Professional Documents

Culture Documents

Partnership Operation 02

Partnership Operation 02

Uploaded by

Cielo DecilloCopyright:

Available Formats

You might also like

- Integrated Review May 2020 Batch Second Monthly Exams AfarDocument94 pagesIntegrated Review May 2020 Batch Second Monthly Exams AfarKriztle Kate Gelogo100% (5)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- The Signs Were There: The clues for investors that a company is heading for a fallFrom EverandThe Signs Were There: The clues for investors that a company is heading for a fallRating: 4.5 out of 5 stars4.5/5 (2)

- BS4Document4 pagesBS4Von Andrei MedinaNo ratings yet

- Advanced Financial Accounting & Reporting JULY 21, 2019 Problem 1Document9 pagesAdvanced Financial Accounting & Reporting JULY 21, 2019 Problem 1FelixNo ratings yet

- Partnership (Dayag) : Advanced Acctg. IDocument33 pagesPartnership (Dayag) : Advanced Acctg. IJanysse Calderon100% (1)

- Practice Problem Income DistributionDocument1 pagePractice Problem Income DistributionViky Rose EballeNo ratings yet

- You Can Do This!: TheoriesDocument3 pagesYou Can Do This!: Theoriesbae joohyunNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- Partnership Operation Part 1 PDFDocument2 pagesPartnership Operation Part 1 PDFazzenethfaye.delacruz.mnlNo ratings yet

- OperationDocument4 pagesOperationRyan SanchezNo ratings yet

- Assignment#2Document10 pagesAssignment#2hae1234No ratings yet

- 2nd Quiz Midterm Acctg12Document3 pages2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- Accounting For Special TransactionsDocument1 pageAccounting For Special TransactionsElvira AriolaNo ratings yet

- Disso and LiquiDocument9 pagesDisso and LiquiDexell Mar MotasNo ratings yet

- Partnership Operations - Seatwork PDFDocument3 pagesPartnership Operations - Seatwork PDFYou're WelcomeNo ratings yet

- Partnership Operations: Problem CDocument3 pagesPartnership Operations: Problem CJoeneil DamalerioNo ratings yet

- Acctg1205 - Chapter 4 PROBLEMSDocument6 pagesAcctg1205 - Chapter 4 PROBLEMSElj Grace BaronNo ratings yet

- 1 PartnershipDocument9 pages1 PartnershipLJBernardo100% (1)

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Magic Dominique Julius Julius TotalDocument4 pagesMagic Dominique Julius Julius TotalPaupauNo ratings yet

- Special Transaction 1Document7 pagesSpecial Transaction 1Josua PagcaliwaganNo ratings yet

- Finals Quiz Dissolution To LiquidationDocument6 pagesFinals Quiz Dissolution To LiquidationJeane Mae Boo75% (4)

- 02Document3 pages02Jodel Castro100% (1)

- HO1 Partnership Formation and OperationDocument3 pagesHO1 Partnership Formation and OperationChristianAquinoNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- PartnershipDocument1 pagePartnershipNyra BeldoroNo ratings yet

- Formation and OperationDocument1 pageFormation and OperationCielo DecilloNo ratings yet

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- University of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Document6 pagesUniversity of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Ian Ranilopa100% (1)

- Soal AKLDocument3 pagesSoal AKLErica Lesmana100% (1)

- Prelim Exam ProblemsDocument4 pagesPrelim Exam Problemslinkin soyNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- The Professional CPA Review SchoolDocument24 pagesThe Professional CPA Review SchoolKYLE LEIGHZANDER VICENTENo ratings yet

- Acp 101Document3 pagesAcp 101Lyca SorianoNo ratings yet

- Profit Sharing ASSIGNMENTDocument4 pagesProfit Sharing ASSIGNMENTRoldan AzueloNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- Wew PDFDocument9 pagesWew PDFLance L. OrlinoNo ratings yet

- Prelim - PART 2Document6 pagesPrelim - PART 2Dan RyanNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG ValenzuelaDocument9 pagesPamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG ValenzuelaLeslie Mae Vargas ZafeNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Partnership - Operation, LiquidationDocument4 pagesPartnership - Operation, LiquidationKenneth Bryan Tegerero TegioNo ratings yet

