Professional Documents

Culture Documents

Tax Unit 1-2 - 15

Tax Unit 1-2 - 15

Uploaded by

joy BoseCopyright:

Available Formats

You might also like

- CHC Exam OutlineDocument69 pagesCHC Exam Outlinevicky100% (2)

- Vir Jen Shipping and Marine Services vs. NLRC 1983 Case DigestDocument1 pageVir Jen Shipping and Marine Services vs. NLRC 1983 Case DigestMelissa Marinduque100% (1)

- Machiavelli Chapter 17Document9 pagesMachiavelli Chapter 17KhooBengKiatNo ratings yet

- TDS On Commission To Non ResidentDocument6 pagesTDS On Commission To Non ResidentAdityaNo ratings yet

- KPMG Flash News Texas Instruments India PVT LTD 2Document5 pagesKPMG Flash News Texas Instruments India PVT LTD 2ABHIJEET CHAKRABORTY RCBSNo ratings yet

- Capsule It PDFDocument25 pagesCapsule It PDFGiri SukumarNo ratings yet

- International Taxation: A Capsule For Quick RecapDocument16 pagesInternational Taxation: A Capsule For Quick RecapShubham jindalNo ratings yet

- Principles of Taxation Law - (Week 6)Document56 pagesPrinciples of Taxation Law - (Week 6)ishikakeswani4No ratings yet

- EXEMPT INCOME (Section 10) : Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument11 pagesEXEMPT INCOME (Section 10) : Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionanarghyahsNo ratings yet

- Taxation Direct Tax Code Assignment 2: SUBMITTED TO: Mrs. Ranjani Matta SUBMITTED BY: Shalini MahawarDocument6 pagesTaxation Direct Tax Code Assignment 2: SUBMITTED TO: Mrs. Ranjani Matta SUBMITTED BY: Shalini MahawarShalini MahawarNo ratings yet

- Salary Part 1Document4 pagesSalary Part 1887 shivam guptaNo ratings yet

- Income Under Head SalariesDocument8 pagesIncome Under Head Salaries887 shivam guptaNo ratings yet

- Definition of SalaryDocument2 pagesDefinition of SalaryJaikishan FabyaniNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- Presentation On Residential Status & Its Incidence On Tax LiabilityDocument13 pagesPresentation On Residential Status & Its Incidence On Tax LiabilitypriyaniNo ratings yet

- Unit IVDocument23 pagesUnit IVDeepak PantNo ratings yet

- Appendix A GehnsDocument3 pagesAppendix A GehnsDevraj DashNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document10 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Kiruthika nagarajanNo ratings yet

- Allowances Allowable To Tax PayerDocument13 pagesAllowances Allowable To Tax PayerbabakababaNo ratings yet

- Treatment of Income From Different Sources Whole Income Tax CoverageDocument58 pagesTreatment of Income From Different Sources Whole Income Tax CoverageAkash BhardwajNo ratings yet

- Income Tax DepartmentDocument14 pagesIncome Tax DepartmentSuman MeenaNo ratings yet

- 5.residence and Tax Liability (Calculation of Taxable Income) PDFDocument1 page5.residence and Tax Liability (Calculation of Taxable Income) PDFDEV BHARGAVANo ratings yet

- Section 9 of Income Tax Act 1961Document55 pagesSection 9 of Income Tax Act 1961Bharath SimhaReddyNaiduNo ratings yet

- Residential Status - May 2024 & Nov 2024Document2 pagesResidential Status - May 2024 & Nov 2024Rahul NegiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document9 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Daniel DasNo ratings yet

- Taxability of 401K and IRADocument2 pagesTaxability of 401K and IRAcivilion.srs.shahNo ratings yet

- Salary and Its Tax Treatment in IndiaDocument20 pagesSalary and Its Tax Treatment in IndiaParth PandeyNo ratings yet

- 182 Day in PY (2022-2023) : and 365 Days in 4 PPY (2018 - 2022)Document13 pages182 Day in PY (2022-2023) : and 365 Days in 4 PPY (2018 - 2022)nadiyakadri246No ratings yet

