Professional Documents

Culture Documents

Formation and Operation

Formation and Operation

Uploaded by

Cielo DecilloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formation and Operation

Formation and Operation

Uploaded by

Cielo DecilloCopyright:

Available Formats

PROBLEM 01: The following transactions of Pizza Parlor, owned by Del Rivera, Candice Ortega and Gloria Tan,

took place July 1 to December 31,

2004:

a. Rivera who owns an ice cream parlor, invested cash of P81,000 and merchandise inventory costing P125,000 but which value was agreed

upon by the partners to be P100,000. Customers’ accounts of P55,000 were also turned over to the partnership which was credited to the

partner at its realizable value of 80%.

b. Ortega invested cash of P40,000 and pieces of furniture and equipment costing P500,000 but already 30% depreciated. Market value of

the furniture and equipment at the date of investment was equal to 75% of its book value. Ortega still owes Fair Mart P52,500 for the

pieces of furniture purchased. It was agreed that the partnership will assume the liability.

c. Tan, an Italian culinary expert, aside from his expertise, invested land costing P350,000 but which market value increased by 100%.

d. Half of the cash invested by Rivera and Ortega was used as a 10% down payment for the delivery panel bought by the partners for home

deliveries to customers. This was supported by a five-year, 18% note.

e. Tan extended a cash loan to the partnership on July 1 amounting to P250,000 payable after one year at 12%.

f. Ortega made a cash withdrawal of P15,000.

g. Rivera issued a 90-day, 12% note to the parlor for a cash loan of P10,000 extended by the parlor.

h. A net profit of P300,000 was earned at the end of the year. Profits are to be divided 1:1:2 respectively by Rivera, Ortega, and Tan.

Required:

1. Prepare the journal entries to record the above transactions in the partnership books.

2. What are the partners’ equity as at December 31? Support by constructing the capital and drawing T accounts with appropriate captions.

3. Prepare a statement of partners’ equity for six months ended December 31, 2004.

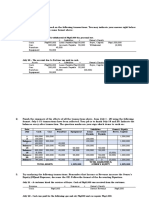

PROBLEM 02: Willy owns a bookstore and Rick owns a beauty shop. They decided to combine their businesses and call it the Beauty and Brain

Store. Prior to the combination, they agreed to adjust some of their assets and liabilities. The following accounts are found in their balance sheets:

Willy’s Ricky’s

Bookstore Beauty Shop

Cash P 25,000 P 11,000

Accounts receivable 25,000

Merchandise inventory 80,000

Supplies inventory 15,000 25,000

Furniture and equipment 50,000 85,000

Total 195,000 121,000

Accounts payable 20,000 5,000

Notes payable 30,000

Capital 145,000 116,000

Total 195,000 121,000

The partners agreed to the following conditions:

a. P5,000 doubtful accounts should be recognized.

b. Furniture and equipment should be at market value of P25,000 for the bookstore and P76,500 for the beauty shop.

c. P10,000 obsolete books should be written off.

d. Beauty supplies should be P15,000 only.

e. Accrued interest should be recognized for P2,500.

Required:

1. List down the adjusted assets and liabilities of each partner.

2. Record the investments in the partnership books.

3. Make an additional entry assuming that they agreed on recognizing bonus so that they will be credited equally based on total adjusted

contributions.

4. Prepare a balance sheet just after formation.

PROBLEM 03: The capital accounts of Fe and Lani showed the following information for the period ending December 31, 2004:

Fe Lani

Jan 1 Balance P 270,000 Jan 1 Balance P 90,000

May 10 Investment 45,000 Mar 18 Investment 45,000

July 25 Withdrawal 67,500

The revenue and expense summary showed a credit balance of P135,000 after tax. Give the entries to record the distribution (with supporting

distribution schedules) based on the following independent cases:

1. In the ratio of average capital considering all changes, where investments and withdrawals are considered as made at beginning of the

year if made before the middle of the month, and are considered as made at the beginning of the following month, if made after the middle

of the month.

