Professional Documents

Culture Documents

Rac 101 - Introduction To Financial Accounting

Rac 101 - Introduction To Financial Accounting

Uploaded by

Miko Manani0 ratings0% found this document useful (0 votes)

12 views2 pagesOriginal Title

Rac 101- Introduction to Financial Accounting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesRac 101 - Introduction To Financial Accounting

Rac 101 - Introduction To Financial Accounting

Uploaded by

Miko MananiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

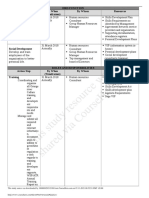

FINANCIAL ACCOUNTING

INTRODUCTION TO FINANCIAL ACCOUNTING

Accounting - the process of recording, classifying, summarizing and communicating economic

information to interested parties to facilitate informed decision making.

Accounting Equation

Assets = Liabilities Owners Equity (Capital)

Accounting

- Financial Accounting (F.A) – External focus

- Management Accounting (M.A) – Internal focus

- Cost accounting- is a blend of management and financial accounting. Typical of

manufacturing firms.

Users of financial reports/statements

1. Investors (present and prospective) – Insurance firms

2. Management – Competitors for benchmarking purposes

3. Development partners – financiers who would want to invest in the firm.

4. Government agencies especially tax authorities

5. Employees of the firm- to judge job security

6. The general public- you and I

7. Creditors- they want to know if the firm will be able to pay them

8. Suppliers-they would want to supply goods and services to a stable firm.

Elements of financial statements

1. Assets – is anything of value owned by a business that is intended to benefit future

operations. Assets may have physical substance inventory e.g. buildings, motor vehicles,

furniture and fittings, good will (fixed assets) or they may be intangible (copyrights,

trademarks, patent etc).

Fixed assets can be current and long term assets

2. Liabilities – they are debts or obligations, examples of debts bankloan creditors (accounts

payables) bonds, debentures (secured corporate bonds of a short term nature)

3. Capital/owner’s equity – constitutes the claims of the owner’s of the business in the

business

4. Revenues: Inflows from utilizing the firm’s assets e.g. sales income, fees income, bus

fare income. These revenues should be from the ordinary course of business.

5. Gains: Inflows from incidental items i.e. business operations that are not part of the

ordinary business e.g. on sale of furniture and fittings, gain on sale of equipments etc.

6. Expenses: The costs incurred in the process of generating revenues; these must be

incurred in the day to day operations of the firm e.g. salaries of employees

Expenses, e.g. rent expenses, utilities, repairs and maintenance, insurance

7. Losses: They are incidental costs incurred in the process of generating revenues – those

must be costs from activities to transactions that are not part of day to day business.

Cash basis versus accrual basis of accounting

Cash basis: Revenues are recognized when cash is actually collected; expenses are recognized

when cash is actually paid for the expenses. This is common with small firms and personal

business e.g. sole proprietorship.

Accrual basis: Revenues are recognized when realized and earned and not necessarily when

cash is collected; expenses are recognized when efforts have been incurred in generating the

revenues and not necessarily when money is paid out. Accrual accounting is often associated

with big/large firms e.g. companies.

Assignment- explain the Double-entry concept in Financial Accounting.

You might also like

- Account Titles With DefinitionDocument5 pagesAccount Titles With DefinitionAngelo Miranda88% (8)

- Fin 550 Milestone 2Document6 pagesFin 550 Milestone 2writer topNo ratings yet

- Presentation On CRISILDocument14 pagesPresentation On CRISILChanchal Gulati80% (5)

- Users of Accounting InformationDocument4 pagesUsers of Accounting InformationWycliffe OgetiiNo ratings yet

- Unit IDocument8 pagesUnit InamianNo ratings yet

- TallyDocument15 pagesTallySujit PaulNo ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerFictional PlayerNo ratings yet

- Financial AccountingDocument16 pagesFinancial AccountingSNo ratings yet

- Assignment of Financial AccountingDocument9 pagesAssignment of Financial Accountingsavi vermaNo ratings yet

- Chapter 1 Introduction To Accounting - 1.5Document4 pagesChapter 1 Introduction To Accounting - 1.5BHAWNANo ratings yet

- Introduction To Accounting: Chapter - 1Document5 pagesIntroduction To Accounting: Chapter - 1Varshitha ReddyNo ratings yet

- Faa IDocument18 pagesFaa INishtha RathNo ratings yet

- CMBE 2 - Lesson 3 ModuleDocument12 pagesCMBE 2 - Lesson 3 ModuleEunice AmbrocioNo ratings yet

- EpfoDocument6 pagesEpfoSiddharth OjhaNo ratings yet

- Chapter 1 Introduction To Accounting - NotesDocument5 pagesChapter 1 Introduction To Accounting - NotesShaji RarothNo ratings yet

- Introduction To Accounting Introduction To Accounting Introduction To AccountingDocument23 pagesIntroduction To Accounting Introduction To Accounting Introduction To AccountingAsitha AjayanNo ratings yet

