Professional Documents

Culture Documents

Tax Unit 1-2 - 21

Tax Unit 1-2 - 21

Uploaded by

joy BoseCopyright:

Available Formats

You might also like

- Ein Macon Storage, LLCDocument2 pagesEin Macon Storage, LLCminhdang03062017No ratings yet

- Other Percentage TaxDocument3 pagesOther Percentage TaxHafi DisoNo ratings yet

- Transfer Receipt PDFDocument2 pagesTransfer Receipt PDFKahinur KarimNo ratings yet

- PDFDocument2 pagesPDFLIMNo ratings yet

- Tort IIDocument2 pagesTort IIchristinelim241004No ratings yet

- Laws & Ethics: Cma InterDocument120 pagesLaws & Ethics: Cma InterNayanNo ratings yet

- immovable propertyDocument1 pageimmovable propertyABISHEKNo ratings yet

- 3 5 15 TPI Inspection Properly Maintained Regularly Maintained InspectionDocument5 pages3 5 15 TPI Inspection Properly Maintained Regularly Maintained InspectionMDR PRAPHUNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Clubbing of IncomeDocument4 pagesClubbing of Incomeapi-3832224100% (1)

- 415 MinicasesDocument5 pages415 MinicasesNikita DaceraNo ratings yet

- Property Law 2020 UP BOC 1Document83 pagesProperty Law 2020 UP BOC 1Common TaoNo ratings yet

- CFR 2020 Title30 Vol1 Part77 SubpartNDocument5 pagesCFR 2020 Title30 Vol1 Part77 SubpartNNtambo KabekeNo ratings yet

- Building Construction Act, 1952Document19 pagesBuilding Construction Act, 1952majedulquaderNo ratings yet

- The Tenant Emancipation Law Presidential Decree No.: Hers" The Title and OwnershDocument7 pagesThe Tenant Emancipation Law Presidential Decree No.: Hers" The Title and OwnershRiaNo ratings yet

- Pune Prebid Query MSIDC EOD ReplytoPrebidQueryDocument239 pagesPune Prebid Query MSIDC EOD ReplytoPrebidQueryBharath MadimalaNo ratings yet

- Detail Work Position of Under Construction 132 D/C: Package 1: Firm NameDocument8 pagesDetail Work Position of Under Construction 132 D/C: Package 1: Firm NamehiNo ratings yet

- TopaDocument268 pagesTopachotu shahNo ratings yet

- Ca Inter Live Class 10Document4 pagesCa Inter Live Class 10Vranda AroraNo ratings yet

- Right To Fair Compensation - Land LawsDocument2 pagesRight To Fair Compensation - Land LawsShaikh Adeeba QureshiNo ratings yet

- Adobe Scan Nov 11, 2021Document5 pagesAdobe Scan Nov 11, 2021Asmita DivekarNo ratings yet

- Contractual Time Bars - General Conditions of The FTDTC - 2017 - RED BOOKDocument6 pagesContractual Time Bars - General Conditions of The FTDTC - 2017 - RED BOOKben hurNo ratings yet

- Merge MiningDocument13 pagesMerge MiningAdityaNo ratings yet

- CG 3Document9 pagesCG 3Arnav MishraNo ratings yet

- Building Construction: Table 3 Seismic-And Wind-Resistant Design Criteria Fig. 5 Floor PlanDocument1 pageBuilding Construction: Table 3 Seismic-And Wind-Resistant Design Criteria Fig. 5 Floor PlanAnh Quoc VuNo ratings yet

- HCT Prices Item Description Civil Work Site Construction & ErectionDocument2 pagesHCT Prices Item Description Civil Work Site Construction & Erectionbiruhtesfaye4No ratings yet

- Loadline Convention 1966 2Document1 pageLoadline Convention 1966 2AARON LOBONo ratings yet

- Tax Law AssgimentDocument8 pagesTax Law AssgimentGopan NishantNo ratings yet

- Vol. 49, February 28, 1973 5: Abeleda vs. Court of Firs Instance of BaguioDocument1 pageVol. 49, February 28, 1973 5: Abeleda vs. Court of Firs Instance of BaguioEmeNo ratings yet

