Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

23 viewsIntax Chap2

Intax Chap2

Uploaded by

Angelyne Gumabayaza

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ETHICS and VALUESDocument15 pagesETHICS and VALUESAngelyne GumabayNo ratings yet

- InTax Chap1Document35 pagesInTax Chap1Angelyne GumabayNo ratings yet

- 3.3-Internet Communication - Twitter, Email, IM, Blogging, RSS - Newsgroups - Video - Lesson TranscriptDocument4 pages3.3-Internet Communication - Twitter, Email, IM, Blogging, RSS - Newsgroups - Video - Lesson TranscriptAngelyne GumabayNo ratings yet

- 3.4-Internet Collaboration - Second Life, VOIP, Video Conferencing, Virtual Reality - Telepresence - Video - Lesson TranscriptDocument4 pages3.4-Internet Collaboration - Second Life, VOIP, Video Conferencing, Virtual Reality - Telepresence - Video - Lesson TranscriptAngelyne GumabayNo ratings yet

- 3.2-The Internet - IP Addresses, URLs, IsPs, DNS - ARPANET - Video - Lesson TranscriptDocument4 pages3.2-The Internet - IP Addresses, URLs, IsPs, DNS - ARPANET - Video - Lesson TranscriptAngelyne GumabayNo ratings yet

- The Top Ten Countries For Outsourcing BusinessDocument2 pagesThe Top Ten Countries For Outsourcing BusinessAngelyne GumabayNo ratings yet

- Ethics Final ExaminationDocument3 pagesEthics Final ExaminationAngelyne GumabayNo ratings yet

- FM Pointers For ReviewDocument12 pagesFM Pointers For ReviewAngelyne GumabayNo ratings yet

Intax Chap2

Intax Chap2

Uploaded by

Angelyne Gumabay0 ratings0% found this document useful (0 votes)

23 views43 pagesaza

Original Title

Intax-Chap2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaza

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

23 views43 pagesIntax Chap2

Intax Chap2

Uploaded by

Angelyne Gumabayaza

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 43

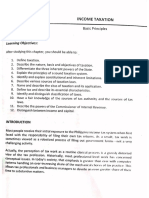

INCOME TAXATION

Taxation of Individuals

Learning Objectives:

After studying this chapter, you should be able to:

Identify the individual income taxpayers.

Define the individual taxpayers and the related terms used.

Illustrate the different classification of individual taxpayers.

State the sources of income of individual taxpayers.

Recognize the categories of income and state the tax rates to be used by each

type of individual taxpayer.

6. List the sources of passive income and state the final tax rates to be used by

each type of individual taxpayer.

7. Discuss the treatment of passive income in the computation of taxable income

from compensation or business/professional income.

8. Define the allowable deductions from gross income.

9. Define and compute taxable income and tax due for each type of individual

taxpayer depending on income category.

10. Explain the taxation of income received by social media influencers.

11. Be familiar with individual taxpayers exempt from income tax.

yey

The Code directs that a tax shall be imposed on the taxable income of every individual.

Our present tax system imposes progressive rates of income taxes on citizens and

resident aliens. This system equitably distributes the tax burden by recognizing the

paying ability of the individual taxpayer.

likewise, the global treatment in taxing compensation and business income has been

restored from the previous schedular treatment. In a schedular system, the income tax

treatment varies depending on.the kind of taxable income of the taxpayer. A schedular

system of taxation provides for a different tax treatment of different types of income so

that a separate tax return is required to be filed for each type of income and the tax is

Computed on a per return or per schedule basis.

A

t, on the other hand, is a system where the tax treatme,

Global treatin base and generally treats in common all categories o

inafferently the payer A global system of taxation is one where the ta

a He pup all items of income earned during a taxable period and pay

ae ee tax rules on these different items of income. Under this sy

eae an is the aggregate of the gross compensation income

business or professional income less the allowable deductions.

unitary but progressive, graduated rates.

Nt View,

f taxabj,

Payer i,

Y Under

stem, the

and gros,

Is being subjected tg,

Unlike financial accounting, tax law does not distinguish between a

unincorporated business. If one person engages in several different bu:

his or her total taxable income is determined by aggregating income and

various sources. If two or more individuals-professionals form a gene

partnership, there is no income tax imposed on the entity. Rather,

include their respective shares of the Partnership's income,

other sources, in determining their individual taxable incom

Person and ay

SINESS activitio,

losses from th,

al professions

the partners mug

along with income from an

es.

While all individuals are subject to tax on their respective taxable incomes,

all taxed at the same rate for two reaso1

levels of income. Second, even at the sa

they are not

fer for higher

CLASSIFICATION OF INDIVIDUAL INCOME TAXPAYERS

1. Citizen

a. Resident

b. Non-resident

2. Alien

a. Resident

b. Non-resident

1. Engaged in trade orb

2. Not engaged in trade

3. Employed by

a

usiness in the Philippines

Or business in the Philippines

b. Offshore banking units,

Petroleum contractors and sub-contractors,

34 | Income Taxation 2023 Edition by Prof win p01.

Definition of Terms

3.

Citizen. The following shall be considered citizens of the Philippines:

«Those who are citizens of the Philippi

Constitution; ' Philippines at the time of the adoption of the Feb. 2, 1987

Those whose fathers or mothers are citizens of the Philippines;

«Those born before Jan. 17, 1973,

Filpin mothers the date of the adoption of the 1973 Constitution, of

tir fron

'0 elect Philippine citizenship upon reaching the age of majority; and

* Those who are naturalized in accordance with law.

Resident Citizen is a Filipino citizen who permanently resides in the Philippines.

Non-Resident Citizen means:

+ Acitizen of the Philippines who establishes to the satisfaction of the Commissioner the

fact of his physical presence abroad with a definite intention to reside therein.

A citizen of the Philippines who leaves the Philippines during the taxable year to reside

abroad, either as an immigrant or for employment on a permanent basis

© A citizen of the Philippines who works and derives income from abroad and whose

employment thereat requires him to be physically present abroad most of the time

during the taxable year. “Most of the time” is interpreted to mean presence abroad for

at least 183 days during the taxable year (BIR Ruling 128-99, Aug. 18, 1999).

© Acitizen who has been previously considered as non-resident citizen and who arrives in

the Philippines at any time during the taxable year to reside permanently in the

Philippines shall likewise be treated as a non-resident citizen for the taxable year in

which he arrives in the Philippines with respect to his income derived from sources

abroad until the date of his arrival in the Philippines.

© The taxpayer shall submit proof to the Commissioner to show his intention of leaving

the Philippines to reside permanently abroad or to return to and reside in the

Philippines, as the case may be.

Resident Alien. An individual whose residence is within the Philippines and who is

not a citizen thereof. He is one who is actually present in the Philippines and who is

not a mere transient or sojourner. But residence does not mean mere physical

presence. An alien is considered a resident or a non-resident depending on his

intention with regard to the length and nature of his stay.

Non-Resident Alien. An individual whose residence is not within the Philippines and

who is not a citizen thereof.

ls | 35

Chapter 2: Taxation of individual |

6. Non-Resident Alien Engaged in Trade and Business (NRAETB) refers to ,

resident alien who shall come to the Philippines and stay for an agaregate nen

ts

more than one hundred eighty (180) days during any calendar year. & what s

actual

7. Non-Resident Alien Not Engaged in Trade and Business (NRANETB) refers to, perfor

resident alien who shall come to the Philippines and stay for an aggregate pe," work,

one hundred eighty (180) days or less during any calendar year. “ee en

4. Fring

8. Compensation Income. In general, means all remuneration for services perfor, al

by an employee for his employer under an employer-employee relationship, uni: aie

specifically excluded by the Code.

:

The name by which the remuneration for services Is designated Is immaterial. Th, t

salaries, wages, emoluments and honoraria, allowances, commissions (ey ‘

transportation, representation, entertainment and the like); fees including direst,

fees, if the director is, at the same time, an employee of the employer/corporatig,

taxable bonuses and fringe benefits, except those which are subject to the fringe

benefits tax under Sec. 33 of the Code and the allowable "de minimis" benef

taxable pensions and retirement pay; and other income of a similar natyy

constitute compensation income.

