Professional Documents

Culture Documents

Aryan Chaudhary BE PSDA 2

Aryan Chaudhary BE PSDA 2

Uploaded by

Anuj VermaCopyright:

Available Formats

You might also like

- Case Study 3 (China vs. India)Document20 pagesCase Study 3 (China vs. India)Jerhica Resurreccion100% (2)

- Withdrawal SlipDocument2 pagesWithdrawal SlipJerwin SamsonNo ratings yet

- 4.3 Q MiniCase Turkish Kriz (A)Document6 pages4.3 Q MiniCase Turkish Kriz (A)SanaFatimaNo ratings yet

- Case 10-1 Columbus Park-WasteDocument2 pagesCase 10-1 Columbus Park-Wastemymoonah100% (1)

- Beepedia Monthly Current Affairs October 2022Document137 pagesBeepedia Monthly Current Affairs October 2022Sovan KumarNo ratings yet

- Monthly Beepedia August 2022Document129 pagesMonthly Beepedia August 2022Sakshi SharmaNo ratings yet

- Monthly Beepedia August 2022Document129 pagesMonthly Beepedia August 2022Rahul AnandNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) February 2023Document101 pagesBeepedia Monthly Current Affairs (Beepedia) February 2023Rishabh MalhotraNo ratings yet

- Entrepreneurship Managementt200813Document7 pagesEntrepreneurship Managementt200813Arpita SrivastavaNo ratings yet

- Monthly Test - February 2020Document7 pagesMonthly Test - February 2020Keigan ChatterjeeNo ratings yet

- Monetary Policy of IndiaDocument6 pagesMonetary Policy of IndiaSOURAV SAMALNo ratings yet

- RBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFDocument5 pagesRBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFswapnaNo ratings yet

- CA - 01-10 May 2022Document36 pagesCA - 01-10 May 2022Tushar SahaNo ratings yet

- 5 MayDocument113 pages5 MayShubhendu VermaNo ratings yet

- Banking Case StudyDocument9 pagesBanking Case Studyainesh_mukherjeeNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) December 2022Document116 pagesBeepedia Monthly Current Affairs (Beepedia) December 2022Sovan KumarNo ratings yet

- Monetary Policy of India - WikipediaDocument4 pagesMonetary Policy of India - Wikipediaambikesh008No ratings yet

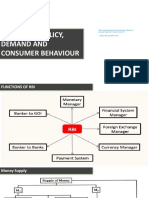

- Monetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreDocument23 pagesMonetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreBhavya NarangNo ratings yet

- Interview Material - TopicDocument72 pagesInterview Material - TopichariprasathNo ratings yet

- Indian Monetary Policy Analysis (2010-2017)Document38 pagesIndian Monetary Policy Analysis (2010-2017)Parang Mehta95% (21)

- Weekly Report 2023-05-15Document3 pagesWeekly Report 2023-05-15Rajat KumarNo ratings yet

- Affairscloud April 2024 Banking & Economy English PDF WatermarkDocument142 pagesAffairscloud April 2024 Banking & Economy English PDF Watermarkbipasha.deyNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023Document48 pagesBeepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023SHANTANU MISHRANo ratings yet

- Rbi Monetary Policy December 2021Document3 pagesRbi Monetary Policy December 2021Josep CorbynNo ratings yet

- Monthly Beepedia May 2022Document122 pagesMonthly Beepedia May 2022Atul sharmaNo ratings yet

- Monetary Policy of IndiaDocument34 pagesMonetary Policy of IndiaJhankar MishraNo ratings yet

- 8th April Monetary PolicyDocument3 pages8th April Monetary PolicyNeeleshNo ratings yet

- The Monthly Hindu Review - Current Affairs - July 2021: WWW - Careerpower.in Adda247 AppDocument47 pagesThe Monthly Hindu Review - Current Affairs - July 2021: WWW - Careerpower.in Adda247 AppSarthak ChauhanNo ratings yet

