Professional Documents

Culture Documents

Xi Acct Rev WS 1 22 23

Xi Acct Rev WS 1 22 23

Uploaded by

RiwaanCopyright:

Available Formats

You might also like

- FIRST Amended Complaint (Case Filed in California) For Being FiredDocument17 pagesFIRST Amended Complaint (Case Filed in California) For Being FiredZackery BisonNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Receivables ProblemsDocument13 pagesReceivables ProblemsIris Mnemosyne0% (1)

- Shulchan Arukh, Even HaEzer - en - Sefaria Community TranslationDocument255 pagesShulchan Arukh, Even HaEzer - en - Sefaria Community TranslationElda Cristina MunteanuNo ratings yet

- Jodie PresentDocument2 pagesJodie PresentFiorence Atmaja100% (1)

- LoA Unconditional 1Document2 pagesLoA Unconditional 1TuswanNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDocument13 pages11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Management Programme: TH STDocument3 pagesManagement Programme: TH ST19BAD007 Bendangsenla JamirNo ratings yet

- 2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Document4 pages2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Mohammad ShahidNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Accounting For Specialized InstituitionsDocument4 pagesAccounting For Specialized InstituitionsTitus Clement100% (1)

- Quiz 02 - FAR - UCP - ANS KEYDocument9 pagesQuiz 02 - FAR - UCP - ANS KEYkarim abitagoNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- Mock TestDocument8 pagesMock TestDiksha DudejaNo ratings yet

- Financial Accounting (CBCS Hons)Document7 pagesFinancial Accounting (CBCS Hons)Devil GamerNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- II PUC Accountancy Paper 2Document6 pagesII PUC Accountancy Paper 2Tarannum KNo ratings yet

- MTP-5 QuestionDocument6 pagesMTP-5 Questionvirat rajputNo ratings yet

- Ar Problems HandoutsDocument18 pagesAr Problems Handoutsxjammer100% (1)

- Quiz 2 Current Liabilities and ProvisionsDocument2 pagesQuiz 2 Current Liabilities and ProvisionsJapon, Jenn RossNo ratings yet

- BCMCMCN 201 (2)Document4 pagesBCMCMCN 201 (2)karthikkarti405No ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- MTP May19 QDocument4 pagesMTP May19 Qomkar sawantNo ratings yet

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- Test Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingDocument4 pagesTest Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingabhimanyuNo ratings yet

- 2 Cash Flow Statement Ledger Accounts Sums Mat 2 19 04 FinakihbDocument3 pages2 Cash Flow Statement Ledger Accounts Sums Mat 2 19 04 FinakihbPrashanth RNo ratings yet

- Adjustment EntriesDocument12 pagesAdjustment EntriesthachuuuNo ratings yet

- HW On ReceivablesDocument20 pagesHW On Receivablesdenvermanapo2000No ratings yet

- Paper - 5: Advanced Accounting: Particulars NosDocument32 pagesPaper - 5: Advanced Accounting: Particulars NosAmolaNo ratings yet

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- Receivables - AccountingDocument11 pagesReceivables - AccountingDairymple MendeNo ratings yet

- Ae 11 Mar 19 AccDocument3 pagesAe 11 Mar 19 AccRitu GuptaNo ratings yet

- Ia Long QuizDocument15 pagesIa Long QuizKennedy Malubay0% (1)

- 12TH Acc QPDocument9 pages12TH Acc QPLOHITHNo ratings yet

- Ugmbcc04 - Business AccountingDocument4 pagesUgmbcc04 - Business AccountingShreya MitraNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- 07 - Mock Paper 1Document6 pages07 - Mock Paper 1monster gamerNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Accountancy PaperDocument7 pagesAccountancy PapersumitaNo ratings yet

- Bad Debts McqsDocument9 pagesBad Debts McqsShaheer Malik100% (1)

- CAF Test2 Accounts June23 R2 (Que)Document4 pagesCAF Test2 Accounts June23 R2 (Que)AISHWARYA DESHMUKHNo ratings yet

- PDF DocumentDocument6 pagesPDF DocumentCiara Abdulhamid BasirNo ratings yet

- Class 11 Accounatncy Sample PaperDocument20 pagesClass 11 Accounatncy Sample PaperGurjit BrarNo ratings yet

