Professional Documents

Culture Documents

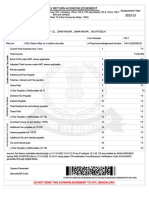

RBI - Third Party Payment

RBI - Third Party Payment

Uploaded by

Anish ITTIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBI - Third Party Payment

RBI - Third Party Payment

Uploaded by

Anish ITTICopyright:

Available Formats

Impex

This column is compiled by Consultant [EXIM Policy] of EPCH. It contains recent Public Notices, Notifications and Circulars

of DGFT, CBEC and Department of Revenue. If a handicraft exporter has question[s] to ask on

Foreign Trade Policy, he/she may please write / e-mail to EPCH at policy@epch.com

Impex # 1 Third Party Payments for Exports/Import Transactions

RBI issues circular amending One of the requirements in RBI's A.P. (DIR Series) Circular No. 100 dt. Nov 8,2013

the condition of 'firm relating to 'Third party payments for export/import transactions' was that 'firm

irrevocable order backed by a tripartite agreement should be in place'. The

irrevocable order backed by a

exporters/importers were finding it difficult to meet the requirement as

tripartite agreement' mentioned above.

Taking note of the difficulty as detailed above, the RBI has issued RBI Circular A.P. (DIR Series) No. 100 dt. 04-02-2014

stating therein that condition in RBI Circular dt. Nov 8, 2013 as detailed above would not be insisted upon.

Copy of RBI's A.P. (DIR Series) Circular No. 100 dt. 04-02-2014 is reproduced below:

(copy)

Third party payments for export/import transactions

Attention of Authorized Dealer Category-I banks is invited to A. P. (DIR Series) Circular No.70 dated November 8,

2013, in terms of which they have been permitted to allow third party payments for export of goods & software/

import of goods subject to the conditions stated therein.

2. In view of the difficulties faced by exporters/importers in meeting the condition "firm irrevocable order backed

by a tripartite agreement should be in place" specified in the abovementioned Circular, it has been decided that

this requirement may not be insisted upon in case where documentary evidence for circumstances leading to

third party payments/name of the third party being mentioned in the irrevocable order/invoice has been

produced. This shall be subject to conditions as under:

(i) AD bank should be satisfied with the bona-fides of the transaction and export documents, such as, invoice/

FIRC.

(ii) AD bank should consider the FATF statements while handling such transaction.

3. Further, with a view to liberalising the procedure, the limit of USD 100,000 eligible for third party payment for

import of goods, stands withdrawn.

4. All other terms & conditions mentioned in the A.P. (DIR Series) Circular No.70 dated November 8, 2013 remain

unchanged.

5. AD Category-I banks may bring the contents of this Circular to the notice of their constituents concerned.

6. The directions contained in this circular have been issued under sections 10(4) and 11(1) of the Foreign

Exchange Management Act (FEMA), 1999 (42 of 1999) and are without prejudice to permissions/approvals, if any,

required under any other law.

e- CRAFTCIL • Issue 2, 2014

Impex # 2 One more handicraft item made eligible for Focus Product Scheme Incentive

In DGFT Public Notice Hand DGFT has issued a Public Notice No. 53(RE 2013/2009-14 dt. 27-02-2014

Worked Sea Shells Within The containing many amendments in the 'Reward/Incentive Schemes of FTP of

2009.

General Description "CHANKS"

By one amendment in Appendix 37 D (Focus Product Scheme) of the current

added to Table No. 1 of

H.B. of Procedure, the 'item' Hand worked seashells within the general

Appendix 37-D of H.B. of description "CHANKS" has been added at S.No. 1069 of Table-1 of 37-D.