- Monetary Policy ReviewsDocument6 pagesMonetary Policy ReviewspundirsandeepNo ratings yet

- Central BankingDocument25 pagesCentral BankingRiya WilsonNo ratings yet

- Rbi Monetary PolicyDocument5 pagesRbi Monetary PolicyRohit GuptaNo ratings yet

- Weekly Beepedia 01st To 08th August 2022Document44 pagesWeekly Beepedia 01st To 08th August 2022Subhajyoti RoyNo ratings yet

- Final Report - Swapnil R. ShendeDocument40 pagesFinal Report - Swapnil R. Shendenitish_735No ratings yet

- Beepedia Monthly Current Affairs (Beepedia) April 2023 PDFDocument134 pagesBeepedia Monthly Current Affairs (Beepedia) April 2023 PDFSAI CHARAN VNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) June 2023Document180 pagesBeepedia Monthly Current Affairs (Beepedia) June 2023Sahil KalerNo ratings yet

- Brochure - Group 9 (Influence of RBI)Document8 pagesBrochure - Group 9 (Influence of RBI)Sugandha Gajanan GhadiNo ratings yet

- Monetary Policy and Stock MarketDocument9 pagesMonetary Policy and Stock MarketSreenivas KuppachiNo ratings yet

- Beepedia Daily Current Affairs (Beepedia) 8th February 2024Document12 pagesBeepedia Daily Current Affairs (Beepedia) 8th February 2024most funny videoNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) October 2023Document121 pagesBeepedia Monthly Current Affairs (Beepedia) October 2023Vikram SharmaNo ratings yet

- Gathering Speed - Update On The Monetary Policy - June 2022Document5 pagesGathering Speed - Update On The Monetary Policy - June 2022Huzefa BharmalNo ratings yet

- RBI, Banking and Economy - 3Document10 pagesRBI, Banking and Economy - 3Rohit SharmaNo ratings yet

- The Hindu Review June 2021Document47 pagesThe Hindu Review June 2021shashank gauravNo ratings yet

- GK Power Capsule NICL AO Assistant 2015Document45 pagesGK Power Capsule NICL AO Assistant 2015Abbie HudsonNo ratings yet

- Monetory PolicyDocument21 pagesMonetory Policyharikrishna k sNo ratings yet

- Research Paper On Monetary Policy of RbiDocument6 pagesResearch Paper On Monetary Policy of Rbiaflbtjglu100% (1)

- Commercial BankingDocument6 pagesCommercial BankingRed bull GameingNo ratings yet

- Monetary Policy: What Are The Main Objectives of Monetary Policy?Document2 pagesMonetary Policy: What Are The Main Objectives of Monetary Policy?abhilasha mehtaNo ratings yet

- Financial Management Report: On "Repo Rate and Impact On GDP"Document10 pagesFinancial Management Report: On "Repo Rate and Impact On GDP"Anjali BhatiaNo ratings yet

- Nil 9 OCT 2020: 11th & 12th October 2020Document24 pagesNil 9 OCT 2020: 11th & 12th October 2020vikramv501No ratings yet

- Assignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryDocument9 pagesAssignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryRohit VermaNo ratings yet

- Latest Policy RatesDocument3 pagesLatest Policy RatesAbhishek BidhanNo ratings yet

- Rbi Monetary Policy 2011-2012 and It'S Impact On IndividualsDocument4 pagesRbi Monetary Policy 2011-2012 and It'S Impact On IndividualsBernard EkkaNo ratings yet

- Financial Institutions and Markets ProjectDocument10 pagesFinancial Institutions and Markets ProjectPallavi AgrawallaNo ratings yet

- Niveshak July 2013Document28 pagesNiveshak July 2013Niveshak - The InvestorNo ratings yet

- Monetary PolicyDocument39 pagesMonetary PolicyTirupal PuliNo ratings yet

- RBI Monetary Policy - August 17Document3 pagesRBI Monetary Policy - August 17pappuNo ratings yet

