings yet

- Conceptual Framework 2020Document14 pagesConceptual Framework 2020Aryadna Sandi CimarraNo ratings yet

- Class Notes - Conceptual FrameworkDocument36 pagesClass Notes - Conceptual FrameworkHarris LuiNo ratings yet

- Chapter 1 Introduction To Accounting Standards PDFDocument29 pagesChapter 1 Introduction To Accounting Standards PDFVikash AnandNo ratings yet

- Accounting Study PackDocument113 pagesAccounting Study Packmainard100% (1)

- 46329bosinter p1 cp1 PDFDocument22 pages46329bosinter p1 cp1 PDFfaisaldorpNo ratings yet

- IFRS 18 Presentation and Disclosure in Financial StatementsDocument180 pagesIFRS 18 Presentation and Disclosure in Financial StatementsSophia Alexandra CabuangNo ratings yet

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Hydrochem, Inc.: Actual v. Standard Cost Accounting SystemsDocument13 pagesHydrochem, Inc.: Actual v. Standard Cost Accounting Systemsmonika1yustiawisdanaNo ratings yet

- Jatin Godrej WCM ReportDocument40 pagesJatin Godrej WCM ReportMini SharmaNo ratings yet

- ENDECA TechnologiesDocument3 pagesENDECA TechnologiesParitoshNo ratings yet

- Maruti Suzuki India LimitedDocument1 pageMaruti Suzuki India LimitedRonnie FrownNo ratings yet

- BASF Factbook 2008Document83 pagesBASF Factbook 2008jubin6025No ratings yet

- Forex Dictionary by AbrahamDocument8 pagesForex Dictionary by AbrahamAbraham Immanuel AdamNo ratings yet

- The Home DepotDocument7 pagesThe Home DepotWawire WycliffeNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードNo ratings yet

- QUIZ - Financial Instruments: Multiple ChoiceDocument6 pagesQUIZ - Financial Instruments: Multiple ChoiceJessaNo ratings yet

- London Fashion Exchange and Roland Tilman The FraudsterDocument7 pagesLondon Fashion Exchange and Roland Tilman The FraudstersamdefreitasNo ratings yet

- Textbook Mergers and Acquisitions From A To Z Andrew J Sherman Ebook All Chapter PDFDocument53 pagesTextbook Mergers and Acquisitions From A To Z Andrew J Sherman Ebook All Chapter PDFfloyd.huskey643100% (12)

- Intermediate Accounting 13ce KiesoDocument44 pagesIntermediate Accounting 13ce Kiesofullgradestore2023No ratings yet

- Profitability of Large Commercial ConstrDocument8 pagesProfitability of Large Commercial ConstrstevenmolisaNo ratings yet

- Cash Flow Statement (Format and Practical Problems)Document21 pagesCash Flow Statement (Format and Practical Problems)Ankit pattnaikNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- Executive Summary 2022Document10 pagesExecutive Summary 2022Barnie BingNo ratings yet

- Capital AllocationDocument75 pagesCapital Allocationak87840% (1)

- Answer 5 Cs of Credit - Caskey Trucking FinancialsDocument1 pageAnswer 5 Cs of Credit - Caskey Trucking FinancialsFintech GroupNo ratings yet

- DuPont Profitability ModelDocument1 pageDuPont Profitability ModelcwkkarachchiNo ratings yet

- 47 CounterDocument102 pages47 CounterkannnamreddyeswarNo ratings yet

- Cheat Sheet Measuring ReturnsDocument1 pageCheat Sheet Measuring ReturnsthisisatrolNo ratings yet

- DR Jawed Sakrani MIS 2023 09-09-2023 Payment DetailsDocument5 pagesDR Jawed Sakrani MIS 2023 09-09-2023 Payment DetailsmunirkhansehwaniNo ratings yet

- Helaian Helaian KerjaDocument77 pagesHelaian Helaian KerjaAnonymous 70qJkxNo ratings yet

- MFE 06 - Financial Market - Case StudyDocument8 pagesMFE 06 - Financial Market - Case StudyKushan Chanaka AmarasingheNo ratings yet

- Expose D'anglaisDocument7 pagesExpose D'anglaisadjouaaureliekoffiNo ratings yet

- Soal Asis 4 IPMDocument2 pagesSoal Asis 4 IPMPutri Dianasri ButarbutarNo ratings yet

- The Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalDocument10 pagesThe Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalSalil Kuwelkar100% (1)

- GLO Top 100 Stockholders As of December 31, 2022Document9 pagesGLO Top 100 Stockholders As of December 31, 2022Bettina BarrionNo ratings yet