- Minor Sheet 1Document1 pageMinor Sheet 1Sanal SamsonNo ratings yet

- LWDC-Non-Fatal (D-PPR, BU-Rani Bagh) Dated 25.01.2024Document2 pagesLWDC-Non-Fatal (D-PPR, BU-Rani Bagh) Dated 25.01.2024hladolflerhit01No ratings yet

- All About Section 54, 54B, 54D, 54F, 54GA, 54EC, 54G & 54GB - Taxguru - inDocument6 pagesAll About Section 54, 54B, 54D, 54F, 54GA, 54EC, 54G & 54GB - Taxguru - inNasimNo ratings yet

- Estimate For Samsipora RUB RampDocument1 pageEstimate For Samsipora RUB Rampapi-3823524No ratings yet

- 2 Vibro CompactionsDocument2 pages2 Vibro CompactionsAmw Mohamed AmwNo ratings yet

- tp movableDocument1 pagetp movableABISHEKNo ratings yet

- Sec 13 - Alteration of MoADocument3 pagesSec 13 - Alteration of MoAiaNo ratings yet

- Rajasthan Judicial Service Exam, 2014 PrelimDocument6 pagesRajasthan Judicial Service Exam, 2014 PrelimMinazNo ratings yet

- EMS Audit Report - April 2024Document80 pagesEMS Audit Report - April 2024pravinrajprasadNo ratings yet

- Lease - Accessory Cs - CreditsDocument21 pagesLease - Accessory Cs - CreditsMikeeNo ratings yet

- Fac3764 Assignment 3Document5 pagesFac3764 Assignment 3matsheporobertsNo ratings yet

- Valid VOIDABLE (Fa'asid) Void (Ba2L)Document12 pagesValid VOIDABLE (Fa'asid) Void (Ba2L)bin abubakarNo ratings yet

- Risk AssessmentDocument21 pagesRisk AssessmentBHARAT TALPADANo ratings yet

- Existing Site/buildings/services: Demolition Non-Hazardous and HazardousDocument1 pageExisting Site/buildings/services: Demolition Non-Hazardous and HazardousVimalNo ratings yet

- SALESDocument2 pagesSALESIsaac Joshua AganonNo ratings yet

- Weekly Coordination Meeting: Elimination: Nil Substitution:Scissors Lift PPE:Dust Mask, SafetyDocument2 pagesWeekly Coordination Meeting: Elimination: Nil Substitution:Scissors Lift PPE:Dust Mask, SafetyRama RajanNo ratings yet

- TPA1Document5 pagesTPA1RosylaNo ratings yet

- CFR 2011 Title49 Vol3 Part193 SubpartdDocument2 pagesCFR 2011 Title49 Vol3 Part193 SubpartdAssemNo ratings yet

- CFR 2011 Title49 Vol3 Part193 SubpartC Subjectgroup Id892Document1 pageCFR 2011 Title49 Vol3 Part193 SubpartC Subjectgroup Id892AssemNo ratings yet

- CFR 2011 Title49 Vol3 Part193 Subpartc Subjectgroup Id892Document1 pageCFR 2011 Title49 Vol3 Part193 Subpartc Subjectgroup Id892AssemNo ratings yet

- Unit 8 Indian Contract Act Handwritten NotesDocument18 pagesUnit 8 Indian Contract Act Handwritten NotesDasharath RautNo ratings yet

- Summary of ContractsDocument1 pageSummary of ContractsDang GVNo ratings yet

- Business - The Villar StyleDocument1 pageBusiness - The Villar StyleLila ShahaniNo ratings yet

- 09.02.2023 Avrpl - Srfa-Aic 03Document1 page09.02.2023 Avrpl - Srfa-Aic 03miqdad halyar kasimNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- SoP For HiringDocument16 pagesSoP For HiringKhurram SherazNo ratings yet

- Form 43Document1 pageForm 43ShobhnaNo ratings yet

- Part 6Document43 pagesPart 6Nithin KumarNo ratings yet

- CFR 2011 Title49 Vol3 Sec193 2509Document1 pageCFR 2011 Title49 Vol3 Sec193 2509assemalzoubi1983No ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- Specific Performance Act PlaintDocument3 pagesSpecific Performance Act PlaintSuranjanaNo ratings yet

