Professional Documents

Culture Documents

Fiscal Impact

Fiscal Impact

Uploaded by

Jeremy Turley0 ratings0% found this document useful (0 votes)

5K views2 pagesThe document summarizes the estimated fiscal impact of proposed income tax relief in the 2023-25 biennial executive budget for North Dakota. It would exempt the first tax bracket from taxation and implement a flat 1.5% tax on income exceeding the first bracket, reducing state revenues by an estimated $566 million. It also estimates the cost of continuing an existing $700/$350 per return tax credit at $229 million. Tables provide estimated tax relief amounts, numbers of tax returns, and tax liabilities for residents and nonresidents under the proposed changes.

Original Description:

Fiscal Impact

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the estimated fiscal impact of proposed income tax relief in the 2023-25 biennial executive budget for North Dakota. It would exempt the first tax bracket from taxation and implement a flat 1.5% tax on income exceeding the first bracket, reducing state revenues by an estimated $566 million. It also estimates the cost of continuing an existing $700/$350 per return tax credit at $229 million. Tables provide estimated tax relief amounts, numbers of tax returns, and tax liabilities for residents and nonresidents under the proposed changes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5K views2 pagesFiscal Impact

Fiscal Impact

Uploaded by

Jeremy TurleyThe document summarizes the estimated fiscal impact of proposed income tax relief in the 2023-25 biennial executive budget for North Dakota. It would exempt the first tax bracket from taxation and implement a flat 1.5% tax on income exceeding the first bracket, reducing state revenues by an estimated $566 million. It also estimates the cost of continuing an existing $700/$350 per return tax credit at $229 million. Tables provide estimated tax relief amounts, numbers of tax returns, and tax liabilities for residents and nonresidents under the proposed changes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Prepared for Representative Ista

LC# 23.9450.02000

January 2023

ESTIMATED INCOME TAX RELIEF -

2023-25 BIENNIUM EXECUTIVE BUDGET

EXECUTIVE BUDGET INCOME TAX RELIEF PROPOSAL

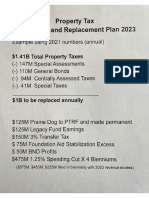

The schedule below provides information on the estimated fiscal impact of the income tax relief proposal as

recommended in the executive budget for the 2023-25 biennium. The proposal exempts taxable income in the first

tax bracket from taxation and implements a flat tax of 1.5 percent for all taxable income exceeding the first bracket.

The income tax relief would result in a decrease in tax collections reducing general fund revenues for the

2023-25 biennium. The amounts reflect information provided by the Tax Department.

Total Estimated Average Annual

Tax Relief - Biennium Tax Relief per Return

Tax Bracket Residents Nonresidents Total Residents Nonresidents

First $96,650,000 $7,580,000 $104,230,000 $219 $77

Second 161,850,000 12,550,000 174,400,000 $780 $225

Third 47,620,000 6,130,000 53,750,000 $1,353 $352

Fourth 38,790,000 7,030,000 45,820,000 $2,607 $468

Fifth 143,890,000 44,310,000 188,200,000 $36,119 $2,102

Total $488,800,000 $77,600,000 $566,400,000

INCOME TAX CREDIT - COST TO CONTINUE

The schedule below provides information on the estimated cost to continue the income tax credit, which was

approved during the November 2021 special legislative session, for the 2023-25 biennium. The credit provides up

to $700 per tax return for married filing jointly returns and up to $350 per tax return for all other returns. The income

tax credit would result in a decrease in tax collections reducing general fund revenues for the 2023-25 biennium.

For reference, the estimated tax relief for the credit in the 2021-23 biennium was $211 million. The amounts shown

reflect information provided by the Tax Department.

Total Estimated Average Annual

Tax Relief - Biennium Tax Relief per Return

Tax Bracket Residents Nonresidents Total Residents Nonresidents

First $91,040,000 $0 $91,040,000 $198 $0

Second 105,160,000 0 105,160,000 $415 $0

Third 18,870,000 0 18,870,000 $419 $0

Fourth 8,470,000 0 8,470,000 $417 $0

Fifth 5,170,000 0 5,170,000 $418 $0

Total $228,710,000 $0 $228,710,000

RESIDENT AND NONRESIDENT INCOME TAX RETURNS AND LIABILITY

The schedule below provides information on the estimated tax liability and tax returns for the 2023-25 biennium

based on residents and nonresidents. The total estimated tax liability reflects the executive budget forecast with

adjustments for the automation income tax credit and income tax relief proposal.

