Professional Documents

Culture Documents

Uganda Tax Amendments 2022-23

Uganda Tax Amendments 2022-23

Uploaded by

Nelson KizangiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Uganda Tax Amendments 2022-23

Uganda Tax Amendments 2022-23

Uploaded by

Nelson KizangiCopyright:

Available Formats

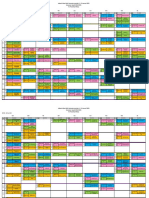

Tax Amendments

FY2022-23

TAX AMENDMENTS BOOKLET 2022/23 1

Tax ammendments 2022/23.indd 1 17/06/2022 17:12

22 TAXAMENDMENT

TAX AMENDMENTS BOOKLET

BOOKLET 2022/23

2021/22

Tax ammendments 2022/23.indd 2 17/06/2022 17:12

Commissioner

General’s Message

Key among the amendments is improving

taxpayer compliance on Value Added Tax

(VAT) remittance and rental income tax

remittance. There is also clarification on the

treatment of income from transportation

embarked outside Uganda.

To ease the administration of tax issues

for both URA and the taxpayers, there is

an increase in the number of members on

the Tax Appeals Tribunal (TAT) which we

expect will enhance the efficient and fair

dispensation of tax appeals.

We also expect that the clarification on the

adoption of the use of the tax stamps and

electronic receipts or invoices will create

a levelled ground for all players in the

Dear Taxpayers,

economy as we jointly mobilise revenue to

develop our country.

Uganda Revenue Authority is pleased to

present to you a booklet on Tax amendments

We acknowledge the tough economic

for the FY 2022-23 containing amendments

times in Uganda and beyond the country

made in several tax laws.

which has affected many individuals,

businesses and the government through

In line with the budget theme of ‘Full

unprecedented inflation driven by post-

Monetisation of Uganda’s Economy through

COVID-19 shocks and global conflicts.

Commercial Agriculture, Industrialisation,

We hope the amendments shall bolster

Expanding and Broadening Services, Digital

our country’s capacity to overcome these

Transformation and Market Access’, these

adverse economic blows.

changes are geared towards reinforcing

Government’s commitment to import

I urge you to remain patriotic, acquaint

substitution, boosting local production,

yourself with these amendments, benefit

creation of employment, supporting

from them and where need be, reach out to

local and foreign investment, easing the

all our offices countrywide for any additional

burden of tax compliance and encouraging

support you may require. I wish you a

compliance.

successful Financial Year 2022/23.

The amendments particularly seek to enable

Developing Uganda Together

Uganda to grow its domestic tax revenue

mobilization capabilities to see it financing

a greater part of the National Budget to

John R. Musinguzi

ultimately liberate Uganda from donor

Commissioner General, URA

dependency.

TAX AMENDMENTS BOOKLET 2022/23 3

Tax ammendments 2022/23.indd 3 17/06/2022 17:12

4 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 4 17/06/2022 17:12

DOMESTIC TAX AMENDMENTS FY2022-23

INCOME TAX ACT AMENDMENTS

No AMENDMENT JUSTIFICATION

1. Reviewed the definition of Beneficial Ownership: As Uganda prepares

Beneficial ownership was first defined in 2019. The to participate in the

revised definition seeks to: Automatic Exchange of

(i) Replace the “final ownership” and “absolute Information arrangement

control” tests with the ultimate control or with other countries,

ownership test; this amendment seeks

(ii) Eliminate the error in the current provision to align with the OECD

by separating the definition of a Beneficial requirements. Other

Owner from the methodology of identifying countries have adopted

beneficial owners. This lack of clarity between the the same criteria to

definition and methodology renders the definition guide the exchange of

redundant and not aligned to the Financial Action information for tax and

Task Force (FATF) and OECD Standards which non-tax purposes. This

Uganda is required to align; provides a framework

(iii) Clarify the methodology for identification of for collecting and

Beneficial Owners for legal entities. Much as the exchanging information

current wording puts in place a methodology for that is consistent

trusts and similar arrangements, it completely with internationally

stays silent on the identification of Beneficial agreed policy and legal

owners for legal entities and partnerships; frameworks.

(iv) Provide for a group of beneficiaries who are

not individually identified in the trust deed e.g.

where the beneficiaries are identified as the sons

of, the grandchildren, etc.

2. Amend the definition of an exempt organization The purpose is to extend

to include a research institution whose object is the exempt organization

not for profit. status to research

institutions whose object

is not profit.

3. Amendment of the Rental Income Tax Regime to This approach has

the effect that: been found effective in

INDIVIDUALS countries like Kenya for

ANNUAL GROSS RENTAL INCOME TAX RATE residential rental owners

earning below Kshs 15

Below UGX 2,820,000 (UGX Nil million annually.

