Professional Documents

Culture Documents

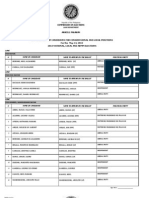

Search Manufacturing BI 0211

Search Manufacturing BI 0211

Uploaded by

Majid AliOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Search Manufacturing BI 0211

Search Manufacturing BI 0211

Uploaded by

Majid AliCopyright:

Available Formats

I

k

3

Can business

intelligence software

help manufacturers

improve efficiency?

k

7

Making the case for

business intelligence

in manufacturing

k

11

Getting started

with manufacturing

business intelligence

software systems

k

15

Seven key questions

for manufacturing

BI tools evaluation

Howtocet

startedwith

ousiness

intellicencein

nanulacturinc

BYCHRIS MAXCER

ASearchManufacturingERP.comeBook

WELCOME

Howtocet started

withbl in

nanulacturinc

FACING INCREASING pressures from globalization and a sagging economy, manu-

facturers are between a rock and a hard spot. And many of them see business

intelligence (BI) as an escape route. As one observer puts it, A lack of informa-

tion is what got us into this mess in the first place, so we had better start con-

verting raw meaningless data into meaningful and actionable information so

we can get out of this mess sooner rather than later.

But does BI hold the answers for every manufacturer? How does BI differ

from manufacturing intelligence? How can a manufacturer calculate the ROI

from a BI implementation? How important is the quality of the data the BI sys-

tem is parsing? There are many BI tools out there; how does a manufacturer

know which are the right ones?

This eBook will answer these questions:

I

Can business intelligence software help manufacturers

improve efficiency?

I

How should manufacturing organizations make the case

for business intelligence?

I

How should manufacturers get started with business intelligence

software systems?

I

What are the best practices for evaluating BI tools for manufacturing?

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

z

MANUFACTURING ORGANIZATIONS are

facing more pressure than ever

before, and the pressure just keeps

rising. Globalization and new compe-

tition, in addition to weak economies,

are forcing manufacturers to run lean-

er and meaner, while they must pro-

duce a greater number of types of

products, if not custom products, as

well as maintain increasingly difficult

standards.

How can manufacturers ensure that

every order is efficient and profitable

while saving money or even taking

on new business?

Does business intelligence (BI) for

manufacturers hold the answers?

I think most leading thinkers

correctly believe a lack of information

is what got us into this mess in the

first place, so we had better start

converting raw meaningless data into

meaningful and actionable informa-

tion so we can get out of this mess

sooner rather than later, said Boris

Evelson, principal analyst of BI for

Cambridge, Mass.-based Forrester

Research.

UNDERSTANDING

MANUFACTURING AND BI

When it comes to manufacturers,

though, there are really two kinds of

intelligencemanufacturing intelli-

gence (a.k.a. enterprise manufactur-

ing intelligence) and business intelli-

gence for manufacturers.

Business intelligence and manu-

facturing intelligence are related in

the sense that BI is all-encompassing,

covering everything from weather

forecasts to consumer behavior, said

Dan Miklovic, vice president of manu-

facturing industries advisory services

at Stamford, Conn.-based Gartner Inc.

Manufacturing intelligence focuses

in on the manufacturing value chain

from ideation through after-delivery

service, even to retirement and recy-

cling in some cases, but with a real

sweet spot of manufacturing itself.

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

!

CHAPTER 1

Canbl soltware

helpnanulacturers

inproveelliciencv`

More specifically, manufacturing

intelligence (MI) tends to be more

about analyzing whats happening on

the production floor in real time or

near real time.

What is happening on the convey-

or belt? How does it compare to yes-

terday? Are there errors? Are things

getting stuck somewhere? Is every-

thing flowing according to plan?

Evelson illustrated, noting that this

kind of operational intelligence is

designed to eke out efficiencies in the

manufacturing process. If youre talk-

ing about measuring and tracking

machine state performance, odds are

youre looking at manufacturing intel-

ligence.

FROM SHOP FLOOR TO TOP FLOOR?

If you want to look at the higher level

of product and process performance,

understanding how certain materials

work at certain times or understand-

ing how a process will affect the sup-

ply chain, thats the crux, said Simon

Jacobson, a research director for

Boston-based AMR Research. The

point you begin integrating the data

with the supply chain, it becomes a

broader architecture where you start

to involve multiple data sources and

multi-site performance to track how

well manufacturing is or isnt per-

forming.

The idea, of course, is to connect

MI types of data with traditional

enterprise dataafter all, companies

that manufacture have something to

sell, and how can executives make the

best decisions with data that shows

only a portion of whats going on?

More importantly, what if were talk-

ing about companies with multiple

manufacturing plants?

The competitive advantage that

were seeing manufacturers try to

achieve is to holistically manage their

manufacturing operations across the

global networkthe large manufac-

turers that have 90 to 100 plants,

said Matthew Littlefield, a senior

research analyst for Boston-based

Aberdeen Group.

If they are able to evaluate and

manage those plants with a common

set of metrics for each plant, thats

really viewed as a competitive advan-

tage for those manufacturers. One of

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

4

The cruxol

a hicher level

ol product

perlornance is

understandinc

howa process

will aect the

supplvchain

SIMONJACOBSON

Researchdirector, AMRResearch

the traditional problems is the silo

approach, where each of their facili-

ties has [its] own set of metrics, [its]

own set of processes, and manages

those processes in [its] own way,

Littlefield explained.

If you have a solution that can nor-

malize across those manufacturing

facilities that are generally distributed

globally, thats viewed as a competi-

tive advantage that can be achieved

by these systems, he added.

