Professional Documents

Culture Documents

MP 504

MP 504

Uploaded by

ptgoCopyright:

Available Formats

You might also like

- 120 Questions That Could Save Your LifeDocument31 pages120 Questions That Could Save Your Lifeptgo50% (2)

- International Economics 4th Edition Feenstra Solutions Manual DownloadDocument15 pagesInternational Economics 4th Edition Feenstra Solutions Manual DownloadJane Wright100% (22)

- Bfsi (English Version) Time: 2: 00Hr Maximum Marks: 30 Part - ADocument2 pagesBfsi (English Version) Time: 2: 00Hr Maximum Marks: 30 Part - AVEDA PRAKASH G100% (1)

- AEPaperII PDFDocument95 pagesAEPaperII PDFptgo100% (1)

- Handbook of International TradeDocument411 pagesHandbook of International TradesrinivasNo ratings yet

- MP 504Document3 pagesMP 504ao slr1No ratings yet

- MP 501Document2 pagesMP 501ptgoNo ratings yet

- MP 502Document2 pagesMP 502ptgoNo ratings yet

- MP 404 (Old) MP 111Document2 pagesMP 404 (Old) MP 111ptgoNo ratings yet

- MP 404 (Old) MP 111Document3 pagesMP 404 (Old) MP 111Antiam GautamNo ratings yet

- MP 503Document2 pagesMP 503ptgoNo ratings yet

- MP 503Document3 pagesMP 503ao slr1No ratings yet

- MP 502Document3 pagesMP 502ao slr1No ratings yet

- MP 505Document2 pagesMP 505ptgoNo ratings yet

- Maharana Pratap College of Professional Studies Pre University Examination BBA (Sem. 4) Production ManagementDocument5 pagesMaharana Pratap College of Professional Studies Pre University Examination BBA (Sem. 4) Production ManagementJyoti SinghNo ratings yet

- MP 505Document3 pagesMP 505ao slr1No ratings yet

- Mec 007Document8 pagesMec 007Lovekesh GargNo ratings yet

- Bba 304Document4 pagesBba 304hodmbaalpineNo ratings yet

- MP 103Document2 pagesMP 103ptgoNo ratings yet

- MBA Finance1YearDocument10 pagesMBA Finance1Yearshahmonali6940% (1)

- School of Distance Education & Learning Internal Assignment No. 1Document2 pagesSchool of Distance Education & Learning Internal Assignment No. 1narenNo ratings yet

- Master of Arts (ECONOMICS) (MEC) Term-End Examination December, 2021Document4 pagesMaster of Arts (ECONOMICS) (MEC) Term-End Examination December, 2021rahul ranjan pratap singhNo ratings yet

- MP 202 (Old) MP 107Document3 pagesMP 202 (Old) MP 107ptgoNo ratings yet

- MMPC 016 Jun 2023Document2 pagesMMPC 016 Jun 2023adas76333No ratings yet

- MP 301 201 (New)Document3 pagesMP 301 201 (New)ptgoNo ratings yet

- Reg. No.: Q.P. Code: (P 09 MB 51) : Elective - International FinancialDocument4 pagesReg. No.: Q.P. Code: (P 09 MB 51) : Elective - International FinancialRamkumarNo ratings yet

- Bba 706Document2 pagesBba 706api-3782519No ratings yet

- Bba Iii Year Assignment Question PapersDocument8 pagesBba Iii Year Assignment Question PapersAfrina ThasneemNo ratings yet

- QP Bba Vi IfmDocument1 pageQP Bba Vi IfmShalini SinghNo ratings yet

- M.B.A. Degree Examination - 2011: 220. International FinanceDocument1 pageM.B.A. Degree Examination - 2011: 220. International FinanceRavi KrishnanNo ratings yet

- 125 Bba-202Document3 pages125 Bba-202Ghanshyam SharmaNo ratings yet

- APRIL 2012 M. Com. (Semester - IV) (Compulsory) Examination - 2012Document3 pagesAPRIL 2012 M. Com. (Semester - IV) (Compulsory) Examination - 2012kavitachordiya86No ratings yet

