Professional Documents

Culture Documents

02 - Withholding Exemption Certificate Jul-Dec 21

02 - Withholding Exemption Certificate Jul-Dec 21

Uploaded by

Raheel AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 - Withholding Exemption Certificate Jul-Dec 21

02 - Withholding Exemption Certificate Jul-Dec 21

Uploaded by

Raheel AhmedCopyright:

Available Formats

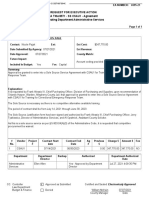

153(4) (Order to grant / refuse reduced rate of withholding on Supplies / Services / Contracts)

(FOR GENERIC EXEMPTION)

Name: PAK ELEKTRON LIMITED Registration 2011386

Address: 17 AZIZ AVENUE CANAL BANK GULBERG V Tax Year : 2022

LAHORE Period : 01-Jul-2021 - 31-Dec-2021

Medium : Online

Contact No: 00923008455770 Due Date : 06-Jul-2021

Valid Upto : 31-Dec-2021

Document 06-Jul-2021

The taxpayer is a Public listed Company and derives income from manufacture and sale of Electrical

capital goods and domestic appliances i.e. Electric Motors, Transformers, switchgears, Energy meters, Air-

conditioners, Refrigerator/ Deep Freezers, Compressors, LED, Washing Machine. Taxpayer has e-filed

return of total income for the tax year 2020 on 04-12-2020 declaring income at Rs.504,983,245/- and

claiming refund at Rs.692,510,713/-. The taxpayer has been maintaining calendar year as special income

year. Accordingly, the period w.e.f. 01-01-2021 to 31-12-2021 relates to tax year 2022. The company has

applied for issuance of exemption certificate under section 153(1)(a)/ 153(1)(c) of the Income Tax

Ordinance, 2001 for the period ending as on 31-12-2021. The updated position of advance tax liability for

the period ending as on 31-12-2021 pertaining to the tax year 2022 and its payments/ adjustment are as

under:

Liability u/s 147 for the period 01-01-2021 to 31-12-2021:

Projection

1) Corporate tax liability

Taxable Income Rs.1,756 (M)

Tax liability @29% Rs. 515 (M)

2) Alternative corporate (ACT)

Accounting profit estimated Rs.2,176 (M)

Tax Rate 17% Rs. 370 (M)

3) Minimum Tax Liability

Turnover Rs.40,000 (M)

Minimum tax rate 1.5% Rs. 500 (M)

Estimated advance tax liability for the tax year 2022

as computed Normal Tax Liability which is higher than others Rs.515 (M)

In view of above chart, tax liability upto 31.12.2021 works out at Rs.515 (M) which has been

discharged as under:

Under Section Period Tax Deducted/verified Remarks

Refund adjusted from

Tax Year 2019 2022 208(M) IT-104 is POF.

Tax deducted on import u/s 148 from 01.01.2021 to 30.06.2021 2022 537.982(M) Verification

sheet from ITMS placed in file

Tax deducted on supplies u/s 153 from 01.01.2021 to 30.06.2021 2022 11.898(M) Verification

sheet from ITMS placed in file

Total Tax 757.88(M)

Description Status Yes/No

Page 1 of 3 Printed on Tue, 6 Jul 2021 12:48:27

LTO LAHORE

153(4) (Order to grant / refuse reduced rate of withholding on Supplies / Services / Contracts)

(FOR GENERIC EXEMPTION)

Name: PAK ELEKTRON LIMITED Registration 2011386

Address: 17 AZIZ AVENUE CANAL BANK GULBERG V Tax Year : 2022

LAHORE Period : 01-Jul-2021 - 31-Dec-2021

Medium : Online

Contact No: 00923008455770 Due Date : 06-Jul-2021

Valid Upto : 31-Dec-2021

Document 06-Jul-2021

1 Whether the unit is Industrial Undertaking? Yes

2 Tax Year for which exemption certificate is required is the first year of the business? No

3 Whether due advance tax liability for the tax year is paid? (Detail is tabulatd below as working of

Tax Liability) Yes

4 Is WWF deposited in cash? Tax Years 2014 to 2020 WWF for T.Y 2014 to 2020 not paid in cash.

Recovery has been stayed by the Lahore High Court Lahore in W.P No.4470 of 2021 dated 05.07.2021

