Professional Documents

Culture Documents

17 - Ni Putu Cherline Berliana - 3.3 & 3.8

17 - Ni Putu Cherline Berliana - 3.3 & 3.8

Uploaded by

putu cherline21Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

17 - Ni Putu Cherline Berliana - 3.3 & 3.8

17 - Ni Putu Cherline Berliana - 3.3 & 3.8

Uploaded by

putu cherline21Copyright:

Available Formats

Nama : Ni Putu Cherline Berliana

NIM : 20106017

No Absen : 17

Prodi : MAH A / 5

Mata Kuliah : Akuntansi Manajemen Hospitaliti

Tugas Akuntansi Manajemen Hospitaliti

Soal & Jawaban

Problem 3.3

The Midnight Inn’s general ledger contains several food and beverage accounts for

the year ended December 31, 19X2, as follow:

Food sales $ 800,000

Beverage sales 300,000

Cover charges (beverage) 6,000

Miscellaneous other income (food) 3,000

Uniforms 2,000

Operating supplies 10,000

Food purchases 300,000

Beverage purchases 75,000

Candy/gum purchases 1,000

Salaries – food 100,000

Wages – food 120,000

Payroll taxes – food 15,000

Fringe benefits – food (excludes employee meals) 20,000

Kitchen fuel 4,000

Laundry 7,000

Contract cleaning 8,000

China 2,000

Linen 1,500

Silver 2,000

Glassware 2,500

Licenses 2,000

Music 10,000

Employee meals – food 3,000

Employee meals – beverage 1,000

Salaries – beverage 50,000

Wages – beverage 70,000

Payroll taxes – beverage 9,000

Fringe benefits – beverage (excludes employee meals) 12,000

Other information is as follows:

Inventories 1/1/X2 12/31/X2

Food $ 10,000 $ 12,000

Beverages 6,000 5,000

Candy/gum 500 400

Required:

Prepare a food and beverage schedule in accordance with the USASH.

Jawab:

Perhitungan cost of sales

Beginning food inventory = 10,000

Food purchases = 300,000

Total available = 310,000

Ending food inventory = 12,000

Total consumed = 298,000

Employee meals – food = 3,000

Cost of food sales = 295,000

Beginning beverage inventory = 6,000

Beverage purchases = 75,000

Total available = 81,000

Ending beverage inventory = 5,000

Total consumed = 76,000

Employee meals – beverage = 1,000

Cost of beverage sales = 75,000

Beginning candy/gum inventory = 500

Candy/gum purchases = 1,000

Total available = 1,500

Ending candy/gum inventory = 400

Cost of candy/gum sales = 1,100

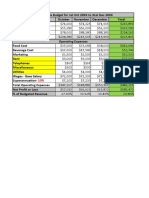

Food & Beverage Schedule sesuai dengan USASH:

The Midnight Inn’s

Food and Beverage

For the year ended December 31, 19X1

Revenue

Food sales $ 800,000

Beverage sales 300,000

Cover charges (beverage) 6,000

Miscellaneous other income (food) 3,000

Net Revenue 1,109,000

Expenses

Cost of Sales

Cost of food sales 295,000

Cost of beverage sales 75,000

Cost of candy/gum sales 1,100

Total cost of sales 371,100

Payroll and related expenses

Salaries – food 100,000

Wages – food 120,000

Payroll taxes – food 15,000

Fringe benefits – food 20,000

Salaries – beverage 50,000

Wages – beverage 70,000

Payroll taxes – beverage 9,000

Fringe benefits – beverage 12,000

Total payroll and related expenses 396,000

Other expenses

Contract cleaning 8,000

Laundry 7,000

Linen 1,500

Operating supplies 10,000

Uniforms 2,000

Kitchen fuel 4,000

China 2,000

Silver 2,000

Glassware 2,500

Licenses 2,000

Music 10,000

Total other expenses 51,000

Total Expenses 818,100

Departmental Income $ 290,900

Problem 3.8

Pat Mulhurn, the founder of Pat’s Place, wants to analyze 19X2 year’s operations

by comparing them with the 19X1 results. To aid him, prepare a comparative income

statement using the 19X1 and 19X2 infomation available.

