Professional Documents

Culture Documents

Tax Unit 1-2 - 22

Tax Unit 1-2 - 22

Uploaded by

joy BoseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Unit 1-2 - 22

Tax Unit 1-2 - 22

Uploaded by

joy BoseCopyright:

Available Formats

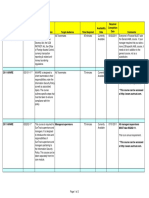

8 Proprrty

ofempover ordirretors

Ineld as vtwk in

trad Pars 87.3

das residenee of

cCs or its

hi cmpl lpany, directors, elc,, wlo reWlienaho

poper1y is (r

y is

coIeed eupired asresidenn r

with

sE wlicthero paynenl proolion of iusinesh

ol rent

icicntly nd letfin! (nl ol or oterwise,

Ioenabe them m tliuharye p"

their

uctionsolthe

t assCssee, such

property is

sibservienl and 1al tt the main

business essee itscll lor

tlhe

anocCIalion amounts Io ineidenl

the as: purposes ol id ueer ed praperty

anoceuppation 'aid

by

is remises,

its

and incoIeIronm such business, cven thouglh obusinC%)

% is aually run

(ITv.Modi bidustries Id.|1994|73 prop*ity is not assewable as ire

incne from bou*

property-

stion of la-

Taxan 691/210ITR 1

Whethcr an assessee is "occupying" (Delhi) (F%)

Oitlcss/profession carricd on any part

O o building for the

aytOflaw-Upper idia Chanber of Conere f which are assesable purpE

by him, the

to ta%, » a

prolits

v.

iation,repairs adcollection eharges -I CIT|1947| 15 FTR 263(AI1.

is

wned by theown wothwhile

assessee and used to ole that in

respect of houe

property by him Sor his own

ciation is underscclion 32

allowable busincs profession,

(or pro

allowed in

(whercas10 deduction on accunt of

un

wance is respect ol house properly,

22). Moreover,in such case,

actual

income fron which is

repair expenses and collection

preciatíon

dcpre

charycablc under

quarters let out to

ofresidentialas

lowcd

charges

employcesor wlierc letting is incidental to (in the

main business)

ca

business deduction under scctions

31 and 37 (instead of

lustcdannualvalue underseclion 24whichis

adju

onc-fourth of nc

applicable only il annual valucis

22).

section

taxablc under

plicability

of sectio 22 in certain

typical situations

7.Apart from

the points discussed in para 86, the

following points are relevant for

understanding the implications ad

scope of section 22

House property in

87.1 a foreign country -A resident assessec is taxable under

section 22in

respect ofannual value ot a property situated in a

foreign country. A resident but not ordinarily

resident or non-resiIdent is, however,chargeable under section

22 in respect of incomeofa

house property situated abroad, if income is reccived in

India during the previous ycar. If

tax

incidence is attracted

under section 22in respect of a house property situated abroad,

be the annual

value will

computed as if

property is situated in India.The Madras

High Court in CT

.R.Venugopala Reddiar[1965]58 ITR 439 obscrved that while taxable

should be made between a house property computing income,no

distinction situated in India and a houseproperty

situated abroad.

87.2 Disputed ownership-Iftitle of ownershipof a house property under dispute inacourt is

is the

of law, the decision as to who owner rests with the Income-tax Department. The

to decide

department has prima facie the power whetherthe assessee is the owner and is

tax under for judicial judgment of any suit filed in

chargeableto section 22, without waiting

respect of the property-Re.Keshardeo Chamaria[1937]5ITR 246 (Cal.). It was observed in

Franklin

v.

IRC 15TC 464 that therecipient of income taxable though there may be a rival

is

claim to the title of sourceof income and he may have to give up and accountfor what he

as

is taxed upon.

