Professional Documents

Culture Documents

2011 New - Income - Tax - Forms20210930 14 RRJFVD

2011 New - Income - Tax - Forms20210930 14 RRJFVD

Uploaded by

JM CBOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2011 New - Income - Tax - Forms20210930 14 RRJFVD

2011 New - Income - Tax - Forms20210930 14 RRJFVD

Uploaded by

JM CBCopyright:

Available Formats

December 9, 2011

REVENUE REGULATIONS NO. 19-11

SUBJECT : New Income Tax Forms

TO : All Revenue Officials, Employees, and Others Concerned

SECTION 1. Objective . —

These Revenue Regulations are issued to prescribe the new BIR Forms

that will be used for Income Tax filing covering and starting with Calendar

Year 2011, and to modify Revenue Memorandum Circular No. 57-2011.

SECTION 2. Scope. —

Pursuant to Section 244 in relation to Sections 6 (H), 51 (A) (1), and 51

(A) (2) of the National Internal Revenue Code of 1997 (Tax Code), as

amended, these Regulations are prescribed to revise BIR Form Nos. 1700,

1701, and 1702 to reflect the changes in information requested from said

BIR Forms and to enable the said forms to be read by an Optical Character

Reader.

SECTION 3. Filing of New Income Tax Return Forms. —

All taxpayers required to file their Income Tax returns under section 51

(A) (1) of the Tax Code, and those not required to file under section 51 (A) (2)

but who nevertheless opt to do so, covering and starting with calendar year

2011 — due for filing on or before April 15, 2012, should use the following

revised forms:

1. BIR Form 1700 version November 2011 (Annual Income Tax

Return for Individuals Earning Purely Compensation Income);

2. BIR Form 1701 version November 2011 (Annual Income Tax

Return for Self-Employed Individuals, Estates and Trusts); and

3. BIR Form 1702 version November 2011 (Annual Income Tax

Return for Corporation, Partnership and Other Non-Individual

Taxpayer).

All juridical entities following fiscal year of reporting are likewise

required to use the new BIR Form 1702 starting with those covered under

fiscal year ending January 31, 2012. IDESTH

SECTION 4. Repealing Clause. —

All existing regulations and other issuances or portions thereof which

are inconsistent with the provisions of these Regulations are hereby

repealed, amended, or modified accordingly.

SECTION 5. Effectivity. —

These Regulations shall take effect covering income earned for taxable

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

year 2011.

(SGD.) CESAR V. PURISIMA

Secretary of Finance

Recommended by:

(SGD.) KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

ATTACHMENT

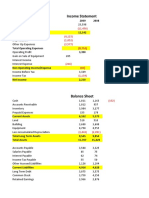

BIR FORM NO. 1700

Annual Income Tax Return

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

BIR FORM NO. 1701

Annual Income Tax Return

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

BIR FORM NO. 1702

Annual Income Tax Return

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

Published in Manila Bulletin on December 12, 2011.

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Cash Flow SolvedDocument3 pagesCash Flow SolvedRahul BindrooNo ratings yet

- ACC 110 - CFE - 21 22 With ANSWERSDocument25 pagesACC 110 - CFE - 21 22 With ANSWERSGiner Mabale Steven100% (2)

- February Payslip 2023.pdf - 1-2Document1 pageFebruary Payslip 2023.pdf - 1-2Arbaz KhanNo ratings yet

- Acct Project Question 4Document15 pagesAcct Project Question 4graceNo ratings yet

- BIR Revenue Regulation No-19-2011Document2 pagesBIR Revenue Regulation No-19-2011BusinessTips.PhNo ratings yet

- Draft : Financial HighlightsDocument4 pagesDraft : Financial Highlightssubashree RaghuramanNo ratings yet

- Ingredient Solutions: That Make Life BetterDocument19 pagesIngredient Solutions: That Make Life BetternawazNo ratings yet

- Nov 2021-97th EditionDocument13 pagesNov 2021-97th EditionSwathi JainNo ratings yet

- 325862-2022-Guidelines in The Filing of Annual Income Tax20220719-11-Pqk5qxDocument3 pages325862-2022-Guidelines in The Filing of Annual Income Tax20220719-11-Pqk5qxRen Mar CruzNo ratings yet

- US Internal Revenue Service: rp-98-31Document3 pagesUS Internal Revenue Service: rp-98-31IRSNo ratings yet

