Professional Documents

Culture Documents

FM202

FM202

Uploaded by

Vinoth KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM202

FM202

Uploaded by

Vinoth KumarCopyright:

Available Formats

Understanding

Income Statement

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Income Statement Format

Item Details

Revenue Income generated from day-to-day (core) activities of the company

Cost of good sold Direct cost related to the revenue

Gross profit Profit after deducting all direct costs from the revenue

Operating expenses Other cost related to operations

EBITDA Profit after deducting all operating costs from the revenue

Depreciation and amortization Charge related to the fixed assets used in the business

EBIT Profit after deducting all costs except for interest and tax

Interest Cost for the borrowed funds

EBT Profit before tax

Tax Corporate tax

PAT Profit After tax

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

1 2 3 4 5

Identify the Identify the Determine the Allocate the Recognize revenue

contract(s) with a performance transaction price transaction price to when (or as) the

customer obligations in the the performance entity satisfies a

contract obligations in the performance

contract obligation.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

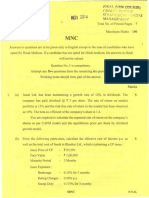

LENOV Ltd got into a contract to supply 50 computers to IMS Proschool on 31st March 2021. Under the terms of

contract, the company will provide computers for Rs 36,000/- each with 3 years onsite maintenance contract.

The computers were delivered on 15th April 2021. When should LENOV recognise revenue?

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

Contract signed by 2 performance Rs 36,000/ each or Rs 9,000/ allocated Rs 27,000/

the companies on obligation: Rs 1,800,000 in total to 3-yr maintenance recognized on 15 th

31 st March 2021 Deliver computers and Rs 27,000/ for April 2021 and

Provide 3-yr service the computers Rs 3,000/ each year

for services

1 2 3 4 5

Identify the Identify the Determine the Allocate the Recognize revenue

contract(s) with a performance transaction price transaction price to when (or as) the

customer obligations in the the performance entity satisfies a

contract obligations in the performance

contract obligation.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

On 31st March, an automobile company sold 50 cars to the distributor with a condition that the automobile

company can change the price of the car any time before it is sold to the ultimate customer. The dealer has

made partial payment and the balance will be paid once the car is sold to the ultimate customer. Can the

automobile company record revenue on 31st March or should wait until it is sold to ultimate customer?

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

Revenue is recognized as control is passed, either over time or at a point in time. Factors that may indicate the

point in time at which control passes include, but are not limited to: [IFRS 15:38]

• the entity has a present right to payment for the asset;

• the customer has legal title to the asset;

• the entity has transferred physical possession of the asset;

• the customer has the significant risks and rewards related to the ownership of the asset;

• the customer has accepted the asset.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

A seller sold goods worth Rs. 100,000 using the Flipcart platform on 31st March. The goods will be delivered on

10th of April to the buyer. Flipcart charges 10% commission on the transaction and pays to the seller after one

month of sale. Questions: Should the seller record revenue on 31st March or 10th April or wait till they receive

money? When should Flipcart recognise revenue and how much (Rs.100,000 or Rs. 10,000)?

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

Revenue is recognized as control is passed, either over time or at a point in time. Factors that may indicate the

point in time at which control passes include, but are not limited to: [IFRS 15:38]

• the entity has a present right to payment for the asset;

• the customer has legal title to the asset;

• the entity has transferred physical possession of the asset;

• the customer has the significant risks and rewards related to the ownership of the asset;

• the customer has accepted the asset.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

If you sell goods with a condition that it can be returned with 1 month, should you record the revenue

immediately or wait for one month to get over?

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

Revenue is recognized as control is passed, either over time or at a point in time. Factors that may indicate the

point in time at which control passes include, but are not limited to: [IFRS 15:38]

• the entity has a present right to payment for the asset;

• the customer has legal title to the asset;

• the entity has transferred physical possession of the asset;

• the customer has the significant risks and rewards related to the ownership of the asset;

• the customer has accepted the asset.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

If you have taken a contract to construct roads (50 kms) for Rs. 1500 million and estimate that it will take 5 years

to complete the project. Should you recognise all the revenue immediately or should you wait for 5 years or

something else?