Pat’s Place

Income Statement

For the years ending December 31, 19X1 and 19X2

19X1 19X2

Revenues

Rooms $ 976,000 $ 1,041,000

Food and beverage 604,000 626,000

Telephone 50,000 52,000

Total 1,630,000 1,719,000

Direct Expenses

Rooms 250,000 264,000

Food and beverage 476,000 507,000

Telephones 68,000 68,000

Total Operational Department Income 836,000 880,000

Undistributed Operating Expenses

Administrative and General 195,000 206,000

Marketing 65,000 68,000

Property Operation and Maintenance 69,000 68,000

Energy Costs 101,000 102,000

Income Before Fixed Charges 406,000 436,000

Rent, Property Taxes, and Insurance 200,000 201,000

Interest 55,000 52,000

Depreciation and Amortization 116,000 116,000

Income Before Income Taxes 35,000 67,000

Income Taxes 7,000 17,000

Net Income $ 28,000 $ 50,000

Required:

Prepare the comparative income statement for Pat’s Place. Note: Rearrange the income statement

to conform to the USASH format as reflected in Exhibit 3.10

Jawab:

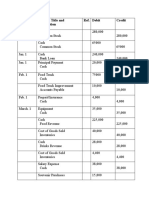

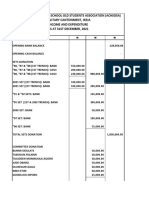

Pat’s Place

Comparative Income Statement

Difference

19X1 19X2 $ %

Total Revenue $ 1,630,000 $ 1,719,000 $ 89,000 5,46%

Rooms – Revenue 976,000 1,041,000 65,000 6.66

Direct Expenses 250,000 264,000 14,000 5.60

Department Income 726,000 777,000 51,000 7.02

Food & Beverage – Revenue 604,000 626,000 22,000 3.64

Direct Expenses 476,000 507,000 31,000 6.51

Department Income 128,000 119,000 (9,000) (7.03)

Telephone – Revenue 50,000 52,000 2,000 4.00

Direct Expenses 68,000 68,000 0 0

Department Income (18,000) (16,000) 2,000 11.11

Total Operated Department Income 836,000 880,000 44,000 5.26

Undistributed Operating Expenses

Administrative and General 195,000 206,000 11,000 5.64

Marketing 65,000 68,000 3,000 4.61

Property Operation and Maintenance 69,000 68,000 (1,000) (1.45)

Energy Costs 101,000 102,000 1,000 0.99

Total Undistributed Operating Expenses 430,000 444,000 14,000 3.25

Income Before Fixed Charges 406,000 436,000 30,000 7.39

Rent, Property Taxes, and Insurance 200,000 201,000 1,000 0.50

Interest 55,000 52,000 (3,000) (5.45)

Depreciation and Amortization 116,000 116,000 0 0

Income Before Income Taxes 35,000 67,000 32,000 91.42

Income Taxes 7,000 17,000 10,000 142.85

Net Income $ 28,000 $ 50,000 $ 22,000 78.57%

You might also like

- Accounting For Not-for-Profit and Public Sector OrganizationsDocument55 pagesAccounting For Not-for-Profit and Public Sector OrganizationsAshley Cleveland100% (4)

- Business Model Generation Project - AMC TheatersDocument7 pagesBusiness Model Generation Project - AMC TheatersUchralzaya MendbayarNo ratings yet

- Business Acc Assignment (57212220057)Document43 pagesBusiness Acc Assignment (57212220057)Lukmanul HakimNo ratings yet

