Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsSalary: 2. House Property: 3. Capital Gains: 4. Business / Profession: 5. Other Sources: Total of All Sources Less Deductions

Salary: 2. House Property: 3. Capital Gains: 4. Business / Profession: 5. Other Sources: Total of All Sources Less Deductions

Uploaded by

Himanshu AroraThis document outlines the key heads of income and deductions under the Indian personal tax system. It discusses the five main heads of income - salary/pension, house property, capital gains, business/profession, and other sources. It also explains some common deductions that can be claimed under sections 80C to 80U, including for provident funds, life insurance premiums, medical expenses, education loans, donations, and interest income. The overall process involves calculating gross total income from all sources, claiming applicable deductions, and paying tax on the total taxable income as per slab rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Income From SalaryDocument26 pagesIncome From SalaryAkash VisputeNo ratings yet

- Test 1 Fact SheetDocument2 pagesTest 1 Fact SheetHenry ZhuNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- Salary Design and Tax Implication by - Omprakash Todwal AnagramDocument15 pagesSalary Design and Tax Implication by - Omprakash Todwal AnagrammagusamNo ratings yet

- Tax Saving FY 2021-22 - FDocument30 pagesTax Saving FY 2021-22 - Fsapreswapnil8388No ratings yet

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- Income Tax Calculator 2016-17 v1804Document2 pagesIncome Tax Calculator 2016-17 v1804Pankaj BatraNo ratings yet

- Deductions 3Document35 pagesDeductions 3sanjeev kumar vsNo ratings yet

- Make Investments: Save On Income TaxDocument30 pagesMake Investments: Save On Income TaxMelinda BartleyNo ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

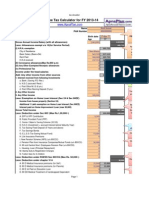

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Auto Income Tax Calculator Version 5.1 2010-11Document19 pagesAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNo ratings yet

- Personal Finance For StartersDocument17 pagesPersonal Finance For Starters9novtarunNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravNo ratings yet

- Comparison Between I.T. and DTCDocument23 pagesComparison Between I.T. and DTCsharma.shalinee1626No ratings yet

- CMA-How To Save Tax 2013-14Document37 pagesCMA-How To Save Tax 2013-14sunilsunny317No ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Deductions From Total IncomeDocument38 pagesDeductions From Total IncomeVikas WadmareNo ratings yet

- Income Tax Calculator FY 2012 13Document4 pagesIncome Tax Calculator FY 2012 13raattaiNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Exemptions From Salary:: 1. Conveyance AllowancesDocument2 pagesExemptions From Salary:: 1. Conveyance AllowancesPrashant UjjawalNo ratings yet

- Click Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyDocument24 pagesClick Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyHARSHITA JOSHINo ratings yet

- Income TaxDocument30 pagesIncome TaxHimani SaxenaNo ratings yet

- Joint Return 5. ResidencyDocument4 pagesJoint Return 5. ResidencyJon LeinsNo ratings yet

- Indian Income Tax DeductionsDocument4 pagesIndian Income Tax DeductionsDivyanshu ShekharNo ratings yet

- Section 80 CDocument5 pagesSection 80 CAmit RoyNo ratings yet

- How To Save Tax For FY 2017-18Document14 pagesHow To Save Tax For FY 2017-18Srinivas Pavan KumarNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- Income Tax ProjectDocument6 pagesIncome Tax Projectdipmoip2210No ratings yet

- Taxation Ce2Document10 pagesTaxation Ce2Ratnesh PalNo ratings yet

- Tax Declaration Form For 2012-13Document1 pageTax Declaration Form For 2012-13Sharique NisarNo ratings yet

- Onby Pa Adp 133rd BatchDocument53 pagesOnby Pa Adp 133rd BatchSreemon P VNo ratings yet

- Making The Best of Tax Saving OptionsDocument12 pagesMaking The Best of Tax Saving Optionssumit_shindeNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- Salary Includes: U/s 17Document14 pagesSalary Includes: U/s 17Ansh NayyarNo ratings yet

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- MG Pricing For 2015Document1 pageMG Pricing For 2015api-191645396No ratings yet

- Tax Planning IndiaDocument13 pagesTax Planning Indiajsaideep23No ratings yet

- Computation of Total IncomeDocument15 pagesComputation of Total Incomekhushi shahNo ratings yet