- 3.4 Business IbDocument11 pages3.4 Business IbsamaraarrobaNo ratings yet

- Financial ControlDocument9 pagesFinancial Controlima funtanaresNo ratings yet

- Acc PDFDocument61 pagesAcc PDFSmarika BistNo ratings yet

- FABM1-CHAP6-Types of Major AccountsDocument5 pagesFABM1-CHAP6-Types of Major AccountsKyla BallesterosNo ratings yet

- BACNTHIDocument3 pagesBACNTHIFaith CalingoNo ratings yet

- FABM 1 Major AccountsDocument31 pagesFABM 1 Major AccountscatajannicolinNo ratings yet

- Accounting - : Basic Terms in Accounting - 1. TransactionDocument14 pagesAccounting - : Basic Terms in Accounting - 1. TransactionKaran Singh RathoreNo ratings yet

- FinanceDocument48 pagesFinanceMimi Adriatico JaranillaNo ratings yet

- Study Material AccountingDocument62 pagesStudy Material Accountingsagar sheralNo ratings yet

- CBSE 11th Commerce Sample Accountancy IDocument18 pagesCBSE 11th Commerce Sample Accountancy ILakshmi PonduriNo ratings yet

- BOOKKEEPING Module (For Printing)Document73 pagesBOOKKEEPING Module (For Printing)Tesda TesdaNo ratings yet

- Accounting Module E BookDocument43 pagesAccounting Module E BookMahima SheromiNo ratings yet

- AccountingDocument4 pagesAccountingKristine Marie ParalNo ratings yet

- FAI - Introduction To AccountingDocument9 pagesFAI - Introduction To Accountingalanorules001No ratings yet

- Fundamentals OF Accounting 1: FOR Grade 11Document29 pagesFundamentals OF Accounting 1: FOR Grade 11Francois GonzalesNo ratings yet

- Fabm 1Document4 pagesFabm 1hanhermosilla0528No ratings yet

- ACCOUNTING NOTES BcomDocument13 pagesACCOUNTING NOTES Bcomjacksonkimani3617No ratings yet

- Account TitlesDocument9 pagesAccount TitlesFaelynnNo ratings yet

- Types of Major AccountsDocument4 pagesTypes of Major AccountsPortia AbestanoNo ratings yet

- Financial Accounting - 1Document42 pagesFinancial Accounting - 1MajdiNo ratings yet

- Unit-Iv Capital and Capital BudgetingDocument16 pagesUnit-Iv Capital and Capital BudgetingSubhas BeraNo ratings yet

- Text 47FF 9B41 4C 0Document4 pagesText 47FF 9B41 4C 0Toph BeifongNo ratings yet

- MEFA - IV and V UnitsDocument30 pagesMEFA - IV and V UnitsMOHAMMAD AZEEMANo ratings yet

- Anglais s1Document9 pagesAnglais s1JassNo ratings yet

- Fabm 1Document8 pagesFabm 1zachie7770No ratings yet

- ACCA NoteDocument21 pagesACCA NoteTanbir Ahsan RubelNo ratings yet

- Hand Out in Basic AccountingDocument32 pagesHand Out in Basic AccountingJemuell RedNo ratings yet

- Unit 1 External Financial Statements and Revenue RecognitionDocument31 pagesUnit 1 External Financial Statements and Revenue Recognitionestihdaf استهدافNo ratings yet

- Accounting and Financial MangementDocument25 pagesAccounting and Financial MangementSHASHINo ratings yet

- Chapter 2: Accounting Equation and The Double-Entry SystemDocument15 pagesChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae Sasutil100% (1)

- Chapter 2: Accounting Equation and The Double-Entry SystemDocument15 pagesChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae SasutilNo ratings yet

- What Is AccountingDocument29 pagesWhat Is Accountingmule mulugetaNo ratings yet

- Lecture in FUNAC 2Document84 pagesLecture in FUNAC 2Shaira Bloom RagonjanNo ratings yet

- Guideline For Financial AccountingDocument65 pagesGuideline For Financial AccountingKhánh PhươngNo ratings yet

- BS Unit 3Document4 pagesBS Unit 3Enea NastriNo ratings yet

- For ACCO 101 - Review of Accounting Concepts and Process (Part 1)Document32 pagesFor ACCO 101 - Review of Accounting Concepts and Process (Part 1)Fionna Rei DeGaliciaNo ratings yet

- Chapter 12 Managing The Finance FunctionDocument16 pagesChapter 12 Managing The Finance Functionedward0% (2)

- Reviewer FinanceDocument9 pagesReviewer FinanceChristine Marie RamirezNo ratings yet

- Chapter 2 HandoutsDocument15 pagesChapter 2 HandoutsBlackpink BtsNo ratings yet

- Business VocabularyDocument2 pagesBusiness VocabularyLiza BazileviciNo ratings yet

- ASSIGMENT ACC - EditedDocument9 pagesASSIGMENT ACC - EditedLuqman SyahbudinNo ratings yet

- Chapter IDocument90 pagesChapter IAdmasu GirmaNo ratings yet

- Parts of The Business Plan EntrepDocument6 pagesParts of The Business Plan EntrepBrev SobremisanaNo ratings yet

- Lesson 1 SFPDocument14 pagesLesson 1 SFPLydia Rivera100% (3)

