Professional Documents

Culture Documents

Form12BB FY2223

Form12BB FY2223

Uploaded by

guruOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form12BB FY2223

Form12BB FY2223

Uploaded by

guruCopyright:

Available Formats

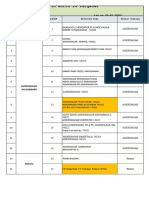

Page No : 1

T705604 Jan 2023 FY20238137021

Tax Proof FY 22-23

RefNo:7056

Employee Code 8137021 Name Raghavendra M R

Department 400 PAN DPYPR4870B

Rent

Landlord

Rental Other Rental Rental Landlord Landlord PAN Landlord Landlord Landlord Address

Rent Month Location Location Amount Address Name 1 1 Address 1 Name 2 PAN 2 2

August Others Bangalore 35000 hayigriva Reddappa AWVPR1835K hayigriva

Nilya, 3rd MV Nilya, 3rd

cross, greens cross, greens

residency, residency,

chimasandra, chimasandra,

bangalore - bangalore -

560049 560049

September Others Bangalore 35000 hayigriva Reddappa AWVPR1835K hayigriva

Nilya, 3rd MV Nilya, 3rd

cross, greens cross, greens

residency, residency,

chimasandra, chimasandra,

bangalore - bangalore -

560049 560049

October Others Bangalore 35000 hayigriva Reddappa AWVPR1835K hayigriva

Nilya, 3rd MV Nilya, 3rd

cross, greens cross, greens

residency, residency,

chimasandra, chimasandra,

bangalore - bangalore -

560049 560049

November Others Bangalore 35000 hayigriva Reddappa AWVPR1835K hayigriva

Nilya, 3rd MV Nilya, 3rd

cross, greens cross, greens

residency, residency,

chimasandra, chimasandra,

bangalore - bangalore -

560049 560049

December Others Bangalore 35000 hayigriva Reddappa AWVPR1835K hayigriva

Nilya, 3rd MV Nilya, 3rd

cross, greens cross, greens

residency, residency,

chimasandra, chimasandra,

bangalore - bangalore -

560049 560049

January Others Bangalore 35000 hayigriva Reddappa AWVPR1835K hayigriva

Nilya, 3rd MV Nilya, 3rd

cross, greens cross, greens

residency, residency,

chimasandra, chimasandra,

bangalore - bangalore -

Employee Code : 8137021 Date : 04 Jan 2023

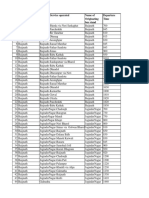

Page No : 2

560049 560049

February Others Bangalore 35000 hayigriva Reddappa AWVPR1835K hayigriva

Nilya, 3rd MV Nilya, 3rd

cross, greens cross, greens

residency, residency,

chimasandra, chimasandra,

bangalore - bangalore -

560049 560049

March Others Bangalore 35000 hayigriva Reddappa AWVPR1835K hayigriva

Nilya, 3rd MV Nilya, 3rd

cross, greens cross, greens

residency, residency,

chimasandra, chimasandra,

bangalore - bangalore -

560049 560049

I hereby digitally accept that the investments/expenses provided have been incurred by me out of my income chargeable to

income-tax during the financial year. I also certify that the attachments provided are true and correct to the best of my knowledge

and understanding. I confirm they are not claimed elsewhere. I understand that the Company reserves the right to conduct

investigation and take appropriate action in case any supporting documents are ascertained to be un-true or incorrect.

I will be solely and wholly responsible to handle any queries from any competent officials and / or to submit all relevant original

documents to Income Tax/Competent Authorities. I am fully aware of the relevant income tax laws in force regarding the nature of

proof required to claim the tax exemption and I will be held responsible for any consequences and any liabilities arise out of this.

This declaration is made in electronic form by filling information on the portal after login and hence deemed signed by you on

submission.