- Monetary PolicyDocument9 pagesMonetary Policytulasi nandamuriNo ratings yet

- TATA AIA Annual Report March 2020Document22 pagesTATA AIA Annual Report March 2020SantoshNo ratings yet

- Assignment 3Document5 pagesAssignment 3SuprityNo ratings yet

- Dec Banking (Eng) by AffairsCloudDocument173 pagesDec Banking (Eng) by AffairsCloudreshpradi1996No ratings yet

- Bank Promotion Interview - 2023Document79 pagesBank Promotion Interview - 2023kumar Raushan RatneshNo ratings yet

- Central BankingDocument28 pagesCentral Bankingneha16septNo ratings yet

- Statement by Governor - First Bi-Monthly Monetary Policy, 2019-20, April 4, 2019Document8 pagesStatement by Governor - First Bi-Monthly Monetary Policy, 2019-20, April 4, 2019Valter SilveiraNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- HBS Table No. 02 - Macro Economic Aggregates (At Constant Prices)Document35 pagesHBS Table No. 02 - Macro Economic Aggregates (At Constant Prices)Anuj VermaNo ratings yet

- Shivansh Tiwari FinalDocument2 pagesShivansh Tiwari FinalAnuj VermaNo ratings yet

- Aditya SoniDocument2 pagesAditya SoniAnuj VermaNo ratings yet

- Aryan Chaudhary Be Psda1Document3 pagesAryan Chaudhary Be Psda1Anuj VermaNo ratings yet

- Junayed - 19 39800 1Document11 pagesJunayed - 19 39800 1gurujeeNo ratings yet

- OD119978131985722000Document1 pageOD119978131985722000pankaj hitlarNo ratings yet

- 4global Capital Market 2Document11 pages4global Capital Market 2roseNo ratings yet

- Assignment 2 Bbce3013 202101 20%Document5 pagesAssignment 2 Bbce3013 202101 20%kannaiahNo ratings yet

- ScotiaBank AUG 04 Daily PointsDocument2 pagesScotiaBank AUG 04 Daily PointsMiir ViirNo ratings yet

- Tax Invoice: Chander TradersDocument2 pagesTax Invoice: Chander Tradersudhaya gNo ratings yet

- Economic Indicators PDFDocument6 pagesEconomic Indicators PDFtahir777No ratings yet

- ASSESSMENT Two ContempoDocument7 pagesASSESSMENT Two ContempoJackie Lou RomeroNo ratings yet

- Devaluation On DenarDocument15 pagesDevaluation On DenarЈованаNo ratings yet

- ENCE 422 Project Cost Accounting and EconomicsDocument6 pagesENCE 422 Project Cost Accounting and EconomicsAvisha NessAiverNo ratings yet

- AAGCT0288G - Computation Sheet - 1033598377 (1) - 21062021Document5 pagesAAGCT0288G - Computation Sheet - 1033598377 (1) - 21062021Rishi KhemaniNo ratings yet

- Arch Waterfront, 5th Floor, Plot No. F4, Block - GP, Sector V, Kolkata-700091, West Bengal, IndiaDocument1 pageArch Waterfront, 5th Floor, Plot No. F4, Block - GP, Sector V, Kolkata-700091, West Bengal, Indiabhavesh kalalNo ratings yet

- The Impact of "Mercantilism and "Capitalism" On The Economy of Sri LankaDocument5 pagesThe Impact of "Mercantilism and "Capitalism" On The Economy of Sri LankaJananthan ThavarajahNo ratings yet

- Poverty Alleviation Programmes in IndiaDocument13 pagesPoverty Alleviation Programmes in IndiaShivani KrishnakumarNo ratings yet

- 01 International Business ImperativeDocument30 pages01 International Business ImperativeBramaNo ratings yet

- Press Release - Asian Paints Q2-FY21 ResultsDocument2 pagesPress Release - Asian Paints Q2-FY21 ResultsVishvajit PatilNo ratings yet

