Professional Documents

Culture Documents

Chapter 11

Chapter 11

Uploaded by

NEIL OBINARIO0 ratings0% found this document useful (0 votes)

10 views2 pagesThis document discusses public goods, common resources, and market failures. Public goods are non-excludable and non-rival, meaning no one can be prevented from using them and one person's use does not reduce availability to others. Common resources are non-excludable but rival. The free rider problem prevents private markets from providing public goods, leading to market failure. The government can potentially remedy this by providing the good and paying for it with tax revenue, making everyone better off. Examples of public goods include national defense and basic research. Common resources prone to overuse include fisheries, clean air and water, and roads.

Original Description:

Original Title

CHAPTER 11

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses public goods, common resources, and market failures. Public goods are non-excludable and non-rival, meaning no one can be prevented from using them and one person's use does not reduce availability to others. Common resources are non-excludable but rival. The free rider problem prevents private markets from providing public goods, leading to market failure. The government can potentially remedy this by providing the good and paying for it with tax revenue, making everyone better off. Examples of public goods include national defense and basic research. Common resources prone to overuse include fisheries, clean air and water, and roads.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views2 pagesChapter 11

Chapter 11

Uploaded by

NEIL OBINARIOThis document discusses public goods, common resources, and market failures. Public goods are non-excludable and non-rival, meaning no one can be prevented from using them and one person's use does not reduce availability to others. Common resources are non-excludable but rival. The free rider problem prevents private markets from providing public goods, leading to market failure. The government can potentially remedy this by providing the good and paying for it with tax revenue, making everyone better off. Examples of public goods include national defense and basic research. Common resources prone to overuse include fisheries, clean air and water, and roads.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

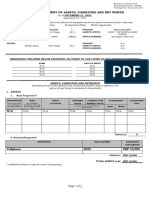

CHAPTER 11: Public Goods and The free-rider problem

Common Resources Public goods are not excludable

Prevents the private market from

Excludability supplying the goods

Property of a good whereby a person can be Market failure

prevented from using it

Government can remedy

Rivalry in consumption the free-rider problem

Property of a good whereby one person’s use If total benefits of a public good exceeds

diminishes other people’s use its costs

Provide the public good

Private goods Pay for it with tax revenue

Excludable & Rival in consumption Make everyone better off

Public goods Some important public goods

Not excludable & Not rival in consumption National defense

Very expensive public good

Common resources $748 billion in 2014

Rival in consumption & Not excludable

Basic research

Club goods General knowledge

Excludable & Not rival in consumption Subsidized by government

One type of natural monopoly The public sector fails to pay for the

rightnamount and the right kinds

Goods can be grouped into four categories

according to two characteristics: Some important public goods

A good is excludable if people can be Antipoverty programs financed by taxes

prevented from using it. Welfare system (Temporary Assistance for

A good is rival in consumption if one person’s Needy Families program, TANF)

use of the good diminishes other people’s use Provides a small income for some poor

of it. families

Food stamps (Supplemental Nutrition

Public goods and common resources Assistance Program, SNAP)

Not excludable Subsidize the purchase of food for those

People cannot be prevented from using with low incomes

them Government housing programs

Available to everyone free of charge Make shelter more affordable

No price attached to it

External effects The difficult job of cost–benefit analysis

Positive externalities (public goods) Government

Negative externalities (common resources) Decide what public goods to provide

In what quantities

Public goods and common resources Cost–benefit analysis

Private decisions about consumption and Compare the costs and benefits to society

productio of providing a public good

Can lead to an inefficient allocation of Doesn’t have any price signals to observe

resources Government findings: rough

Government intervention approximations at best

Can potentially raise economic well-being

Common resources

Not excludable

Free rider Rival in consumption

Person who receives the benefit of a good

but avoids paying for it The tragedy of the commons

Parable that shows why common

resources are used more than desirable

From society’s standpoint Private goods

Social and private incentives differ Ice-cream cones

Arises because of a negative externality Clothing

Congested toll roads

The tragedy of the commons

Negative externality Public goods

One person uses a common resource Tornado siren

diminishes other people’s enjoyment of it National defense

Common resources tend to be used Uncongested nontoll roads

excessively

Common resources

Government can solve the problem Fish in the ocean

Regulation or taxes to reduce consumption The environment

of the common resource Congested nontoll roads

Turn the common resource into a private

good Club goods

Fire protection

Some important common resources Cable TV

Clean air and water Uncongested toll roads

Negative externality: pollution

Regulations or corrective taxes When there is no price attached to a good, it can

Congested roads lead to market failure and the government can

Negative externality: congestion potentially remedy the market failure by the use of