235,000 per month)

The goal of this

Above UGX 2,820,000 (UGX 12% amendment was to:

235,000 per month) – no • Create a simplified

deductions rental tax regime for

individual taxpayers

COMPANIES who generally do not

• Companies earning rental income will claim keep records;

expenditures and losses up to 50% of their

TAX AMENDMENTS BOOKLET 2022/23 5

Tax ammendments 2022/23.indd 5 17/06/2022 17:12

No AMENDMENT JUSTIFICATION

gross rental income and without carrying • Increase the

forward any excess expenditures and losses; productivity of the

• Company rental income to be taxed at a flat tax among non-

rate of 30%. individual rental

taxpayers.

4. Extending Bujagali Hydro Power Project Parliament allowed a

exemption by one year. The Bujagali Hydro Power one-year extension to

Project 5-year income tax exemption that was June 2023 pending a

given in 2017 was due to end in June 2022. cost/benefit analysis

of the exemption. The

exemption seeks to

reduce the average

electricity tariff of the

Bujagali Hydro Power

Project

5. Exempt income earned from transport not Good practice

embarked in Uganda: international tax policy

To clarify that income from the transport of practice guides that

passengers or goods or mail embarked outside international transport

Uganda is not income derived from a Ugandan- for cargo and goods is

source service contract, and therefore exempt. taxed in the country of

residence of the foreign

transporter. However, in

Uganda, such income

may be taxed under

Section 85(1) and (2).

In addition, such a

tax renders Uganda’s

economy uncompetitive

since the cost of all

imports would increase

by 15% as the transporters

pass the cost of the tax to

importers.

6. Supremacy of Income Tax Act (ITA) over the Tax To clarify the tax law and

Procedures Code Act (TPCA) on the penalties deter non-compliance

for petroleum and mining licensees who do not

file returns. There was ambiguity on whether to

apply the TPCA or ITA penalty for licensees in the

petroleum and mining sectors.

7. Amended the First Schedule of the Income Tax IDLO supports

Act (Exempt entities) Government bodies with

Added: International Development Law legal advice without

Organisation (IDLO) to the First Schedule. charge.

6 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 6 17/06/2022 17:12

No AMENDMENT JUSTIFICATION

Replaced: Department for International DFID is now known as

Development (DFID) WITH Foreign, FCDO

Commonwealth and Development Office

(FCDO).

VALUE ADDED TAX (AMENDMENT) ACT, 2022

No AMENDMENT JUSTIFICATION

1 Amended the definition of an exempt To correct an error in drafting

imported service: the revised definition made in the tax amendments for

states the principle that was passed by 2021.

Parliament last financial year by clarifying To ensure fair treatment as the

the scope of the exemption on imported old wording exempted VAT on

services. The clarification eliminates services when imported which

the unintended beneficiaries from the would be standard rated when

exemption e.g. entities making exempt supplied locally. This has been

supplies such as banks changed such that there is

equal treatment between locally

supplied and imported services.

2 Added supplies to Government to To enable suppliers to the

the Cash Basis Accounting; In this government to only account

arrangement revenue and expenses are for VAT after the government

recognized when actual payments are has paid for supplies. Previously

received or paid. Usually, VAT taxpayers the suppliers were required

are expected to report on transactions to account for such VAT even

on an accrual basis where a transaction before the government has paid

is considered to have happened on the them which affected their cash

earliest date of: flow. And where they delayed

(i) delivering the goods or service; paying the tax due to the delay

(ii) paying for the goods or services; or by the government to pay for

(iii) issuing the tax invoice. the supplies, they were forced to

This has previously only been allowed to accrue penal interest.

VAT-registered taxpayers with sales below

UGX 500 million.

3 Amending the First Schedule of the VAT IDLO supports Government

Act (Exempt entities). bodies with legal advice without

Added: International Development Law charge.

Organisation (IDLO) to the First

Schedule.

Replaced: Department for DFID is now known as FCDO

International Development (DFID)

WITH Foreign, Commonwealth and

Development Office (FCDO).

TAX AMENDMENTS BOOKLET 2022/23 7

Tax ammendments 2022/23.indd 7 17/06/2022 17:12

No AMENDMENT JUSTIFICATION

4 Removed the requirement to develop To ease and increase the usage of

a hospital to a national referral level, the incentive by investors setting

as a prerequisite for benefiting from up hospitals. The requirement for

the VAT exemption. There is an existing the hospital to be at a national

exemption on the supply of services referral level required confirmation

to conduct a feasibility study, design, from the Ministry of Health which

and construction; the supply of locally made the process of accessing

produced materials for the construction the incentive complicated.

of premises and other infrastructure,

machinery and equipment or furnishings

and fittings to a hospital facility developer.