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Revenue

An entity recognizes revenue over time if one of the following criteria is met:

• the customer simultaneously receives and consumes all the benefits provided by the entity as the entity

performs;

• the entity’s performance creates or enhances an asset that the customer controls as the asset is created; or

• the entity’s performance does not create an asset with an alternative use to the entity and the entity has an

enforceable right to payment for performance completed to date.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Expense Recognition

Matching Principle

üMatch expenses with associated revenues

ü The matching principle requires that the company matches the COGS with the revenues of the period

Period Costs

üExpenses that less directly matching the timing of revenues

ü Administrative Expenses

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Expense Recognition

Matching Principle

üMatch expenses with associated revenues

ü The matching principle requires that the company matches the COGS with the revenues of the period

Period Costs

üExpenses that less directly matching the timing of revenues

ü Administrative Expenses

Sometimes we must estimate expenses

For example:

1. Provision for warranties

2. Provision for doubtful debt

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Depreciation & Amortization

üDepreciation is a process of systematically allocating costs of long-lived assets over the period during which the assets are

,-./0123 5.6/3 7819:1;3 :19-3

expected to provide economic benefits 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 =

<6=3 >= ?03 1223?

ü Various methods of depreciation, such as straight line, WDV and units of production

ü Owned land is never depreciated

üDepreciation of intangible assets (patents, copyrights etc) is called amortization

Goodwill is an intangible asset.

For accounting purpose goodwill arises only in a purchase transaction.

It is excess of purchase price over the net assets acquired. So, if X Ltd acquired Y Ltd for $120 million when its net assets (A - L =

E = Net Asset = Net Worth) was $100 million, the $20 million access paid will be reported as goodwill in X Ltd books of accounts.

Goodwill is never amortized but is tested for impairment.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Non-Recurring Items

üA company needs to separate revenues and expenses into items that are likely to continue in the future and items that are not

üHelps analysts to predict future earnings of the company

üItems that are not likely to continue can be classified as:

ü Discontinued operations:

ü An operation that the company has disposed in the current period or is planning to dispose in future.

ü Discontinued operations are shown as a separate line item, net of tax, after net income from continuing operations.

ü Unusual or infrequent items:

ü These are either unusual in nature or infrequent in occurrence

ü For example, gains or losses from selling an equipment.

ü they are shown as a separate line item, but before tax, and are included in the income from continuing operations.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Non-Recurring Items

ü Change in accounting policy

ü Refers to change from one accounting method to another. For example, changing inventory valuation from LIFO to FIFO

ü It requires retrospective application, i.e. all prior period financial statements need to be restated

ü Retrospective application, helps maintain comparability of the statements across periods

ü Changes in accounting estimate

ü This refers to change in the management’s estimate. For example, changing the useful life of a depreciable asset.

ü It requires prospective application, i.e. no need to restate prior period financial statements

ü Correction of prior-period error

ü This refers to an adjustment done to correct a prior period accounting error. All prior period statements should be restated

ü In addition, disclosure of the nature of the adjustment is required in footnotes

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Non-Operating Items

üNon-operating items are portion of income or expenses that relates to activities not core to business operations

ü For a non-financial services company, interest income and expenses are non-operating in nature

ü For a financial services company, interest income and expenses are operating in nature

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

EPS

,.>=6? 1??.6C-?1C93 ?> >.D6E1.F 201.3

Earnings per share (EPS) is the profit or loss attributable to each share. 𝐸𝑃𝑆 =

G> >= 201.32

Profit attributable to the equity is the Net profit less any dividend to be paid to preference shareholders

No of shares in the denominator refers to the weighted average number of shares (weights given based on number of months)

G3? 5.>=6? 7 ,.3=3.3D J6:6D3ED

𝐵𝑎𝑠𝑖𝑐 𝐸𝑃𝑆 =

K36;0?3D 1:3.1;3 E> >= 201.32

number of shares is calculated by adjusting

also known as a common share or a share which entitles the holder to a fixed

the shares at the beginning of the period

common stock. An equity instrument dividend, whose payment takes priority

by the number of shares bought back or

that is subordinate to all other classes of over that of ordinary share dividends.

issued, multiplied by a time-weighting

equity instruments .

factor.