- P&L: Christmas Party: Profit Before Tax 3,794,082Document2 pagesP&L: Christmas Party: Profit Before Tax 3,794,082quy_qqqNo ratings yet

- Coffeeville: End of Financial Year StatementsDocument5 pagesCoffeeville: End of Financial Year StatementsAndresPradaNo ratings yet

- SITXFIN009 Cafe Quarterly BudgetDocument3 pagesSITXFIN009 Cafe Quarterly Budgetaishariaz342No ratings yet

- Financial Income StatementDocument1 pageFinancial Income StatementLei Angielin DurwinNo ratings yet

- P&L ProformaDocument1 pageP&L Proformamokasha51No ratings yet

- Efren Quesada SITXFI EXCELDocument4 pagesEfren Quesada SITXFI EXCELefrenquesada84No ratings yet

- Sales ProjectionDocument3 pagesSales ProjectionChandria SimbulanNo ratings yet

- Bri Managemement Accounting Final Paper v.1Document49 pagesBri Managemement Accounting Final Paper v.1Kathlene JaoNo ratings yet

- Group4 Cityu8b Assignment Corporate FinanceDocument16 pagesGroup4 Cityu8b Assignment Corporate Financeđức nguyên anhNo ratings yet

- Income and Expenditure StatementDocument5 pagesIncome and Expenditure StatementdjharshaNo ratings yet

- Chupotatoes Group 4Document16 pagesChupotatoes Group 4Allen DagsilNo ratings yet

- Neraca Keuangan CV Dietary FoodDocument3 pagesNeraca Keuangan CV Dietary Foodnurul jannah0% (1)

- Buchesa - Final Edit 1Document147 pagesBuchesa - Final Edit 1Patrick ValenzuelaNo ratings yet

- GRP1 CalicoyDocument4 pagesGRP1 CalicoyAllanis Mae E. MateoNo ratings yet

- ENTREP Income AnalysisDocument5 pagesENTREP Income AnalysisMary Rose Bragais OgayonNo ratings yet

- Chapter Viii RevDocument5 pagesChapter Viii RevIrasna AbmiugNo ratings yet

- Cash Flow JulianaDocument1 pageCash Flow JulianaJulianaNo ratings yet

- Budget PlanDocument10 pagesBudget PlanVasantha Reddy GundetiNo ratings yet

- Alekaya StatementDocument4 pagesAlekaya Statementapi-527776626No ratings yet

- Exercises ManAcc Cases and NotesDocument7 pagesExercises ManAcc Cases and NotesIrish AlonNo ratings yet

- Financial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarDocument5 pagesFinancial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet

- Nomor 16Document4 pagesNomor 16m habiburrahman55No ratings yet

- Budget HR June 17Document6 pagesBudget HR June 17fitrah jayaNo ratings yet

- Accounting Problem 5 5ADocument8 pagesAccounting Problem 5 5AParbon Acharjee100% (1)

- Section Vi: Financial A. Financial ForecastDocument4 pagesSection Vi: Financial A. Financial ForecastYna mae BonsolNo ratings yet

- M1 U3 A1 ANMC Objetivosfinancieros.Document14 pagesM1 U3 A1 ANMC Objetivosfinancieros.Armando RamirezNo ratings yet

- Balance Income TableDocument2 pagesBalance Income TableJay Francis ClaveNo ratings yet

- Dulcet Bakers ..: Finance Project B-PlanDocument6 pagesDulcet Bakers ..: Finance Project B-Plan9049444625No ratings yet

- Grocery Stall ProjectDocument8 pagesGrocery Stall Projectmohamed haneefaNo ratings yet

- Copy of Broiler FinancialsDocument5 pagesCopy of Broiler Financialskevior2No ratings yet

- Budget JUANUARY-2020 FEBRUARY-2020 MARCH-2020 APRIL - 2020 May-20Document2 pagesBudget JUANUARY-2020 FEBRUARY-2020 MARCH-2020 APRIL - 2020 May-20ANDREINA ALCALA ARNEDONo ratings yet