The developer must have investment

capital of at least five million United States

Dollars and the hospital should be at the

level of a national referral hospital with the

capacity to provide specialized medical

care.

EXEMPT SUPPLIES

5 Exempt the supply of Oxygen for Medical goods and services are

medical use exempted from VAT

6 Exempt the supply of assistive devices To ensure that the supply of

for persons with disability. These assistive devices to PWDs is

assistive devices like hearing aids, orthotic affordable

devices, etc enable PWDs to conduct

activities of daily living (e.g. talking, eating,

bathing, dressing, toileting, and home

maintenance).

7 Exempt the supply of airport user To enhance Uganda’s

services charged by the Civil Aviation competitiveness in East Africa as

Authority (CAA) a tourist destination

ZERO-RATED SUPPLIES

8 Zero rate the supply of educational To fulfil the requirements of the

materials including educational materials East African Community (EAC)

manufactured in a Partner State of the

East African Community (EAC). The

VAT Act zero-rated educational materials

manufactured in Uganda, the amendment

seeks to, also zero-rate educational

materials manufactured in the EAC

8 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 8 17/06/2022 17:12

No AMENDMENT JUSTIFICATION

9 Zero-rate the supply of menstrual cups. This will make menstrual cups

The existing VAT exemption on menstrual affordable as the manufacturers

cups is repealed. Menstrual cups, just like are able to claim input VAT.

tampons are now zero-rated including the

inputs for their manufacture.

THE TAX PROCEDURES CODE ACT AMENDMENTS

No AMENDMENT JUSTIFICATION

1. Change of the effective date of expiry of all To match with customs

tax agents’ registration to 31st December every agents’ expiry window

calendar year irrespective of their registration and harmonize the

commencement date renewal timelines

2. Imposing a penal tax that is double the tax due To encourage activation

on the goods or Uganda Shillings fifty Million of tax stamps

(UGX 50,000,000) whichever is higher on any

person who fails to activate a tax stamp on locally

manufactured or imported goods.

3. Temporary closure of businesses that do not To ensure compliance

comply with the requirements of electronic with the EFRIS system

receipting and invoicing or tax stamps after and tax

receiving a URA notice of the intention to close the Stamps.

business.

4. Requirement for persons in construction or To widen the tax base by

extractive industries to disclose all contractors bringing more persons

to be used in conducting all operations within 7 into the tax bracket

days from the date of signing of the contract and

introduction of a penalty of UGX 20 million for

failure to comply.

5. Increased the penalty for making false or To encourage voluntary

misleading statements from UGX 4M UGX to UGX compliance

110M

PAYMENT OF INFORMERS

6. • Exclusion of URA staff as whistle-blowers/ To encourage voluntary

informers. compliance

• Revision of the scope of informers and

their reward to include persons who provide

information leading to;

i. identification of unassessed tax or duty and the

reward is the lesser of 1% or UGX 15M

ii. recovery of unassessed tax or duty and the

reward is the lesser of 5% or UGX 100M

TAX AMENDMENTS BOOKLET 2022/23 9

Tax ammendments 2022/23.indd 9 17/06/2022 17:12

OFFENCES RELATING TO EFRIS AND TAX STAMP

7. A fine of 1500 Currency points/imprisonment not To encourage voluntary

exceeding 10 years or both for; compliance

• Failure to fix or activate tax stamps

• Forgery of an EFRIS invoice

• Printing over or defacing tax stamps

• Interfering with an EFRIS control device

• Forgery of tax stamps

• Failure to use EFRIS

Note: Currency point = UGX 20,000

OFFENCES RELATING TO EFRIS AND TAX STAMP

8. A fine of 2,500 Currency points for each day in To encourage voluntary

default or imprisonment not exceeding ten years; compliance and support

• Failure to file an information return relating to implementation of

automatic exchange of information. the global Automatic

• Failure to maintain records for purposes of Exchange of Information

automatic exchange of information regime.

• Making a false or misleading statement in the

information return

• Omitting from a statement made in the

information return

Note: Currency point = UGX 20,000

THE TAX APPEALS TRIBUNAL ACT AMENDMENTS

No. AMENDMENT JUSTIFICATION

1. Increasing the number of The increase in the members of the TAT

the Tax Appeals Tribunal is intended to improve the efficiency and

members from four (4) to eight objectivity of the TAT.

(8) members.