Estimated Number of Tax Returns - Biennium Estimated Tax Liability - Biennium

Tax Bracket Residents Nonresidents Total Residents Nonresidents Total

First 221,000 58,000 279,000 $116,330,000 $9,210,000 $125,540,000

Second 95,000 29,000 124,000 297,150,000 24,190,000 321,340,000

Third 17,000 10,000 27,000 126,690,000 17,280,000 143,970,000

Fourth 7,000 7,000 14,000 107,110,000 19,580,000 126,690,000

Fifth 4,000 10,000 14,000 322,490,000 111,720,000 434,210,000

Total 344,000 114,000 458,000 $969,770,000 $181,980,000 $1,151,750,000

23.9450.02000

INCOME TAX BRACKETS

The schedule below provides information on the estimated income brackets for the 2023-25 biennium based on

information provided by the Tax Department.

Annual Taxable Income Over

Single Married Filing Married Filing Head of Qualifying

Tax Tax Rate Filer Jointly Separately Household Widow(er)

Bracket (Current Law) Return Return Return Return Return

First 1.10% $0 $0 $0 $0 $0

Second 2.04% $44,725 $74,750 $37,375 $59,950 $74,750

Third 2.27% $108,325 $180,550 $90,275 $154,750 $180,550

Fourth 2.64% $225,975 $275,100 $137,550 $250,550 $275,100

Fifth 2.90% $491,350 $491,350 $245,675 $491,350 $491,350

North Dakota Legislative Council 2 January 2023

You might also like

- Richardson Repair Services Inc. - Financial WorksheetDocument7 pagesRichardson Repair Services Inc. - Financial WorksheetAli kamakuraNo ratings yet

- 2023-Quiz (Income From Salary)Document7 pages2023-Quiz (Income From Salary)SunnyNo ratings yet

- AACT 2173 FM Lesson 4 Tutorial (Additional)Document11 pagesAACT 2173 FM Lesson 4 Tutorial (Additional)Ashvin Kaur100% (1)

- Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLibDocument1 pageMatheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLibVarun Sharma0% (1)

- Merger Analysis COMPUTER CONCEPTS/COMPUTECHDocument24 pagesMerger Analysis COMPUTER CONCEPTS/COMPUTECHJerry K Floater0% (2)

- Assessment 4 Tax 1Document3 pagesAssessment 4 Tax 1Judy Ann Gaceta0% (1)

- Mayes 8e CH05 SolutionsDocument36 pagesMayes 8e CH05 SolutionsRamez AhmedNo ratings yet

- 39.1 SolutionDocument5 pages39.1 SolutionJeanelle ColaireNo ratings yet

- CFIUS LetterDocument1 pageCFIUS LetterJeremy TurleyNo ratings yet

- Council Requested Budget Adjustment AdditionsDocument58 pagesCouncil Requested Budget Adjustment AdditionsDarren KrauseNo ratings yet

- Week 3 SolutionDocument5 pagesWeek 3 SolutionI190006 Taimoor JanNo ratings yet

- Assignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Document8 pagesAssignment 2: Tracy Van Rensburg STUDENT NUMBER 59548525Chris NdlovuNo ratings yet

- A Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified PersonsDocument26 pagesA Revenue Guide To Professional Services Withholding Tax (PSWT) For Accountable Persons and Specified Personstere1330No ratings yet

- Montefiore Health System Q3 2018 FinancialsDocument48 pagesMontefiore Health System Q3 2018 FinancialsJonathan LaMantiaNo ratings yet

- Government Regulation 24/2012Document14 pagesGovernment Regulation 24/2012Adria SaputeroNo ratings yet

- IT-AE-41-G01 - Completion Guide For IRP3a and IRP3s Form - External GuideDocument26 pagesIT-AE-41-G01 - Completion Guide For IRP3a and IRP3s Form - External GuideKriben Rao100% (1)

