Professional Documents

Culture Documents

Slths Lect&Tut05

Slths Lect&Tut05

Uploaded by

Shaun MikeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Slths Lect&Tut05

Slths Lect&Tut05

Uploaded by

Shaun MikeCopyright:

Available Formats

JCU Singapore Campus

JCU-MBA-CF Lecture 5 (Ross Chapter 7)

Capital Budgeting 1: Net present value and other investment criteria

SOLUTIONS TO TUTORIAL QUESTIONS: PRS 3. Payback period A: 2000 1040 = 960; 960/1260 = 0.76 Payback = 1.76 years Payback period B: 2000 820 880 =300; 300/3800 = 0.08 Payback = 2.08 years Two-year payback required: Investment A would be accepted. It is not necessarily the best investment because payback ignores cash flows that occur after the cut-off period, resulting in a bias for short-term projects. 4. Investment A: NPV = 2,000 + 1040/1.06 + 1260/(1.06)2 + 1954/(1.06)3 = $1,743 Investment B: NPV = 2,000 + 820/1.06 + 880/(1.06)2 + 3800/(1.06)3 = $2,748 Investment B is the better investment. A: 100 = 100/(1 + IRR) + 200/(1 + IRR)2 100/(1 + IRR)3 Descartes rule of sign states there could be two solutions. IRR = 80.19% or 55.50% B: 100 = 100/(1 + IRR)2 + 200/(1 + IRR)3 IRR = 52.14% Project A: 8,000 = 4,820/(1 +IRR) + 5,860/(1 + IRR)2 IRR = 20.86% Project B: 4,000 = 2,620/(1 + IRR) + 3,440/(1 + IRR)2 IRR = 31.10% At 0% interest rate NPVA is $2,680 and NPVB is $2,060. At the IRRs the NPVs are both zero so on an NPV/interest profile the plotted curves must cross. If the required rate of return is less than the crossover rate the IRR will incorrectly accept B. Consider the project AB 4,000 = 2,200/(1 + IRR) + 2,420/(1 + IRR)2

12.

13.

JCU-MBA-CF: Solutions to Lecture/Tutorial 05

IRR = 10% = crossover rate. Ping would be indifferent between the two projects at this discount rate.

28.

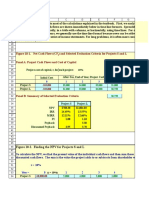

To calculate the IRR we have to use trial and error. The table summarises some possible results:

Discount rate 0% 10% 20% 30% 40% Limp $55.00 28.83 9.95 (4.09) (14.80) Stumble $50.00 32.14 18.40 7.57 (1.17)

The IRR for Limp must be between 20% and 30% because this is where the NPV is zero. With more trial and error we find it is 26.79%. The IRR for Stumble must be between 30% and 40% because this is where the NPV is zero. With more trial and error we find it is 38.54%. Between 0% and 10% the NPVs are close so the crossover is in this range. To find the crossover we find the IRR on the difference in the cash flows. If we take the cash flows of Limp less the cash flows of Stumble we have:

Year 0 1 2 3 Limp Stumble $0 (40) (10) 55

The cash flows look odd but the sign changes once, so there is only one IRR. The zero NPV occurs at 5.42% so this is the crossover rate. Stumble has the higher IRR. Limp has higher NPVs in the range from 0% to 5.42%, so the rankings will conflict over this range. Who would bother with IRRs when ranking projects?

JCU-MBA-CF: Solutions to Lecture/Tutorial 05

You might also like

- Corporate Financial Management 5th Edition Glen Arnold Solutions ManualDocument25 pagesCorporate Financial Management 5th Edition Glen Arnold Solutions ManualDonnaNguyengpij98% (54)

- Ch10 Tool KitDocument30 pagesCh10 Tool KitRimpy Sondh100% (1)

- Chapter 13 SolutionsDocument8 pagesChapter 13 Solutionsflyerfan3767% (3)