- Industries in Gujarat: - Ashish Kumar SinghDocument9 pagesIndustries in Gujarat: - Ashish Kumar SinghKAMALESH KUMAR SINGHNo ratings yet

- NPA & Categories Provisioning NormsDocument26 pagesNPA & Categories Provisioning NormsSarabjit KaurNo ratings yet

- 4.8 S. International Trade - MCQsDocument1 page4.8 S. International Trade - MCQsbakerallb1No ratings yet

- The Banking Crisis in NorwayDocument2 pagesThe Banking Crisis in NorwayAteeb AhmedNo ratings yet

- Financial Times Europe - 16-10-2019Document20 pagesFinancial Times Europe - 16-10-2019Ashutosh YadavNo ratings yet

- Icici Bank DataDocument12 pagesIcici Bank DatananiNo ratings yet

- Multinational Corporations (MNCS) : Linda Young Pols 400 International Political Economy Wilson Hall - Room 1122Document41 pagesMultinational Corporations (MNCS) : Linda Young Pols 400 International Political Economy Wilson Hall - Room 1122dhanrajkishoreNo ratings yet

- E StatementDocument2 pagesE Statementinvincibilitized abdominizer100% (1)

- Short Term Financial Management in A Multinational CorporationDocument19 pagesShort Term Financial Management in A Multinational CorporationSiddhant AggarwalNo ratings yet

- Preliminary Examination The Contemporary WorldDocument2 pagesPreliminary Examination The Contemporary WorldJane M100% (1)

Aryan Chaudhary BE PSDA 2

Aryan Chaudhary BE PSDA 2

Uploaded by

Anuj VermaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aryan Chaudhary BE PSDA 2

Aryan Chaudhary BE PSDA 2

Uploaded by

Anuj VermaCopyright:

Available Formats

SUBJECT: Business Environment

(MGMT103)

PSDA 2: Study the latest monetary policy. Analyse

its implications on achieving various macroeconomic

objectives

Submitted By: Guided By:

Aryan Chaudhary Dr Kushi Sharma

Enrolment No.: A3906421132

Section/Roll No.: A-39

Batch/Semester: 2021-2024/3

Latest Monetary Policy

The Reserve Bank of India announced renewed rate hikes in the August 2022

Monetary Policy committee review. The repo rate was hiked by 50 bps to 5.40

per cent. The RBI Governor Shaktikanta Das stated that inflation is a primary

concern, and stressed that in the near term will be observing a 4 per

cent inflation.

Shantikanta stressed that the rupee's performance was much better than other

emerging market economy currencies. Post the announcement, yields on 10-

year-old government bonds also increased.

Professor Jayanth Verma, the MOC member, disagreed with the committee’s

policy.

Shaktikanta Das has expressed that liquidity has substantially increased from

the market. The loan-demand growth and the current policy rate hike are raising

deposit rates. Thus, more banks are raising more funds for lending. The

governor announced that the FY23 GDP growth forecast has been retained at

7.2 per cent.

RBI Monetary Policy 2022: Key points

Repo rate or key short-term lending rate increased by 50 basis points

(bps) to 5.4 per cent for the third consecutive time in 2022.

140 bps hike in repo rate since May 2022 to control inflation.

Real GDP growth forecast: Q1 at 16.2 per cent; Q2 at 6.2 per cent ; Q3 at

4.1 per cent and Q4 at 4 per cent.

GDP growth forecast for 2022-23 retained at 7.2 per cent.

Real GDP growth for Q1: 2023-24 projected at 6.7 per cent.

Retail inflation forecast too retained at 6.7-per cent for 2022-23.

Inflation forecast for: Q2 at 7.1 per cent; Q3 at 6.4 per cent, Q4 at 5.8 per

cent ; Q1:2023-24 at 5 per cent.

