Professional Documents

Culture Documents

Buffett Salomonltr

Buffett Salomonltr

Uploaded by

uew702Copyright:

Available Formats

You might also like

- Memo To Client Regarding Choice of Business EntityDocument6 pagesMemo To Client Regarding Choice of Business EntityAaron Burr100% (2)

- Solution Manual For Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Jeffrey Jaffe Bradford Jordan 3Document37 pagesSolution Manual For Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Jeffrey Jaffe Bradford Jordan 3athanormimictsf1l95% (22)

- S Corporation ESOP Traps for the UnwaryFrom EverandS Corporation ESOP Traps for the UnwaryNo ratings yet

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507No ratings yet

- Spin Off & Corporate Restructuring in BriefDocument11 pagesSpin Off & Corporate Restructuring in BriefTushar Kadam100% (1)

- Chart of Accounts For A Merchandising BusinessDocument3 pagesChart of Accounts For A Merchandising BusinessJosh LeBlanc100% (5)

- Bank Stetment PDFDocument21 pagesBank Stetment PDFraj100% (1)

- Analysis of The Nature of Company's Corporate Entity, Benefits and Disadvantages of Incorporating BusinessDocument4 pagesAnalysis of The Nature of Company's Corporate Entity, Benefits and Disadvantages of Incorporating BusinessParvez SovonNo ratings yet

- Choosing The Right Entity For Your Emerging Growth CompanyDocument24 pagesChoosing The Right Entity For Your Emerging Growth CompanyflastergreenbergNo ratings yet

- Intro To Corporate FinanceDocument75 pagesIntro To Corporate FinanceRashid HussainNo ratings yet

- Chairman's Letter - 1990Document24 pagesChairman's Letter - 1990j3r1c0d5No ratings yet

- Ernest and Young Interview QuestionsDocument57 pagesErnest and Young Interview QuestionsPratyush Raj Benya100% (2)

- Chapter One - Introduction To Corporate FinanceDocument25 pagesChapter One - Introduction To Corporate Financeonkarskulkarni100% (2)

- To The Shareholders of Berkshire Hathaway Inc.Document22 pagesTo The Shareholders of Berkshire Hathaway Inc.gjangNo ratings yet

- Tap Into This Debt-Free Financing For Your New BusinessDocument20 pagesTap Into This Debt-Free Financing For Your New BusinessKevin SearlsNo ratings yet

- Berkshire Letters 1992Document25 pagesBerkshire Letters 1992nirajppNo ratings yet

- Chairman's Letter - 1992Document22 pagesChairman's Letter - 1992SuperGuyNo ratings yet

- Aefman Module 1 5Document28 pagesAefman Module 1 5TUGADE, AMADOR EMMANUELLE R.No ratings yet

- Corporate FinanceDocument108 pagesCorporate FinanceKenneth AdokohNo ratings yet

- Memo To Client Regarding Choice of Business EntityDocument6 pagesMemo To Client Regarding Choice of Business EntityJ.P. FernandesNo ratings yet

- Corporate Governance..Document5 pagesCorporate Governance..Shazia HameedNo ratings yet

- Semester 1 TheoryDocument11 pagesSemester 1 TheoryRajeev GiriNo ratings yet

- Financial Distress - Meaning, Causes, and Evaluation of Financial Distress Using Different ModelsDocument19 pagesFinancial Distress - Meaning, Causes, and Evaluation of Financial Distress Using Different ModelsRajeev RanjanNo ratings yet

- Top 7 Biggest If Rs MistakesDocument18 pagesTop 7 Biggest If Rs MistakesKyleRodSimpsonNo ratings yet

- Burry Scion1q2001Document6 pagesBurry Scion1q2001frankal1016147No ratings yet

- Company LawDocument20 pagesCompany LawZahid SafdarNo ratings yet

- LBO Interviews Questions BIWSDocument5 pagesLBO Interviews Questions BIWSartemidualikNo ratings yet

- Restructuring An Underperforming Company in China: Case StudyDocument7 pagesRestructuring An Underperforming Company in China: Case StudyAkansha SinhaNo ratings yet

- Capitalmind Financial Shenanigans Part 1Document17 pagesCapitalmind Financial Shenanigans Part 1abhinavnarayanNo ratings yet

- The "Rollover As Business Start-Up" Strategy-Should Your Client Use Retirement Rollover Funds To Finance A Business?Document5 pagesThe "Rollover As Business Start-Up" Strategy-Should Your Client Use Retirement Rollover Funds To Finance A Business?Priyanka DargadNo ratings yet

- Questions DuresDocument25 pagesQuestions DuresAnna-Maria Müller-SchmidtNo ratings yet