- Scan 18 Apr 2023Document5 pagesScan 18 Apr 2023Jayshree YadavNo ratings yet

- Client Authority Engineer EPC Contractor P.W. (Roads) DirectorateDocument1 pageClient Authority Engineer EPC Contractor P.W. (Roads) DirectorateLASA IllambazarNo ratings yet

- Method of Statement For Deep ExcavationDocument2 pagesMethod of Statement For Deep ExcavationDavid_PuenNo ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- বাহাদুর বিড়াল (1)Document52 pagesবাহাদুর বিড়াল (1)joy BoseNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- ( )Document65 pages( )joy BoseNo ratings yet

- Tax Unit 1-2 - 24Document1 pageTax Unit 1-2 - 24joy BoseNo ratings yet

- Tax Unit 1-2 - 15Document1 pageTax Unit 1-2 - 15joy BoseNo ratings yet

- Tax Unit 1-2 - 18Document1 pageTax Unit 1-2 - 18joy BoseNo ratings yet

- Tax Unit 1-2 - 14Document1 pageTax Unit 1-2 - 14joy BoseNo ratings yet

- Tax Unit 1-2 - 16Document1 pageTax Unit 1-2 - 16joy BoseNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- Tax Unit 1-2 - 22Document1 pageTax Unit 1-2 - 22joy BoseNo ratings yet

- Tax Unit 1-2 - 11Document1 pageTax Unit 1-2 - 11joy BoseNo ratings yet

- Ecom QuesDocument4 pagesEcom Quesjoy BoseNo ratings yet

- Tax Unit 1-2 - 7-8Document2 pagesTax Unit 1-2 - 7-8joy BoseNo ratings yet

- Nonte Fonte DhamakaDocument56 pagesNonte Fonte Dhamakajoy BoseNo ratings yet

- Nonte Fonte La JobabDocument55 pagesNonte Fonte La Jobabjoy BoseNo ratings yet

- Tax Unit 1-2 - 1-2Document2 pagesTax Unit 1-2 - 1-2joy BoseNo ratings yet

- Tax Unit 1-2 - 5-6Document2 pagesTax Unit 1-2 - 5-6joy BoseNo ratings yet

- Tax Unit 1-2 - 12Document1 pageTax Unit 1-2 - 12joy BoseNo ratings yet

- Tax Unit 1-2 - 9-10Document2 pagesTax Unit 1-2 - 9-10joy BoseNo ratings yet

- Tax Unit 1-2 - 3-4Document2 pagesTax Unit 1-2 - 3-4joy BoseNo ratings yet

- Allied Engineering & Services (PVT.) LTDDocument2 pagesAllied Engineering & Services (PVT.) LTDmuhammad omerNo ratings yet

- Account Statement: Tarun Kumar JasoriaDocument1 pageAccount Statement: Tarun Kumar JasoriaTarun kumarNo ratings yet

- NCR Biotech Science Cluster, Faridabad-121001, INDIA: Regional Centre For BiotechnologyDocument1 pageNCR Biotech Science Cluster, Faridabad-121001, INDIA: Regional Centre For BiotechnologySonam Kaur BrarNo ratings yet

- Aws Romp03 1142 Aarkfab EngDocument1 pageAws Romp03 1142 Aarkfab EngNAQIB METKARNo ratings yet

- The Mini Supermarket Checkout SystemDocument2 pagesThe Mini Supermarket Checkout SystemmonighosNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pavan ÇherryNo ratings yet

- Merchant Business Solutions Merchant Operating GuideDocument32 pagesMerchant Business Solutions Merchant Operating GuideMuumini De Souza NezzaNo ratings yet

- Tax Glimpses 2019Document97 pagesTax Glimpses 2019DarshanaNo ratings yet

- RR No. 6-2019 - IRR Estate Tax AmnestyDocument5 pagesRR No. 6-2019 - IRR Estate Tax AmnestyAlexander Julio ValeraNo ratings yet

- CA Final GST Chart 2Document1 pageCA Final GST Chart 2Kailash KumarNo ratings yet