Ordinary Shares Preference Shares Weighted Average

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Basic EPS - Example

Y Ltd has 10,000 shares outstanding at the beginning of the year. On April 1, the company issues 4,000 new

shares. On September 1, it repurchases 3,000 shares. Calculate weighted average number of shares outstanding

for the year, for its reporting of basic earnings per share.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Basic EPS - Example

Date No. Sh Weight Wt Sh

1-Ja n 10,000.0 12/12 10,000.0

1-Apr 4,000.0 9/12 3,000.0

1-Sep (3,000.0) 4/12 (1,000.0)

Weighted average 12,000.0

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Basic EPS - Example

Y Ltd has 10,000 shares outstanding at the beginning of the year. On April 1, the company issues 4,000 new

shares. On July 1, distributes a 10% stock dividend. On September 1, it repurchases 3,000 shares. Calculate

weighted average number of shares outstanding for the year, for its reporting of basic earnings per share.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Basic EPS - Example

Date No. Sh Weight Adj Wt Sh

1-Jan 10,000.0 12/12 1.1 11,000.0

1-Apr 4,000.0 9/12 1.1 3,300.0

1-Sep (3,000.0) 4/12 (1,000.0)

Weighted average 13,300.0

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Basic EPS - Example

Y Ltd has net income of $150,000, paid $10,000 cash dividends to its preferred shareholders, and paid $14,750

cash dividends to its common shareholders. Calculate basic EPS using 14,000 as weighted average number of

shares.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Basic EPS - Example

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑

𝐵𝑎𝑠𝑖𝑐 𝐸𝑃𝑆 =

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑆ℎ𝑎𝑟𝑒𝑠

150,000 − 10,000

𝐵𝑎𝑠𝑖𝑐 𝐸𝑃𝑆 =

14000

𝐵𝑎𝑠𝑖𝑐 𝐸𝑃𝑆 = 10

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Basic EPS

üIn case of stock splits:

ü 2 for 1 stock split increases the shares outstanding by 100%

ü For EPS calculation purposes, a stock split is treated as if it occurred at the beginning of the year

üIn case of dividends:

ü The weighted average outstanding shares increases with the dividend

ü 10% dividend results in a 10% increase in the shares outstanding

number of shares is calculated by adjusting

also known as a common share or a share which entitles the holder to a fixed

the shares at the beginning of the period

common stock. An equity instrument dividend, whose payment takes priority

by the number of shares bought back or

that is subordinate to all other classes of over that of ordinary share dividends.

issued, multiplied by a time-weighting

equity instruments .

factor.

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS

Diluted earnings per share (DEPS) is the EPS considering all convertible securities have been converted to ordinary shares.

G3? 5.>=6? 7 ,.3=3.3D J6:6D3ED ^ ,.3=3..3D J6:6D3ED ^_E?3.32? ∗(b7c1d .1?3)

𝐷𝐸𝑃𝑆 =

K? 1:; E> >= 201.32^ Shares from conversion of convertible Pref Stock ^ Shares from conversion of convertible debt + Shares issuable for warrants and option

üWe assume that the convertible securities are convert to ordinary shares (even though they will convert in future)