- More Chapter 5 Exercises TVMDocument11 pagesMore Chapter 5 Exercises TVMaprilNo ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- Ch10 Tool Kit NPV Dan IRRDocument23 pagesCh10 Tool Kit NPV Dan IRRSyarif Bin DJamalNo ratings yet

- FM Notes by Dipan SirDocument178 pagesFM Notes by Dipan SirchimbanguraNo ratings yet

- Chapter 10 SolutionsDocument9 pagesChapter 10 Solutionsaroddddd23No ratings yet

- Test - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswersDocument10 pagesTest - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswerswinNo ratings yet

- Ch10 Tool KitDocument18 pagesCh10 Tool KitElias DEBSNo ratings yet

- Project Management For Managers: Lec - 16 Capital Budgeting Techniques-IDocument24 pagesProject Management For Managers: Lec - 16 Capital Budgeting Techniques-IBiswanathMudiNo ratings yet

- Acct 260 Chapter 14Document33 pagesAcct 260 Chapter 14John GuyNo ratings yet

- 2 Capital Budegeting NPV IRR MIRR Other Investment Rules FinalDocument44 pages2 Capital Budegeting NPV IRR MIRR Other Investment Rules FinalnikhilNo ratings yet

- 2-Capital Budegeting-GMPDocument26 pages2-Capital Budegeting-GMPAtul SudhakaranNo ratings yet

- Corporate FinanceDocument10 pagesCorporate FinanceMayur AgarwalNo ratings yet

- Corporate FinanceDocument5 pagesCorporate Financesureshgovekar98No ratings yet

- 6 Lec Nov 5 Ch5 Part IDocument20 pages6 Lec Nov 5 Ch5 Part Ixq67mcfhfcNo ratings yet

- Chapter 12 SolutionsDocument11 pagesChapter 12 SolutionswieNo ratings yet

- 12. DISCOUNTING TECHNIQUEDocument40 pages12. DISCOUNTING TECHNIQUEemirsolehloveNo ratings yet

- Institute of Management Technology, Ghaziabad End Term Exam (Term - I) Take Home Exam (Time Duration: 04 HRS) Batch 2020 - 22 Answer-SheetDocument6 pagesInstitute of Management Technology, Ghaziabad End Term Exam (Term - I) Take Home Exam (Time Duration: 04 HRS) Batch 2020 - 22 Answer-SheetTushar GuptaNo ratings yet

- Assignment 4 - Cost of Capital and Capital BudgetiDocument5 pagesAssignment 4 - Cost of Capital and Capital BudgetiBrian AlalaNo ratings yet

- Chapter7Solutions 7theditionDocument19 pagesChapter7Solutions 7theditionR Nurul QANo ratings yet

- Investment CriteriaDocument27 pagesInvestment CriteriaCharu ModiNo ratings yet

- Bsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDocument6 pagesBsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDerek LowNo ratings yet

- Tutorial 4 CHP 5 - SolutionDocument6 pagesTutorial 4 CHP 5 - SolutionwilliamnyxNo ratings yet

- 35 Practice MCQ Solutions For Website - UPDATEDDocument7 pages35 Practice MCQ Solutions For Website - UPDATEDBaher WilliamNo ratings yet

- Brealey - Principles of Corporate Finance - 13e - Chap05 - SMDocument11 pagesBrealey - Principles of Corporate Finance - 13e - Chap05 - SMpt94jykqvqNo ratings yet

- Net Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BDocument23 pagesNet Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BNaila FaradilaNo ratings yet

- BA303 - 1002057831 - Rahmandika Adipradana (Supplementary Examination)Document13 pagesBA303 - 1002057831 - Rahmandika Adipradana (Supplementary Examination)Pump AestheticsNo ratings yet

- Rate of Return RevisedDocument27 pagesRate of Return Revisedlight yagamiNo ratings yet

- Engineering Economics: Rate of Return AnalysisDocument29 pagesEngineering Economics: Rate of Return AnalysisEkoNo ratings yet

- CH19Document8 pagesCH19Lyana Del Arroyo OliveraNo ratings yet

- Chapter 5Document63 pagesChapter 5Daniel BalchaNo ratings yet

- Corporate Finance Solution Chapter 5Document8 pagesCorporate Finance Solution Chapter 5Kunal KumarNo ratings yet