- Residential Status and Taxation For Individuals - Taxguru - inDocument2 pagesResidential Status and Taxation For Individuals - Taxguru - inSubhamNo ratings yet

- Back To Basics Series - Section 4, 5, 6 and 9 - SIRC of ICAIDocument59 pagesBack To Basics Series - Section 4, 5, 6 and 9 - SIRC of ICAISangeetha NaharNo ratings yet

- TDS Rates 2021 - 22Document7 pagesTDS Rates 2021 - 22Shantanu BhadkamkarNo ratings yet

- Form PDF 500272630130921Document6 pagesForm PDF 500272630130921Technical Section- Sr.DEE/G/ASNNo ratings yet

- Wealth Tax InterDocument66 pagesWealth Tax IntersamstarmoonNo ratings yet

- Social Security in India An Overview v9Document19 pagesSocial Security in India An Overview v9bengaltigerNo ratings yet

- Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument15 pagesSection Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionPrashant GavadeNo ratings yet

- Exempted IncomeDocument6 pagesExempted Incomeshyam visanaNo ratings yet

- Sec 195 Gandhidham BR of WIRC of ICAIDocument19 pagesSec 195 Gandhidham BR of WIRC of ICAIरायटर लेखनवालाNo ratings yet

- Taxation of Cross Border Mergers and Acquisitions: D. Satya Siva Darshan, Iv LL.B, Ils Law College, PuneDocument23 pagesTaxation of Cross Border Mergers and Acquisitions: D. Satya Siva Darshan, Iv LL.B, Ils Law College, PuneD.Satya Siva DarshanNo ratings yet

- 50,000 Regarding Taxability ofDocument1 page50,000 Regarding Taxability ofmshashi5No ratings yet

- Income Deemed To Arise in IndiaDocument7 pagesIncome Deemed To Arise in IndiaDebaNo ratings yet

- Short Notes of Residential StatusDocument3 pagesShort Notes of Residential StatusutsavNo ratings yet

- Taxable On Receipt Basis No Deduction and No Loss Adjustment Against SalaryDocument3 pagesTaxable On Receipt Basis No Deduction and No Loss Adjustment Against SalaryAli FarooqNo ratings yet

- Amendments To The Finance Bill, 2020, As Passed by The Lok SabhaDocument14 pagesAmendments To The Finance Bill, 2020, As Passed by The Lok SabhaKARTHIK ANo ratings yet

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax Incidenceambarishan mrNo ratings yet

- Income Tax DepartmentDocument19 pagesIncome Tax DepartmentSharathNo ratings yet

- Corporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)Document10 pagesCorporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)imamNo ratings yet

- Income Tax DepartmentDocument22 pagesIncome Tax DepartmentAkash GuptaNo ratings yet

- Air India B777 Captain Brief - Dec 2022Document2 pagesAir India B777 Captain Brief - Dec 2022gujkmmnhNo ratings yet

- Residential Status and Incidence of Tax - Study MaterialDocument6 pagesResidential Status and Incidence of Tax - Study MaterialEmeline SoroNo ratings yet

- 01 Section 9Document54 pages01 Section 9ABHIJEETNo ratings yet

- Lec 3 SalaryDocument28 pagesLec 3 SalaryManasi PatilNo ratings yet

- Computation Income From SalaryDocument14 pagesComputation Income From SalaryHajra MalikNo ratings yet

- Computation Income From SalaryDocument15 pagesComputation Income From SalaryIzma HussainNo ratings yet

- Income From Salaries: 1. Employer-Employee RelationshipDocument25 pagesIncome From Salaries: 1. Employer-Employee RelationshipNanadan S NandaNo ratings yet

- TDS 21-22Document25 pagesTDS 21-22dinesh kasnNo ratings yet

- Acrobat DocumentDocument117 pagesAcrobat DocumentAchulendra Ji PushkarNo ratings yet

- Form PDF 779696090311221Document6 pagesForm PDF 779696090311221Sumit SainiNo ratings yet