- 2019 ATAF Online Course On Introduction To Tax Audit-Written ExamDocument4 pages2019 ATAF Online Course On Introduction To Tax Audit-Written ExamWilson Costa0% (1)

- Mashin TaxDocument6 pagesMashin TaxSharavkhorol ErdenebayarNo ratings yet

- Assignment-Code 438Document5 pagesAssignment-Code 438Alice JasperNo ratings yet

- Tax Cuts and Jobs Act - Full TextDocument429 pagesTax Cuts and Jobs Act - Full TextWJ Editorial Staff0% (1)

- ch09Document26 pagesch09Mudit Kapoor100% (1)

- IAF-MD1-2018 Certification of Multiple SitesDocument19 pagesIAF-MD1-2018 Certification of Multiple Siteswi2d_arie100% (1)

- Hungry SoulsDocument2 pagesHungry SoulsHeidi100% (2)

- FS5188-DurablePOA ForSecurtiesDocument3 pagesFS5188-DurablePOA ForSecurtiestafilli54100% (2)

- Full Accounting Questions and AnswersDocument7 pagesFull Accounting Questions and Answersdiane dildine100% (2)

- First EngrossmentDocument6 pagesFirst EngrossmentJeremy TurleyNo ratings yet

- F6zwe 2016 Jun Q PDFDocument11 pagesF6zwe 2016 Jun Q PDFGamuchirai KarisinjeNo ratings yet

- Principles of Taxation 2019 ICAS IMPDocument803 pagesPrinciples of Taxation 2019 ICAS IMPVeronica BaileyNo ratings yet

- t10 2010 Jun QDocument10 pagest10 2010 Jun QAjay TakiarNo ratings yet

- Mac006 A T2 2021 FexDocument7 pagesMac006 A T2 2021 FexHaris MalikNo ratings yet

- 2016 CommentaryDocument41 pages2016 Commentaryduong duongNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- Payroll Template Single Employee - Segun Akiode - 2022Document1 pagePayroll Template Single Employee - Segun Akiode - 2022Eben-Haezer100% (1)

- BTCK HDNSDTDocument14 pagesBTCK HDNSDTMy Linh HuynhNo ratings yet

- Tutorial 9 - PIT1-Summer 2023-Sample AnswerDocument4 pagesTutorial 9 - PIT1-Summer 2023-Sample Answerkien tran100% (1)

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFutkarsh varshneyNo ratings yet

- Revenue Report January 2022Document8 pagesRevenue Report January 2022Russ LatinoNo ratings yet

- VAT Training Day 3Document31 pagesVAT Training Day 3iftekharul alamNo ratings yet

- Saito Solar Case - ValuationDocument3 pagesSaito Solar Case - Valuationsebastien.parmentierNo ratings yet

- Assignment # 2 - Chapter 3 - March 2023Document2 pagesAssignment # 2 - Chapter 3 - March 2023GIAN ALEXANDER CARTAGENA100% (1)

- Boa Financials For q3 30 Sept. 2021Document1 pageBoa Financials For q3 30 Sept. 2021Fuaad DodooNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- 1702 July 08Document7 pages1702 July 08Jchelle Lustre DeligeroNo ratings yet

- HI5020Document13 pagesHI5020takeshiru000No ratings yet

- AC2101 SemGrp4 Team6Document34 pagesAC2101 SemGrp4 Team6Kwang Yi JuinNo ratings yet

- TRA Taxes at Glance - 2016-17Document22 pagesTRA Taxes at Glance - 2016-17Timothy Rogatus67% (3)

- 2014 CommentaryDocument46 pages2014 Commentaryduong duongNo ratings yet

- NPS Calculator Free Download ExcelDocument7 pagesNPS Calculator Free Download Excelsambhavjoshi100% (1)

- Stonecrest 2022 BudgetDocument29 pagesStonecrest 2022 BudgetZachary HansenNo ratings yet

- Kirk Fulford - AASB PresentationDocument33 pagesKirk Fulford - AASB PresentationTrisha Powell CrainNo ratings yet

- Gar 29Document2 pagesGar 29smvpdy0% (1)