- Tutor Marked AssignmentDocument4 pagesTutor Marked AssignmentCSNo ratings yet

- Mms Mbs Apr2012Document32 pagesMms Mbs Apr2012Fernandes RudolfNo ratings yet

- International Business Management QPDocument26 pagesInternational Business Management QPAashutosh PandeyNo ratings yet

- Bba 101Document14 pagesBba 101jithindas050% (1)

- International Business 210621Document1 pageInternational Business 210621Nikeeta PawarNo ratings yet

- NRT/KS/19/5542: CLS-17300 1 (Contd.)Document2 pagesNRT/KS/19/5542: CLS-17300 1 (Contd.)prajwal khotNo ratings yet

- Mba DEC 2022 Exam - MergedDocument13 pagesMba DEC 2022 Exam - MergedAman SharmaNo ratings yet

- Mba 209Document2 pagesMba 209Abhinandan Nath0% (1)

- Bba Ii Year Assignment Question PapersDocument7 pagesBba Ii Year Assignment Question PapersAfrina ThasneemNo ratings yet

- Assignment 2021-2022: For July 2021 and January 2022 Admission CycleDocument11 pagesAssignment 2021-2022: For July 2021 and January 2022 Admission CycleCSNo ratings yet

- Bcom 101Document2 pagesBcom 101ajtt38No ratings yet

- MBFM4002 Global Financial ManagementDocument3 pagesMBFM4002 Global Financial ManagementShakthi RaghaviNo ratings yet

- Bcca 6 Sem Entrepreneurship Development 5542 Summer 2019Document2 pagesBcca 6 Sem Entrepreneurship Development 5542 Summer 2019jayesh.gaming9212No ratings yet

- Eps-07 Eng PDFDocument54 pagesEps-07 Eng PDFPrashant PatilNo ratings yet

- MB0037G International Business Management-Assignments-Feb-11Document2 pagesMB0037G International Business Management-Assignments-Feb-11Bryan KnoxNo ratings yet

- Bba 502Document4 pagesBba 502Innocent BwalyaNo ratings yet

- M ThNkU7EwuBWR7I 2Fq - 4763Document1 pageM ThNkU7EwuBWR7I 2Fq - 4763dipusharma4200No ratings yet

- IBO 01 June 2017 - RemovedDocument2 pagesIBO 01 June 2017 - RemovedJay PatelNo ratings yet

- Uka Tarsadia UniversityDocument1 pageUka Tarsadia UniversityDivyesh G GamitNo ratings yet

- Mercantilism Absolute Advantage Theory Comparative Advantage Theory Product Lifecycle Theory Porter's Diamond ModelDocument2 pagesMercantilism Absolute Advantage Theory Comparative Advantage Theory Product Lifecycle Theory Porter's Diamond ModelSowdhamini GanesunNo ratings yet

- Financial Institution & MarketsDocument1 pageFinancial Institution & MarketsPILLO PATELNo ratings yet

- Mece-004 EngDocument35 pagesMece-004 EngnitikanehiNo ratings yet

- Mec 007Document8 pagesMec 007Kirti Chopra SabarwalNo ratings yet

- Mec-007 EngDocument36 pagesMec-007 EngnitikanehiNo ratings yet

- PgdiboDocument8 pagesPgdiboVinod GehlotNo ratings yet

- DMGT401 4Document1 pageDMGT401 4amanNo ratings yet

- MB0053G International Business Management Assignments Feb 11Document2 pagesMB0053G International Business Management Assignments Feb 11shazmekoolNo ratings yet

- IFS Suggested Questions by GKJDocument5 pagesIFS Suggested Questions by GKJNayanNo ratings yet

- MP 102Document2 pagesMP 102ptgoNo ratings yet

- Ilililffiilfiffiililililtffiilll:: LnternationalDocument2 pagesIlililffiilfiffiililililtffiilll:: LnternationalMunni ChukkaNo ratings yet

- International Finance 2021-22Document3 pagesInternational Finance 2021-22NAITIK SHAHNo ratings yet

