Professional Documents

Culture Documents

Individual Taxpayer

Individual Taxpayer

Uploaded by

LL. yangz0 ratings0% found this document useful (0 votes)

17 views10 pagesThis document defines and distinguishes between different types of individual taxpayers in the Philippines: resident citizens, non-resident citizens, resident aliens, non-resident aliens engaged in trade or business, and non-resident aliens not engaged in trade or business. It provides details on their tax base (e.g. net or gross income) and applicable tax rates, as well as tax situs for each taxpayer classification.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines and distinguishes between different types of individual taxpayers in the Philippines: resident citizens, non-resident citizens, resident aliens, non-resident aliens engaged in trade or business, and non-resident aliens not engaged in trade or business. It provides details on their tax base (e.g. net or gross income) and applicable tax rates, as well as tax situs for each taxpayer classification.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views10 pagesIndividual Taxpayer

Individual Taxpayer

Uploaded by

LL. yangzThis document defines and distinguishes between different types of individual taxpayers in the Philippines: resident citizens, non-resident citizens, resident aliens, non-resident aliens engaged in trade or business, and non-resident aliens not engaged in trade or business. It provides details on their tax base (e.g. net or gross income) and applicable tax rates, as well as tax situs for each taxpayer classification.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 10

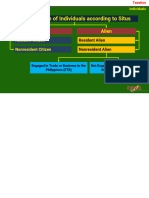

Individual Taxpayers

O Are natural persons with income derived

from within the territorial jurisdiction of a

taxing authority.

Individual Taxpayer

Resident Citizen

Citizen na nakatira sa

Pilipinas

Citizen

Non-resident Citizen

Individual Taxpayer

Resident Alien (RA)

Non-resident Alien

Alien Engaged in Trade or

Business (NRAETB)

Non-Resident Alien

Non-Resident Alien

not engaged in Trade

or Business

(NRANETB)

Citizens

Under the 1987 Philippine Constitution, Article IV,

Section 1, it states that:

The following are citizens of the Philippines:

O Those who are citizens of the Philippines at the time

of the adoption of this Constitution;

O Those whose fathers or mothers are citizens of the

Philippines;

O Those born before January 17, 1973, of Filipino

mothers, who elect Philippine citizenship upon

reaching the age of majority; and

O Those who are naturalized in accordance of law

RESIDENT CITIZEN

O A citizen of the Philippines residing therein.

Non-resident Citizen

is a citizen of the Philippines who:

(a) establishes the fact of his/her physical presence abroad with

the definite intention to reside therein;

(b) leaves the country to reside abroad, either as an immigrant or

for employment on a permanent basis;

(c) works and derives income from abroad and whose

employment thereat requires him to be physically present abroad

most of the time during the taxable year; or,

who has been considered nonresident citizen previously and who

arrives in the Philippines at anytime during the taxable year to

reside permanently in the Philippines shall be treated as

nonresident citizen for the taxable year in which he arrives in the

Philippines with respect to his income abroad until the date of his

arrival in the Philippines.

Alien

O Individuals who are not Filipinos.

RESIDENT ALIEN

An individual whose residence is within the Philippines

and who is not a citizen thereof.

O An alien who lives in the Philippines with no definite

intention as to his stay;

O One who comes to the Philippines for a definite

purpose which in its nature would require an

extended stay and to that end makes his home

temporarily in the Philippines, although it may be his

intention at all times to return to his domicile abroad;

O An alien who has acquired residence in the

Philippines retains his status as such until he

abandons the same and actually departs from the

Philippines.

NON-RESIDENT ALIEN

An individual whose residence is not within the

Philippines and who is not a citizen thereon.

O One who comes to the Philippines for a definite

purpose which in its nature may be promptly

accomplished.

O A non-resident alien individual who shall come to

the Philippines and stay therein for an aggregate

period of more than 180 days during any

calendar year shall be deemed a "non resident

alien doing business in the Philippines”

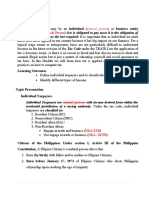

Tax Base and Tax Rate

Taxpayer Tax Base Tax Rate Tax Situs

RC Net Income Graduated Within & Without

NRC Net Income Graduated Within

RA Net Income Graduated Within

NRAETB Net Income Graduated Within

NRANETB Gross Income Final Tax of 25% Within

You might also like

- Income Tax On Individuals - Ust PDFDocument15 pagesIncome Tax On Individuals - Ust PDFKana Lou Cassandra Besana100% (1)

- Reviewer Chapter 2Document6 pagesReviewer Chapter 2Ken NavarroNo ratings yet

- Taxation 1 NotesDocument15 pagesTaxation 1 NotesTricia SandovalNo ratings yet

- COMPARISON of SEC 222 and 203 - CABUSOGDocument2 pagesCOMPARISON of SEC 222 and 203 - CABUSOGKristine Jay Perez-CabusogNo ratings yet