STAMP DUTY ACT AMENDMENTS

No. AMENDMENT JUSTIFICATION

1 NIL stamp duty on an • To ease access to credit by reducing

AGREEMENT relating to the the cost of stamp duty.

deposit of title- deeds, pawn • As part of the 2020 COVID-19 tax

pledge – of the total value: The waivers, stamp duty on most loan

instrument AGREEMENT relating instruments like loan agreements,

to deposit of title- deeds, pawn debentures, and equitable mortgages

pledge – of the total value is was made nil. However, the stamp duty

primarily used when movable relating to the deposit of title remained

chattels like motor vehicles are at 1%. The amendment extends the

used as security in getting a loan. same treatment to this instrument

Hitherto the stamp duty payable as is the case for most other loan

was 1% of the loan amount instruments to ease access to credit.

secured by the motor vehicle.

10 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 10 17/06/2022 17:12

No. AMENDMENT JUSTIFICATION

2 NIL stamp duty on Agricultural • To support the growth and recovery of

Insurance Policies: This makes the agricultural sector by reducing the

Agricultural Insurance Policies cost of agricultural insurance.

pay NIL duty.

Currently, each agricultural

insurance Policy pays stamp duty

of UGX 35,000 per policy.

3 NIL stamp duty on SECURITY • To ease access to credit by reducing

BOND OR MORTGAGE DEED the cost of stamp duty

executed by way of security • As part of the 2020 COVID-19 tax

for the due execution of an waivers, stamp duty on most loan

office, or to account for money instruments like loan agreements,

or other property received debentures, and equitable mortgages

by virtue of security bond or was made nil. However, the stamp duty

mortgage deed executed by a relating to the deposit of title remained

surety to secure a loan or credit at 1%. The amendment extends the

facility– of entry total value: same treatment to this instrument

Hitherto the stamp duty payable as is the case for most other loan

was 1% on the loan instrument. instruments to ease access to credit.

4 Reducing the threshold for • To encourage foreign and local direct

the investor incentive: The investment in manufacturing by

investment threshold has been reducing the exemption requirement.

reduced to USD 35 million There is a current stamp duty

from USD 50 million for stamp exemption on certain instruments for

duty exemption on certain a manufacturer who has the capacity

instruments for manufacturers to use at least seventy percent of the

who meet the specified criteria. locally produced raw materials and

employs at least seventy percent

citizens with an aggregate wage of

at least seventy percent of the total

wage bill of the new manufacturer and

whose investment capital is at least

fifty million United States Dollars.

5 Clarifying stamp duty on the • To ensure that there is no dissipation

transfer from a holder of letters of assets of the estate in transferring

of administration or probate to property to the beneficiary.

a beneficiary to be UGX 15,000:

TAX AMENDMENTS BOOKLET 2022/23 11

Tax ammendments 2022/23.indd 11 17/06/2022 17:12

12 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 12 17/06/2022 17:12

CUSTOMS AMENDMENTS FY2022-23

No. HS CODE DESCRIPTION ILLUSTRATION DECISION COMMENTS

1. Fabrics as per Various tariff Grant This is

the attach- lines across Uganda intended to

ment Annex all fabrics a stay of promote the

II (Legal regardless application textile sector

Notice No. of what is of the EAC in Uganda

EAC/118/2021) made by local CET rate of

players and or 0%, 10% and

imported as 25% and

per Annex II apply a duty

rate of 35%

or USD 3.0/

kg whichever

is higher for

one year.

2. Garments as Various tariff Grant This is

per the attach- lines across Uganda intended to

ment all garments a stay of promote the

regardless application textile sector

Annex III of what is of the EAC in Uganda.

made by local CET rate

(Legal players and or of 0%, 10%,

Notice No. imported as and 25% and

EAC/119/2021) per Annex III apply a duty

rate of 35%

or USD 3.5/

kg whichever

is higher for

one year.

3. 3917.40.00 PVC Trunking Grant Promotion of

- Fittings Uganda local content

a stay of

application

of the EAC

CET rate

of 25% and

apply a duty

rate of 35%

for one year

1511.90.90 Edible Palm Import duty To protect

Oil is applicable local industries

at a rate of and promote

9. 35% instead import

of 25% for substitution.

one year

TAX AMENDMENTS BOOKLET 2022/23 13

Tax ammendments 2022/23.indd 13 17/06/2022 17:12

No. HS CODE DESCRIPTION ILLUSTRATION DECISION COMMENTS

25. 2201.10.00 Waters, Import duty This is in

including is applicable line with the

mineral waters at a rate of current EAC

and aerated 35% instead Common

waters, of 25% for External Tariff

containing one year. review where

added sugar the maximum

or other rate of 35%

sweetening is being

matter or proposed

flavoured for the EAC

region.