For BI implementations, a manufac-

turer needs to have at least three to

five good-sized facilities before it will

see much return on investment in

manufacturing BI initiatives, he said,

though any manufacturer can benefit

from highly focused MI solutions that

can be implemented at lower price

points.

Still, is there room for intelligence in

well-running plants?

More advanced companies are

now taking a next look and are saying,

We have our production line in con-

trol, we know whats happening there,

we have the system alerting us. So

now, what can we do with that data?

How can we use the data and use the

information to compete and conquer

our competitors? Evelson explained.

And teasing out competitive ad-

vantage is key in todays small, com-

moditized world. Whether a company

is producing a commodity or not, are

there some key advantages manufac-

turers can uncover by using BI

strategies?

At the higher BI level, it ranges

from better demand forecastingby

[better] identifying customer needs,

for exampleto improved sourcing

through a better understanding of

supplier performance, Gartners

Miklovic said, noting that common

use cases for BI in manufacturing

include R&D productivity/innovation

and warranty/quality areas.

In addition, if management has a

clear understanding of how difficult

or risky it is to produce a given prod-

uct, they might not sign contracts

that appear profitable on the surface

but really arent the smartest moves.

For example, if a high-volume, big-

contract sale requires changes in sup-

ply chain orders and plant floor labor,

the profitability of that big-ticket

order may plummet. In this scenario,

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

'

lor bl inplenen

tations a nanulac

turer needs tohave

at least three tove

coodsizedlacilities

oelore it will see

nuchreturnon

investnent in

nanulacturinc bl

initiatives

it may be more profitable to take on a

lower-volume, lower-ticket order that

ironically carries a much higher profit

marginbut you need data and tools

to help you measure the pros and cons.

DOES BI FOR MANUFACTURING

OFFER EVEN MORE OPPORTUNITY?

All manufacturers, no matter what

products come off their assembly

lines, share common areas of oppor-

tunity. A good place to start is under-

standing customer needs and buying

behavior to reduce costly inventory.

Can you change operations in a plant

or multiple plants so you can take on

even more business?

If you drive this level of informa-

tion integration and availability that

shows the tradeoffs at the supply

chain level with whats going on in

manufacturing, you can start shifting

capacityor make better decisions

around capacitybut you can also

really gain [insight] into multiple site

performance, Jacobson said. Basical-

ly, opportunities that are blurry when

looking at a single plant can become

clear when youre looking at several.

The million-dollar question: Can BI

tools magically uncover gold in hard

times?

No, Littlefield said. Technology is

not the answer; its just a tool.

If a company tries to apply BI with-

out a strategy, it could end up causing

harm, and if the information revealed

by BI tools isnt acted on, its just a big

waste of money.

The key to success is getting the

strategy and philosophy right, then

applying the right tools to get the

data to make the necessary deci-

sions, Littlefield explained. And

finally, you have to use the tools to

validate that the corrective actions

taken have yielded the results you

desiredand expected. I

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

o

The kevto

success is cettinc

the stratecvand

philosophvricht

thenapplvinc the

richt tools tocet

the data tonake

the necessarv

decisions

MATTHEWLITTLEFIELD

Senior researchanalyst, AberdeenGroup

BUSINESS INTELLIGENCE (BI) in manufac-

turing environments is emerging as a

worthwhile investment for many savvy

companies. These firms are starting

to realize that the gap between manu-

facturing intelligence designed to

keep assembly lines running smooth-

ly and their traditional BI systems is

more like a chasm.

How does what happens on the

production floor affect sales? Prof-

itability? Can small changes driven

through many manufacturing sites

deliver large returns for the company

as a whole?

If companies with significant manu-

facturing operations want to beam

light into the dark, they have to make

a case for implementing BI thats

capable of creating meaning from

manufacturing activity.

MAKING THE CASE FOR BI IMPLE-

MENTATION IN MANUFACTURING

Building the BI business case begins

with a number of questions, includ-

ing: Where do you start? How do you

calculate business intelligence ROI?

Who needs to be involved? Who

drives the BI projects?

Depending on the characteristics

of the company, whos driving it

determines what it [the BI project]

looks like, said Simon Jacobson, a

research director for Boston-based

AMR Research. You can see anyone

from VPs of the supply chain demand-

ing this just for information integra-

tion, or you can see this from a chief

financial officer whos looking at how

to compensate plants, especially

throughout manufacturing as a P&L,

where the [goal] is to free up as much

working capital as possibleyou have

to understand how these plants are

performing.

Alternatively, a vice president of

supply chain might want to under-

stand what performance capacity

looks like so he can better map where

to drive response based on global

demand, Jacobson added.

1. Make sure you have a driver

for BI in manufacturing

As with any road trip, drivers have the

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

/

CHAPTER 2

Makinc thecaselor

bl innanulacturinc

steering wheel, but that doesnt mean

they dont get navigational assistance

from their passengers. IT may end up

taking over the wheel at various

points of the project, but organiza-

tions need more than just executive-

level buy-in. They need executive-

level ownership.

Traditionally, a business guy says,

I need this type of information, and

an IT guy figures out how to collect

and present it, said Boris Evelson,

principal analyst of business intelli-

gence for Cambridge, Mass.-based

Forrester Research. IT would be

architecting, building, delivering, and

buying BI solutionsthats the tradi-

tional approach.

But that doesnt work, he said. A

business person has to step up and

say: Not only do I need information,

but let me tell you exactly what kind,

and let me be the owner of the initia-

tive. Its my budget, my data, its my

neck on the line before my CEO, so

Im going to own the products. When

we hear CEOs, COOs and CMOs talk

like that . . . thats when we see suc-

cessful implementations.