9. Compensation Income Earners. Individuals whose source of income is Purely

derived from an employer-employee relationship.

10, Employee. An individual performing services under an employer-employe 15. Mit

relationship. The term covers all employees, including officers and employees wit

whether elected or appointed, of the Government of the Philippines; or any politics wit

subdivision thereof or any agency or instrumentality. the

mir

11, Rank and File Employee refers to an employee holding neither managerial rx cov

supervisory position as defined under existing provisions of the Labor Code of the ear

Philippines, as amended. Ace

erd

12. Employer. Any person for whom an individual performs or performed any senitt

of whatever nature, under an employer-employee relationship. It is not necessat! 17.

that the services be continuing at the time the wages are paid in order that the

status of employer may exist. Thus, for purposes of withholding, a person for who" Sol

an individual has performed: past services and from whom he is still receiié

compensation is an "employer."

18. OC

. fs

13. Employer and Employee Relationship exists when a person for whom services Vet ie

Performed (employer) has the right to control and direct an. individual W° OF

Performs the services (employee), not only as to the result of the work t0

accomplished but also as to the details, methods and means by which

accomplished. An employee is subject to the control of the employer not only 5"

36 | Income Taxation 2023 Edition by Prof. WIN Ballada and Susan Ballada

15.

16.

17.

18,

What shall be done, but how it shall be done. It is not necessary that the employer

actually exercises the right to direct or control the manner in which the services are

performed. It is sufficient that there exists a right to control the manner of doing the

work

Fringe Benefits means

any good, service or other benefit furnished or granted in

cash or in kind other th

an the basic compensation, by an employer to an individual

employee (except rank and file employee as defined herein) such as, but not limited

to the following:

a. Housing;

b. Expense account;

€. Vehicle of any kind;

d. Household personnel, such as maid, driver and others;

@. Interest on loan at less than market rate to the extent of the difference between

the market rate and actual rate granted;

f. Membership fees, dues and other expenses borne by the employer for the

employee in social and athletic clubs or other similar organizations;

Expenses for foreign travel;

Holiday and vacation expenses;

i. Education assistance to the employee or his dependents; and

j. life or health insurance and other non-life insurance premiums or similar amounts

in excess of what the law allows.

azo

Minimum Wage Earner (MWE) refers to a worker in the private sector who is paid

with a statutory minimum wage (SMW) rates, or to an employee in the public sector

with compensation income of not more than the statutory minimum wage rates in

the non-agricultural sector where the worker/employee is assigned. Such statutory

minimum wage rates are exempted from income tax. Likewise, the exemption

covers the holiday pay, overtime pay, night shift differential pay, and hazard pay

earned by an MWE.

Marginal Income Earner refers to an individual whose business does not realize

gross sales or receipts exceeding P100,000 in any 12-month period.

‘Mixed Income Earner. An individual earning compensation income from

employment, and income from business, practice of profession and/or other

sources aside from employment.

OCWs or OFWs refer to Filipino citizens employed in foreign countries who are

physically present in a foreign country as a consequence of their employment

thereat. Their salaries and wages are paid by an employer abroad and are not

borne by any entity or person in the Philippines. To be considered as an OCW or

OFW, they must be duly registered as such with the Philippine Overseas

Chapter 2: Taxation of individuals | 37

19.

20.

21,

22,

nt Adminis a ‘seas Employment Cg,

POEA), with a valid Oversea: :

istration (POEA), wi

yyiment Admit

Employ

- cive ensatio

seamen are Filipino citizens who receive compensation for se,

Seafarers or sea

broad as a member of the complement of a vessel engaged Xclusive

ered abroad as a me

a altrade. They must be duly registered as such with the POEA with aya

international trade u A

GEC and Seafarers Identification Record Book (SIRB) or Seaman's Book issueq,

Maritime industry Authority (MARINA) (Revenue Regulations 1-2011, Feb, 24 2011,

Self-employed. A sole proprietor or an independent contractor who reports incom,

earned from self-employment. S/he controls who s/he works for, how the Work

done and when it is done. It includes those hired under a contract of service OF jg

order, and professionals whose income is derived purely from the Practice 9,

profession and not under an employer-emoloyee relationship.

Professional. A person formally certified by a professional body belonging toa

Specific profession by virtue of having completed a required examination OF course

of studies and/or practice, whose competence can usually be measured against a,

established set of standards. It also refers to a person who engages in some art g

Sport for money, as a means of livelihood, rather than as a hobby. It includes but i

not limited to doctors, lawyers, engineers, architects, CPAs, professiona|

entertainers, artists, professional athletes, directors, Producers, insurance agents,

insurance adjusters, management and technical consultants, bookkeeping agents,

and other recipients of professional, promotional and talent fees.

Gross Receipts refers to the total amount of Money or its equivalent representing

the contract price, compensation, service fee, rental or royalty, including the

amount charged for materials supplied with the services, and deposits and advance

Payments actually or constructively received during the taxable period for the

services performed or to be Performed for another Person, except returnable

Security deposits for purposes of these regulations. In the case of VAT taxpayer, this

shall exclude the VAT component.

14. Taxable Income refers to the pertinent items of grass income specified in the Code

Code or ather

less deductions, if any, authorized for such types of income by the

special laws

A VAT Threshold refers to the ceiling fixed by law to determine VAT re

taxpayers. The VAT threshold is curre ntly set at three million pesos (P3,000,000) and

tax liability of self-employed

1d 24(A)(2)(c){2) of the

the same shall be used to determine the income

and/or professionals under Sections 24(A)(2)(b)

individu

Tax Code, as amended.

Yy Hegional or Area Headquarters (RHQs) shall mean a branch established in the

nd which headquarters do not earn or

Phitippin

by multinational companie

supervisory, communications

s, or branches in the Asia-

derive income from the Philippines and which act as

and coordinating center for their affiliates, subsidian

Pacific Region and other foreign markets,

26. Regional Operating Headquarters (ROHQs) shall ynean a branch established in the

Philippines by multinational companies which are engaged in any of the following

services: general administration and planning; business planning and coordination;

sourcing and procurement of raw materials and components; corporate finance

‘advisory services; marketing control and sales promotion; training and personnel

management; logistic services; research and development services and product

development; technical support and maintenance; data processing and

communications; and business development.

27. Deposits, in connection with offshore banking, shall mean funds in foreign

currencies which are accepted and held by an Offshore Banking Unit or Foreign

Currency Deposit Unit in the regular course of business, with the obligation to

return an equivalent amount to the owner thereof, with or without interest.

28. Deposit Substitutes shall mean an alternative from of obtaining funds from the

public (the term ‘public’ means borrowing from twenty (20) or more individual or

Corporate lenders at any one time) other than deposits, through the issuance,

endorsement, or acceptance of debt instruments for the borrowers own account,

for the purpose of relending or purchasing of receivables and other obligations, or

financing their own needs or the needs of their agent or dealer. These instruments

may include, but need not be limited to bankers’ acceptances, promissory notes,

repurchase agreements, including reverse repurchase agreements entered into by

and between the Bangko Sentral ng Pilipinas (BSP) and any authorized agent bank,

certificates of assignment or participation and similar instruments with recourse:

Provided, however, That debt instruments issued for interbank call loans with

maturity of not more than five (5) days to cover deficiency in reserves against

deposit liabilities, including those between or among banks and quasi-banks, shall

not be considered as deposit substitute debt instruments.

Chapter 2: Taxation of Individuals | 39

oN

Foreign Currency Deposit System (FCDS) shall refer to the conduct ofp,

transactions whereby any person, whether natural or juridieal, may deposi 2%

currencies forming part of the Philippine international reserves, in accordan(o?

the provisions of R.A. 6426 entitled “An Act Instituting a Foreign Currency <2

system in the Philippines, and For Other Purposes.” Po,

29.