Employee Code : 8137021 Date : 04 Jan 2023

Page No : 3

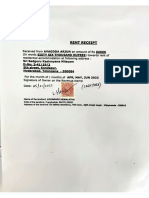

FORM NO. 12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee: Raghavendra M R

658, Venkateshwara Nilaya, 5th Cross, Nisarga Layout,

Basavanpura Main Road, K R Puram, Bangalore Bangalore

560035

2. Permanent Account Number of the employee: DPYPR4870B

3. Financial year: 2022 - 2023

Details of claims and evidence thereof

SI.No Nature of claim Amount Evidence / particulars

(Rs.)

(1) (2) (3) (4)

1. House Rent Allowance:

(i) Rent paid to the landlord 280000

(ii) Name of the landlord

1. Reddappa M V

(iii) Address of the landlord

1. hayigriva Nilya, 3rd cross,

greens residency,

chimasandra, bangalore -

560049

(iv) Permanent Account Number of the landlord

1. AWVPR1835K

Note: Permanent Account Number shall be furnished if the

aggregate rent paid during the previous year exceeds one lakh

rupees

2. Leave travel concessions or assistance

3. Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

(ii)Name of the lender

(iii) Address of the lender

(iv) Permanent Account Number of the lender

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

Employee Code : 8137021 Date : 04 Jan 2023

Page No : 4

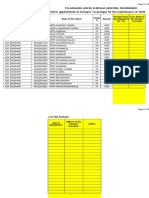

4. Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

Verification

I, Raghavendra M R ,son/daughter of ____________________ do hereby certify that the information given above is complete and correct.

Place : BLR ATC

Digitally accepted by 8137021, Raghavendra M R, 04/01/2023,

Date : 04/01/2023 116.75.83.181

(Signature of the employee)

Designation : Lead Consultant - Technology Full Name: Raghavendra M R

Employee Code : 8137021 Date : 04 Jan 2023

You might also like

- Embark Sri LankaDocument46 pagesEmbark Sri LankaShayy67% (9)

- Vietnam BIDV Bank StatementDocument1 pageVietnam BIDV Bank Statement张慧萍No ratings yet

- Cases AnswerDocument4 pagesCases Answerjonna laysonNo ratings yet

- HEARSAYreporting Islcollective Worksheets Upperintermediate b2 Advanced c1 Proficient c2Document4 pagesHEARSAYreporting Islcollective Worksheets Upperintermediate b2 Advanced c1 Proficient c2Tijana CurcicNo ratings yet

- Complete Notes On Special Sit Class Joel Greenblatt 2Document311 pagesComplete Notes On Special Sit Class Joel Greenblatt 2eric_stNo ratings yet

- Form12BB FY2223 WITH SIGNEDDocument4 pagesForm12BB FY2223 WITH SIGNEDguruNo ratings yet

- Tax Proof FormsDocument8 pagesTax Proof FormsguruNo ratings yet

- E-Construct Design and Build PVT LTDDocument4 pagesE-Construct Design and Build PVT LTDmohammed ameenNo ratings yet

- Adhoc Request - Carlsberg BandhanDocument18 pagesAdhoc Request - Carlsberg BandhanJoyel DsouzaNo ratings yet

- TC Data 05 APR 2017Document954 pagesTC Data 05 APR 2017Uday kumarNo ratings yet

- List of Villages (Below 2000 Population) Covered by Bank Through BC ModelDocument234 pagesList of Villages (Below 2000 Population) Covered by Bank Through BC ModelAnuj SinghNo ratings yet

- Vrdfcu8508 - Allocation - August 18-BVILDocument404 pagesVrdfcu8508 - Allocation - August 18-BVILSamsRsNo ratings yet

- Containment Zones in North 24 Parganas: - As On 05-07-2020Document55 pagesContainment Zones in North 24 Parganas: - As On 05-07-2020Samantha SinghNo ratings yet

- Chittor Sand ReachesDocument5 pagesChittor Sand Reachessrinivas rao100% (1)