- Mgu Questions & AnswersDocument43 pagesMgu Questions & AnswersAsher SibinNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- II PUC Accountancy Paper Model PaperDocument6 pagesII PUC Accountancy Paper Model PaperCommunity Institute of Management Studies100% (1)

- XIIPrelim17 18Document7 pagesXIIPrelim17 18hareshNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- 106 1648004706 PDFDocument15 pages106 1648004706 PDFMohd AmanullahNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- The Power of Lies - Transgression in Victorian FictionDocument4 pagesThe Power of Lies - Transgression in Victorian Fictionkryykett100% (1)

- Euro 2020 Tactical TrendsDocument9 pagesEuro 2020 Tactical TrendsFernando AguiarNo ratings yet

- Investing in LondonDocument36 pagesInvesting in Londoncesperon39No ratings yet

- 2022-2023 Approved Calendar 11152021Document1 page2022-2023 Approved Calendar 11152021api-265172077No ratings yet

- Go 55 DT 05.07.2012Document6 pagesGo 55 DT 05.07.2012Narasimha Sastry100% (1)

- Name Registration NoDocument15 pagesName Registration Noapi-324043401No ratings yet

- Tamil Nadu National Law University: Course ObjectivesDocument4 pagesTamil Nadu National Law University: Course ObjectivesAgrawal DeekshaNo ratings yet

- Sample Letter To Landlord To Request Rent Relief or Payment PlanDocument3 pagesSample Letter To Landlord To Request Rent Relief or Payment PlanS P JaladharanNo ratings yet

- ISLAMIC MEDICAL EDUCATION RESOURCES PURPOSES AND PRINCIPLES OF MEDICINE, Maqāsid Wa Qawā'id Al - A BībDocument7 pagesISLAMIC MEDICAL EDUCATION RESOURCES PURPOSES AND PRINCIPLES OF MEDICINE, Maqāsid Wa Qawā'id Al - A Bībanis suraya mohamed said100% (1)

- SCDL Financial ManagementDocument3 pagesSCDL Financial Managementnehagupta2537471100% (1)

- SCRIPTDocument9 pagesSCRIPTJesu EbacuadoNo ratings yet

- Columbia County Property Transfers Aug. 29 - Sept. 4Document2 pagesColumbia County Property Transfers Aug. 29 - Sept. 4augustapressNo ratings yet

- St. Peter's College of Ormoc: Claim LetterDocument5 pagesSt. Peter's College of Ormoc: Claim LetterMichael BarceloNo ratings yet

- Traffic Management and Accident InvestigationDocument80 pagesTraffic Management and Accident InvestigationHarold GaraoNo ratings yet

- Affidavit by Parent - StudentDocument2 pagesAffidavit by Parent - Student43045731No ratings yet

- History of Radio in PalestineDocument8 pagesHistory of Radio in PalestineDINA ABUJARADNo ratings yet

- 5187 0103Document141 pages5187 0103Aravind ArjunanNo ratings yet

- Prosys Wireless Receiver: InstallationDocument2 pagesProsys Wireless Receiver: InstallationFabio BolivarNo ratings yet

- Weitzer, Ronald. 2020. Modern Slavery and Human TraffickingDocument12 pagesWeitzer, Ronald. 2020. Modern Slavery and Human TraffickingMaria LitoshNo ratings yet

- Oregon Firearms Federation Lawsuit DocumentsDocument18 pagesOregon Firearms Federation Lawsuit DocumentsJonathan SotoNo ratings yet

- Budgets MCQ - S - Past Exam QuestionsDocument24 pagesBudgets MCQ - S - Past Exam QuestionsAadhitya NarayananNo ratings yet

- Fujitsu Mainboard D3 Mainboard D3162-A ATX: Data SheetDocument3 pagesFujitsu Mainboard D3 Mainboard D3162-A ATX: Data SheetpziolkoNo ratings yet

- Be Programme Final2.0Document4 pagesBe Programme Final2.0Ernal Jovit GavinoNo ratings yet

- Thank You LetterDocument4 pagesThank You LetterCorrosion FactoryNo ratings yet

- Dr. Superintendent Charles Foust Bills - 2023Document2 pagesDr. Superintendent Charles Foust Bills - 2023Ben SchachtmanNo ratings yet

- CPR3701 ExaminationDocument8 pagesCPR3701 Examinationnhlapozanele108No ratings yet