Foreign Currency Deposit Unit (FCDU) shall refer to that unit ofa local bang

loca branch ofa foreign bank authorized by the Bangko Sentral ng Plipina gg”

engage in foreign currency-denominated transactions, pursuant to the Provision

R.A, 6426, as amended. Local bank shal refer toa thrift bank or acommervian

organized under the laws of the Republic of the Philippines. Local branche

foreign bank shall refer to a branch of a foreign bank doing business int,

Philippines, pursuant to the provisions of R.A. 337, as amended, ;

30.

31. Offshore Banking System shall refer to the conduct of banking transaction i

foreign currencies involving the receipt of funds principally from external ang

internal sources and the utilization of such fund pursuant to Presidential Decre:

1034 as implemented by Central Bank (now Bangko Sentral ng Pilipinas (B59)

Circular 1389, as amended.

32. Offshore Banking Unit (OBU) shall mean a branch, subsidiary or affiliate of a foreign

banking corporation which is duly authorized by the BSP to transact offshore

banking business in the Philippines in accordance with the provisions of Presidential

Decree 1034 as implemented by Central Bank (now BSP) Circular 1389, as amended

Mlustrations:

1. A British computer expert was hired by a Philippine corporation to assist in ts

computer system installation for which he had to stay in the Philippines for &

months. Is he a resident alien?

Answer: One who comes to the Philippines for a definite purpose which in its nature

would require an extended stay and to that end makes his home temporarily in the

Philippines, becomes a resident, though it may be his intention at all times to retu™

to his domicile (place of habitual or permanent residence) abroad when the purpos?

for which he came has been accomplished.

2. A British cultural performer was engaged to perform in the Philippines for t*?

weeks after which he returned to his country. Is he a resident alien?

Answer: No. One who comes to the Philippines for a definite purpose which ins

nature may be promptly accomplished is a transient.

, in

‘An alien owns shares of stock in the Philippines. Is he considered as engaged

business or trade in the Philippines?

40 | Income Taxation 2023 Edition by Prof. WIN Balada and Susan Ballada

‘Answer: No, mere ownership of shares of stock in the Philippines is not enough to

constitute as engaging in trade or business in the Philippines.

4. An alien temporarily serves as executive manager of an airline in Manila. Is he

considered engaged in trade or business in the Philippines?

‘Answer: Yes, because he is performing the functions of a public office.

5. Aresident alien left the Philippines and abandoned his residency thereof without

any intention of returning. May he still be considered a resident alien?

‘Answer: No, because he has no intention at all to return to the Philippines.

6. A resident alien left the Philippines with a re-entry permit. Is he still a resident

alien?

‘Answer: Yes, his re-entry permit proves that he has not abandoned his residence in

the Philippines.

‘A non-resident citizen went to Manila under the Balikbayan Program. Does his

return to Manila interrupt his residence abroad?

Answer: No, his trip to Manila did not interrupt his residence abroad. The phrase

“uninterrupted period” should not be interpreted literally. His trip to Manila did not

affect the continuity of his residence abroad.

Illustration, Source: BIR Ruling 053-2010, Sept. 14, 2010

An alien who holds a Special Retiree Residents Visa is considered a resident alien subject to Philippine

income tax under Section 24(A) of the Tax Code.

Illustration. Source: BIR Ruling DA-290-2008, June 27, 2005

‘an alien is a stockholder of a PEZA-registered enterprise. He has been involved in the company since its

incorporation in 1996, has obtained a special non-immigrant visa and was required 25 company president to

be in the Philippines most of the time to manage the day-to-day operations of the company. This alien

qualifies asa resident alien for Philippine income tax purposes. His dividend income shall be subject tothe

410% final tox imposed under Section 24(8)(2) ofthe Tax Code to be withheld by the payor-company.

SOURCES OF INCOME

but the property, activity or service that produced the

derived from labor, it is the place where the labor is

.d from the use of capital, it is the place where

¥ profits from the sale or exchange of capital

Source of income is not a place

income. In the case of income

performed; in the case of income derive

the capital is employed; and in the case o'

assets, its the place where the sale or transaction occurs.

Chapter 2: Taxation of Individuals | 41

It is important to know the source of income of an individual taxpayer—whether fron

within the Philippines or without—because not all individual taxpayers are taxed on

income. The following rules apply:

1, Resident citizens are taxable on all income derived from sources within ang

without.

2. Non-resident citizens and alien individuals—resident and non-resident—ary

taxable only on income derived from sources within the Philippines. An overseas

contract worker is taxable only on his income from sources within.

Individual Source of Income

Within the Phils. Without the Phils,

1. Resident Citizen V v

2. Non-Resident Citizen y

3. Resident Alien v

4, Non-Resident Alien v

CATEGORIES OF INCOME AND TAX RATES

1, Compensation Income. Individuals earning purely compensation income shall be

taxed based on the graduated income tax rates (from 20% to 35% effective Jan. 1,

2018 to Dec. 31, 2022; from 15% to 35% effective Jan. 1, 2023 onwards) prescribed

under Sec. 24(A) of the Tax Code.

Total Compensation Income Pxxx.

Less: Mandatory Contributions/Non-Taxable Benefits xx,

Net Taxable Income PXXX

2. Business Income arises from self-employment or practice of profession. This shall

not include income from performance of services by the taxpayer as an employee.

Individuals earning income purely from self-employment and/or practice of

profession whose gross sales/receipts and other non-operating income (GSRONO!)

do not exceed the P3.0M VAT threshold, shall have the option to avail of:

a. the graduated rates under Section 24(A) of the Tax Code, as amended; or

b. 8% tax of GSRONOI in excess of P250,000* in lieu of the graduated income t&X

rates under Section 24(A) and the percentage tax under Section 116 all under

the Tax Code, as amended.

Gross Sales/Receipts Prox

Less: Cost of Sales ie

Gross Income Pas

Less: Operating Expenses oe

Taxable Income (if graduated rates) P xx

Ballad

42 | Income Taxation 2023 Edition by Prof. WIN Ballada and Susan Ballada

* oned i

The 250,000 mentioned is not applicable to mixed income earners since it is

already incorporated in the first tier of the graduated income tax rates applicable to

compensation income.

3, Mixed Income Earners. There are individuals who earn income both from

compensation and from self-employment (business or practice of profession). They

shall be subject to the following taxes:

a. Oncompensation income — at graduated rates; plus

b. On income from business or practice of profession shall be subject to the

following:

b.1. If GSRONOI do not exceed the VAT threshold -

* either at graduated rates or

* 8% of GSRONOI in lieu of graduated rates and percentage tax, at the

option of the taxpayer.

b.2. 1f GSRONOI exceed the VAT threshold — at graduated rates.

These will be illustrated later.

4, Passive Income. Passive income is subject to a separate and final tax. Examples of

passive income are interests, royalties, prizes, winnings and dividends. A table

showing the passive income and the corresponding tax rates is provided later.

Ilustration: Helena Dela Cruz, single and a resident citizen, has the following passive

income for the year 2018:

Interest from BPI Savings Deposit P75,000

Royalty from Invention 80,000

Prize in a Painting Competition 50,000

Dividends Received from a Domestic Corporation 30,000

Computation of Final Tax:

Interest (P75,000 x 20%) 15,000

Royalty (P80,000 x 20%) 16,000

Prize (P50,000 x 20%) 10,000

Dividends (P30,000 x 10%) 3,000

44,000

Total

For this illustration, it is assumed that the passive income are all gross of final taxes

(FT) or final withholding taxes (FWT).