- MP 304 (Old) 204 (New)Document3 pagesMP 304 (Old) 204 (New)ptgoNo ratings yet

- MP 404 (Old) MP 111Document2 pagesMP 404 (Old) MP 111ptgoNo ratings yet

- MP 503Document2 pagesMP 503ptgoNo ratings yet

- MP 501Document2 pagesMP 501ptgoNo ratings yet

- MP 505Document2 pagesMP 505ptgoNo ratings yet

- MP 502Document2 pagesMP 502ptgoNo ratings yet

- MP 201 (Old) MP 106Document2 pagesMP 201 (Old) MP 106ptgoNo ratings yet

- MP 101Document2 pagesMP 101ptgoNo ratings yet

- MP 301 201 (New)Document3 pagesMP 301 201 (New)ptgoNo ratings yet

- MP 202 (Old) MP 107Document3 pagesMP 202 (Old) MP 107ptgoNo ratings yet

- MP 103Document2 pagesMP 103ptgoNo ratings yet

- MP 104Document3 pagesMP 104ptgoNo ratings yet

- MP 204 (Old) MP 109Document4 pagesMP 204 (Old) MP 109ptgoNo ratings yet

- MP 102Document2 pagesMP 102ptgoNo ratings yet

- MP 203 (Old) MP 108Document2 pagesMP 203 (Old) MP 108ptgoNo ratings yet

- Apprentices ActDocument4 pagesApprentices ActptgoNo ratings yet

- MANAGERIAL ECONOMICS 3 KkhsouDocument188 pagesMANAGERIAL ECONOMICS 3 KkhsouptgoNo ratings yet

- IFMDocument2 pagesIFMN ArunsankarNo ratings yet

- 2011 Management ExamDocument33 pages2011 Management ExamEdwin UcheNo ratings yet

- International Finance - Short Notes (Theory)Document20 pagesInternational Finance - Short Notes (Theory)Amit SinghNo ratings yet

- IF Sem IV Word Success and ThakurDocument28 pagesIF Sem IV Word Success and ThakurSanket MhetreNo ratings yet

- International Financial Management: by Jeff MaduraDocument32 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- Total Pages: 15Document15 pagesTotal Pages: 15sureshdevidasNo ratings yet

- Gist of XII Class Economy NCERT (Microeconomics & Macroeconomics) Web Notes at Abhipedia Powered by ABHIMANU IASDocument15 pagesGist of XII Class Economy NCERT (Microeconomics & Macroeconomics) Web Notes at Abhipedia Powered by ABHIMANU IASRahul ChaudharyNo ratings yet

- Ebook International Business The Challenges of Globalization Global Edition 10Th Edition PDF Full Chapter PDFDocument67 pagesEbook International Business The Challenges of Globalization Global Edition 10Th Edition PDF Full Chapter PDFjoseph.gonzalez799100% (38)

- Impact of Currency Fluctuations On Indian Stock MarketDocument5 pagesImpact of Currency Fluctuations On Indian Stock MarketShreyas LavekarNo ratings yet

- Contemporary World Lesson 1-2Document9 pagesContemporary World Lesson 1-2Mark John Albesa CrebilloNo ratings yet

- Specie Resumption Act of 1879Document12 pagesSpecie Resumption Act of 1879AndrewNo ratings yet

- Tragakes Paper 2 AnswersDocument49 pagesTragakes Paper 2 Answersapi-26051256367% (3)

- Yeni Microsoft Word BelgesiDocument4 pagesYeni Microsoft Word BelgesiSercan DoğancıNo ratings yet

- Chapter 7 Dornbusch ModelDocument25 pagesChapter 7 Dornbusch ModelDương Quốc TuấnNo ratings yet

- PSM 204 Role and Functions of IMFDocument16 pagesPSM 204 Role and Functions of IMFZubair JuttNo ratings yet

- Fixed and Flexible Exchange Rate SystemsDocument11 pagesFixed and Flexible Exchange Rate SystemsAliciaNo ratings yet

- Economics ProjectDocument24 pagesEconomics ProjectBendoverNo ratings yet

- GE3Document16 pagesGE3Aries C. GavinoNo ratings yet

- Industrial Finance Corporation of India (IFCI)Document33 pagesIndustrial Finance Corporation of India (IFCI)Government College of Engineering & Ceramic TechnologyNo ratings yet

- Role of IMF in International Monetary System - 2 - 2Document18 pagesRole of IMF in International Monetary System - 2 - 2Sushma VegesnaNo ratings yet

- Halimani Notes Exchange RatesDocument3 pagesHalimani Notes Exchange RatesMalvin D GarabhaNo ratings yet