Xi Acct Rev WS 1 22 23

Xi Acct Rev WS 1 22 23

Uploaded by

RiwaanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Xi Acct Rev WS 1 22 23

Xi Acct Rev WS 1 22 23

Uploaded by

RiwaanCopyright:

Available Formats

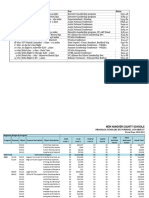

Revision worksheet :0 1

Name :_____________________ Roll No : ____

Class : XI C Subject : Accountancy

Schooling, as i t should be…

Date :07 /01/2023 D.O.S. : 09/01/2023

1. Rahul’s trial balance provide you the following information :

Debtors 80,000 Bad debts 2,000 Provision for doubtful debts 4,000 It is desired to maintain a

provision for bad debts of 1,000 State the amount to be debited/credited in profit and loss account :

(a) 5,000 (Debit) (b) 3,000 (Debit) (c) 1,000 (Credit) (d) none of these.

2. If the rent of one month is still to be paid the adjustment entry will be :

(a) Debit outstanding rent account and Credit rent account

(b) Debit profit and loss account and Credit rent account

(c) Debit rent account and Credit profit and loss account

(d) Debit rent account and Credit outstanding rent account.

3. If the rent received in advance 2,000. The adjustment entry will be :

(a) Debit profit and loss account and Credit rent account

(b) Debit rent account Credit rent received in advance account

(c) Debit rent received in advance account and Credit rent account

(d) None of these.

4. If the opening capital is 50,000 as on April 01, 2016 and additional capital introduced

10,000 on January 01, 2017. Interest charge on capital 10% p.a. The amount of interest on capital

shown in profit and loss account as on March 31, 2017 will be :

(a) 5,250 (b) 6,000 (c) 4,000 (d) 3,000.

5. If the insurance premium paid 1,000 and pre-paid insurance 300. The amount of insurance premium

shown in profit and loss account will be :

(a) 1,300 (b) 1,000 (c) 300 (d) 700

6. Compute cost of goods sold for the year 2017 with the help of the following information.

` Sales 20, 00,000

Purchases 15, 00,000

Wages 1, 00,000

Stock (Apr. 01, 2016) 3, 00,000

Stock (March 31, 2017) 4,00,000

Freight inwards 1,00,000

7. An extract from a trial balance on March 31, 2017 is given below :

Sundry debtors 32,000

Bad debts 2,000

Provision for doubtful debts 3,500

Additional Information :

Write-off further bad debts Rs 1,000 and create a provision for doubtful debts @

5% on debtors.

8. Ankit’s manager is entitled to a commission @ 10%. Net profit for the financial year is Rs20,623, if it

is based on :

(i) amount of net profit before charging such commission

Page No : 1 © Nirma Vidyavihar

No part of the content may be reproduced, without prior permission

(ii) amount of profit after charging such commission

8. Following balances are taken from the trial balance of a trader as at 31st March, 2022

Sundry Debtors 1,00,000 Bad Debts 2,000 Discount Allowed 1,500

Provision for Discount on debtors 1,000 Provision for doubtful debts 6,000

You are required to show extracts of Profit and Loss Account for the year ending 31st March, 2022 and

from the balance sheet as on that date after taking into consideration the following:-

Make provision for doubtful debts @3% of the sundry debtors.

Make provision for discount on debtors @2%.

Page No : 2 © Nirma Vidyavihar

No part of the content may be reproduced, without prior permission

You might also like

- FIRST Amended Complaint (Case Filed in California) For Being FiredDocument17 pagesFIRST Amended Complaint (Case Filed in California) For Being FiredZackery BisonNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Receivables ProblemsDocument13 pagesReceivables ProblemsIris Mnemosyne0% (1)

- Shulchan Arukh, Even HaEzer - en - Sefaria Community TranslationDocument255 pagesShulchan Arukh, Even HaEzer - en - Sefaria Community TranslationElda Cristina MunteanuNo ratings yet

- Jodie PresentDocument2 pagesJodie PresentFiorence Atmaja100% (1)

- LoA Unconditional 1Document2 pagesLoA Unconditional 1TuswanNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDocument13 pages11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Management Programme: TH STDocument3 pagesManagement Programme: TH ST19BAD007 Bendangsenla JamirNo ratings yet

- 2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Document4 pages2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Mohammad ShahidNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Accounting For Specialized InstituitionsDocument4 pagesAccounting For Specialized InstituitionsTitus Clement100% (1)