5 Are any Arrears of income tax, sales tax and federal excise duty outstanding? No

6 Are all Income Tax Returns (alongwith audited accounts) filed since Tax Year 2014? Yes

7 Are all IT Withholding statements filed since 01.07.2018? Yes

8 Are all Sales Tax Returns filed since June, 2020? Yes

No income tax/sales tax demand is outstanding against the taxpayer. Since the advance

tax liability upto 31.12.2021 has been discharged by the taxpayer, exemption certificate u/s 153(1)(a) [on

supplies of manufactured goods] and u/s 153(1)(c) [on execution of contracts] is issued to the taxpayer till

31.12.2021.

The taxpayer is allowed to make supply of goods manufactured by him without tax deduction under clause

(a) of sub-section (1) of Section 153 of the Income Tax Ordinance, 2001.

Tax already deducted before the issuance of this certificate is not refundable and shall be deposited in the

Government Treasury. This exemption is valid for the period mentioned above only, unless cancelled

earlier.

Withholding Tax

Description Code Rate

Payment for Goods u/s 153(1)(a) @3% 64060006 0 0 0

Payment for Goods u/s 153(1)(a) @4% 64060008 0 0 0

Advance tax on persons remitting amounts abroad through

64151905 0 0 0

credit / debit / prepaid cards u/s 236Y

Payment for Services u/s 153(1)(b) @8% 64060166 0 0 0

Attributes

Attribute Value

Decision Granted / Accepted

Page 2 of 3 Printed on Tue, 6 Jul 2021 12:48:27

LTO LAHORE

153(4) (Order to grant / refuse reduced rate of withholding on Supplies / Services / Contracts)

(FOR GENERIC EXEMPTION)

Name: PAK ELEKTRON LIMITED Registration 2011386

Address: 17 AZIZ AVENUE CANAL BANK GULBERG V Tax Year : 2022

LAHORE Period : 01-Jul-2021 - 31-Dec-2021

Medium : Online

Contact No: 00923008455770 Due Date : 06-Jul-2021

Valid Upto : 31-Dec-2021

Document 06-Jul-2021

Attachments

Evidence with 153(4) (Application for reduced rate of APPLICATION FOR ISSUANCE OF EXEMPTION

withholding on Supplies / Services / Contracts) (FOR GENERIC CERTIFICATE US 153(1)(a) and 153 (1)(c) read

EXEMPTION) with section 153(4) valid upto 31-12-2021.PDF

Aftab Alam

Commissioner (Enforcement-I)

Inland Revenue, Zone-II

LTO

LAHORE

This is a generic exemption order, and it does not require any party additions; this order is applicable to all

withholding agents.

Page 3 of 3 Printed on Tue, 6 Jul 2021 12:48:27

LTO LAHORE

You might also like

- Deliria-Faerie Tales For A New Millennium PDFDocument344 pagesDeliria-Faerie Tales For A New Millennium PDFJuan Del Desierto100% (4)

- Geriatric Consideration in NursingDocument31 pagesGeriatric Consideration in NursingBabita Dhruw100% (5)

- Exemption Ali Packages Jan To Jun 2021Document2 pagesExemption Ali Packages Jan To Jun 2021khawarNo ratings yet

- Exemption Poly Pac Valid Up To 31.12.2020 (2) - 1Document1 pageExemption Poly Pac Valid Up To 31.12.2020 (2) - 1khawarNo ratings yet

- Karachi Steel 2021 Exemption CertificateDocument2 pagesKarachi Steel 2021 Exemption CertificateAqeel ZahidNo ratings yet

- Exemption Certificate Top Link Upto June 2021Document2 pagesExemption Certificate Top Link Upto June 2021khawarNo ratings yet

- Exemption Certificate of Ghandhara Industries 2021Document2 pagesExemption Certificate of Ghandhara Industries 2021Waqar RaoNo ratings yet

