Professional Documents

Culture Documents

Transaction Statement1673011931

Transaction Statement1673011931

Uploaded by

SAMIR KUMAROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transaction Statement1673011931

Transaction Statement1673011931

Uploaded by

SAMIR KUMARCopyright:

Available Formats

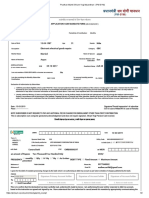

CENTRAL RECORDKEEPING AGENCY

Transaction Statement-ATAL PENSION YOJANA (APY) for the period of:01-Apr-2015 to 31-Mar-2016

Subscriber Details

PRAN : 500235863498 Statement Date : Jan 06, 2023 07:02 PM

Name : MR SAMIR BARUI PRAN Generation

: 15-Feb-2018

Date

: C/O SUPER SMELTERS LIMITED EMP CODE 71922 JAMURIA

INDUSTRIAL AREA PO IKRA Date Of Birth : 10-Apr-1994

JAMURIA

Saving Bank A/C No. : 50100182029626

WEST BENGAL713362

INDIA APY-SP Bank Reg. APY-SP Bank Branch

: 7000965 : NPS162605E

no. Reg. No.

IRA Status : IRA compliant

APY-SP Bank Name : HDFC BANK LTD APY-SP Bank Branch : HDFC-ASANSOL - WEST

Name BENGAL-324

Mobile Number : 9749352695

Pension Amount

: 1000

Email ID :SAMIRBARUI95@GMAIL.COM Selected

Periodicity of

: Monthly

Contribution

Spouse Name

:

AADHAAR :

Nominee Name BIJALA BARUI Percentage 100%

The total contribution to your pension account till March 31,2016 was Rs.0.00

The details of your Transaction are as under

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Govt. Co-

Date Particulars Uploaded By Subscriber

Contribution/Overdue Total

Contribution

Charges (Rs)

(Rs)

(Rs)

01-Apr-2015 Opening balance 0.00

31-Mar-2016 Closing Balance 0.00

Billing Summary

No records found for the selected period

Government Co-contribution Details

No records found for the selected period

Notes for Transaction Statement::

1. The section 'Contribution Details' gives the details of the contributions processed in subscriber's account during the period.

The Central Government would co-contribute 50% of the total contribution or Rs.1000 per annum, whichever is lower, to each eligible subscriber for

a period of 5 years, i.e., from Financial Year 2015-16 to 2019-20, who joins APY before March 31, 2016 and who are not members of any statutory

2.

social security scheme & who are not income tax payers. This Government co-contribution is payable into subscriber's savings bank account half

yearly basis in a Financial Year once subscriber has made the entire contribution for six months.

3. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

The balances and respective narrations reflecting in your account are based on the contribution amount and details uploaded by your APY bank

4. branch. In case there is no/less/excess contribution for any month or no clarity in the narration, please contact your APY Bank Branch. In case of any

discrepancy, you must contact your APY bank branch immediately.

Contribution amount is invested as per the guidelines of Government of India (upto 85% of the money will be invested in debt and government

5.

securities and upto 15% will be invested in equity).

Legends

Term Description

Under APY, the individual subscribers shall have an option to make the contribution on a monthly, quarterly, half yearly basis. Banks are required to collect additional amount for delayed

payments. The overdue interest for delayed contributions would be as shown below: Overdue interest for delayed contribution:Rs. 1 per month for contribution for every Rs. 100, or part

Overdue interest

thereof, for each delayed monthly payment. Overdue interest for delayed contribution for quarterly / half yearly mode of contribution shall be recovered accordingly. The overdue interest

amount collected will remain as part of the pension corpus of the subscriber.

You might also like

- Payslip 25 09 2020 1Document1 pagePayslip 25 09 2020 1Monica SzollosiNo ratings yet

- InvoiceDocument1 pageInvoiceUdit jainNo ratings yet

- Reliance General Insurance Company Limited: Reliance Private Car Package Policy-ScheduleDocument9 pagesReliance General Insurance Company Limited: Reliance Private Car Package Policy-ScheduleFarhana PervinNo ratings yet

- Continuing Case Part 1Document20 pagesContinuing Case Part 1api-309341411No ratings yet

- Problem 1 Citisavings Bill-Processing OperationsDocument18 pagesProblem 1 Citisavings Bill-Processing OperationsCamille SantosNo ratings yet

- Transaction Statement1676126669Document1 pageTransaction Statement1676126669Vasanth EllendulaNo ratings yet

- Transaction Statement1563132579Document1 pageTransaction Statement1563132579Vincent VNo ratings yet

- Transaction Statement1656568636Document2 pagesTransaction Statement1656568636Gulzar Ali QadriNo ratings yet

- Transaction Statement1627022355Document1 pageTransaction Statement1627022355RamakantaSahooNo ratings yet