Corrective tax: charge drivers a tool taxes

Tax on gasoline

Some important common resources

Fish, whales, and other wildlife

Oceans: the least regulated common

resource

Needs international cooperation

Difficult to enforce an agreement

Fishing and hunting licenses

Limits on fishing and hunting seasons

Limits on size of fish

Limits on quantity of animals killed

Market fails to allocate resources

Efficiently

Because property rights are not well

established

Some item of value does not have an

owner with the legal authority to control it

The government can potentially solve the

problem

Help define property rights and thereby

unleash market forces

Regulate private behavior

Use tax revenue to supply a good that the

market fails to supply

You might also like

- The Privatization of Everything: How the Plunder of Public Goods Transformed America and How We Can Fight BackFrom EverandThe Privatization of Everything: How the Plunder of Public Goods Transformed America and How We Can Fight BackNo ratings yet

- Studies in The Macedonian Coinage of Alexander The Great - Hyla A. TroxellDocument204 pagesStudies in The Macedonian Coinage of Alexander The Great - Hyla A. TroxellSonjce Marceva100% (3)

- E-Sys Cafd Id's p3.59 v4Document2 pagesE-Sys Cafd Id's p3.59 v4Галин Желев100% (1)

- Yahoo! Finance SpreadsheetDocument9 pagesYahoo! Finance Spreadsheetsandip_exlNo ratings yet

- B504 - Lesson 11 ExamDocument20 pagesB504 - Lesson 11 ExamsallieNo ratings yet

- 11 Public Goods & Common ResourcesDocument11 pages11 Public Goods & Common ResourcesShantyruckmalla Ciie PiscesgirlNo ratings yet

- CH 11 Presentation PDFDocument23 pagesCH 11 Presentation PDFKevin OrtizNo ratings yet

- Public GoodsDocument7 pagesPublic GoodsArmand RoblesNo ratings yet

- Chapter 11 Public Goods and Common ResourcesDocument1 pageChapter 11 Public Goods and Common ResourceslavNo ratings yet

- Chapter 6 EconomicsDocument3 pagesChapter 6 EconomicsLorenzo, Patricia AnnNo ratings yet

- Public Goods and Common ResourcesDocument23 pagesPublic Goods and Common ResourcesGayle AbayaNo ratings yet

- In This Chapter, Look For The Answers To These Questions:: Chapter 11 Public Goods and Common ResourcesDocument20 pagesIn This Chapter, Look For The Answers To These Questions:: Chapter 11 Public Goods and Common Resourcesco lamNo ratings yet

- Market FailuresDocument36 pagesMarket Failuresyansisay00No ratings yet

- Unit 2 Part 1Document18 pagesUnit 2 Part 1FeelipeferrerNo ratings yet

- Public Goods and Public UtilityDocument13 pagesPublic Goods and Public Utilitykaiserjadonanto007No ratings yet

- Chapter 11 PDFDocument8 pagesChapter 11 PDFJulie HuynhNo ratings yet

- Public Good - 2024Document32 pagesPublic Good - 2024Keshav KumarNo ratings yet

- Economics ReviewerDocument12 pagesEconomics ReviewerAndrea PepitoNo ratings yet

- B2B Global Public Goods ChinDocument2 pagesB2B Global Public Goods ChinTiago GonçalvesNo ratings yet

- Ae Module14Document11 pagesAe Module14Koshu KunNo ratings yet

- Political Economy of Goods: The Concept of "Goods & Public Goods"Document20 pagesPolitical Economy of Goods: The Concept of "Goods & Public Goods"Jeicel BarairoNo ratings yet

- ExternalitiesDocument13 pagesExternalitiesken dahunanNo ratings yet

- Economics Unit 5 - 1457145468349Document5 pagesEconomics Unit 5 - 1457145468349VaanazhaganNo ratings yet

- Classification of GoodsDocument3 pagesClassification of GoodsSheldon JosephNo ratings yet

- ExternalitiesDocument28 pagesExternalitiesMac FerdsNo ratings yet

- Private GoodsDocument2 pagesPrivate GoodsnenzzmariaNo ratings yet

- Microeconomics: Key IdeasDocument9 pagesMicroeconomics: Key Ideaslily chanNo ratings yet

- Barang Publik: Muhammad Hasyim Ibnu Abbas, S.E.,M.ScDocument15 pagesBarang Publik: Muhammad Hasyim Ibnu Abbas, S.E.,M.ScIsmi AndariNo ratings yet

- Chapter 11 - MicroeconomicsDocument6 pagesChapter 11 - MicroeconomicsFidan MehdizadəNo ratings yet

- Lecture 9 10 - 27Document27 pagesLecture 9 10 - 27ChristopherNo ratings yet

- Public Finance: Unit 1: Fiscal Function An OverviewDocument22 pagesPublic Finance: Unit 1: Fiscal Function An OverviewJoseph PrabhuNo ratings yet