Chapter 2: Toxation of Individuals | 43

“OTT "285 Japun asoys ydaaxa saxe) aBeiUaosag say0 04 Dalqns suaAedxe) -z

pue ‘siohedxe3 pasaysifas vA“

301 aiqeyrene Jou s1 xe3 968 241 “papualue se ‘apo xe] a3 Jo OTT “22S JapUN xe| aBeyUaDAg pue (Y)pz "2a Jo NAY] UL ,

suse Une 22s)

3eu 8200 ((v)ez “Wvlve 295)

Sos ondosee cov'osz4 03093

sid.a394/s9}¢5 $8013

‘w024

uysidiaoay/sayes oon isto

sr 9woouraigexe $8008 5 atuoouy ‘g sidianay/sayes

A we aigeren A $5015 UO x81 568

xo x0

“syauaa/awoour “siyauag/ewoout

exer-UoU $59) aigexer-uou s53)

‘2uioout uso ss018 ‘swioou}reu | awoaul‘duloa 55008 :

Wea Jo ploysauyy rn _ a (vive 95 sapun

noes ge an ewooulsieeres | srawosurayeney | stowoouaygexey | (V2 295 9Pun

a (re 5209 (IONO¥SD) (2 a a a payenpes

IN3WOAWS-FS Nouvsnaawoo INaWAOTEN swoon saya xvi 3wooMI

“mas 3nd Nousn3awoo sung

a wow Huog I

Nv LN3GIS3Y GNY N3ZILID TYNGIAIGNI NO S3LVY XL 3WOONI 40 AYVWIWNS

Mada

44 | Income Taxation 2023 Edition by Prof. WIN Balada and Susan Balla

Final tax imposed on income or gain shall no longer be included as taxable incom

4 without any deduction and

5 net of the

subject to the graduated rates. The final tax is imp

is withheld at source. The amount received by p:

final tax. The final tax on passive income is remitted by the payor who serves as the

withholding agent! to the BIR. For example, if the prize in a painting competition is

50,000, the amount to be received by the winner wil only be P40,000

sive income earner

Capital Gains from Sale of Shares of Stock, Not Traded through the Local Stock

Exchange. Taxed at 15% final tax on a per transaction basis,

IMustration: in 2018, Uri Dangal, a resident citizen, owns and holds as capital assets,

shares of stocks of Prudential Guarantee and Assurance, Inc., a domestic

corporation, costing P40,000. He sold all the shares directly to Lilibeth Buen for

160,000. How much final tax must be paid?

Selling Price P160,000

Cost 40,000

Capital Gains 00

Capital Gains Tax (P120,000 x 15%) P18,000

6. Capital Gains from Sale of Real Property. Taxed at 6% final tax on the gross selling

price or current fair market value at the time of sale, whichever is higher.

In 2018, Nicos Luna, a resident citizen, sold his residential house and

lot in Singalong, Manila for P2,500,000. The cost of the house and lot three years

ago when he acquired the property was P1,500,000 and the fair market value at the

time of sale is P2,300,000. How much is the capital gains from the sale?

Illustration:

Selling Price 2,500,000

Tax Rate 6%

P 150,000

Final Tax

7. Fringe Benefits. Means any good, service, or other benefit furnished or granted by

an employer in cash or in kind in addition to basic salaries, to an individual

employee (except rank-and-file employee) under an employer-employee

relationship.

ed up monetary value granted to

2018. The grossed-up monetary value of the fringe

by dividing the actual monetary value of the fringe

monetary value is not to be included in the gross

Taxed at 35% final tax based on the gross!

employee beginning Jan. 1,

benefit shall be determined

benefit by 65%. The grossed up

old any *¥x under the provisions of Sec. 57 of the Tax Code.

1 any person required to deduct ‘and withh

Chapter 2: Taxation of Individuals | 45

ON

Income

Secti

of the taxpayer for purposes of computing the income tax abi

(A). The tax imposed is payable by the employer. im

tustration: In June 2018, Bor's Del Pilar, a resident citizen, recived fi

employer, fringe benefit of P65,000. This fringe benefit is subject to the x

benefit tax, Compute the tax that shall be paid by Boris’s employer ™

Monetary Value of the Fringe Benefit P65,000

Divide by 65%

Grossed-up Monetary Value ~P100,000°

Multiply by 35%

Fringe Benefit Tax

The categories of income and the tax rates applicable for each type of indivig

taxpayer are presented below: :

| “Resident”

INCOME | citizen —

LON TAXABLE INCOME as, a

| detined in Sec. 31 the tox 20% to 35% 20% - 35%

computed under the (eff. Jan. 1, 2018 to Dec. 31, 2022) FB.

revised See. 24(A), except 15% to 35% 15% - 35%

for NRANETD (eff. Jan. 1, 2023 onwards)

ON PASSIVE INCOME ali ea

2ingeneral, interests,

royalties, prizes and other 20% 20% =| FrasK.

winnings

Cash and/or property

dividends -

ONCAPITALGAIN___|

4, Sale of shares of stock not

traded in stack exchange _|

5. Sale of real pre

Notes:

1. The taxable income referred to in the table (no. 1) is discussed later in this chaps,

hereon, any reference to Section 24(A) means the revised Section 24(A)(2)a) per TA

for simplicity. R.A, 10963, Tax Reform for Acceleration and Inclusion Act (TRAIN):

effect on Jan. 1, 2018,

a val,

Non-Resident Allen Engaged in Trade or Business Within the Philippines. In seit

income tax rates applicable to this taxpayer shall be the rates imposed on indivi i

and a resident alien individual on the taxable income derived within the Philippines.

1 i Upo!

3. Non-Resident Allen Not Engaged in Trade or Business Within the Philippines.

entire income received from all sources within the Philippines by this taxPaVer “ye

interest, cash and/or property dividends, rents, salaries, wages, Ler annual

compensation, remuneration, emoluments, or other fixed or determinadl hs

periodic or casual gains, profits, and income, and capital gains—income ta

ptt

46. | Income Taxation 2023 Edition by Prof. WIN Ballada and susan Balada .

4, Before TRAIN, all income received by a non-resident alien employed by:

° ay or area headquarters (RHOz) and regional operating headquarters (ROHQs) of

FR es engaged in international trade

haa and subsidiary branch offices in the Asia-Pacific region and other foreign

b. Offshore banking units (OBU),

c. Petroleum service contractors and sub-contractors (PSS),

were included as gross income taxed at 15% final tax. This same tax treatment applied toa

Filipino employed by such firms. But such Filipinos have the option to be taxed at either 15%

or under Section 24(A).

This preferential tax treatment no longer applies for employees of RHQ, ROHO, copy, and

p86 beginning Jan, 1, 2018, without prejudice to the application of preferential tax rates

under existing international tax treaties, if warranted. Thus, all concerned employees shall

be subject to the regular income tax rate under Sec. 24(A) of the Tax Code, as amended.

Illustration, Ms. CCF, an alien employed in MCUD Corporation that Is @ Petroleum Service

Contractor, received compensation income of P5,000,000 for 2018, inclusive of P400,000

13th month pay and other benefits.

Total Compensation Income 5,000,000

Less: Non-Taxable 13th Month Pay and Other Benefits (Max) 90,000

Taxable Compensation Income 4,910,000

Tax Due:

On 2,000,000 490,000 *

On Excess (P4,910,000 - P2,000,000) x 32% 931,200

P1,421,200

Total Income Tax Due

5, Revenue Memorandum Circular 31-2013 prescribes the guidelines on the taxation of

compensation income of Philippine nationals ‘and alien individuals employed. by foreign

governments, embassies, diplomatic missions, and international organizations situated in

the Philippines.

6. Revenue Regulations 5-2013 prescribes the tax treatment of the sale of jewelry, gold and

other metalic minerals to a non-resident alien individual not engaged in trade or business

within the Philippines, or to a non-resident foreign corporation.

gold, and other metallic minerals are required to pay business tax (VAT or

percentage tax), income and excise tax, if applicable, in advance through the assigned

Revenue Collection Officers of the Revenue District Office (RDO) having jurisdiction over the

place where the subject transaction occurs, regardiess of whether the sellers are duly

Sellers of jewelry,

registered with the BIR:

a. Advance payment of 12% VAT on gross selling price, or percentage tax 2t the rate of 3%

on gross sales, as the case may be;

Chapter 2: Taxation of individuals | 47

buyer to the seller.