Procedure (Vol.1) of 2009-14. Relevant extract of the addition as detailed below is reproduced below:

3. The following products are added in Table 1 of Appendix 37D (Focus Product Scheme) after SI.No. 1065 for export

made with effect for 01.03.2014

S.No. EFPS SL. No. HS CODE Description Rate Percentage Bonus Benefits

1069 1069 05080020 Hand worked Seashells within 5% -

the general description 'CHANKS"

Impex # 3 Questions & Answers

Question : How long we can retain foreign exchange in EEFC Account to pay for imports?

Answer : All categories of foreign exchange earners are allowed to credit 100 per cent of their foreign exchange

earnings in their EEFC Accounts with the condition that the sum total of the accruals in the account

during a calendar month should be converted into Rupees on or before the last day of the succeeding

calendar month after adjusting for utilization of the balances for approved purposes or forward

commitments. Further, in case of requirements, EEFC account holders are permitted to access the forex

market for purchasing foreign exchange.

Question : We sent goods to our buyer who is not keen to take the delivery of Goods. We have located an

alternative buyer that wants to take the goods but wants 20 per cent reduction in prices. Do we

require RBI approval?

Answer : Prior approval of the Reserve Bank of India is not required if, after goods have been shipped, they are to

be transferred to a new buyer other than the original buyer in the event of default by the latter,

provided the reduction in value involved does not exceed 25 per cent of the invoice value and the

realization of export proceeds is not delayed beyond the period allowed for realization of export

proceeds reckoned from the date of export.

Question : We would like to avail the facility of receipt of import documents from overseas suppliers directly.

Can we do it under banking regulation?

Answer : Import documents should normally be received from the banker of the supplier by the banker of the

importer in India, except in the following cases:

i) Where the value of import bill does not exceed USD 300,000.

ii) Import bills received by whollyowned Indian subsidiaries of foreign companies from their principals.

iii) Import bills received by Status Holder Exporters, 100 per cent Export Oriented Units/Units in Special

Economic Zones, Public Sector Undertakings and Limited Companies.

e- CRAFTCIL • Issue 2, 2014

You might also like

- Import and Export ProceduresDocument27 pagesImport and Export Proceduressubbu2raj3372No ratings yet

- EDPMSDocument20 pagesEDPMSrani jeyarajNo ratings yet

- Big Numbers and Small Numbers V 2Document7 pagesBig Numbers and Small Numbers V 2julucesNo ratings yet

- FAQs EFSDocument5 pagesFAQs EFSHassan MukhtarNo ratings yet

- EDF L/C Master Circular by BB 2009Document6 pagesEDF L/C Master Circular by BB 2009Mohammad Shafiqul Islam RoneeNo ratings yet

- Technology Transfer Fees and Royalty PaymentsDocument4 pagesTechnology Transfer Fees and Royalty PaymentsS Asif RazaNo ratings yet

- Import Export Code NumberDocument8 pagesImport Export Code NumberShailesh DsouzaNo ratings yet

- 75359cajournal August2023 10Document5 pages75359cajournal August2023 10S M SHEKARNo ratings yet

- Export Finance Schme2Document19 pagesExport Finance Schme2sadullahNo ratings yet

- India New Foreign Trade Policy 2015Document15 pagesIndia New Foreign Trade Policy 2015Hameem KhanNo ratings yet

- Foreign Trade Policy 2015-20Document9 pagesForeign Trade Policy 2015-20manjulaNo ratings yet

- Foreign Trade Policy 2015Document20 pagesForeign Trade Policy 2015mechunkNo ratings yet

- ImportsDocument55 pagesImportsDeepthi RavichandhranNo ratings yet

- Memorandum: Memorandum of Instructions On Project & Service ExportsDocument97 pagesMemorandum: Memorandum of Instructions On Project & Service ExportsAmbar PurohitNo ratings yet

- Anf 1BDocument11 pagesAnf 1Bdkhatri01No ratings yet

- How To ImportDocument28 pagesHow To ImportHarinder SinghNo ratings yet

- EXPORT Licence ProceduresDocument9 pagesEXPORT Licence ProceduresdheerajdorlikarNo ratings yet