- Economics NotesDocument21 pagesEconomics NotesYen Lee83% (6)

- Public Expenditure Theory 5. Public Goods and Publicly Provided Private GoodsDocument25 pagesPublic Expenditure Theory 5. Public Goods and Publicly Provided Private GoodsPun Xí XớnNo ratings yet

- Econ - ReviewerDocument7 pagesEcon - ReviewermialynNo ratings yet

- CH 11Document15 pagesCH 11Eymen GürNo ratings yet

- Market, Externalities and Market FailureDocument20 pagesMarket, Externalities and Market FailureMamun RanaNo ratings yet

- Market FailureDocument20 pagesMarket FailurePratham GarodiaNo ratings yet

- Market FailureDocument22 pagesMarket FailureSanchit Singhal100% (1)

- Market Failure: Externalities, Monopoly, Asymmetric Information, and Public GoodsDocument45 pagesMarket Failure: Externalities, Monopoly, Asymmetric Information, and Public Goodssumit sharmaNo ratings yet

- Chapter 11: Public Goods and Common Resource Learning ObjectivesDocument5 pagesChapter 11: Public Goods and Common Resource Learning ObjectivesGuru DeepNo ratings yet

- CH1 Fundamental Principles of Public FinanceDocument29 pagesCH1 Fundamental Principles of Public Financefadwa100% (1)

- Microeconomics Types of Goods Session 12: July 2018Document45 pagesMicroeconomics Types of Goods Session 12: July 2018lucifer1711No ratings yet

- Public Goods and Publicly Provided Private GoodsDocument56 pagesPublic Goods and Publicly Provided Private GoodsDrashti ChoudharyNo ratings yet

- CH 11 Public GoodsDocument24 pagesCH 11 Public Goodsm5qffwv288No ratings yet

- Aug 5Document24 pagesAug 5etebark h/michaleNo ratings yet

- Economics Week 5Document15 pagesEconomics Week 5Éssâ HàîdárïNo ratings yet

- Market FailureDocument4 pagesMarket FailureCassie ChenNo ratings yet

- 1public Goods PDFDocument13 pages1public Goods PDFKatie BarnesNo ratings yet

- 2.10 Market FailureDocument102 pages2.10 Market FailureHiken YiuNo ratings yet

- Barang PublikDocument29 pagesBarang PublikMudita RahmawatiNo ratings yet

- MICRO-3-Public GoodsDocument32 pagesMICRO-3-Public GoodsLỘC LÊ QUÝNo ratings yet

- Public Goods: Slides by Pamela L. Hall Western Washington UniversityDocument48 pagesPublic Goods: Slides by Pamela L. Hall Western Washington UniversityTeed DwilightNo ratings yet

- Lecture 5 FPE2022Document29 pagesLecture 5 FPE2022SkagedaNo ratings yet

- BADM 780 - Lecture 4 NotesDocument2 pagesBADM 780 - Lecture 4 NotesHarrisNo ratings yet

- Market Failure - 2Document26 pagesMarket Failure - 2ananya.vasishthaNo ratings yet

- NotesDocument13 pagesNotesPrestine Faith SalinasNo ratings yet

- Null 7Document21 pagesNull 7preciouskazvita7No ratings yet

- MDS 529 - Handout 2Document7 pagesMDS 529 - Handout 2faruque.ddsNo ratings yet

- Acfrogafllamjwlya0wdq Pncyry4nsrhx9m3kfhvrrqaaw8rlxirnphwgvlb08owjhg4xf1isttvuurcqgeaw0v48txr6kvma Hca2gtjwkv4hp7915wdn4us Aknm0d Wemfsagpehcnq9hxy8Document9 pagesAcfrogafllamjwlya0wdq Pncyry4nsrhx9m3kfhvrrqaaw8rlxirnphwgvlb08owjhg4xf1isttvuurcqgeaw0v48txr6kvma Hca2gtjwkv4hp7915wdn4us Aknm0d Wemfsagpehcnq9hxy8Alyssa Jane G. AlvarezNo ratings yet

- Chapter 11 - Public Goods and Common ResourcesDocument14 pagesChapter 11 - Public Goods and Common ResourcesDale RomeroNo ratings yet

- Ch11 RedbookDocument5 pagesCh11 Redbookmirai6831No ratings yet

- Econ Long Test ReviewerDocument7 pagesEcon Long Test ReviewerscarNo ratings yet

- CHAPTER 21 The Theory of Consumer ChoiceDocument5 pagesCHAPTER 21 The Theory of Consumer ChoiceNEIL OBINARIONo ratings yet

- Chapter 14 Firms in Competitive MarketsDocument4 pagesChapter 14 Firms in Competitive MarketsNEIL OBINARIONo ratings yet