41 4015.12.00 Surgical and Import duty Promote local

4015.19.00 other Gloves is applicable manufacturing

4015.90.00 at a rate of

10% instead

of 0% for

one year

3926.90.90 Other articles Import duty Sanitation

of applicable at improvement

plastics and a rate of 10% and faecal

articles instead of waste

of other 25% for one management

materials year

(Compositing

dry toilets)

8417.94.00 Brakes, Import duty Protect local

including applicable at industries

coaster a rate of 25% and promote

braking hubs instead of import

and hub 10% for one substitution

brakes, and year

parts thereof

- motorcycle

brake shoes.

14 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 14 17/06/2022 17:12

RAW MATERIALS AND INDUSTRIAL INPUTS TO BE CONSIDERED FOR DUTY

REMISSION FOR A PERIOD OF ONE YEAR (NEW)

No. HS CODE DESCRIPTION ILLUSTRATION DECISION COMMENTS

1 4823.69.00 Other paper, Grant Uganda These are

4804.19.90 paperboard, a remission of packaging

3920.69.90 Uncoated Kraft duty from 35%, materials and

3921.90.00 paper and 25% and 10% raw materials

4821.10.90 paperboard, to apply a used in the

other plates, duty rate of manufacture

sheets, film, foil 10% and 0% of surgical and

and strip, of respectively for examination

plastics, Paper one year. medical

or paperboard gloves.

labels of all

kinds, whether

or not printed.

Packaging

materials and

raw materials

used in the

manufacture

of surgical

and medical

examination

Gloves

2 3815.90.00 Catalytic Granted Promote local

preparations remission of manufacturing

for the duty from

manufacture 10% to apply

of foam a duty rate of

and spring 0% for one

mattresses year for the

manufacture

of foam

and spring

mattresses.

3 7320.90.00 Other springs Granted Promote local

and leaves remission of manufacturing

for the duty from

manufacture 25% to 10%

of foam for one

and spring year for the

mattresses manufacturers

of foam

and spring

mattresses

TAX AMENDMENTS BOOKLET 2022/23 15

Tax ammendments 2022/23.indd 15 17/06/2022 17:12

No. HS CODE DESCRIPTION ILLUSTRATION DECISION COMMENTS

4 8481.90.00 Valves Granted a Promote local

and their remission of manufacturing

corresponding duty to apply

component a duty rate of

parts used 0% for one

for the year.

manufacture

of motorcycle

tubes

5 6813.81.00 Brake linings Grant Uganda Promote local

8708.30.00 and pads, a remission of manufacturing

3506.99.00 Brakes and duty to apply

a duty rate of

servo-brakes;

0% for one

parts thereof; year.

Other

Adhesive Glues

Raw materials

for the

manufacturers

of motorcycle

brake shoes

ITEMS AFFECTED BY THE EAC MINISTERS’ ADOPTION OF 35% IN THE NEW EAC

CET 4TH TARIFF BAND

• The new Common External Tariff (CET) as transposed from the World Customs

Organization (WCO) Harmonized System (HS) 2022 will start to take effect on the

1st of July 2022 with the new CET rate of 35%

• There shall be four (4) tax Bands which include 0%, 10%, 25%, and 35%. The

sensitive items still remain with a rate above 35%.

NO DESCRIPTION ILLUSTRATION RATE AND COMMENT

1. Dairy products 35%

2. Meat products 35%

16 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 16 17/06/2022 17:12

NO DESCRIPTION ILLUSTRATION RATE AND COMMENT

3. Cereals 35%

4. Cotton and 35%

Textiles

Note: Uganda was granted a stay of

application of the EAC CET rate of 0%,

10% and 25% and apply a duty rate of

35% or USD 3.0/kg whichever is higher

for one year.

5. Iron and steel 35%

Products

6. Edible oils 35%

7. Beverages 35%

and spirits

8. Furniture 35%

9. Leather 35%

products

TAX AMENDMENTS BOOKLET 2022/23 17

Tax ammendments 2022/23.indd 17 17/06/2022 17:12

NO DESCRIPTION ILLUSTRATION RATE AND COMMENT

10. Fresh-cut 35%

flowers

11. Fruits and 35%

nuts

12. Sugar and 35%

confectionery

13. Coffee, tea 35%

and spices

14. Textiles and 35%

garments Note: Uganda was granted a stay of

application of the EAC CET rate of 0%,

10% and 25% and apply a duty rate of

35% or USD 3.0/kg whichever is higher

for one year.

