Professional Documents

Culture Documents

03-Casiguran Aurora09 Executive Summary

03-Casiguran Aurora09 Executive Summary

Uploaded by

Kasiguruhan AuroraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03-Casiguran Aurora09 Executive Summary

03-Casiguran Aurora09 Executive Summary

Uploaded by

Kasiguruhan AuroraCopyright:

Available Formats

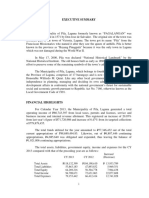

EXECUTIVE SUMMARY A.

HIGHLIGHTS OF FINANCIAL INFORMATION The analysis of the agencys financial condition for the year 2009 is shown below:

Increase 2009 2008 (Decrease) % Assets P 123,254,688.30 P 106,383,260.64 P 16,871,427.66 5.35 Liabilities 7,300,047.45 5,400,556.12 1,899,491.33 25.68 Government Equity 115,954,640.85 100,982,704.52 14,971,936.33 3.94

For Calendar Year 2009, the Municipality had realized a total income of P85,233,798.13, while total expenses was P71,628,540.91. The total appropriation for the year was P103,205,264.65, of which P84,144.716.55 was obligated as of December 31, 2009. B. OPERATIONAL HIGHLIGHTS To accelerate the social and economic development of the municipality for CY 2008, the following are the significant plans and programs vis--vis accomplishments based on the report submitted by the Municipal Planning Development Coordinator. Programs/Projects/Activities Amount 1. Construction/Pipe laying of water Brgy. Tinib P 200,000.00 2. Completionn of Const off Paterno Ext. Street 150,000.00 3. Installation of Street Lights Calangcuasan 50,000.00 4. Concreting of Mabini Street, Brgy. Lual 300,000.00 5. Construction of Waiting Shed Brgy. Calancuasan 50,000.00 6. Construction of Elevated Tank w/ pipeline Bianoan 150,000.00 7. Repair of School Building Esperanza E/S 80,000.00 8. Construction of School Stage Brgy. Calantas 100,000.00 9. Repair of Bridge n Brgy. Tabas 50,000.00 10. Construction of Welcome Arc Phase II 150,000.00 11. Const. of Multi-purpose Covered Court Phase II 8,500,000.00 C. SCOPE OF AUDIT A financial and compliance audit was conducted on the accounts and operations of the Municipality for calendar year 2009. The audit was made to ascertain the propriety of financial transactions and compliance with prescribed rules and regulations. It was also conducted to ascertain the accuracy of financial records and reports, as well as the fairness of presentation of the financial statements. Percent of Accomplished 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

D. STATE AUDITORS REPORT ON THE FINANCIAL STATEMENTS The Auditor rendered a qualified opinion on the fairness of presentation of the financial statements because these were not free of material misstatements such as: 1) Cash in Bank account amounting to P29.63 million could not be ascertained due to non-preparation of monthly bank reconciliation statements and 2) the reliability and validity of the Property, Plant and Equipment account amounting to P81.92 million appeared doubtful due to inability to submit complete physical inventory report. Due to the nature of Agencys records, we were unable to satisfy ourselves as to the carrying value of these accounts by means of other audit procedures. E. SIGNIFICANT FINDINGS AND RECOMMENDATIONS The following recommendations: are the significant findings and the corresponding

1. Disbursement vouchers which are subject to pre-audit were paid even without coursing through the required pre-audit action in violation to pertinent provision of COA Circular No. 2009-002. We advise the Municipal Mayor to require the accountable officer concern, particularly the head of the internal audit unit to submit for audit action all disbursement vouchers including their supporting documents subject to pre-audit. 2. The municipality allowed the claim for payment/reimbursement of the amount paid to a private law practitioner in violation to Section 2.2 Article IX-D of the 1987 Philippine Constitution. The Municipal Mayor is advised not to allow reimbursement or payment of legal fees for services rendered by a private counsel as it is against the established law and jurisprudence. In the event that availing legal service cannot be avoided or in case of exceptional circumstances, the written conformity and acquiescence of the Solicitor General and the Commission on Audit shall first be secured before hiring or employing a private lawyer or law firm as provided under COA Circular No. 98-002. 3. Construction in Progress account of P12,531,647.00 remained open in the book of account despite the infrastructure projects it referred to were already completed contrary to Section 50 of the NGAS Manual for local government unit, thus artificially bloated the assets and government equity account. Public Infrastructure account of P7,034,239.21 not yet categorized as to specific asset account and likewise, not transferred yet to registry of public infrastructure