- June, 2021: Where Are We Now?Document13 pagesJune, 2021: Where Are We Now?l chanNo ratings yet

- Outline For Burkhard - Business CorpsDocument148 pagesOutline For Burkhard - Business CorpsLauren Lorraine BaileyNo ratings yet

- Naimur Rahman Navan (BBA 066 18963) MGMJT 446 LLCDocument19 pagesNaimur Rahman Navan (BBA 066 18963) MGMJT 446 LLCNaimur NavanNo ratings yet

- What Is Lifting The Corporate Veil of CompanyDocument4 pagesWhat Is Lifting The Corporate Veil of CompanyAminul IslamNo ratings yet

- How To Know Fraud in AdvanceDocument6 pagesHow To Know Fraud in AdvanceMd AzimNo ratings yet

- Quitting A Cushy Corporate Job To Join A Start-Up Venture.: A Guide For ExecutivesDocument10 pagesQuitting A Cushy Corporate Job To Join A Start-Up Venture.: A Guide For ExecutivesBayu De JeNo ratings yet

- Employee Buyout - A Compelling Exit StrategyDocument5 pagesEmployee Buyout - A Compelling Exit StrategyheenaieibsNo ratings yet

- Colgate Palmolive AnalysisDocument5 pagesColgate Palmolive AnalysisprincearoraNo ratings yet

- Different Types of Corporate StructuresDocument9 pagesDifferent Types of Corporate StructuresDavid AtkinsonNo ratings yet

- USMO White Paper (Updated)Document3 pagesUSMO White Paper (Updated)ContrarianIndustriesNo ratings yet

- Sources of FinanceDocument22 pagesSources of FinanceAkshay S PulimootilNo ratings yet

- Auditing Revision For ExamDocument22 pagesAuditing Revision For ExamcollegeofhateNo ratings yet

- Taxation - Paper T5Document20 pagesTaxation - Paper T5Kabutu ChuungaNo ratings yet

- Current Ratio: Current Assets/current LiabilitiesDocument7 pagesCurrent Ratio: Current Assets/current LiabilitiesSambit MishraNo ratings yet

- Drilling For WealthDocument12 pagesDrilling For WealthSchn1eck7No ratings yet

- Postscripts On The Fundamentals of Corporate FinanceDocument6 pagesPostscripts On The Fundamentals of Corporate FinancebehcetNo ratings yet

- Concepts of Financial ManagementDocument13 pagesConcepts of Financial ManagementHarris NarbarteNo ratings yet

- Solution Manual For M Finance 4th Edition Marcia Cornett Troy Adair John NofsingerDocument36 pagesSolution Manual For M Finance 4th Edition Marcia Cornett Troy Adair John Nofsingerjuristvesicantg7egkNo ratings yet

- Chapter 1Document25 pagesChapter 1ragi malikNo ratings yet

- LLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessFrom EverandLLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessNo ratings yet

- Accounts Case StudyDocument22 pagesAccounts Case StudyShashank RaiNo ratings yet

- Third Point Q1'09 Investor LetterDocument4 pagesThird Point Q1'09 Investor LetterDealBook100% (2)

- CM 172010Document5 pagesCM 172010Giancarlo CobinoNo ratings yet

- A Report On WIndow DressingDocument6 pagesA Report On WIndow DressingsaumyabratadasNo ratings yet

- Starting A Business Los AngelesDocument14 pagesStarting A Business Los AngelesCompany Counsel PCNo ratings yet

- 06 07 Tax Planning With Limited Liability ParDocument1 page06 07 Tax Planning With Limited Liability Parmax_ashiNo ratings yet

- Entrepreneurs Wealth Management ChecklistDocument7 pagesEntrepreneurs Wealth Management ChecklistThree Bell CapitalNo ratings yet

- 1 Company Law Part 1 3-11-2019 NotesDocument7 pages1 Company Law Part 1 3-11-2019 Notesshahinasaroudeen03No ratings yet

- Res WorkingPaper14Document44 pagesRes WorkingPaper14aakashkagarwalNo ratings yet

- Wheel Power: A Guide To Starting Your Own Trucking Company “Everything They Don’t Tell You”From EverandWheel Power: A Guide To Starting Your Own Trucking Company “Everything They Don’t Tell You”No ratings yet

- FAR 2922 Investments in Equity Instruments PDFDocument5 pagesFAR 2922 Investments in Equity Instruments PDFEki OmallaoNo ratings yet

- Pegasus Bullion PMB Plan-EngDocument21 pagesPegasus Bullion PMB Plan-EngabadmasihiNo ratings yet

- Working Capital ManagementDocument56 pagesWorking Capital ManagementVarun KalseNo ratings yet