- Mabini Shopping Center 3 Floor Mabini Shopping Center 3 Floor Mabini Shopping Center 3 FloorDocument2 pagesMabini Shopping Center 3 Floor Mabini Shopping Center 3 Floor Mabini Shopping Center 3 FloorCG WitchyNo ratings yet

- Canotes - Ipcc Negotiable Instrument Act - 250620134421Document41 pagesCanotes - Ipcc Negotiable Instrument Act - 250620134421sureshstipl sureshNo ratings yet

- Tax Planning and Compliance - JA-2022 - QuestionDocument6 pagesTax Planning and Compliance - JA-2022 - QuestionsajedulNo ratings yet

- Letter of IntentDocument3 pagesLetter of IntentMARY ANN LIWANAGNo ratings yet

- Solution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeDocument19 pagesSolution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeCourtneyCollinsntwex100% (43)

- Target2 SSP Udfs Book 2 Version 4.01 - tcm46-242572Document226 pagesTarget2 SSP Udfs Book 2 Version 4.01 - tcm46-242572jcskNo ratings yet

- Tax Invoice: Jadhav Chemist Arjun VishwakarmaDocument1 pageTax Invoice: Jadhav Chemist Arjun Vishwakarmaarjun vsNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMonty ChaudharyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961SURANA1973No ratings yet

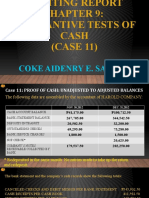

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Basic Principles LectureDocument7 pagesBasic Principles LectureevaNo ratings yet

- CDocument1 pageCAakash GuptaNo ratings yet

- StatementDocument5 pagesStatementanandNo ratings yet

- Chapter 4 FARDocument20 pagesChapter 4 FARSree Mathi SuntheriNo ratings yet

- Taxation-IT For Individuals Part3Document5 pagesTaxation-IT For Individuals Part3EmperiumNo ratings yet

- Taxation I: (General Principles)Document108 pagesTaxation I: (General Principles)RAPHNo ratings yet

Tax Unit 1-2 - 21

Tax Unit 1-2 - 21

Uploaded by

joy BoseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Unit 1-2 - 21

Tax Unit 1-2 - 21

Uploaded by

joy BoseCopyright:

Available Formats

propery thatbui

house building

from ownerof

-ncone asthe

Para 86.3 come-tar is deemed

Act,

1882, aresatisfied:

iss not overcd by

in section 53A of the Transfer of

Property conditions olgifi

following by way

IC 142. v. Oo Ki.

(or part thereot) |sec. 27(iia)

only if the on. Transfer

Transl23 Kim

operation oniy, fficient-UPLe

suffic

dection 53A comes

into *afion

forconsidet Po Hn

HIai[1929| not

. There should

be a contract

Hla Moumng

onsideration.

v. Moung

An oral

cement

agrcem

is

is notappli. n

section 53A-Maung 53A 152IC42

be writing.

2. The contract

should

on his bchall. Section 2

144 IC 825.

or is nof

property. 53A Subbplicable

Seng[1933] the transferor immovable

v. Ramlaiyanaljl954]

Section

3. It should besigneedby to transfer

Dutt Ch7na

be oftheproperty.

The contrac

fer ofmovable

property-Bhablhi

taken possessionof the property-//201a

to perform

m his part the

case of transfer have

ce should have possession be willing

5. The transferee

shouldnot taken orshould red from hen Cing

if the transferee

has FCR 484. is debarre had taken

the

Raju [1949] performed transferor transferce

Malapalli should have then

the of which

1sferee

transfer

6.The aresatisfied, ofthe property (exclhsd

uding a

any rights one year) in or

contract. is not registered.

conditions inrespect

any right oftransfer who acquires

notexceeding as iIs

If all the oresaid person a

the transferee instrument for period transaction orCrred

against

possession,

even

if the

to

in section

269UA(£)-A

month

to month

or

by virtue

ofany suchlease

a

for period

on (orpart thereoh from the

.