- Declaration3520115189692 - LahoreDocument5 pagesDeclaration3520115189692 - LahoreFarhan AliNo ratings yet

- Declaration1610186023151Document3 pagesDeclaration1610186023151asiashah1975No ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- Tax Collector Correspondence3362544Document5 pagesTax Collector Correspondence3362544hamza awanNo ratings yet

- Exemption 153 TY2021Document1 pageExemption 153 TY2021Usama AjazNo ratings yet

- ASHI RETURNDocument4 pagesASHI RETURNTOUSEEF AHMADNo ratings yet

- Declaration 3966758Document6 pagesDeclaration 3966758mehboob rehmanNo ratings yet

- Exemption Certificate Us 159 (1) 153Document2 pagesExemption Certificate Us 159 (1) 153ijazaslam.huaweiNo ratings yet

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastNo ratings yet

- Munir Industry Exemption 2021 FBRDocument2 pagesMunir Industry Exemption 2021 FBRAqeel ZahidNo ratings yet

- Statement of Account: # 83 Calachuchi St. Blk-14 L-5 Gordon Heights Olongapo City ZambalesDocument1 pageStatement of Account: # 83 Calachuchi St. Blk-14 L-5 Gordon Heights Olongapo City ZambalesMary grace TabacoNo ratings yet

- Exemption Certificate Top Link Upto Dec 2020Document1 pageExemption Certificate Top Link Upto Dec 2020khawarNo ratings yet

- Declaration 3710389890025Document2 pagesDeclaration 3710389890025Speed CallNo ratings yet

- With Tax Jul 22 To June 23Document2 pagesWith Tax Jul 22 To June 23Mirza Naseer AbbasNo ratings yet

- Declaration 3310085249835Document4 pagesDeclaration 3310085249835Farhan AliNo ratings yet

- Declaration 4210159671252Document4 pagesDeclaration 4210159671252Muhammad Noman PalariNo ratings yet

- Form 16 - Vijaya Raja SelvanDocument4 pagesForm 16 - Vijaya Raja SelvansadhanaNo ratings yet

- Ntp-Asac ASALUS Corporation: Ap Voucher Vendor Code: Vendor NameDocument8 pagesNtp-Asac ASALUS Corporation: Ap Voucher Vendor Code: Vendor NameEloiza Lajara RamosNo ratings yet

- CSAU Contract With Allegheny County JailDocument28 pagesCSAU Contract With Allegheny County JailAllegheny JOB WatchNo ratings yet

- Adm Csau1 6595-21 SS8571 CDocument28 pagesAdm Csau1 6595-21 SS8571 CAllegheny JOB WatchNo ratings yet

- Allegheny County CSAU ContractDocument28 pagesAllegheny County CSAU ContractAllegheny JOB WatchNo ratings yet

- Declaration I.tax Return 2022 Ahsan Ullah KPTDocument4 pagesDeclaration I.tax Return 2022 Ahsan Ullah KPTAdeel KhanNo ratings yet

- 3rd Floor, Suleman Center, SC-5, (ST-17) Sector-15, Near Brooks Roundabout, KIA,, Karachi East Rasul Flour Mills (Private) LimitedDocument2 pages3rd Floor, Suleman Center, SC-5, (ST-17) Sector-15, Near Brooks Roundabout, KIA,, Karachi East Rasul Flour Mills (Private) LimitedMuhammad HamzaNo ratings yet

- E StatementDocument4 pagesE StatementkhatzjlimzNo ratings yet

- Fixedline and Broadband Services: This Month'S Charges Your Account SummaryDocument2 pagesFixedline and Broadband Services: This Month'S Charges Your Account SummaryJawedNo ratings yet

- Declaration 3520228712048Document5 pagesDeclaration 3520228712048hinamuzammil.acaNo ratings yet

- Declaration 3120292219185Document4 pagesDeclaration 3120292219185umerkhanNo ratings yet

- 3Rd Floor PNSC Building M. T Khan Road Inayat Ali: Thu, 16 Sep 2021 20:53:04 +0500Document4 pages3Rd Floor PNSC Building M. T Khan Road Inayat Ali: Thu, 16 Sep 2021 20:53:04 +0500ZeeshanNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023MUHAMMAD TABRAIZNo ratings yet