Clearly the person whos driving the

initiative has the power to determine

the direction and course of action. But

organizations should make sure they

dont have a driver whos soliciting

different destinations from everyone

and ends up pulling over in a state of

confusion.

2. Find your pain points

that BI could solve

A company needs to know its pain

points and address them quickly dur-

ing the implementation.

But, at the same time, even if com-

panies fix their existing pain points,

they may be ignoring far greater

opportunitiesand this knowledge

cuts both ways.

Realize you are going to want to be

able to do some analysis on your

entire global manufacturing net-

workso for a large manufacturer, its

probably a very large project, said

Matthew Littlefield, a senior research

analyst for Boston-based Aberdeen

Group.

And large projects carry expense

and risk.

It is risky in not having a clearly

defined goal and not understanding

where youre going to derive your

value from, Littlefield explained,

adding that trying to do too much is a

common mistake.

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

8

Orcanizations

neednore than

}ust executive

level ouvin

Thevneed

executivelevel

ownership

3. Clearly define your goals for BI

If an organization doesnt have easily

identifiable pain pointsor they dont

seem to justify the cost of a manufac-

turing-focused BI systemthat does-

nt necessarily mean theres little to

gain. Smart organizations will want to

see whether theres information they

can deliver to decision-makers that

can help them meet company goals

or align corporate priorities with busi-

ness metrics.

THE CRITICAL IT ANGLE IN BI FOR

MANUFACTURING IMPLEMENTATIONS

Meanwhile, even with business-

focused stakeholders and clear exec-

utive support, IT remains critical in

any manufacturing-focused intelli-

gence rollout.

You need to have a mature IT

department within the manufactur-

ers, so you need to have a relatively

large size company to have that, Lit-

tlefield said.

An underpowered or inexperienced

IT staff will have to be addressed

right away. In addition, even in an IT

department packed with super brains,

organizations need to be able to con-

nect three critical groups: IT experts,

manufacturing experts and business

experts.

Its tough to do, but we do see that

best-in-class manufacturers are con-

siderably more likely do that, and

steering committees and cross-func-

tional continuous improvement

teams are two ways we see that com-

ing together, Littlefield said.

A steering committee helps direct

the vendor selection process and ini-

tial project implementation, and once

theyre up and running, a cross-func-

tional continuous improvement team

will ensure that the organization con-

tinues delivering new business value.

UNDERSTANDING THE ROI

OF BI FOR MANUFACTURERS

Determining ROI can be the hardest

part of any large-scale business intel-

ligence initiative. Even with pain

points and clear goals, business intel-

ligence projects are notorious for slid-

ing out of scope, breaking budgets,

and passing deadlines. With large

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

9

lveninanlTde

partnent packed

withsuper orains

orcanizations need

tooe aole tocon

nect three critical

croups lTexperts

nanulacturinc

experts and

ousiness experts

projects that can take months, if not

years, a reasonable ROI calculation

can be difficult to determine.

Focused BI efforts can often show

ROI, but many of those cases also line

up with manufacturing intelligence

systems that are focused on a portion

of a plants performancewith very

little connection to the broader busi-

ness. Figuring BI ROI is a difficult prop-

osition, and often a bit of a gamble.

Can you prove ROI in two years?

Nobody can prove that today, Evel-

son said. You [must], unfortunately,

be a believer that this is the future

and you cant survive without it.

He weighs spending $100 million to

revamp an organizations BI environ-

ment against spending the same

amount of money to buy another fac-

tor. Which will give you more ROI? I

dont think anybody can come to you

and answer this question.

However, savvy manufacturers

tend to invest in constant improve-

ment and optimization. That will

inevitably lead to a tradeoff down the

road when companies that invested

in more plants are facing competition

from companies that invested in mak-

ing themselves smarter.

The key is creating short-term goals

with long-term investment. I

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

IC

Canvouprove

ROl intwovears`

Nooodvcan

You'nust]

unlortunatelv

oe a oeliever that

this is the luture

andvoucant sur

vive without it

BORIS EVELSON

Principal analyst, Forrester Research

GETTING STARTED with business intelli-

gence (BI) software systems can be

particularly challenging for manufac-

turing companies. The problem faced

by many organizations with multiple

manufacturing units starts close to

hometheyve probably grown them-

selves into something barely recog-

nizable.

Say, for example, that my com-

pany became large by acquiring 10

different manufacturing companies,

and they all have their own customer

list, their own product naming con-

ventions, said Boris Evelson, princi-

pal analyst of Business Intelligence

for Cambridge, Mass.-based Forrester

Research. How do I make sure I am

not stepping on my own toes? How

do I know my factory is calling the

same product by the same name

as my factory in another country?

The answers lie in your business

intelligence dataand data prepara-

tion, it turns out, is critical.

BUSINESS MUST OWN THE DATA

No intelligence tool can work without

data, and if the data isnt accurate

and specific, the tools used will only

spew more meaningless data. Sur-

prisingly, the first step isnt building a

data warehouse or creating special-

ized databases. No, the real prepara-

tion starts far sooner than many

expect.

We always say the very first step

is to admit that what you do as a CEO

or COOin addition to owning widg-

ets and factoriesis that you own

data, Evelson said. When business

owners look at their data problems as

a technology problem, they say, My

data is all over the place. Its not syn-

chronized. What is my IT doing

wrong? That, to me, typically is the

first indication that a company isnt

going to be successful doing business

intelligence.

After ownership is defined and

embraced, the steps become clearer.