PASSIVE INCOME

Passive income is subject to a separate and final tax at fixed rates ranging from 5;

25% (for NRA-NETB). They are not included in the computation of taxable incomes.

compensation or business/professional income, the tax due on which is ci

accordance with the graduated income tax schedule for individuals in Sectioi

ON PASSIVE INCOME

Advance payment of income tax at the rate of 5% on gross payment;

Actual payment of 23 excise tax based on either the actual market value of

output at the time of removal, in the case of those locally extracted or produesr®

value used by the Bureau of Customs (BOC) in computing tariff and duties, in tha”

importations. Actual market value shall refer to the actual consideration paig’®

Vs,

Resident Citizen

Non-Resident Citizen

Resident Alien

in the

ME fren

OMPuteg ».

n 24(A),

Non-Resident Aig

Engaged in Trade

or Business in the

Philippines wages

Interests

Interest from any currency bank

deposit and yield or any other

monetary benefit from deposit

substitutes and from trust funds and

similar arrangements

20%

20%

Interest income from a depository

bank under the Expanded Foreign

Currency Deposit System (FCDS)

15% (TRAIN)

Non-resident citizen

is tax exempt.

Exempt

Interest income from long-term

deposit or investment in the form of

savings, common or individual trust

funds, deposit substitute, investment

management accounts (IMA) and

other investments evidenced by

certificates in such form prescribed

by the BSP with five-year term or

longer.

If deposit is pre-terminated

before the fifth year, the

corresponding final tax shall be:

4 years to less than 5 years

3 years to less than 4 years

Less than 3 years

Exempt

5%

12%

20%

Exempt

5%

12%

20%,

aman Cditinn hy Denf WIM Bailnda and Ccan Belleacde

Non-Resident Alien |

| © _ Resident Citizen_ .

ON PASSIVE INCOME [+ Non-Resident Citizen | Engaged in Trade

| . int Alien or Business in the

_ Philippines (NRA-ETB)

Royalties

Royalties, in general 20% 20%

Royalties on books, literary works and

|__ musical composition 10% 10% |

Prizes

| prizes, in general 20% 20%

Prizes amounting to P10,000 or less are

subject to the graduated income tax

| schedule in Sec. 24(A).

Winnings

Winnings, in general 20% 20%

Philippine Charity Sweepstakes Office

(PCSO) Winnings

Under TRAIN Law:

More than 10,000 20% Exempt*

| (Amended in CREATE)

10,000 or less Exempt Exempt

| ,

| Under CREATE Act:

More than P10,000 20% 20%* (Sec. 5, CREATE;

eff. Apr. 11, 2021)

10,000 or less Exempt Exempt

Cash and/or Property Dividends

actually or constructively received

from a domestic corporation, joint

stock company, insurance, mutual

fund companies and regional

operating headquarter of a |

|__ multinational company of ___| |

Share of an individual in the 10% 20%

distributable net income after tax of

| apartnership (except 2 general

|__ professional partnership) or

Chapter 2: Taxation of Individuals | 49

Share of an individual in the net

10%

20%

income after tax of an association,

joint account or a joint venture or

consortium taxable as a corporation

of which he is a member or co-

venturer,

—

Notes:

zh; eee Government Debts and Securities: Government Debt Instry

re ine as cgi of Treasury (BTr) issued instruments and securities ned

ieee pa fs), Treasury bills (T-bills) and Treasury notes, are considers

deposi es, itrespective of the number of lenders at the time of origination, i,

struments and securities are to be traded or exchanged on the secondary market

The mere issuance of government debt instruments and securities is considered as fy

within the coverage of ‘deposit substitutes irrespective ofthe number of lenders thes!

of origination; therefore, interest income derived shall be subject to 20% FWT imposes

deposit substitutes (Sec. 2, Revenue Regulations 14-2012, Nov. 7, 2012). a

In the case of zero-coupon instruments and securities, the FWT is payable upon their orgy

issuance. In the case of interest-bearing instruments and securities, the FWT is payable uy,

payment of the interest (RMC 77-2012, Nov. 22, 2012).

Interest income derived from any other debt instrument not within the coverage of depo:

substitutes — The 20% Creditable WT shall apply to each interest payment to be met

beginning on Nov. 23, 2012, irrespective of when the instruments or securities were isust

This covers interest income from current outstanding instruments, securities, or accouns

of Nov. 23, 2012 (Sec. 7, Revenue Regulations 14-2012, Nov. 7, 2012 and RMC 77-2012, No

22, 2012).

2. Interest Income from Long-Term Deposits or Investment Securities: The depositor #

investor ig an individual citizen (resident or non-resident) or resident alien or non-residet

tert

alien engaged in trade or business in the Philippines and not a corporation. The long:

hould be under the name of the individual and

‘he bank or the trust department/unit of the bank.

deposits or investments certificates s!

under the name of the corporation or t!

sits or investments must be issued by banks only and not by obs

its or investme

ation does

14-2012,"

The long-term depo:

financial institutions. Only the interest income from long-term deposi

centficates is covered by the income tax exemption. The income tax exer

cover any other income such as gains from trading, foreign exchange gain (RR

22, 2012; RMC 18-2011, Apr. 12, 2011; BIR Ruling 84-2012, Feb. 15, 2012).

t income from long-term deposit or investment shall be subject to 25% i

the Philippine’

Interes'

received by a non-resident alien not engaged in trade or business in

NETB).

50 | Income Taxation 2023 Edition by Prof. WIN Ballada and Susan Ballada

4

On investments of individuals in long-term trust invested by a bank's trust department in

five-year corporate bond ~ Even if the individual does not withdraw his money from the trust

‘agreement for at least five years, his interest income from the trust agreement will not be

exempt from the FWT as the underlying instrument is a corporate bond, even if such

corporate bond has a maturity of five years. Corporate bonds or any other debt instrument

issued by a non-bank corporation as underlying instrument will not meet the requirements

of Section 22(FF) of the Tax Code since it is not issued by a bank.

iduals in long-term trust invested in long-term deposits placed under

name of a bonk’s trust department ~ if a bank's trust department invests a fund in a long-

term deposit or investment certificate in its own name without mentioning the particular

individual for whom the investment is being made, this long-term deposit and investment

gre not exempt from the 20% FWT. Only those made specifically in trust for the name of

Specific qualified individual investors may be exempt from income tax under the Tax Code

(RMC 81-2012, Dec. 10, 2012).

On investments of indi

lent alien not engaged in

Income from cinematographic films and similar works by a non-re:

trade or business in the Philippines is taxed at 25% final tax.

PCD) Nominees: If the PCD Nominee

\dividual subject to the 10% final tax

the actual

4, Dividend Payments to Philippine Central Depository (

is a Filipino, the income recipient is deemed to be an in

pursuant to Sec. 24(B)(2) of the Tax Code, unless it is satisfactorily shown that ¢

equity investor is a domestic corporation.

the income recipient is deemed to be a non-resident

foreign corporation subject to the 30% final tax under Sec. 28(8)(1) of the Tax Code, unless it

is satisfactorily shown that the actual equity investor is a resident alien, non-resident alien

whether engaged or not engaged in trade or business in the Philippines or resident foreign

corporation (Revenue Memorandum Circular 73-2014, Sept. 12, 2014).

If the PCD Nominee is not a Filipino,

Illustration, Source: BIR Ruling DA (FIT-016) 492-2009, Sept. 4, 2009

trust or long-term investment management arrangements with a

ling is based on the following facts:

Interest income from long-term individual

bankis exempt from the 20% final WT. This BIR rul

(

intends to launch new products or accounts namely: 8 Co. Personal

Retirement Account and B Co. Personal Pension Account. These are long-term individual trust or long-term

investment management arrangements. Under these arrangements, the client, as trustor or principal,

contributes funds to an account and B Co., as the trustee or investment manager, holds and manages the

fund for the future needs of the client/trustor/principal, particularly at retirement. The objective of the

accounts is primarily to provide supplemental funds to individuals for thelr retirement in addition to

government or company retirement plans.

