Professional Documents

Culture Documents

Accounting Taxation

Accounting Taxation

Uploaded by

Aia Sophia Sindac0 ratings0% found this document useful (0 votes)

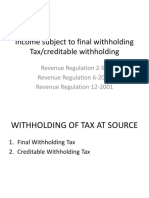

18 views2 pagesFinal income taxation refers to taxes that are withheld at the source of income payment. The taxpayer receives income after tax has been deducted, and the payer remits the tax directly to the government. Passive income includes interest, royalties, prizes, and other winnings that are subject to final tax rates ranging from 10-20%, as well as cash and property dividends taxed at 10%.

Original Description:

TAXATION

Original Title

ACCOUNTING TAXATION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinal income taxation refers to taxes that are withheld at the source of income payment. The taxpayer receives income after tax has been deducted, and the payer remits the tax directly to the government. Passive income includes interest, royalties, prizes, and other winnings that are subject to final tax rates ranging from 10-20%, as well as cash and property dividends taxed at 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views2 pagesAccounting Taxation

Accounting Taxation

Uploaded by

Aia Sophia SindacFinal income taxation refers to taxes that are withheld at the source of income payment. The taxpayer receives income after tax has been deducted, and the payer remits the tax directly to the government. Passive income includes interest, royalties, prizes, and other winnings that are subject to final tax rates ranging from 10-20%, as well as cash and property dividends taxed at 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

From the National Internal Revenue Code of 1997, as amended, answer

the following:

1) What is final income taxation?

Final income taxation is characterized by final taxes were taxes are

withheld or deducted at source. The taxpayer receives Income net of

tax. The payer of the income remits the tax to the government. Final

taxation is applicable to certain passive income. Not all passive

income is subject to final tax.

2) What is passive income?

People who support passive income generation frequently support

professional lifestyles where you may work from home and are your own

boss. The phrase "passive income" has been bandied about a lot lately.

Informally, it has come to mean money that is consistently obtained

with little to no work on the recipient's part.

3) Enumerate the passive income subject to final tax and their

corresponding tax rates?

PASSIVE INCOME SUBJECT TO FINAL TAX

Interests, Royalties, Prizes, and Other Winnings. – A final tax at the

rate of twenty percent (20%) is hereby imposed upon the amount of

interest from any currency bank deposit and yield or any other

monetary benefit from deposit substitutes and from trust funds and

similar arrangements; royalties, except on books, as well as other

literary works and musical compositions, which shall be imposed a

final tax of ten percent (10%); prizes (except prizes amounting to Ten

thousand pesos (P10,000) or less which shall be subject to tax under

Subsection (A) of Section 24; and other winnings (except winning

amounting to Ten thousand pesos (P10,000) or less [13] from Philippine

Charity Sweepstakes and Lotto which shall be exempt [13]), derived

from sources within the Philippines: Provided, however, That interest

income received by an individual taxpayer (except a nonresident

individual) from a depository bank under the expanded foreign currency

deposit system shall be subject to a final income tax at the rate of

fifteen percent (15%) [14] of such interest income [4]: Provided,

further, That interest income from long-term deposit or investment in

the form of savings, common or individual trust funds, deposit

substitutes, investment management accounts and other investments

evidenced by certificates in such form prescribed by the Bangko

Sentral ng Pilipinas (BSP) shall be exempt from the tax imposed under

this Subsection: Provided, finally, That should the holder of the

certificate pre-terminate the deposit or investment before the fifth

(5th) year, a final tax shall be imposed on the entire income and

shall be deducted and withheld by the depository bank from the

proceeds of the long-term deposit or investment certificate based on

the remaining maturity thereof:

Four (4) years to less than five (5) years - 5%;