Vear

asreferredleasea from thereof) a

house

Rightby way of (orpartifapersontakes of that building

rights to any building

269UA [ie, the owner or prof

as

with respect

()

of section

is deemed his own

business

his own buiO

to in clause

see para 472.2] [sec.27(iüib)] the ownerfor purpose of or

or more, year 1988-89 by

for the ofsuch business pron

Ssion

assessment

86.3Property

should

not be occupled

occupied

by the owner profit

22,providedthat notional

reason

rent of

income of such ISsessee

S

not

section

value ofproperty underis so,for the business

Annual

is not assessable This computing

assessed. while property. be regarded

profession, of being deduction his own house should to theDeng

is capable in by the firm

allowable

a

as permissible

or profession carried on

a

building

belonging in iSe

on business 22,the

business valueof

is partner,

is not includible

(Mad

e

carrying ofsection Thus,annualletting 180ITR 191

the assessee

Forthepurpose partners. in which 1989J 180ITR 198A

onby all

the

carriedisin the occupation

ofa firm KMJaganmathan|

22-CITv. CITv.N.Vaiadhyanathan[1989]

which undersection 108(Ker.), 799 (Ori.).

oftheassessee Taxman 211 ITR and property belonoino.

[1995] capacity 22willl

PI Mannel[1989]47Bhol

firm in representative under section be?

CIT v. Rabindranath partnerin exemption

HUF

is on

business, 215 ITR 289 (Mad.).

Where karta of firm for carrying [1995] GuruSwamy [1984

by Jeevraj CIT v. A.N.

K.N Guruswamy[19841

HUF is occupied Shri Champalal Court in

to HUF-CIZTv. Karnataka High

available by the reconsideration.

view expressed requires If assesse - an

The contr

it is respectfully

submitted, the main business

and letting out of

146 ITR 34, and incidental to

out issubservient them out to his employees the residential

86.3-1 Where

letting and lets business,

to the main

residential quarters and incidentalassesseefor thepurpose of his business

constructs

is subservient

residential quarters

used by the section22-CITv.

Delhi

will be treated

ashouse property not be chargeable under the assesse,

quarters will if charged by

annual valuethereof

ITR 152(Punj.). Rent, any, the

and,accordingly, of busíness or profession".

If

Co.Lid [1966]59

Cloth &General Mills and gains a branch ot

the head "Profits

in such a case,

is taxable under to the Government for locatingstaff quartes

available

its accommodation office and railway

assessee makes station, central excise is

office,police rent collected nol

nationalised bank,post and smoothly, 2A

on its business efficiently under section

the aim of carrying but is assessable

with from house property'

under the head "Income

chargeable

You might also like

- Ein Macon Storage, LLCDocument2 pagesEin Macon Storage, LLCminhdang03062017No ratings yet

- Other Percentage TaxDocument3 pagesOther Percentage TaxHafi DisoNo ratings yet

- Transfer Receipt PDFDocument2 pagesTransfer Receipt PDFKahinur KarimNo ratings yet

- PDFDocument2 pagesPDFLIMNo ratings yet

- Tort IIDocument2 pagesTort IIchristinelim241004No ratings yet

- Laws & Ethics: Cma InterDocument120 pagesLaws & Ethics: Cma InterNayanNo ratings yet

- immovable propertyDocument1 pageimmovable propertyABISHEKNo ratings yet

- 3 5 15 TPI Inspection Properly Maintained Regularly Maintained InspectionDocument5 pages3 5 15 TPI Inspection Properly Maintained Regularly Maintained InspectionMDR PRAPHUNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Clubbing of IncomeDocument4 pagesClubbing of Incomeapi-3832224100% (1)

- 415 MinicasesDocument5 pages415 MinicasesNikita DaceraNo ratings yet

- Property Law 2020 UP BOC 1Document83 pagesProperty Law 2020 UP BOC 1Common TaoNo ratings yet

- CFR 2020 Title30 Vol1 Part77 SubpartNDocument5 pagesCFR 2020 Title30 Vol1 Part77 SubpartNNtambo KabekeNo ratings yet

- Building Construction Act, 1952Document19 pagesBuilding Construction Act, 1952majedulquaderNo ratings yet

- The Tenant Emancipation Law Presidential Decree No.: Hers" The Title and OwnershDocument7 pagesThe Tenant Emancipation Law Presidential Decree No.: Hers" The Title and OwnershRiaNo ratings yet