- C.1. Advance Remittance C.1.1. Advance Remittance For Import of GoodsDocument4 pagesC.1. Advance Remittance C.1.1. Advance Remittance For Import of GoodsRaja GopalakrishnanNo ratings yet

- Itpp U-3Document3 pagesItpp U-3MOHAMMAD ZUBERNo ratings yet

- ANF 5B LIC - NoDocument5 pagesANF 5B LIC - Nosuman_gourh100% (2)

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- Master Direction Risk ManagementDocument94 pagesMaster Direction Risk ManagementRajeev CHATTERJEENo ratings yet

- RBI Notfn Jan-Jun 2019 - Intnl TFDocument22 pagesRBI Notfn Jan-Jun 2019 - Intnl TFArjun PatilNo ratings yet

- Export House, Trading House, Star Trading House and Super Star Trading HouseDocument15 pagesExport House, Trading House, Star Trading House and Super Star Trading HouseUlsasiNo ratings yet

- Foreign Trade Policy 1Document31 pagesForeign Trade Policy 1vmchawlaNo ratings yet

- Exports of Goods and ServicesDocument40 pagesExports of Goods and ServicesAbhinav SharmaNo ratings yet

- Master Circular On Export of GoodsDocument107 pagesMaster Circular On Export of GoodsArindam BiswasNo ratings yet

- Export Refinance SchemeDocument29 pagesExport Refinance SchemeUsman RajputNo ratings yet

- 12me PDFDocument33 pages12me PDFmohit2700No ratings yet

- RBI Circular On Export Finance - 1Document21 pagesRBI Circular On Export Finance - 1Anonymous l0MTRDGu3MNo ratings yet

- FEMA - Memo of Instructions Governing Money Changing Activities PDFDocument76 pagesFEMA - Memo of Instructions Governing Money Changing Activities PDFNidhi SinglaNo ratings yet

- Import ProcedureDocument33 pagesImport Procedureshreyans singhNo ratings yet

- Appendix - A - Application Form For Allotment of Importer-Exporter Code (Iec) Number and Modification in Particulars of An Existing Iec No. HolderDocument4 pagesAppendix - A - Application Form For Allotment of Importer-Exporter Code (Iec) Number and Modification in Particulars of An Existing Iec No. HolderdaljitkaurNo ratings yet

- Foreign Exchange Management (Exports of Goods and Services) RegulationsDocument37 pagesForeign Exchange Management (Exports of Goods and Services) RegulationsSawan SharmaNo ratings yet

- Merchant Export Under CGST Act 2017 - Taxguru - inDocument3 pagesMerchant Export Under CGST Act 2017 - Taxguru - inkrishnaNo ratings yet

- IMPEX Procedure PDFDocument174 pagesIMPEX Procedure PDFKrishna SinghNo ratings yet

- RR No. 34-2020 v2Document3 pagesRR No. 34-2020 v2JejomarNo ratings yet

- Unit V: Export IncentivesDocument37 pagesUnit V: Export IncentivesthensureshNo ratings yet

- RBI Master Circular On Import PaymentsDocument22 pagesRBI Master Circular On Import PaymentsInter NetNo ratings yet

- Advisory 2710 2Document20 pagesAdvisory 2710 2Pushpraj SinghNo ratings yet

- Trade Finance Work Book Part 1Document25 pagesTrade Finance Work Book Part 1Lakshmi VakkalagaddaNo ratings yet

- Guidelines/Clarification On Margin Collection and Reporting: Annexure ADocument11 pagesGuidelines/Clarification On Margin Collection and Reporting: Annexure ASatish KumarNo ratings yet

- FDI Declaration - 2Document1 pageFDI Declaration - 2nomito2038No ratings yet

- Presentation On Export CreditDocument21 pagesPresentation On Export CreditArpit KhandelwalNo ratings yet