- RR 1999Document127 pagesRR 1999Maisie Rose VilladolidNo ratings yet

- Accountants of Pakistan: Assignment Questions - (Fall-2013 Session) Business Taxation Semester - 4Document8 pagesAccountants of Pakistan: Assignment Questions - (Fall-2013 Session) Business Taxation Semester - 4Adil HashmiNo ratings yet

- Income Tax Part 1 (Theory + MCQ)Document200 pagesIncome Tax Part 1 (Theory + MCQ)Neha SharmaNo ratings yet

- PGDFM Taxation Syllabus Notes PDF FormatDocument231 pagesPGDFM Taxation Syllabus Notes PDF Formatamrutahirukade2005No ratings yet

- Circular 7 2018Document2 pagesCircular 7 2018inti binduNo ratings yet

- Mo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven StoresDocument4 pagesMo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven Storesbuwa moNo ratings yet

- Revenue Regulations No. 25-20: September 30, 2020Document3 pagesRevenue Regulations No. 25-20: September 30, 2020rian.lee.b.tiangcoNo ratings yet

- Guidance NoteDocument410 pagesGuidance NotesandeepbhallaNo ratings yet

- TAX BRIEF AmendmentsMadeThroughFinanceAct - 2022Document39 pagesTAX BRIEF AmendmentsMadeThroughFinanceAct - 2022haiderNo ratings yet

- Switching Technologies Günther LimitedDocument34 pagesSwitching Technologies Günther LimitedJack SpiroNo ratings yet

- Peza MC 2021-051Document6 pagesPeza MC 2021-051rajgonzNo ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2JejomarNo ratings yet

- Income Tax Declaration User Manual: Fc&A Services - Taxation TeamDocument6 pagesIncome Tax Declaration User Manual: Fc&A Services - Taxation TeammikekikNo ratings yet

- CINDocument74 pagesCINJanki RawatNo ratings yet

- Revenue Regulation 1-2013Document7 pagesRevenue Regulation 1-2013Jerwin DaveNo ratings yet

- Checklist of RequirementsDocument1 pageChecklist of RequirementsamaelferiaNo ratings yet

- Manual Return Ty 2017Document56 pagesManual Return Ty 2017Muhammad RizwanNo ratings yet

- Volume 1 - 75 PagesDocument75 pagesVolume 1 - 75 PagesMarsNo ratings yet

- Zeal Notice, Auditors & Directors Report AY 12-13Document10 pagesZeal Notice, Auditors & Directors Report AY 12-13Kamalalakshmi NarayananNo ratings yet

- Circular-No-10-2022 Income Tax ActDocument4 pagesCircular-No-10-2022 Income Tax Actsaurabh14014No ratings yet

- Revenue Memorandum Circular No. 028-19Document2 pagesRevenue Memorandum Circular No. 028-19Alvin AgullanaNo ratings yet

- Rmo 1 2012Document4 pagesRmo 1 2012Earl PatrickNo ratings yet

- Balance SheetDocument17 pagesBalance SheetvineminaiNo ratings yet

- 5E Kenya Budget Highlights and Analysis 2017Document17 pages5E Kenya Budget Highlights and Analysis 2017STRATEGIC REGISTRARNo ratings yet

- Report BE210 - Solution To The AnswersDocument5 pagesReport BE210 - Solution To The AnswersWasim ShahzadNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceHanabishi RekkaNo ratings yet

- Statement of Managements ResponsibilityDocument1 pageStatement of Managements ResponsibilityDonnie Ray DistajoNo ratings yet

- Circular No 10 2022Document4 pagesCircular No 10 2022Shobhit ShuklaNo ratings yet

- Itr Deadline Extended ITR Filing, Tax Audit Report Deadlines For FY 2020-21 Extended by CBDT - The Economic TimesDocument1 pageItr Deadline Extended ITR Filing, Tax Audit Report Deadlines For FY 2020-21 Extended by CBDT - The Economic TimesVittal TalwarNo ratings yet

- Income Tax - Guidelines Financial Year 2022-23Document13 pagesIncome Tax - Guidelines Financial Year 2022-23Pradeep KVKNo ratings yet

- REVENUE REGULATIONS Issued On The 1st Semester of 2021Document71 pagesREVENUE REGULATIONS Issued On The 1st Semester of 2021HC LawNo ratings yet

- 1700 Job AidDocument12 pages1700 Job AidAljohn Stephen Dela cruzNo ratings yet

- TDS Rates and ReturnsDocument3 pagesTDS Rates and ReturnsKashishKumarNo ratings yet

