Professional Documents

Culture Documents

Tax Unit 1-2 - 14

Tax Unit 1-2 - 14

Uploaded by

joy BoseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Unit 1-2 - 14

Tax Unit 1-2 - 14

Uploaded by

joy BoseCopyright:

Available Formats

Para 47.

2 Salaries

Income-tax

by or on bcha

hall of

b.

any salary paid or allowed to him in the previous year an

or before it became due; and eimp,,

due

mer employer), though not him the prevIOus year by

or o in

any arTcars of salary paid orallowednot charged to

to income-tlax for any

earli

Cmployer (ora former employer),

if

year. previous 1999. ycar

o put it

differently,

the following are

taxable during ihe

although

it is received in a s1uh

during 1999-2000,

1.Salarywhich becomes"due" which will becomc duc masul..

1999-2000 but

which isreceived during ins to

it pertains to one

2Salary ol

1999-2000, although th

3.Any arrears ofsalary received during on due basis].

earlier

were not taxed

years and the same isearlier -Basis

Bas of

on "due"or"receipt" basis whichever is chargeable to ax eithe ha

47.2 Salaryis taxable section 15. Salary

income is fixed by if salary of 2000,

respect of salary earlier. For instance, -011

matures in the total income

of the

oron "receipt"basis, whichever is included previ

it

earlier on "receipt"hae

in advance in 1999-2000, matures

basis (as tax incidence in total incomer lu

1999-2000on "receipt" therefore, salary will not beincluded due in

1996-97 andpr

year 2000-01).

in

isnot relevant On the

this case;

other hand,salary,

in total income

which has

of the previous year

become

1996-97 on "due" basis t1

thes

2000-01, is included, basis is inapplicable; salary, wili, elor

matures earlier on "due" basis, "receipt" Tax is, thus, attracted at i

of tax

previous year

2000-01).

wherea

beincluded in totalincome of the it has been clarified

that

of time. For the removalofdoubt, it cannot char

possible point

in the yearof payment, be subsequently

is assessed

sec. 15). Similarly, salarv paid

if

paid in advance, I to

it becomes due (Erpin.

in the year in which it be taxed again when it is pauc

the past on "due" basis, cannot

has been assessed in

not been assessed on "due" basis ,it is

in arrears has

i

la

2to sec.5]. If, however, salary paid

which it is paid.

in

to be assessed in the year

Method of accountines

adoptedby employeenotrelevant- g ann

47.3 Methodofaccounting fixed by section 15.

vary the basis of charge

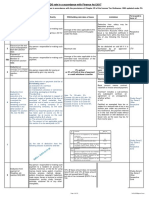

Ld. on the fixedsalary of Rs. 25,000

is in the employment of A

X

47-P1 Uptill June 30, 1999, month. On July 1, I999, joins B LId. X lars

the first day of the next

(s:a

which becomes due"on is

month). Salar actualh,

Pu

un,

which becomes due"onthe last day of each of salary (beforestandard dedue

Rs.30,000 per month Find out the amount clton

month in both cases.

seventh day of the next

to tax for the assessment

year 2000-01.

chargeable

the previous year 1999-2000-

Computation of salary for date or "receipt" date, nount

Due Rs.

Different months whichever is earlier

1999 25,000

April 1,

1. March 1999

May 1, 1999 25,000

2 April

1999

1, 1999

June 25,000

3. May 1999 1999 25,000

July 1,

4. June 1999 30,000

July 31, 1999

5. July 1999

August 31, 1999 30,000

6 August 1999

September 30, 1999 30,000

7.September 1999

October 31, 1999 30,000

& October 1999

1999 30,000

9 November 1999 November 30,

30,000

December 31, 1999

10 December 1999

2000 30,000

January 31,

11. January 2000

30,000

12 February 2000 February 28, 2000

30,000

13. March 2000 March 31, 2000

3,70,000

Total

You might also like

- S4 HANA-1909 FICO ConfigurationDocument224 pagesS4 HANA-1909 FICO ConfigurationUrandi Mendes100% (11)

- Computation Income From SalaryDocument15 pagesComputation Income From SalaryIzma HussainNo ratings yet

- Computation Income From SalaryDocument14 pagesComputation Income From SalaryHajra MalikNo ratings yet

- Income-Tax Law: A Capsule For Quick Recap: Chapter 9: Advance Tax and Tax Deduction at SourceDocument5 pagesIncome-Tax Law: A Capsule For Quick Recap: Chapter 9: Advance Tax and Tax Deduction at Sourcem310235No ratings yet

