Professional Documents

Culture Documents

Seatwork No. 2 PDF

Seatwork No. 2 PDF

Uploaded by

SARAH ANDREA TORRESOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Seatwork No. 2 PDF

Seatwork No. 2 PDF

Uploaded by

SARAH ANDREA TORRESCopyright:

Available Formats

Intermediate Accounting 3

SEATWORK NO. 2

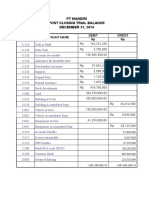

SUDAN COMPANY uses the direct method to prepare its statement of cash flows. Sudan’s trial balances at

December 31, 2023 and 2022 are shown below:

DECEMBER 31

DEBITS 2023 2022

Cash P105,000 P96,000

Accounts receivable 99,000 90,000

Inventory 93,000 141,000

Property, plant and equipment 300,000 285,000

Unamortized bond discount 13,500 15,000

Cost of goods sold 750,000 1,140,000

Selling expenses 424,500 516,000

General and administrative expenses 411,000 453,900

Interest expense 12,900 7,800

Income tax expense 61,200 183,600

TOTAL P2,270,100 P2,928,300

DECEMBER 31

CREDITS 2023 2022

Allowance for bad debts P3,900 P3,300

Accumulated depreciation 49,500 45,000

Accounts payable – trade 75,000 46,500

Income taxes expense 63,000 87,300

Deferred income taxes payable 15,900 13,800

8% Bonds payable 135,000 60,000

Ordinary share capital 150,000 120,000

Share premium 27,300 22,500

Retained earnings 134,100 193,800

Sales 1,616,400 2,336,100

TOTAL P2,270,100 P2,928,300

Additional data are as follows:

a. Sudan purchased P15,000 equipment during 2023.

b. One-third of Sudan’s depreciation expense is allocated to selling expenses and the remainder to

general and administrative expenses.

c. Bad debt expense for 2023 was P15,000. During the year, uncollectible accounts totaling P14,400

were written off. The Company reports bad debts as selling expense.

Required:

Based on the preceding data, determine the amounts that should be reported on Sudan’s Statement of

cash flows for the year ended December 31, 2023, for the following:

1. Cash collected from customers

2. Cash paid to suppliers

3. Cash paid for interest

4. Cash paid for income taxes

5. Cash paid for selling expenses

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- NEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDocument7 pagesNEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDiana Yunus DianaNo ratings yet

- P14 - Statement of Cashflows Requirement No. 1: Kim Zairelle Bibal Bsa - IiiDocument7 pagesP14 - Statement of Cashflows Requirement No. 1: Kim Zairelle Bibal Bsa - Iiishineneigh00No ratings yet

- Pre Operating Cash FlowDocument43 pagesPre Operating Cash FlowCamille ManalastasNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- FINAMAA Topic 2 Additional ActivityDocument2 pagesFINAMAA Topic 2 Additional ActivityJeasmine Andrea Diane PayumoNo ratings yet

- Preparing FSDocument7 pagesPreparing FSJohn AlbateraNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Discussion Problems - Consolidation Subsequent To Date of AcquisitionDocument2 pagesDiscussion Problems - Consolidation Subsequent To Date of AcquisitionMikee CincoNo ratings yet

- UntitledDocument49 pagesUntitledAdinda Lidya Rahayu SapphiraNo ratings yet

- Laporan KeuanganDocument18 pagesLaporan KeuanganJirjiz RasheedNo ratings yet

- Bahan Praktikum Pertemuan Ke 13 NOR MAULIDA 1CDocument11 pagesBahan Praktikum Pertemuan Ke 13 NOR MAULIDA 1CNor MaulidaNo ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- Kunci Jawaban 3Document18 pagesKunci Jawaban 3Mar YaniNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Accounting Sample Question Along With A SolutionDocument17 pagesAccounting Sample Question Along With A SolutionNoor Mohammad Abu RaihanNo ratings yet

- Problem 1Document5 pagesProblem 1jhie boterNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Arus Kas DKKDocument5 pagesArus Kas DKKsri nur aulyaNo ratings yet