- RBI - Master - Direction - Import of Goods and ServicesDocument33 pagesRBI - Master - Direction - Import of Goods and ServicesShin ShanNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- Approved Toll Manufacturer SchemeDocument16 pagesApproved Toll Manufacturer SchemetenglumlowNo ratings yet

- C CC CCCCC CCCC C CCC C CCCCCCCC C!CCDocument10 pagesC CC CCCCC CCCC C CCC C CCCCCCCC C!CCravi_umang2001No ratings yet

- Audit of Foreign Exchange TransactionsDocument15 pagesAudit of Foreign Exchange TransactionsVenkata Raman RedrowtuNo ratings yet

- DGFTDocument35 pagesDGFTgagan15095895No ratings yet

- Nse Circular - 2Document14 pagesNse Circular - 2Arup GhoshNo ratings yet

- Duty Drawback India Presentation 2003Document10 pagesDuty Drawback India Presentation 2003dinkar13375No ratings yet

- IMT-18 Export Finance and Documentation: NotesDocument3 pagesIMT-18 Export Finance and Documentation: NotesPrasanta Kumar NandaNo ratings yet

- Hand Book of Procedures Export & Import - Volume 1, India 2009 - 2014Document157 pagesHand Book of Procedures Export & Import - Volume 1, India 2009 - 2014focusindiagroupNo ratings yet

- A Synopsis ON Study of Working of Foreign Exchange Market: Submitted By: Anant ChhajedDocument6 pagesA Synopsis ON Study of Working of Foreign Exchange Market: Submitted By: Anant ChhajedAnant ChhajedNo ratings yet

- MC - Risk MDocument86 pagesMC - Risk MKunal MathurNo ratings yet

- Implementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportFrom EverandImplementation of the ASEAN+3 Multi-Currency Bond Issuance Framework: ASEAN+3 Bond Market Forum Sub-Forum 1 Phase 3 ReportNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Housie Game StoryDocument4 pagesHousie Game StoryAnish ITTI100% (1)

- Final Avant HW Brouchure Inside PageDocument21 pagesFinal Avant HW Brouchure Inside PageAnish ITTINo ratings yet

- Sample Test Paper For Class IIIDocument4 pagesSample Test Paper For Class IIIAnish ITTINo ratings yet

- Sample Paper-3Document3 pagesSample Paper-3Anish ITTINo ratings yet

- Interest Rate and Equity Factors April2022Document10 pagesInterest Rate and Equity Factors April2022Anish ITTINo ratings yet

- Employee Enagement Manual - As On 24.09.2020 (Wecompress - Com) - CompressedDocument21 pagesEmployee Enagement Manual - As On 24.09.2020 (Wecompress - Com) - CompressedAnish ITTINo ratings yet

- Air Drying MahoganyDocument4 pagesAir Drying MahoganyAnish ITTINo ratings yet

- Safety Tips & Precautions From Covid-19Document2 pagesSafety Tips & Precautions From Covid-19Anish ITTINo ratings yet

- Laxmi Shrushti Take Away Brochure - 7Document11 pagesLaxmi Shrushti Take Away Brochure - 7Anish ITTINo ratings yet

- Country & State List - 05-12-22Document38 pagesCountry & State List - 05-12-22Anish ITTINo ratings yet

- Design Simulation and Realization of Solar Battery Charge Controller Using Arduino UnoDocument5 pagesDesign Simulation and Realization of Solar Battery Charge Controller Using Arduino UnoRushiraj DesaiNo ratings yet

- A Practical Grammar of The Paali LanguageDocument316 pagesA Practical Grammar of The Paali LanguageĐinh Trường ThọNo ratings yet

- World English 1: Unit 8: ReportDocument5 pagesWorld English 1: Unit 8: ReportTotti CruzNo ratings yet

- Hearst Demystifying Media Fireside Chat - The Bloomberg Way With Matthew WinklerDocument16 pagesHearst Demystifying Media Fireside Chat - The Bloomberg Way With Matthew WinklerDemystifying MediaNo ratings yet

