Professional Documents

Culture Documents

Topics Banking

Topics Banking

Uploaded by

khursheed rasool0 ratings0% found this document useful (0 votes)

21 views5 pagesThis document outlines the table of contents for a book on banking. Chapter 1 discusses the introduction, history and evolution of banks. Chapter 2 focuses on commercial banks, their functions, role in economic development and organizational structure. Chapter 3 covers electronic banking methods like ATMs, online and mobile banking. Subsequent chapters address central banks, scheduled and non-scheduled banks, bank accounts, relationships between bankers and customers, use of bank funds, negotiable instruments, foreign exchange transactions, money markets, the banking system in Pakistan and Islamic banking principles.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the table of contents for a book on banking. Chapter 1 discusses the introduction, history and evolution of banks. Chapter 2 focuses on commercial banks, their functions, role in economic development and organizational structure. Chapter 3 covers electronic banking methods like ATMs, online and mobile banking. Subsequent chapters address central banks, scheduled and non-scheduled banks, bank accounts, relationships between bankers and customers, use of bank funds, negotiable instruments, foreign exchange transactions, money markets, the banking system in Pakistan and Islamic banking principles.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

21 views5 pagesTopics Banking

Topics Banking

Uploaded by

khursheed rasoolThis document outlines the table of contents for a book on banking. Chapter 1 discusses the introduction, history and evolution of banks. Chapter 2 focuses on commercial banks, their functions, role in economic development and organizational structure. Chapter 3 covers electronic banking methods like ATMs, online and mobile banking. Subsequent chapters address central banks, scheduled and non-scheduled banks, bank accounts, relationships between bankers and customers, use of bank funds, negotiable instruments, foreign exchange transactions, money markets, the banking system in Pakistan and Islamic banking principles.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