- Pune Prebid Query MSIDC EOD ReplytoPrebidQueryDocument239 pagesPune Prebid Query MSIDC EOD ReplytoPrebidQueryBharath MadimalaNo ratings yet

- Detail Work Position of Under Construction 132 D/C: Package 1: Firm NameDocument8 pagesDetail Work Position of Under Construction 132 D/C: Package 1: Firm NamehiNo ratings yet

- TopaDocument268 pagesTopachotu shahNo ratings yet

- Ca Inter Live Class 10Document4 pagesCa Inter Live Class 10Vranda AroraNo ratings yet

- Right To Fair Compensation - Land LawsDocument2 pagesRight To Fair Compensation - Land LawsShaikh Adeeba QureshiNo ratings yet

- Adobe Scan Nov 11, 2021Document5 pagesAdobe Scan Nov 11, 2021Asmita DivekarNo ratings yet

- Contractual Time Bars - General Conditions of The FTDTC - 2017 - RED BOOKDocument6 pagesContractual Time Bars - General Conditions of The FTDTC - 2017 - RED BOOKben hurNo ratings yet

- Merge MiningDocument13 pagesMerge MiningAdityaNo ratings yet

- CG 3Document9 pagesCG 3Arnav MishraNo ratings yet

- Building Construction: Table 3 Seismic-And Wind-Resistant Design Criteria Fig. 5 Floor PlanDocument1 pageBuilding Construction: Table 3 Seismic-And Wind-Resistant Design Criteria Fig. 5 Floor PlanAnh Quoc VuNo ratings yet

- HCT Prices Item Description Civil Work Site Construction & ErectionDocument2 pagesHCT Prices Item Description Civil Work Site Construction & Erectionbiruhtesfaye4No ratings yet

- Loadline Convention 1966 2Document1 pageLoadline Convention 1966 2AARON LOBONo ratings yet

- Tax Law AssgimentDocument8 pagesTax Law AssgimentGopan NishantNo ratings yet

- Vol. 49, February 28, 1973 5: Abeleda vs. Court of Firs Instance of BaguioDocument1 pageVol. 49, February 28, 1973 5: Abeleda vs. Court of Firs Instance of BaguioEmeNo ratings yet

- Minor Sheet 1Document1 pageMinor Sheet 1Sanal SamsonNo ratings yet

- LWDC-Non-Fatal (D-PPR, BU-Rani Bagh) Dated 25.01.2024Document2 pagesLWDC-Non-Fatal (D-PPR, BU-Rani Bagh) Dated 25.01.2024hladolflerhit01No ratings yet

- All About Section 54, 54B, 54D, 54F, 54GA, 54EC, 54G & 54GB - Taxguru - inDocument6 pagesAll About Section 54, 54B, 54D, 54F, 54GA, 54EC, 54G & 54GB - Taxguru - inNasimNo ratings yet

- Estimate For Samsipora RUB RampDocument1 pageEstimate For Samsipora RUB Rampapi-3823524No ratings yet

- 2 Vibro CompactionsDocument2 pages2 Vibro CompactionsAmw Mohamed AmwNo ratings yet

- tp movableDocument1 pagetp movableABISHEKNo ratings yet

- Sec 13 - Alteration of MoADocument3 pagesSec 13 - Alteration of MoAiaNo ratings yet

- Rajasthan Judicial Service Exam, 2014 PrelimDocument6 pagesRajasthan Judicial Service Exam, 2014 PrelimMinazNo ratings yet

- EMS Audit Report - April 2024Document80 pagesEMS Audit Report - April 2024pravinrajprasadNo ratings yet

- Lease - Accessory Cs - CreditsDocument21 pagesLease - Accessory Cs - CreditsMikeeNo ratings yet

- Fac3764 Assignment 3Document5 pagesFac3764 Assignment 3matsheporobertsNo ratings yet

- Valid VOIDABLE (Fa'asid) Void (Ba2L)Document12 pagesValid VOIDABLE (Fa'asid) Void (Ba2L)bin abubakarNo ratings yet