2. 12% interest based on ending capital balances considering all changes, annual salaries to Fe and Lani in the amount of P50,000 and

P100,000 respectively, balance to be divided equally.

PROBLEM 04: Dennis, Larry and Greg divide profit and loss in the ratio of 2:1:1 respectively, after giving a bonus of 20% to Dennis. Determine the

share of the partners in each of the following independent cases:

1. Net income for the year was P180,000 with bonus based on net income before bonus.

2. Net income for the year was P180,000 with bonus based on net income after bonus.

3. If Larry received a profit share of P50,000, how much did Dennis receive if bonus is based on net income before bonus?

4. If Larry received a profit share of P50,000, how much did Dennis receive if bonus is based on net income after bonus?

You might also like

- Ferrari IPO CaseDocument13 pagesFerrari IPO CaseKelsey100% (4)

- Pestle of South AfricaDocument8 pagesPestle of South AfricaSanket Borhade100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Advantages and Disadvantages of TechnologyDocument2 pagesAdvantages and Disadvantages of TechnologyArim Arim100% (4)

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- Accounting Paper-Zoom 2Document7 pagesAccounting Paper-Zoom 2Sufyan SheikhNo ratings yet

- ACCTSPTRANS All About PartnershipDocument7 pagesACCTSPTRANS All About PartnershipShailene David0% (1)

- Practical Accounting P-2Document7 pagesPractical Accounting P-2KingChryshAnneNo ratings yet

- Session 6 - Evaluation of AlternativesDocument7 pagesSession 6 - Evaluation of Alternativesmark flores100% (1)

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- Accounting QuizDocument5 pagesAccounting QuizLloyd Lameon0% (1)

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- HO1 Partnership Formation and OperationDocument3 pagesHO1 Partnership Formation and OperationChristianAquinoNo ratings yet

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

- Brief Exercises - Formation: Jose Rizal University ACC C102 - Financial Accounting and ReportingDocument3 pagesBrief Exercises - Formation: Jose Rizal University ACC C102 - Financial Accounting and ReportingAngeline SanchezNo ratings yet

- Assignment July 2022Document6 pagesAssignment July 2022Dusabamahoro JoniveNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- CMPC 131 1-Partneship-FormationDocument7 pagesCMPC 131 1-Partneship-FormationGab IgnacioNo ratings yet

- Problems Lecture - Partnership FormationDocument4 pagesProblems Lecture - Partnership FormationNiccoRobDeCastroNo ratings yet

- Analyzing Transactions To Start A BusinessDocument8 pagesAnalyzing Transactions To Start A BusinessJose Cruz100% (1)

- CH2 Illustrative Problems-1Document3 pagesCH2 Illustrative Problems-1Joan ClaireNo ratings yet

- Chapter 1 Practice ProblemsDocument5 pagesChapter 1 Practice ProblemsChristine Joyce SalvadorNo ratings yet

- Part 3Document3 pagesPart 3Ja Mi LahNo ratings yet

- PartnershipDocument10 pagesPartnershipJasmine Marie Ng Cheong50% (2)

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- Partnership-Formation HandoutDocument1 pagePartnership-Formation HandoutKarl SolomeroNo ratings yet

- Partnership Formation 46A 46JDocument11 pagesPartnership Formation 46A 46JRaella FernandezNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- AdVacc Q1Document5 pagesAdVacc Q1Red Yu100% (1)

- Partnership Home WorkDocument3 pagesPartnership Home WorkVinay KumarNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- ACC 100 Partnership FormationDocument3 pagesACC 100 Partnership FormationAlfred DalaganNo ratings yet

- Admission of A Partner - Work Sheet No .4Document12 pagesAdmission of A Partner - Work Sheet No .4Hamza MudassirNo ratings yet