- Tax NotesDocument11 pagesTax NotesVishal DeshwalNo ratings yet

- Income From HPDocument17 pagesIncome From HPaKSHAT sHARMANo ratings yet

- TDS On OTADocument4 pagesTDS On OTAabcxyznoneNo ratings yet

- Offer LetterDocument1 pageOffer Lettertoughguy_850No ratings yet

- ( )Document65 pages( )joy BoseNo ratings yet

- বাহাদুর বিড়াল (1)Document52 pagesবাহাদুর বিড়াল (1)joy BoseNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- Tax Unit 1-2 - 24Document1 pageTax Unit 1-2 - 24joy BoseNo ratings yet

- Tax Unit 1-2 - 21Document1 pageTax Unit 1-2 - 21joy BoseNo ratings yet

- Tax Unit 1-2 - 22Document1 pageTax Unit 1-2 - 22joy BoseNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- Tax Unit 1-2 - 18Document1 pageTax Unit 1-2 - 18joy BoseNo ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- Tax Unit 1-2 - 16Document1 pageTax Unit 1-2 - 16joy BoseNo ratings yet

- Tax Unit 1-2 - 12Document1 pageTax Unit 1-2 - 12joy BoseNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Tax Unit 1-2 - 11Document1 pageTax Unit 1-2 - 11joy BoseNo ratings yet

- Tax Unit 1-2 - 14Document1 pageTax Unit 1-2 - 14joy BoseNo ratings yet

- Tax Unit 1-2 - 1-2Document2 pagesTax Unit 1-2 - 1-2joy BoseNo ratings yet

- Tax Unit 1-2 - 7-8Document2 pagesTax Unit 1-2 - 7-8joy BoseNo ratings yet

- Tax Unit 1-2 - 9-10Document2 pagesTax Unit 1-2 - 9-10joy BoseNo ratings yet

- Tax Unit 1-2 - 5-6Document2 pagesTax Unit 1-2 - 5-6joy BoseNo ratings yet

- Tax Unit 1-2 - 3-4Document2 pagesTax Unit 1-2 - 3-4joy BoseNo ratings yet

- Ecom QuesDocument4 pagesEcom Quesjoy BoseNo ratings yet

- Nonte Fonte DhamakaDocument56 pagesNonte Fonte Dhamakajoy BoseNo ratings yet

- Nonte Fonte La JobabDocument55 pagesNonte Fonte La Jobabjoy BoseNo ratings yet

- Srimanigandan MM Resume HR OperationsDocument2 pagesSrimanigandan MM Resume HR OperationsSrimanigandan Madurai MuthuramalingamNo ratings yet

- Quality Circles and Total Quality-A Case study-NCDocument9 pagesQuality Circles and Total Quality-A Case study-NCabuchoriNo ratings yet

- Alpari Limited AmlDocument7 pagesAlpari Limited AmlFlavianaAbreuNo ratings yet

- How To Conduct A Good InterviewDocument6 pagesHow To Conduct A Good InterviewUmmeAaiman100% (1)

- A Project Report On TaxationDocument71 pagesA Project Report On TaxationHveeeeNo ratings yet

- Gul AhmedDocument7 pagesGul AhmedSwiff CeoNo ratings yet

- Romania's Urban Architectural Heritage: Between Neglect and RevitalizationDocument20 pagesRomania's Urban Architectural Heritage: Between Neglect and RevitalizationRadu GalNo ratings yet

- Ac4012 Ch1 Accounting ConceptDocument68 pagesAc4012 Ch1 Accounting ConceptYin LiuNo ratings yet

- Project Human Resource Development: "Apple"Document16 pagesProject Human Resource Development: "Apple"cjksdbvjkcsbNo ratings yet

- Chapter 1 and Chapter 2Document10 pagesChapter 1 and Chapter 2Robie Jean Malacura PriegoNo ratings yet

- Research ProjectDocument65 pagesResearch Projectfila488No ratings yet

- World Bank PensionDocument8 pagesWorld Bank PensionroymalpicarNo ratings yet

- Abhinav Reddy Quality of Work Life at HDFC BankDocument79 pagesAbhinav Reddy Quality of Work Life at HDFC BankSri0% (1)