- FT Partners Research FinTech in Africa 2024 1711624237Document214 pagesFT Partners Research FinTech in Africa 2024 1711624237Amal BourkiNo ratings yet

- Macroeconomics Canadian 5th Edition Blanchard Test BankDocument16 pagesMacroeconomics Canadian 5th Edition Blanchard Test Bankmabelleonardn75s2100% (27)

- Chapter 3 of International Financial ManagementDocument26 pagesChapter 3 of International Financial ManagementAimon L'EngleNo ratings yet

- ch16 Krugman 10eDocument37 pagesch16 Krugman 10eoguliyev201No ratings yet

- The International Monetary System and The CaseDocument35 pagesThe International Monetary System and The CaseLucianaNo ratings yet

- Ibps Po Mains Cracker - 2016Document51 pagesIbps Po Mains Cracker - 2016Vimal PokalNo ratings yet

- REGULATION CompressedDocument46 pagesREGULATION CompressedSamplamanNo ratings yet

MP 504

MP 504

Uploaded by

ptgoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MP 504

MP 504

Uploaded by

ptgoCopyright:

Available Formats

533

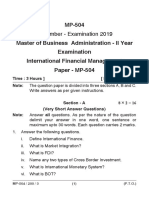

MP-504

December - Examination 2016

Master of Business Administration - II Year Examination

International Financial Management

Paper - MP-504

Time : 3 Hours ] [ Max. Marks :- 80

Note: The question paper is divided into three sections A, B and C.

Write answers as per given instructions.

Section - A 8 × 2 = 16

(Very Short Answer Questions)

Note: Answer all questions. As per the nature of the question

delimit your answer in one word, one sentence or

maximum upto 30 words. Each question carries 2 marks.

1) (i) What is the another name of the World Bank?

(ii) What is Current Account Deficit (CAD)?

(iii) What was the main reason of creating Special Drawing

Rights (SDRs)?

(iv) What do you mean by currency pegging?

(v) What do you understand by Cocktail Bonds?

(vi) Mention any two important objectives of International

Monetary Fund.

(vii) Define Foreign Direct Investment (FDI).

(viii) What is another name of translation exposure?

MP-504 / 200 / 2 (1) (P.T.O.)

533

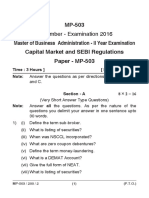

Section - B 4 × 8 = 32

(Short Answer Questions)

Note: Answer any four questions. Each answer should not

exceed 200 words. Each question carries 8 marks.

2) Explain the key characteristics of classical gold standard.

3) Why the World Bank was established?

4) Write a brief note on Asian Stock Exchanges.

5) Explain the different types of disequilibrium in balance of

payments.

6) What are the advantages and problems of forward exchange

rates.

7) Write a brief note on translation exposure.

8) Explain the objectives of Foreign Exchange Control.

9) Why two affiliates (IDA and IFC) of World Bank were established?

Section - C 2 × 16 = 32

(Long Answer Questions)

Note: Answer any two questions. Each answer should not

exceed 500 words. Each question carries 16 marks.

10) Discuss the functions and progress of Asian Development

Bank.

11) Critically examine the demand and supply theory of exchange

rate determination.

12) Explain the types of foreign exchange exposure.

13) Discuss the International Investment Strategies.

MP-504 / 200 / 2 (2)

You might also like

- 120 Questions That Could Save Your LifeDocument31 pages120 Questions That Could Save Your Lifeptgo50% (2)

- International Economics 4th Edition Feenstra Solutions Manual DownloadDocument15 pagesInternational Economics 4th Edition Feenstra Solutions Manual DownloadJane Wright100% (22)

- Bfsi (English Version) Time: 2: 00Hr Maximum Marks: 30 Part - ADocument2 pagesBfsi (English Version) Time: 2: 00Hr Maximum Marks: 30 Part - AVEDA PRAKASH G100% (1)

- AEPaperII PDFDocument95 pagesAEPaperII PDFptgo100% (1)

- Handbook of International TradeDocument411 pagesHandbook of International TradesrinivasNo ratings yet