- Types of Major AccountsDocument30 pagesTypes of Major AccountsEstelle GammadNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Rac 101 - Example of Journal Entries Posting and Extracting Trial BalanceDocument1 pageRac 101 - Example of Journal Entries Posting and Extracting Trial BalanceMiko MananiNo ratings yet

- Rac 101 - Trial Balance - An ExampleDocument1 pageRac 101 - Trial Balance - An ExampleMiko MananiNo ratings yet

- Rac 101 - Adjusting Entries or Year End AjustmentsDocument6 pagesRac 101 - Adjusting Entries or Year End AjustmentsMiko MananiNo ratings yet

- Online and Blended Courses-RCS102-Object Oriented Programming 2022Document2 pagesOnline and Blended Courses-RCS102-Object Oriented Programming 2022Miko MananiNo ratings yet

- Lesson: 39: Give and Take: Collective BargainingDocument32 pagesLesson: 39: Give and Take: Collective Bargainingsarthak1826No ratings yet

- Tugas 2Document14 pagesTugas 2Tri Sunanda FathanahNo ratings yet

- Kesari ToursDocument15 pagesKesari ToursBhumika ShrivastavaNo ratings yet

- NCFM Technical AnalysisDocument18 pagesNCFM Technical AnalysisJagannathasarmaNo ratings yet

- Ismailia Public Free Zone About UsDocument3 pagesIsmailia Public Free Zone About UsAhmed El-AdawyNo ratings yet

- Grade 4 Multiplication: Answer The QuestionsDocument6 pagesGrade 4 Multiplication: Answer The QuestionsEduGainNo ratings yet

- Vertical Integration at Suguna Poultry Farms - A Critical Look at Pro PoorDocument24 pagesVertical Integration at Suguna Poultry Farms - A Critical Look at Pro PoorRamen LewisNo ratings yet

- Executive SummaryDocument2 pagesExecutive SummaryAshlindah KisakuraNo ratings yet

- Bentley Investment Group: Tuesday August 25, 2009Document1 pageBentley Investment Group: Tuesday August 25, 2009bentleyinvestmentgroupNo ratings yet

- Meaning of A Director: " Any Person Occupying The Position of Director, by Whatever Name Called" - Sec. 2Document21 pagesMeaning of A Director: " Any Person Occupying The Position of Director, by Whatever Name Called" - Sec. 2smsmbaNo ratings yet

- C39 - Fraud Awareness and Prevention - 2015 - AddendumDocument3 pagesC39 - Fraud Awareness and Prevention - 2015 - AddendumNidhi KatyalNo ratings yet

- International and Dutch Standards On Business and Human RightsDocument3 pagesInternational and Dutch Standards On Business and Human RightsjosienkapmaNo ratings yet

- AE13 Final ActivityDocument5 pagesAE13 Final ActivityWenjunNo ratings yet

- What Is Indivisible Works ContractDocument1 pageWhat Is Indivisible Works ContractAnonymous Q3J7APoNo ratings yet

- Advanced Corporate Finance 1st Edition Ogden Test BankDocument13 pagesAdvanced Corporate Finance 1st Edition Ogden Test Bankpottpotlacew8mf1t100% (17)

- A STUDY ON Financial Statement Analysis of Axis BankDocument94 pagesA STUDY ON Financial Statement Analysis of Axis BankKeleti Santhosh75% (8)

- When A New Manager Stumbles, Who's at Fault?Document11 pagesWhen A New Manager Stumbles, Who's at Fault?Shivam Khandelwal100% (1)

- SHRM Action PlanDocument3 pagesSHRM Action PlanAvery Jan Magabanua SilosNo ratings yet

- Scope of Health EconomicsDocument33 pagesScope of Health EconomicsSanjeev Chougule100% (2)

- BSIE Cost AccountingDocument5 pagesBSIE Cost AccountingJoovs JoovhoNo ratings yet

- Up SellingDocument3 pagesUp SellingNora GambronNo ratings yet

- Case Study SummaryDocument3 pagesCase Study Summary4 7No ratings yet

- A Literature Review On Social Enterprise: Yuting Zhang & Yong LiDocument6 pagesA Literature Review On Social Enterprise: Yuting Zhang & Yong LiJEFFREY WILLIAMS P M 20221013No ratings yet

- Personal Finance Canadian 7th Edition Kapoor Solutions ManualDocument25 pagesPersonal Finance Canadian 7th Edition Kapoor Solutions ManualDrAnnaHubbardDVMitaj100% (46)

- SPK Akugrosir 2018 (Staff Gudang) in EnglishDocument3 pagesSPK Akugrosir 2018 (Staff Gudang) in EnglishBimo Mahendra PutraNo ratings yet

- Howden Capabilities Oct 2017 ScreenDocument68 pagesHowden Capabilities Oct 2017 ScreenukdealsNo ratings yet

- Support Resistance For Day TradingDocument1,103 pagesSupport Resistance For Day Tradingnbhnbhnnb nhbbnh50% (2)

- Work To Build The Country: Mousumi NetworkDocument55 pagesWork To Build The Country: Mousumi NetworkSelim KhanNo ratings yet