- TDS 21-22Document25 pagesTDS 21-22dinesh kasnNo ratings yet

- Salary PDFDocument14 pagesSalary PDFNITESH SINGHNo ratings yet

- Referencer For Quick Revision: Intermediate Course Paper-4: TaxationDocument24 pagesReferencer For Quick Revision: Intermediate Course Paper-4: TaxationHinduja KumarNo ratings yet

- Seminar 2 - Heads of ChargeDocument8 pagesSeminar 2 - Heads of ChargeYong Kwang HanNo ratings yet

- DIrect TaxDocument17 pagesDIrect Taxsureshkappe98No ratings yet

- TDS Rate DetailsDocument10 pagesTDS Rate DetailsAsif Assistant ManagerNo ratings yet

- Income From SalariesDocument7 pagesIncome From SalariesSneha PotekarNo ratings yet

- Salary, HPDocument21 pagesSalary, HPNickyta UpadhyayNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitsPaulo Emmanuel SantosNo ratings yet

- PGBP ChartsDocument11 pagesPGBP ChartsMohitNo ratings yet

- Tax Inter Quick Referencer by ICAIDocument17 pagesTax Inter Quick Referencer by ICAITushar kumarNo ratings yet

- Scope of TaxDocument12 pagesScope of TaxHajra MalikNo ratings yet

- Adobe Scan 25-Oct-2023Document7 pagesAdobe Scan 25-Oct-2023Onkar BandichhodeNo ratings yet

- TDS Rates 2021 - 22Document7 pagesTDS Rates 2021 - 22Shantanu BhadkamkarNo ratings yet

- Let Us Recapitulate: I. Tax Deduction at SourceDocument16 pagesLet Us Recapitulate: I. Tax Deduction at SourceVishalNo ratings yet

- Kenya Tax CardDocument2 pagesKenya Tax Cardwebryan2kNo ratings yet

- Advance Taxation (P6) Summary of NoteDocument31 pagesAdvance Taxation (P6) Summary of NoteYivon TeoNo ratings yet

- Adobe Scan Dec 08, 2022Document7 pagesAdobe Scan Dec 08, 2022Durgesh SrivastavaNo ratings yet

- PenaltiesDocument44 pagesPenaltiesabcNo ratings yet

- 1 OcrDocument2 pages1 OcrAbhishek GuptaNo ratings yet

- Form-1770-Attachment I Page 1Document1 pageForm-1770-Attachment I Page 1rover2010No ratings yet

- Referencer For Quick Revision: Intermediate Course Paper-4: TaxationDocument15 pagesReferencer For Quick Revision: Intermediate Course Paper-4: TaxationRamNo ratings yet

- Income TaxDocument4 pagesIncome TaxPULKITNo ratings yet

- Bir Form NO. Title of The Form Description Filing Date Where To FileDocument2 pagesBir Form NO. Title of The Form Description Filing Date Where To FileAb CNo ratings yet

- Ind As 12: Income Taxes: Current Tax Temporary Difference: TaxableDocument2 pagesInd As 12: Income Taxes: Current Tax Temporary Difference: Taxablechandrakumar k pNo ratings yet

- TDS VDS Rate Thorugh FA 2017.pdf 1348997815Document10 pagesTDS VDS Rate Thorugh FA 2017.pdf 1348997815Abu KawcherNo ratings yet

- Reimbursement Claim CircularDocument4 pagesReimbursement Claim CirculargovindNo ratings yet

- IAS 19 NewDocument11 pagesIAS 19 Newsehrish.cmaNo ratings yet

- Module 1 - Introduction To Business TaxesDocument14 pagesModule 1 - Introduction To Business TaxesfrecymaebaraoNo ratings yet

- Current Liabilities (Payroll)Document13 pagesCurrent Liabilities (Payroll)Bona MisbaNo ratings yet

- Deferred Tax ACCA ArticleDocument9 pagesDeferred Tax ACCA ArticleJavid HumbatovNo ratings yet

- Unit II Salary Solutions 22-23Document23 pagesUnit II Salary Solutions 22-23kpnandini12No ratings yet

- Refund ChartDocument1 pageRefund ChartManiGandan CNo ratings yet

- Mind Maps - IFOS - Nikunj GoenkaDocument8 pagesMind Maps - IFOS - Nikunj GoenkaAnkur PattaniNo ratings yet

- Master Sheet On IT DEFINITIONS - SirTariqTunio-1Document3 pagesMaster Sheet On IT DEFINITIONS - SirTariqTunio-1Tooba MaqboolNo ratings yet