- Test Bank Advanced Acctg. I Antonio Dayag: D. A, P65,000 B, P81,000Document45 pagesTest Bank Advanced Acctg. I Antonio Dayag: D. A, P65,000 B, P81,000We WNo ratings yet

- Assignment July 2022Document6 pagesAssignment July 2022Dusabamahoro JoniveNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- Afar I. Partnership FormationDocument4 pagesAfar I. Partnership FormationIrish SantiagoNo ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Toaz - Info Afar PRDocument95 pagesToaz - Info Afar PRMiraflor Sanchez BiñasNo ratings yet

- Toaz - Info Partnership Qs PRDocument8 pagesToaz - Info Partnership Qs PRToni Rose Hernandez LualhatiNo ratings yet

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNo ratings yet

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDocument5 pagesAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNo ratings yet

- AST Seatwork - 05 15 2021Document6 pagesAST Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- QuestionDocument3 pagesQuestionAyushNo ratings yet

- PARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019Document4 pagesPARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019BrIzzyJNo ratings yet

- Buy Now: The Ultimate Guide to Owning and Investing in PropertyFrom EverandBuy Now: The Ultimate Guide to Owning and Investing in PropertyRating: 5 out of 5 stars5/5 (1)

- Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinFrom EverandWinning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinNo ratings yet

- Exam 14 February 2020 Questions and AnswersDocument6 pagesExam 14 February 2020 Questions and AnswersCielo DecilloNo ratings yet

- Roque Standard Costing QuestionsDocument7 pagesRoque Standard Costing QuestionsCielo DecilloNo ratings yet

- Input MethodsDocument6 pagesInput MethodsCielo DecilloNo ratings yet

- DAYAG Prac ConstructionDocument40 pagesDAYAG Prac ConstructionCielo DecilloNo ratings yet

- Dayag Hoba PracDocument19 pagesDayag Hoba PracCielo DecilloNo ratings yet

- Dayag Hoba Prac Answer KeyDocument14 pagesDayag Hoba Prac Answer KeyCielo DecilloNo ratings yet

- Partnership Operation 03Document6 pagesPartnership Operation 03Cielo DecilloNo ratings yet

- Partnership DissolutionDocument9 pagesPartnership DissolutionCielo DecilloNo ratings yet

- Formation and OperationDocument1 pageFormation and OperationCielo DecilloNo ratings yet

- Chapter 4Document30 pagesChapter 4Cielo DecilloNo ratings yet

- Student's Name: - Bogun Pathmaraj - ID: - 300829172Document9 pagesStudent's Name: - Bogun Pathmaraj - ID: - 300829172Bogun PathmarajNo ratings yet

- Logging Into AADSDocument4 pagesLogging Into AADSpawarsanjuNo ratings yet

- Axure Templates - Free and Premium Axure RP Templates at UX UI GuideDocument2 pagesAxure Templates - Free and Premium Axure RP Templates at UX UI Guidenevin guptaNo ratings yet

- Is It Nothing To You - Ouseley PDFDocument3 pagesIs It Nothing To You - Ouseley PDFManado Chamber SingersNo ratings yet

- HRP GridDocument51 pagesHRP GridYassine LahlouNo ratings yet

- Official Receipt Writing ScenariosDocument3 pagesOfficial Receipt Writing ScenariosJoseph EnriquezNo ratings yet

- DOJ OIG Issues 'Fast and Furious' ReportDocument512 pagesDOJ OIG Issues 'Fast and Furious' ReportFoxNewsInsiderNo ratings yet

- 1 - Safety-Wherever-I-Go-BoyDocument7 pages1 - Safety-Wherever-I-Go-Boyapi-378883173No ratings yet

- 50 Marta C Ortega Vs Daniel Leonardo103 Phil 870Document3 pages50 Marta C Ortega Vs Daniel Leonardo103 Phil 870Nunugom SonNo ratings yet