- Helpdesk - Nel@actcorp - In: Atria Convergence Technologies Limited, Due Date: 15/06/2021Document2 pagesHelpdesk - Nel@actcorp - In: Atria Convergence Technologies Limited, Due Date: 15/06/2021Bhanu PrakashNo ratings yet

- Koharian, Dhak Khana Khas, Barki, Lahore Wahgah Town Qasim ShahzadDocument4 pagesKoharian, Dhak Khana Khas, Barki, Lahore Wahgah Town Qasim ShahzadBasit RiazNo ratings yet

- It 2024021301011181291Document1 pageIt 2024021301011181291islamchohan443No ratings yet

- Acknowledgement Slip: 38, Umer Street, Street No 3, HASAN TOWN MULTAN ROAD, Lahore, Iqbal Town. Muhammad ZubairDocument4 pagesAcknowledgement Slip: 38, Umer Street, Street No 3, HASAN TOWN MULTAN ROAD, Lahore, Iqbal Town. Muhammad ZubairMuhammad Dilawar HayatNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2021Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2021krisivaNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2022Document3 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2022MUHAMMAD TABRAIZNo ratings yet

- BilldataDocument2 pagesBilldataSAHIL CYBER CAFE40% (1)

- Declaration 4230118366657Document5 pagesDeclaration 4230118366657Jahanzaib MemonNo ratings yet

- Declaration6110118446641 2Document4 pagesDeclaration6110118446641 2czeeshan318No ratings yet

- Inv-Ka-B1-36680539-102017859871-14th February-2021 To 13TH September 2021Document2 pagesInv-Ka-B1-36680539-102017859871-14th February-2021 To 13TH September 2021CLS AKNo ratings yet

- Fixedline and Broadband Services: This Month'S Charges Your Account SummaryDocument2 pagesFixedline and Broadband Services: This Month'S Charges Your Account SummaryJawedNo ratings yet

- Continental Print ExemptionDocument2 pagesContinental Print ExemptionkhawarNo ratings yet

- FVCreport - 2023-02-06T114342.040Document1 pageFVCreport - 2023-02-06T114342.040ओमप्रकाश चौरसियाNo ratings yet

- Tax Compliance SummaryDocument2 pagesTax Compliance SummaryModiegi SeaneNo ratings yet

- Declaration 4230135146936Document4 pagesDeclaration 4230135146936quick PakNo ratings yet

- With Tax Apr 23 To June 23Document2 pagesWith Tax Apr 23 To June 23Mirza Naseer AbbasNo ratings yet

- H One (PVT) LTD 20-21-ExemptDocument164 pagesH One (PVT) LTD 20-21-ExemptShehara GamlathNo ratings yet

- Total Amount PayableDocument2 pagesTotal Amount Payablesumit sharma100% (1)

- Total Amount PayableDocument3 pagesTotal Amount PayableAMIT0% (1)

- Annual Information Statement (AIS) : BQBPR5441J XXXX XXX X 60 05 Jogin Sanganakal Ravi KumarDocument2 pagesAnnual Information Statement (AIS) : BQBPR5441J XXXX XXX X 60 05 Jogin Sanganakal Ravi KumarravikumarNo ratings yet

- LA0122001372967Document1 pageLA0122001372967bidda samuelNo ratings yet

- Order 7268570Document2 pagesOrder 7268570Muhammad SufyanNo ratings yet

- August 2021Document1 pageAugust 2021Harold Gemiel GalvoNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2022Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2022billallahmedNo ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Declaration 3420201925001Document5 pagesDeclaration 3420201925001Raheel AhmedNo ratings yet

- Atl AqilDocument1 pageAtl AqilRaheel AhmedNo ratings yet

- Abdul Sattar AppealDocument2 pagesAbdul Sattar AppealRaheel AhmedNo ratings yet

- 2017 Iftikhar WDocument3 pages2017 Iftikhar WRaheel AhmedNo ratings yet

- PAYROLLMANAGEMENTDocument5 pagesPAYROLLMANAGEMENTSai Prabhav (Sai Prabhav)No ratings yet