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

II

CHAPTER 3

Cettinc startedwith

nanulacturinc bl

soltwaresvstens

1. Define your data

IT is there to help you, but you have

to come up with the definitions. What

is a widget? What is a customer con-

tact? Evelson said. Try getting two

or three people in a room to define a

product or customer profitability met-

ric... you have to understand how

profitable each customer is. Tracking

revenue from each customer is easy,

but understanding how much youre

spending on a customer is a very diffi-

cult task. You can calculate your cost

over raw materials, but electricity,

real estate, work force... thats not

attributable to a single customer.

How do you allocate all of your costs

across your company? Youll get dif-

ferent opinions.

A business has to have a very clear

understanding of what they are going

to measure and how they are going to

measure it, and then, and only then,

can they hand it off to IT, Evelson

added.

2. Aggregate your data

Many traditional BI software systems

start with a dedicated data ware-

house. But as tools get better at

accessing data from various source

systems, data warehouses are

becoming less necessary.

It doesnt matter what you call it,

but you need some kind of integrated

way to have all your data in one logi-

cal placenot necessarily physical

but it has to be brought together so

you can, for example, relate your

financial data to chart data, or relate

North American data to European

data, Evelson said. You can build

a virtual data warehouse.

Companies can evaluate new

technologies designed for BI, he said,

as opposed to older relational data-

bases that may have been designed

decades ago and augmented over

the years.

There are some new technologies

that came from the ground up specifi-

cally for data warehousingthings

like columnar databases or inverted

index databases, which are especially

useful for any company looking to

analyze structured and unstructured

data, Evelson said.

Clearly, companies will need to

map out their data architecture early.

3. Clean your data

Meanwhile, manufacturing-focused

companies need some sort of master

data management plan to ensure that

their BI data is accuratethey simply

cant make decisions based on faulty

data.

All this data aggregation, data

synchronization, and data cleansing

is a very tough exercisethats the

bulk of the difficulty in BI environ-

ments. Once you get the data in one

place, and its clean, you can start

using it, Evelson said. That first part

is huge, and thats what companies

are spending millions of dollars

on.

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

Iz

PRINCIPLES FOR BI SUCCESS

FOR MANUFACTURERS

Of course, in any major undertaking,

the rules are rarely hard and fast.

There are no strict, well-defined

methodologiesthe whole process is

much more an art than a science,

Evelson said. Its all about lessons

learned, not repeating someone elses

mistakes. You cant really buy a

strategic Business Intelligence 101

textbook.

Still, there are solid principles for

success. Here are some important

ones:

Call in the consultants: While it may

be theoretically possible for an organ-

ization to create its own manufactur-

ing-focused business intelligence sys-

tem, its going to be much more

difficult if it doesnt hire consultants.

One best practice, according to

Evelson, is to work with consultants

who have done this before, who know

best practices, who have already

accumulated a long list of potential

pitfalls, so when they come to you,

you pay them so you dont repeat the

same mistakes.

Dont try to boil the ocean: Manufac-

turers have to take small steps, and

plan waypoints into their journey.

Pick a metric you can implement in

a few weeks, Evelson said. Try to

show your key stakeholders some-

thing tangible, because if they dont

see something tangible within a few

weeks, people lose interest, lose

focus, and business requirements

change. You cant have long-term

strategic planning without still deliv-

ering something tactical every few

weeks.

From KPIs to real-time datause

only what you need: Manufacturing

intelligence thats focused on the pro-

duction line can be particularly useful

if the data is real-time or near real-

time. But for strategic analysis and

decisions, data thats a few days old

may be of little use. Real-time dash-

boards are impressive, but a company

has to consider the metrics its meas-

uringin some instances, it might not

be worth the cost of managing real-

time data. Still, if the goal is to better

understand manufacturing perform-

ance, the further you go away from a

line or process, arguably the less valu-

able your data becomes, noted

Simon Jacobson, a research director

for Boston-based AMR Research.

Build flexibility: One of the problems

with large BI rollouts, if you build your

system without flexibility, and it takes

a year to roll out a cross-functional

system, then something is going to

change, said Matthew Littlefield,

senior research analyst for Aberdeen

Group.

Buy some BI and data management

tools: Organizations shouldnt rein-

vent the wheel, but rather buy some

tools. They may be bolt-on products

from the enterprise manufacturing

system or the ERP system, or a com-

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

I!

bination of the two with some best-

of-breed solutions thrown in. Theres

no way around it, though: Selecting

applications from vendors is going to

take a lot of time.

Theres two major places weve

seen people using BIone is to ana-

lyze and connect production data to

corporate performance, and the other

is to connect maintenance and down-

time data and then to analyze that

data, Littlefield said. So on an asset

maintenance side, if youre looking to

find trends and reliabilityreduce

downtimevery often that downtime

data is stored in ERP or data ware-

houses, and the analysis tools that

come with the BI system can help you

do that.

It all depends on the metrics an

organization is using, and it will want

to make sure that the possible ven-

dors have tools that have been used

in similar situations with similar types

of data.

WHERE TO START WITH BI

FOR MANUFACTURERSGETTING

YOUR HANDS DIRTY

The last three key lessons learned are

strategic rather than tactical, and

they ensure that a company navigates

toward the areas that will reveal the

best return on investment.

Look for variability: Many organiza-

tions get stuck finding the best places

to start, but theres a simple rule of

thumb that always helps: Its a mat-

ter of attacking the biggest point of

variability and getting visibility into

that, Jacobson said.

Find points of leverage: Where to

start will always depend on a combi-

nation of factors that will vary by

company, industry and geography.

Market factors create opportunity,

too.