- MP 504Document3 pagesMP 504ao slr1No ratings yet

- MP 501Document2 pagesMP 501ptgoNo ratings yet

- MP 502Document2 pagesMP 502ptgoNo ratings yet

- MP 404 (Old) MP 111Document2 pagesMP 404 (Old) MP 111ptgoNo ratings yet

- MP 404 (Old) MP 111Document3 pagesMP 404 (Old) MP 111Antiam GautamNo ratings yet

- MP 503Document2 pagesMP 503ptgoNo ratings yet

- MP 503Document3 pagesMP 503ao slr1No ratings yet

- MP 502Document3 pagesMP 502ao slr1No ratings yet

- MP 505Document2 pagesMP 505ptgoNo ratings yet

- Maharana Pratap College of Professional Studies Pre University Examination BBA (Sem. 4) Production ManagementDocument5 pagesMaharana Pratap College of Professional Studies Pre University Examination BBA (Sem. 4) Production ManagementJyoti SinghNo ratings yet

- MP 505Document3 pagesMP 505ao slr1No ratings yet

- Mec 007Document8 pagesMec 007Lovekesh GargNo ratings yet

- Bba 304Document4 pagesBba 304hodmbaalpineNo ratings yet

- MP 103Document2 pagesMP 103ptgoNo ratings yet

- MBA Finance1YearDocument10 pagesMBA Finance1Yearshahmonali6940% (1)

- School of Distance Education & Learning Internal Assignment No. 1Document2 pagesSchool of Distance Education & Learning Internal Assignment No. 1narenNo ratings yet

- Master of Arts (ECONOMICS) (MEC) Term-End Examination December, 2021Document4 pagesMaster of Arts (ECONOMICS) (MEC) Term-End Examination December, 2021rahul ranjan pratap singhNo ratings yet

- MP 202 (Old) MP 107Document3 pagesMP 202 (Old) MP 107ptgoNo ratings yet

- MMPC 016 Jun 2023Document2 pagesMMPC 016 Jun 2023adas76333No ratings yet

- MP 301 201 (New)Document3 pagesMP 301 201 (New)ptgoNo ratings yet

- Reg. No.: Q.P. Code: (P 09 MB 51) : Elective - International FinancialDocument4 pagesReg. No.: Q.P. Code: (P 09 MB 51) : Elective - International FinancialRamkumarNo ratings yet

- Bba 706Document2 pagesBba 706api-3782519No ratings yet

- Bba Iii Year Assignment Question PapersDocument8 pagesBba Iii Year Assignment Question PapersAfrina ThasneemNo ratings yet

- QP Bba Vi IfmDocument1 pageQP Bba Vi IfmShalini SinghNo ratings yet

- M.B.A. Degree Examination - 2011: 220. International FinanceDocument1 pageM.B.A. Degree Examination - 2011: 220. International FinanceRavi KrishnanNo ratings yet

- 125 Bba-202Document3 pages125 Bba-202Ghanshyam SharmaNo ratings yet

- APRIL 2012 M. Com. (Semester - IV) (Compulsory) Examination - 2012Document3 pagesAPRIL 2012 M. Com. (Semester - IV) (Compulsory) Examination - 2012kavitachordiya86No ratings yet

- Tutor Marked AssignmentDocument4 pagesTutor Marked AssignmentCSNo ratings yet

- Mms Mbs Apr2012Document32 pagesMms Mbs Apr2012Fernandes RudolfNo ratings yet

- International Business Management QPDocument26 pagesInternational Business Management QPAashutosh PandeyNo ratings yet

- Bba 101Document14 pagesBba 101jithindas050% (1)

- International Business 210621Document1 pageInternational Business 210621Nikeeta PawarNo ratings yet

- NRT/KS/19/5542: CLS-17300 1 (Contd.)Document2 pagesNRT/KS/19/5542: CLS-17300 1 (Contd.)prajwal khotNo ratings yet

- Mba DEC 2022 Exam - MergedDocument13 pagesMba DEC 2022 Exam - MergedAman SharmaNo ratings yet

- Mba 209Document2 pagesMba 209Abhinandan Nath0% (1)

- Bba Ii Year Assignment Question PapersDocument7 pagesBba Ii Year Assignment Question PapersAfrina ThasneemNo ratings yet

