Professional Documents

Culture Documents

1A Sales Transactions

1A Sales Transactions

Uploaded by

Crest TineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1A Sales Transactions

1A Sales Transactions

Uploaded by

Crest TineCopyright:

Available Formats

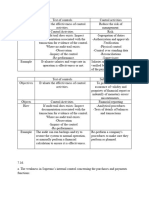

SALES TRANSACTIONS

TESTS OF CONTROLS (IWORI) SUBSTANTIVE TESTS (VICTORIA)

Potential Audit Procedures Test ASSERTIONS Substantive test of transactions Substantive test of details of balances Analytical Procedures

Controls Potential Substantive Audit Substantive Audit Analytical

Misstatements of Controls Assertions Misstatements

Misstatements Procedures Procedures Procedures

1. Recording of sales is supported by Sales that did not occur may be Examine approved customer order, Sales for which shipment of goods For a sample of entries in the sales Sales and accounts receivable are for 1. Confirm accounts receivable and Overstatement or 1. Compare the sales amount and

customer orders, sales orders recorded. sales order, shipping document, and was not made and therefore did not journal, compare sales invoice copy, shipments made to customers. perform alternative procedures for understatement of sales gross profit percentage for product

approved by the credit department, copy of sales invoice for a sample of Existence/ occur may be recorded. customer order, and sales invoice. confirmations not returned. lines by month and with those of

and approved and executed entries in the sales journal. Occurrence previous years.

shipping documents. 2. Perform analytical procedures to

test sales and accounts receivable. 2. Compare the gross profit with

industry data.

2. A clerk independent of accounts Errors in recording sales may not be Observe procedure and examine

receivable prepares and mails detected. follow-up files. Recorded sales are for shipments

monthly statements to customers actually made to customers

Overstatement or 3. Compare sales returns and

for all trade accounts receivable and understatement of sales returns allowances as a percentage of gross

follows up on any complaints. and allowances sales with previous years’

percentage.

4.Pre-numbered shipping documents Goods may be shipped but not billed. Observe procedure. Goods may be shipped but not billed For a sample of shipping documents, Sales transactions that occurred and 3. Perform a test of sales cutoff.

are accounted for to determine that Examine copy of invoices for a sample and therefore not recorded. trace sales invoice and entry to ales existing accounts receivable are Overstatement or 4. Compare the AR turnover with the

sales invoice is prepared for all of shipping documents. journal and accounts receivable recorded. understatement of allowance for rate for previous years and with

shipments. subsidiary ledger.

Completeness uncollectible accounts industry data.

Perform cutoff tests. 5. Compare uncollectible accounts

5.Pre-numbered sales invoices are Unrecorded sales may exist. Observe procedure. expense as a percentage of sales with

accounted for to determine that all Examine entries for a sequence of the rate for previous years and with

All sales transactions that occurred

sales are recorded. sales invoices in sales journal. industry data.

are recorded.

6. Compare the allowance accounts as

6.Procedures to ensure timely Sales transactions may be recorded in Inquire how procedures are followed, a percentage of AR with the %age for

recording of sales and proper cut-off the wrong period. observe procedures being followed, previous years and with industry data.

are established. and inspect report on last shipments.

7. Compute the percentage of AR by

age category and compare with

6. Clerk checks sales order and sales Consignment transactions may be Observe procedure. Goods shipped on consignment may From a sample of sales invoice, Accounts receivable are owned by the 4. Review minutes of BODs meetings, previous years’ data

invoice for terms to determine that recorded as sales.

Rights be recorded as sales. examine the customer order and client. inquire of client personnel, read

transaction is a sale rather than a & obligations shipping document to determine contracts and agreements, and 8. Compare written-off accounts that

consignment. whether the transaction should have confirm with lender any indications are outstanding at the end of the

Sales recorded represent only sales been recorded as a consignment that accounts have been assigned, previous year with the allowance for

transactions. transaction rather than as a sale. sold, or pledged. uncollectible accounts to evaluate the

adequacy of the previous allowance.