- Chapter 7 Exercises With SolutionDocument5 pagesChapter 7 Exercises With Solutionmohammad khataybehNo ratings yet

- Xamination Questions: Mark QuestionDocument12 pagesXamination Questions: Mark QuestionHarsahib SinghNo ratings yet

- Performance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFDocument166 pagesPerformance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFSwahibu MgamboNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesAanindya ChoudhuryNo ratings yet

- Export of Services: BY PL - SubramanianDocument31 pagesExport of Services: BY PL - SubramanianArun KennethNo ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Story of A Stock Market Legend: Radhakishan DamaniDocument6 pagesStory of A Stock Market Legend: Radhakishan Damaniraj78krNo ratings yet

- Client Agreement: PO Box 2760 Omaha, NE 68103-2760 Fax: 866-468-6268Document10 pagesClient Agreement: PO Box 2760 Omaha, NE 68103-2760 Fax: 866-468-6268Tamara LizevskyNo ratings yet

- Secretary Certificate SampleDocument2 pagesSecretary Certificate SampleAngelica DaoNo ratings yet

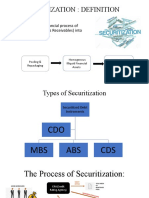

- SECURITIZATIONDocument5 pagesSECURITIZATIONASHISH KUMARNo ratings yet

- Chapter 3 National Income Test BankDocument44 pagesChapter 3 National Income Test BankmchlbahaaNo ratings yet

- Trading Ebook Thomas Stridsman Trading Systems That Work PDFDocument366 pagesTrading Ebook Thomas Stridsman Trading Systems That Work PDFJavi Crepo Sierra100% (3)

- HDMF Citizens CharterDocument24 pagesHDMF Citizens CharterEarl Russell S PaulicanNo ratings yet

- IBDP Mathematics Topic 1 To Topic 4 Revision WorksheetDocument42 pagesIBDP Mathematics Topic 1 To Topic 4 Revision Worksheetq9zfyx5wzfNo ratings yet

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollLALAINE BONILLA100% (1)

- C3 - Problem 11 - Journalizing TransactionsDocument2 pagesC3 - Problem 11 - Journalizing TransactionsLorence John ImperialNo ratings yet

- Disbursement Voucher1111Document2 pagesDisbursement Voucher1111Jocelyn Militar Amancio - DaprozaNo ratings yet

- Dhruva Placement BrochureDocument24 pagesDhruva Placement BrochurePranav KolaganiNo ratings yet

- Morocco: Financial System Stability Assessment-Update: International Monetary Fund Washington, D.CDocument41 pagesMorocco: Financial System Stability Assessment-Update: International Monetary Fund Washington, D.CPatsy CarterNo ratings yet

- Greif Q4 2017 Earnings Deck FINALDocument29 pagesGreif Q4 2017 Earnings Deck FINALVinod MenonNo ratings yet

- Om Sai Ent GGN DLFDocument5 pagesOm Sai Ent GGN DLFVinod RahejaNo ratings yet

- MPA - 6SA2 - 1710110471 - Alfina Fadhila SoesiloDocument4 pagesMPA - 6SA2 - 1710110471 - Alfina Fadhila SoesiloAlfina FadhilaNo ratings yet

- Retail Capital Gain Based Case Study 1Document8 pagesRetail Capital Gain Based Case Study 1KirankumarNo ratings yet

- 2010 Annual ReportDocument68 pages2010 Annual ReportMbongeni ShongweNo ratings yet

Buffett Salomonltr

Buffett Salomonltr

Uploaded by

uew702Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buffett Salomonltr

Buffett Salomonltr

Uploaded by

uew702Copyright:

Available Formats

SalomonInc_Buffet-Nov, 1991

SALOMON INC A report by the Chairman on the Companys Position and Outlook Source - Asian Wall St Journal . 1st, November, 1991 (Advertisement )

To the Shareholders of Salomon Inc: In this report, I want not only to tell you about Salomon Inc's third-quarter results but also to give you my thinking as to where the company must head. From announcements we have made and from the media you have learned about the events that led to my appointment as interim Chairman of Salomon Inc on August 18. We have since continued to investigate Salomon's past actions in the Government securities market and in other areas as well. Our conclusion so far: A few Salomon employees behaved egregiously-a fact that will prove costly to you as shareholders-but the misconduct and misjudgments were limited to those few. In short, I believe that we had an extremely serious problem, but not a pervasive one. ....... CONTROLS AND COMPLIANCE