When crude oil was $150-plus,

logistics and supply chain efficiency

were critical, but thats less so now,

said Dan Miklovic, vice president of

Manufacturing Industries Advisory

Services with Stamford, Conn.-based

Gartner Inc. In general, the best

advice isafter a few pilots to vali-

date you know how to use the tool

and build some credibilitygo after

the areas with the greatest leverage.

If labor is a major contributor to cost,

use business intelligence to improve

labor productivityi.e., increase vol-

ume or lower cost or both. If energy is

a major factor, go after that.

Change your philosophy: To use BI

tools and principles successfully in

dynamic, global manufacturing envi-

ronments, companies may need to

tweak their basic worldview.

Adopt a philosophy of continuous

improvement, Miklovic said. It really

is making a cultural shift and not just

implementing a tool. I

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

I4

A LOT GOES into developing a business

intelligence (BI) software system for

manufacturing organizationsdata

aggregation, cleansing, and synchro-

nization, plus defining metrics and

creating specific targets for analysis.

At the heart of any system, however,

are the software and hardware that

do the heavy lifting. Choosing the

wrong tool guarantees a costly mis-

take.

For instance, theres manufacturing

intelligence that focuses on real-time

or near-real-time data and is

designed to ensure that manufactur-

ing processes run as efficiently as

possible. Then theres more tradition-

al business intelligence that focuses

on historical transactional data that

rests in various databases, which is

then cubed and analyzed. And there

are varied connections of everything

in between.

Certainly, the vendors in this space

are trying to confuse ita lot of BI

vendors are trying to go down to the

shop floor and deal with real-time

data, and its not necessarily their tra-

ditional strength, said Matthew Lit-

tlefield, senior research director with

Boston-based Aberdeen Group. Con-

versely, some manufacturing intelli-

gence solution providers are looking

to provide tools to help manufactur-

ers connect and analyze their data

with more business-focused systems.

There are, however, lots of tips for

cutting through the hypehere are

several questions buyers will want to

answer as they begin the BI tools

evaluation process:

1. Should you write an RFP for

manufacturing BI systems?

The writing of an RFP isnt the only

way to solicit bids and buy solutions,

but the act of writing one forces an

organization to nail down what it real-

ly needs. Thats a critical starting

point.

Its still good common sense that

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

I'

CHAPTER 4

Sevenkevquestions

lor nanulacturinc

bl tools evaluation

you really need to define your require-

ments very welland nobody else

can do that for you, said Boris Evel-

son, principal analyst of BI for Cam-

bridge, Mass.-based Forrester

Research. You have to take the time

to write the requirements.

2. Can the BI vendor address IT and

manufacturing? Can the BI vendor

speak the languages of IT as well as

manufacturing operations?

If they have that ability to talk and

work collaboratively with both organi-

zations, thats a start, Littlefield said.

I would only work with a vendor who

had that ability to make those con-

nections.

3. Does the BI vendor have

experience in manufacturing or

your particular industry vertical?

When it comes to BI tools evaluation

for manufacturing-related uses,

howimportant is industry-specific

functionality?

On a scale of 1 to 10, about a 7 or 8,

said Dan Miklovic, vice president of

Manufacturing Industries Advisory

Services for Stamford, Conn.-based

Gartner Inc. It clearly will speed up

your implementation if the solution

has templates using the terminology

specific to your industry, and it is

always good to have access to indus-

try-standard practice.

However, just because a vendor

has limited or minimal experience in

your industry, you should not rule

them out, Miklovic said. Proximity

and fit with your overall architecture

are two other factors that should

weigh heavily on your choice, he

added.

4. Is your EMS or ERP vendor

the best option for BI?

Clearly, fit with your architecture is

essential, and if your ERP vendor

offers a solution, it should be on the

short list, but it should not be the de

facto choice, Miklovic said. ERP

vendors are generally broad and

cross-industry and so have breadth

on their side, but not always depth.

5. BI can be expensiveis off-

shoring a good option for manufac-

turing?

Aside from the politics of off-shoring,

the initial stages of BI rollouts might

not be a good fit for companies con-

sidering it.

Unlike traditional software devel-

opment where you can write your

specification and hand it over to

somebody that can be anywhere, take

a couple of months and bring it back,

with business intelligence, you have

to be talking to a person face-to-

face, Evelson said. Its very hard to

define requirements because there

are multiple definitions. You have to

be in the same room when business

people are discussing these things. If

you take notes and hand over a piece

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

Io

of paper, you just cant get the com-

plete BI picture.

Off-shoring for certain parts of BI

doesnt workyou can off-shore

maintenance, support, help desk; but

all the initial stages, like rapid proto-

typingthese guys need to be sitting

right in your office doing everything

interactively, Evelson added.

6. What are the tradeoffs for manu-

facturers between larger ERP ven-

dors and more focused BI vendors?

It is always a challenge in that the

larger ERP firms generally write good

code but are not intimate with the

processes, Miklovic explained. Bou-

tique vendors write great functionali-

ty into their products, but their soft-

ware skills may not be the best.

At the same time, an industry-

focused vendor might fit nicely but lack

flexibility, while an ERP-based system

might require more customization.

7. Is a BI pilot programnecessary?

Odds are, companies are spending a

lot of money on BI for manufacturing,

and a test drive isnt just a routine

tradition.