- Taxguru - In-Extended Due Dates of Income Tax Return Tax Audit TP AuditDocument5 pagesTaxguru - In-Extended Due Dates of Income Tax Return Tax Audit TP AuditJessica NulphNo ratings yet

- E-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyDocument38 pagesE-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyRaj Kumar M0% (2)

- Index For Income TaxDocument20 pagesIndex For Income TaxSandyNo ratings yet

- Banking Finance 2017033Document8 pagesBanking Finance 2017033saurabh3129No ratings yet

- Quiz 2Document24 pagesQuiz 2Lee TeukNo ratings yet

- Filing of Income Tax ReturnDocument11 pagesFiling of Income Tax Returnkirko100% (1)

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- Ca IfrsDocument7 pagesCa IfrsyogeshNo ratings yet

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoNo ratings yet

- Instruction For The Completion of Income Tax Return For Corporate in IndonesiaDocument51 pagesInstruction For The Completion of Income Tax Return For Corporate in IndonesiaJonathan Bara DiskaPutra KrisnantoNo ratings yet

- BCO 11 Block 03Document70 pagesBCO 11 Block 03Al OkNo ratings yet

- Budget Proposals 2021 (Kreston Sri Lanka)Document45 pagesBudget Proposals 2021 (Kreston Sri Lanka)Sri Lankan Travel BlogNo ratings yet

- OLD Income Tax Performa-2021-22Document13 pagesOLD Income Tax Performa-2021-22Research AccountNo ratings yet

- Guidelines TaxRelatedDeclarations2021 22 - MAILDocument22 pagesGuidelines TaxRelatedDeclarations2021 22 - MAILLalit mohan PradhanNo ratings yet

- SJMS Associates Budget Highlights 2012Document42 pagesSJMS Associates Budget Highlights 2012Tharindu PereraNo ratings yet

- SAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.Document56 pagesSAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.imran mughalNo ratings yet

- HAC - Tax Memorandum 2022-23-FinalDocument18 pagesHAC - Tax Memorandum 2022-23-FinalAsad ZahidNo ratings yet

- The Bureau of Internal RevenueDocument2 pagesThe Bureau of Internal RevenueSamuel EviaNo ratings yet

- Final IND AS Summary For Nov 19-CA PS BeniwalDocument15 pagesFinal IND AS Summary For Nov 19-CA PS BeniwalChirag AggarwalNo ratings yet

- RR - 3-2021 - Tax-Related Info - As of 20210409Document10 pagesRR - 3-2021 - Tax-Related Info - As of 20210409LLYOD FRANCIS LAYLAYNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 2023 - 20230721 - SEC MSRD - Notice20230817 11 6mtti7Document5 pages2023 - 20230721 - SEC MSRD - Notice20230817 11 6mtti7JM CBNo ratings yet

- 2011 Santos - v. - Qui - Ones20230310 12 15jkj7pDocument3 pages2011 Santos - v. - Qui - Ones20230310 12 15jkj7pJM CBNo ratings yet

- Nwanaka v. Quijano20230310-12-Wim21oDocument4 pagesNwanaka v. Quijano20230310-12-Wim21oJM CBNo ratings yet

- Magsino v. Retoriano20220909-11-J57gtDocument2 pagesMagsino v. Retoriano20220909-11-J57gtJM CBNo ratings yet

- Manilag v. Bautista20230310-12-VmbeqkDocument5 pagesManilag v. Bautista20230310-12-VmbeqkJM CBNo ratings yet

- 2004 Comelec - Very - Urgent - Advisory20210424 14 5ip2wlDocument1 page2004 Comelec - Very - Urgent - Advisory20210424 14 5ip2wlJM CBNo ratings yet

- 57241-1959-Income Tax of New and Necessary Industries20210519-11-PfpfswDocument2 pages57241-1959-Income Tax of New and Necessary Industries20210519-11-PfpfswJM CBNo ratings yet

- Technology Recommendations On The 2019 National and Local ElectionsDocument5 pagesTechnology Recommendations On The 2019 National and Local ElectionsJM CBNo ratings yet

- 62483-1991-Adjustment of Income Tax Exemptions20210519-11-Mu3ldsDocument2 pages62483-1991-Adjustment of Income Tax Exemptions20210519-11-Mu3ldsJM CBNo ratings yet

- 193678-2015-Requirements On The Maritime Occupational20210424-14-X7o8nrDocument4 pages193678-2015-Requirements On The Maritime Occupational20210424-14-X7o8nrJM CBNo ratings yet