- Transaction Statement1676376886Document2 pagesTransaction Statement1676376886mukeshpradhan675No ratings yet

- Transaction Statement1624372022Document1 pageTransaction Statement1624372022RamakantaSahooNo ratings yet

- Welcome To Central Record Keeping Agency PDFDocument2 pagesWelcome To Central Record Keeping Agency PDFparthi janaNo ratings yet

- Welcome To Central Record Keeping Agency 22-23Document2 pagesWelcome To Central Record Keeping Agency 22-23tsvvpkumarNo ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- Wa0007Document2 pagesWa0007sandhya.iyyanar1992No ratings yet

- Transaction Statement1705415418Document1 pageTransaction Statement1705415418bhavanakatakam0No ratings yet

- Account Statement 2019-2020Document2 pagesAccount Statement 2019-2020suhasNo ratings yet

- Transaction Statement1703726923Document2 pagesTransaction Statement1703726923dipuhansda6300No ratings yet

- Transaction Statement1698469666Document2 pagesTransaction Statement1698469666rk370666No ratings yet

- Welcome To Central Record Keeping Agency 2023Document2 pagesWelcome To Central Record Keeping Agency 2023pratik patilNo ratings yet

- Welcome To Central Record Keeping Agency - PRDocument2 pagesWelcome To Central Record Keeping Agency - PRAbhishek SenguptaNo ratings yet

- Transaction Statement1705397004Document2 pagesTransaction Statement1705397004sureshpatil25No ratings yet

- Welcome To Central Record Keeping Agency 2019Document2 pagesWelcome To Central Record Keeping Agency 2019pratik patilNo ratings yet

- Transaction Statement1700677173Document2 pagesTransaction Statement1700677173Madhav LungareNo ratings yet

- Pradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Document2 pagesPradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Honey Ali33% (3)

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- Welcome To Central Record Keeping AgencyDocument2 pagesWelcome To Central Record Keeping AgencyAbhishek SenguptaNo ratings yet

- WHRBG 1224421 Payslip 02 2019 PDFDocument1 pageWHRBG 1224421 Payslip 02 2019 PDFAmit RamaniNo ratings yet

- Arunkumar Ravi Veli240424cr319250880Document11 pagesArunkumar Ravi Veli240424cr319250880Rathish KumarNo ratings yet

- Balwinder Singh - PUNJ230421CR506736086Document2 pagesBalwinder Singh - PUNJ230421CR506736086Sajan BokoliaNo ratings yet

- Cattle Insurance Policy UIN NUMBER - IRDAN190RP0152V01100001Document3 pagesCattle Insurance Policy UIN NUMBER - IRDAN190RP0152V01100001sandeepNo ratings yet

- Date:13-10-2015 Accounts OfficerDocument1 pageDate:13-10-2015 Accounts OfficerchozhaganNo ratings yet

- Vijay Kumar CrifDocument3 pagesVijay Kumar CrifSajan BokoliaNo ratings yet

- Annexure KDocument1 pageAnnexure KHeet ShahNo ratings yet

- Renewal Notice: Policy No.P/151115/01/2018/008058Document1 pageRenewal Notice: Policy No.P/151115/01/2018/008058Khel Manoranjan Mitra MandalNo ratings yet

- Reliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy ScheduleDocument5 pagesReliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy Schedulezaid AhmedNo ratings yet

- Acctstmt LDocument8 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- Pre Invoice Car No Mh48aw9545Document3 pagesPre Invoice Car No Mh48aw9545Amit KirtawadeNo ratings yet

- Mamta RaniDocument2 pagesMamta RaniAjay AroraNo ratings yet

- PDFDocument6 pagesPDFShwethaNo ratings yet

- Vijay Yogi SipDocument1 pageVijay Yogi SipAmit YadavNo ratings yet

- Renewal NoticeDocument1 pageRenewal NoticeankitNo ratings yet

- Portfolio 1680405795614Document5 pagesPortfolio 1680405795614shravanvk35No ratings yet

- June 2019 - PaySlipDocument1 pageJune 2019 - PaySlipVishal GauravNo ratings yet

- First Premium Receipt: Branch Office: 59D Policy No.: 858757851Document1 pageFirst Premium Receipt: Branch Office: 59D Policy No.: 858757851sarbjeet kumarNo ratings yet

- Eastern Power Distribution Company of A.P Ltd. Receipt For Online Payment (Regular Payment)Document1 pageEastern Power Distribution Company of A.P Ltd. Receipt For Online Payment (Regular Payment)pradeepkalali kNo ratings yet

- Client Master List: National Securities Depository LimitedDocument2 pagesClient Master List: National Securities Depository Limitedsumit sinhaNo ratings yet

- Jajulabanda FTODocument1 pageJajulabanda FTOb9042192No ratings yet

- InvoiceDocument1 pageInvoicesablejanhavi291No ratings yet

- Invoice 221214 144420Document2 pagesInvoice 221214 144420neelima khandelwalNo ratings yet