Since August 18, we have installed rules and procedures at Salomon Brothers Inc, our securities subsidiary, that we think set a standard for the industry. In addition, we have begun to monitor what goes on in Salomon Brothers in new ways-for example, by setting up a Compliance Committee of the Board-and expect in that area also to be a leader. Even so, an atmosphere encouraging exemplary behavior is probably even more important than rules, necessary though these are. During my tenure as Chairman, I will consider myself the firm's chief compliance officer and I have asked all 9,000 of Salomon's employees to assist me in that effort. I have also urged them to be guided by a test that goes beyond rules: Contemplating any business act, an employee should ask himself whether he would be willing to see it immediately described by an informed and critical reporter on the front page of his local paper, there to be read by his spouse, children and friends. At Salomon we simply want no part of any activities that pass legal tests but that we, as citizens, would find offensive. . . . . . . . . . . OPERATING RESULTS . . . . . . . . . . Ordinary operations during the third quarter produced excellent profits, in large part because of exceptionally favorable trends in the fixed-income markets. I need to alert you, however, to two major adjustments that affected the bottom line, one negatively, one positively. In the first instance, we have set up a pre-tax legal reserve of $200 million for potential settlements, judgments, penalties, fines, litigation expense and other related costs. In the second instance, the compensation expense we have recorded for Salomon Brothers is about $110 million less than what might normally be expected. Because certain legal 1

SalomonInc_Buffet-Nov, 1991

costs may not be deductible for tax purposes, different tax rates apply to the two unusual items. Their combined effect, therefore, was a reduction in net income of about $75 million. LEGAL COSTS . . . . . . . . . . . . . I would like to elaborate on each of these unusual items, beginning with legal costs. No one can now estimate with any degree of certainty what the eventual direct costs of Salomon's past misdeeds and misjudgments will be to the company. (There are also very important secondary costs, such as loss of business and increased funding, costs; but, as I shall detail later, there may additionally be' secondary benefits, perhaps substantial.). Whatever these costs are , however, our large equity base - $ 4 billion virtually insures that they will not be crippling. We will pay any fines or penalties with dispatch and we will also try to settle valid legal claims promptly. However, we will litigate invalid or inflated claims, of which there will be many, to whatever extent necessary. That is, we will make appropriate amends for past conduct but we will be no one's patsy. Accounting rules require that we review the size of our reserve with Our auditors and counsel. That has been, done and-based on the limited amount of information presently available-they agree with the present estimate. We will make upward or downward adjustments to the reserve ~s information and events clarify the situation. ............ COMPENSATION

Most of you have read articles about the high levels of compensation at Salomon Brothers. Some of you have also read discussions of incentive compensation that I have written in the Berkshire Hathaway annual report. In those, I have said that I believe a rational incentive compensation plan to be an excellent way to reward managers, and I have also embraced the concept of truly extraordinary pay for extraordinary managerial performance. I continue to subscribe to those views. But the problem at Salomon Brothers has been a compensation plan that was irrational in certain crucial respects. One irrationality has been compensation levels that overall have been too high in relation to overall results. For example, last year the securities unit earned about 10% oil equity capital-far tinder the average earned by American business-yet 106 individuals who worked for the unit earned $1 million or more. Many of these people pet-formed exceedingly well and clearly deserved their pay. But the overall result made no sense: Though 1990 operating profits. before compensation were flat versus 1989, pay jumped by more than $120 million. And that, of course, meant earnings for shareholders fell by the same amount. A related irrationality is connected to the lopsided way in which Salomon has earned its profits-a matter, indeed, on which Salomon's directors were not supplied sufficient information. The data I now have available show that Salomon's lackluster overall profits of recent years resulted from a combination of excellent earnings in a few areas of the

SalomonInc_Buffet-Nov, 1991

business-operating in an honest and ethical manner, it should be added-with inadequate or non-existent earnings at the remainder. Yet the compensation plan did not take this extreme unevenness into account. In effect, the fine performance of some People Subsidized truly out-sized rewards for others. It would be understandable if a private partnership opted For such all egalitarian, share-the-wealth system. But Salomon is a publicly owned company depending on vast amounts of shareholders' capital. In such an operation, it is appropriate that the excess earnings of' the exceptional performers-that is, what they generate beyond what they are justly paid-go to the stockholders. Of course, it is difficult to quantify performance in many vital jobs, such as compliance, audit, funding, and research. For these activities, and for operational and support jobs as well, Salomon employees should normally be paid in line with industry standards, whether profits are high or low. Our compensation plans must also both reward cooperative, for-the-good-of-the-firm behavior and recognize that some business units earn relatively little in profits but deliver valuable, if hard to quantify, collateral benefits to the firm. All that said, there remain many jobs for which performance can be concretely measured and ought to, be. In these, employees who produce exceptional results for the firm, while operating both honorably and without excessive risk, should expect to receive first-class compensation. On the other hand, employees producing mediocre returns for owners should expect their pay to reflect this shortfall. In the past that has neither been the expectation at Salomon nor the practice. Salomon Inc's directors have decided that total compensation at Salomon Brothers in 1991 will be slightly below the level of 1990. Through June 30, 1991, however, compensation accruals had been made at a rate that considerably exceeded 1990's. Therefore, a $110 million downward adjustment of the accrual was made in the third quarter. In 1991 and in the future, the top-paid people at Salomon Brothers will get much of their compensation in the form of stock, pursuant to the Equity Partnership Plat] (EPP), which previous management instituted last year and which we heartily applaud. The EPP motivates managers to think like owners, since it obliges them to hold the stock they buy for at least five years and therefore exposes them to the risks of the business as well as the opportunities. Contrast this arrangement with stock-option plans, in which managers commit money only if the game has already been won and then often move quickly to sell their shares. In Salomon Brothers' business, which combines leverage with earnings volatility, it is particularly necessary and appropriate that the financial equation applying personally to managers be comparable to that applying to the ordinary shareholder. We wish to see the unit's managers become wealthy through ownership, not by simply free-riding on the ownership of others, I think in fact that ownership can in time bring our best managers substantial wealth, perhaps in amounts well beyond what they now think possible.