- 6342 1993 Separation - Pay Tax - Exempt20210505 12 1s3nsv5Document2 pages6342 1993 Separation - Pay Tax - Exempt20210505 12 1s3nsv5JM CBNo ratings yet

- 2020morb 3Document1,290 pages2020morb 3JM CBNo ratings yet

- PSA Authorization LetterDocument1 pagePSA Authorization LetterJM CBNo ratings yet

- ) NDA (Foreign Counterparty)Document5 pages) NDA (Foreign Counterparty)JM CBNo ratings yet

- Amended Draft Circular Transfer of Significant InterestDocument13 pagesAmended Draft Circular Transfer of Significant InterestJM CBNo ratings yet

- 1999 BIR - Ruling - DA 087 99 - 20210505 13 16oil1yDocument2 pages1999 BIR - Ruling - DA 087 99 - 20210505 13 16oil1yJM CBNo ratings yet

- For Birth Certificate - Joint Affidavit of Two Disinterested PersonsDocument1 pageFor Birth Certificate - Joint Affidavit of Two Disinterested PersonsJM CB100% (1)

- Task 1Document3 pagesTask 1Simran GanganeNo ratings yet

- MARCH 2020 AnswerDocument16 pagesMARCH 2020 AnswerXianFa WongNo ratings yet

- IBM Balance SheetDocument7 pagesIBM Balance Sheettahseen7fNo ratings yet

- Fabm2 Q3 M2-3Document10 pagesFabm2 Q3 M2-3Jessamine Romano AplodNo ratings yet

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamNo ratings yet

- Tax 2 TSN Complete PDFDocument131 pagesTax 2 TSN Complete PDFIan M. LasacaNo ratings yet

- Chapter TwoDocument16 pagesChapter TwoHananNo ratings yet

- Test Bank For Mcgraw Hills Taxation of Individuals and Business Entities 2016 Edition 7th Edition Full DownloadDocument94 pagesTest Bank For Mcgraw Hills Taxation of Individuals and Business Entities 2016 Edition 7th Edition Full DownloadkristinwilliamscmwtgznejdNo ratings yet

- CAPITAL BUDGETING HandoutDocument2 pagesCAPITAL BUDGETING HandoutAndrea TorcendeNo ratings yet

- Budgetting 1Document6 pagesBudgetting 1rhenz villafuerteNo ratings yet

- Cash Flows Statement - Two ExamplesDocument4 pagesCash Flows Statement - Two Examplesakash srivastavaNo ratings yet

- January Salary SlipDocument1 pageJanuary Salary SlipAmanNo ratings yet

- Semester Paper CostDocument4 pagesSemester Paper CostMd HussainNo ratings yet

- BB LTD Company AnalysisDocument15 pagesBB LTD Company Analysispatrick wafulaNo ratings yet

- Chapter 3 - Deferred TaxDocument61 pagesChapter 3 - Deferred Taxansath193No ratings yet

- Chapter 5 SolutionsDocument29 pagesChapter 5 SolutionsFahad BataviaNo ratings yet

- Pepsico Inc 2019 Annual ReportDocument1 pagePepsico Inc 2019 Annual ReportToodley DooNo ratings yet

- Final Exam TaxDocument3 pagesFinal Exam TaxMulugeta Akalu50% (4)

- Income Taxation 01 Chapter 1 Summary - CompressDocument7 pagesIncome Taxation 01 Chapter 1 Summary - CompressALTHEA REN'EE LIMPAONo ratings yet

- EVALUATING Financial Business PlanDocument21 pagesEVALUATING Financial Business PlanEunice GithuaNo ratings yet

- Final Income TaxDocument27 pagesFinal Income TaxKai Son-MyoiNo ratings yet

- Finance ActDocument2 pagesFinance Actrakshitha9reddy-1No ratings yet

- Section B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?Document11 pagesSection B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?18071369 Nguyễn ThànhNo ratings yet

- Full Download Solution Manual For Mcgraw Hills Taxation of Business Entities 2020 Edition 11th by Spilker PDF Full ChapterDocument35 pagesFull Download Solution Manual For Mcgraw Hills Taxation of Business Entities 2020 Edition 11th by Spilker PDF Full Chapterbenjaminmckinney3l5cv100% (21)

- Local Media3073034167591689534Document6 pagesLocal Media3073034167591689534Desiree Nicole ReyesNo ratings yet

- English For Financial Markets2Document72 pagesEnglish For Financial Markets2Zijian ZHUNo ratings yet