- Soal Spreadsheet PT SejahteraDocument7 pagesSoal Spreadsheet PT SejahteraFaishal KiromNo ratings yet

- Lembar Jawaban Jurnal U.anakDocument38 pagesLembar Jawaban Jurnal U.anakjohannahtheresiaNo ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Fa Pilot Paper AnswerDocument11 pagesFa Pilot Paper Answer刘宝英No ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Lembar Jawaban Mahesa - SalinDocument10 pagesLembar Jawaban Mahesa - Salinricoananta10No ratings yet

- Final Accouts Unsolved QuestionsDocument27 pagesFinal Accouts Unsolved Questionsmayank shridharNo ratings yet

- SPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesDocument8 pagesSPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesOladapo Oluwakayode AbiodunNo ratings yet

- Tutorial 2 - A202 QuestionDocument6 pagesTutorial 2 - A202 QuestionFuchoin ReikoNo ratings yet

- Sanjay Industries: Final AccountsDocument16 pagesSanjay Industries: Final AccountsNickNo ratings yet

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Document17 pagesTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- LembarDocument26 pagesLembarIbnu Kamajaya75% (4)

- FMA AssignmentDocument2 pagesFMA AssignmentGetahun MulatNo ratings yet

- Copia de Economatica Apple 2Document12 pagesCopia de Economatica Apple 2Juan o Ortiz aNo ratings yet

- ROCO - SCI Unit TestDocument9 pagesROCO - SCI Unit TestRaymond Roco100% (1)

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- ACT 302 - ASSIGNMENT (Statement of Cash Flows) - 2024Document4 pagesACT 302 - ASSIGNMENT (Statement of Cash Flows) - 2024rafikdaachasalamNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Topic No. 2 - Statement of Cash Flows PDFDocument3 pagesTopic No. 2 - Statement of Cash Flows PDFSARAH ANDREA TORRESNo ratings yet

- Layto CashtoaccrualDocument6 pagesLayto CashtoaccrualVivienne Rozenn LaytoNo ratings yet

- FINAN204-21A Tutorial 10 Week 13Document24 pagesFINAN204-21A Tutorial 10 Week 13Danae YangNo ratings yet

- AI Amended Online Tutorial 4 Slides - Block 3Document26 pagesAI Amended Online Tutorial 4 Slides - Block 3Allan GhmNo ratings yet

- CBM CompanyDocument7 pagesCBM CompanyKlarizel Lapugan HolibotNo ratings yet

- Tutorials Topic 7Document9 pagesTutorials Topic 7haniNo ratings yet

- Father Saturnino Urios University Accountancy Program San Francisco St. Butuan CityDocument9 pagesFather Saturnino Urios University Accountancy Program San Francisco St. Butuan CityHanna Niña MabrasNo ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- Audit Report For Azahar Trading Ltd.Document11 pagesAudit Report For Azahar Trading Ltd.Muhammad Humayun IslamNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- PT Sejahtera Neraca Saldo Per 31 Desember 2018 No Akun Nama Akun D KDocument15 pagesPT Sejahtera Neraca Saldo Per 31 Desember 2018 No Akun Nama Akun D Kdanie RidwanNo ratings yet

- Soal Cash FlowDocument6 pagesSoal Cash FlowSantiNo ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- GCB-Q3 2023 - Interim - ReportDocument16 pagesGCB-Q3 2023 - Interim - ReportGan ZhiHanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Case 2 ContDocument2 pagesCase 2 ContSARAH ANDREA TORRESNo ratings yet

- Chapter 1 17 PROBLEMS PDFDocument46 pagesChapter 1 17 PROBLEMS PDFSARAH ANDREA TORRESNo ratings yet

- Topic No. 2 - Statement of Cash Flows PDFDocument3 pagesTopic No. 2 - Statement of Cash Flows PDFSARAH ANDREA TORRESNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- Eco Notes (1) - CompressedDocument60 pagesEco Notes (1) - Compressedbmstf9hyfmNo ratings yet

- Units: Example: One Way To Help The Poor Is To Donate Clothing and FoodDocument3 pagesUnits: Example: One Way To Help The Poor Is To Donate Clothing and FoodJOSELYN LIZBETH NAULA GUILLCATANDANo ratings yet