- Income: According To Ordinary Concepts and Statutory Income. Income AccordingDocument194 pagesIncome: According To Ordinary Concepts and Statutory Income. Income AccordingHan Ny PhamNo ratings yet

- CLWTAXN Module 4 Principles of Income Taxation (Income Tax Notes) v012024-1Document7 pagesCLWTAXN Module 4 Principles of Income Taxation (Income Tax Notes) v012024-1kdcngan162No ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeHeinie Joy PauleNo ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeSharmaine Clemencio0No ratings yet

- Base Amonut Does Not Exceed-Tk. 50 Lakh/ - 3%. Exceeds 50 Lakh To 2 Crore - 5% Exceeds 2 Crore - 7%Document8 pagesBase Amonut Does Not Exceed-Tk. 50 Lakh/ - 3%. Exceeds 50 Lakh To 2 Crore - 5% Exceeds 2 Crore - 7%Mohammad BaratNo ratings yet

- LossesDocument1 pageLossesRabia SohailNo ratings yet

- Tds N Adv TaxDocument133 pagesTds N Adv TaxanuNo ratings yet

- 71147bos57143 cp9Document147 pages71147bos57143 cp9shivani singhNo ratings yet

- US Internal Revenue Service: I2220 - 1992Document4 pagesUS Internal Revenue Service: I2220 - 1992IRSNo ratings yet

- Deferred Tax Accounting - Lecture NotesDocument6 pagesDeferred Tax Accounting - Lecture Notesmax pNo ratings yet

- Factsheet IAS19 Employee BenefitsDocument15 pagesFactsheet IAS19 Employee BenefitsHamza Fath-dinNo ratings yet

- New TDS & TCS Provisions - SummaryDocument12 pagesNew TDS & TCS Provisions - Summaryyashgoyal87502No ratings yet

- My Sip 2021-22Document28 pagesMy Sip 2021-22Xenqiyj XyenttukNo ratings yet

- Income From SalaryDocument28 pagesIncome From SalarykumarNo ratings yet

- New Income Tax Calculator For Old & New Tax Regime For Salaried EmployeeDocument4 pagesNew Income Tax Calculator For Old & New Tax Regime For Salaried EmployeeKiran KumarNo ratings yet

- PDF 15aug23 0724 SplittedDocument1 pagePDF 15aug23 0724 SplittedAshish ChaudharyNo ratings yet

- Adobe Scan Dec 28, 2022Document6 pagesAdobe Scan Dec 28, 2022Vijay 0011No ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- বাহাদুর বিড়াল (1)Document52 pagesবাহাদুর বিড়াল (1)joy BoseNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- Tax Unit 1-2 - 16Document1 pageTax Unit 1-2 - 16joy BoseNo ratings yet

- ( )Document65 pages( )joy BoseNo ratings yet

- Tax Unit 1-2 - 24Document1 pageTax Unit 1-2 - 24joy BoseNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- Tax Unit 1-2 - 21Document1 pageTax Unit 1-2 - 21joy BoseNo ratings yet

- Tax Unit 1-2 - 15Document1 pageTax Unit 1-2 - 15joy BoseNo ratings yet

- Tax Unit 1-2 - 18Document1 pageTax Unit 1-2 - 18joy BoseNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Tax Unit 1-2 - 22Document1 pageTax Unit 1-2 - 22joy BoseNo ratings yet

- Tax Unit 1-2 - 11Document1 pageTax Unit 1-2 - 11joy BoseNo ratings yet

- Ecom QuesDocument4 pagesEcom Quesjoy BoseNo ratings yet

- Tax Unit 1-2 - 7-8Document2 pagesTax Unit 1-2 - 7-8joy BoseNo ratings yet

- Nonte Fonte DhamakaDocument56 pagesNonte Fonte Dhamakajoy BoseNo ratings yet

- Nonte Fonte La JobabDocument55 pagesNonte Fonte La Jobabjoy BoseNo ratings yet

- Tax Unit 1-2 - 1-2Document2 pagesTax Unit 1-2 - 1-2joy BoseNo ratings yet

- Tax Unit 1-2 - 5-6Document2 pagesTax Unit 1-2 - 5-6joy BoseNo ratings yet

- Tax Unit 1-2 - 12Document1 pageTax Unit 1-2 - 12joy BoseNo ratings yet

- Tax Unit 1-2 - 9-10Document2 pagesTax Unit 1-2 - 9-10joy BoseNo ratings yet

- Tax Unit 1-2 - 3-4Document2 pagesTax Unit 1-2 - 3-4joy BoseNo ratings yet

- Business CommunicationsDocument22 pagesBusiness CommunicationsPrince DiuNo ratings yet