üIf DEPS > EPS than while reporting DEPS, we make it equal to EPS

üIn such case the securities are call antidilutive

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS - Example

Net Income for the year is $500,000,000

Common Stock of $10 each 20000000

Tax Rate 40%

Preferred stock outstanding ($10 each) = $ 7,500,000

Preferred Dividend Rate = 6%

One preferred stock is converted into 1.25 common shares

Calculate fully diluted EPS34

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS - Example

Particulars Calculation Output

Net Income 500,000,000

Less Preference Dividend

34 6% * 7,500,000 450,000

Divided by Wt No of Shares 20,000,000

BEPS 24.98

Number of Preference Shares 7,500,000 / 10 750,000

New Shares Post Conversion 750,000 *1.25 937,500

Total Shares 20,000,000 + 937,500 20,937,500

Diluted EPS 500,000,000 / 20,937,500 23.88

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS - Example

Net Income for the year is $500,000,000

Common Stock of $10 each 20000000

Tax Rate 40%

Convertible Debt outstanding ($1000 each) = $ 25,000,000

Bond Rate = 5%

One bond is converted into 125 common shares

Calculate fully diluted EPS

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS - Example

Particulars Calculation Output

Net Income 500,000,000

Divided by Wt

34 No of Shares 20,000,000

BEPS 25

Number of Convertible Bonds 25,000,000 / 1,000 25,000

New Shares Post Conversion 25,000 *125 3,125,000

Total Shares 20,000,000 + 937,500 23,125,000

Interest on the Bond 25,000,000*5% 1,250,000

Diluted EPS [500,000,000 + 1,250,000*(1-40%) / 21.64

23,125,000

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS - Example

Net Income $500,000,000

Common Stock of $10 each 20,000,000 Number of Shares

Average Price of stock $20.00

Exercise Price $15.00

Number of Options outstanding 1000000

Basic EPS $25.00

Calculate fully diluted EPS

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS - Example

Particulars Calculation Output

Proceed from Warrants Conversion 1,000,000* 15 15,000,000

34

No of shares that can be purchased 15,000,000 / 20 750,000

from above proceed at average price

Number of shares issued 1,000,000

Number of shares issued at no cost 1,000,000 – 750,000 250,000

Diluted EPS 500,000,000/ (20,000,000 + 250,000) 24.69

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS - Example

Net income = $2,500,000

600,000 common stock outstanding

20,000 shares of convertible preferred

Preferred dividend per share of $10, each preferred share is convertible into 2 shares of common stock

Calculate fully diluted EPS

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Diluted EPS - Example

Particulars Calculation Output

Net Income 2,500,000

34

Less Preference Dividend 10 * 20,000 200,000

Divided by Wt No of Shares 600,000

BEPS 3.83

New Shares Post Conversion 20,000 *2 40,000

Total Shares 600,000 + 40,000 640,000

Diluted EPS 2,500,000 / 640,000 3.91

Since DEPS > BEPS, we report 3.83 as BEPS and DEPS. Here convertible preference shares are anti-dilutive

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Comprehensive Income

Comprehensive income is the change in equity of a business enterprise during a period from transactions and other events and

circumstances from non-owner sources.

34

Total Comprehensive Income =

Net Income

+Foreign Currency Translation Adjustment

+Unrealized gains or losses on derivatives contracts accounted for as hedges

+Unrealized gains and losses on available for sale securities

+Pension Adjustment to funded status

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

Common Size Income Statement

34

FINANCE | ACCOUNTS | DIGITAL www.proschoolonline.com

You might also like

- Solution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDocument18 pagesSolution Manual For Entrepreneurship Starting and Operating A Small Business 5th Edition Caroline Glackin Steve MariottiDeanBucktdjx100% (40)

- Part II ProjectDocument81 pagesPart II ProjectTasmay Enterprises100% (2)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Module 3Document27 pagesModule 3Sajid IqbalNo ratings yet

- Ifrs 15 Revenue RecognitionDocument46 pagesIfrs 15 Revenue Recognitionesulawyer2001No ratings yet

- Ifrs 15: Revenue From Contracts With CustomersDocument46 pagesIfrs 15: Revenue From Contracts With CustomersHace AdisNo ratings yet

- Business Requirement: Accrual Accounting Matching Principle Accounting Period Revenues ExpensesDocument8 pagesBusiness Requirement: Accrual Accounting Matching Principle Accounting Period Revenues ExpensesshekarNo ratings yet

- Topic 4 - Lecture Slides - Part IDocument25 pagesTopic 4 - Lecture Slides - Part INeha LalNo ratings yet

- This Study Resource Was: AFAR02Document8 pagesThis Study Resource Was: AFAR02admiral spongebob100% (1)