8 Co, a domestic universal bank,

The pertinent features of the new products or accounts are:

.d to individuals who are Filipino citizens or resident

a. Eligible trustors/prineipals are Ii

aliens;

b. The underlying agreements are non-negotiable and non-transferrable and will comply with

the BSP requirements for long-term trust and investment management accounts;

c. There will be a five-year holding period for the amounts contributed into the accounts;

Chapter 2: Taxation of Individuals | 51

SS

hI ihe Principal's withdrawn within the five-year holding period, interest in

Subject to a final WH atthe applicable rates depending on the holding pera

COME shal,

Section 24 (1) (1) and 25 (A) (2) of the Tax Code, as follows

SPeCifed ung

Holding period

Four years to less than five years | -

Three years to less than four years

[Less than three years

The exemption continues regardless o

the long-term deposit or investment

principal deposit/investment before th

‘on the holding period of the instrument

# the terms of the investment or maturity

's subsequently invested (see (e) above).

fe fifth year will subject the entire earnings

itn accordance with the above schedule

0.2 final WT depecs,

TAXABLE INCOME AND TAX DUE?

Taxable Income refers to the pertinent items of

deductions, if any, authorized for such types

laws.

f gross income specified in the Code

of income by the Code or other spe;

INDIVIDUAL CITIZEN AND INDIVIDUAL RESIDENT ALIEN OF THE PHILIPPINES? |

general, the income tax on the individual's taxable income shall be computed based o,

the following schedules as provided under Sec. 24(A) of the Tax Code, as amended;

(A) Income Tax Rates

Effective Jan. 1, 2018 until Dec. 31, 2022:

RANGE orrataele a

INC

BASIC] ADDITIONAL |” oFexcess |

nate OVER

jorover | AMOUNT

a . (a) (b) ()

= | 250,000.00 ;

x 00,

250,000.00 | 400,000.00 - 20% 200% a

400,000.00 | 800,000.00 30,000.00 | 25% son 0008

00,000.00 | 2,000,000.00 | 130,000.00 | 30% sone

000,000.00 | 8,000,000.00 | 490,000.00 | 32% 21 ons

,000,000.00 : 210,000.00 | 35% | _8,000,000.00.

e tax

a

it the

from income and/or tax credit is deducted from

fit id

2 Cregtable withholding tax withheld fom (These are discussed in later chapters.)

penalties, if any shall be added to the tax

3 por Rev. Reg. 8-2018 Implementing TRAIN.

Susan Balada

52 | Income Taxation 2023 Edition by Prof. WIN Ballada and Su’

Effective Jan. 1, 2023 and onwards:

TAX DUE =a + (b xc)

BASIC | ADDITIONAL | OF EXCESS

OVER NOT OVER AMOUNT RATE OVER

—— | |) | te

: [250,000.00 | -

__250,000. 400,000.00 - 15% 250,000.00

| 400,000, 800,000.00 22,500.00 | 20% ‘400,000.00 |

800,000.00 | 2,000,000.00 | 102,500.00 25% 00,000.00 _|

8,000,000.00 | 402,500.00 30% 2,000,000.00

= ___|_2,202,500.00 35% 8,000,000.00

Individuals earning purely

(8) Individuals Earning Purely Compensation Income.

come tax rates prescribed

compensation income shall be taxed based on the in

under subsection (A) hereof.

‘Taxable income for compensation earners is the gross compensation income less

nontaxable income/benefits such as but not limited to the Thirteenth (13")

ject to limitations, see Section 6(G)(e) of these

month pay and other benefits (subj

Regulations), de minimis benefits, and employee's share in the $55, GSIS, PHIC,

Pag-IBIG contributions and union dues.

Total Compensation Income Prox

Less: Mandatory Contributions/Non-Taxable Benefits xx

Prox

Net Taxable Income

Husband and wife shall compute their individual income tax separately based on

their respective taxable income; if any income cannot be definitely attributed to

or identified as income exclusively earned or realized by either of the spouses,

the same shall be divided equally between the spouses for the purpose of

determining their respective taxable income.

all be exempt from the payment of income tax based

im wage rates. The holiday pay, overtime pay, night

ich earner are likewise exempt.

Minimum wage earners shi

on their statutory minimu

‘Shift differential pay and hazard pay received by su

4. Mr. C50, 2 minimum wage earner, works for G.0.D., Ine. He is not

has any other source of income other than his

0 earned a total compensation income of

Mustration

engaged in business nor

employment. For 2018, Mr.

135,000.

.e $55, Philhealth, and HOMF amounting to

a, The taxpayer contributed to th

‘onth pay of P11,000. His income tax liability

5,000 and has received 13th m

will be computed as follows:

Chapter 2: Taxation of individuals | 53

os

Total Compensation Income

P135,000

Less: Mandatory Contributions PS,000

Non-Taxable Benefits 11,000 16,000

Taxable income a ~Pi19,000~

—tHe.000

* Taxpayer is exempt since he is considered a minimum income earner,

b. The following year, Mr. cso earned, aside from his basic wage,

Pay of P140,000 which consists of the overtime pay - P80,000, ae

differential - P30,000, hazard pay - P15,000, and holiday pay . pis 00.

has the same benefits and contributions as above, a

Total Compensation Income .

Add: Overtime, Night Shift Differential, Hazard and nae

Holiday Pay 140,000

Total Income ~~ P275,000"

Less: Mandatory Contributions P5,000

Non-Taxable Benefits 11,000 16,000

Net Taxable income 259,000

—2259,000°

: Tax Due EXEMPT

* Taxpayer is tax exempt as an MWE. The statutory minimum wage as

well as the holiday pay, overtime pay, night shift differential pay and

hazard pay received by such MWE are specifically exempted from

income tax under the law.

(Cc) Self-Employed Individuals Earning Income Purely from Self-Employment o

Practice of Profession. Individuals earning income purely from self-employmenl

and/or practice of profession whose gross sales/receipts and other not

operating income (GSRONOI) do not exceed the P3.0M VAT threshold, shall havt

the option to avail of:

1. the graduated rates under Section 24(A) of the Tax Code, as amended; or

‘2. 8% tax of GSRONOI in excess of P250,000* in lieu of the graduated ah

tax rates under Section 24(A) and the percentage tax under Section 11

under the Tax Code, as amended.

Pxxx

xx

Gross Sales/Receipts

Less: Cost of Sales ae

Prxxx

Gross Income

Less: Operating Expenses

Taxable Income (if graduated rates, option 1)

itt

a sine

* The P250,000 mentioned is not applicable to mixed income earner

ada

54 | Income Taxation 2023 Edition by Prof. WIN Ballada and Susan Ballac

already incorporated in the first tier of the graduated income tax rates

applicable to compensation income.

Unless the taxpayer signifies the intention to elect the 8% income tax rate in the

1st Quarter Percentage and/or Income Tax Return, or on the initial quarter return

of the taxable year after the commencement of a new business/practice of

profession, the taxpayer shall be considered as having availed of the graduated

rates under Section 24(A) of the Tax Code, as amended. Such election shall be

irrevocable and no amendment of option shall be made for the said taxable year.

The option to be taxed at 8% income tax rate is not available to the following:

1. AVAT-registered taxpayer, regardless of the amount of gross sales/receipts.

2. A taxpayer wha is subject to Other Percentage Taxes under Title V of the Tax

Code, as amended, except those subject under Section 116 of the same Title.

3. Partners of a General Professional Partnership (GPP) by virtue of their

distributive share from GPP which is already net of cost and expenses.

A taxpayer who signifies the intention to avail of the 8% income tax rate option,

and is conclusively qualified for said option at the end of the taxable year [annual

gross sales/receipts and other non-operating income did not exceed the VAT

threshold (P3,000,000)] shall compute the final annual income tax due based on

the actual annual gross sales/receipts and other non-operating income. The said

income’tax due shall be in lieu of the graduated rates of income tax and the

percentage tax under Sec. 116 of the Tax Code, as amended. The Financial

Statements (FS) is not required to be attached in filing the final income tax

return, However, existing rules and regulations on bookkeeping and

invoicing/receipting shall still apply.