- Chapter 14Document2 pagesChapter 14NEIL OBINARIONo ratings yet

- Chapter 13Document2 pagesChapter 13NEIL OBINARIONo ratings yet

- Chapter 10Document2 pagesChapter 10NEIL OBINARIONo ratings yet

- ACCTG + PRELIM Activity With Key Answers (Lesson 1.1-1.4)Document7 pagesACCTG + PRELIM Activity With Key Answers (Lesson 1.1-1.4)NEIL OBINARIONo ratings yet

- Lesson 3 and 4Document2 pagesLesson 3 and 4NEIL OBINARIONo ratings yet

- ACCTG + PRELIM Activity With Key Answers (Lesson 1.1-1.4) - WPS PDF ConvertDocument6 pagesACCTG + PRELIM Activity With Key Answers (Lesson 1.1-1.4) - WPS PDF ConvertNEIL OBINARIONo ratings yet

- Double Entry Accounting System. Part 1 And2Document6 pagesDouble Entry Accounting System. Part 1 And2NEIL OBINARIONo ratings yet

- Rusliefe2901 760141847.CSVDocument4 pagesRusliefe2901 760141847.CSVrusliefendi998No ratings yet

- Saln 2023Document2 pagesSaln 2023Ngirp Alliv TreborNo ratings yet

- Women's Green Business Initiative: Turning The Climate Change Challenge Into Economic Opportunities For Women - 2010Document4 pagesWomen's Green Business Initiative: Turning The Climate Change Challenge Into Economic Opportunities For Women - 2010UNDP Gender TeamNo ratings yet

- Principles of The EcosystemDocument2 pagesPrinciples of The EcosystemFebz Canutab0% (2)

- Bangalore Residential Market Report April 2012 PDFDocument44 pagesBangalore Residential Market Report April 2012 PDFPonchuNo ratings yet

- Lecture+2 Mgmt.+of+Agro-Industrial+ProjectsDocument60 pagesLecture+2 Mgmt.+of+Agro-Industrial+Projectsabadi girsangNo ratings yet

- BPSMDocument36 pagesBPSMritesh palitNo ratings yet

- Business Cycles 2Document13 pagesBusiness Cycles 2Prakash KrishnamoorthyNo ratings yet

- Sime Darby Berhad: Confidence Still Shaky - 31/5/2010Document5 pagesSime Darby Berhad: Confidence Still Shaky - 31/5/2010Rhb InvestNo ratings yet

- Title Proposal: Bulsu-OP-CAFA-03F1 Revision:0Document4 pagesTitle Proposal: Bulsu-OP-CAFA-03F1 Revision:0Renzo MiclatNo ratings yet

- Marketing Environment Are Divided Into Two PartsDocument4 pagesMarketing Environment Are Divided Into Two Partstrinath1No ratings yet

- Maheshwari AdminReformDocument40 pagesMaheshwari AdminReformaar_unlimited9351No ratings yet

- Ongoing Projects in DelhiDocument5 pagesOngoing Projects in Delhirahulchauhan7869No ratings yet

- Competition Law OutlineDocument2 pagesCompetition Law OutlinegauravbhuwaniaNo ratings yet

- Electric Vehicles - Latest EditionsDocument5 pagesElectric Vehicles - Latest EditionsSaeedAhmedKhan100% (1)

- April 1Document14 pagesApril 1PCNRNo ratings yet

- Cash Deposit Machine ListDocument32 pagesCash Deposit Machine ListSunil MahantyNo ratings yet

- Wallstreetjournal 20221207 TheWallStreetJournal PDFDocument39 pagesWallstreetjournal 20221207 TheWallStreetJournal PDFRazvan Catalin CostinNo ratings yet

- Commercial Registered Agents ListDocument10 pagesCommercial Registered Agents ListDerek FrancisNo ratings yet

- Real Estate SectorDocument98 pagesReal Estate SectorIzzah CurlNo ratings yet

- About EthicsDocument21 pagesAbout EthicsJade MarkNo ratings yet

- Part 1 Social ScienceDocument109 pagesPart 1 Social ScienceRowena CastillanoNo ratings yet

- Accounting For Government Grants and Disclosure of Government AssistanceDocument18 pagesAccounting For Government Grants and Disclosure of Government AssistanceMaria DevinaNo ratings yet

- Critical Analysis of Marxist TheoryDocument18 pagesCritical Analysis of Marxist TheoryChudap Cell Inc.No ratings yet

- Geography in RomaniaDocument9 pagesGeography in RomaniaJovoMedojevicNo ratings yet

- Load ForecastingDocument36 pagesLoad Forecastingpowerman619No ratings yet

- Energy Bulletin Volume 2 Issue 10Document56 pagesEnergy Bulletin Volume 2 Issue 10ABAliNo ratings yet