SalomonInc_Buffet-Nov, 1991

To avoid dilution, the trustee of the EPP purchases stock for the plan in the market and at some point in the future the company may itself elect to make stock repurchases to reduce the shares outstanding. Within a relatively few years Salomon Inc's key employees could own 25% or more of the business, purchased with their own compensation. The better job each employee does for the company, the more stock he or she will own. Our pay-for-performance philosophy will undoubtedly cause some managers to leave. But very importantly, this same philosophy may induce the top performers to stay, since these people may identify themselves as .350 hitters about to be paid appropriately instead of seeing their just rewards partially assigned to lesser performers. Indeed, I am pleased to report that certain of our very best managers have already asked that the EPP be modified to allow them to substantially increase the proportion of their earnings that can be invested through the plan. Were an abnormal number of people to leave the firm, the results would not necessarily be bad. Other men and women who share our thinking and values would then be given added responsibilities and opportunities. In the end we must have people to match our principles, not the reverse. .............. LEVERAGE

Our September 30th balance sheet totals are down by over $37 billion from those of June 30th-from $134 billion to $97 billion. The pace of change, however, has been even more dramatic than these figures indicate: Total assets on August 16, just before I became Chairman, were about $150 billion. In Salomon Brothers' business, I should point out, substantial amounts of' borrowed money are necessary and proper. We will continue, for example, to make large, shortterm commitments to finance under-writings and block-purchases of equities, mortgages and bonds. Indeed, we expect to be a leader in these fields. Nonetheless, we have deliberately brought our balance sheet totals down to reduce our leverage, and you will see the totals come down further in the months ahead. I am no fan of huge leverage in general, and in Salomon's case I believe that the swelling of the balance sheet that took place in the past was often done for the sake of all-too-marginal returns. Larger totals can actually lead to smaller profits: Undisciplined decision-making is a frequent consequence of ultra-easy access to funding, as both commercial and investment banks have learned in recent years. One final, reassuring point about the balance sheet: Salomon's previous management strongly favored conservative reserving. Significant allowances for various risks of the business have been-and will be-maintained.

SalomonInc_Buffet-Nov, 1991

. . . . . . . . . . . . PHIBRO ENERGY . . . . . . . . . . . . Phibro, the other major business owned by Salomon Inc, is achieving only mediocre profits this year after a terrific performance in 1990. Many investors recognize Phibro as a world leader in the trading of oil and related derivative instruments but are unaware of the magnitude of Phibro's oil refinery business. Phibro's four refineries typically process about 330,000 barrels of oil per day, which is equal to more than a third of the U.S. refining output of Exxon. But refining spreads this year have been narrow and Phibro's profits from this business have fallen sharply. The company has made excellent progress, however, with White Nights (WNJE), its Siberian oil project, in which our Russian partner is Varyeganneftegaz Production Association. I have met with Anatoli Sivak, the talented Director General of Varyeganneftegaz and Chairman of WNJE, and share his enthusiasm about developments to date. Essentially, this venture is drilling new wells and reworking existing wells in three designated fields. In payment, it is entitled to the incremental output it succeeds in producing over what the output would have been had WNJE's development not occurred. To date, WNJE has undertaken 37 workovers, of which 25 were successful. Additionally, one new well has recently been completed. In aggregate, these wells have increased production by about 4,700 barrels per day. WNJE is receiving hard currency for its oil and the pace of drilling will accelerate. Though the project entails political and petroleum engineering risks, WNJE's potential is large. . . . . . . . . . . . . . CONCLUSION . . . . . . . . . . . . . In recent years both Salomon Inc, the parent, and Phibro Energy have been treated by top management as adjuncts to Salomon Brothers. That was understandable, given that the managers of the parent came from the securities unit. Now, however, we are viewing Salomon Inc as the owner of two independent and substantial businesses, each of which will be measured by return on the equity capital it requires. I noted earlier that there may well be future benefits that arise from our current problems. We have the prospect of correcting certain weaknesses at Salomon Brothers that were likely to remain unaddressed absent a change in management; meanwhile, the firm's strengths in large part remain intact. Though earnings volatility will always be high, Salomon Inc has the capacity amid favorable market conditions to earn substantial slims. Furthermore, I believe that we can earn these Superior returns playing aggressively in the center of the court, without resorting to close-to-the-line acrobatics. Good profits simply are not inconsistent with good behavior.