- Organizational Creativity and Innovation Institutional Affiliation Students Name DateDocument14 pagesOrganizational Creativity and Innovation Institutional Affiliation Students Name DateJoseph KariukiNo ratings yet

- MAS 4 GROUP 2 Business Ethics ADocument23 pagesMAS 4 GROUP 2 Business Ethics ASadile May KayeNo ratings yet

- Revision Cards (NEBOSH)Document44 pagesRevision Cards (NEBOSH)Sardar Majid80% (5)

- Preparing Students For Their Future Accounting Careers PDFDocument15 pagesPreparing Students For Their Future Accounting Careers PDFakituchNo ratings yet

- Economic Geology and Mining Economics: Example QuestionsDocument12 pagesEconomic Geology and Mining Economics: Example QuestionsGabriel Gurrea MatusNo ratings yet

- Toast Payroll Cheat SheetDocument2 pagesToast Payroll Cheat SheetRubbert CoolNo ratings yet

- Ministry of Co-Operative Development & MarketingDocument20 pagesMinistry of Co-Operative Development & MarketingNabeel Ahmed KhanNo ratings yet

- United States Court of Appeals, Fifth CircuitDocument11 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsNo ratings yet

- Hudson Meridian Defects and Due Diligence. Fact Sheet On Letterhead 1-9-16Document4 pagesHudson Meridian Defects and Due Diligence. Fact Sheet On Letterhead 1-9-16John CarterNo ratings yet

- SMM2Document139 pagesSMM2Shazwan Taib0% (1)

- Assignment 2 Front SheetDocument17 pagesAssignment 2 Front SheetPhanh NguyễnNo ratings yet

- GMAT Practice Set 13 - VerbalDocument73 pagesGMAT Practice Set 13 - VerbalKaplanGMATNo ratings yet

- Royal Crown vs. NLRCDocument1 pageRoyal Crown vs. NLRCJolynne Anne GaticaNo ratings yet

- My Lsbu CourseworkDocument8 pagesMy Lsbu Courseworkf5de9mre100% (2)

Tax Unit 1-2 - 15

Tax Unit 1-2 - 15

Uploaded by

joy BoseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Unit 1-2 - 15

Tax Unit 1-2 - 15

Uploaded by

joy BoseCopyright:

Available Formats

Leave

salary

Para 49.8

ofsalaryincome

of accrual [Sec.9(1)]

Place under the head""Salaris" is

ncosDect of deemed to

e ered in Indiawhich it accruesis accrueor arisrise at the

is rendered. Under place where the

deemed to section

sicerer or hayable alter the

accrue or arise in 9(1Xi), salary ini respect of

India, even if it is

paid contract of dia

or is is deemed to id outside

paid

a accrue in India, il itemployment

is

in India

comes to an end. Pension

paida eave salary paid abroad in paid in

respect of leave respect of services ndercd in India.

carned in India is rend

in India. deemed to accrueor

to the rule -

arise

Section9()(ii),

aEroeptiosoffthis se

this section, however,makes a

virtue salary paid by the Indian departure to the aforesaid

By .orarise in India Government to anIndian rule,

even if service is national is

1oaccrue.1ijd areapplicable only in rendered outside

India. deemed

respect of Deeming provisions o

paid/allowed by the Government salary and not in respect of

to Indian allowances and

tes are national

exempt under section working abroad as sucn

ns of section 10(7) [see para 50.5|

Theprovis (1(i)/(ii) are summarized below

servce is rendered). (i* is assumed

that salary is

where paid at the place

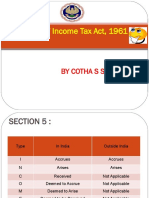

Who is employee Who is

employer Where service It is taxable in India

is

rendered

Salary Allowance/

1 Indian citizen (resident perquisite

Case Government

or non-resident) Outside India

of India Yes No

Case 2 Non-resident (but not

Any

covered by Case 1) Outside India No No

Case 3 Resident and ordinarily Any

resident (butother than Anywhere Yes Yes

Case 1)

ate

Na :Incase1,salary is taxable by virtue of

section

of section 10( 7. 9(! )(i)and allowanceand

as per the provisions perquisites arenot taxable

Tax treatment of different forms of salary

income

49. Basic salary anddearness pay are

charged to tax undersection 15. Tax

treatment of other

receiptsisgiven below:

49.1 Advance salary [Sec. -

17(1)(v)] Advance salary is taxable on

assessment year relevant tothe receipt basis, in the

previous year in which it is received,

incidence of taxin the hands the irrespective of the

of employee. Therecipientcan, however,claim relief in termns

ofsection89(1) read with rule 21A

[see para 60.1]. A loan taken from

of this section. employer is outside the

scope

49.2 t

Arrear salary - is taxable on

receipt basis, if the same has not been

earlier on due basis. Inthis case also subjected to tax

recipient can claim relief under section

rule 21A [seepara 60.1 89(1) read with

49.3 Leave salary- As per service rules,an

to earn leave in the first instance and

employeegets differentleaves. An employeehas

only when he has leave to his credit, he can

leave. If a leave apply for

(standing to his credit) is not taken within a

year, as per the service rules it

may lapse orit may be encashed orit may be accumulated. The accumulated

leaves standing

the credit of an employee may be availed by the

to

to

employeeduring his service time or,

subject service rules,such leaves may be encashed at the time of

retirement or leaving the

Job. Encashmentof leave by surrendering leave standing to one's credit is known as

"leave

salary".

Tax Itis given below:

treatment-

Leave encashment during continuity of employment -If leave encashment is received

aurning the continuity of employment,it is

chargeable to tax, irrespective of the fact whether

employee is in Government service orprivate service.The employeecan however,claim

relief in terms

of section 89(1).

You might also like

- CHC Exam OutlineDocument69 pagesCHC Exam Outlinevicky100% (2)

- Vir Jen Shipping and Marine Services vs. NLRC 1983 Case DigestDocument1 pageVir Jen Shipping and Marine Services vs. NLRC 1983 Case DigestMelissa Marinduque100% (1)

- Machiavelli Chapter 17Document9 pagesMachiavelli Chapter 17KhooBengKiatNo ratings yet

- TDS On Commission To Non ResidentDocument6 pagesTDS On Commission To Non ResidentAdityaNo ratings yet

- KPMG Flash News Texas Instruments India PVT LTD 2Document5 pagesKPMG Flash News Texas Instruments India PVT LTD 2ABHIJEET CHAKRABORTY RCBSNo ratings yet

- Capsule It PDFDocument25 pagesCapsule It PDFGiri SukumarNo ratings yet

- International Taxation: A Capsule For Quick RecapDocument16 pagesInternational Taxation: A Capsule For Quick RecapShubham jindalNo ratings yet

- Principles of Taxation Law - (Week 6)Document56 pagesPrinciples of Taxation Law - (Week 6)ishikakeswani4No ratings yet

- EXEMPT INCOME (Section 10) : Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument11 pagesEXEMPT INCOME (Section 10) : Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionanarghyahsNo ratings yet

- Taxation Direct Tax Code Assignment 2: SUBMITTED TO: Mrs. Ranjani Matta SUBMITTED BY: Shalini MahawarDocument6 pagesTaxation Direct Tax Code Assignment 2: SUBMITTED TO: Mrs. Ranjani Matta SUBMITTED BY: Shalini MahawarShalini MahawarNo ratings yet

- Salary Part 1Document4 pagesSalary Part 1887 shivam guptaNo ratings yet

- Income Under Head SalariesDocument8 pagesIncome Under Head Salaries887 shivam guptaNo ratings yet

- Definition of SalaryDocument2 pagesDefinition of SalaryJaikishan FabyaniNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- Presentation On Residential Status & Its Incidence On Tax LiabilityDocument13 pagesPresentation On Residential Status & Its Incidence On Tax LiabilitypriyaniNo ratings yet