7. For all goods shipped, goods are More or fewer goods may have been Observe procedure. Sales and accounts receivable may be For sample entries in the sales journal, Account receivable are properly 5. Verify the mathematical accuracy Errors in individual customers’ 9. Compare individual customer

counted and descriptions and shipped than ordered. Customer For a sample, examine signature on misvalued. (a) Examine sales invoice, shipping valued. of the accounts receivable aging accounts receivable balances with balances of the

quantities are compared to quantities returns may occur. documents evidencing performance. document, and customer order for schedule and trace it to the previous year.

and descriptions on sales orders and consistency of descriptions and accounts receivable subsidiary

shipping documents prior to shipping. quantities; (b) Examine sales orders ledger.

for credit approval; and (c) check

prices and extensions. 6. Test the adequacy of the allowance

8. Customer credit is approved by a Accounts receivable may be Examine sales order for selected Valuation/ for uncollectible accounts.

responsible official prior to uncollectible. transactions. Measurement Foot sales journal and general ledger

merchandise shipment. account.

9. Sales invoices are checked for Sales/accounts receivable may be Inquire about the updating and use of Sales are correctly billed and

proper pricing, mathematical overstated or understated. approved price lists. recorded.

accuracy, and terms. For sample of invoices, examine

signature indicating performance of

task.

10. The accounts subsidiary ledger is Likelihood of errors in accounts Observe procedure.

balanced to the general ledger control receivable increases. Foot subsidiary ledger.

account regularly.

An independent review is made of Revenues may be misclassified. Observe procedure. Revenues may not be properly For a sample of entries in the sales Sales and accounts receivable are 7. Review the FS and perform

account coding for recorded sales. For a sample of invoices, recheck

Presentation classified. journal, verify the accuracy of account properly presented and disclosed in analytical procedures to determine

account coding. & disclosure coding. accordance with PFRS. whether accounts are classified

and disclosed in accordance with

Sales and accounts receivable are PFRS.

recorded to result in presentation and

disclosure in accordance with PFRS.

You might also like

- 13.performance of Substantive Testing and Summary of Results of Substantive TestingDocument3 pages13.performance of Substantive Testing and Summary of Results of Substantive TestingKen Aaron DelosReyes PedroNo ratings yet

- Branding Project ReportDocument20 pagesBranding Project Reportrameshmatcha8375% (8)

- Business Processes - Part 1Document15 pagesBusiness Processes - Part 1Malinda NayanajithNo ratings yet

- 2A Cash Receipts TransactionsDocument2 pages2A Cash Receipts TransactionsCrest TineNo ratings yet

- 4A Purchases TransactionsDocument2 pages4A Purchases TransactionsCrest TineNo ratings yet

- Specific Further Audit ProceduresDocument4 pagesSpecific Further Audit ProceduresCattleyaNo ratings yet

- Lê Viết Nhật Quang - 31221025758 aaDocument2 pagesLê Viết Nhật Quang - 31221025758 aaquangle.31221025758No ratings yet

- Lab Iii Audit of Sales and Collection Cycle: I. TujuanDocument8 pagesLab Iii Audit of Sales and Collection Cycle: I. TujuanyenitaNo ratings yet

- BKAA2013 Answer A182 2019 StudentDocument7 pagesBKAA2013 Answer A182 2019 StudentJoNo ratings yet

- Substantive Audit Receivables PDFDocument23 pagesSubstantive Audit Receivables PDFnanabaNo ratings yet

- Business Processes - Part 2Document17 pagesBusiness Processes - Part 2Malinda NayanajithNo ratings yet

- Substantive TestingDocument18 pagesSubstantive TestingMichelle SicangcoNo ratings yet

- Test and ControlsDocument5 pagesTest and ControlsKristen HathcockNo ratings yet

- Applicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresDocument3 pagesApplicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresRosept ParnesNo ratings yet