Three (3) years to less than (4) years - 12%; and

Less than three (3) years - 20%

Cash and/or Property Dividends. - A final tax at the rate of ten

percent (10%) [15] shall be imposed upon the cash and/or property

dividends actually or constructively received by an individual from a

domestic corporation or from a joint stock company, insurance or

mutual fund companies and regional operating headquarters of

multinational companies, or on the share of an individual in the

distributable net income after tax of a partnership (except a general

professional partnership) of which he is a partner, or on the share of

an individual in the net income after tax of an association, a joint

account, or a joint venture or consortium taxable as a corporation of

which he is a member or co-venture:

You might also like

- Medical Insurance ParentsDocument1 pageMedical Insurance Parentsraghuveer9303No ratings yet

- Revenue Regulation 2-98Document52 pagesRevenue Regulation 2-98Jeanne Pabellena Dayawon100% (1)

- RR 2-98Document85 pagesRR 2-98Elaine LatonioNo ratings yet

- BIR Revenue Regulation No. 02-98 Dated 17 April 1998Document74 pagesBIR Revenue Regulation No. 02-98 Dated 17 April 1998wally_wanda93% (14)

- Rev Reg NO. 02-98Document35 pagesRev Reg NO. 02-98Bon BonsNo ratings yet

- RR 2-98Document74 pagesRR 2-98Richard CaneteNo ratings yet

- Revenue Regulations No 2-98Document70 pagesRevenue Regulations No 2-98azzy_km100% (1)

- RR 2-98Document41 pagesRR 2-98matinikki100% (2)

- Revenue Regulations 2-1998Document44 pagesRevenue Regulations 2-1998Jaypee LegaspiNo ratings yet

- Tax Law ReviewDocument8 pagesTax Law ReviewIon FashNo ratings yet

- Income Tax Part IIIDocument6 pagesIncome Tax Part IIImary jhoyNo ratings yet

- RR No. 11-2018 SummaryDocument6 pagesRR No. 11-2018 SummaryCaliNo ratings yet

- Chapter 5 - Final Income TaxationDocument13 pagesChapter 5 - Final Income TaxationBisag AsaNo ratings yet

- Lecture Notes - Atty Steve Part 1Document9 pagesLecture Notes - Atty Steve Part 1Tesia MandaloNo ratings yet

- Kind of Income Tax RateDocument2 pagesKind of Income Tax RateTJ MerinNo ratings yet

- BIR Revenue Regulations No. 2-98Document93 pagesBIR Revenue Regulations No. 2-98Maan Espinosa100% (2)

- Tax Codal ReviewerDocument37 pagesTax Codal ReviewerPaulo BurroNo ratings yet

- Revenue Etc For Income TaxationDocument286 pagesRevenue Etc For Income TaxationpurplebasketNo ratings yet

- TaxLawRev1 UpdatedDocument277 pagesTaxLawRev1 UpdatedKaira TanhuecoNo ratings yet

- AS ReviewerDocument2 pagesAS ReviewerPem AndoyNo ratings yet

- NIRC Sec. 23 - 26Document5 pagesNIRC Sec. 23 - 26Loren MandaNo ratings yet

- Income TaxationDocument32 pagesIncome TaxationkarlNo ratings yet

- Passive IncomeDocument5 pagesPassive IncomeRandom VidsNo ratings yet

- Withholding Tax Bir Issuances & ProvisionsDocument22 pagesWithholding Tax Bir Issuances & ProvisionsJm CruzNo ratings yet

- RR 2-98 - Implementing Republic Act No. 8424Document41 pagesRR 2-98 - Implementing Republic Act No. 8424Vince Lupango (imistervince)No ratings yet

- Chapter 2.1 - Income Subject To Final TaxDocument30 pagesChapter 2.1 - Income Subject To Final Taxjudel ArielNo ratings yet

- UntitledDocument127 pagesUntitledemielyn lafortezaNo ratings yet

- Taxation CH 5Document6 pagesTaxation CH 5Kristel Nuyda LobasNo ratings yet

- Categories of Income and Tax RatesDocument5 pagesCategories of Income and Tax RatesRonel CacheroNo ratings yet

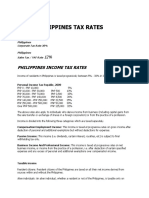

- Philippines Tax RatesDocument7 pagesPhilippines Tax RatesRonel CacheroNo ratings yet