Introduction

Derivation of Word Bank

History of the Bank

Chapter 1 : BEGINNING AND Evolution of the Bank

EVOLUTION OF BANK Definition of the Bank

Kinds of the Bank

Formation of the Bank

Characteristics of Stable

Banking System

Introduction and Definition of

Commercial Bank

Functions of Commercial Bank

Commercial Banks and

Economic Development

Cash Reserve of Bank and its

Chapter 2 : COMMERCIAL BANK Factors

Creation of Credit by

Commercial Banks

Organizational Structure of

Commercial Bank

Balance Sheet of Commercial

Bank

Introduction & Advantages

Credit Card

Debit Card

Automated Teller Machine

Chapter 3: E ( ELECTRONIC ) (i) Introduction & Working

BANKING (ii) ATM Card & its use

(iii) Advantages of ATM

Online Banking

Mobile Phone / Phone Banking

Introduction and Growth of

Central Bank

Chapter 4: CENTRAL BANK Definition of Central Bank

and its Principles

Functions of Central Bank

Clearing House and Working of

Clearing House

Tools of Monetary Policy

Difficulties in Controlling Credit

Difference between Central

Bank and Commercial Bank

Definition of Scheduled & Non-

Scheduled Bank

Difference between Scheduled &

Chapter 5: SCHEDULED & Non-Scheduled Bank

NON- SCHEDULED BANKS Merits of Scheduled Bank

Procedure to Convert Non-

Scheduled Bank into

Scheduled Bank

Introduction and Definition of

Bank Account

Causes of Opening a Bank

Account

Procedure of Opening a Bank

Account

Chapter 5: BANK ACCOUNTS Precaution of Bank Before

Opening an Account

Documents of Bank

Types of Bank Accounts

Comparison of Different Bank

Accounts

Merits of Opening bank Account

Definition of Banker and

Customer

Relationship between Banker

Chapter 7 : BANKER AND and Customer

CUSTOMER RELATIONSHIP Rights and Duties of Customer

Rights and Duties of Banker

Termination of relationship

Kinds of Bank’s Customer

and their characteristics

Sources of Bank Funds

Use of Bank Funds

(i) Advancing Loans

(ii) Direct Investment

(iii) Purchase of shares

Chapter 8 : BANK FUNDS AND & Debentures

THEIR USE Principles of Advancing Loans

Precaution of Advancing Loans

Securities and their

Characteristics

Kinds of securities

Terms used in Bank Loans

Word Credit and its Definition

Credit instruments,

Characteristics and its

kinds

History of Cheque

and Definition

Chapter 9 : NEGOTIABLE Parties of Cheque and its

INSTRUMENTS (I) Elements

Characteristics and Advantages

of Cheque

Kinds of Cheque

Comparison of Bearer, order

and Cross Cheques

Causes of Dishonoring Cheque

Endorsement of Cheque,

its elements and Types

Crossing of Cheque and types

Suggestions to improve the use

of Cheques

Definition and Parties of Bills of

Exchange

Characteristics of Bills

of Exchange

Kinds of Bills of Exchange

Advantages of Bills of Exchange

Definition and Parties of

Chapter 10 : NEGOTIABLE Promissory Note

INSTRUMENTS (II) Kinds of Promissory Note

Definition, Parties and Kinds of

Bank Draft

Features and Merits of

Bank Draft

Definition and Features of

Treasury Bill

Comparison of Different Credit

Instruments

Banker’s Letters of Credit

(I) Commercial Letter of Credit

(II) Personal Letters of Credit

Chapter 11 : NON-NEGOTIABLE Money Order

INSTRUMENTS Postal Order

I Owe You (I.O.U.)

Stock Certificate

Meaning and Importance of

Foreign Exchange

Kinds of Foreign Exchange

Transactions

Methods of Making Foreign

Chapter 12 : FOREIGN Payments

EXCHANGE TRANSACTIONS Foreign Exchange Market and its

Functions

Exchange Control, its

Objectives and Methods

Determination of Exchange Rate

Types of Exchange Rate

Causes of Changes in

Exchange Rate

Introduction & Definition

Institutions of Money Market

Chapter 13 : MONEY MARKET Functions of Money Market

Features of Good Money Market

Money Market in Pakistan

Banking System of Pakistan

and its Elements

Nationalization of Banks

Privatization of Banks

Chapter 14 : BANKING SYSTEM Pakistan’s Important

IN PAKISTAN Financial Institutions

(I) State Bank of Pakistan

(II) National Bank of Pakistan

(III) Z.T.B.L

(IV) I.D.B.L

Concept of Riba & Interest

Pakistan and Islamic Banking

Chapter 15 : ISLAMIC BANKING Interest Free Modes of Financing

Islamic Development

Bank (I.D.B)

Chapter 16 : Banking Terms

You might also like

- Internship Report On Cooperative Bank LovelyDocument49 pagesInternship Report On Cooperative Bank Lovelylovely64% (28)

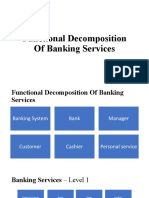

- Functional Decomposition of Banking Services 12Document4 pagesFunctional Decomposition of Banking Services 12MUSYOKA KITUKUNo ratings yet

- WellsFargoDocument7 pagesWellsFargosayma kandafNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- A Project Report On Credit AppraisalDocument107 pagesA Project Report On Credit AppraisalPrabhakar Kunal87% (115)

- Emerging Market Bank Lending and Credit Risk Control: Evolving Strategies to Mitigate Credit Risk, Optimize Lending Portfolios, and Check Delinquent LoansFrom EverandEmerging Market Bank Lending and Credit Risk Control: Evolving Strategies to Mitigate Credit Risk, Optimize Lending Portfolios, and Check Delinquent LoansRating: 3 out of 5 stars3/5 (3)

- Analyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementFrom EverandAnalyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk ManagementRating: 5 out of 5 stars5/5 (5)

- Analysis of Singapore AirlinesDocument5 pagesAnalysis of Singapore AirlinesRahadian Pena Persada100% (1)

- Elements of BankingDocument84 pagesElements of BankingMwanza MaliiNo ratings yet