15. Head gears 35%

16. Ceramic 35%

products

17. Paints 35%

18 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 18 17/06/2022 17:12

TAX AMENDMENTS BOOKLET 2022/23 19

Tax ammendments 2022/23.indd 19 17/06/2022 17:12

Tax ammendments 2022/23.indd 20 17/06/2022 17:12

Tax ammendments 2022/23.indd 21 17/06/2022 17:12

Tax ammendments 2022/23.indd 22 17/06/2022 17:12

Tax ammendments 2022/23.indd 23 17/06/2022 17:12

24 TAX AMENDMENTS BOOKLET 2022/23

Tax ammendments 2022/23.indd 24 17/06/2022 17:12

You might also like

- National Budget 2024 - EnglishDocument68 pagesNational Budget 2024 - EnglishAdaderana Online100% (1)

- Year 11 Business Management Unit 1 Exam Revision SheetDocument7 pagesYear 11 Business Management Unit 1 Exam Revision SheetnorbetNo ratings yet

- India "Preventive Manual" Central ExciseDocument205 pagesIndia "Preventive Manual" Central ExciseKuttralingam AmmaiyappanNo ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document11 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali100% (1)

- KPMG Kenya Finance Bill, 2024 AnalysisDocument75 pagesKPMG Kenya Finance Bill, 2024 Analysisanniebabbie77No ratings yet

- Overview of FinanceBill 2022Document2 pagesOverview of FinanceBill 2022Prashant MunotNo ratings yet

- Finance Act 2023 - Analysis by Grant ThorntonDocument39 pagesFinance Act 2023 - Analysis by Grant ThorntonoogafelixNo ratings yet

- TAX BRIEF AmendmentsMadeThroughFinanceAct - 2022Document39 pagesTAX BRIEF AmendmentsMadeThroughFinanceAct - 2022haiderNo ratings yet

- 2022 Mid-Year BudgetDocument33 pages2022 Mid-Year BudgetKaahwa VivianNo ratings yet

- Vision 360 Edition 6 1614142642Document43 pagesVision 360 Edition 6 1614142642Swapnil PatilNo ratings yet

- GRA 2022 Annual ReportDocument85 pagesGRA 2022 Annual ReportKaahwa VivianNo ratings yet

- Taxjournal July 2020Document60 pagesTaxjournal July 2020Venkatesh PrabhuNo ratings yet

- Xeinadin / Liam Burns & Co 2023 Budget ReviewsDocument12 pagesXeinadin / Liam Burns & Co 2023 Budget ReviewsDeaglanO'MaitiuNo ratings yet

- Tax Glimpses 2019Document97 pagesTax Glimpses 2019DarshanaNo ratings yet

- AFF's Memorandum On Federal & Provincial Finance Acts, 2022Document61 pagesAFF's Memorandum On Federal & Provincial Finance Acts, 2022ABODE PVT LIMITEDNo ratings yet

- OECD Report For G7 Finance Ministers and CB GovernorsDocument31 pagesOECD Report For G7 Finance Ministers and CB GovernorsOscar PurnamaNo ratings yet

- Laporan Tahunan DJP 2020 - EnglishDocument256 pagesLaporan Tahunan DJP 2020 - EnglishHaryo BagaskaraNo ratings yet

- My Tax Espresso Newsletter Budget 2022 Part 1Document34 pagesMy Tax Espresso Newsletter Budget 2022 Part 1kkyouNo ratings yet

- 2022 Tax Expenditure Report FinalDocument43 pages2022 Tax Expenditure Report FinalKirimi StanleyNo ratings yet

- Ie Taxing Times Budget 2024Document24 pagesIe Taxing Times Budget 2024unblockmesummerNo ratings yet

- C 1keu-Neg-Bag 3 Ui (Pajak)Document28 pagesC 1keu-Neg-Bag 3 Ui (Pajak)Hasiib BintangNo ratings yet

- Commissioner's Foreword: Annual Report 2020-21Document3 pagesCommissioner's Foreword: Annual Report 2020-21Wang Hon YuenNo ratings yet

- Maven Minds Budget Brief 2022Document24 pagesMaven Minds Budget Brief 2022Salman AhmedNo ratings yet

- Section 2Document14 pagesSection 2Hafiz TajuddinNo ratings yet

- DT Alert - CBDT Issues Guidelines For Removal of Difficulties On New Withholding Provision On Payment of BusinessDocument9 pagesDT Alert - CBDT Issues Guidelines For Removal of Difficulties On New Withholding Provision On Payment of BusinessGanesh G GageNo ratings yet

- Finance Act 2021 - PWC Insight Series and Sector Analysis Interactive 2Document25 pagesFinance Act 2021 - PWC Insight Series and Sector Analysis Interactive 2Oyeleye TofunmiNo ratings yet

- Finance Act Era Critical Evaluation 1 1Document22 pagesFinance Act Era Critical Evaluation 1 1Folawiyo AgbokeNo ratings yet

- Tri Hita Karana ForumDocument14 pagesTri Hita Karana Forumtonitoni27No ratings yet