- Financial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarDocument4 pagesFinancial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet

- Kelompok 2 - Segment Reporting-1Document8 pagesKelompok 2 - Segment Reporting-1Khansa AuliaNo ratings yet

- Submitted By:-Submitted To: - Name - Govinda DR Dilbag Sir ROLL NO - 191543 Department - DTHMDocument10 pagesSubmitted By:-Submitted To: - Name - Govinda DR Dilbag Sir ROLL NO - 191543 Department - DTHMGovind JaatNo ratings yet

- Monthly (Dec)Document10 pagesMonthly (Dec)Marielle TagardaNo ratings yet

- Bri Managemement Accounting Final PaperDocument27 pagesBri Managemement Accounting Final PaperKathlene JaoNo ratings yet

- BRIMNACCDocument12 pagesBRIMNACCKathlene JaoNo ratings yet

- JEAA Instamart Income StatementDocument1 pageJEAA Instamart Income StatementJEAA InstamartNo ratings yet

- PNL EventDocument2 pagesPNL EventFood & Beverage ARTOTEL OTISTA BANDUNGNo ratings yet

- Profit and Loss Statement - StatementDocument1 pageProfit and Loss Statement - StatementTirta syah putra AlamNo ratings yet

- Earning Money 2Document10 pagesEarning Money 2Thắng NguyễnNo ratings yet

- Be-Desi Chatka: OrgnisationnDocument7 pagesBe-Desi Chatka: OrgnisationnANKIT KUMAR AGARWALNo ratings yet

- Lao Soil & Nutrition Company WhitepaperDocument11 pagesLao Soil & Nutrition Company WhitepaperJulianNo ratings yet

- Academic Club Budget TemplateDocument1 pageAcademic Club Budget Templaterainesiusdohling.iitrNo ratings yet

- Academic Club Budget TemplateDocument1 pageAcademic Club Budget TemplatedanielebenezerNo ratings yet

- Steve (Till Trial Balance Fixed)Document5 pagesSteve (Till Trial Balance Fixed)A StrangerNo ratings yet

- NPO SolutionsDocument6 pagesNPO Solutionswhoaskedx69No ratings yet

- Event Budget TemplateDocument2 pagesEvent Budget Templatekartikeys271No ratings yet

- Achsosa Central Financial Report As at 31ST December, 2021Document7 pagesAchsosa Central Financial Report As at 31ST December, 2021Mohammed KazeemNo ratings yet

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- PartyweekDocument10 pagesPartyweekapi-352464625No ratings yet

- Personnel Household Budgets & Actual SpendingDocument4 pagesPersonnel Household Budgets & Actual Spendingazad121No ratings yet

- Fabm Dipolog Rice MillDocument10 pagesFabm Dipolog Rice Millgamer boyNo ratings yet

- Foundations of Accounting Written Home Assigment Series 1: Assets and LiabilitiesDocument5 pagesFoundations of Accounting Written Home Assigment Series 1: Assets and LiabilitiesThomas GombosNo ratings yet

- UTS-Cost Control Class DDocument2 pagesUTS-Cost Control Class DWilliam SalimNo ratings yet

- Sample Natural Form of Statement of Comprehensive IncomeDocument1 pageSample Natural Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- VBS Income ExpenseDocument1 pageVBS Income ExpensefamilylifechurcheldNo ratings yet

- 24-25 Budget 1st ReadingDocument3 pages24-25 Budget 1st Readingapi-38761527No ratings yet

- Practice - 1 - 2020-2021Document4 pagesPractice - 1 - 2020-2021Musthari KhanNo ratings yet

- APK2Document3 pagesAPK2putu cherline21No ratings yet

- MarticulationDocument3 pagesMarticulationputu cherline21No ratings yet

- Mid Semester Test: Translate at Least 5 of These Accounting Terms Into EnglishDocument4 pagesMid Semester Test: Translate at Least 5 of These Accounting Terms Into Englishputu cherline21No ratings yet