The best approach is a robust

pilot, Miklovic said. Make the pilot

rich enough to validate the claims and

broad enough to encounter the most

likely issues. Only upon successful

completion of the pilot [should you]

commit to a rollout. I

HOW TO GET STARTED WI TH BI I N MANUFACTURI NG

a

HOW TO GET

STARTED

a

CAN BI IMPROVE

EFFICIENCY?

a

BI IN MANU-

FACTURING

a

GETTING

STARTED WITH

MANUFACTURING

BI SOFTWARE

SYSTEMS

a

SEVEN KEY

QUESTIONS FOR

MANUFACTURING

BI TOOLS

EVALUATIONS

I/

ABOUT THE AUTHOR:

Chris Maxcer has spent more than a dozen years reporting on everything from enterprise tech-

nology to consumer gadgets. While tech brings him great joy, there's something to be said for

getting out in the wild and turning it all offor most of it. When he's plugged in, you can reach

him at chrismaxcer@gmail.com.

The oest

approachis a

rooust pilot

DANMIKLOVIC

Vice president, Gartner Inc.

RESOURCES FROM OUR SPONSORS

Short-Run Manufacturer Builds Long-term Success with EnterpriseIQ

ERP In A Recovering Economy: Now is the perfect time to invest!

Leading Automotive Supplier Accelerates Lean Operations with EnterpriseIQ

About IQMS:

IQMS offers the innovative EnterpriseIQ ERP software for the manufacturing industry. Designed

as a scalable, single source solution with multiple location, language and currency capabilities,

EnterpriseIQ is the best industry specific solution available.

RESOURCES FROM OUR SPONSORS

Discover Sage ERP X3

Accelerate Your Business Exchanges

Grows With Your Business

About Sage:

Trust a leader - Sage is the number one worldwide provider of accounting and ERP solutions for

small and midsized businesses. We support more than 3.1 million customers in the U.S. and

Canada, and over 6.1 million customers worldwide. Traditionally, we have been associated with

financial management software, but over the last 25 years we have taken this experience and

applied it to other areas. Today, we are the third largest provider of ERP solutions worldwide for

companies regardless of size. Our ERP solutions help businesses and organizations manage

processes across all functionsfrom purchasing, manufacturing, and inventory management, to

sales, CRM, accounting, payroll, and human resource management. For more information,

please visit our website at www.SageERPsolutions.com

RESOURCES FROM OUR SPONSORS

Five Ways ERP Can Help You Implement Lean

2010 Aberdeen ERP in Manufacturing Report

Epicor ERP Virtual Tour

About Epicor:

Epicor Software is a global leader delivering business software solutions to the manufacturing,

distribution, retail, hospitality and services industries. With 20,000 customers in over 150

countries, Epicor provides integrated enterprise resource planning (ERP), customer relationship

management (CRM), supply chain management (SCM) and enterprise retail software solutions

that enable companies to drive increased efficiency and improve profitability. Founded in 1984,

Epicor takes pride in more than 25 years of technology innovation delivering business solutions

that provide the scalability and flexibility businesses need to build competitive advantage. Epicor

provides a comprehensive range of services with a single point of accountability that promotes

rapid return on investment and low total cost of ownership, whether operating business on a

local, regional or global scale.

You might also like

- A Project Report On Business Intelligence and It's Use in Decision Making" at TARANG SOFTWARE TECHNOLOGY LTD, BangaloreDocument65 pagesA Project Report On Business Intelligence and It's Use in Decision Making" at TARANG SOFTWARE TECHNOLOGY LTD, BangaloreBabasab Patil (Karrisatte)100% (1)

- Big Data in PracticeDocument23 pagesBig Data in PracticevikasNo ratings yet

- Unit VDocument13 pagesUnit VArushi SrivastavaNo ratings yet

- Business Intelligence ArticleDocument22 pagesBusiness Intelligence ArticlesumahithaNo ratings yet

- Information Builders in The Bi Survey 13Document34 pagesInformation Builders in The Bi Survey 13Mam'selle HajarNo ratings yet

- Cie sp002 - en PDocument16 pagesCie sp002 - en PCarlos LozadaNo ratings yet

- Business Intelligence 2Document8 pagesBusiness Intelligence 2Ghazwan KhalidNo ratings yet

- IBM sBusAnalytics LI#461099 E-Guide 092211Document10 pagesIBM sBusAnalytics LI#461099 E-Guide 092211Usman FarooqiNo ratings yet

- A Smarter Approach: Inside IBM Business Analytics Solutions For Mid-Size BusinessesDocument6 pagesA Smarter Approach: Inside IBM Business Analytics Solutions For Mid-Size Businessessekhar1982No ratings yet

- Manufacturing Slideshare EnusDocument19 pagesManufacturing Slideshare EnusKrishna SinghNo ratings yet

- RTP RT292 BITechGuide Feb 2021 FinalDocument10 pagesRTP RT292 BITechGuide Feb 2021 FinalHarmendar S KothariNo ratings yet

- Top 10 Trends For Winners in Mobile 2016Document24 pagesTop 10 Trends For Winners in Mobile 2016Soundar SrinivasanNo ratings yet

- How Can AI Improve Production Planning in ManufacturingDocument3 pagesHow Can AI Improve Production Planning in ManufacturingEmekaNo ratings yet

- Big DataDocument13 pagesBig DataSantosh JosephNo ratings yet

- Business Intelligence Systems - Types of BI Tools in 2023Document16 pagesBusiness Intelligence Systems - Types of BI Tools in 2023Jhumri TalaiyaNo ratings yet

- Business Intelligence For Wet Stock Inventory ManagementDocument3 pagesBusiness Intelligence For Wet Stock Inventory ManagementworldtelemetryNo ratings yet

- Do It Smart: Seven Rules for Superior Information Technology PerformanceFrom EverandDo It Smart: Seven Rules for Superior Information Technology PerformanceRating: 3 out of 5 stars3/5 (1)