SalomonInc_Buffet-Nov, 1991

Our goal is going to be that stated many decades ago by J.P. Morgan, who wished to see his bank transact "first-class business-in a first-class way." We will judge ourselves in fact not only by the business we do, but also by the business we decline to do. As is the case at all large organizations, there will be mistakes at Salomon and even failures, but to the best of our ability we will acknowledge our errors quickly and correct them with equal promptness. The best decision I have made since assuming my post was my appointment of Deryck Maughan as Chief Operating Officer of Salomon Brothers Inc. He, along with the management of Phibro, join me in a pledge to make Salomon Inc a company that produces superior results for clients, employees and owners.

You might also like

- Memo To Client Regarding Choice of Business EntityDocument6 pagesMemo To Client Regarding Choice of Business EntityAaron Burr100% (2)

- Solution Manual For Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Jeffrey Jaffe Bradford Jordan 3Document37 pagesSolution Manual For Corporate Finance 12th Edition Stephen Ross Randolph Westerfield Jeffrey Jaffe Bradford Jordan 3athanormimictsf1l95% (22)

- S Corporation ESOP Traps for the UnwaryFrom EverandS Corporation ESOP Traps for the UnwaryNo ratings yet

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507No ratings yet

- Spin Off & Corporate Restructuring in BriefDocument11 pagesSpin Off & Corporate Restructuring in BriefTushar Kadam100% (1)

- Chart of Accounts For A Merchandising BusinessDocument3 pagesChart of Accounts For A Merchandising BusinessJosh LeBlanc100% (5)

- Bank Stetment PDFDocument21 pagesBank Stetment PDFraj100% (1)

- Analysis of The Nature of Company's Corporate Entity, Benefits and Disadvantages of Incorporating BusinessDocument4 pagesAnalysis of The Nature of Company's Corporate Entity, Benefits and Disadvantages of Incorporating BusinessParvez SovonNo ratings yet

- Choosing The Right Entity For Your Emerging Growth CompanyDocument24 pagesChoosing The Right Entity For Your Emerging Growth CompanyflastergreenbergNo ratings yet

- Intro To Corporate FinanceDocument75 pagesIntro To Corporate FinanceRashid HussainNo ratings yet

- Chairman's Letter - 1990Document24 pagesChairman's Letter - 1990j3r1c0d5No ratings yet

- Ernest and Young Interview QuestionsDocument57 pagesErnest and Young Interview QuestionsPratyush Raj Benya100% (2)

- Chapter One - Introduction To Corporate FinanceDocument25 pagesChapter One - Introduction To Corporate Financeonkarskulkarni100% (2)

- To The Shareholders of Berkshire Hathaway Inc.Document22 pagesTo The Shareholders of Berkshire Hathaway Inc.gjangNo ratings yet

- Tap Into This Debt-Free Financing For Your New BusinessDocument20 pagesTap Into This Debt-Free Financing For Your New BusinessKevin SearlsNo ratings yet

- Berkshire Letters 1992Document25 pagesBerkshire Letters 1992nirajppNo ratings yet

- Chairman's Letter - 1992Document22 pagesChairman's Letter - 1992SuperGuyNo ratings yet

- Aefman Module 1 5Document28 pagesAefman Module 1 5TUGADE, AMADOR EMMANUELLE R.No ratings yet

- Corporate FinanceDocument108 pagesCorporate FinanceKenneth AdokohNo ratings yet

- Memo To Client Regarding Choice of Business EntityDocument6 pagesMemo To Client Regarding Choice of Business EntityJ.P. FernandesNo ratings yet

- Corporate Governance..Document5 pagesCorporate Governance..Shazia HameedNo ratings yet

- Semester 1 TheoryDocument11 pagesSemester 1 TheoryRajeev GiriNo ratings yet

- Financial Distress - Meaning, Causes, and Evaluation of Financial Distress Using Different ModelsDocument19 pagesFinancial Distress - Meaning, Causes, and Evaluation of Financial Distress Using Different ModelsRajeev RanjanNo ratings yet