87.3Property held asstock-in-trade-Asa specifichead of charge is provided forincome from

house property, annualvalue of houseproperty cannot bebrought to tax underany other head

of income. It will remain so even if property is held by the assessee as stock-in-trade of a

business,or if the assessee is engaged in the business of letting outofproperty on rent, orif

the assessee is a company which is incorporated for the purpose of owning house property.

House-owning, however profitable, is neither trade nor business for the purposeof the Act.

Where income is derived from house property by the exercise of property rights, income falls

under the head"Income from houseproperty"-CITv. National

Storage (P)Ltd[1963]48

ITR

577 (Bom.).

of is taxable under

87.3-1

Exceptions-Therule that incomefrom ownership house property

the head "Income from house property" has the following exceptions

incidentalandsubservient

is to the main business-If the letting is only incidental and

Letting

the main business of the assessee, rental income is not taxable under the head

Subservient to

the head "Profits

Income from house property"

but is chargeable as business income under

and gains of business or profession" [see also para 86.3-1]

You might also like

- Acc 310 - 313 Advanced Cost Accounting - LMSDocument6 pagesAcc 310 - 313 Advanced Cost Accounting - LMSokwejiechoice41No ratings yet

- 204 April 2022Document2 pages204 April 2022Shubham Satish WakhareNo ratings yet

- Business Plan Cover PageDocument3 pagesBusiness Plan Cover PageKeen KurashNo ratings yet

- Classification of ContractsDocument3 pagesClassification of ContractsShobhigaNo ratings yet

- Coef. of Correlation and Linear Bivariate Regression AnalysisDocument8 pagesCoef. of Correlation and Linear Bivariate Regression Analysispifana5995No ratings yet

- Uni Versi Tyofkashmi R: I Ncomef R Om Housepr Oper T I EsDocument11 pagesUni Versi Tyofkashmi R: I Ncomef R Om Housepr Oper T I EssamarNo ratings yet

- 10 Best IT Security Companies in IndiaDocument20 pages10 Best IT Security Companies in Indiatripathivikas4No ratings yet

- Recycling and Refurbishment For Microsoft DevicesDocument1 pageRecycling and Refurbishment For Microsoft DevicesTatenda MarimoNo ratings yet

- Act132 Part 2Document23 pagesAct132 Part 2Muadz D. LucmanNo ratings yet

- Professional PracticeDocument5 pagesProfessional PracticeDaljeet ThethiNo ratings yet

- Loading On BridgesDocument14 pagesLoading On Bridges115Akshay RathodNo ratings yet

- Section 2-MCQDocument9 pagesSection 2-MCQAbdelaziz MohamedNo ratings yet

- Mintopps PVT LTD BroucherDocument6 pagesMintopps PVT LTD Broucherkrishna sandhyaNo ratings yet

- Ind As 36 - Eob FTDocument25 pagesInd As 36 - Eob FTbhallavishal1996No ratings yet

- Constitution 2Document2 pagesConstitution 2jebox20262No ratings yet

- Rohan Pai Solution San 5Document4 pagesRohan Pai Solution San 5BLR MngNo ratings yet

- Job Order Costing ReviewerDocument40 pagesJob Order Costing RevieweraidanNo ratings yet

- AP20530 - ARIHANT J - Tendering Assignment 2Document10 pagesAP20530 - ARIHANT J - Tendering Assignment 2SandeepNo ratings yet

- FMA Assignment 3Document6 pagesFMA Assignment 3varmaria004No ratings yet

- Sick IndustriesDocument7 pagesSick IndustriesHarshit GuptaNo ratings yet

- Plant and Intangible Assets: Mcgraw-Hill/IrwinDocument17 pagesPlant and Intangible Assets: Mcgraw-Hill/IrwinAyaz Ul HaqNo ratings yet

- Cost Accounting TheoriesDocument2 pagesCost Accounting TheoriesDip KunduNo ratings yet