- Assignment 2021-2022: For July 2021 and January 2022 Admission CycleDocument11 pagesAssignment 2021-2022: For July 2021 and January 2022 Admission CycleCSNo ratings yet

- Bcom 101Document2 pagesBcom 101ajtt38No ratings yet

- MBFM4002 Global Financial ManagementDocument3 pagesMBFM4002 Global Financial ManagementShakthi RaghaviNo ratings yet

- Bcca 6 Sem Entrepreneurship Development 5542 Summer 2019Document2 pagesBcca 6 Sem Entrepreneurship Development 5542 Summer 2019jayesh.gaming9212No ratings yet

- Eps-07 Eng PDFDocument54 pagesEps-07 Eng PDFPrashant PatilNo ratings yet

- MB0037G International Business Management-Assignments-Feb-11Document2 pagesMB0037G International Business Management-Assignments-Feb-11Bryan KnoxNo ratings yet

- Bba 502Document4 pagesBba 502Innocent BwalyaNo ratings yet

- M ThNkU7EwuBWR7I 2Fq - 4763Document1 pageM ThNkU7EwuBWR7I 2Fq - 4763dipusharma4200No ratings yet

- IBO 01 June 2017 - RemovedDocument2 pagesIBO 01 June 2017 - RemovedJay PatelNo ratings yet

- Uka Tarsadia UniversityDocument1 pageUka Tarsadia UniversityDivyesh G GamitNo ratings yet

- Mercantilism Absolute Advantage Theory Comparative Advantage Theory Product Lifecycle Theory Porter's Diamond ModelDocument2 pagesMercantilism Absolute Advantage Theory Comparative Advantage Theory Product Lifecycle Theory Porter's Diamond ModelSowdhamini GanesunNo ratings yet

- Financial Institution & MarketsDocument1 pageFinancial Institution & MarketsPILLO PATELNo ratings yet

- Mece-004 EngDocument35 pagesMece-004 EngnitikanehiNo ratings yet

- Mec 007Document8 pagesMec 007Kirti Chopra SabarwalNo ratings yet

- Mec-007 EngDocument36 pagesMec-007 EngnitikanehiNo ratings yet

- PgdiboDocument8 pagesPgdiboVinod GehlotNo ratings yet

- DMGT401 4Document1 pageDMGT401 4amanNo ratings yet

- MB0053G International Business Management Assignments Feb 11Document2 pagesMB0053G International Business Management Assignments Feb 11shazmekoolNo ratings yet

- IFS Suggested Questions by GKJDocument5 pagesIFS Suggested Questions by GKJNayanNo ratings yet

- MP 102Document2 pagesMP 102ptgoNo ratings yet

- Ilililffiilfiffiililililtffiilll:: LnternationalDocument2 pagesIlililffiilfiffiililililtffiilll:: LnternationalMunni ChukkaNo ratings yet

- International Finance 2021-22Document3 pagesInternational Finance 2021-22NAITIK SHAHNo ratings yet

- MP 304 (Old) 204 (New)Document3 pagesMP 304 (Old) 204 (New)ptgoNo ratings yet

- MP 404 (Old) MP 111Document2 pagesMP 404 (Old) MP 111ptgoNo ratings yet

- MP 503Document2 pagesMP 503ptgoNo ratings yet

- MP 501Document2 pagesMP 501ptgoNo ratings yet

- MP 505Document2 pagesMP 505ptgoNo ratings yet

- MP 502Document2 pagesMP 502ptgoNo ratings yet

- MP 201 (Old) MP 106Document2 pagesMP 201 (Old) MP 106ptgoNo ratings yet

- MP 101Document2 pagesMP 101ptgoNo ratings yet

- MP 301 201 (New)Document3 pagesMP 301 201 (New)ptgoNo ratings yet

- MP 202 (Old) MP 107Document3 pagesMP 202 (Old) MP 107ptgoNo ratings yet

- MP 103Document2 pagesMP 103ptgoNo ratings yet

- MP 104Document3 pagesMP 104ptgoNo ratings yet

- MP 204 (Old) MP 109Document4 pagesMP 204 (Old) MP 109ptgoNo ratings yet

- MP 102Document2 pagesMP 102ptgoNo ratings yet

- MP 203 (Old) MP 108Document2 pagesMP 203 (Old) MP 108ptgoNo ratings yet

- Apprentices ActDocument4 pagesApprentices ActptgoNo ratings yet

- MANAGERIAL ECONOMICS 3 KkhsouDocument188 pagesMANAGERIAL ECONOMICS 3 KkhsouptgoNo ratings yet