We recommend that the Accounting Office and General Service Office exert effort to identify the completed projects under the construction in progress account for appropriate classification of assets account and closed the same to Public Infrastructure account. Make adjustment further at the end of the year by closing the Public Infra account to Government Equity, to eliminate the overstatement of PPE account. Conversely, a Registry of Public Infrastructure should be maintained for transfer of infra projects already closed to government equity account but are intended for public use, such as roads, bridges and highways among others. Henceforth, compliance with section 50 of the NGAS Manual should be observed and adhered to so as to present the true condition of the total net worth of the agency. 4. Collections totaling to P1,146,580.73 as of December 31, 2008 were not deposited intact with its depository bank, thus exposing municipal funds to risk of loss and misappropriation. The Local Chief Executive should instruct the Municipal Treasurer to deposit intact all collections regularly with the authorized depository bank to avoid possible misappropriation and exposure of municipal funds to risk. The practice of retaining part of collections in the Municipal Treasury as cash reserve for cash disbursement should be discontinued 5. The Municipality failed to comply fully with the provision of RA 7191 particularly in providing 5% appropriation for the Gender and Development related activities and the monitoring of accomplishment relative thereto in violation to DBM, NEDA and NCRFW Joint Circular No. 2001. We recommend that for proper implementation and evaluation on effectiveness of the GAD related activities, a comprehensive and responsive plan and program be formulated and a report for the end result be submitted to the office concerned. Likewise, we recommend that an oversight committee be created which shall be responsible for the smooth implementation of the program. 6. Full implementation of the plans, programs and activities funded out of the 20% Development Fund was satisfactorily attained. However, there was no standard of performance designed and formulated to measure the benefits the constituents had derived from the projects. To effectively monitored and evaluate the effectiveness of the accomplished projects and activities, we recommend that in the succeeding submission of accomplishment report, such shall be prepared in accordance with the plans and targets set at the beginning of the year with direct impact on the number of intended beneficiaries actually benefitted from the projects.

F.

STATUS OF IMPLEMENTATION BY THE MUNICIPALITY OF PRIOR YEARS AUDIT RECOMMENDATIONS Of the eight audit recommendations contained in the 2008 Annual Audit Report, five were implemented by the municipality by complying with our recommended course of action, while three were not yet implemented.

You might also like

- Test Bank For Walston Dunham Introduction To Law 7thDocument10 pagesTest Bank For Walston Dunham Introduction To Law 7thamberleemakegnwjbd100% (14)

- San Pablo City Water District Laguna Executive Summary 2021 PDFDocument8 pagesSan Pablo City Water District Laguna Executive Summary 2021 PDFJohn Archie SerranoNo ratings yet

- Feudalism Compare ContrastDocument12 pagesFeudalism Compare Contrastapi-240966525No ratings yet

- Executive Summary A. Highlights of Financial InformationDocument3 pagesExecutive Summary A. Highlights of Financial InformationKasiguruhan AuroraNo ratings yet

- Sipocot Executive Summary 2012Document6 pagesSipocot Executive Summary 2012Tintin N. XiaoNo ratings yet

- Esperanza Executive Summary 2018Document5 pagesEsperanza Executive Summary 2018Ma. Danice Angela Balde-BarcomaNo ratings yet

- Luna Executive Summary 2012Document4 pagesLuna Executive Summary 2012The ApprenticeNo ratings yet

- PantaoRagatMun2017 Audit ReportDocument90 pagesPantaoRagatMun2017 Audit ReportMubarrach MatabalaoNo ratings yet

- Executive Summary: A. Highlights of Financial InformationDocument3 pagesExecutive Summary: A. Highlights of Financial InformationEd SalangaNo ratings yet