- Banking LawDocument23 pagesBanking LawHarshdeep groverNo ratings yet

- Corporate Banking: Products & Credit Analysis: Course OutlinesDocument7 pagesCorporate Banking: Products & Credit Analysis: Course OutlinesJhilik PradhanNo ratings yet

- Ba7026 Banking Financial Services ManagemntDocument122 pagesBa7026 Banking Financial Services ManagemntRithesh RaNo ratings yet

- BLP AssignmentDocument2 pagesBLP AssignmentSekar MuruganNo ratings yet

- 2 Principles of BankingDocument3 pages2 Principles of Bankingtanzila khanNo ratings yet

- Info About Flip CoursesDocument6 pagesInfo About Flip CoursesShivangi DubeyNo ratings yet

- Retail BankingDocument200 pagesRetail BankingJugnu mahourNo ratings yet

- Banking Domain Curricula MDocument9 pagesBanking Domain Curricula MRedSunNo ratings yet

- Dcom208 Banking Theory and Practice PDFDocument251 pagesDcom208 Banking Theory and Practice PDFLakshmanrao NayiniNo ratings yet

- Functions of Banks PDFDocument10 pagesFunctions of Banks PDFSumit K SankhlaNo ratings yet

- Course OutlineDocument4 pagesCourse Outlinefbicia218No ratings yet

- Banking Theory Law and PracticeDocument17 pagesBanking Theory Law and PracticeDr.Satish RadhakrishnanNo ratings yet

- Learning Objective: Bank Lending Policy and Loan TypesDocument15 pagesLearning Objective: Bank Lending Policy and Loan TypesGooby PlsNo ratings yet

- Banking Insurance and Financial Services: Unit 1: Introduction To BANKING (25%)Document13 pagesBanking Insurance and Financial Services: Unit 1: Introduction To BANKING (25%)sunगीत मजे्seNo ratings yet

- Bank Audit - Opportunities and Concerns: 1) IntroductionDocument14 pagesBank Audit - Opportunities and Concerns: 1) IntroductionSURYA DEEPAK BEHERANo ratings yet

- Co-Operative Bank MGTDocument85 pagesCo-Operative Bank MGTmilin_a_k100% (2)

- Sem I and II Banking and Finance Syllabus A.Y. 2021 22Document33 pagesSem I and II Banking and Finance Syllabus A.Y. 2021 22Sayyed Muhammad MustafahNo ratings yet

- Financial Awareness Capsule PDF For SBI Clerk Mains 2024Document40 pagesFinancial Awareness Capsule PDF For SBI Clerk Mains 2024ssimu6967No ratings yet

- SBI CBO Banking Knowledge PDF by Ambitious BabaDocument91 pagesSBI CBO Banking Knowledge PDF by Ambitious Babaசிவா நடராஜன்No ratings yet

- Post-Graduate Diploma in Management (Banking & Financial Services) 2021-23 Term IDocument5 pagesPost-Graduate Diploma in Management (Banking & Financial Services) 2021-23 Term IAbhinav MahajanNo ratings yet

- 66576bos53772 cp5Document75 pages66576bos53772 cp5HemanthNo ratings yet

- Basics of Banking - Study NotesDocument13 pagesBasics of Banking - Study NotesTanmoy GhoshNo ratings yet

- Jaiib Exam SyllabusDocument19 pagesJaiib Exam SyllabusRupesh RanjanNo ratings yet

- Develop Understanding of Debt and Consumer CreditDocument14 pagesDevelop Understanding of Debt and Consumer CreditDo Dothings100% (5)

- Banking Law and Practice PDFDocument658 pagesBanking Law and Practice PDFshahidNo ratings yet

- ch-5 EIS PDFDocument75 pagesch-5 EIS PDFInvestor GurujiNo ratings yet

- Banking Law Long QuestionsDocument4 pagesBanking Law Long QuestionsDEEPAKNo ratings yet

- Lecture ThreeDocument10 pagesLecture ThreeHassan HaibeNo ratings yet

- Branch Banking Complete PDFDocument263 pagesBranch Banking Complete PDF03322080738No ratings yet