- WTS Tax Consulting (Mauritius) LTD - Budget Highlights - 2022-2023Document31 pagesWTS Tax Consulting (Mauritius) LTD - Budget Highlights - 2022-2023akshar maherallyNo ratings yet

- KSA VAT Rate Increase Webinar PresentationDocument24 pagesKSA VAT Rate Increase Webinar PresentationAhmedNo ratings yet

- Tax Memorandum 2012 FinalDocument58 pagesTax Memorandum 2012 FinalAzka KhalidNo ratings yet

- Comments On Significant Amendments Through Finance Act, 2022Document40 pagesComments On Significant Amendments Through Finance Act, 2022Pacific DataNo ratings yet

- Nigeria Taxation Post Covid - What To ExpectDocument3 pagesNigeria Taxation Post Covid - What To ExpectOmotayo AlabiNo ratings yet

- Deloitte Malaysia Tax Espresso (Special Edition) - 231014 - 050707Document22 pagesDeloitte Malaysia Tax Espresso (Special Edition) - 231014 - 050707steve leeNo ratings yet

- KPMG - Newsletter Loi de Finances 2024 (English Version)Document6 pagesKPMG - Newsletter Loi de Finances 2024 (English Version)boukhlefNo ratings yet

- 51 Insights August 2022Document25 pages51 Insights August 2022Rheneir MoraNo ratings yet

- Budget 2023: Summary of 2023 Budget Measures - Policy ChangesDocument12 pagesBudget 2023: Summary of 2023 Budget Measures - Policy Changesjcruz88No ratings yet

- Comments On Amended Finance Bill, 2022Document14 pagesComments On Amended Finance Bill, 2022Arsalan MinhasNo ratings yet

- Trusted. Transformational. Together.: Trinidad & Tobago - National Budget 2021/2022 ReviewDocument40 pagesTrusted. Transformational. Together.: Trinidad & Tobago - National Budget 2021/2022 ReviewKza RamganeshNo ratings yet

- GNV Tax News February 2022Document5 pagesGNV Tax News February 2022BenjaminNo ratings yet

- Tricor Insights - Special Edition - 2022 Budget - 30 Oct 2021-Dr VeerinderjeetDocument37 pagesTricor Insights - Special Edition - 2022 Budget - 30 Oct 2021-Dr VeerinderjeetLin AriefNo ratings yet

- Recent Tax and Expenditure Reforms in IndiaDocument18 pagesRecent Tax and Expenditure Reforms in IndiaSatyam KanwarNo ratings yet

- Individuals Receiving Profit On Govt.: Importer CategoryDocument1 pageIndividuals Receiving Profit On Govt.: Importer CategoryMuhammad Arham KhaliqNo ratings yet

- Proposed Tax Changes Under The Finance Bill 2022 ALN Kenya Legal Alert April 2022Document24 pagesProposed Tax Changes Under The Finance Bill 2022 ALN Kenya Legal Alert April 2022yomak94018No ratings yet

- Does The Finance Bill 2022 Advance Nigeria S Esg AmbitionDocument7 pagesDoes The Finance Bill 2022 Advance Nigeria S Esg AmbitionGeorges BordaNo ratings yet

- Budget Bulletin 2023 24Document52 pagesBudget Bulletin 2023 24Ouma OdhongNo ratings yet

- Budget 2021 Analysis 1612255286Document23 pagesBudget 2021 Analysis 1612255286Ishita FarsaiyaNo ratings yet

- PWC Budget Brief 2023Document61 pagesPWC Budget Brief 2023ttaashNo ratings yet

- Aino Communique 110th Dec EditionDocument12 pagesAino Communique 110th Dec EditionSwathi JainNo ratings yet

- National: BudgetDocument68 pagesNational: BudgetChamika Nuwan ObeyesekeraNo ratings yet

- Tax and Business Strategy - Impact of New Ghanaian Tax LawsDocument6 pagesTax and Business Strategy - Impact of New Ghanaian Tax LawsM ArmahNo ratings yet

- Global Minimum Tax - Journey So Far and Impact On India: Image Image ImageDocument8 pagesGlobal Minimum Tax - Journey So Far and Impact On India: Image Image Imagekumar kartikeyaNo ratings yet

- Budget 2022 - Comprehensive Guide On Personal Finance-17Document15 pagesBudget 2022 - Comprehensive Guide On Personal Finance-17Shubham ShawNo ratings yet

- Nec Retreat Tax Alert 1Document3 pagesNec Retreat Tax Alert 1Mireille MathildeNo ratings yet

- Shuttlers Metropolitan ReportDocument7 pagesShuttlers Metropolitan ReportAkinyemi SilasNo ratings yet