Domestic economic activity to expand

MPC decided to stay focused on withdrawal of accommodative stance to

observe inflation

RBI will try maintaining the stability of the rupee

Currently, the rupee is devalued by 4.7 per cent against the US dollar in

fiscal year 2022 till August 4.

Devaluation and depreciation of rupee depends more on the US dollar's

growth than the inability of the Indian economy.

India witnessed large portfolio outflow of USD 13.3 billion in FY23 up to

August 3.

Foreign exchange reserves of India stays as the fourth largest

internationally

A mechanism to be implemented to allow NRIs to utilise Bharat Bill

Payment system for payments of education and utility on behalf of their

families in the country.

The forthcoming meeting of the rate-setting panel is scheduled for

September 28-30, 2022.

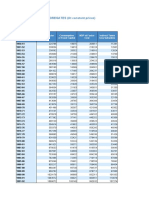

RBI Repo Rate Changes

Interest rate Rate (Percent)

Repo Rate 4.9

Bank Rate 5.15

Reverse Repo Rate 3.35

Marginal Standing Facility Rate 5.15

RBI Repo Rate History

Date Rate Change

5-Aug-22 5.4 0.5

8-Jun-22 4.9 0.5

May-22 4.4 0.4

9-Oct-20 4 0

6-Aug-20 4 0

22-May-20 4 0.4

27-Mar-20 4.4 0.75

Instruments of Monetary policy in various macro-economic

objectives

1. Open market operations: An open market operation is an instrument

which involves buying/selling of securities like government bond from or

to the public and banks. The RBI sells government securities to control

thye flow of credit and buys government securities to increase credit

flow.

2. Statutory Liquidity Ratio: All financial institutions have to maintain a

certain quantity of liquid assets with themselves at any point of time and

demand liabilities. This is known as statuatory liquidity ratio. The assets

are kept in non cash forms such as precious materials, bonds, etc. As of

December 2019, SLR stands at 18.25%.

3. Bank Rate Policy: Also known as the discount rate, bank rates are

interests charged by the RBI for providing funds and loans to the banking

system. An increase in bank rate increases the cost of borrowing by

commercial banks which results in the reduction in the credit volume and

hence the supply of money declines. An increase in the bank rate is the

symbol of the tightening of the RBI monetary policy.

4. Credit Ceiling: With this instrument, RBI issues prior information or

direction that loans to the commercial bank will be given upto a certain

limit. In this case, commercial banks will be tight in advancing loans to

the public. They will allocate loans to limited sectors. A few examples of

credit ceiling are agriculture sector advances and priority sector lending.

You might also like

- Case Study 3 (China vs. India)Document20 pagesCase Study 3 (China vs. India)Jerhica Resurreccion100% (2)

- Withdrawal SlipDocument2 pagesWithdrawal SlipJerwin SamsonNo ratings yet

- 4.3 Q MiniCase Turkish Kriz (A)Document6 pages4.3 Q MiniCase Turkish Kriz (A)SanaFatimaNo ratings yet

- Case 10-1 Columbus Park-WasteDocument2 pagesCase 10-1 Columbus Park-Wastemymoonah100% (1)

- Beepedia Monthly Current Affairs October 2022Document137 pagesBeepedia Monthly Current Affairs October 2022Sovan KumarNo ratings yet

- Monthly Beepedia August 2022Document129 pagesMonthly Beepedia August 2022Sakshi SharmaNo ratings yet

- Monthly Beepedia August 2022Document129 pagesMonthly Beepedia August 2022Rahul AnandNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) February 2023Document101 pagesBeepedia Monthly Current Affairs (Beepedia) February 2023Rishabh MalhotraNo ratings yet

- Entrepreneurship Managementt200813Document7 pagesEntrepreneurship Managementt200813Arpita SrivastavaNo ratings yet

- Monthly Test - February 2020Document7 pagesMonthly Test - February 2020Keigan ChatterjeeNo ratings yet

- Monetary Policy of IndiaDocument6 pagesMonetary Policy of IndiaSOURAV SAMALNo ratings yet

- RBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFDocument5 pagesRBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFswapnaNo ratings yet

- CA - 01-10 May 2022Document36 pagesCA - 01-10 May 2022Tushar SahaNo ratings yet

- 5 MayDocument113 pages5 MayShubhendu VermaNo ratings yet

- Banking Case StudyDocument9 pagesBanking Case Studyainesh_mukherjeeNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) December 2022Document116 pagesBeepedia Monthly Current Affairs (Beepedia) December 2022Sovan KumarNo ratings yet

- Monetary Policy of India - WikipediaDocument4 pagesMonetary Policy of India - Wikipediaambikesh008No ratings yet

- Monetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreDocument23 pagesMonetary Policy, Demand and Consumer Behaviour: Alculator/repo-Rate-Vs-Bank-Rate - HTML - Repo Rate and Bank RatreBhavya NarangNo ratings yet

- Interview Material - TopicDocument72 pagesInterview Material - TopichariprasathNo ratings yet

- Indian Monetary Policy Analysis (2010-2017)Document38 pagesIndian Monetary Policy Analysis (2010-2017)Parang Mehta95% (21)

- Weekly Report 2023-05-15Document3 pagesWeekly Report 2023-05-15Rajat KumarNo ratings yet

- Affairscloud April 2024 Banking & Economy English PDF WatermarkDocument142 pagesAffairscloud April 2024 Banking & Economy English PDF Watermarkbipasha.deyNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023Document48 pagesBeepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023SHANTANU MISHRANo ratings yet

- Rbi Monetary Policy December 2021Document3 pagesRbi Monetary Policy December 2021Josep CorbynNo ratings yet

- Monthly Beepedia May 2022Document122 pagesMonthly Beepedia May 2022Atul sharmaNo ratings yet

- Monetary Policy of IndiaDocument34 pagesMonetary Policy of IndiaJhankar MishraNo ratings yet

- 8th April Monetary PolicyDocument3 pages8th April Monetary PolicyNeeleshNo ratings yet

- The Monthly Hindu Review - Current Affairs - July 2021: WWW - Careerpower.in Adda247 AppDocument47 pagesThe Monthly Hindu Review - Current Affairs - July 2021: WWW - Careerpower.in Adda247 AppSarthak ChauhanNo ratings yet

- Monetary Policy ReviewsDocument6 pagesMonetary Policy ReviewspundirsandeepNo ratings yet

- Central BankingDocument25 pagesCentral BankingRiya WilsonNo ratings yet

- Rbi Monetary PolicyDocument5 pagesRbi Monetary PolicyRohit GuptaNo ratings yet

- Weekly Beepedia 01st To 08th August 2022Document44 pagesWeekly Beepedia 01st To 08th August 2022Subhajyoti RoyNo ratings yet

- Final Report - Swapnil R. ShendeDocument40 pagesFinal Report - Swapnil R. Shendenitish_735No ratings yet

- Beepedia Monthly Current Affairs (Beepedia) April 2023 PDFDocument134 pagesBeepedia Monthly Current Affairs (Beepedia) April 2023 PDFSAI CHARAN VNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) June 2023Document180 pagesBeepedia Monthly Current Affairs (Beepedia) June 2023Sahil KalerNo ratings yet

- Brochure - Group 9 (Influence of RBI)Document8 pagesBrochure - Group 9 (Influence of RBI)Sugandha Gajanan GhadiNo ratings yet

- Monetary Policy and Stock MarketDocument9 pagesMonetary Policy and Stock MarketSreenivas KuppachiNo ratings yet

- Beepedia Daily Current Affairs (Beepedia) 8th February 2024Document12 pagesBeepedia Daily Current Affairs (Beepedia) 8th February 2024most funny videoNo ratings yet

- Beepedia Monthly Current Affairs (Beepedia) October 2023Document121 pagesBeepedia Monthly Current Affairs (Beepedia) October 2023Vikram SharmaNo ratings yet