- Baniya Kirana Stores F.Y. 2074-75 TaxDocument17 pagesBaniya Kirana Stores F.Y. 2074-75 TaxasasasNo ratings yet

- Jawaban C ArthaDocument2 pagesJawaban C ArthaArtha HutapeaNo ratings yet

- Calculation of Total Tax Incidence (TTI) For ImportDocument4 pagesCalculation of Total Tax Incidence (TTI) For ImportMd. Mehedi Hasan AnikNo ratings yet

- FY24 Proposed Budget 091523Document207 pagesFY24 Proposed Budget 091523WXMINo ratings yet

- Test 3 - Chap 24Document7 pagesTest 3 - Chap 24Bhushan Sawant100% (1)

- Week 6 Tutorial SolutionsDocument13 pagesWeek 6 Tutorial SolutionsFarah PatelNo ratings yet

- Adm Guidelines Cov 19 LevyDocument12 pagesAdm Guidelines Cov 19 LevyFuaad DodooNo ratings yet

- Making Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime GiftsDocument36 pagesMaking Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime Giftsrobertkolasa100% (1)

- ACCO 420 Final F2020 Version 2Document4 pagesACCO 420 Final F2020 Version 2Wasif SethNo ratings yet

- If Answer Is Zero, Please Enter 0. Do Not Leave Any Fields Blank.Document1 pageIf Answer Is Zero, Please Enter 0. Do Not Leave Any Fields Blank.acurashahNo ratings yet

- ACCT 4342-F13 Final AIS Project Spreadsheet (Printable 2)Document30 pagesACCT 4342-F13 Final AIS Project Spreadsheet (Printable 2)chrismg89No ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Hamden Audit FY20Document131 pagesHamden Audit FY20Helen BennettNo ratings yet

- Appendix D Accounting For Deferred Income TaxesDocument2 pagesAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNo ratings yet

- Diestas CompanyDocument24 pagesDiestas CompanyCpa ThesisNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- HB 1141Document1 pageHB 1141Jeremy TurleyNo ratings yet

- Senate Bill 2231 Veto MessageDocument2 pagesSenate Bill 2231 Veto MessageJeremy TurleyNo ratings yet

- Sisseton Wahpeton OyateDocument3 pagesSisseton Wahpeton OyateJeremy TurleyNo ratings yet

- Prichard BillDocument4 pagesPrichard BillJeremy TurleyNo ratings yet

- SupCo Abortion DecisionDocument1 pageSupCo Abortion DecisionJeremy TurleyNo ratings yet

- HB 1460Document4 pagesHB 1460Jeremy TurleyNo ratings yet

- HB1536Document14 pagesHB1536Jeremy TurleyNo ratings yet

- HB 1379Document12 pagesHB 1379Jeremy TurleyNo ratings yet

- House Bill No. 1311Document2 pagesHouse Bill No. 1311Jeremy TurleyNo ratings yet

- VandeWalle Retirement LetterDocument1 pageVandeWalle Retirement LetterJeremy TurleyNo ratings yet

- HB 1135Document3 pagesHB 1135Jeremy TurleyNo ratings yet

- SCR 4001Document3 pagesSCR 4001Jeremy TurleyNo ratings yet

- HB1155Document1 pageHB1155Jeremy TurleyNo ratings yet

- General Atomics Email ChainDocument11 pagesGeneral Atomics Email ChainJeremy TurleyNo ratings yet

- Draft ReleaseDocument3 pagesDraft ReleaseJeremy TurleyNo ratings yet

- ND Election SystemDocument7 pagesND Election SystemJeremy TurleyNo ratings yet

- Sales Tax ExemptionsDocument7 pagesSales Tax ExemptionsJeremy TurleyNo ratings yet

- Investigative Report of The Office of The Attorney GeneralDocument45 pagesInvestigative Report of The Office of The Attorney GeneralJeremy TurleyNo ratings yet

- Becker Tax ProposalDocument1 pageBecker Tax ProposalJeremy TurleyNo ratings yet

- Red Tape Public SubmissionsDocument21 pagesRed Tape Public SubmissionsJeremy TurleyNo ratings yet