- Moving Towards A World-Class GST: Vijay Kelkar Arvind Datar Rahul RenavikarDocument13 pagesMoving Towards A World-Class GST: Vijay Kelkar Arvind Datar Rahul Renavikarmsharma22No ratings yet

- Fundamentals of Beps: After Studying This Chapter, You Would Be Able ToDocument29 pagesFundamentals of Beps: After Studying This Chapter, You Would Be Able ToZ H SolutionsNo ratings yet

- TTR 2022-WebDocument24 pagesTTR 2022-WebFatima BlaliNo ratings yet

- Uae CTDocument33 pagesUae CTTina PhilipNo ratings yet

- E-ISSN 2829-5404, P-ISSN 2829-7040:, Wajib - Ginting@inaba - Ac.idDocument7 pagesE-ISSN 2829-5404, P-ISSN 2829-7040:, Wajib - Ginting@inaba - Ac.idYohanaNo ratings yet

- The Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesDocument13 pagesThe Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Budget Highlights Athena Law-R1Document4 pagesBudget Highlights Athena Law-R1Ashar AkhtarNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Ins3010 Final ThuếiDocument3 pagesIns3010 Final ThuếiLinh DoNo ratings yet

- LCS-CSD-FORM-MR-S1Updated As of 25 April 2017Document6 pagesLCS-CSD-FORM-MR-S1Updated As of 25 April 2017AdyNo ratings yet

- TAX CIR Vs IsabelaDocument1 pageTAX CIR Vs IsabelaEly VelascoNo ratings yet

- Governance and Development 1992Document69 pagesGovernance and Development 1992Walter A GuerreroNo ratings yet

- The Social and Economic Impacts of GamblingDocument14 pagesThe Social and Economic Impacts of GamblingJoseph Noel CoscosNo ratings yet

- Handout PP R. Roumen ATAD3Document14 pagesHandout PP R. Roumen ATAD3bacha436No ratings yet

- Import Procedures of Customs House AgentDocument59 pagesImport Procedures of Customs House AgentAnuj MalwadeNo ratings yet

- Ever Blue Equity SDN BHD (202201007684)Document6 pagesEver Blue Equity SDN BHD (202201007684)INFINITY GROUPNo ratings yet

- Test - 2 PDFDocument6 pagesTest - 2 PDFHåris Khån MøhmånďNo ratings yet

- DIGEST Philippine Acetylene V.Document2 pagesDIGEST Philippine Acetylene V.Rhenfacel ManlegroNo ratings yet

- Ra 1752 - HDMF Law of 1980Document10 pagesRa 1752 - HDMF Law of 1980nemo_nadalNo ratings yet

- The Income Tax Act SEC 6Document9 pagesThe Income Tax Act SEC 6MohsinNo ratings yet

- Payslip2 PDFDocument1 pagePayslip2 PDFSumanthNo ratings yet

- Financial Statement Analysis First LectureDocument17 pagesFinancial Statement Analysis First LectureDavid Obuobi Offei KwadwoNo ratings yet

- Pricing of Cancer Medicines and Its ImpactDocument173 pagesPricing of Cancer Medicines and Its ImpactJennifer BuenoNo ratings yet

- Cfas Chapter 25Document6 pagesCfas Chapter 25Kristel FieldsNo ratings yet

- Cash CA NCA CLDocument8 pagesCash CA NCA CL15vinayNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- BM Short Notes (PBP)Document99 pagesBM Short Notes (PBP)Asim AnsariNo ratings yet

- Us Crypto Asset Management 01Document13 pagesUs Crypto Asset Management 01achmad zainuddinNo ratings yet

- Jadwal UAS Ganjil 20221 Periode 3 - 12 Jan 2022 (MHS)Document2 pagesJadwal UAS Ganjil 20221 Periode 3 - 12 Jan 2022 (MHS)Desi RahmuniNo ratings yet

- Reviewer of Accounting For Government and Npo Chapter 5 Revenue and Other ReceiptsDocument15 pagesReviewer of Accounting For Government and Npo Chapter 5 Revenue and Other ReceiptsGT BackyardNo ratings yet

- Certificate of Ownership Template 09Document1 pageCertificate of Ownership Template 09RichardwilsonNo ratings yet

- Release Order Notification (Inward Processing) and Bonded TransportationDocument14 pagesRelease Order Notification (Inward Processing) and Bonded TransportationAung LattNo ratings yet

- Local Authorities Report 2020Document343 pagesLocal Authorities Report 2020Euston ChinharaNo ratings yet

- ABDC JQL 2022 v3 100523Document600 pagesABDC JQL 2022 v3 100523arijitbhaduri2012No ratings yet

- EligibilityResultsNotice 3Document14 pagesEligibilityResultsNotice 3Haley BrightNo ratings yet