- 5 Estrategias de RespaldoDocument7 pages5 Estrategias de RespaldoLuis Jesus Malaver GonzalezNo ratings yet

- Propelling Digital Transformation in Manufacturing Operations With Power BIDocument8 pagesPropelling Digital Transformation in Manufacturing Operations With Power BIAlexis PachecoNo ratings yet

- BCG Inside OPS Dec 2015Document36 pagesBCG Inside OPS Dec 2015daniaticoNo ratings yet

- Micro Strategy White PaperDocument88 pagesMicro Strategy White Papersinghsa3No ratings yet

- Iot in The Real World: Ebook SeriesDocument17 pagesIot in The Real World: Ebook SeriesJalil RazaNo ratings yet

- Howindustry4 0willboostyourmanufacturingproductivityDocument6 pagesHowindustry4 0willboostyourmanufacturingproductivityaimanakmal485No ratings yet

- How To Make Business Intelligence Pay: A Practical Guide For Manufacturers and Distributors July 2006Document12 pagesHow To Make Business Intelligence Pay: A Practical Guide For Manufacturers and Distributors July 2006Software GuyNo ratings yet

- LogiAnalytics BuildingvsBuyingDocument21 pagesLogiAnalytics BuildingvsBuyingHafidz Ash ShidieqyNo ratings yet

- Manufacturing Industry FinalDocument15 pagesManufacturing Industry FinalBhakti Mehta100% (1)

- 11 Manufacturing AnalyticsDocument6 pages11 Manufacturing AnalyticsII MBA 2021No ratings yet

- Accelerate and Improve Business Outcomes With AIoTDocument26 pagesAccelerate and Improve Business Outcomes With AIoTMan HumanNo ratings yet

- Challenges in Adopting It in Manufacturing Sector ForDocument25 pagesChallenges in Adopting It in Manufacturing Sector ForDheeraj KhatriNo ratings yet

- Business Analytics Yearbook: ButlerDocument87 pagesBusiness Analytics Yearbook: ButlerkevindsizaNo ratings yet

- National Conference Paper - GokulDocument2 pagesNational Conference Paper - Gokulgokulresearch 19No ratings yet

- CH 3Document7 pagesCH 3geo023No ratings yet

- International Journal of Management (Ijm) : ©iaemeDocument11 pagesInternational Journal of Management (Ijm) : ©iaemeIAEME PublicationNo ratings yet

- Tableau Dashboard Best PracticesDocument15 pagesTableau Dashboard Best Practicesaman2007_shNo ratings yet

- Excerpt From The IBM Cognos Business Intelligence 10: The Official GuideDocument3 pagesExcerpt From The IBM Cognos Business Intelligence 10: The Official Guideapi-169326875No ratings yet

- Executive's Guide To Prescriptive Analytics - ZDNetDocument19 pagesExecutive's Guide To Prescriptive Analytics - ZDNetJohn PatlolNo ratings yet

- DocInfo Understanding Business Intelligence and Your Bottom LineDocument8 pagesDocInfo Understanding Business Intelligence and Your Bottom LinecmokayNo ratings yet

- Service-Oriented Architecture: A Practical Guide To Measuring Return On That InvestmentDocument16 pagesService-Oriented Architecture: A Practical Guide To Measuring Return On That InvestmentLuis Hernan Vidal VidalNo ratings yet

- Sumaiya Selim Sushme - BUS203 - 4 - Write UpsDocument14 pagesSumaiya Selim Sushme - BUS203 - 4 - Write UpsSumaiya Selim SushmeNo ratings yet

- Business Intelligence Vs Business AnalyticsDocument7 pagesBusiness Intelligence Vs Business AnalyticsKenneth OkoyeNo ratings yet

- Discussion Questions (10 Pts. Each)Document5 pagesDiscussion Questions (10 Pts. Each)Mary Joy M. GananciasNo ratings yet

- Edition 10 The View Inside Technologies Collide and Industries TransformDocument8 pagesEdition 10 The View Inside Technologies Collide and Industries TransformKhushii NaamdeoNo ratings yet

- Five Ways Artificial Intelligence and Machine Learning Deliver Business Impacts - GartnerDocument8 pagesFive Ways Artificial Intelligence and Machine Learning Deliver Business Impacts - GartnerKeren MendesNo ratings yet

- WP Supply Chain Visibility and Optimization enDocument8 pagesWP Supply Chain Visibility and Optimization enmilanmvd1No ratings yet

- Business Intelligence Definition and SolutionsDocument4 pagesBusiness Intelligence Definition and Solutionslazaro maizNo ratings yet

- Unit 5 BiDocument24 pagesUnit 5 Bitanisha.singh.1rNo ratings yet

- Enterprise Digital TwinDocument3 pagesEnterprise Digital TwinContineo world100% (1)

- Procurement: Managing Maverick Spend: Register Log inDocument4 pagesProcurement: Managing Maverick Spend: Register Log inabhishekgupta07100% (1)

- Business @ the Speed of Thought (Review and Analysis of Gates' Book)From EverandBusiness @ the Speed of Thought (Review and Analysis of Gates' Book)Rating: 5 out of 5 stars5/5 (2)

- SAP Harness Your Data PaperDocument10 pagesSAP Harness Your Data PaperLuis Jesus Malaver GonzalezNo ratings yet

- Manufacturing Enterprise 3.0: The New Information Management Paradigm Built On ProcessesDocument16 pagesManufacturing Enterprise 3.0: The New Information Management Paradigm Built On ProcessesBoris MilovanovićNo ratings yet

- Enterprise Applications: A Conceptual Look at ERP, CRM, and SCMDocument13 pagesEnterprise Applications: A Conceptual Look at ERP, CRM, and SCMpatalnoNo ratings yet