- RR 02-98Document60 pagesRR 02-98Michelle Ann OrendainNo ratings yet

- Digest RR 11-2018Document38 pagesDigest RR 11-2018Mo MuNo ratings yet

- Tax For Rental Income in The PhilippinesDocument3 pagesTax For Rental Income in The PhilippinesRESIE GALANGNo ratings yet

- Chapter 5 Final Income TaxDocument51 pagesChapter 5 Final Income Taxdeleonrzlyn20No ratings yet

- Philippine Corporate TaxDocument3 pagesPhilippine Corporate TaxRaymond FaeldoñaNo ratings yet

- Items of Gross Income: Mutually Exclusive CoverageDocument23 pagesItems of Gross Income: Mutually Exclusive CoverageW-304-Bautista,PreciousNo ratings yet

- Final Income Taxation: Lesson 5Document28 pagesFinal Income Taxation: Lesson 5lc50% (4)

- Revenue Regs 10-98Document4 pagesRevenue Regs 10-98John Michael VidaNo ratings yet

- RR 11-18Document55 pagesRR 11-18Cuayo JuicoNo ratings yet

- Rev Reg 2-98Document86 pagesRev Reg 2-98Anonymous ghNvoT2No ratings yet

- Section 5. Section 25 of The National Internal Revenue Code of 1997, AsDocument5 pagesSection 5. Section 25 of The National Internal Revenue Code of 1997, AsthebeautyinsideNo ratings yet

- Chapter Ii - General P RinciplesDocument19 pagesChapter Ii - General P RincipleskkkNo ratings yet

- Canvas Activity 2Document10 pagesCanvas Activity 2Micol VillaflorNo ratings yet

- Summary of You Tube VideoDocument2 pagesSummary of You Tube VideoErylle Jeen VivasNo ratings yet

- Tax On IndividualsDocument9 pagesTax On IndividualsshakiraNo ratings yet

- Axsdaqgasdgasdg 123123 Aeasdfw SadgDocument6 pagesAxsdaqgasdgasdg 123123 Aeasdfw SadgMark LimNo ratings yet

- CHAPTER 6 Final Income Taxation (Module)Document14 pagesCHAPTER 6 Final Income Taxation (Module)Shane Mark CabiasaNo ratings yet

- Lecture-Corporate-Income-Tax 2Document5 pagesLecture-Corporate-Income-Tax 2Ragelli Mae NatalarayNo ratings yet

- Domestic Corporations Not Subject To MCITDocument3 pagesDomestic Corporations Not Subject To MCITMeghan Kaye LiwenNo ratings yet

- Chapter Iii - Tax On Individuals SEC. 24. Income Tax RatesDocument4 pagesChapter Iii - Tax On Individuals SEC. 24. Income Tax RatesangelaggabaoNo ratings yet

- Philippines Income Tax RatesDocument6 pagesPhilippines Income Tax RatesKristina AngelieNo ratings yet

- Tax On CorporationsDocument4 pagesTax On Corporationsdenise airaNo ratings yet

- Taxation Reviewer 1Document110 pagesTaxation Reviewer 1bigbully23No ratings yet

- Nirc As Amended by TrainDocument16 pagesNirc As Amended by TrainKDANo ratings yet

- Gross IncomeDocument32 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- KV Jaipur 10 SQP 2023-24Document121 pagesKV Jaipur 10 SQP 2023-24Sandesh kumar SharmaNo ratings yet

- Joseph Monks - Operations Management - Theory and Problems (1987, McGraw-Hill Education) - Libgen - LiDocument744 pagesJoseph Monks - Operations Management - Theory and Problems (1987, McGraw-Hill Education) - Libgen - LiGantavya GulatiNo ratings yet

- Cost Allocation: Learning ObjectivesDocument5 pagesCost Allocation: Learning ObjectivesHardy PutraNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial Positionbobo tangaNo ratings yet