- Individual Taxpayers (Ordinary Income and Fringe Benefits)Document86 pagesIndividual Taxpayers (Ordinary Income and Fringe Benefits)ipbsalanguitNo ratings yet

- (TAX) Income Taxation Updated Jan 9 2022Document133 pages(TAX) Income Taxation Updated Jan 9 2022Reginald ValenciaNo ratings yet

- Taxation of IndividualsDocument22 pagesTaxation of IndividualsTurksNo ratings yet

- Income Taxation - Part 2Document12 pagesIncome Taxation - Part 2Prie DitucalanNo ratings yet

- Income Tax On Individuals PDFDocument20 pagesIncome Tax On Individuals PDFKaren Joy MagsayoNo ratings yet

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S ADocument12 pagesTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoNo ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- Tax 601Document11 pagesTax 601C.J. Clarisse FranciscoNo ratings yet

- 2 Classification of Individual TaxpayersDocument2 pages2 Classification of Individual TaxpayersDiana SheineNo ratings yet

- Classification of Individual Taxpayers - AlienDocument32 pagesClassification of Individual Taxpayers - AlienMarria FrancezcaNo ratings yet

- Types of TaxpayerDocument23 pagesTypes of TaxpayerReina Rose LebrillaNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Handout TaxationDocument2 pagesHandout TaxationJohn Oicemen RocaNo ratings yet

- Individual TaxpayersDocument3 pagesIndividual TaxpayersJoy Orena100% (2)

- Income Taxation: Income Tax For IndividualsDocument8 pagesIncome Taxation: Income Tax For IndividualsJohnnoff Bagacina0% (1)

- Tax CompiledDocument379 pagesTax Compiledlayla scotNo ratings yet

- G.Income Tax-Kinds of TaxpayerDocument1 pageG.Income Tax-Kinds of TaxpayerVinteNo ratings yet

- Taxation of IndividualsDocument6 pagesTaxation of IndividualsLyca V100% (1)

- Kinds of Taxpayers and Situs of IncomeDocument2 pagesKinds of Taxpayers and Situs of IncomeMelanie SamsonaNo ratings yet

- Tax601 Individual Itx Lecture Notes 122Document12 pagesTax601 Individual Itx Lecture Notes 122Justine JaymaNo ratings yet

- Income Tax On IndividualsDocument7 pagesIncome Tax On IndividualsThe man with a Square stacheNo ratings yet

- Citizenship and Residency Inside RP Outside RPDocument2 pagesCitizenship and Residency Inside RP Outside RPRhea Royce CabuhatNo ratings yet

- InTax Unit 2Document3 pagesInTax Unit 2ElleNo ratings yet

- What Are The Kinds of TaxpayersDocument4 pagesWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Introduction To Income Taxation - 625041052Document21 pagesIntroduction To Income Taxation - 625041052ANGELA JOY FLORESNo ratings yet

- PreFi Tax PDFDocument21 pagesPreFi Tax PDFJoesil Dianne SempronNo ratings yet

- Quickie PreFi Tax PDFDocument12 pagesQuickie PreFi Tax PDFJoesil Dianne Sempron100% (1)

- Midterm Assignment Number 1 - CABINASDocument3 pagesMidterm Assignment Number 1 - CABINASJoshua CabinasNo ratings yet

- Personal Income Taxation 1Document29 pagesPersonal Income Taxation 1Rovic OrdonioNo ratings yet

- TYPES OF INCOME TAXPAYERS-Individual&CorporationDocument4 pagesTYPES OF INCOME TAXPAYERS-Individual&CorporationSariephine Grace ArasNo ratings yet

- Template Taxation Unit IIDocument29 pagesTemplate Taxation Unit IINacion, Jaime G.No ratings yet

- Introduction To Individual Income Taxation Chapter Overview and ObjectivesDocument25 pagesIntroduction To Individual Income Taxation Chapter Overview and ObjectivesMatta, Jherrie MaeNo ratings yet

- Income Tax For IndividualsDocument90 pagesIncome Tax For IndividualsRubyjane Kim100% (1)

- Types of Individual Taxpayers Citizens Revenue Regulations No. 1-79Document8 pagesTypes of Individual Taxpayers Citizens Revenue Regulations No. 1-79James Evan I. ObnamiaNo ratings yet

- Taxation of IndividualsDocument9 pagesTaxation of IndividualsBrielle GabNo ratings yet

- Classification of Individual Income TaxpayersDocument3 pagesClassification of Individual Income TaxpayersOdessa De JesusNo ratings yet

- Individual TaxpayerDocument3 pagesIndividual TaxpayerJovie Ann RamiloNo ratings yet

- Types of Income Tax PayersDocument3 pagesTypes of Income Tax PayersAce Fati-igNo ratings yet

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Document5 pagesHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoNo ratings yet