- Unit IVDocument23 pagesUnit IVDeepak PantNo ratings yet

- Appendix A GehnsDocument3 pagesAppendix A GehnsDevraj DashNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document10 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Kiruthika nagarajanNo ratings yet

- Allowances Allowable To Tax PayerDocument13 pagesAllowances Allowable To Tax PayerbabakababaNo ratings yet

- Treatment of Income From Different Sources Whole Income Tax CoverageDocument58 pagesTreatment of Income From Different Sources Whole Income Tax CoverageAkash BhardwajNo ratings yet

- Income Tax DepartmentDocument14 pagesIncome Tax DepartmentSuman MeenaNo ratings yet

- 5.residence and Tax Liability (Calculation of Taxable Income) PDFDocument1 page5.residence and Tax Liability (Calculation of Taxable Income) PDFDEV BHARGAVANo ratings yet

- Section 9 of Income Tax Act 1961Document55 pagesSection 9 of Income Tax Act 1961Bharath SimhaReddyNaiduNo ratings yet

- Residential Status - May 2024 & Nov 2024Document2 pagesResidential Status - May 2024 & Nov 2024Rahul NegiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document9 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Daniel DasNo ratings yet

- Taxability of 401K and IRADocument2 pagesTaxability of 401K and IRAcivilion.srs.shahNo ratings yet

- Salary and Its Tax Treatment in IndiaDocument20 pagesSalary and Its Tax Treatment in IndiaParth PandeyNo ratings yet

- 182 Day in PY (2022-2023) : and 365 Days in 4 PPY (2018 - 2022)Document13 pages182 Day in PY (2022-2023) : and 365 Days in 4 PPY (2018 - 2022)nadiyakadri246No ratings yet

- Residential Status and Taxation For Individuals - Taxguru - inDocument2 pagesResidential Status and Taxation For Individuals - Taxguru - inSubhamNo ratings yet

- Back To Basics Series - Section 4, 5, 6 and 9 - SIRC of ICAIDocument59 pagesBack To Basics Series - Section 4, 5, 6 and 9 - SIRC of ICAISangeetha NaharNo ratings yet

- TDS Rates 2021 - 22Document7 pagesTDS Rates 2021 - 22Shantanu BhadkamkarNo ratings yet

- Form PDF 500272630130921Document6 pagesForm PDF 500272630130921Technical Section- Sr.DEE/G/ASNNo ratings yet

- Wealth Tax InterDocument66 pagesWealth Tax IntersamstarmoonNo ratings yet

- Social Security in India An Overview v9Document19 pagesSocial Security in India An Overview v9bengaltigerNo ratings yet

- Section Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionDocument15 pagesSection Eligible Assessee Type of Income Limits Conditions For Claiming ExemptionPrashant GavadeNo ratings yet

- Exempted IncomeDocument6 pagesExempted Incomeshyam visanaNo ratings yet

- Sec 195 Gandhidham BR of WIRC of ICAIDocument19 pagesSec 195 Gandhidham BR of WIRC of ICAIरायटर लेखनवालाNo ratings yet

- Taxation of Cross Border Mergers and Acquisitions: D. Satya Siva Darshan, Iv LL.B, Ils Law College, PuneDocument23 pagesTaxation of Cross Border Mergers and Acquisitions: D. Satya Siva Darshan, Iv LL.B, Ils Law College, PuneD.Satya Siva DarshanNo ratings yet

- 50,000 Regarding Taxability ofDocument1 page50,000 Regarding Taxability ofmshashi5No ratings yet

- Income Deemed To Arise in IndiaDocument7 pagesIncome Deemed To Arise in IndiaDebaNo ratings yet

- Short Notes of Residential StatusDocument3 pagesShort Notes of Residential StatusutsavNo ratings yet

- Taxable On Receipt Basis No Deduction and No Loss Adjustment Against SalaryDocument3 pagesTaxable On Receipt Basis No Deduction and No Loss Adjustment Against SalaryAli FarooqNo ratings yet