- Gathering Speed - Update On The Monetary Policy - June 2022Document5 pagesGathering Speed - Update On The Monetary Policy - June 2022Huzefa BharmalNo ratings yet

- RBI, Banking and Economy - 3Document10 pagesRBI, Banking and Economy - 3Rohit SharmaNo ratings yet

- The Hindu Review June 2021Document47 pagesThe Hindu Review June 2021shashank gauravNo ratings yet

- GK Power Capsule NICL AO Assistant 2015Document45 pagesGK Power Capsule NICL AO Assistant 2015Abbie HudsonNo ratings yet

- Monetory PolicyDocument21 pagesMonetory Policyharikrishna k sNo ratings yet

- Research Paper On Monetary Policy of RbiDocument6 pagesResearch Paper On Monetary Policy of Rbiaflbtjglu100% (1)

- Commercial BankingDocument6 pagesCommercial BankingRed bull GameingNo ratings yet

- Monetary Policy: What Are The Main Objectives of Monetary Policy?Document2 pagesMonetary Policy: What Are The Main Objectives of Monetary Policy?abhilasha mehtaNo ratings yet

- Financial Management Report: On "Repo Rate and Impact On GDP"Document10 pagesFinancial Management Report: On "Repo Rate and Impact On GDP"Anjali BhatiaNo ratings yet

- Nil 9 OCT 2020: 11th & 12th October 2020Document24 pagesNil 9 OCT 2020: 11th & 12th October 2020vikramv501No ratings yet

- Assignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryDocument9 pagesAssignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryRohit VermaNo ratings yet

- Latest Policy RatesDocument3 pagesLatest Policy RatesAbhishek BidhanNo ratings yet

- Rbi Monetary Policy 2011-2012 and It'S Impact On IndividualsDocument4 pagesRbi Monetary Policy 2011-2012 and It'S Impact On IndividualsBernard EkkaNo ratings yet

- Financial Institutions and Markets ProjectDocument10 pagesFinancial Institutions and Markets ProjectPallavi AgrawallaNo ratings yet

- Niveshak July 2013Document28 pagesNiveshak July 2013Niveshak - The InvestorNo ratings yet

- Monetary PolicyDocument39 pagesMonetary PolicyTirupal PuliNo ratings yet

- RBI Monetary Policy - August 17Document3 pagesRBI Monetary Policy - August 17pappuNo ratings yet

- Monetary PolicyDocument9 pagesMonetary Policytulasi nandamuriNo ratings yet

- TATA AIA Annual Report March 2020Document22 pagesTATA AIA Annual Report March 2020SantoshNo ratings yet

- Assignment 3Document5 pagesAssignment 3SuprityNo ratings yet

- Dec Banking (Eng) by AffairsCloudDocument173 pagesDec Banking (Eng) by AffairsCloudreshpradi1996No ratings yet

- Bank Promotion Interview - 2023Document79 pagesBank Promotion Interview - 2023kumar Raushan RatneshNo ratings yet

- Central BankingDocument28 pagesCentral Bankingneha16septNo ratings yet

- Statement by Governor - First Bi-Monthly Monetary Policy, 2019-20, April 4, 2019Document8 pagesStatement by Governor - First Bi-Monthly Monetary Policy, 2019-20, April 4, 2019Valter SilveiraNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- HBS Table No. 02 - Macro Economic Aggregates (At Constant Prices)Document35 pagesHBS Table No. 02 - Macro Economic Aggregates (At Constant Prices)Anuj VermaNo ratings yet

- Shivansh Tiwari FinalDocument2 pagesShivansh Tiwari FinalAnuj VermaNo ratings yet

- Aditya SoniDocument2 pagesAditya SoniAnuj VermaNo ratings yet

- Aryan Chaudhary Be Psda1Document3 pagesAryan Chaudhary Be Psda1Anuj VermaNo ratings yet