- Good Manufacturing PracticeDocument3 pagesGood Manufacturing PracticeTinturulezNo ratings yet

- Cost&management OverheadsDocument16 pagesCost&management OverheadsAlexa KintuNo ratings yet

- Free Consent - Business LawDocument5 pagesFree Consent - Business LawArnav ChaturvediNo ratings yet

- A6 Audit of Ppe Part 2Document5 pagesA6 Audit of Ppe Part 2KezNo ratings yet

- P v. Diocado GR 170567Document11 pagesP v. Diocado GR 170567JanMarkMontedeRamosWongNo ratings yet

- GTD For Teens Goals Canvas PDFDocument2 pagesGTD For Teens Goals Canvas PDFMarta Balula DiasNo ratings yet

- DECENA Case Digest RARAB V CADocument2 pagesDECENA Case Digest RARAB V CAEli DecenaNo ratings yet

- MauryasDocument6 pagesMauryasKritika MalikNo ratings yet

- 611 Series Tech 757454 ENd PDFDocument536 pages611 Series Tech 757454 ENd PDFMinhDuc HoNo ratings yet

- Classification of ContractsDocument3 pagesClassification of ContractsNaeem AnwarNo ratings yet

- CanadaDocument5 pagesCanadaIgor KontescuNo ratings yet

- TenancyDocument7 pagesTenancyBenjamin Goo KWNo ratings yet

- Reminders IN Court Appearance: Atty. Jaydee Peregrino-CoDocument41 pagesReminders IN Court Appearance: Atty. Jaydee Peregrino-Cojd_prgrin_coNo ratings yet

- Chotanagpur Tenancy Act PDFDocument276 pagesChotanagpur Tenancy Act PDFRohan Vijay100% (1)

- Public International LawDocument77 pagesPublic International LawILI PHHC100% (1)

- Essentials of A Valid ConsiderationDocument4 pagesEssentials of A Valid ConsiderationAyush sharmaNo ratings yet

- Anristu 2438ADocument322 pagesAnristu 2438Aengineer_3No ratings yet

- Community and Resistance in Marie Clements' The Unnatural and AccidentalDocument29 pagesCommunity and Resistance in Marie Clements' The Unnatural and AccidentalAkshita BansalNo ratings yet

- State of Madhya Pradesh VsDocument2 pagesState of Madhya Pradesh VsPratyush mishraNo ratings yet

- MSDS PrimaseptDocument6 pagesMSDS PrimaseptMelissa ThompsonNo ratings yet

- Home Designer Suite 2021 Users GuideDocument122 pagesHome Designer Suite 2021 Users Guiderick.mccort2766No ratings yet

Partnership Operation 02

Partnership Operation 02

Uploaded by

Cielo DecilloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Operation 02

Partnership Operation 02

Uploaded by

Cielo DecilloCopyright:

Available Formats

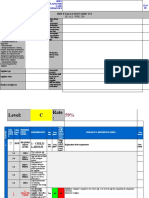

DIVINE WORD COLLEGE OF CALAPAN

AC_FAR- FINANCIAL ACCOUNTING AND REPORTING

Partnership Operation

PROBLEM 1

Harvyn, Rico and Acel are manufacturers’ representative in the architecture business. Their capital accounts in the HRA

Partnership for 2012 are as follows:

Harvyn Rico Acel

January 1, Balances P 45,000 P 60,000 P 25,000

March 1, withdrawal 12,000

April 1, investment 10,000

May 1, investment 24,000

June 1, investment 9,000

August 1, withdrawal 3,000

October 1, withdrawal 18,000

December 1, investment 6,000

Required:

For each of the following independent income-sharing agreements, prepare an income distribution schedule:

1. Monthly salaries are P15,000 to Harvyn, P20,000 to Rico, and P18,000 to Acel. Harvyn receives a bonus of 5% of net

income after deducting his bonus. Interest is 10% of ending capital balances. Any remainder is divided by Harvyn, Rico

and Acel in a 5:2:3 ratio. The Income Summary account has a credit balance of P945,000 before closing.