- Group 1 PresentationDocument46 pagesGroup 1 PresentationHossain AlmasNo ratings yet

- AFARevenue RecognitionDocument34 pagesAFARevenue RecognitionRameen ShehzadNo ratings yet

- BAB 6 Analyzing Operating Activities 081016Document56 pagesBAB 6 Analyzing Operating Activities 081016Haniedar NadifaNo ratings yet

- Presentation On Audit Program of Revenue From Contract With Customer Under IFRS 15Document15 pagesPresentation On Audit Program of Revenue From Contract With Customer Under IFRS 15msiam4566No ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- BAB 6 Analyzing Operating ActivitiesDocument56 pagesBAB 6 Analyzing Operating ActivitiesMaun GovillianNo ratings yet

- BSA 3101 Topic 3A - Revenue From ContractsDocument14 pagesBSA 3101 Topic 3A - Revenue From ContractsDerek ShepherdNo ratings yet

- Pfrs 15 Revenue From Contracts With CustomersDocument3 pagesPfrs 15 Revenue From Contracts With CustomersR.A.No ratings yet

- Chapter 3Document29 pagesChapter 3Minh Khanh LeNo ratings yet

- REVENUE RECOGNITION and MeasurementDocument16 pagesREVENUE RECOGNITION and MeasurementMukesh ChauhanNo ratings yet

- Chapter 6 Accounting For Franchise Operations - Franchisor-PROFE01Document7 pagesChapter 6 Accounting For Franchise Operations - Franchisor-PROFE01Steffany RoqueNo ratings yet

- 2 Revenue - IFRS 15Document43 pages2 Revenue - IFRS 15Haseeb SethyNo ratings yet

- NFRS 15 - Revenue From Contracts With CustomerDocument18 pagesNFRS 15 - Revenue From Contracts With CustomerApilNo ratings yet

- Chapter 11. RevenueDocument62 pagesChapter 11. RevenueАйбар КарабековNo ratings yet

- Reviewer in Revenue and Expense RecognitionDocument7 pagesReviewer in Revenue and Expense RecognitionPaupauNo ratings yet

- 2021-2024 Semester-I Division-A Accounting Standard-9 Revenue Recognition Subject:Financial AccountingDocument8 pages2021-2024 Semester-I Division-A Accounting Standard-9 Revenue Recognition Subject:Financial AccountingTushar NarangNo ratings yet

- Accounting For Franchise Operations2Document21 pagesAccounting For Franchise Operations2Jaira Mae AustriaNo ratings yet

- IFRS 15 - RevenueDocument44 pagesIFRS 15 - RevenueEXAM RASWANNo ratings yet

- Revenue Recognition 23-25Document23 pagesRevenue Recognition 23-25Yashveer SinghNo ratings yet

- FRA - Accounting PoliciesDocument4 pagesFRA - Accounting PoliciesGarima SharmaNo ratings yet

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisMuhammad KhawajaNo ratings yet

- Revenue From Contracts With CustomersDocument5 pagesRevenue From Contracts With Customers70fugnayjanetNo ratings yet

- Inter 2 ProjectDocument8 pagesInter 2 ProjectOm BasimNo ratings yet

- IFRS 15 - Revenue Recognition 2022Document66 pagesIFRS 15 - Revenue Recognition 2022leshenitaleniNo ratings yet

- Reviewer Pfrs 15 Revenue From Contracts With CustomersDocument4 pagesReviewer Pfrs 15 Revenue From Contracts With CustomersMaria TheresaNo ratings yet

- Pfrs 15 Summary NotesDocument5 pagesPfrs 15 Summary NotesSHARON SAMSONNo ratings yet

- ACC2001 Lecture 1Document49 pagesACC2001 Lecture 1michael krueseiNo ratings yet

- PFRS15Document14 pagesPFRS15cris allea catacutanNo ratings yet

- Revenue CDocument22 pagesRevenue CAnushka JindalNo ratings yet

- Chapter 04 RevenueDocument16 pagesChapter 04 RevenueMuhammad IrfanNo ratings yet