- Amendments To The Finance Bill, 2020, As Passed by The Lok SabhaDocument14 pagesAmendments To The Finance Bill, 2020, As Passed by The Lok SabhaKARTHIK ANo ratings yet

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax Incidenceambarishan mrNo ratings yet

- Income Tax DepartmentDocument19 pagesIncome Tax DepartmentSharathNo ratings yet

- Corporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)Document10 pagesCorporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)imamNo ratings yet

- Income Tax DepartmentDocument22 pagesIncome Tax DepartmentAkash GuptaNo ratings yet

- Air India B777 Captain Brief - Dec 2022Document2 pagesAir India B777 Captain Brief - Dec 2022gujkmmnhNo ratings yet

- Residential Status and Incidence of Tax - Study MaterialDocument6 pagesResidential Status and Incidence of Tax - Study MaterialEmeline SoroNo ratings yet

- 01 Section 9Document54 pages01 Section 9ABHIJEETNo ratings yet

- Lec 3 SalaryDocument28 pagesLec 3 SalaryManasi PatilNo ratings yet

- Computation Income From SalaryDocument14 pagesComputation Income From SalaryHajra MalikNo ratings yet

- Computation Income From SalaryDocument15 pagesComputation Income From SalaryIzma HussainNo ratings yet

- Income From Salaries: 1. Employer-Employee RelationshipDocument25 pagesIncome From Salaries: 1. Employer-Employee RelationshipNanadan S NandaNo ratings yet

- TDS 21-22Document25 pagesTDS 21-22dinesh kasnNo ratings yet

- Acrobat DocumentDocument117 pagesAcrobat DocumentAchulendra Ji PushkarNo ratings yet

- Form PDF 779696090311221Document6 pagesForm PDF 779696090311221Sumit SainiNo ratings yet

- Tax NotesDocument11 pagesTax NotesVishal DeshwalNo ratings yet

- Income From HPDocument17 pagesIncome From HPaKSHAT sHARMANo ratings yet

- TDS On OTADocument4 pagesTDS On OTAabcxyznoneNo ratings yet

- Offer LetterDocument1 pageOffer Lettertoughguy_850No ratings yet

- ( )Document65 pages( )joy BoseNo ratings yet

- বাহাদুর বিড়াল (1)Document52 pagesবাহাদুর বিড়াল (1)joy BoseNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- Tax Unit 1-2 - 24Document1 pageTax Unit 1-2 - 24joy BoseNo ratings yet

- Tax Unit 1-2 - 21Document1 pageTax Unit 1-2 - 21joy BoseNo ratings yet

- Tax Unit 1-2 - 22Document1 pageTax Unit 1-2 - 22joy BoseNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- Tax Unit 1-2 - 18Document1 pageTax Unit 1-2 - 18joy BoseNo ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- Tax Unit 1-2 - 16Document1 pageTax Unit 1-2 - 16joy BoseNo ratings yet

- Tax Unit 1-2 - 12Document1 pageTax Unit 1-2 - 12joy BoseNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Tax Unit 1-2 - 11Document1 pageTax Unit 1-2 - 11joy BoseNo ratings yet

- Tax Unit 1-2 - 14Document1 pageTax Unit 1-2 - 14joy BoseNo ratings yet

- Tax Unit 1-2 - 1-2Document2 pagesTax Unit 1-2 - 1-2joy BoseNo ratings yet

- Tax Unit 1-2 - 7-8Document2 pagesTax Unit 1-2 - 7-8joy BoseNo ratings yet

- Tax Unit 1-2 - 9-10Document2 pagesTax Unit 1-2 - 9-10joy BoseNo ratings yet

- Tax Unit 1-2 - 5-6Document2 pagesTax Unit 1-2 - 5-6joy BoseNo ratings yet

- Tax Unit 1-2 - 3-4Document2 pagesTax Unit 1-2 - 3-4joy BoseNo ratings yet

- Ecom QuesDocument4 pagesEcom Quesjoy BoseNo ratings yet

- Nonte Fonte DhamakaDocument56 pagesNonte Fonte Dhamakajoy BoseNo ratings yet

- Nonte Fonte La JobabDocument55 pagesNonte Fonte La Jobabjoy BoseNo ratings yet

- Srimanigandan MM Resume HR OperationsDocument2 pagesSrimanigandan MM Resume HR OperationsSrimanigandan Madurai MuthuramalingamNo ratings yet