- 03-OrmocCity2018 Executive SummaryDocument6 pages03-OrmocCity2018 Executive Summarysandra bolokNo ratings yet

- Anda Executive Summary 2010Document5 pagesAnda Executive Summary 2010Henry AunzoNo ratings yet

- CebuCity ES08Document7 pagesCebuCity ES08Jess JessNo ratings yet

- Sta. Fe Executive Summary 2011Document3 pagesSta. Fe Executive Summary 2011JaniceNo ratings yet

- Casiguran Executive Summary 2020Document5 pagesCasiguran Executive Summary 2020recx.jyke06No ratings yet

- 02-Loboc2012 Executive SummaryDocument9 pages02-Loboc2012 Executive SummaryMiss_AccountantNo ratings yet

- Asingan Executive Summary 2019Document4 pagesAsingan Executive Summary 2019izuku midoriyaNo ratings yet

- Concepcion Tarlac ES2015Document9 pagesConcepcion Tarlac ES2015James SusukiNo ratings yet

- Lala2017 Audit ReportDocument146 pagesLala2017 Audit ReportEm SanNo ratings yet

- Koronadal City Executive Summary 2019Document5 pagesKoronadal City Executive Summary 2019flordeliciousssNo ratings yet

- Executive Summary: in Thousands of PesosDocument6 pagesExecutive Summary: in Thousands of PesosDAS MAGNo ratings yet

- Basud Executive Summary 2011Document6 pagesBasud Executive Summary 2011Maria CharessaNo ratings yet

- Taytay09 Audit ReportDocument57 pagesTaytay09 Audit ReportIpah L. SaidNo ratings yet

- SBMA2021 Audit Report PDFDocument189 pagesSBMA2021 Audit Report PDFJoshua Andrie GadianoNo ratings yet

- Executive Summary: Highlights of OperationsDocument6 pagesExecutive Summary: Highlights of OperationsJaniceNo ratings yet

- Executive SummaryDocument8 pagesExecutive SummaryNathan Roy OngcarrancejaNo ratings yet

- La Paz Executive Summary 2021Document5 pagesLa Paz Executive Summary 2021kmarkcramosNo ratings yet

- TaclobanCity2017 Audit Report PDFDocument170 pagesTaclobanCity2017 Audit Report PDFJulPadayaoNo ratings yet

- Agusan Del Sur Executive Summary 2018Document8 pagesAgusan Del Sur Executive Summary 2018Sittie Fatma ReporsNo ratings yet

- San Jose Executive Summary 2021Document7 pagesSan Jose Executive Summary 2021Thea CastilloNo ratings yet

- 04-KalingaProvince2018 Executive SummaryDocument7 pages04-KalingaProvince2018 Executive SummaryMarcus SalvateroNo ratings yet

- Bislig City Executive Summary 2017Document8 pagesBislig City Executive Summary 2017liezeloragaNo ratings yet

- 01-Mun of Himamaylan09 Audit Report - COA ANNUAL AUDIT REPORT 2009Document50 pages01-Mun of Himamaylan09 Audit Report - COA ANNUAL AUDIT REPORT 2009himamaylancitywatchNo ratings yet

- Alicia Executive Summary 2014Document6 pagesAlicia Executive Summary 2014Gier Rizaldo BulaclacNo ratings yet

- Naguilian Executive Summary 2021Document5 pagesNaguilian Executive Summary 2021Willie FabroaNo ratings yet

- Pila Executive Summary 2013Document4 pagesPila Executive Summary 2013quezonleedaphneNo ratings yet

- San Jose Executive Summary 2015Document5 pagesSan Jose Executive Summary 2015The ApprenticeNo ratings yet

- Meycauayan City Executive Summary 2019Document8 pagesMeycauayan City Executive Summary 2019Secret secretNo ratings yet

- Jabonga Executive Summary 2021Document10 pagesJabonga Executive Summary 2021maramaehermogenoNo ratings yet

- Villaba Executive Summary 2021Document5 pagesVillaba Executive Summary 2021Johanna Mae AutidaNo ratings yet