- Bank Loan and Credit Collection in NigeriaDocument4 pagesBank Loan and Credit Collection in NigeriaJimbaA'whyNo ratings yet

- AB Financial Awareness Capsule For RRB SO Officer Scale 2 PDFDocument95 pagesAB Financial Awareness Capsule For RRB SO Officer Scale 2 PDFsanat samanta100% (2)

- Banking Law Questions - 024016Document4 pagesBanking Law Questions - 024016Nanditha SwamyNo ratings yet

- BRO IMP QPDocument3 pagesBRO IMP QPshashank reddyNo ratings yet

- Audit of BanksDocument4 pagesAudit of BanksSyamala GadupudiNo ratings yet

- Banking Ope Art IonsDocument26 pagesBanking Ope Art IonsChinmay KhetanNo ratings yet

- Banking Ope Art IonsDocument26 pagesBanking Ope Art IonsPurti TiwariNo ratings yet

- Basics of Banking-For IIMS-June21-Prof - GvsRaoDocument87 pagesBasics of Banking-For IIMS-June21-Prof - GvsRaosubba raoNo ratings yet

- Chapter 7 Bank Loans - SVDocument78 pagesChapter 7 Bank Loans - SVNguyễn Mạnh ThắngNo ratings yet

- DMHSL - Banking and Insurance Law Semester VI PDFDocument4 pagesDMHSL - Banking and Insurance Law Semester VI PDFDisha BafnaNo ratings yet

- 01 - Model Curriculum - BCBF - 23122015Document8 pages01 - Model Curriculum - BCBF - 23122015Ashutosh Workaholic MishraNo ratings yet

- Fin 1 PDFDocument53 pagesFin 1 PDFGowtham krishnaNo ratings yet

- Merchant Banking - Meaning - SEBI Regulations & ConditionsDocument1 pageMerchant Banking - Meaning - SEBI Regulations & Conditionsannpurna pathakNo ratings yet

- Bba Elective 3-Unit 1Document22 pagesBba Elective 3-Unit 1Pridhvi Raj ReddyNo ratings yet

- Credit Appraisal of Term Loans by Financial Institutions Like BanksDocument4 pagesCredit Appraisal of Term Loans by Financial Institutions Like BanksKunal GoldmedalistNo ratings yet

- Naan MudhalvanDocument4 pagesNaan Mudhalvanharishguhan92No ratings yet

- CAIIB 2023 - BRBL - Objective NotesDocument223 pagesCAIIB 2023 - BRBL - Objective NotesSaurabh SiddhantNo ratings yet

- Money & Banking: Principles of MacroeconomicsDocument11 pagesMoney & Banking: Principles of MacroeconomicsSaiyam AhujaNo ratings yet

- DecompositionDocument4 pagesDecompositionMUSYOKA KITUKUNo ratings yet

- 411 Banking - and - Insurance - Updated - IX PDFDocument117 pages411 Banking - and - Insurance - Updated - IX PDFJanavi M SNo ratings yet

- Banking & Insurance Law SyllabusDocument3 pagesBanking & Insurance Law Syllabusriko avNo ratings yet

- CBPTM - Course OutlineDocument3 pagesCBPTM - Course OutlineAru RanjanNo ratings yet

- The Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaFrom EverandThe Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Chapter 6 2022Document7 pagesChapter 6 2022khursheed rasoolNo ratings yet

- Past PapersDocument26 pagesPast Paperskhursheed rasoolNo ratings yet

- Chapter 7 2022Document11 pagesChapter 7 2022khursheed rasoolNo ratings yet

- Banking, Geo, B.stats-IIDocument2 pagesBanking, Geo, B.stats-IIkhursheed rasoolNo ratings yet

- Chapter 8 EdittedDocument14 pagesChapter 8 Edittedkhursheed rasoolNo ratings yet

- Banking P-II (1) - SampleDocument5 pagesBanking P-II (1) - Samplekhursheed rasoolNo ratings yet