Taxable income for individuals earning income from self-employment/practice of

profession shall be the net income, if taxpayer opted to be taxed at graduated

ignify the chosen option, However, if the option availed of

rates or has failed to si

is the 8% income tax rate, the taxable base is the gross sales/receipts and other

non-operating income.

2. Ms. EBQ operates a convenience store while she offers

bookkeeping services to her clients. In 2018, her gross sales amounted to

800,000, in addition to her receipts from bookkeeping services of P300,000. She

already signified her intention to be taxed at 8% income tax rate in her 1st

quarter return. Her income tax liability for the year will be computed as follows:

Illustration

Chapter 2: Taxation of Individuals | 55

Gross Sales — Convenience Store 800,000

Gross Receipts — Bookkeeping 300,000

Total Sales/Receipts 1,100,000

Less: Amount Allowed as Deduction under Sec. 24(A)(2)(b) 250,000

Taxable Income P850,000

—

Tax Due:

8% x P850,000 68,000

* The total of gross sales and gross receipts is below the VAT threshold of

P3,000,000.

* Taxpayer's source of income is purely from self-employment, thus she jg

gntitled to the amount allowed as deduction of P250,000 unde, car

24(A)(2)(b) of the Tax Code, as amended,

* Income tax imposed herein is based on the total of Bross sales and grog

receipts.

* Income tax payment is in'liew of the graduated income tax rates Under

subsection (A) hereof and percentage tax due, by express provision of law.

A taxpayer subject to the graduated income tax rates (either selected this a the

income tax regime, or failed to signify chosen intention or failed to qualify to be

taxed at the 8% income tax rate) is also subject to the applicable business ty i

any. Subject to the provisions of Section & of these Regulations, an FS shall te

required as an attachment to the annual income tax return even if the gros

sales/receipts and other non-operating income is less than the VAT threshol

However, the annual income tax return of a taxpayer with gross sales/recept

and other non-operating income of more than the said VAT threshold shal be

accompanied by an audited FS:

Illustration 3. Ms. EBQ above, failed to signify her intention to be taxed at 8%

income tax rate on gross sales in her initial Quarterly Income Tax Return, ani

she incurred cost of sales and operating expenses amounting to P600,000 atl

P200,000, respectively, or a total of P800,000; the income tax shall be compute!

as follows:

Gross Sales/Receipts P1,100,000

Less: Cost of Sales 600,000

Gross Income 500,000

Less: Operating Expenses 200,000,

Taxable Income

<1 Income Taxation 2023 Edition by Prof. WIN Ballada and Susan Ballada

e

Tax Due:

(On Excess (P300,000 - P250,000) x 20% 10,000

* Aside from income tax, Ms. EBQ is likewise liable to pay business tax.

A taxpayer shall automatically be subject to the graduated rates under Section

24(A) of the Tax Code, as amended, even if the flat 8% income tax rate option is

initially selected, when taxpayer's gross sales/receipts and other non-operating

income exceeded the VAT threshold during the taxable year. In such case, his

income tax shall be computed under the graduated income tax rates and shall

be allowed a tax credit for the previous quarter/s income tax payment/s under

the 8% income tax rate option.

Illustration 4. Mr. JMLH signified his intention to be taxed at 8% income tax rate

on gross sales in his 1st Quarter Income Tax Return. He has no other source of

income. His total sales for the first three (3) quarters amounted to P3,000,000

with 4th quarter sales of 3,500,000.

Ast Qtr. 2nd Qtr. 3rd Qtr. 4th tr.

(g%Rate) (8%Rate) (8% Rate)

500,000 P500,000 2,000,000 3,500,000

Gross Sales/Receipts

Less: Cost of Sales 300,000 300,000 1,200,000 _1,200,000

Gross Income 200,000. 200,000 800,000 2,300,000

Less: Operating Expenses 120,000 120,000 480,000 720,000

Taxable Income 80,000, 80,000 320,000 _P1,580,000

Tax due shall be computed as follows:

Total Sales 6,500,000

Less: Cost of Sales 3,000,000,

Gross Income 3,500,000

Less: Operating Expenses 1,440,000

Taxable Income 2,060,000

‘Tax Due Under the Graduated Rates

P509,200

[P490,000 + (P60,000 x 32%)]

Less: 8% Income Tax Previously Patd (Q1 to Q3)

(P3,000,000 - P250,000) x 8%

‘Annual Income Tax Payable

220,000

289,200

eded the VAT threshold of P3,000,000. Taxpayer shall

» The gross receipts exce

tax under graduated rates pursuant to Section 24(A)

be liable to pay income

of the Tax Code, as amended.

+ Taxpayer shall be allowed an income tax credit of quarterly payments initially

Chapter 2: Taxation of individuals | 57

oF

made under the 8 eAax option computed net of the allo

% income ta t

deduction of P250,000 granted for purely b siness income. " :

* Taxpayer is likewise liable for business tax(es), in addition to inc

this purpose, the taxpayer is required to update his registration fon 2% For

£0 VAT taxpayer. Percentage tax pursuant to Section 116 of the ty on VAT

amended, shall be imposed from the beginning of the year until toe

liable to VAT. VAT shall be imposed prospectively. wPayer is

* Percentage tax due on the non-VAT portion of the sales/receipts shall b.

collected without penalty, if timely paid on the due date immediate:

following the month/quarter when taxpayer ceases to be a non.VAT .

Mlustration 5. Ms. RPSV is a prominent independent contractor who offers

architectural and engineering services. Since her career flourished, her tota

ross receipts amounted to P4,250,000 for taxable year 2018. Her recorded cost

of service and operating expenses were P2,150,000 and 1,000,000,

respectively. Her income tax liability will be computed as follows: '

Gross Receipts — Architectural & Engineering Services 4,250,000

Less: Cost of Service 2,150,000

2,100,000

Gross Income

Less: Operating Expenses

Taxable Income

1,000,000

P1,100,000

Tax Due:

(On P800,000 130,000

On Excess (P1,100,000 - P800,000) x 30% 90,000

Income Tax Due P220,000

* The gross receipts exceeded the VAT threshold of P3,000,000; subject to

graduated income tax rates; liable for business tax - VAT, in addition to

income tax.

Illustration 6. In 2018, Mr. GCC owns a nightclub and videoke bar, with gross

sales/receipts of P2,500,000. His cost of sales and operating expenses afé

P1,000,000 and P600,000, respectively, and with non-operating income of

P100,000. His tax due for 2018 shall be computed as follows:

Gross Sales 2,500,000

Less: Cost of Sales 1,000,000

Gross Income 1,500,000

Less: Operating Expenses 600,000

Net Income from Operation 900,000

Add: Non-Operating Income 100,000

P 1,000,000

Taxable Income

58 | Income Taxation 2023 Edition by Prof. WIN Ballada and Susan Ballada

Tax Due:

On P800,000 P130,000

On Excess (P1,000,000 - P800,000) x 30% 60,000

Total Income Tax 0

. The taxpayer has no option to avail of the 8% income tax rate on his

income from business since his business income is subject to Other

Percentage Tax under Section 125 of the Tax Code, as amended.

* Aside from income tax, taxpayer is liable to pay the prescribed business tax,

which in this case is percentage tax of 18% on the gross receipts as

prescribed under Sec. 125 of the Tax Code, as amended.

(0) Individuals Earning Income Both from Compensation and from Self-

Employment (business or practice of profession). — For mixed income earners,

the income tax rates applicable are:

\

1. On compensation income ~ at graduated rates; plus

2. On income from business or practice of profession shall be subject to the

following:

2.a. If GSRONO! do not exceed the VAT threshold of P3.0M —

* cither at graduated rates or

© 8% of GSRONOI in lieu of graduated rates and percentage tax, at the

option of the taxpayer.

2.b. If GSRONO! exceed the VAT threshold — at graduated rates.