- Sr. No. Name of Depot Name of Service Operated Name of Originating Bus Stand Departure TimeDocument5 pagesSr. No. Name of Depot Name of Service Operated Name of Originating Bus Stand Departure TimeAbhishek SharmaNo ratings yet

- LicenseDocument132 pagesLicenseRanjith KumarNo ratings yet

- WWW Bandbaajabarat Com Vendors All Event PlannerDocument11 pagesWWW Bandbaajabarat Com Vendors All Event PlannerbandbaajabaratNo ratings yet

- Rent Receipt: Hyderabad. Telangana - 500084Document1 pageRent Receipt: Hyderabad. Telangana - 500084Sai SiriNo ratings yet

- HDFC Bank MasterDocument138 pagesHDFC Bank MasterYash MehtaNo ratings yet

- November - 2023Document4 pagesNovember - 2023Rohit ParmarNo ratings yet

- Hyd Live ProjectsDocument126 pagesHyd Live Projectsabdul.sNo ratings yet

- Tally Integrated PropertiesDocument3 pagesTally Integrated PropertiesGreat HelperNo ratings yet

- Internship SheetDocument8 pagesInternship SheetVartika NagarNo ratings yet

- Old Commercial-Rate List 12-13Document72 pagesOld Commercial-Rate List 12-13Kamini SrivastavNo ratings yet

- PpflistofbrsDocument104 pagesPpflistofbrsVape Lion DubaiNo ratings yet

- INDocument481 pagesINSUBIRMITRANo ratings yet

- Rent Receipt: 5th Street, KondapurDocument1 pageRent Receipt: 5th Street, KondapurSai SiriNo ratings yet

- Directorate of Indian Medicines & Homoeopathy, Orissa, Bhubaneswar Listof The Homoeopathic Dispensaries KalahandiDocument1 pageDirectorate of Indian Medicines & Homoeopathy, Orissa, Bhubaneswar Listof The Homoeopathic Dispensaries KalahandiPradyumna Kumar SabarNo ratings yet

- Lions Club of Bangalore Sundarnagar e Scrap Book Upto December 18Document64 pagesLions Club of Bangalore Sundarnagar e Scrap Book Upto December 18Vinay BabanagarNo ratings yet

- Irs Demographics and Media ConsumptionDocument67 pagesIrs Demographics and Media ConsumptionPradip PandaNo ratings yet

- Tender Notice UpdatedDocument7 pagesTender Notice UpdatedsachinardeNo ratings yet

- Travelled From Ankleshwar To MehasanaDocument51 pagesTravelled From Ankleshwar To MehasanaVinod S INo ratings yet

- 2nd Part South ParagnaDocument30 pages2nd Part South Paragnaarbaz khanNo ratings yet

- Details Called For Appointment of Sweeper / Scavenger For The Maintenance of Toilets in The SchoolsDocument2 pagesDetails Called For Appointment of Sweeper / Scavenger For The Maintenance of Toilets in The SchoolsAnil KonakantiNo ratings yet

- NOVA Campaigns 2021 22.Document1,343 pagesNOVA Campaigns 2021 22.Harshit HandaNo ratings yet

- Vaccine Slots 27-06-2021Document1,506 pagesVaccine Slots 27-06-2021Ashutosh RaiNo ratings yet

- Daily Conveyance Expense SheetDocument3 pagesDaily Conveyance Expense Sheetjamshed idcolNo ratings yet

- List of 572 Properties For Mega Eauction 10th Novenber 2022 30th 03 17Document47 pagesList of 572 Properties For Mega Eauction 10th Novenber 2022 30th 03 17BharatAIMNo ratings yet

- Bulk Supply - Red - 20-26 NovDocument133 pagesBulk Supply - Red - 20-26 NovBUKA RAMAKANTHNo ratings yet

- NEET 2023 Exam Cities ListDocument17 pagesNEET 2023 Exam Cities Listlawor40771No ratings yet