- Revenue Recognition 3 - Sobelco WebinarDocument23 pagesRevenue Recognition 3 - Sobelco WebinarAldrin ZolinaNo ratings yet

- AFAR-06 (Revenue From Contracts With Customers - Other Topics)Document26 pagesAFAR-06 (Revenue From Contracts With Customers - Other Topics)MABI ESPENIDONo ratings yet

- Chapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesDocument21 pagesChapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesRey Joyce AbuelNo ratings yet

- 13) IFRS-15 RevenueDocument34 pages13) IFRS-15 Revenuemanvi jainNo ratings yet

- Revenue RecognitionDocument1 pageRevenue Recognitionarmor.coverNo ratings yet

- Chapter 18 Revenue RecognitionDocument15 pagesChapter 18 Revenue RecognitionjingyanNo ratings yet

- Long Term Construction ContractsDocument20 pagesLong Term Construction Contractsgerald anthony salasNo ratings yet

- Ac08605 - Revenue From Contracts With CustomersDocument30 pagesAc08605 - Revenue From Contracts With CustomersWilie MichaelNo ratings yet

- Franchise AccountingDocument4 pagesFranchise AccountingCatherine AncananNo ratings yet

- Unit VIII Accounting For Long Term Construction ContractsDocument8 pagesUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveNo ratings yet

- Lesson 10 FranchiseDocument7 pagesLesson 10 FranchiseheyheyNo ratings yet

- Chapter-3 Income Statementand Related InformationsDocument113 pagesChapter-3 Income Statementand Related InformationsEmbassy and NGO jobsNo ratings yet

- Accounting Seminar - Assignment CH 10 (Doni Rahmad & Fachriza Mizafin)Document5 pagesAccounting Seminar - Assignment CH 10 (Doni Rahmad & Fachriza Mizafin)Kazuyano DoniNo ratings yet

- As 9Document27 pagesAs 9AATHARSH RADHAKRISHNANNo ratings yet

- Process of Corporate LiquidationDocument56 pagesProcess of Corporate LiquidationJanelle CatoNo ratings yet

- Afar 2 Module CH 6 PDFDocument15 pagesAfar 2 Module CH 6 PDFRazmen Ramirez PintoNo ratings yet

- (Intermediate Accounting 3) : Lecture AidDocument28 pages(Intermediate Accounting 3) : Lecture AidFrost Garison100% (1)

- AFAR-06 (Revenue From Customer Contracts - Other Topics)Document26 pagesAFAR-06 (Revenue From Customer Contracts - Other Topics)mysweet surrenderNo ratings yet

- Chapter 7 Revenue From Contracts With Customers SVDocument21 pagesChapter 7 Revenue From Contracts With Customers SV21073141No ratings yet

- Study Unit 2 Revenue From ContractsDocument13 pagesStudy Unit 2 Revenue From ContractsKarabo MofokengNo ratings yet

- Accounting Quick Update - IFRS 16 - Leases and IFRS 15 - RevenueDocument50 pagesAccounting Quick Update - IFRS 16 - Leases and IFRS 15 - RevenueTAWANDA CHIZARIRANo ratings yet

- Factor and ForfaitingDocument11 pagesFactor and ForfaitingDishaNo ratings yet

- Revenue RecognitionDocument6 pagesRevenue RecognitionBOBBY212No ratings yet

- FM201Document26 pagesFM201Vinoth KumarNo ratings yet

- Persistent Annual Report 2022Document316 pagesPersistent Annual Report 2022Vinoth KumarNo ratings yet

- FM203Document11 pagesFM203Vinoth KumarNo ratings yet

- Persistent Annual Report 2018Document299 pagesPersistent Annual Report 2018Vinoth KumarNo ratings yet

- FM205Document4 pagesFM205Vinoth KumarNo ratings yet

- FM204Document8 pagesFM204Vinoth KumarNo ratings yet

- Nov 10Document7 pagesNov 10chandreshNo ratings yet

- Risk and Return Analysis of Commercial Bank in Nepal (Proposal Body)Document34 pagesRisk and Return Analysis of Commercial Bank in Nepal (Proposal Body)Bhupendra TamangNo ratings yet