- Pamantasan NG CabuyaoDocument2 pagesPamantasan NG CabuyaoHhhhhNo ratings yet

- AtcpDocument2 pagesAtcpnavie VNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- 1a Partnership FormationDocument8 pages1a Partnership FormationMark TaysonNo ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Learning Task No. 1.2Document3 pagesLearning Task No. 1.2Carl Oliver LacanlaleNo ratings yet

- Account DR CR: To Record The Investments of The PartnersDocument3 pagesAccount DR CR: To Record The Investments of The PartnersJanea Lorraine TanNo ratings yet

- Ga ParcorDocument3 pagesGa ParcorSky RamirezNo ratings yet

- AC15 Quiz 1 Test PaperDocument6 pagesAC15 Quiz 1 Test PaperKristine Esplana ToraldeNo ratings yet

- Finals Quiz Dissolution To LiquidationDocument6 pagesFinals Quiz Dissolution To LiquidationJeane Mae Boo75% (4)

- AFAR001 PartnershipDocument11 pagesAFAR001 PartnershipLen Charisse Sioco100% (1)

- Farparcor 2 Chapter 1 Exercises Problem AnswersDocument10 pagesFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNo ratings yet

- Formation 2022 RDocument5 pagesFormation 2022 Rpamriri8No ratings yet

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.No ratings yet

- Acc 11 HandoutDocument5 pagesAcc 11 HandoutRenalyn MadeloNo ratings yet

- Problems On Liquidation:: Seatwork # 5Document2 pagesProblems On Liquidation:: Seatwork # 5Shiela Mae CalangiNo ratings yet

- Module 7 ActDocument3 pagesModule 7 ActairamaecsibbalucaNo ratings yet

- PARCOR Exercises PFormationDocument4 pagesPARCOR Exercises PFormationangelovilladoresNo ratings yet

- Exercise 1: Discussion QuestionsDocument2 pagesExercise 1: Discussion QuestionsCharice Anne VillamarinNo ratings yet

- Handouts 1 Partnership AccountingDocument5 pagesHandouts 1 Partnership AccountingRozel MontevirgenNo ratings yet

- Assignment Intangible Assets GoodwillDocument3 pagesAssignment Intangible Assets Goodwilldayannaaa0304No ratings yet

- Comprehensive Examinations 2 (Part II)Document4 pagesComprehensive Examinations 2 (Part II)Yander Marl BautistaNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationMary Elisha PinedaNo ratings yet

- Ganibo - Fabm Accounting EquationDocument6 pagesGanibo - Fabm Accounting EquationShereen Mallorca GaniboNo ratings yet

- Activity Partnership Formation and OperationDocument8 pagesActivity Partnership Formation and OperationSharon AnchetaNo ratings yet

- 1 Formation 1Document7 pages1 Formation 1martinfaith958No ratings yet

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- Exam 14 February 2020 Questions and AnswersDocument6 pagesExam 14 February 2020 Questions and AnswersCielo DecilloNo ratings yet

- Roque Standard Costing QuestionsDocument7 pagesRoque Standard Costing QuestionsCielo DecilloNo ratings yet

- Input MethodsDocument6 pagesInput MethodsCielo DecilloNo ratings yet

- DAYAG Prac ConstructionDocument40 pagesDAYAG Prac ConstructionCielo DecilloNo ratings yet

- Dayag Hoba PracDocument19 pagesDayag Hoba PracCielo DecilloNo ratings yet

- Dayag Hoba Prac Answer KeyDocument14 pagesDayag Hoba Prac Answer KeyCielo DecilloNo ratings yet

- Partnership Operation 03Document6 pagesPartnership Operation 03Cielo DecilloNo ratings yet

- Partnership DissolutionDocument9 pagesPartnership DissolutionCielo DecilloNo ratings yet

- Partnership Operation 02Document1 pagePartnership Operation 02Cielo DecilloNo ratings yet