The provision under Section 24(A)(2)(b) of the Tax Code, as amended, which

allows an option of 8% income tax rate on gross sales/receipts and other non-

operating income in excess of P250,000 is available only to purely self-employed

individuals and/or professionals. The P250,000 mentioned is not applicable to

mixed income earners since it is already incorporated in the first tier of the

graduated income tax rates applicable to compensation income. Under the said

graduated rates, the excess of the P250,000 over the actual taxable

compensation income is not deductible against the taxable income from

business/practice of profession under the 8% income tax rate option.

x due shall be the sum of: (1) tax due from compensation, computed

income tax rates; and (2) tax due from self-

fession, resulting from the multiplication of the 8%

f the gross sales/receipts and other non-

The total ta

using the graduated

employment/practice of pro!

income tax rate with the total of

operating income.

Chopter 2: Taxation of Individuals | 59

oN

vad income earner who opted to be taxed under the graduated |

rates for income from business/practice of profession, shall combine the %

income tram be ‘ompensation and business/practice of profess) ia

he total taxable income and consequently, the income tax qo,

ue

eer a Financial Comptroller of JAB Company, earned any,

iaTieTancenrTerlea of P1,500,000, inclusive of 13th month and other bene,

Ae 20,000 but net of mandatory contributions to sss 7

ae employment income, he owns a convenience store, na

P1,000,000 and papa His cost of sales and operating expenses 5,

Picanol ,000, respectively, and with non-operating income ,

a. His tax due for 2018 shall be computed as follows if he opted to be tay

8% income tax rate on his gross sales for his income from business:

Total Compensation Income 1,500,009

Less: Non-Taxable 13th Month Pay and Other Benefits (Max) 90,000

Taxable Compensation Income ~P1,410,000

Tax Due: —

On Compensation:

On P800,000 130,000

On Excess (P1,410,000 - 800,000) x 30% 183,000

Tax Due on Compensation Income ~P313,000_

On Business Income:

Gross Sales 2,400,000

Add: Non-Operating Income 100,000

Taxable Business Income 2,500,000

Multiplied by Income Tax Rate 8%

200,000

Tax Due on Business Income

Total Income Tax Due (Compensation and Business) 513,000

applicable only to taxpayer's incor?

lieu of the income tax under the

ection 116¢

& The option of 8% income tax rate is

from business, and the same is in

graduated income tax rates and the percentage tax under Si

the Tax Code, as amended.

* The amount of P250,000 allows

iy from self-employment/practice of (pr

d income earner under the 8% income

red as deduction under the law for taxpartt

ofession, is ™

earning solel

i tax rate oti"

applicable for mixet :

i i tier

* The P250,000 mentioned above is already incorporated in the first

tes applicable to compensation income.

the graduated income tax rat

come Taxation 2023 Edition by Prof. WIN Ballada and Susan Ballada

60 | In

b. His tax due for 2018

shall be i

incoraer ta ae omputed as follows if he

a id not opt tor the 8%

1d on gross sales/receipts Lopt for the 8

and other non-operating income

Total Compensation Income

1,500,000

Less: Non-Taxable

tral Compensation neon fone Hes on 6000

Add: Taxable Income from Business iene

es ales 2,800,000

25: Cost of Sales 41,000,000

Gross Income 1,400,000

Less: Operating Expenses “600,000

Net Income from Operation 800,000

Add: Non-Operating Income 100,000 900,000

Total Taxable Income P2,310,000

Tax Due

On P2,000,000 490,000

On Excess (P2,310,000 - P2,000,000) x 32% 99,200

Total Income Tax Due 589,200

* The taxable income from both compensation and business shall be

combined for purposes of computing the income tax due if the taxpayer

chose to be subject under the graduated income tax rates.

* In addition to the income tax, Mr. MAG is likewise liable to pay percentage

tax of P72,000, which is 3% of P2,400,000.

On February 2019, taxpayer tendered his resignation to concentrate on his

business. His total compensation income amounted to P150,000, inclusive of

benefits of P20,000. His business operations for taxable year 2019 remains

the same. He opted for the 8% income tax rate.

Total Compensation Income P1S0,000

Less: Non-Taxable Benefits 20,000

Taxable Compensation Income 130,000

Tax Due:

On Compensation: vo

‘On P130,000 (not over P250,000)

me:

On — Incor v.40. 00

Gross Sales

100,000

‘Add: Non-Operating Income __ lense

Taxable Business Income caus

Multiplied by Income Tax Rate — sac

‘Tax Due on Business Income be ,

and Business) 200,000

Total Income Tax Due (Compensation

Chapter 2: Taxation of Individuals | 61

+ The option of 8% income tax rate is applicable only to taxpayer's,

from business, and the same is in lieu of the income tax nq

graduated income tax rates and the percentage tax under Section

the Tax Code, as amended. 4

te

* The amount of P250,000 which is allowed as deduction under the,

taxpayers earning solely from self-employment/practice of profeg

not applicable for mixed income earner under the 8% income >

option. :

+ The P250,000 mentioned above is already incorporated in the first,

the graduated income tax rates applicable to compensation income

excess of the P250,000 over the actual taxable compensation income),

creditable against the taxable income from business/practice of profey,

under the 8% income tax rate option.

Illustration 8, Mr. WBV, an officer of AMBS International Corp., earney

2018 an annual compensation of P1,200,000, inclusive of 13th month

other benefits in the amount of P120,009. Aside from employment incor

he owns a farm, with gross sales of P3,500,000. His cost of sales »

operating expenses are P1,000,000 and P600,000, respectively, and with n

operating income of P100,000. His tax due for 2018 shall be computed

follows:

Total Compensation Income

Less: Non-Taxable 13th Month Pay and Other Benefits (Max)

Taxable Compensation Income P1100

‘Add: Taxable Income from Business

Gross Sales 3,500,000

Less: Cost of Sales 1,000,000

Gross Income 2,500,000

Less: Operating Expenses 600,000

Net Income from Operation P1,900,000

Add: Non-Operating Income 100,000 2,000,000

Total Taxable Income 3,110,000

Tax Due:

‘On P2,000,000 490,000

‘On Excess (P3,110,000 - P2,000,000) x 32% 355,200_

Total Income Tax Due 845,200

pelle

* The taxpayer has no option to avail of the 8% income tax rate on his incor

from business since his gross sales exceeds the VAT threshold. Howev®"

still not subject to business tax since the nature of his business transact”!

VAT exempt.

62 | Income Taxation 2023 Edition by Prof. WIN Balada and Susan Ballada

TAXATION OF INCOME RECEIVED BY SOCIAL MEDIA INFLUENCERS

Definition of Social Media Influencers

the term “social media influencers” referred to in the Revenue Memorandum Circular

97-2021 includes all taxpayers, individuals or corporations, receiving income, in cash or

in kind, from any social media sites and platforms (YouTube, Facebook, Instagram,

quitter, TikTok, Reddit, Snapchat, etc.) in exchange for services performed as bloggers,

video bloggers or “vloggers” oF as an influencer, in general, and from any other activities

performed on such social media sites and platforms

Liability for Income Tax and Percentage or Value-Added Tax

ursuant to the provisions of the National Internal Revenue Code

4 and other existing laws,° social media influencers shall be

e or value-added tax,° as shown below:

Unless exempted pt

(NIRC) of 1997, as amended,

liable to income tax and percentage

Income Tax

Social media influencers other than corporations and partnerships are classified for tax

purposes as self-employed individuals or persons ‘engaged in trade or business as sole

proprietors, and therefore, their income is generally considered business income.

ources:

Social media influencers derive their income from the following s

1. YouTube Partner Program — this allows an influencer to make money from~

le — the influencer gets ad revenue from display, overlay, and video

a. advertising revenu

ads.

b. channel membership ~ the influencer makes recurring monthly payments in exchange

for special perks that he/she/it offers.

.d buy official branded merchandise from the

merch shelf — followers can browse an

influencer’s watch pages.

dd, super chat and super stickers ~ fol

streams.

ue — the influencer gets @ part of a YouTube Premium

e. YouTube Premium Reven

subscriber's subscription fee when followers watch his/her/its contents.