- En 2014-03-17 RTU500 Series Product Catalogue OnlineDocument78 pagesEn 2014-03-17 RTU500 Series Product Catalogue OnlineЖорж КаназирскиNo ratings yet

- 1602lcd PDFDocument25 pages1602lcd PDFGHOST 22035No ratings yet

- Poems of The 1970sDocument4 pagesPoems of The 1970sKaren LNo ratings yet

- Professor Charles Fraser Beckingham 19141998Document4 pagesProfessor Charles Fraser Beckingham 19141998aymericNo ratings yet

- Chapter 28 Bouguer and Isostatic Maps of The Central Andes PDFDocument4 pagesChapter 28 Bouguer and Isostatic Maps of The Central Andes PDFTato Amoros BarrantesNo ratings yet

- 7.1.1 Administrator's Guide AIXDocument1,170 pages7.1.1 Administrator's Guide AIXÁgoston Péter100% (1)

- Telergon CosDocument20 pagesTelergon CosDicky FirmansyahNo ratings yet

- SOCIOLOGICAL FOUNDATION ReportDocument14 pagesSOCIOLOGICAL FOUNDATION Reportᜃᜒᜈ᜔ᜎᜒ ᜇᜒᜋᜈ᜔ᜇᜒᜋᜈ᜔No ratings yet

- AaDocument4 pagesAaCheck OndesNo ratings yet

- Biological Conservation: Policy AnalysisDocument8 pagesBiological Conservation: Policy AnalysisEmilio Lecaros BustamanteNo ratings yet

- Catalogue EnglishDocument36 pagesCatalogue EnglishSMT InnovationNo ratings yet

- English ReviewerDocument11 pagesEnglish ReviewerShinjiNo ratings yet

- Guru 1 - 5 Whats NewDocument19 pagesGuru 1 - 5 Whats NewLuca RosacutaNo ratings yet

- Calculation of Interception Efficiencies For Mesh-Type Air-Terminations According To Iec 62305-3 Using A Dynamic Electro-Geometrical ModelDocument6 pagesCalculation of Interception Efficiencies For Mesh-Type Air-Terminations According To Iec 62305-3 Using A Dynamic Electro-Geometrical ModelgilbertomjcNo ratings yet

- Microsoft-Case StudyDocument26 pagesMicrosoft-Case StudyHiten GuptaNo ratings yet

- Itr 22-23 PDFDocument1 pageItr 22-23 PDFPixel computerNo ratings yet

- Binomial Worksheet SolutionDocument8 pagesBinomial Worksheet SolutionjayeshpNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationjinyangsuelNo ratings yet

- Curriculum Vitae With Track Record: Role in The Project Personal InformationDocument3 pagesCurriculum Vitae With Track Record: Role in The Project Personal InformationNuralfin4No ratings yet

- Ethiopia Team Member Left To Right-Brenda Carr, John Gross, Dan Zacharias, Aroea Knox, Sean Hughley, Kevin Knox, and Travis KolderDocument4 pagesEthiopia Team Member Left To Right-Brenda Carr, John Gross, Dan Zacharias, Aroea Knox, Sean Hughley, Kevin Knox, and Travis KolderJohn GrossNo ratings yet

- HRM Concept PaperDocument6 pagesHRM Concept PaperAlexis Andrew Antonio100% (1)

- AFI - 10-248 - Fitness ProgramDocument89 pagesAFI - 10-248 - Fitness ProgramDongelxNo ratings yet

- Adult Education in Tanzania - A Review - 3611Document120 pagesAdult Education in Tanzania - A Review - 3611elia eliaNo ratings yet

- Child and Adolescent Development 2Document58 pagesChild and Adolescent Development 2Princess Mae CuayzonNo ratings yet

- Compressor Dry Gas SealsDocument12 pagesCompressor Dry Gas SealsRajeev Domble100% (3)