- It Takes Systems BainsDocument8 pagesIt Takes Systems Bainsshabir khanNo ratings yet

- AI in Banking Setting Up For & Continuing Down A Path of SuccessDocument39 pagesAI in Banking Setting Up For & Continuing Down A Path of SuccessNguyenNo ratings yet

- Abi Module 5Document17 pagesAbi Module 5Santhosh MSNo ratings yet

- DBTA Best Practices The New World of Business Intelligence and AnalyticsDocument9 pagesDBTA Best Practices The New World of Business Intelligence and Analyticscharanmann9165No ratings yet

- Choosing The Right BIDocument7 pagesChoosing The Right BISathish VenkataramanNo ratings yet

- Business Intelligence For RetailDocument4 pagesBusiness Intelligence For RetailzagovorichNo ratings yet

- Self Service Bi ThesisDocument4 pagesSelf Service Bi ThesisShannon Green100% (2)

- Designing A Competitive Innovation Portfolio MIT CISRDocument11 pagesDesigning A Competitive Innovation Portfolio MIT CISRKondal RaoNo ratings yet

- Balanced ScorecardDocument3 pagesBalanced ScorecardJoshua JaganNo ratings yet

- 04 Achieving Operational Excellence & CustomerDocument29 pages04 Achieving Operational Excellence & CustomerAlvi KabirNo ratings yet

- The Practice of Corporate Governance in Shareholder-Owned Microfinance InstitutionsDocument34 pagesThe Practice of Corporate Governance in Shareholder-Owned Microfinance InstitutionsHelena ThomasNo ratings yet

- Syllabus: St. Michael's College College of Accountancy Iligan CityDocument10 pagesSyllabus: St. Michael's College College of Accountancy Iligan CityJohanna AdremesinNo ratings yet

- Fed EssayDocument3 pagesFed EssayjnfurstNo ratings yet

- Lean Shipbuilding I EngDocument7 pagesLean Shipbuilding I EngGanesh FakatkarNo ratings yet

- Essay Question1Document14 pagesEssay Question1Aldrich AmoguisNo ratings yet

- Araceli, PalawanDocument2 pagesAraceli, PalawanSunStar Philippine NewsNo ratings yet

- Blockchain in Accounting, Accountability and Assurance An OverviewDocument14 pagesBlockchain in Accounting, Accountability and Assurance An Overviewmohamed ramadanNo ratings yet

- Screenshots Itil Process Map Visio PDFDocument16 pagesScreenshots Itil Process Map Visio PDFspamdamanNo ratings yet

- Performance Management Workshop From ExeQserve CorporationDocument6 pagesPerformance Management Workshop From ExeQserve CorporationWilson BautistaNo ratings yet

- Annie Porbeni, PHDDocument6 pagesAnnie Porbeni, PHDAnonymous wqu5Bnvlr4No ratings yet

- District Election: GaniamDocument16 pagesDistrict Election: GaniamAstroHub Astrology CentreNo ratings yet

- HRISDocument11 pagesHRISJitendra KumarNo ratings yet

- Are Federal Systems Better Than Unitary SystemsDocument33 pagesAre Federal Systems Better Than Unitary SystemsMuizuriNo ratings yet

- BenchmarkingDocument13 pagesBenchmarkingvivek sinha67% (6)

- The Dell Direct Model: What It Means For Customers (Users) : - ProsDocument12 pagesThe Dell Direct Model: What It Means For Customers (Users) : - ProsAbhinandan MattelaNo ratings yet

- Has Your Organization Implemented CMDBDocument8 pagesHas Your Organization Implemented CMDBAnuj DhawanNo ratings yet

- Best Practices For Agile Change and Release ManagementDocument8 pagesBest Practices For Agile Change and Release Managementdrops2sea100% (1)

- Mia Suzzette B. Illescas Bsat-3CDocument11 pagesMia Suzzette B. Illescas Bsat-3CJoseph SeriritanNo ratings yet

- Cobit Case Study - OracleDocument11 pagesCobit Case Study - OracleAdil AbdelganiNo ratings yet

- Strategic Human Resource Management and The HR ScorecardDocument18 pagesStrategic Human Resource Management and The HR ScorecardOMAR SAMIRNo ratings yet

- Voucher-FAIZ NET-5-JAM-up-744-06.01.23-Surabaye71Document9 pagesVoucher-FAIZ NET-5-JAM-up-744-06.01.23-Surabaye71Azka pixelNo ratings yet

- GCG MC No. 2012-09 - The Chief Executive Officer (CEO)Document13 pagesGCG MC No. 2012-09 - The Chief Executive Officer (CEO)eg_abadNo ratings yet

- YouthVote NewsRelease 25 10Document3 pagesYouthVote NewsRelease 25 10YouthVotePhilippinesNo ratings yet

- Human Resource PlanningDocument3 pagesHuman Resource PlanningVincent John Agustin AlipioNo ratings yet

- Introduction To Logistic ManagementDocument28 pagesIntroduction To Logistic ManagementRosalie RosalesNo ratings yet

- Buug, Zamboanga SibugayDocument2 pagesBuug, Zamboanga SibugaySunStar Philippine NewsNo ratings yet

- VP Director HR in Greater New York City Resume Debbie RyanDocument2 pagesVP Director HR in Greater New York City Resume Debbie RyanDebbie RyanNo ratings yet

- Problem Areas and Personnel Management in National, Local, and GOCC'sDocument3 pagesProblem Areas and Personnel Management in National, Local, and GOCC'sJenelyn Baguhin BudionganNo ratings yet