- Chapter - 9: Solutions - To - End - of - Chapter - 9 - Problems - On - Estimating - Cost - of - CapitalDocument7 pagesChapter - 9: Solutions - To - End - of - Chapter - 9 - Problems - On - Estimating - Cost - of - CapitalMASPAKNo ratings yet

- Revision: GDB 3023 Engineering Economics and EntrepreneurshipDocument25 pagesRevision: GDB 3023 Engineering Economics and Entrepreneurshipfaris yusofNo ratings yet

- Engineering Economics Take Home Quiz QuiDocument5 pagesEngineering Economics Take Home Quiz QuiMUHAMMAD WAJID SHAHZADNo ratings yet

- How To Calculate Present ValuesDocument15 pagesHow To Calculate Present Valuesdiana.p7reiraNo ratings yet

- Dwnload Full Corporate Financial Management 5th Edition Glen Arnold Solutions Manual PDFDocument35 pagesDwnload Full Corporate Financial Management 5th Edition Glen Arnold Solutions Manual PDFhofstadgypsyus100% (20)

- Level 1 AnswersDocument7 pagesLevel 1 AnswersBisera KrstevskaNo ratings yet

- Capital Budgeting Analysis: Abhisekh Nitesh Pankaj Indrajit KundanDocument19 pagesCapital Budgeting Analysis: Abhisekh Nitesh Pankaj Indrajit KundanNitesh SinghNo ratings yet

- Tutorial Chapter 9 (Week 4) ADocument9 pagesTutorial Chapter 9 (Week 4) AwinnietsjNo ratings yet

- GE03. BM BL Solution CMA January 2022 ExaminationDocument6 pagesGE03. BM BL Solution CMA January 2022 ExaminationTameemmahmud rokibNo ratings yet

- Solution Manual For Corporate Financial Management 5th Edition by Glen Arnold ISBN 0273758837 9780273758839Document36 pagesSolution Manual For Corporate Financial Management 5th Edition by Glen Arnold ISBN 0273758837 9780273758839kevinhopkinsjqoxycnbsp100% (32)

- RWJ 08Document38 pagesRWJ 08Kunal PuriNo ratings yet

- Fin322 Week2 2018Document12 pagesFin322 Week2 2018chi_nguyen_100No ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document31 pagesThe Basics of Capital Budgeting: Should We Build This Plant?Riza Joie VersalesNo ratings yet

- Investment Appraisal 1: Process and MethodsDocument22 pagesInvestment Appraisal 1: Process and MethodsAshura ShaibNo ratings yet

- Rate of Return CalculationsDocument25 pagesRate of Return CalculationsarunNo ratings yet

- Lecture 8: Rate of Return Analysis: Instructional Material ForDocument20 pagesLecture 8: Rate of Return Analysis: Instructional Material ForAziezah PalintaNo ratings yet

- Chap 6 Notes To Accompany The PP TransparenciesDocument8 pagesChap 6 Notes To Accompany The PP TransparenciesChantal AouadNo ratings yet

- Assignment 01 FIN-701Document8 pagesAssignment 01 FIN-701farhanacse5No ratings yet

- CQF L01P01Document16 pagesCQF L01P01Mn AbdullaNo ratings yet

- Cost of Capital: Answers To Concepts Review and Critical Thinking Questions 1Document7 pagesCost of Capital: Answers To Concepts Review and Critical Thinking Questions 1Trung NguyenNo ratings yet

- A) Project ADocument9 pagesA) Project AАнастасия ОсипкинаNo ratings yet

- 2 Capital Budegeting NPV IRR MIRR Other Investment RulesDocument54 pages2 Capital Budegeting NPV IRR MIRR Other Investment RulesnikhilNo ratings yet

- EM 059 - Assignment 4 - Rev 1 - FINALDocument10 pagesEM 059 - Assignment 4 - Rev 1 - FINALzv5jmgnw99No ratings yet