2. Interest is 12% of weighted average capital balances. Annual salaries are P175,000 to Harvyn, P210,000 to Rico and

P190,000 to Acel. Rico receives a bonus of 25% of net income after deducting the bonus and his salary. Any

remainder is divided in a 3:1:1 ratio by Harvyn, Rico and Acel, respectively. Net income was P350,000 before any

allocations.

3. Acel receives a bonus of 20% net income after deducting the bonus and salaries. Annual salaries are P200,000 to

Harvyn, P180,000 to Rico and P250,000 to Acel. Interest is 12% of the ending capital in excess of P40,000. Any

remainder is to be divided by Harvyn, Rico and Acel in the ratio of their beginning capital balances. Net income was

P580,000 before any allocations.

4. Monthly salaries are P12,000 to Harvyn, P14,000 to Rico and P15,000 to Acel. Rico receives a bonus of 10% of net

income after deducting his bonus. Interest is 20% on the excess of the ending capital balances over the beginning

capital balances. Remainder is to be divided by Harvyn, Rico and Acel in a 2:1:2 ratio. The Income Summary account

has a debit balance of P200,000 before closing.

5. Annual salaries of P150,000 to Harvyn, P180,000 to Rico and P270,000 to Acel are allowed to the extent of the

earnings only. Any remainder is to be divided equally among the partners. Net income before allocation P320,000.

---------End here------

You might also like

- Integrated Review May 2020 Batch Second Monthly Exams AfarDocument94 pagesIntegrated Review May 2020 Batch Second Monthly Exams AfarKriztle Kate Gelogo100% (5)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- The Signs Were There: The clues for investors that a company is heading for a fallFrom EverandThe Signs Were There: The clues for investors that a company is heading for a fallRating: 4.5 out of 5 stars4.5/5 (2)

- BS4Document4 pagesBS4Von Andrei MedinaNo ratings yet

- Advanced Financial Accounting & Reporting JULY 21, 2019 Problem 1Document9 pagesAdvanced Financial Accounting & Reporting JULY 21, 2019 Problem 1FelixNo ratings yet

- Partnership (Dayag) : Advanced Acctg. IDocument33 pagesPartnership (Dayag) : Advanced Acctg. IJanysse Calderon100% (1)

- Practice Problem Income DistributionDocument1 pagePractice Problem Income DistributionViky Rose EballeNo ratings yet

- You Can Do This!: TheoriesDocument3 pagesYou Can Do This!: Theoriesbae joohyunNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- Partnership Operation Part 1 PDFDocument2 pagesPartnership Operation Part 1 PDFazzenethfaye.delacruz.mnlNo ratings yet

- OperationDocument4 pagesOperationRyan SanchezNo ratings yet

- Assignment#2Document10 pagesAssignment#2hae1234No ratings yet

- 2nd Quiz Midterm Acctg12Document3 pages2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- Accounting For Special TransactionsDocument1 pageAccounting For Special TransactionsElvira AriolaNo ratings yet

- Disso and LiquiDocument9 pagesDisso and LiquiDexell Mar MotasNo ratings yet

- Partnership Operations - Seatwork PDFDocument3 pagesPartnership Operations - Seatwork PDFYou're WelcomeNo ratings yet

- Partnership Operations: Problem CDocument3 pagesPartnership Operations: Problem CJoeneil DamalerioNo ratings yet

- Acctg1205 - Chapter 4 PROBLEMSDocument6 pagesAcctg1205 - Chapter 4 PROBLEMSElj Grace BaronNo ratings yet

- 1 PartnershipDocument9 pages1 PartnershipLJBernardo100% (1)

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Magic Dominique Julius Julius TotalDocument4 pagesMagic Dominique Julius Julius TotalPaupauNo ratings yet

- Special Transaction 1Document7 pagesSpecial Transaction 1Josua PagcaliwaganNo ratings yet

- Finals Quiz Dissolution To LiquidationDocument6 pagesFinals Quiz Dissolution To LiquidationJeane Mae Boo75% (4)

- 02Document3 pages02Jodel Castro100% (1)