- Chapter 4Document30 pagesChapter 4Cielo DecilloNo ratings yet

- This - Thread - Goes - Over - Thread - by - Dodgysdd - Apr 1, 23 - From - RattibhaDocument24 pagesThis - Thread - Goes - Over - Thread - by - Dodgysdd - Apr 1, 23 - From - RattibhaDaniel EduahNo ratings yet

- 138 NI Act FormatDocument3 pages138 NI Act FormatmauryaNo ratings yet

- Economics 181 International Trade Homework 3 SolutionsDocument4 pagesEconomics 181 International Trade Homework 3 Solutionsh4a0nawc100% (2)

- Cleaning Service Invoice Template Word 333Document1 pageCleaning Service Invoice Template Word 333Murtaza MansoorNo ratings yet

- Bills - of - Exchange (1) CommerceNotesByPraveenShuklaDocument15 pagesBills - of - Exchange (1) CommerceNotesByPraveenShuklauptec kprNo ratings yet

- Cost Sheet: Basics and FormatDocument33 pagesCost Sheet: Basics and FormatShubham Saurav SSNo ratings yet

- What Makes Private Sector Partnership Works: Some Learnings From The FieldDocument12 pagesWhat Makes Private Sector Partnership Works: Some Learnings From The Fieldsto rmNo ratings yet

- JSW Steel Investor Presentation (PDFDrive)Document48 pagesJSW Steel Investor Presentation (PDFDrive)taranjeet.17024No ratings yet

- Pcpar Backflush Costing and JitDocument2 pagesPcpar Backflush Costing and Jitdoora keysNo ratings yet

- Lean Production As A Tool For Green Production TheDocument5 pagesLean Production As A Tool For Green Production ThekamalashrafhkNo ratings yet

- Entrepreneurial Teams 123742Document29 pagesEntrepreneurial Teams 123742jonas sserumaga100% (1)

- 20 Pip ChallangeDocument3 pages20 Pip ChallangeHARJEET singhNo ratings yet

- Entrepreneur: Job/Career InvolvementDocument5 pagesEntrepreneur: Job/Career InvolvementYlaissa GeronimoNo ratings yet

- Lecture 4Document18 pagesLecture 4mustajabNo ratings yet

- Problem Lecture - Relevant CostingDocument9 pagesProblem Lecture - Relevant CostingAhga MoonNo ratings yet

- Competition TracDocument12 pagesCompetition Tracdarshan shettyNo ratings yet

- ACG016 Variable CostingDocument5 pagesACG016 Variable CostingMicay FuensalidaNo ratings yet

- Australian Economy and Its PoliciesDocument2 pagesAustralian Economy and Its PoliciesAdvaith IlavajhalaNo ratings yet

- Statement of Axis Account No:922010035421074 For The Period (From: 01-05-2022 To: 19-11-2022)Document17 pagesStatement of Axis Account No:922010035421074 For The Period (From: 01-05-2022 To: 19-11-2022)Rohit KumarNo ratings yet

- Introduction To Business: Course Code: BUSI-1101Document36 pagesIntroduction To Business: Course Code: BUSI-1101hasib_ahsanNo ratings yet

- Financial - Education - Workbook-VIII (R) - 220924 - 083544Document15 pagesFinancial - Education - Workbook-VIII (R) - 220924 - 083544No oneNo ratings yet

- ch15 - Harestya - SentDocument42 pagesch15 - Harestya - SentBenedict MihoyoNo ratings yet

- How Can Corruption Influence The Work Practice?Document5 pagesHow Can Corruption Influence The Work Practice?Stacy LieutierNo ratings yet

- Strategic Management Ansoff Matrix of P&G: March 2016Document15 pagesStrategic Management Ansoff Matrix of P&G: March 2016HUONG NGUYEN VU QUYNHNo ratings yet

- Five Force AnalysisDocument4 pagesFive Force Analysisdhanaraj39100% (2)

- Quiz - Operating Segments With QuestionsDocument5 pagesQuiz - Operating Segments With Questionsjanus lopezNo ratings yet