- Pom Ita1Document5 pagesPom Ita1Chirag AwasthiNo ratings yet

- Tax Unit 1-2 - 24Document1 pageTax Unit 1-2 - 24joy BoseNo ratings yet

- Unit 3 BoeeDocument25 pagesUnit 3 BoeeVidhi GabaNo ratings yet

- Adobe Scan 23 Apr 2023Document4 pagesAdobe Scan 23 Apr 2023raviborsadiya1092No ratings yet

- ARINC BusbarsDocument6 pagesARINC Busbarskunal bhartiNo ratings yet

- 017-1211-0898-20 (CC-2.1ch)Document10 pages017-1211-0898-20 (CC-2.1ch)Bhavna ChopraNo ratings yet

- Book 5Document4 pagesBook 5Bhavika KewalramaniNo ratings yet

- AllowancesDocument1 pageAllowancesSwapnaKarma BhaktiNo ratings yet

- Objective of DesignDocument2 pagesObjective of DesignsabishanuNo ratings yet

- NACA Report 2 - Airplane Performance As Influenced by The Use of A Supercharged EngineDocument9 pagesNACA Report 2 - Airplane Performance As Influenced by The Use of A Supercharged EngineSesquipedaliacNo ratings yet

- Automatic Power Factor Correction at OranjemundDocument1 pageAutomatic Power Factor Correction at Oranjemundelias vasquezNo ratings yet

- Buyer Guide CatalogueDocument5 pagesBuyer Guide CatalogueChellaiah GanesanNo ratings yet

- Paper .Rne: of Tlisclosc Inforlratir:nDocument7 pagesPaper .Rne: of Tlisclosc Inforlratir:nYuh Deff JopNo ratings yet

- AP宏观经济学 2000Document18 pagesAP宏观经济学 2000seoyoon1012No ratings yet

- Labour LegislationDocument9 pagesLabour LegislationKaran BhardwajNo ratings yet

- Code 1Document25 pagesCode 1Lili DebataNo ratings yet

- Adobe Scan Dec 27, 2023 PDFDocument4 pagesAdobe Scan Dec 27, 2023 PDFNaresh YadavNo ratings yet

- Accu RalDocument1 pageAccu RalSwapnaKarma BhaktiNo ratings yet

- Office Order For Vehicle Management in DoRDocument1 pageOffice Order For Vehicle Management in DoRsonam phunthsoNo ratings yet

- Iot Assignment 1Document6 pagesIot Assignment 1Shankar SNo ratings yet

- Book 29 May 2024Document12 pagesBook 29 May 2024EktaNo ratings yet

- Mi Dterm Exami Nati On: Jenni F Erant I ADocument9 pagesMi Dterm Exami Nati On: Jenni F Erant I AKhizzyia Paula Gil ManiscanNo ratings yet

- Theconst I T Ut I Onandbyl Awsof Bmei Nvest Mentcl UbDocument6 pagesTheconst I T Ut I Onandbyl Awsof Bmei Nvest Mentcl UbProsper ShumbaNo ratings yet

- The Debating Club: Welcomes You All To A Quiz Competition On "Customs"Document97 pagesThe Debating Club: Welcomes You All To A Quiz Competition On "Customs"Shankhesh MehtaNo ratings yet

- Winding UpDocument22 pagesWinding Upamrit singhNo ratings yet

- Oshyiyard Sumney MR: RecordiDocument11 pagesOshyiyard Sumney MR: RecordiManas KumarNo ratings yet

- NCB Guidelines DocumentationDocument18 pagesNCB Guidelines Documentationuntitled randNo ratings yet

- Liabilities ReSA Handouts PDFDocument13 pagesLiabilities ReSA Handouts PDFNinaNo ratings yet

- Radiology Quotation ReceivedDocument2 pagesRadiology Quotation Receivedmoinul shuvoNo ratings yet

- 20bce2387 VL2022230503120 DaDocument12 pages20bce2387 VL2022230503120 DaKarunesh AnandNo ratings yet