- HO1 Partnership Formation and OperationDocument3 pagesHO1 Partnership Formation and OperationChristianAquinoNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- PartnershipDocument1 pagePartnershipNyra BeldoroNo ratings yet

- Formation and OperationDocument1 pageFormation and OperationCielo DecilloNo ratings yet

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- University of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Document6 pagesUniversity of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Ian Ranilopa100% (1)

- Soal AKLDocument3 pagesSoal AKLErica Lesmana100% (1)

- Prelim Exam ProblemsDocument4 pagesPrelim Exam Problemslinkin soyNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- The Professional CPA Review SchoolDocument24 pagesThe Professional CPA Review SchoolKYLE LEIGHZANDER VICENTENo ratings yet

- Acp 101Document3 pagesAcp 101Lyca SorianoNo ratings yet

- Profit Sharing ASSIGNMENTDocument4 pagesProfit Sharing ASSIGNMENTRoldan AzueloNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- Wew PDFDocument9 pagesWew PDFLance L. OrlinoNo ratings yet

- Prelim - PART 2Document6 pagesPrelim - PART 2Dan RyanNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG ValenzuelaDocument9 pagesPamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG ValenzuelaLeslie Mae Vargas ZafeNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines Manilaxara mizpahNo ratings yet

- Partnership - Operation, LiquidationDocument4 pagesPartnership - Operation, LiquidationKenneth Bryan Tegerero TegioNo ratings yet

- Test Bank Advanced Acctg. I Antonio Dayag: D. A, P65,000 B, P81,000Document45 pagesTest Bank Advanced Acctg. I Antonio Dayag: D. A, P65,000 B, P81,000We WNo ratings yet

- Assignment July 2022Document6 pagesAssignment July 2022Dusabamahoro JoniveNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- Afar I. Partnership FormationDocument4 pagesAfar I. Partnership FormationIrish SantiagoNo ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Toaz - Info Afar PRDocument95 pagesToaz - Info Afar PRMiraflor Sanchez BiñasNo ratings yet

- Toaz - Info Partnership Qs PRDocument8 pagesToaz - Info Partnership Qs PRToni Rose Hernandez LualhatiNo ratings yet

- 12 Accounts Summer Vacation Assignment 2022-23Document15 pages12 Accounts Summer Vacation Assignment 2022-23Ashelle DsouzaNo ratings yet

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDocument5 pagesAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNo ratings yet

- AST Seatwork - 05 15 2021Document6 pagesAST Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- QuestionDocument3 pagesQuestionAyushNo ratings yet

- PARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019Document4 pagesPARTNERSHIP LIQUIDATION Handout DECEMBER 8 2019BrIzzyJNo ratings yet

- Buy Now: The Ultimate Guide to Owning and Investing in PropertyFrom EverandBuy Now: The Ultimate Guide to Owning and Investing in PropertyRating: 5 out of 5 stars5/5 (1)

- Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinFrom EverandWinning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinNo ratings yet

- Exam 14 February 2020 Questions and AnswersDocument6 pagesExam 14 February 2020 Questions and AnswersCielo DecilloNo ratings yet

- Roque Standard Costing QuestionsDocument7 pagesRoque Standard Costing QuestionsCielo DecilloNo ratings yet

- Input MethodsDocument6 pagesInput MethodsCielo DecilloNo ratings yet

- DAYAG Prac ConstructionDocument40 pagesDAYAG Prac ConstructionCielo DecilloNo ratings yet

- Dayag Hoba PracDocument19 pagesDayag Hoba PracCielo DecilloNo ratings yet

- Dayag Hoba Prac Answer KeyDocument14 pagesDayag Hoba Prac Answer KeyCielo DecilloNo ratings yet

- Partnership Operation 03Document6 pagesPartnership Operation 03Cielo DecilloNo ratings yet

- Partnership DissolutionDocument9 pagesPartnership DissolutionCielo DecilloNo ratings yet

- Formation and OperationDocument1 pageFormation and OperationCielo DecilloNo ratings yet