- IFMDocument2 pagesIFMN ArunsankarNo ratings yet

- 2011 Management ExamDocument33 pages2011 Management ExamEdwin UcheNo ratings yet

- International Finance - Short Notes (Theory)Document20 pagesInternational Finance - Short Notes (Theory)Amit SinghNo ratings yet

- IF Sem IV Word Success and ThakurDocument28 pagesIF Sem IV Word Success and ThakurSanket MhetreNo ratings yet

- International Financial Management: by Jeff MaduraDocument32 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- Total Pages: 15Document15 pagesTotal Pages: 15sureshdevidasNo ratings yet

- Gist of XII Class Economy NCERT (Microeconomics & Macroeconomics) Web Notes at Abhipedia Powered by ABHIMANU IASDocument15 pagesGist of XII Class Economy NCERT (Microeconomics & Macroeconomics) Web Notes at Abhipedia Powered by ABHIMANU IASRahul ChaudharyNo ratings yet

- Ebook International Business The Challenges of Globalization Global Edition 10Th Edition PDF Full Chapter PDFDocument67 pagesEbook International Business The Challenges of Globalization Global Edition 10Th Edition PDF Full Chapter PDFjoseph.gonzalez799100% (38)

- Impact of Currency Fluctuations On Indian Stock MarketDocument5 pagesImpact of Currency Fluctuations On Indian Stock MarketShreyas LavekarNo ratings yet

- Contemporary World Lesson 1-2Document9 pagesContemporary World Lesson 1-2Mark John Albesa CrebilloNo ratings yet

- Specie Resumption Act of 1879Document12 pagesSpecie Resumption Act of 1879AndrewNo ratings yet

- Tragakes Paper 2 AnswersDocument49 pagesTragakes Paper 2 Answersapi-26051256367% (3)

- Yeni Microsoft Word BelgesiDocument4 pagesYeni Microsoft Word BelgesiSercan DoğancıNo ratings yet

- Chapter 7 Dornbusch ModelDocument25 pagesChapter 7 Dornbusch ModelDương Quốc TuấnNo ratings yet

- PSM 204 Role and Functions of IMFDocument16 pagesPSM 204 Role and Functions of IMFZubair JuttNo ratings yet

- Fixed and Flexible Exchange Rate SystemsDocument11 pagesFixed and Flexible Exchange Rate SystemsAliciaNo ratings yet

- Economics ProjectDocument24 pagesEconomics ProjectBendoverNo ratings yet

- GE3Document16 pagesGE3Aries C. GavinoNo ratings yet

- Industrial Finance Corporation of India (IFCI)Document33 pagesIndustrial Finance Corporation of India (IFCI)Government College of Engineering & Ceramic TechnologyNo ratings yet

- Role of IMF in International Monetary System - 2 - 2Document18 pagesRole of IMF in International Monetary System - 2 - 2Sushma VegesnaNo ratings yet

- Halimani Notes Exchange RatesDocument3 pagesHalimani Notes Exchange RatesMalvin D GarabhaNo ratings yet

- FT Partners Research FinTech in Africa 2024 1711624237Document214 pagesFT Partners Research FinTech in Africa 2024 1711624237Amal BourkiNo ratings yet

- Macroeconomics Canadian 5th Edition Blanchard Test BankDocument16 pagesMacroeconomics Canadian 5th Edition Blanchard Test Bankmabelleonardn75s2100% (27)

- Chapter 3 of International Financial ManagementDocument26 pagesChapter 3 of International Financial ManagementAimon L'EngleNo ratings yet

- ch16 Krugman 10eDocument37 pagesch16 Krugman 10eoguliyev201No ratings yet

- The International Monetary System and The CaseDocument35 pagesThe International Monetary System and The CaseLucianaNo ratings yet

- Ibps Po Mains Cracker - 2016Document51 pagesIbps Po Mains Cracker - 2016Vimal PokalNo ratings yet

- REGULATION CompressedDocument46 pagesREGULATION CompressedSamplamanNo ratings yet