- Presentation On BataDocument11 pagesPresentation On BataRana WaqarNo ratings yet

- Principles of Marketing 2022 Question PaperDocument2 pagesPrinciples of Marketing 2022 Question PaperJibangkur BaishyaNo ratings yet

- FS CW2Document20 pagesFS CW2Ishmael FofanahNo ratings yet

- Hoover Digest, 2022, No. 4, FallDocument224 pagesHoover Digest, 2022, No. 4, FallHoover InstitutionNo ratings yet

- Cost Reduction Strategies and Performance of Supermarket Stores in Port Harcourt February, 2019Document66 pagesCost Reduction Strategies and Performance of Supermarket Stores in Port Harcourt February, 2019ruthNo ratings yet

- Topic 5 - Intangible Asset (Bai Tap - For Student)Document12 pagesTopic 5 - Intangible Asset (Bai Tap - For Student)Tuan Huy Cao pcp100% (2)

- Individual Assignment 2 (Marks 10) Due Date: Saturday 8 April 2023: 11:30 PMDocument1 pageIndividual Assignment 2 (Marks 10) Due Date: Saturday 8 April 2023: 11:30 PMThanisshkaNo ratings yet

- 6202.0 Labour Force, Australia Table 8. Labour Force Status by Sex, Western Australia - Trend, Seasonally Adjusted and OriginalDocument156 pages6202.0 Labour Force, Australia Table 8. Labour Force Status by Sex, Western Australia - Trend, Seasonally Adjusted and OriginalEhizNo ratings yet

- Notes On The Economics of Enterprise and EntrepreneurshipDocument2 pagesNotes On The Economics of Enterprise and EntrepreneurshipManu KrishNo ratings yet

- Strategic Human Resource Mgmt. CH 1 Pulak DasDocument15 pagesStrategic Human Resource Mgmt. CH 1 Pulak DasPareen Joshi100% (2)

- In The Name of Allah The Merciful Holding A Commercial Partnership at Maandeeq Poultry FarmDocument3 pagesIn The Name of Allah The Merciful Holding A Commercial Partnership at Maandeeq Poultry FarmWandaNo ratings yet

- CFAS - Asynchronus ActivityDocument10 pagesCFAS - Asynchronus ActivityAira Santos VibarNo ratings yet

- Case Study On Mukesh Ambani Vs Anil AmbaniDocument4 pagesCase Study On Mukesh Ambani Vs Anil AmbaniRahat SignsUpNo ratings yet

- Risk and Return (Part I)Document16 pagesRisk and Return (Part I)mimiNo ratings yet

- Shriram Group PresentationDocument36 pagesShriram Group Presentationchoudharyankush731No ratings yet

- Taco 0067596020700018Document1 pageTaco 0067596020700018Meera CompanyNo ratings yet

- Green Economy EssayDocument2 pagesGreen Economy EssayDilesh VeeramahNo ratings yet

- Contract To SellDocument1 pageContract To Selljamaica deangNo ratings yet

- CPCCOM1013 PresentationDocument58 pagesCPCCOM1013 PresentationSana DuraniNo ratings yet

- Outline of Indian Labour MarketDocument11 pagesOutline of Indian Labour MarketAnurag JayswalNo ratings yet

- Timeline (History of Entrepreneurship)Document6 pagesTimeline (History of Entrepreneurship)Karen DaloraNo ratings yet

- How Economics Affects Business: The Creation and Distribution of WealthDocument37 pagesHow Economics Affects Business: The Creation and Distribution of WealthRio DanovanNo ratings yet

- 4 - Case Study - The IMF and Ukraine's Economic CrisisDocument2 pages4 - Case Study - The IMF and Ukraine's Economic CrisisAhmerNo ratings yet

- Ottoman EmpireDocument2 pagesOttoman EmpireEzekiel WangNo ratings yet

- BMO Tax Documents 2023-02-15 15-27-03Document2 pagesBMO Tax Documents 2023-02-15 15-27-03elenaNo ratings yet