- NFO SBI Multicap Fund 4 Page LeafletDocument4 pagesNFO SBI Multicap Fund 4 Page LeafletAnoop AravindNo ratings yet

- Transport Company Invoice FormatDocument1 pageTransport Company Invoice FormatLokesh RavNo ratings yet

- Multiple Choice QuestionsDocument18 pagesMultiple Choice Questionsnadya erlyNo ratings yet

- FA 2 Chapter 1 Control AccountsDocument19 pagesFA 2 Chapter 1 Control AccountsMhd Amin0% (1)

- Cost Concept and ApplicationDocument11 pagesCost Concept and ApplicationGilbert TiongNo ratings yet

- Four Phases of Business CycleDocument10 pagesFour Phases of Business CycleSiddharth SamantakurthiNo ratings yet

- Status of Ecommerce in NepalDocument4 pagesStatus of Ecommerce in NepalSuraj Thapa100% (1)

- 019 CpaleDocument15 pages019 CpaleJohn DoeNo ratings yet

- Waiver of Interest FormsDocument9 pagesWaiver of Interest FormsJordan MillerNo ratings yet

- Manufacturers Vs MeerDocument4 pagesManufacturers Vs MeerAlandia GaspiNo ratings yet

- In 2015 Laetner Industries Decided To Discontinue Its Laminating DivisionDocument1 pageIn 2015 Laetner Industries Decided To Discontinue Its Laminating DivisionDoreenNo ratings yet

- National Culture Impact On Earnings ManagementDocument38 pagesNational Culture Impact On Earnings ManagementtreatrraNo ratings yet

- Chapter 3 Intermediate AccountingDocument56 pagesChapter 3 Intermediate AccountingMae Ann RaquinNo ratings yet

- Proof of Claim Form-1Document3 pagesProof of Claim Form-1Anonymous oumGYHOx8No ratings yet

- Banks Can't Own Property CASELAWDocument5 pagesBanks Can't Own Property CASELAWthenjhomebuyer100% (1)

- Banque de FranceDocument10 pagesBanque de FranceBianca GabrielaNo ratings yet

- Presented By: URVI SINGH Research Scholar Enrollment Number: 2014PHDCOM003 Supervisor: Dr. RUCHITA VERMA Assistant ProfessorDocument18 pagesPresented By: URVI SINGH Research Scholar Enrollment Number: 2014PHDCOM003 Supervisor: Dr. RUCHITA VERMA Assistant ProfessorHari KrishnaNo ratings yet

- Understanding The T-Bond Tables in The WSJDocument2 pagesUnderstanding The T-Bond Tables in The WSJkwstisx2450No ratings yet

- Answer: D: Statement 2: The Share of A Co-Venturer Corporation in The Net Income of Tax Exempt Joint Venture orDocument3 pagesAnswer: D: Statement 2: The Share of A Co-Venturer Corporation in The Net Income of Tax Exempt Joint Venture orRosemarie CruzNo ratings yet

- City of Oakland Staff Summayr of E. 12th Street DevelopmentDocument18 pagesCity of Oakland Staff Summayr of E. 12th Street DevelopmentKQED NewsNo ratings yet

- Budget Cycle (Budget Accountability) TEAM 1Document43 pagesBudget Cycle (Budget Accountability) TEAM 1Patrick LanceNo ratings yet

- Model-Free Hedge Ratios and Scale-Invariant Models: Carol Alexander, Leonardo M. NogueiraDocument23 pagesModel-Free Hedge Ratios and Scale-Invariant Models: Carol Alexander, Leonardo M. NogueiramshchetkNo ratings yet

- EngEcon InterestDocument9 pagesEngEcon InterestLilet P. DalisayNo ratings yet

- Integrated Report Fy2021Document114 pagesIntegrated Report Fy2021Raghav SawhneyNo ratings yet

- Statement: (Including Pots)Document3 pagesStatement: (Including Pots)13KARATNo ratings yet

- Indium - Overview May 2023Document6 pagesIndium - Overview May 2023Devharsh ToshniwalNo ratings yet

- Consolidation End Solutions Demo in SAP BPCDocument36 pagesConsolidation End Solutions Demo in SAP BPCjoesaranNo ratings yet

- Ms8-Set C Midterm - With AnswersDocument5 pagesMs8-Set C Midterm - With AnswersOscar Bocayes Jr.No ratings yet