- Scholastic Instant Practice Packets Numbers - CountingDocument128 pagesScholastic Instant Practice Packets Numbers - CountingcaliscaNo ratings yet

- Asmaa Mamdouh CVDocument1 pageAsmaa Mamdouh CVAsmaa MamdouhNo ratings yet

- Informe Sobre El Manejo de CostasDocument88 pagesInforme Sobre El Manejo de CostasMetro Puerto RicoNo ratings yet

- GDPR ReportDocument84 pagesGDPR ReportKingPlaysNo ratings yet

- Dsm-5 Icd-10 HandoutDocument107 pagesDsm-5 Icd-10 HandoutAakanksha Verma100% (1)

- Alameda Investments - Alameda InvestmentsDocument9 pagesAlameda Investments - Alameda InvestmentsLuisNo ratings yet

- No Overlord Rulebook For Descent: Journeys in The Dark (2nd Edition)Document21 pagesNo Overlord Rulebook For Descent: Journeys in The Dark (2nd Edition)Jeremy ForoiNo ratings yet

- A 182Document20 pagesA 182Thomas100% (1)

- Dialogic DSI Signaling Servers: SIU Mode User ManualDocument304 pagesDialogic DSI Signaling Servers: SIU Mode User ManualAdiansyah Rama67% (3)

- Permanent Magnet GuidelineDocument32 pagesPermanent Magnet GuidelineJaime FalaganNo ratings yet

- Sword of DestinyDocument435 pagesSword of DestinyJailouise Perez100% (1)

- Alarm Security Pic - Google ShoppingDocument1 pageAlarm Security Pic - Google Shoppingleeleeleebc123No ratings yet

- Emmanuel Levinas - God, Death, and TimeDocument308 pagesEmmanuel Levinas - God, Death, and Timeissamagician100% (3)

- Research PaperDocument7 pagesResearch PaperHazirah AmniNo ratings yet

- Object Oriented Programming (OOP) - CS304 Power Point Slides Lecture 21Document49 pagesObject Oriented Programming (OOP) - CS304 Power Point Slides Lecture 21Sameer HaneNo ratings yet

- Domain Model Ppt-1updatedDocument17 pagesDomain Model Ppt-1updatedkhadija akhtarNo ratings yet

- Crossing The Bar Critique PaperDocument2 pagesCrossing The Bar Critique PapermaieuniceNo ratings yet

- Admin,+56 Ism.v11i1.557Document5 pagesAdmin,+56 Ism.v11i1.557Reni Tri AstutiNo ratings yet

- Physical Pendulum - Angular SHM - Solved ProblemsDocument7 pagesPhysical Pendulum - Angular SHM - Solved ProblemsHomayoon GeramifarNo ratings yet

- Dungeon 190Document77 pagesDungeon 190Helmous100% (4)

- Reflection Paper On "Legal Research, Legal Writing, and Legal Analysis: Putting Law School Into Practice" by Suzanne RoweDocument2 pagesReflection Paper On "Legal Research, Legal Writing, and Legal Analysis: Putting Law School Into Practice" by Suzanne RoweRobert Jay Regz Pastrana IINo ratings yet

- RCHAPAC1 Eng 01 307567465Document2 pagesRCHAPAC1 Eng 01 307567465Hmg HamidiNo ratings yet

- 2021-01-01 Good Organic GardeningDocument110 pages2021-01-01 Good Organic GardeningValéria GarcezNo ratings yet

- Assignment 04 Solved (NAEEM HUSSAIN 18-CS-47)Document7 pagesAssignment 04 Solved (NAEEM HUSSAIN 18-CS-47)NAEEM HUSSAINNo ratings yet

- Themelis Ulloa LandfillDocument15 pagesThemelis Ulloa LandfillHenry Bagus WicaksonoNo ratings yet

- Manual Tecnico Jblgo PDFDocument2 pagesManual Tecnico Jblgo PDFMarcosDanielSoaresNo ratings yet

- Biogas ProductionDocument7 pagesBiogas ProductionFagbohungbe MichaelNo ratings yet