- Risk AssessmentDocument21 pagesRisk AssessmentBHARAT TALPADANo ratings yet

- Existing Site/buildings/services: Demolition Non-Hazardous and HazardousDocument1 pageExisting Site/buildings/services: Demolition Non-Hazardous and HazardousVimalNo ratings yet

- SALESDocument2 pagesSALESIsaac Joshua AganonNo ratings yet

- Weekly Coordination Meeting: Elimination: Nil Substitution:Scissors Lift PPE:Dust Mask, SafetyDocument2 pagesWeekly Coordination Meeting: Elimination: Nil Substitution:Scissors Lift PPE:Dust Mask, SafetyRama RajanNo ratings yet

- TPA1Document5 pagesTPA1RosylaNo ratings yet

- CFR 2011 Title49 Vol3 Part193 SubpartdDocument2 pagesCFR 2011 Title49 Vol3 Part193 SubpartdAssemNo ratings yet

- CFR 2011 Title49 Vol3 Part193 SubpartC Subjectgroup Id892Document1 pageCFR 2011 Title49 Vol3 Part193 SubpartC Subjectgroup Id892AssemNo ratings yet

- CFR 2011 Title49 Vol3 Part193 Subpartc Subjectgroup Id892Document1 pageCFR 2011 Title49 Vol3 Part193 Subpartc Subjectgroup Id892AssemNo ratings yet

- Unit 8 Indian Contract Act Handwritten NotesDocument18 pagesUnit 8 Indian Contract Act Handwritten NotesDasharath RautNo ratings yet

- Summary of ContractsDocument1 pageSummary of ContractsDang GVNo ratings yet

- Business - The Villar StyleDocument1 pageBusiness - The Villar StyleLila ShahaniNo ratings yet

- 09.02.2023 Avrpl - Srfa-Aic 03Document1 page09.02.2023 Avrpl - Srfa-Aic 03miqdad halyar kasimNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- SoP For HiringDocument16 pagesSoP For HiringKhurram SherazNo ratings yet

- Form 43Document1 pageForm 43ShobhnaNo ratings yet

- Part 6Document43 pagesPart 6Nithin KumarNo ratings yet

- CFR 2011 Title49 Vol3 Sec193 2509Document1 pageCFR 2011 Title49 Vol3 Sec193 2509assemalzoubi1983No ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- Specific Performance Act PlaintDocument3 pagesSpecific Performance Act PlaintSuranjanaNo ratings yet

- Scan 18 Apr 2023Document5 pagesScan 18 Apr 2023Jayshree YadavNo ratings yet

- Client Authority Engineer EPC Contractor P.W. (Roads) DirectorateDocument1 pageClient Authority Engineer EPC Contractor P.W. (Roads) DirectorateLASA IllambazarNo ratings yet

- Method of Statement For Deep ExcavationDocument2 pagesMethod of Statement For Deep ExcavationDavid_PuenNo ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- বাহাদুর বিড়াল (1)Document52 pagesবাহাদুর বিড়াল (1)joy BoseNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- ( )Document65 pages( )joy BoseNo ratings yet

- Tax Unit 1-2 - 24Document1 pageTax Unit 1-2 - 24joy BoseNo ratings yet

- Tax Unit 1-2 - 15Document1 pageTax Unit 1-2 - 15joy BoseNo ratings yet

- Tax Unit 1-2 - 18Document1 pageTax Unit 1-2 - 18joy BoseNo ratings yet

- Tax Unit 1-2 - 14Document1 pageTax Unit 1-2 - 14joy BoseNo ratings yet

- Tax Unit 1-2 - 16Document1 pageTax Unit 1-2 - 16joy BoseNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- Tax Unit 1-2 - 22Document1 pageTax Unit 1-2 - 22joy BoseNo ratings yet