- Top 7 Biggest If Rs MistakesDocument18 pagesTop 7 Biggest If Rs MistakesKyleRodSimpsonNo ratings yet

- Burry Scion1q2001Document6 pagesBurry Scion1q2001frankal1016147No ratings yet

- Company LawDocument20 pagesCompany LawZahid SafdarNo ratings yet

- LBO Interviews Questions BIWSDocument5 pagesLBO Interviews Questions BIWSartemidualikNo ratings yet

- Restructuring An Underperforming Company in China: Case StudyDocument7 pagesRestructuring An Underperforming Company in China: Case StudyAkansha SinhaNo ratings yet

- Capitalmind Financial Shenanigans Part 1Document17 pagesCapitalmind Financial Shenanigans Part 1abhinavnarayanNo ratings yet

- The "Rollover As Business Start-Up" Strategy-Should Your Client Use Retirement Rollover Funds To Finance A Business?Document5 pagesThe "Rollover As Business Start-Up" Strategy-Should Your Client Use Retirement Rollover Funds To Finance A Business?Priyanka DargadNo ratings yet

- Questions DuresDocument25 pagesQuestions DuresAnna-Maria Müller-SchmidtNo ratings yet

- June, 2021: Where Are We Now?Document13 pagesJune, 2021: Where Are We Now?l chanNo ratings yet

- Outline For Burkhard - Business CorpsDocument148 pagesOutline For Burkhard - Business CorpsLauren Lorraine BaileyNo ratings yet

- Naimur Rahman Navan (BBA 066 18963) MGMJT 446 LLCDocument19 pagesNaimur Rahman Navan (BBA 066 18963) MGMJT 446 LLCNaimur NavanNo ratings yet

- What Is Lifting The Corporate Veil of CompanyDocument4 pagesWhat Is Lifting The Corporate Veil of CompanyAminul IslamNo ratings yet

- How To Know Fraud in AdvanceDocument6 pagesHow To Know Fraud in AdvanceMd AzimNo ratings yet

- Quitting A Cushy Corporate Job To Join A Start-Up Venture.: A Guide For ExecutivesDocument10 pagesQuitting A Cushy Corporate Job To Join A Start-Up Venture.: A Guide For ExecutivesBayu De JeNo ratings yet

- Employee Buyout - A Compelling Exit StrategyDocument5 pagesEmployee Buyout - A Compelling Exit StrategyheenaieibsNo ratings yet

- Colgate Palmolive AnalysisDocument5 pagesColgate Palmolive AnalysisprincearoraNo ratings yet

- Different Types of Corporate StructuresDocument9 pagesDifferent Types of Corporate StructuresDavid AtkinsonNo ratings yet

- USMO White Paper (Updated)Document3 pagesUSMO White Paper (Updated)ContrarianIndustriesNo ratings yet

- Sources of FinanceDocument22 pagesSources of FinanceAkshay S PulimootilNo ratings yet

- Auditing Revision For ExamDocument22 pagesAuditing Revision For ExamcollegeofhateNo ratings yet

- Taxation - Paper T5Document20 pagesTaxation - Paper T5Kabutu ChuungaNo ratings yet

- Current Ratio: Current Assets/current LiabilitiesDocument7 pagesCurrent Ratio: Current Assets/current LiabilitiesSambit MishraNo ratings yet

- Drilling For WealthDocument12 pagesDrilling For WealthSchn1eck7No ratings yet

- Postscripts On The Fundamentals of Corporate FinanceDocument6 pagesPostscripts On The Fundamentals of Corporate FinancebehcetNo ratings yet

- Concepts of Financial ManagementDocument13 pagesConcepts of Financial ManagementHarris NarbarteNo ratings yet

- Solution Manual For M Finance 4th Edition Marcia Cornett Troy Adair John NofsingerDocument36 pagesSolution Manual For M Finance 4th Edition Marcia Cornett Troy Adair John Nofsingerjuristvesicantg7egkNo ratings yet

- Chapter 1Document25 pagesChapter 1ragi malikNo ratings yet

- LLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessFrom EverandLLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessNo ratings yet

- Accounts Case StudyDocument22 pagesAccounts Case StudyShashank RaiNo ratings yet

- Third Point Q1'09 Investor LetterDocument4 pagesThird Point Q1'09 Investor LetterDealBook100% (2)

- CM 172010Document5 pagesCM 172010Giancarlo CobinoNo ratings yet

- A Report On WIndow DressingDocument6 pagesA Report On WIndow DressingsaumyabratadasNo ratings yet