- Chapter 4Document30 pagesChapter 4Cielo DecilloNo ratings yet

- Student's Name: - Bogun Pathmaraj - ID: - 300829172Document9 pagesStudent's Name: - Bogun Pathmaraj - ID: - 300829172Bogun PathmarajNo ratings yet

- Logging Into AADSDocument4 pagesLogging Into AADSpawarsanjuNo ratings yet

- Axure Templates - Free and Premium Axure RP Templates at UX UI GuideDocument2 pagesAxure Templates - Free and Premium Axure RP Templates at UX UI Guidenevin guptaNo ratings yet

- Is It Nothing To You - Ouseley PDFDocument3 pagesIs It Nothing To You - Ouseley PDFManado Chamber SingersNo ratings yet

- HRP GridDocument51 pagesHRP GridYassine LahlouNo ratings yet

- Official Receipt Writing ScenariosDocument3 pagesOfficial Receipt Writing ScenariosJoseph EnriquezNo ratings yet

- DOJ OIG Issues 'Fast and Furious' ReportDocument512 pagesDOJ OIG Issues 'Fast and Furious' ReportFoxNewsInsiderNo ratings yet

- 1 - Safety-Wherever-I-Go-BoyDocument7 pages1 - Safety-Wherever-I-Go-Boyapi-378883173No ratings yet

- 50 Marta C Ortega Vs Daniel Leonardo103 Phil 870Document3 pages50 Marta C Ortega Vs Daniel Leonardo103 Phil 870Nunugom SonNo ratings yet

- Good Manufacturing PracticeDocument3 pagesGood Manufacturing PracticeTinturulezNo ratings yet

- Cost&management OverheadsDocument16 pagesCost&management OverheadsAlexa KintuNo ratings yet

- Free Consent - Business LawDocument5 pagesFree Consent - Business LawArnav ChaturvediNo ratings yet

- A6 Audit of Ppe Part 2Document5 pagesA6 Audit of Ppe Part 2KezNo ratings yet

- P v. Diocado GR 170567Document11 pagesP v. Diocado GR 170567JanMarkMontedeRamosWongNo ratings yet

- GTD For Teens Goals Canvas PDFDocument2 pagesGTD For Teens Goals Canvas PDFMarta Balula DiasNo ratings yet

- DECENA Case Digest RARAB V CADocument2 pagesDECENA Case Digest RARAB V CAEli DecenaNo ratings yet

- MauryasDocument6 pagesMauryasKritika MalikNo ratings yet

- 611 Series Tech 757454 ENd PDFDocument536 pages611 Series Tech 757454 ENd PDFMinhDuc HoNo ratings yet

- Classification of ContractsDocument3 pagesClassification of ContractsNaeem AnwarNo ratings yet

- CanadaDocument5 pagesCanadaIgor KontescuNo ratings yet

- TenancyDocument7 pagesTenancyBenjamin Goo KWNo ratings yet

- Reminders IN Court Appearance: Atty. Jaydee Peregrino-CoDocument41 pagesReminders IN Court Appearance: Atty. Jaydee Peregrino-Cojd_prgrin_coNo ratings yet

- Chotanagpur Tenancy Act PDFDocument276 pagesChotanagpur Tenancy Act PDFRohan Vijay100% (1)

- Public International LawDocument77 pagesPublic International LawILI PHHC100% (1)

- Essentials of A Valid ConsiderationDocument4 pagesEssentials of A Valid ConsiderationAyush sharmaNo ratings yet

- Anristu 2438ADocument322 pagesAnristu 2438Aengineer_3No ratings yet

- Community and Resistance in Marie Clements' The Unnatural and AccidentalDocument29 pagesCommunity and Resistance in Marie Clements' The Unnatural and AccidentalAkshita BansalNo ratings yet

- State of Madhya Pradesh VsDocument2 pagesState of Madhya Pradesh VsPratyush mishraNo ratings yet

- MSDS PrimaseptDocument6 pagesMSDS PrimaseptMelissa ThompsonNo ratings yet

- Home Designer Suite 2021 Users GuideDocument122 pagesHome Designer Suite 2021 Users Guiderick.mccort2766No ratings yet