- Surallah Executive Summary 2020Document5 pagesSurallah Executive Summary 2020Kynard PatrickNo ratings yet

- Umingan Executive Summary 2012Document4 pagesUmingan Executive Summary 2012Maria CharessaNo ratings yet

- Maigo Executive Summary 2021Document8 pagesMaigo Executive Summary 2021Rowena MahusayNo ratings yet

- Bamban Executive Summary 2017Document6 pagesBamban Executive Summary 2017Reyna YlenaNo ratings yet

- 03-DRT2019 Executive SummaryDocument6 pages03-DRT2019 Executive SummaryGiovanni MartinNo ratings yet

- Aurora Executive Summary 2012Document7 pagesAurora Executive Summary 2012Mary Joy Sedenio LopezNo ratings yet

- Mga Tao Sa KapehanDocument4 pagesMga Tao Sa KapehanJoshua Lavega AbrinaNo ratings yet

- Executive Summary: A. Highlights of Financial OperationDocument10 pagesExecutive Summary: A. Highlights of Financial OperationGloria AlamilNo ratings yet

- Kalayaan Executive Summary 2014Document6 pagesKalayaan Executive Summary 2014Aira Kathrina PerezNo ratings yet

- Sasmuan Pampanga ES2019Document7 pagesSasmuan Pampanga ES2019Wilmar AbriolNo ratings yet

- San Vicente Executive Summary 2012Document6 pagesSan Vicente Executive Summary 2012Maria CharessaNo ratings yet

- Executive Summary: A. IntroductionDocument6 pagesExecutive Summary: A. IntroductionCrislyn BayawaNo ratings yet

- Isulan Executive Summary 2020Document5 pagesIsulan Executive Summary 2020janeldelosreyes321No ratings yet

- Boac Marinduque ES2014Document10 pagesBoac Marinduque ES2014J JaNo ratings yet

- Malolos City Executive Summary 2019Document7 pagesMalolos City Executive Summary 2019Arisu SakamotoNo ratings yet

- Subic Executive Summary 2022Document7 pagesSubic Executive Summary 2022Jezreel GironNo ratings yet

- Baclayon Executive Summary 2011Document9 pagesBaclayon Executive Summary 2011carlvincenttalaboc47No ratings yet

- Santo Tomas Executive Summary 2016Document4 pagesSanto Tomas Executive Summary 2016Justine CastilloNo ratings yet

- San Agustin Executive Summary 2018Document4 pagesSan Agustin Executive Summary 2018minds2magicNo ratings yet

- Group 1 Budget ProcessDocument26 pagesGroup 1 Budget ProcessCassie ParkNo ratings yet

- 12-Casiguran Aurora 2010 Part3-Status of PY's RecommendationsDocument7 pages12-Casiguran Aurora 2010 Part3-Status of PY's RecommendationsKasiguruhan AuroraNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- 10-Casiguran Aurora09 Part2-Findings and RecommendationsDocument7 pages10-Casiguran Aurora09 Part2-Findings and RecommendationsKasiguruhan AuroraNo ratings yet

- 09-Casiguran Aurora09 Part1-Notes To FSDocument9 pages09-Casiguran Aurora09 Part1-Notes To FSKasiguruhan AuroraNo ratings yet

- 08 Casiguran Aurora09 Part1 FSDocument3 pages08 Casiguran Aurora09 Part1 FSKasiguruhan AuroraNo ratings yet

- Part I - Audited Financial StatementsDocument4 pagesPart I - Audited Financial StatementsKasiguruhan AuroraNo ratings yet

- 12-Casiguran Aurora 2010 Part3-Status of PY's RecommendationsDocument7 pages12-Casiguran Aurora 2010 Part3-Status of PY's RecommendationsKasiguruhan AuroraNo ratings yet

- 10-Casiguran Aurora 2010 Part1-Notes To FSDocument9 pages10-Casiguran Aurora 2010 Part1-Notes To FSKasiguruhan AuroraNo ratings yet

- 02-Casiguran Aurora 2010 CoverDocument1 page02-Casiguran Aurora 2010 CoverKasiguruhan AuroraNo ratings yet