- Trade FundamentalDocument12 pagesTrade FundamentalSaboor HaiderNo ratings yet

- Chapter 2 108 131Document25 pagesChapter 2 108 131Arielle CabritoNo ratings yet

- Jayson B. Gatch-WPS OfficeDocument3 pagesJayson B. Gatch-WPS Officegamiermr.13No ratings yet

- Company Profi LE: Your Saf Ety, Our Pri Ori TyDocument31 pagesCompany Profi LE: Your Saf Ety, Our Pri Ori Tymedhat alnagarNo ratings yet

- Tolerance Chart 2Document8 pagesTolerance Chart 2raj6260578026kumarNo ratings yet

- Mba (CM)Document8 pagesMba (CM)Varun VKNo ratings yet

- Drone 2Document32 pagesDrone 2Zero MrNo ratings yet

- Tax Unit 1-2 - 23Document1 pageTax Unit 1-2 - 23joy BoseNo ratings yet

- বাহাদুর বিড়াল (1)Document52 pagesবাহাদুর বিড়াল (1)joy BoseNo ratings yet

- Tax Unit 1-2 - 25Document1 pageTax Unit 1-2 - 25joy BoseNo ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- ( )Document65 pages( )joy BoseNo ratings yet

- Tax Unit 1-2 - 24Document1 pageTax Unit 1-2 - 24joy BoseNo ratings yet

- Tax Unit 1-2 - 15Document1 pageTax Unit 1-2 - 15joy BoseNo ratings yet

- Tax Unit 1-2 - 18Document1 pageTax Unit 1-2 - 18joy BoseNo ratings yet

- Tax Unit 1-2 - 14Document1 pageTax Unit 1-2 - 14joy BoseNo ratings yet

- Tax Unit 1-2 - 16Document1 pageTax Unit 1-2 - 16joy BoseNo ratings yet

- Tax Unit 1-2 - 19Document1 pageTax Unit 1-2 - 19joy BoseNo ratings yet

- Tax Unit 1-2 - 21Document1 pageTax Unit 1-2 - 21joy BoseNo ratings yet

- Tax Unit 1-2 - 11Document1 pageTax Unit 1-2 - 11joy BoseNo ratings yet

- Ecom QuesDocument4 pagesEcom Quesjoy BoseNo ratings yet

- Tax Unit 1-2 - 7-8Document2 pagesTax Unit 1-2 - 7-8joy BoseNo ratings yet

- Nonte Fonte DhamakaDocument56 pagesNonte Fonte Dhamakajoy BoseNo ratings yet

- Nonte Fonte La JobabDocument55 pagesNonte Fonte La Jobabjoy BoseNo ratings yet

- Tax Unit 1-2 - 1-2Document2 pagesTax Unit 1-2 - 1-2joy BoseNo ratings yet

- Tax Unit 1-2 - 5-6Document2 pagesTax Unit 1-2 - 5-6joy BoseNo ratings yet

- Tax Unit 1-2 - 12Document1 pageTax Unit 1-2 - 12joy BoseNo ratings yet

- Tax Unit 1-2 - 9-10Document2 pagesTax Unit 1-2 - 9-10joy BoseNo ratings yet

- Tax Unit 1-2 - 3-4Document2 pagesTax Unit 1-2 - 3-4joy BoseNo ratings yet

- Regulations2013 PDFDocument301 pagesRegulations2013 PDFEng Venance MasanjaNo ratings yet

- 2019-02-04 Bloomberg Businessweek PDFDocument72 pages2019-02-04 Bloomberg Businessweek PDFThinh LeNo ratings yet

- Constable Police Employee Payslip - IFMISDocument1 pageConstable Police Employee Payslip - IFMISpraveen kumarNo ratings yet

- Updated Subscription Sheet For Electives (Batch 2020-22)Document50 pagesUpdated Subscription Sheet For Electives (Batch 2020-22)Raveendra SrnNo ratings yet