- District Wise NABARD DDM DetailsDocument1 pageDistrict Wise NABARD DDM Detailsrapc80No ratings yet

- For DisbDocument144 pagesFor Disbvicky.vccl.jlgNo ratings yet

- List of Villages (Above 2000 Population) Covered by Bank Through BC ModelDocument55 pagesList of Villages (Above 2000 Population) Covered by Bank Through BC ModelAnuj SinghNo ratings yet

- No Nama Kader Nama Posyandu Desa Tanda Tangan Jumlah Bulan Biaya Per Bulan Jumlah Di TerimaDocument8 pagesNo Nama Kader Nama Posyandu Desa Tanda Tangan Jumlah Bulan Biaya Per Bulan Jumlah Di TerimaMunawir MunNo ratings yet

- Chapter 05 B PDFDocument237 pagesChapter 05 B PDFronuoiNo ratings yet

- NOVA Campaigns 2021 22.Document1,343 pagesNOVA Campaigns 2021 22.Harshit HandaNo ratings yet

- PDF CropDocument11 pagesPDF CropTecnoji GamerNo ratings yet

- SBI BPC-ro-list-for-pos-redemptionDocument23 pagesSBI BPC-ro-list-for-pos-redemptionSoumabha BhimNo ratings yet

- Book 1Document4 pagesBook 1saswatimishra62No ratings yet

- 33kv Alternate SupplyDocument11 pages33kv Alternate Supplysrikanth chippaNo ratings yet

- KSFC Dec 22Document7 pagesKSFC Dec 22IFFCO TOKIONo ratings yet

- ITI Gradings - MSDEDocument255 pagesITI Gradings - MSDEsatishnamalaNo ratings yet

- Apollo ClinicsDocument34 pagesApollo ClinicsChaitanya TallapaneniNo ratings yet

- Aganampudi R.NO. LISTDocument4 pagesAganampudi R.NO. LISTRaju TummaNo ratings yet

- Laporan Revenue TGL 13 Nov - 18 Nov 2023Document24 pagesLaporan Revenue TGL 13 Nov - 18 Nov 2023Anasthasia ManaluNo ratings yet

- Presentation for Bangladesh Studies. Section B. AfnanDocument16 pagesPresentation for Bangladesh Studies. Section B. Afnanafnan mannaNo ratings yet

- Post Code of Gazipur DistrictDocument5 pagesPost Code of Gazipur DistrictFarzana HappyNo ratings yet

- Kerala OLADocument16 pagesKerala OLAZaheer SiddiquiNo ratings yet

- Lic Premium CentreDocument13 pagesLic Premium Centrehiteshmohakar15No ratings yet

- Odisha State Financial Inclusion Cell Update Status (Ganjam District-37 Village)Document6 pagesOdisha State Financial Inclusion Cell Update Status (Ganjam District-37 Village)AnupamaNo ratings yet

- LableDocument1 pageLableSteelForge GamerNo ratings yet

- RJ Pol ObsDocument4 pagesRJ Pol ObsKamesh tanwarNo ratings yet

- Tehsil Part PDFDocument1,638 pagesTehsil Part PDFSridhar RaparthiNo ratings yet

- List of Designated Depot of DCP States - 1Document50 pagesList of Designated Depot of DCP States - 1AvijitSinharoyNo ratings yet

- Tax Proof FormsDocument1 pageTax Proof FormsguruNo ratings yet

- House Rent ReceiptDocument8 pagesHouse Rent ReceiptguruNo ratings yet

- Tax Proof FormsDocument8 pagesTax Proof FormsguruNo ratings yet

- Form12BB FY2223 WITH SIGNEDDocument4 pagesForm12BB FY2223 WITH SIGNEDguruNo ratings yet

- DBCR00527722265 00Document2 pagesDBCR00527722265 00guruNo ratings yet

- A Possible Framework For Your WorkDocument2 pagesA Possible Framework For Your Workkn7m2dnwvkNo ratings yet