- Taxation of Salary Income 2017 IndiaDocument19 pagesTaxation of Salary Income 2017 Indiarpiyer72No ratings yet

- Investments For Section 80CDocument17 pagesInvestments For Section 80CAsħîŞĥLøÝåNo ratings yet

- Salary TDS Provisions 2011-12Document56 pagesSalary TDS Provisions 2011-12dharan2001No ratings yet

- Yesha Mehta (PES1201800966)Document8 pagesYesha Mehta (PES1201800966)nishanth vNo ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- How To Save Tax For FY 2013 14Document42 pagesHow To Save Tax For FY 2013 14duderamNo ratings yet

- SalaryDocument13 pagesSalaryErik Treasuryvala100% (1)

- Budgetworksheet 1Document1 pageBudgetworksheet 1api-313772308No ratings yet

- Genpact Vs InfosysDocument3 pagesGenpact Vs InfosysNidhi MishraNo ratings yet

- Tax Cheat Sheet - Exam 1Document2 pagesTax Cheat Sheet - Exam 1tyg1992100% (1)

- Bifurcation of Salary ArrearsDocument3 pagesBifurcation of Salary ArrearsSrikant SheelNo ratings yet

- Money Matters Money MattersDocument24 pagesMoney Matters Money MattersLakshmi YeddulaNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Assignment of Economic and Business Legislature: Submitted To-Submitted byDocument7 pagesAssignment of Economic and Business Legislature: Submitted To-Submitted byMohit SahniNo ratings yet

- Special Treatment of Fringe BenefitsDocument20 pagesSpecial Treatment of Fringe BenefitsMartin EstreraNo ratings yet

- Orientation ProgramDocument1 pageOrientation ProgramHimanshu AroraNo ratings yet

- DocScanner Feb 14, 2023 1-16 PMDocument1 pageDocScanner Feb 14, 2023 1-16 PMHimanshu AroraNo ratings yet

- DocScanner Feb 14, 2023 1-16 PMDocument1 pageDocScanner Feb 14, 2023 1-16 PMHimanshu AroraNo ratings yet

- DocScanner Feb 14, 2023 1-15 PMDocument1 pageDocScanner Feb 14, 2023 1-15 PMHimanshu AroraNo ratings yet

Salary: 2. House Property: 3. Capital Gains: 4. Business / Profession: 5. Other Sources: Total of All Sources Less Deductions

Salary: 2. House Property: 3. Capital Gains: 4. Business / Profession: 5. Other Sources: Total of All Sources Less Deductions

Uploaded by

Himanshu Arora0 ratings0% found this document useful (0 votes)

7 views3 pagesThis document outlines the key heads of income and deductions under the Indian personal tax system. It discusses the five main heads of income - salary/pension, house property, capital gains, business/profession, and other sources. It also explains some common deductions that can be claimed under sections 80C to 80U, including for provident funds, life insurance premiums, medical expenses, education loans, donations, and interest income. The overall process involves calculating gross total income from all sources, claiming applicable deductions, and paying tax on the total taxable income as per slab rates.

Original Description:

Original Title

FL-PPT

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the key heads of income and deductions under the Indian personal tax system. It discusses the five main heads of income - salary/pension, house property, capital gains, business/profession, and other sources. It also explains some common deductions that can be claimed under sections 80C to 80U, including for provident funds, life insurance premiums, medical expenses, education loans, donations, and interest income. The overall process involves calculating gross total income from all sources, claiming applicable deductions, and paying tax on the total taxable income as per slab rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views3 pagesSalary: 2. House Property: 3. Capital Gains: 4. Business / Profession: 5. Other Sources: Total of All Sources Less Deductions

Salary: 2. House Property: 3. Capital Gains: 4. Business / Profession: 5. Other Sources: Total of All Sources Less Deductions

Uploaded by

Himanshu AroraThis document outlines the key heads of income and deductions under the Indian personal tax system. It discusses the five main heads of income - salary/pension, house property, capital gains, business/profession, and other sources. It also explains some common deductions that can be claimed under sections 80C to 80U, including for provident funds, life insurance premiums, medical expenses, education loans, donations, and interest income. The overall process involves calculating gross total income from all sources, claiming applicable deductions, and paying tax on the total taxable income as per slab rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Personal Tax Heads of Income