- College Accounting A Contemporary Approach 4th Edition Haddock Test BankDocument51 pagesCollege Accounting A Contemporary Approach 4th Edition Haddock Test Bankmelissazunigaiwspkcbfnt100% (29)

- Tunis Stock ExchangeDocument54 pagesTunis Stock ExchangeAnonymous AoDxR5Rp4JNo ratings yet

- MODULE Quarter 2 GenmathDocument41 pagesMODULE Quarter 2 GenmathJeneva EleccionNo ratings yet

- Financial StatementsDocument34 pagesFinancial StatementsRadha GanesanNo ratings yet

- Athletic World Is A Sporting Goods Store The Following DataDocument2 pagesAthletic World Is A Sporting Goods Store The Following Datatrilocksp SinghNo ratings yet

- PRELIMINARY EXAMINATION Acctg 339Document2 pagesPRELIMINARY EXAMINATION Acctg 339Liza Magat MatadlingNo ratings yet

- MPU 3353 Personal Financial Planning in Malaysia: Investment Basics: The Management of RiskDocument35 pagesMPU 3353 Personal Financial Planning in Malaysia: Investment Basics: The Management of RiskherueuxNo ratings yet

- PHS - RHB US Growth Fund - 28122023 (FINAL)Document5 pagesPHS - RHB US Growth Fund - 28122023 (FINAL)Patrick ArchibaldNo ratings yet

- Kurla: India Limited LimitedDocument1 pageKurla: India Limited LimitedKushal PatelNo ratings yet

- CFO VP Finance CPA in Orange County CA Resume Scott SussmanDocument2 pagesCFO VP Finance CPA in Orange County CA Resume Scott SussmanScottSussmanNo ratings yet

- Atswa: Financial AccountingDocument344 pagesAtswa: Financial AccountingOyedola Gafar BabatundeNo ratings yet

- Index: Scope of Study 3 Research Methodology Limitations of Study 11Document70 pagesIndex: Scope of Study 3 Research Methodology Limitations of Study 11Krishna Pradeep Lingala100% (1)

- Reviewer On Partnership AccountingDocument27 pagesReviewer On Partnership AccountingannegelieNo ratings yet

- The Beauty of The GP Co-Investment Structure - CrowdStreetDocument6 pagesThe Beauty of The GP Co-Investment Structure - CrowdStreetJerry WilliamsonNo ratings yet

- UAS Muhammad Misbahul HudaDocument6 pagesUAS Muhammad Misbahul Hudawhite shadowNo ratings yet

- 12th Accountancy One Word Question Paper With Answer Keys English Medium PDF DownloadDocument6 pages12th Accountancy One Word Question Paper With Answer Keys English Medium PDF Downloadskrockers9056No ratings yet

- Ifrs9 New Insurance Standard Ifrs4 ApproachesDocument21 pagesIfrs9 New Insurance Standard Ifrs4 ApproachesErnestNo ratings yet

- Idx Monthly October 2021Document142 pagesIdx Monthly October 2021Trick UnikNo ratings yet

- 3.1 Corporate Reporting GhanaDocument28 pages3.1 Corporate Reporting GhanamohedNo ratings yet

- Digital Asset 2021 Outlook The Block ResearchDocument102 pagesDigital Asset 2021 Outlook The Block ResearchChen LiangNo ratings yet

- Marketing StrategyDocument8 pagesMarketing StrategyYeshua ResearchNo ratings yet

- Corporate LiquidationDocument7 pagesCorporate LiquidationJemarie Alamon100% (1)

- Risk Management at Pim CoDocument12 pagesRisk Management at Pim CorpcampbellNo ratings yet

- Beneish M ScoreDocument6 pagesBeneish M ScoreAlex ElliottNo ratings yet

- Gold Market Forecast 2010Document8 pagesGold Market Forecast 2010Anonymous fE2l3DzlNo ratings yet

- Tire City INCDocument3 pagesTire City INCReetik ParekhNo ratings yet