- converted-RR Control ObjectivesDocument3 pagesconverted-RR Control ObjectivesWillowNo ratings yet

- ACCA Notes On Cycle SystemDocument12 pagesACCA Notes On Cycle Systemc7rw76krwtNo ratings yet

- Test of Controls For Some Major ActivitiesDocument22 pagesTest of Controls For Some Major ActivitiesMohsin RazaNo ratings yet

- InventoryDocument16 pagesInventorybobocbanhNo ratings yet

- Lab 3Document10 pagesLab 3valen martaNo ratings yet

- CompiledDocument74 pagesCompiledNeil Richmond RecierdoNo ratings yet

- Test of ControlDocument10 pagesTest of ControlShrividhyaNo ratings yet

- Audit Exercise3Document2 pagesAudit Exercise3Nhung NguyễnNo ratings yet

- Audit Evidence and Audit Documentation: Mcgraw-Hill/IrwinDocument30 pagesAudit Evidence and Audit Documentation: Mcgraw-Hill/IrwinyebegashetNo ratings yet

- Chapter 10 Audit f8 - 2.3Document33 pagesChapter 10 Audit f8 - 2.3JosephineMicheal17No ratings yet

- 2.1 Audit of Sales and ReceivablesDocument2 pages2.1 Audit of Sales and ReceivablesNavsNo ratings yet

- Audit Objectives Techniques Assertions Procedures and TestsDocument14 pagesAudit Objectives Techniques Assertions Procedures and TestsNieza Marie MirandaNo ratings yet

- Presentation Audit of Acquisition and Payment CycleDocument38 pagesPresentation Audit of Acquisition and Payment CycleSyaffiq UbaidillahNo ratings yet

- Auditing The Expenditure Cycle: Chapter 15 (Tutor Financial Audit)Document15 pagesAuditing The Expenditure Cycle: Chapter 15 (Tutor Financial Audit)Himawan TanNo ratings yet

- Audit of The Inventory and Warehousing CycleDocument10 pagesAudit of The Inventory and Warehousing Cyclenanda rafsanjaniNo ratings yet

- Revenue CycleDocument10 pagesRevenue CycleMart BanaresNo ratings yet

- SVFC BS Accountancy1Document29 pagesSVFC BS Accountancy1Lorraine TomasNo ratings yet

- Audit Evidence: THE USE OF ASSERTIONS BY AUDITORS - 85Document6 pagesAudit Evidence: THE USE OF ASSERTIONS BY AUDITORS - 85Hillary MageroNo ratings yet

- F8 Summary TopicDocument1 pageF8 Summary TopicChoi HongNo ratings yet

- Example Audit Program 2017Document24 pagesExample Audit Program 2017Hans DovonouNo ratings yet

- Substantive ProcedureDocument8 pagesSubstantive ProcedureGoldaNo ratings yet

- Substantive Testing, Computer Audit Techniques and Audit ProgrammesDocument46 pagesSubstantive Testing, Computer Audit Techniques and Audit ProgrammesJeklin LewaneyNo ratings yet

- Audit Procedur ES Cash Accounts Receivable Accounts Payable InventoryDocument2 pagesAudit Procedur ES Cash Accounts Receivable Accounts Payable InventoryRoseyy GalitNo ratings yet

- Purchase and Inventory: Dream HighDocument35 pagesPurchase and Inventory: Dream HighTrangMiNo ratings yet

- 3A Cash Payments TransactionsDocument2 pages3A Cash Payments TransactionsCrest TineNo ratings yet

- Risk Assessment TemplateDocument1 pageRisk Assessment TemplateYến Hoàng HảiNo ratings yet

- Jawaban Audit 16-25Document4 pagesJawaban Audit 16-25Lisca Nabilah50% (4)

- Business ProcessesDocument6 pagesBusiness Processeskyania duncanNo ratings yet

- Treasury - Banking Investments ForexDocument3 pagesTreasury - Banking Investments Forexshibin_raj_4No ratings yet