- Junayed - 19 39800 1Document11 pagesJunayed - 19 39800 1gurujeeNo ratings yet

- OD119978131985722000Document1 pageOD119978131985722000pankaj hitlarNo ratings yet

- 4global Capital Market 2Document11 pages4global Capital Market 2roseNo ratings yet

- Assignment 2 Bbce3013 202101 20%Document5 pagesAssignment 2 Bbce3013 202101 20%kannaiahNo ratings yet

- ScotiaBank AUG 04 Daily PointsDocument2 pagesScotiaBank AUG 04 Daily PointsMiir ViirNo ratings yet

- Tax Invoice: Chander TradersDocument2 pagesTax Invoice: Chander Tradersudhaya gNo ratings yet

- Economic Indicators PDFDocument6 pagesEconomic Indicators PDFtahir777No ratings yet

- ASSESSMENT Two ContempoDocument7 pagesASSESSMENT Two ContempoJackie Lou RomeroNo ratings yet

- Devaluation On DenarDocument15 pagesDevaluation On DenarЈованаNo ratings yet

- ENCE 422 Project Cost Accounting and EconomicsDocument6 pagesENCE 422 Project Cost Accounting and EconomicsAvisha NessAiverNo ratings yet

- AAGCT0288G - Computation Sheet - 1033598377 (1) - 21062021Document5 pagesAAGCT0288G - Computation Sheet - 1033598377 (1) - 21062021Rishi KhemaniNo ratings yet

- Arch Waterfront, 5th Floor, Plot No. F4, Block - GP, Sector V, Kolkata-700091, West Bengal, IndiaDocument1 pageArch Waterfront, 5th Floor, Plot No. F4, Block - GP, Sector V, Kolkata-700091, West Bengal, Indiabhavesh kalalNo ratings yet

- The Impact of "Mercantilism and "Capitalism" On The Economy of Sri LankaDocument5 pagesThe Impact of "Mercantilism and "Capitalism" On The Economy of Sri LankaJananthan ThavarajahNo ratings yet

- Poverty Alleviation Programmes in IndiaDocument13 pagesPoverty Alleviation Programmes in IndiaShivani KrishnakumarNo ratings yet

- 01 International Business ImperativeDocument30 pages01 International Business ImperativeBramaNo ratings yet

- Press Release - Asian Paints Q2-FY21 ResultsDocument2 pagesPress Release - Asian Paints Q2-FY21 ResultsVishvajit PatilNo ratings yet

- Industries in Gujarat: - Ashish Kumar SinghDocument9 pagesIndustries in Gujarat: - Ashish Kumar SinghKAMALESH KUMAR SINGHNo ratings yet

- NPA & Categories Provisioning NormsDocument26 pagesNPA & Categories Provisioning NormsSarabjit KaurNo ratings yet

- 4.8 S. International Trade - MCQsDocument1 page4.8 S. International Trade - MCQsbakerallb1No ratings yet

- The Banking Crisis in NorwayDocument2 pagesThe Banking Crisis in NorwayAteeb AhmedNo ratings yet

- Financial Times Europe - 16-10-2019Document20 pagesFinancial Times Europe - 16-10-2019Ashutosh YadavNo ratings yet

- Icici Bank DataDocument12 pagesIcici Bank DatananiNo ratings yet

- Multinational Corporations (MNCS) : Linda Young Pols 400 International Political Economy Wilson Hall - Room 1122Document41 pagesMultinational Corporations (MNCS) : Linda Young Pols 400 International Political Economy Wilson Hall - Room 1122dhanrajkishoreNo ratings yet

- E StatementDocument2 pagesE Statementinvincibilitized abdominizer100% (1)

- Short Term Financial Management in A Multinational CorporationDocument19 pagesShort Term Financial Management in A Multinational CorporationSiddhant AggarwalNo ratings yet

- Preliminary Examination The Contemporary WorldDocument2 pagesPreliminary Examination The Contemporary WorldJane M100% (1)