- AECMB 2457499 PaySlip 07 2022Document1 pageAECMB 2457499 PaySlip 07 2022suprakash samantaNo ratings yet

- Shri Tarzan SyndaiDocument4 pagesShri Tarzan SyndaiJasper DkharNo ratings yet

- January 2019 PaySlipDocument1 pageJanuary 2019 PaySlipAjay KumarNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeSai Kiran KodipyakaNo ratings yet

- Acctstmt B 1017529778Document2 pagesAcctstmt B 1017529778kc wardhaNo ratings yet

- PaySlip Payslip 2023 DECDocument1 pagePaySlip Payslip 2023 DECKhan AdnanNo ratings yet

- Renewal Notice-5hshsDocument2 pagesRenewal Notice-5hshsHshshsvd hdhdNo ratings yet

- PAYROLLDocument14 pagesPAYROLLJay DeeNo ratings yet

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy-BundledDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy-Bundledu want some then come and get someNo ratings yet

- Acctstmt LDocument2 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- Sbi PDFDocument5 pagesSbi PDFshweta pundirNo ratings yet

- Reliance General Insurance Company Limited: Reliance Healthgain Policy ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Healthgain Policy Schedulekundanjha82No ratings yet

- 2021 Tax Return: Prepared ByDocument12 pages2021 Tax Return: Prepared ByRobert James100% (1)

- AgeUK Annual Report 0405Document34 pagesAgeUK Annual Report 0405My AuthorsNo ratings yet

- Bookmakers NightmareDocument50 pagesBookmakers NightmarefabihdroNo ratings yet

- Ecc Gsis SssDocument4 pagesEcc Gsis SssWinnie Ann Daquil LomosadNo ratings yet

- p5101 - 2019-10-00 1Document53 pagesp5101 - 2019-10-00 1api-495108136No ratings yet

- Starter Form TemplateDocument6 pagesStarter Form TemplatelucyjohufferNo ratings yet

- Pay SlioDocument1 pagePay SlioBenhar BenzzNo ratings yet

- Actuarial Science Consists of Total 15 PapersDocument5 pagesActuarial Science Consists of Total 15 PapersAkku Chaudhary100% (1)

- 2010 11HEAP ApplicationDocument4 pages2010 11HEAP ApplicationEnder751No ratings yet

- OLD Pension OptionDocument5 pagesOLD Pension OptionEC1 CPWDNo ratings yet

- Educational Consultant AgreementDocument2 pagesEducational Consultant Agreementapi-285697311No ratings yet

- Understanding Roth IRA Jonathan BeckDocument10 pagesUnderstanding Roth IRA Jonathan BeckjonathanbeckadvisorNo ratings yet

- Quantum GravityDocument2 pagesQuantum GravitySubhodeep BanerjeeNo ratings yet

- AnnuityDocument5 pagesAnnuityTimothy FigueroaNo ratings yet

- IRA Deadlines Are ApproachingDocument1 pageIRA Deadlines Are ApproachingDoug PotashNo ratings yet

- Employee/Contractor Questionnaire Employer/Principal'S VersionDocument4 pagesEmployee/Contractor Questionnaire Employer/Principal'S VersionDicky LuthfiandiNo ratings yet

- Part A: PersonalDocument2 pagesPart A: PersonalSudhakar JannaNo ratings yet

- Term Paper On "Performance Linked Incentive Schemes of Schedule Banks"Document23 pagesTerm Paper On "Performance Linked Incentive Schemes of Schedule Banks"10805997No ratings yet

- LI&R Val S1 2020 M04 Liabilities PDFDocument22 pagesLI&R Val S1 2020 M04 Liabilities PDFJeff GundyNo ratings yet

- Vacancy For Retired PersonnelDocument6 pagesVacancy For Retired Personnelp srivastavaNo ratings yet

- Topic: Payroll Method CalculationDocument17 pagesTopic: Payroll Method CalculationsonalliNo ratings yet

- Honeywell 1Document21 pagesHoneywell 1rikitariganNo ratings yet

- Commutation Values For A Pension of Re. 1 Per Annum: Explanatory NoteDocument1 pageCommutation Values For A Pension of Re. 1 Per Annum: Explanatory NoteSreekumar U DileepNo ratings yet

- Business and Financial Mathematics-AnnuityDocument5 pagesBusiness and Financial Mathematics-Annuitywijanaimade875350% (2)

- Employee Separation (Notes)Document15 pagesEmployee Separation (Notes)Vatsal BanwariNo ratings yet

- This Is The Sample Illustration Issued by HDFC Standard Life Insurance Company LimitedDocument3 pagesThis Is The Sample Illustration Issued by HDFC Standard Life Insurance Company LimitedsenthilkumarNo ratings yet

- Best HR Practices in 2008Document60 pagesBest HR Practices in 2008parishi20No ratings yet