- 325 Answers 1Document15 pages325 Answers 1joshua ChiramboNo ratings yet

- Auditing Problems Ocampo/Ocampo AP.2900.SyllabusDocument1 pageAuditing Problems Ocampo/Ocampo AP.2900.SyllabusFuturamaramaNo ratings yet

- Sol18 Sebagian2Document11 pagesSol18 Sebagian2Chotimatul ChusnaaNo ratings yet

- Part 2 For StudentsDocument34 pagesPart 2 For StudentsLea JoaquinNo ratings yet

- Horngrenima14e - ch01 Accounting INfo & EthicDocument26 pagesHorngrenima14e - ch01 Accounting INfo & EthicMagnolia KhineNo ratings yet

- TOC and Substantive Test Cyle Production and Inventory WarehousingDocument7 pagesTOC and Substantive Test Cyle Production and Inventory WarehousingGirl langNo ratings yet

- Chapter 9 (3) : Completing The AuditDocument1 pageChapter 9 (3) : Completing The AuditARMIZAWANI BINTI MOHAMED BUANG BMNo ratings yet

- Substantive Tests of Transactions and Balances: Learning ObjectivesDocument61 pagesSubstantive Tests of Transactions and Balances: Learning ObjectivesMatarintis A Zulqarnain IINo ratings yet

- AFS 2023 - Lecture 4 - Sale IIDocument29 pagesAFS 2023 - Lecture 4 - Sale IIKiều TrangNo ratings yet

- Chapter 12 Audit ProceduresDocument8 pagesChapter 12 Audit ProceduresRichard de LeonNo ratings yet

- LECTURE 2 Applied AuditingDocument9 pagesLECTURE 2 Applied AuditingJoanna GarciaNo ratings yet

- Audit Planning - Analytical ProceduresDocument35 pagesAudit Planning - Analytical ProceduresVenus Lyka LomocsoNo ratings yet

- Chapter 12 Audit Procedures - ppt179107590Document8 pagesChapter 12 Audit Procedures - ppt179107590Clar Aaron BautistaNo ratings yet

- A. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionDocument5 pagesA. Key Internal Control B. Transaction Related Audit Objectives C. Test of Control D. Substantive Test of TransactionRosanaDíazNo ratings yet

- Chapter+4+ +Audit+of+Receivables+ (Part+1)Document10 pagesChapter+4+ +Audit+of+Receivables+ (Part+1)Dan MorettoNo ratings yet

- LS 3.00 - PSA 330 Auditor's Response To Assessed RiskDocument5 pagesLS 3.00 - PSA 330 Auditor's Response To Assessed RiskSkye LeeNo ratings yet

- How to Comply with Sarbanes-Oxley Section 404: Assessing the Effectiveness of Internal ControlFrom EverandHow to Comply with Sarbanes-Oxley Section 404: Assessing the Effectiveness of Internal ControlNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- 7B Notes PayablesDocument2 pages7B Notes PayablesCrest TineNo ratings yet

- 7 Financing and InvestingDocument1 page7 Financing and InvestingCrest TineNo ratings yet

- 7C SheDocument2 pages7C SheCrest TineNo ratings yet

- 4A Purchases TransactionsDocument2 pages4A Purchases TransactionsCrest TineNo ratings yet

- 6 Production CycleDocument1 page6 Production CycleCrest TineNo ratings yet

- 7A InvestmentsDocument1 page7A InvestmentsCrest TineNo ratings yet

- 3A Cash Payments TransactionsDocument2 pages3A Cash Payments TransactionsCrest TineNo ratings yet

- 3 Disbursement CycleDocument1 page3 Disbursement CycleCrest TineNo ratings yet

- 2A Cash Receipts TransactionsDocument2 pages2A Cash Receipts TransactionsCrest TineNo ratings yet