- Tax Unit 1-2 - 11Document1 pageTax Unit 1-2 - 11joy BoseNo ratings yet

- Ecom QuesDocument4 pagesEcom Quesjoy BoseNo ratings yet

- Tax Unit 1-2 - 7-8Document2 pagesTax Unit 1-2 - 7-8joy BoseNo ratings yet

- Nonte Fonte DhamakaDocument56 pagesNonte Fonte Dhamakajoy BoseNo ratings yet

- Nonte Fonte La JobabDocument55 pagesNonte Fonte La Jobabjoy BoseNo ratings yet

- Tax Unit 1-2 - 1-2Document2 pagesTax Unit 1-2 - 1-2joy BoseNo ratings yet

- Tax Unit 1-2 - 5-6Document2 pagesTax Unit 1-2 - 5-6joy BoseNo ratings yet

- Tax Unit 1-2 - 12Document1 pageTax Unit 1-2 - 12joy BoseNo ratings yet

- Tax Unit 1-2 - 9-10Document2 pagesTax Unit 1-2 - 9-10joy BoseNo ratings yet

- Tax Unit 1-2 - 3-4Document2 pagesTax Unit 1-2 - 3-4joy BoseNo ratings yet

- Allied Engineering & Services (PVT.) LTDDocument2 pagesAllied Engineering & Services (PVT.) LTDmuhammad omerNo ratings yet

- Account Statement: Tarun Kumar JasoriaDocument1 pageAccount Statement: Tarun Kumar JasoriaTarun kumarNo ratings yet

- NCR Biotech Science Cluster, Faridabad-121001, INDIA: Regional Centre For BiotechnologyDocument1 pageNCR Biotech Science Cluster, Faridabad-121001, INDIA: Regional Centre For BiotechnologySonam Kaur BrarNo ratings yet

- Aws Romp03 1142 Aarkfab EngDocument1 pageAws Romp03 1142 Aarkfab EngNAQIB METKARNo ratings yet

- The Mini Supermarket Checkout SystemDocument2 pagesThe Mini Supermarket Checkout SystemmonighosNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pavan ÇherryNo ratings yet

- Merchant Business Solutions Merchant Operating GuideDocument32 pagesMerchant Business Solutions Merchant Operating GuideMuumini De Souza NezzaNo ratings yet

- Tax Glimpses 2019Document97 pagesTax Glimpses 2019DarshanaNo ratings yet

- RR No. 6-2019 - IRR Estate Tax AmnestyDocument5 pagesRR No. 6-2019 - IRR Estate Tax AmnestyAlexander Julio ValeraNo ratings yet

- CA Final GST Chart 2Document1 pageCA Final GST Chart 2Kailash KumarNo ratings yet

- Mabini Shopping Center 3 Floor Mabini Shopping Center 3 Floor Mabini Shopping Center 3 FloorDocument2 pagesMabini Shopping Center 3 Floor Mabini Shopping Center 3 Floor Mabini Shopping Center 3 FloorCG WitchyNo ratings yet

- Canotes - Ipcc Negotiable Instrument Act - 250620134421Document41 pagesCanotes - Ipcc Negotiable Instrument Act - 250620134421sureshstipl sureshNo ratings yet

- Tax Planning and Compliance - JA-2022 - QuestionDocument6 pagesTax Planning and Compliance - JA-2022 - QuestionsajedulNo ratings yet

- Letter of IntentDocument3 pagesLetter of IntentMARY ANN LIWANAGNo ratings yet

- Solution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeDocument19 pagesSolution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeCourtneyCollinsntwex100% (43)

- Target2 SSP Udfs Book 2 Version 4.01 - tcm46-242572Document226 pagesTarget2 SSP Udfs Book 2 Version 4.01 - tcm46-242572jcskNo ratings yet

- Tax Invoice: Jadhav Chemist Arjun VishwakarmaDocument1 pageTax Invoice: Jadhav Chemist Arjun Vishwakarmaarjun vsNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMonty ChaudharyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961SURANA1973No ratings yet

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Basic Principles LectureDocument7 pagesBasic Principles LectureevaNo ratings yet

- CDocument1 pageCAakash GuptaNo ratings yet

- StatementDocument5 pagesStatementanandNo ratings yet

- Chapter 4 FARDocument20 pagesChapter 4 FARSree Mathi SuntheriNo ratings yet

- Taxation-IT For Individuals Part3Document5 pagesTaxation-IT For Individuals Part3EmperiumNo ratings yet

- Taxation I: (General Principles)Document108 pagesTaxation I: (General Principles)RAPHNo ratings yet