- Quality Circles and Total Quality-A Case study-NCDocument9 pagesQuality Circles and Total Quality-A Case study-NCabuchoriNo ratings yet

- Alpari Limited AmlDocument7 pagesAlpari Limited AmlFlavianaAbreuNo ratings yet

- How To Conduct A Good InterviewDocument6 pagesHow To Conduct A Good InterviewUmmeAaiman100% (1)

- A Project Report On TaxationDocument71 pagesA Project Report On TaxationHveeeeNo ratings yet

- Gul AhmedDocument7 pagesGul AhmedSwiff CeoNo ratings yet

- Romania's Urban Architectural Heritage: Between Neglect and RevitalizationDocument20 pagesRomania's Urban Architectural Heritage: Between Neglect and RevitalizationRadu GalNo ratings yet

- Ac4012 Ch1 Accounting ConceptDocument68 pagesAc4012 Ch1 Accounting ConceptYin LiuNo ratings yet

- Project Human Resource Development: "Apple"Document16 pagesProject Human Resource Development: "Apple"cjksdbvjkcsbNo ratings yet

- Chapter 1 and Chapter 2Document10 pagesChapter 1 and Chapter 2Robie Jean Malacura PriegoNo ratings yet

- Research ProjectDocument65 pagesResearch Projectfila488No ratings yet

- World Bank PensionDocument8 pagesWorld Bank PensionroymalpicarNo ratings yet

- Abhinav Reddy Quality of Work Life at HDFC BankDocument79 pagesAbhinav Reddy Quality of Work Life at HDFC BankSri0% (1)

- Organizational Creativity and Innovation Institutional Affiliation Students Name DateDocument14 pagesOrganizational Creativity and Innovation Institutional Affiliation Students Name DateJoseph KariukiNo ratings yet

- MAS 4 GROUP 2 Business Ethics ADocument23 pagesMAS 4 GROUP 2 Business Ethics ASadile May KayeNo ratings yet

- Revision Cards (NEBOSH)Document44 pagesRevision Cards (NEBOSH)Sardar Majid80% (5)

- Preparing Students For Their Future Accounting Careers PDFDocument15 pagesPreparing Students For Their Future Accounting Careers PDFakituchNo ratings yet

- Economic Geology and Mining Economics: Example QuestionsDocument12 pagesEconomic Geology and Mining Economics: Example QuestionsGabriel Gurrea MatusNo ratings yet

- Toast Payroll Cheat SheetDocument2 pagesToast Payroll Cheat SheetRubbert CoolNo ratings yet

- Ministry of Co-Operative Development & MarketingDocument20 pagesMinistry of Co-Operative Development & MarketingNabeel Ahmed KhanNo ratings yet

- United States Court of Appeals, Fifth CircuitDocument11 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsNo ratings yet

- Hudson Meridian Defects and Due Diligence. Fact Sheet On Letterhead 1-9-16Document4 pagesHudson Meridian Defects and Due Diligence. Fact Sheet On Letterhead 1-9-16John CarterNo ratings yet

- SMM2Document139 pagesSMM2Shazwan Taib0% (1)

- Assignment 2 Front SheetDocument17 pagesAssignment 2 Front SheetPhanh NguyễnNo ratings yet

- GMAT Practice Set 13 - VerbalDocument73 pagesGMAT Practice Set 13 - VerbalKaplanGMATNo ratings yet

- Royal Crown vs. NLRCDocument1 pageRoyal Crown vs. NLRCJolynne Anne GaticaNo ratings yet

- My Lsbu CourseworkDocument8 pagesMy Lsbu Courseworkf5de9mre100% (2)