- Kisi-Kisi Ujian Sekolah Bahasa InggrisDocument5 pagesKisi-Kisi Ujian Sekolah Bahasa Inggrischandraadhi5617No ratings yet

- Handelsrecht 7Document25 pagesHandelsrecht 7KiewrNo ratings yet

- Marketing PlanDocument18 pagesMarketing PlanPatricia Mae ObiasNo ratings yet

- Inding A Job: My Learning EssentialsDocument4 pagesInding A Job: My Learning EssentialsLuthfi LegooNo ratings yet

- RBI Circular - Release of Property Documents On Rep - 230915 - 085021Document2 pagesRBI Circular - Release of Property Documents On Rep - 230915 - 085021Motorola G6No ratings yet

- Minimalist Sales PitchDocument20 pagesMinimalist Sales Pitchkaran128No ratings yet

- Chapter 1Document2 pagesChapter 1Reno PhillipNo ratings yet

- Republic of The PhilippinesDocument6 pagesRepublic of The PhilippinessantasantitaNo ratings yet

- Ra 10121Document6 pagesRa 10121Nowell SimNo ratings yet

- 5th Glocal Advocacy Leadership in Asia - DRAFT - Angela AdivosoDocument26 pages5th Glocal Advocacy Leadership in Asia - DRAFT - Angela AdivosoAngela AdivosoNo ratings yet

- Gratuity CalculationDocument4 pagesGratuity CalculationmeetushekhawatNo ratings yet

- Rashid Solanki Roll No. 294 Bandhan Bank Final Year ProjectDocument60 pagesRashid Solanki Roll No. 294 Bandhan Bank Final Year Projectsarah IsharatNo ratings yet

- CMGT 553 Final Isabella JimenezDocument21 pagesCMGT 553 Final Isabella Jimenezapi-524854335No ratings yet

- Me MartsDocument2 pagesMe Martsmuhereza markNo ratings yet

- Cumulative Causation Theory - 2Document3 pagesCumulative Causation Theory - 222PBA132 RAVISH.TNo ratings yet

- Ar Adirafinance-2018 EngDocument586 pagesAr Adirafinance-2018 EngHendra GuntoroNo ratings yet

- Chapter 2 Introduction To Transaction Processing 02Document1 pageChapter 2 Introduction To Transaction Processing 02Marklein DumangengNo ratings yet

- Anurag - B Resume 2020Document1 pageAnurag - B Resume 2020Anurag BhatiaNo ratings yet

- Test-001 (Paper-I) 11th Oct 2020Document4 pagesTest-001 (Paper-I) 11th Oct 2020Raghav KumarNo ratings yet

- Desalination Study Report - WebsiteDocument251 pagesDesalination Study Report - Websitewissem3No ratings yet

- Commerce N Accts II (BLM) 21-22 (EM)Document44 pagesCommerce N Accts II (BLM) 21-22 (EM)Anu BantyNo ratings yet

- Governor in Council Appointments Baseline 2016Document20 pagesGovernor in Council Appointments Baseline 2016Institute for Research on Public Policy (IRPP)No ratings yet

- Auction NoticeDocument6 pagesAuction Noticebobn bobnnNo ratings yet

- 15) Pear International - Controls and TOC QuestionDocument2 pages15) Pear International - Controls and TOC QuestionkasimranjhaNo ratings yet

- Example Thesis On Business EthicsDocument6 pagesExample Thesis On Business Ethicsafkogsfea100% (1)

- Assesment-FMMBAnewDocument16 pagesAssesment-FMMBAnewAYUSHI KULTHIANo ratings yet

- Entrepreneurial Attitude of Addis AbabaDocument7 pagesEntrepreneurial Attitude of Addis Ababahabtamut1930No ratings yet

- Organizational BehaviourDocument14 pagesOrganizational BehaviourbhavanyaNo ratings yet

- Chapter-25 - Insurance - Pension Fund OperationsDocument35 pagesChapter-25 - Insurance - Pension Fund Operationsmohammad olickNo ratings yet