- Executive Summary A. Highlights of Financial InformationDocument3 pagesExecutive Summary A. Highlights of Financial InformationKasiguruhan AuroraNo ratings yet

- Msa Newsletter 2014Q3Q4Document72 pagesMsa Newsletter 2014Q3Q4Tan Bak PingNo ratings yet

- Anti Plunder ActDocument3 pagesAnti Plunder ActmeriiNo ratings yet

- Issues and Taboo Topics For Debate - Nobody Needs A GunDocument2 pagesIssues and Taboo Topics For Debate - Nobody Needs A GunluciasnmNo ratings yet

- Bien Chapter17Document2 pagesBien Chapter17Bien EstrellaNo ratings yet

- SUPCT3095 Brief Appellant Tamara SweeneyDocument31 pagesSUPCT3095 Brief Appellant Tamara SweeneyJaniceWolkGrenadierNo ratings yet

- Chapter 0 - Introduction - UEFDocument17 pagesChapter 0 - Introduction - UEFPhúc Phạm HồngNo ratings yet

- Romans: Comprehensive Questions On The Book ofDocument42 pagesRomans: Comprehensive Questions On The Book ofFrancis NkyiNo ratings yet

- Calendar of ActivitiesDocument2 pagesCalendar of ActivitiesGabriel-Fortunato EufracioNo ratings yet

- Naguiat V NLRCDocument9 pagesNaguiat V NLRCArJanNo ratings yet

- Answers Installment Sales Dayag PDFDocument11 pagesAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- Dahmer BIO (Radford University, 2004)Document9 pagesDahmer BIO (Radford University, 2004)buru100% (1)

- Bramley 2000Document5 pagesBramley 2000Andres SalcedoNo ratings yet

- PG-QP - 02: Q. B. No.Document16 pagesPG-QP - 02: Q. B. No.Vamsi KrishnaNo ratings yet

- FRM Registration Step 2Document2 pagesFRM Registration Step 2Anonymous YN7Qw6pH3No ratings yet

- Omvic Automotive Certification Course Student Manual English 2024 Edition Georgian College Feb 06 24Document198 pagesOmvic Automotive Certification Course Student Manual English 2024 Edition Georgian College Feb 06 24viterittidevidNo ratings yet

- Bloche Settlementagreementandrelease Ausexample 2 503 1929Document8 pagesBloche Settlementagreementandrelease Ausexample 2 503 1929ghilphilNo ratings yet

- HBL Chip and PIN PDFDocument4 pagesHBL Chip and PIN PDFNomanNo ratings yet

- Turn Over and Acceptance Ceremony June 30 2022Document2 pagesTurn Over and Acceptance Ceremony June 30 2022Mio LBPNo ratings yet

- Account Statement: NSDL Payments BankDocument3 pagesAccount Statement: NSDL Payments BankSantosh Kumar GuptaNo ratings yet

- ASTM-2030 SandDocument1 pageASTM-2030 SandSauron2014No ratings yet

- Sillage v. Kenrose Perfumes - ComplaintDocument42 pagesSillage v. Kenrose Perfumes - ComplaintSarah BursteinNo ratings yet

- Gr1-2 Make The ClockDocument2 pagesGr1-2 Make The ClockThérèse NgoundeNo ratings yet

- 7CRRYDDocument1 page7CRRYDShoutook JohnNo ratings yet

- Smoke Detector 2351EC HoneywellDocument2 pagesSmoke Detector 2351EC HoneywellFAMYA FIRE SAFETY SYSTEMSNo ratings yet

- Con Law Simulation Elonis VDocument15 pagesCon Law Simulation Elonis Vapi-353466722No ratings yet

- ID TheftDocument3 pagesID TheftShawn FreemanNo ratings yet

- Accounts Payable Task T-Code Process DescriptionDocument7 pagesAccounts Payable Task T-Code Process DescriptionShahmeen Ashraf FahadNo ratings yet

- El Cóndor Pasa: Daniel Alomía Robles / TraditionalDocument1 pageEl Cóndor Pasa: Daniel Alomía Robles / TraditionalJames Wilfrido Cardenas AmezquitaNo ratings yet