- Romanick FindingsDocument11 pagesRomanick FindingsJeremy TurleyNo ratings yet

- Doh AuditDocument38 pagesDoh AuditJeremy TurleyNo ratings yet

- Investigative Report of The Office of The Attorney GeneralDocument45 pagesInvestigative Report of The Office of The Attorney GeneralJeremy TurleyNo ratings yet

- Proposed CRT RulesDocument1 pageProposed CRT RulesJeremy TurleyNo ratings yet

- Brief AbortionDocument5 pagesBrief AbortionJeremy TurleyNo ratings yet

- Pot ReportDocument11 pagesPot ReportJeremy TurleyNo ratings yet

- Romanick OrderDocument8 pagesRomanick OrderJeremy TurleyNo ratings yet

- Supco RulingDocument13 pagesSupco RulingJeremy TurleyNo ratings yet

- 2021 Crime ReportDocument175 pages2021 Crime ReportJeremy TurleyNo ratings yet

- ALFARUUQDocument226 pagesALFARUUQabdicasis rashid0% (1)

- Aristotle PDFDocument6 pagesAristotle PDFAnonymous p5jZCn100% (1)

- Scra Series 1 CamsurDocument263 pagesScra Series 1 CamsurAlexis RancesNo ratings yet

- Tendernotice 1Document223 pagesTendernotice 1kaushalkumar085No ratings yet

- Amberti v. CADocument6 pagesAmberti v. CAPatNo ratings yet

- Examination On International Money MarketsDocument5 pagesExamination On International Money MarketsRandy ManzanoNo ratings yet

- Allied Lomar v. Lone Star Distillery - Cowboy Bourbon Trademark Complaint PDFDocument24 pagesAllied Lomar v. Lone Star Distillery - Cowboy Bourbon Trademark Complaint PDFMark JaffeNo ratings yet

- Lao Gi V CA ESCRA Full Text CaseDocument11 pagesLao Gi V CA ESCRA Full Text CaseYaz CarlomanNo ratings yet

- Aznar Vs ComelecDocument3 pagesAznar Vs ComelecBeboyNo ratings yet

- Brochure of Abhiruchi ParisarDocument11 pagesBrochure of Abhiruchi ParisarbhatepoonamNo ratings yet

- Jackson 1.4 Homework Problem SolutionDocument4 pagesJackson 1.4 Homework Problem SolutionJhonNo ratings yet

- Chapter 9 Review QuestionsDocument8 pagesChapter 9 Review QuestionsKanika DahiyaNo ratings yet

- Carbonilla Vs AbieraDocument2 pagesCarbonilla Vs AbieraRegine Yu100% (1)

- 8 Ad-Art YayasanDocument13 pages8 Ad-Art YayasanBambang SulisNo ratings yet

- 3 Statement Model Alphabet GoogleDocument8 pages3 Statement Model Alphabet GoogleSimran GargNo ratings yet

- Q1. Patson Corp: Journal EntriesDocument2 pagesQ1. Patson Corp: Journal EntriesPrince-SimonJohnMwanzaNo ratings yet

- Gr1-2 Make The ClockDocument2 pagesGr1-2 Make The ClockThérèse NgoundeNo ratings yet

- Astm A794-97Document3 pagesAstm A794-97FeteneNo ratings yet

- Company Law Final Examination - September 2021Document4 pagesCompany Law Final Examination - September 2021TemwaniNo ratings yet

- Notice Min Agenda PPT .PPSXDocument13 pagesNotice Min Agenda PPT .PPSXakankshaNo ratings yet

- BCS English Preparation Fill in The Appropriate Preposition PDFDocument7 pagesBCS English Preparation Fill in The Appropriate Preposition PDFTabassum MeemNo ratings yet

- Ballarpur Industries LTD.: Paper Industry OverviewDocument3 pagesBallarpur Industries LTD.: Paper Industry OverviewMadhukar ShyamNo ratings yet

- REALDocument17 pagesREALRoger ThatooNo ratings yet

- Khushwant Singh (Born Khushal Singh, 15 August 1915Document5 pagesKhushwant Singh (Born Khushal Singh, 15 August 1915LipikaNo ratings yet