- Summary PBI Regulation in Regard To The Reporting of Offshore BorrowingDocument3 pagesSummary PBI Regulation in Regard To The Reporting of Offshore BorrowingAditya NuramaliaNo ratings yet

- Kamus Candle StickDocument89 pagesKamus Candle Stickrudi eko prasetyoNo ratings yet

- MAS CPAR - EconomicsDocument7 pagesMAS CPAR - EconomicsJulie Ann LeynesNo ratings yet

- Healthcare Energy Efficiency HospitalsDocument12 pagesHealthcare Energy Efficiency HospitalsHujiLokoNo ratings yet

- TSLADocument2 pagesTSLAxue qiuNo ratings yet

- SAPMDocument26 pagesSAPMJawed KhanNo ratings yet

- Finance Compliance Training Calendar - Current v1Document2 pagesFinance Compliance Training Calendar - Current v1shilpan9166No ratings yet

- USSC Application No. 17A878 GRANTED by Justice ThomasDocument171 pagesUSSC Application No. 17A878 GRANTED by Justice ThomasNeil GillespieNo ratings yet

- Hba 2303 Financial Accounting Theory Assessment 1Document2 pagesHba 2303 Financial Accounting Theory Assessment 1kennedyNo ratings yet

- GL Setup ListDocument88 pagesGL Setup ListSundaroraclefinNo ratings yet

- 4A Syllabus Spring 2014Document7 pages4A Syllabus Spring 2014Leticia GarciaNo ratings yet

- My Invoice JULY 2023Document1 pageMy Invoice JULY 2023Ch JEEVANA SANDHYANo ratings yet

- Non Banking Financial Company Industry AnalysisDocument8 pagesNon Banking Financial Company Industry AnalysisHariNo ratings yet

- Classroom Exercises On Consolidation With Intercompany Sale of InventoryDocument7 pagesClassroom Exercises On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- Government of India Ministry of Corporate Affairs Form I.R Certificate of IncorporationDocument12 pagesGovernment of India Ministry of Corporate Affairs Form I.R Certificate of IncorporationVaibhav SinghNo ratings yet

- Learning Objective 11-1: Chapter 11 Considering The Risk of FraudDocument25 pagesLearning Objective 11-1: Chapter 11 Considering The Risk of Fraudlo0302100% (1)

- Inflation, Deflation and StagflationDocument13 pagesInflation, Deflation and StagflationSteeeeeeeeph100% (1)

- Graycliff Exploration Ltd. (CSE:GRAY) - As You Like It: Exploring For High-Grade Au Near SudburyDocument14 pagesGraycliff Exploration Ltd. (CSE:GRAY) - As You Like It: Exploring For High-Grade Au Near SudburyJames HudsonNo ratings yet

- Bimal Jalan: A Review of The Asian Clearing UnionDocument3 pagesBimal Jalan: A Review of The Asian Clearing UnionAK NgleNo ratings yet

- Scrum Master AgreementDocument5 pagesScrum Master AgreementNoorul AmeenNo ratings yet

- Truth in Lending HandbookDocument225 pagesTruth in Lending HandbookHelpin HandNo ratings yet

- Cancellation PolicyDocument1 pageCancellation PolicyHershey Ramos SabinoNo ratings yet

- Annual Report: Royal Dutch Shell PLC Annual Report and Form 20-F For The Year Ended December 31, 2009Document192 pagesAnnual Report: Royal Dutch Shell PLC Annual Report and Form 20-F For The Year Ended December 31, 2009Khageshwar RongkaliNo ratings yet

- Financial Accounting Theory 3Rd Edition Deegan Test Bank Full Chapter PDFDocument38 pagesFinancial Accounting Theory 3Rd Edition Deegan Test Bank Full Chapter PDFchristinecohenceyamrgpkj100% (11)

- FINMAN2Document4 pagesFINMAN2Vince BesarioNo ratings yet

- The Board of Directors or TrusteesDocument5 pagesThe Board of Directors or TrusteesKaty OlidanNo ratings yet