- Module 3 Individual Taxpayers 1Document8 pagesModule 3 Individual Taxpayers 1Chryshelle Anne Marie LontokNo ratings yet

- 20240313T061944584 Att 908654264076627Document113 pages20240313T061944584 Att 908654264076627klee042697No ratings yet

- Income Tax On Individuals - REVISED 2022Document141 pagesIncome Tax On Individuals - REVISED 2022rav dano100% (2)

- INDIVIDUALSDocument6 pagesINDIVIDUALSAnne KimNo ratings yet

- Classification of Individual TaxpayerDocument4 pagesClassification of Individual TaxpayerJj helterbrandNo ratings yet

- Classification of Individual TaxpayerDocument4 pagesClassification of Individual TaxpayerJj helterbrandNo ratings yet

- Summary Lesson 4Document6 pagesSummary Lesson 4Janien MedestomasNo ratings yet

- Income Tax ConDocument2 pagesIncome Tax ConMaricon EstradaNo ratings yet

- Taxation One CompleteDocument90 pagesTaxation One CompleteCiena MaeNo ratings yet

- Taxation of IndividualsDocument49 pagesTaxation of IndividualsAnastasha Grey100% (1)

- Tax Reviewer PDFDocument6 pagesTax Reviewer PDFdave excelleNo ratings yet

- Individual Income TaxDocument9 pagesIndividual Income TaxCharmaine RosalesNo ratings yet

- Produced The Income)Document4 pagesProduced The Income)bluesNo ratings yet

- DateDocument11 pagesDateShiela Jane CrismundoNo ratings yet

- Prelim Income TaxationDocument55 pagesPrelim Income TaxationclytemnestraNo ratings yet

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- Tax 1 Matrix - Sections 23-25 NIRCDocument1 pageTax 1 Matrix - Sections 23-25 NIRCMarieNo ratings yet

- American Mail Line V City of BasilanDocument1 pageAmerican Mail Line V City of BasilanDenise Lim0% (1)

- Learning Task Week 3 & 4 AccountingDocument7 pagesLearning Task Week 3 & 4 AccountingMariane Gale SuaNo ratings yet

- PayslipYTD 202209Document1 pagePayslipYTD 202209Mary TiewNo ratings yet

- Salient Points of TRAIN LawDocument21 pagesSalient Points of TRAIN LawNani kore100% (1)

- 2021-09-10T17-54 Transaction #4257733994341359-8401863Document1 page2021-09-10T17-54 Transaction #4257733994341359-8401863fetacademymediaNo ratings yet

- B.K.Enterprisers: Continued... 2Document33 pagesB.K.Enterprisers: Continued... 2Alok NayakNo ratings yet

- Acca F6 Uk Tax - Due Dates For Tax Payments 2016/17: IndividualsDocument2 pagesAcca F6 Uk Tax - Due Dates For Tax Payments 2016/17: IndividualsSumiya YousefNo ratings yet

- Rmo No. 42 Annex D Bir Form No. 1942Document1 pageRmo No. 42 Annex D Bir Form No. 1942Gil PinoNo ratings yet

- Class Work: Lecture - 57 CAF-06: Question-1Document1 pageClass Work: Lecture - 57 CAF-06: Question-1huzaifah malikNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- 50PADDocument1 page50PADtfmfszrpsfNo ratings yet

- SalespersonDocument1 pageSalespersonShantanu KesarwaniNo ratings yet

- DADEX Flow Line Price List Mar '21Document2 pagesDADEX Flow Line Price List Mar '21Jugno ShahNo ratings yet

- Corporate Income TaxationDocument3 pagesCorporate Income TaxationKezNo ratings yet

- Sss Hemant 562Document1 pageSss Hemant 562msNo ratings yet

- PDF 121154120310723Document1 pagePDF 121154120310723Steve BurnsNo ratings yet

- Ang, Andre Payslip 7.30.23Document1 pageAng, Andre Payslip 7.30.23Chz Trinh VoNo ratings yet

- MohitDocument1 pageMohitʀɛX々 KratøsNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDMittal GalaxyNo ratings yet

- Form PDFDocument1 pageForm PDFRaghava SharmaNo ratings yet

- Direct Tax Challan ReportDocument2 pagesDirect Tax Challan ReportVivek MurtadakNo ratings yet

- Tax Information Account 943420759Document12 pagesTax Information Account 943420759DavidNo ratings yet

- Imposto de Renda em InglesDocument5 pagesImposto de Renda em InglesIago MartinsNo ratings yet

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- Statement of Earnings and DeductionsDocument2 pagesStatement of Earnings and Deductionstaylorizabella1No ratings yet

- 2021 Libertas Christian SchoolDocument32 pages2021 Libertas Christian SchoolFergus BurnsNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- DTI Business Name Official ReceiptDocument1 pageDTI Business Name Official ReceiptJasper SiguaNo ratings yet