1. Salary: Pension too; Cash or Kinds; Allowances; Deductions

2. House Property: Self-Occupied/Let-out/Deemed to be Let Out

3. Capital Gains: Short Term/Long Term; Shares/Gold/House

4. Business / Profession: Gross Turnover/Receipts; Expenses

5. Other Sources: Family Pension/Intt/Div/Lease Rent/Gifts

GROSS TOTAL INCOME (GTI) = Total of all Sources

Section 10-Exempted Incomes not included in Gross Total Income

Less Deductions: LIC/PPF/PF/NSCs/Med Ins/Donations/Disability

TOTAL TAXABLE INCOME = Gross Total Income - Deductions

Tax on Total Income: Normal Slab Rates / Special Tax Rates

Five Heads of Income (GTI)

Salary/Pension: Cash or in Kinds (Perquisites-House, Car….)

• Gross Salary: Basic Salary + Dearness Allowance + House Rent

Allowance + Travelling Allowance + LTA + Bonus + Commission…

• Less Exemptions: House Rent Allowance (Rent paid)

• Less Standard Deduction: Max Rs. 50000

House Property: Self-Occupied Residential House Property

• Interest on H. Loan taken for Purchase/Construction Max Rs. 200000

Other Sources: Residuary Head

• Family Pension (Standard Deduction Lower of Rs. 15000 or 1/3)

• Saving Bank Interest (Deduction u/s 80TTA Max Rs. 10000)

• Fixed Deposit/Term Deposit Interest (Bank/Post Office/Comp..)

• Income from Winning Lottery/TV Games (Taxable @ 30%)

• Interest on Senior Citizen Saving Scheme / Post office (MIS)

• Dividend / Income from Sub-Letting / Swimming Pool

Deductions u/s 80C to 80U

Section 80C: Prov Fund/PPF/National Saving Schemes/ Five years

Tax Saver Bank FDR/Tuition Fees /Repayment of Housing Loan-

Principal Amount/LIC Premium (Max Limit Rs. 150000)

Section 80D: Medical Insurance Prem; Preventive Health Check-Up

Max Rs. 5000 allowed; Max Limit Rs. 25000; Rs. 50000 (Senior Citizen)

Self, Spouse, Dependent Children/ Parents (Dependency not linked)

Section 80E: Interest on Education Loan for Self/Spouse/Dependents

Section 80G: PM Cares Fund/Temple/Gurdwara/Church/Religious or

Charitable Institutions, etc (100% or 50%)

Section 80TTA: Saving Bank Interest (Non-Sr Citizen) Max Rs. 10000

Section 80TTB: Interest from Bank or Post Office Savings/Fixed

Deposit (Not included-Interest from Companies or Interest from

Income Tax Refund) Maximum Limit Rs. 50000 (Sr Citizen)

You might also like

- Income From SalaryDocument26 pagesIncome From SalaryAkash VisputeNo ratings yet

- Test 1 Fact SheetDocument2 pagesTest 1 Fact SheetHenry ZhuNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- Salary Design and Tax Implication by - Omprakash Todwal AnagramDocument15 pagesSalary Design and Tax Implication by - Omprakash Todwal AnagrammagusamNo ratings yet

- Tax Saving FY 2021-22 - FDocument30 pagesTax Saving FY 2021-22 - Fsapreswapnil8388No ratings yet

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- Income Tax Calculator 2016-17 v1804Document2 pagesIncome Tax Calculator 2016-17 v1804Pankaj BatraNo ratings yet

- Deductions 3Document35 pagesDeductions 3sanjeev kumar vsNo ratings yet

- Make Investments: Save On Income TaxDocument30 pagesMake Investments: Save On Income TaxMelinda BartleyNo ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Auto Income Tax Calculator Version 5.1 2010-11Document19 pagesAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNo ratings yet

- Personal Finance For StartersDocument17 pagesPersonal Finance For Starters9novtarunNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravNo ratings yet

- Comparison Between I.T. and DTCDocument23 pagesComparison Between I.T. and DTCsharma.shalinee1626No ratings yet

- CMA-How To Save Tax 2013-14Document37 pagesCMA-How To Save Tax 2013-14sunilsunny317No ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Deductions From Total IncomeDocument38 pagesDeductions From Total IncomeVikas WadmareNo ratings yet