- Starting A Business Los AngelesDocument14 pagesStarting A Business Los AngelesCompany Counsel PCNo ratings yet

- 06 07 Tax Planning With Limited Liability ParDocument1 page06 07 Tax Planning With Limited Liability Parmax_ashiNo ratings yet

- Entrepreneurs Wealth Management ChecklistDocument7 pagesEntrepreneurs Wealth Management ChecklistThree Bell CapitalNo ratings yet

- 1 Company Law Part 1 3-11-2019 NotesDocument7 pages1 Company Law Part 1 3-11-2019 Notesshahinasaroudeen03No ratings yet

- Res WorkingPaper14Document44 pagesRes WorkingPaper14aakashkagarwalNo ratings yet

- Wheel Power: A Guide To Starting Your Own Trucking Company “Everything They Don’t Tell You”From EverandWheel Power: A Guide To Starting Your Own Trucking Company “Everything They Don’t Tell You”No ratings yet

- FAR 2922 Investments in Equity Instruments PDFDocument5 pagesFAR 2922 Investments in Equity Instruments PDFEki OmallaoNo ratings yet

- Pegasus Bullion PMB Plan-EngDocument21 pagesPegasus Bullion PMB Plan-EngabadmasihiNo ratings yet

- Working Capital ManagementDocument56 pagesWorking Capital ManagementVarun KalseNo ratings yet

- Chapter 7 Exercises With SolutionDocument5 pagesChapter 7 Exercises With Solutionmohammad khataybehNo ratings yet

- Xamination Questions: Mark QuestionDocument12 pagesXamination Questions: Mark QuestionHarsahib SinghNo ratings yet

- Performance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFDocument166 pagesPerformance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFSwahibu MgamboNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesAanindya ChoudhuryNo ratings yet

- Export of Services: BY PL - SubramanianDocument31 pagesExport of Services: BY PL - SubramanianArun KennethNo ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Story of A Stock Market Legend: Radhakishan DamaniDocument6 pagesStory of A Stock Market Legend: Radhakishan Damaniraj78krNo ratings yet

- Client Agreement: PO Box 2760 Omaha, NE 68103-2760 Fax: 866-468-6268Document10 pagesClient Agreement: PO Box 2760 Omaha, NE 68103-2760 Fax: 866-468-6268Tamara LizevskyNo ratings yet

- Secretary Certificate SampleDocument2 pagesSecretary Certificate SampleAngelica DaoNo ratings yet

- SECURITIZATIONDocument5 pagesSECURITIZATIONASHISH KUMARNo ratings yet

- Chapter 3 National Income Test BankDocument44 pagesChapter 3 National Income Test BankmchlbahaaNo ratings yet

- Trading Ebook Thomas Stridsman Trading Systems That Work PDFDocument366 pagesTrading Ebook Thomas Stridsman Trading Systems That Work PDFJavi Crepo Sierra100% (3)

- HDMF Citizens CharterDocument24 pagesHDMF Citizens CharterEarl Russell S PaulicanNo ratings yet

- IBDP Mathematics Topic 1 To Topic 4 Revision WorksheetDocument42 pagesIBDP Mathematics Topic 1 To Topic 4 Revision Worksheetq9zfyx5wzfNo ratings yet

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollLALAINE BONILLA100% (1)

- C3 - Problem 11 - Journalizing TransactionsDocument2 pagesC3 - Problem 11 - Journalizing TransactionsLorence John ImperialNo ratings yet

- Disbursement Voucher1111Document2 pagesDisbursement Voucher1111Jocelyn Militar Amancio - DaprozaNo ratings yet

- Dhruva Placement BrochureDocument24 pagesDhruva Placement BrochurePranav KolaganiNo ratings yet

- Morocco: Financial System Stability Assessment-Update: International Monetary Fund Washington, D.CDocument41 pagesMorocco: Financial System Stability Assessment-Update: International Monetary Fund Washington, D.CPatsy CarterNo ratings yet

- Greif Q4 2017 Earnings Deck FINALDocument29 pagesGreif Q4 2017 Earnings Deck FINALVinod MenonNo ratings yet

- Om Sai Ent GGN DLFDocument5 pagesOm Sai Ent GGN DLFVinod RahejaNo ratings yet

- MPA - 6SA2 - 1710110471 - Alfina Fadhila SoesiloDocument4 pagesMPA - 6SA2 - 1710110471 - Alfina Fadhila SoesiloAlfina FadhilaNo ratings yet

- Retail Capital Gain Based Case Study 1Document8 pagesRetail Capital Gain Based Case Study 1KirankumarNo ratings yet

- 2010 Annual ReportDocument68 pages2010 Annual ReportMbongeni ShongweNo ratings yet