- CH 8 Derivatives Analysis & Valuation PDFDocument44 pagesCH 8 Derivatives Analysis & Valuation PDFrbmjainNo ratings yet

- CurrencyDocument5 pagesCurrencymonaNo ratings yet

- Guidance For Ship InspectionsDocument26 pagesGuidance For Ship InspectionsFr BNo ratings yet

- Black MoneyDocument5 pagesBlack Moneyroy lexterNo ratings yet

- 10 Budget Word Problems To Practice in ClassDocument2 pages10 Budget Word Problems To Practice in ClasshellkatNo ratings yet

- Tang Dynasty, Imperial China's Golden AgeDocument106 pagesTang Dynasty, Imperial China's Golden AgeJan Michael Dave LaoNo ratings yet

- Recent Performance in Singapore'S Tourism Industry and Tourism YieldDocument7 pagesRecent Performance in Singapore'S Tourism Industry and Tourism YieldJoya HossainNo ratings yet

- भारतीय इतिहासDocument60 pagesभारतीय इतिहासAkash NagarNo ratings yet

- Course Code: ACT 202 Section:07 Group Assignment: Submitted ToDocument25 pagesCourse Code: ACT 202 Section:07 Group Assignment: Submitted ToMd.Mahmudul Hasan 1722269030100% (1)

- Major and Minor PairsDocument16 pagesMajor and Minor PairsAdam SehramNo ratings yet

- Cultural Studies: To Cite This Article: Richard Maxwell (1996) Ethics and Identity in Global Market ResearchDocument21 pagesCultural Studies: To Cite This Article: Richard Maxwell (1996) Ethics and Identity in Global Market ResearchSaravanakkumar KRNo ratings yet

- Tara ProjectDocument9 pagesTara ProjectALEX D LOPEZ RNo ratings yet

- 7a Exact and Ordinary InterestDocument9 pages7a Exact and Ordinary InterestVj McNo ratings yet

- Pleaser Single Sole Vol 1Document83 pagesPleaser Single Sole Vol 1Woman ShopNo ratings yet

- s.6 Economics Past PaperDocument7 pagess.6 Economics Past PaperMukasa Najib100% (1)

- Starbucks FinalDocument4 pagesStarbucks Finalpaul mulwaNo ratings yet

- A Beginner's Guide To Credit Default Swaps (Part 4) - Rich NewmanDocument6 pagesA Beginner's Guide To Credit Default Swaps (Part 4) - Rich NewmanOUSSAMA NASRNo ratings yet

- A Proposal On Liquidity Analysis of Nepal Investment Bank Limited (Nibl)Document6 pagesA Proposal On Liquidity Analysis of Nepal Investment Bank Limited (Nibl)Samira ShakyaNo ratings yet

- Edoc - Tips Test Bank International Financial Management 12th Edition JeffDocument24 pagesEdoc - Tips Test Bank International Financial Management 12th Edition Jeffmeem 98No ratings yet

- CA Pak-Saudi RelationsDocument11 pagesCA Pak-Saudi RelationsMehwish AwaanNo ratings yet

- GF Tower Construction PhotosDocument23 pagesGF Tower Construction PhotosAVENON MardocheeNo ratings yet

- Idea Infinity It Solutions (P) : I EasybillDocument12 pagesIdea Infinity It Solutions (P) : I EasybillHariharan RNo ratings yet

- Annex F - Salesperson'S Checklist On Customer Due Diligence (CDD) For Rental TransactionsDocument10 pagesAnnex F - Salesperson'S Checklist On Customer Due Diligence (CDD) For Rental Transactionshatoris1987No ratings yet

- Impact of Foreign Direct Investment On Various Setors of The EconomyDocument5 pagesImpact of Foreign Direct Investment On Various Setors of The EconomyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Net Working CapitalDocument8 pagesNet Working CapitalJoseph AbalosNo ratings yet

- Economics Commentary (Macro - Economics)Document4 pagesEconomics Commentary (Macro - Economics)ariaNo ratings yet

- Kashato Practice SetDocument53 pagesKashato Practice SetLolli PopNo ratings yet