- Income Tax Calculator FY 2012 13Document4 pagesIncome Tax Calculator FY 2012 13raattaiNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Exemptions From Salary:: 1. Conveyance AllowancesDocument2 pagesExemptions From Salary:: 1. Conveyance AllowancesPrashant UjjawalNo ratings yet

- Click Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyDocument24 pagesClick Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyHARSHITA JOSHINo ratings yet

- Income TaxDocument30 pagesIncome TaxHimani SaxenaNo ratings yet

- Joint Return 5. ResidencyDocument4 pagesJoint Return 5. ResidencyJon LeinsNo ratings yet

- Indian Income Tax DeductionsDocument4 pagesIndian Income Tax DeductionsDivyanshu ShekharNo ratings yet

- Section 80 CDocument5 pagesSection 80 CAmit RoyNo ratings yet

- How To Save Tax For FY 2017-18Document14 pagesHow To Save Tax For FY 2017-18Srinivas Pavan KumarNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- Income Tax ProjectDocument6 pagesIncome Tax Projectdipmoip2210No ratings yet

- Taxation Ce2Document10 pagesTaxation Ce2Ratnesh PalNo ratings yet

- Tax Declaration Form For 2012-13Document1 pageTax Declaration Form For 2012-13Sharique NisarNo ratings yet

- Onby Pa Adp 133rd BatchDocument53 pagesOnby Pa Adp 133rd BatchSreemon P VNo ratings yet

- Making The Best of Tax Saving OptionsDocument12 pagesMaking The Best of Tax Saving Optionssumit_shindeNo ratings yet

- Unit 4 Return FillingDocument71 pagesUnit 4 Return FillingAnshu kumarNo ratings yet

- Salary Includes: U/s 17Document14 pagesSalary Includes: U/s 17Ansh NayyarNo ratings yet

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- MG Pricing For 2015Document1 pageMG Pricing For 2015api-191645396No ratings yet

- Tax Planning IndiaDocument13 pagesTax Planning Indiajsaideep23No ratings yet

- Computation of Total IncomeDocument15 pagesComputation of Total Incomekhushi shahNo ratings yet

- Taxation of Salary Income 2017 IndiaDocument19 pagesTaxation of Salary Income 2017 Indiarpiyer72No ratings yet

- Investments For Section 80CDocument17 pagesInvestments For Section 80CAsħîŞĥLøÝåNo ratings yet

- Salary TDS Provisions 2011-12Document56 pagesSalary TDS Provisions 2011-12dharan2001No ratings yet

- Yesha Mehta (PES1201800966)Document8 pagesYesha Mehta (PES1201800966)nishanth vNo ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- How To Save Tax For FY 2013 14Document42 pagesHow To Save Tax For FY 2013 14duderamNo ratings yet

- SalaryDocument13 pagesSalaryErik Treasuryvala100% (1)

- Budgetworksheet 1Document1 pageBudgetworksheet 1api-313772308No ratings yet

- Genpact Vs InfosysDocument3 pagesGenpact Vs InfosysNidhi MishraNo ratings yet

- Tax Cheat Sheet - Exam 1Document2 pagesTax Cheat Sheet - Exam 1tyg1992100% (1)

- Bifurcation of Salary ArrearsDocument3 pagesBifurcation of Salary ArrearsSrikant SheelNo ratings yet

- Money Matters Money MattersDocument24 pagesMoney Matters Money MattersLakshmi YeddulaNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Assignment of Economic and Business Legislature: Submitted To-Submitted byDocument7 pagesAssignment of Economic and Business Legislature: Submitted To-Submitted byMohit SahniNo ratings yet

- Special Treatment of Fringe BenefitsDocument20 pagesSpecial Treatment of Fringe BenefitsMartin EstreraNo ratings yet

- Orientation ProgramDocument1 pageOrientation ProgramHimanshu AroraNo ratings yet

- DocScanner Feb 14, 2023 1-16 PMDocument1 pageDocScanner Feb 14, 2023 1-16 PMHimanshu AroraNo ratings yet

- DocScanner Feb 14, 2023 1-16 PMDocument1 pageDocScanner Feb 14, 2023 1-16 PMHimanshu AroraNo ratings yet

- DocScanner Feb 14, 2023 1-15 PMDocument1 pageDocScanner Feb 14, 2023 1-15 PMHimanshu AroraNo ratings yet