- Auditing Notes B.com Part 2 Punjab UniversityDocument73 pagesAuditing Notes B.com Part 2 Punjab Universitykhursheed rasoolNo ratings yet

- PDP 2023 2028Document120 pagesPDP 2023 2028Maria KarlaNo ratings yet

- JxModi Option BuyDocument9 pagesJxModi Option BuySriram GaneshNo ratings yet

- PDFDocument1 pagePDFcorbumonaNo ratings yet

- Leather Industry of BDDocument30 pagesLeather Industry of BDsams zeesha100% (1)

- Goods & Services Tax Invoice Insurance Invoice (Labour)Document1 pageGoods & Services Tax Invoice Insurance Invoice (Labour)Deepak SharmaNo ratings yet

- Circular Business ModelDocument13 pagesCircular Business ModelShalini BartwalNo ratings yet

- Resources and Trade: The Heckscher-Ohlin ModelDocument43 pagesResources and Trade: The Heckscher-Ohlin ModelDharmajaya SoetotoNo ratings yet

- Reconcilation Statement PDFDocument3 pagesReconcilation Statement PDFNimur RahamanNo ratings yet

- 1-350 Bismarck For RevellDocument12 pages1-350 Bismarck For RevellDoru SicoeNo ratings yet

- Unit 2 C Global Interstate and Global GovernanceDocument15 pagesUnit 2 C Global Interstate and Global GovernanceJohn Lloyd LopezツNo ratings yet

- Imperfectly Competitive Markets: Imperfect Heterogenous Not All Price TakersDocument19 pagesImperfectly Competitive Markets: Imperfect Heterogenous Not All Price TakersRomit BanerjeeNo ratings yet

- Mid Term 1 2020 - SolutionsDocument17 pagesMid Term 1 2020 - Solutionsshaneice_lewisNo ratings yet

- 2020 Landfill Capacity Calculation Work SheetDocument4 pages2020 Landfill Capacity Calculation Work SheetLYNo ratings yet

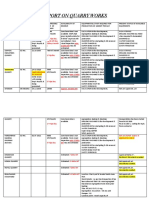

- Report On Quarry WorksDocument5 pagesReport On Quarry WorksSaravananNo ratings yet

- Appendix F: Preparation of Interim Payment CertificatesDocument4 pagesAppendix F: Preparation of Interim Payment CertificatesEticala RohithNo ratings yet

- Lista Contribuabililor Mari 2014Document57 pagesLista Contribuabililor Mari 2014szeni_csNo ratings yet

- Connect - Reasoning - Set 1Document31 pagesConnect - Reasoning - Set 1Rajesh100% (3)

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingDocument79 pages(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakNo ratings yet

- Name Mukul Milind Joshi: Part ADocument6 pagesName Mukul Milind Joshi: Part AMukul JoshiNo ratings yet

- Ut Standard Document Instructions and ChecklistDocument4 pagesUt Standard Document Instructions and ChecklistEwoirNo ratings yet

- Levy and Charges of GSTDocument16 pagesLevy and Charges of GSTMoosa ZaidiNo ratings yet

- Unit 3 Mba-02Document17 pagesUnit 3 Mba-02Himanshu AwasthiNo ratings yet

- General IndustryDocument1 pageGeneral IndustryMuhammad Aidil FitrahNo ratings yet

- 2WUP2011 ReportDocument318 pages2WUP2011 Reportedgar caceresNo ratings yet

- GR 10 Buss Notes Chapter 5Document7 pagesGR 10 Buss Notes Chapter 5edwardskhathutsheloNo ratings yet

- Operations Management (OPM530) - C4 LocationDocument41 pagesOperations Management (OPM530) - C4 Locationazwan ayop100% (2)

- Township Recovering Following Hurricane: Don't Miss Our Town' This WeekDocument12 pagesTownship Recovering Following Hurricane: Don't Miss Our Town' This WeekelauwitNo ratings yet

- Finning Q3 2023 Interim Report Nov 6 2023Document64 pagesFinning Q3 2023 Interim Report Nov 6 2023Allan ShepherdNo ratings yet