- Gradable and Ungradable Adjectives ExercisesDocument2 pagesGradable and Ungradable Adjectives ExercisesVictor YaconoNo ratings yet

- NF EN 15221-3 - 2011 (Anglaise)Document48 pagesNF EN 15221-3 - 2011 (Anglaise)Emmanuel Boquet100% (1)

- RoD BloodlineDocument13 pagesRoD BloodlineChris FalcoNo ratings yet

- Paket Coffee Break & Lunch BoxDocument1 pagePaket Coffee Break & Lunch BoxAlan Bin HarNo ratings yet

- UNIT 1 / Pre-Intermediate Generations: Didn't Go (Go / Not) To A Movie Last Night. I Stayed (Stay) at HomeDocument24 pagesUNIT 1 / Pre-Intermediate Generations: Didn't Go (Go / Not) To A Movie Last Night. I Stayed (Stay) at HomeEren KırıcıNo ratings yet

- Virtue EthicsDocument6 pagesVirtue EthicsTheLight7 Dark6No ratings yet

- Cosca V PalaypayonDocument1 pageCosca V PalaypayonAngelicaNo ratings yet

- Difference B/W Financial Creditor and Operational Creditor Under IBC, 2016Document5 pagesDifference B/W Financial Creditor and Operational Creditor Under IBC, 2016Ezhil KaviyaNo ratings yet

- Sample of Analytical EssayDocument3 pagesSample of Analytical Essaypylbfjbaf100% (2)

- MDG AssignmentDocument11 pagesMDG AssignmentfostinaNo ratings yet

- Welcome To Ninjacart. Everything You Need To Know About - by Ninjacart - Ninjacart - MediumDocument13 pagesWelcome To Ninjacart. Everything You Need To Know About - by Ninjacart - Ninjacart - MediumebeNo ratings yet

- Wal MartDocument21 pagesWal MartSeptember Irish MaldonadoNo ratings yet

- Public Transport Interchange Design Guidelines PDFDocument89 pagesPublic Transport Interchange Design Guidelines PDFaprilia nurul hanissaNo ratings yet

- Written Prelims ReviewerDocument1 pageWritten Prelims ReviewerSean MaglacasNo ratings yet

- Latest LSC TT Asgn Submission J-2021Document2 pagesLatest LSC TT Asgn Submission J-2021rohitbanerjeeNo ratings yet

- Mohammad Hakim Bin Hasnul Arien Heryansyah, Tarmizi IsmailDocument17 pagesMohammad Hakim Bin Hasnul Arien Heryansyah, Tarmizi IsmailVsascirega VvadivalooNo ratings yet

- Doctor of Philosophy in CommerceDocument18 pagesDoctor of Philosophy in CommerceNishant KushwahaNo ratings yet

- Obligations: GR: Obligation Is Not Demandable Before Lapse of The PeriodDocument1 pageObligations: GR: Obligation Is Not Demandable Before Lapse of The PeriodDiane CabiscuelasNo ratings yet

- G.R. No. 143993 McDonalds v. LC Big MakDocument16 pagesG.R. No. 143993 McDonalds v. LC Big MakNat ImperialNo ratings yet

- Activation Process For Android Mobile CA Inter NovDocument3 pagesActivation Process For Android Mobile CA Inter NovNandan GambhirNo ratings yet

- Chapter 3 Strat CostDocument19 pagesChapter 3 Strat CostAngela AquinoNo ratings yet

- Umer Afzal 70073638 Ass# 1Document3 pagesUmer Afzal 70073638 Ass# 1Muhammad Umer AfzalNo ratings yet

- Topic 3: The Manunggul JARDocument21 pagesTopic 3: The Manunggul JARKenneth JameroNo ratings yet

- 1 (C & D) 1st Phase English3InOne - by Razibul Hoq RazDocument20 pages1 (C & D) 1st Phase English3InOne - by Razibul Hoq RazKamal BU100% (1)