- 17 - Ni Putu Cherline Berliana - Problem 11.1 & 11.8Document6 pages17 - Ni Putu Cherline Berliana - Problem 11.1 & 11.8putu cherline21No ratings yet

- Financial Aspects of Health Care ManagmentDocument20 pagesFinancial Aspects of Health Care ManagmentInderpal SinghNo ratings yet

- 1 - Intro To Financial AccountingDocument20 pages1 - Intro To Financial AccountingChaarLeene SusanöNo ratings yet

- (Esp121) Informal Reports - HandoutDocument45 pages(Esp121) Informal Reports - HandoutLinh Ngô KhánhNo ratings yet

- Sample of Questions With AnswersDocument2 pagesSample of Questions With Answersdoaa alaaNo ratings yet

- 1990 AMG Legal Systems Prototype Text From 1987 Criminal ConspiracyDocument242 pages1990 AMG Legal Systems Prototype Text From 1987 Criminal ConspiracyStan J. CaterboneNo ratings yet

- CA Inter Paper 1 All Question PapersDocument205 pagesCA Inter Paper 1 All Question PapersNivedita SharmaNo ratings yet

- Tutorial Meeting 6Document5 pagesTutorial Meeting 6Ve DekNo ratings yet

- Learning Reflection TaxDocument4 pagesLearning Reflection TaxShamimi ShahNo ratings yet

- Ipsas 18 Segment Reporting 1Document31 pagesIpsas 18 Segment Reporting 1Rutuja KaleNo ratings yet

- LiquidityDocument2 pagesLiquidityibrahimNo ratings yet

- SA520Document12 pagesSA520Laura D'souzaNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Account TitleDocument4 pagesAccount Titleerna Tri CahyaniNo ratings yet

- TAX Summary Lecture (15 May 2021)Document30 pagesTAX Summary Lecture (15 May 2021)rav danoNo ratings yet

- Profitability Turnover RatiosDocument32 pagesProfitability Turnover RatiosAnushka JindalNo ratings yet

- ABC CorporationDocument2 pagesABC CorporationAA BB MMNo ratings yet

- Hotel Management Contracts - To Lease or Not To Lease PDFDocument10 pagesHotel Management Contracts - To Lease or Not To Lease PDFraj tanwarNo ratings yet

- Accountancy Project Ratio AnalysisDocument21 pagesAccountancy Project Ratio AnalysisTanmay ChaitanyaNo ratings yet

- Ratio Analysis Profitability and Turnover RatiosDocument6 pagesRatio Analysis Profitability and Turnover RatiosVaibhav KhokharNo ratings yet

- Executive SummaryDocument23 pagesExecutive SummarySuresh KumarNo ratings yet

- Ibf Project-1 (Analysis Report)Document34 pagesIbf Project-1 (Analysis Report)Hassan AliNo ratings yet

- Craddock Cup SummaryDocument3 pagesCraddock Cup SummaryRaja Hazman Rd100% (1)

- PWC Study Fit For Growth Ecosystems in InsuranceDocument16 pagesPWC Study Fit For Growth Ecosystems in InsuranceFARA100% (1)

- McDonalds Financial Model - (Before Revenue Forecasts)Document55 pagesMcDonalds Financial Model - (Before Revenue Forecasts)Nick JamesNo ratings yet

- Group C - Financial Analysis - FB - Twitter-2Document83 pagesGroup C - Financial Analysis - FB - Twitter-2payprima paytongNo ratings yet

- Acco 30033 Final Departmental Examination February 20 2023 3 PDFDocument43 pagesAcco 30033 Final Departmental Examination February 20 2023 3 PDFssslll2No ratings yet

- Ross 12e PPT Ch02Document6 pagesRoss 12e PPT Ch02Giang HoàngNo ratings yet