- Quiz 02 - FAR - UCP - ANS KEYDocument9 pagesQuiz 02 - FAR - UCP - ANS KEYkarim abitagoNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- Mock TestDocument8 pagesMock TestDiksha DudejaNo ratings yet

- Financial Accounting (CBCS Hons)Document7 pagesFinancial Accounting (CBCS Hons)Devil GamerNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- II PUC Accountancy Paper 2Document6 pagesII PUC Accountancy Paper 2Tarannum KNo ratings yet

- MTP-5 QuestionDocument6 pagesMTP-5 Questionvirat rajputNo ratings yet

- Ar Problems HandoutsDocument18 pagesAr Problems Handoutsxjammer100% (1)

- Quiz 2 Current Liabilities and ProvisionsDocument2 pagesQuiz 2 Current Liabilities and ProvisionsJapon, Jenn RossNo ratings yet

- BCMCMCN 201 (2)Document4 pagesBCMCMCN 201 (2)karthikkarti405No ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- MTP May19 QDocument4 pagesMTP May19 Qomkar sawantNo ratings yet

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- Test Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingDocument4 pagesTest Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingabhimanyuNo ratings yet

- 2 Cash Flow Statement Ledger Accounts Sums Mat 2 19 04 FinakihbDocument3 pages2 Cash Flow Statement Ledger Accounts Sums Mat 2 19 04 FinakihbPrashanth RNo ratings yet

- Adjustment EntriesDocument12 pagesAdjustment EntriesthachuuuNo ratings yet

- HW On ReceivablesDocument20 pagesHW On Receivablesdenvermanapo2000No ratings yet

- Paper - 5: Advanced Accounting: Particulars NosDocument32 pagesPaper - 5: Advanced Accounting: Particulars NosAmolaNo ratings yet

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- Receivables - AccountingDocument11 pagesReceivables - AccountingDairymple MendeNo ratings yet

- Ae 11 Mar 19 AccDocument3 pagesAe 11 Mar 19 AccRitu GuptaNo ratings yet

- Ia Long QuizDocument15 pagesIa Long QuizKennedy Malubay0% (1)

- 12TH Acc QPDocument9 pages12TH Acc QPLOHITHNo ratings yet

- Ugmbcc04 - Business AccountingDocument4 pagesUgmbcc04 - Business AccountingShreya MitraNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- 07 - Mock Paper 1Document6 pages07 - Mock Paper 1monster gamerNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Accountancy PaperDocument7 pagesAccountancy PapersumitaNo ratings yet

- Bad Debts McqsDocument9 pagesBad Debts McqsShaheer Malik100% (1)

- CAF Test2 Accounts June23 R2 (Que)Document4 pagesCAF Test2 Accounts June23 R2 (Que)AISHWARYA DESHMUKHNo ratings yet

- PDF DocumentDocument6 pagesPDF DocumentCiara Abdulhamid BasirNo ratings yet

- Class 11 Accounatncy Sample PaperDocument20 pagesClass 11 Accounatncy Sample PaperGurjit BrarNo ratings yet

- Mgu Questions & AnswersDocument43 pagesMgu Questions & AnswersAsher SibinNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- II PUC Accountancy Paper Model PaperDocument6 pagesII PUC Accountancy Paper Model PaperCommunity Institute of Management Studies100% (1)

- XIIPrelim17 18Document7 pagesXIIPrelim17 18hareshNo ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- 106 1648004706 PDFDocument15 pages106 1648004706 PDFMohd AmanullahNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- The Power of Lies - Transgression in Victorian FictionDocument4 pagesThe Power of Lies - Transgression in Victorian Fictionkryykett100% (1)

- Euro 2020 Tactical TrendsDocument9 pagesEuro 2020 Tactical TrendsFernando AguiarNo ratings yet

- Investing in LondonDocument36 pagesInvesting in Londoncesperon39No ratings yet

- 2022-2023 Approved Calendar 11152021Document1 page2022-2023 Approved Calendar 11152021api-265172077No ratings yet

- Go 55 DT 05.07.2012Document6 pagesGo 55 DT 05.07.2012Narasimha Sastry100% (1)

- Name Registration NoDocument15 pagesName Registration Noapi-324043401No ratings yet

- Tamil Nadu National Law University: Course ObjectivesDocument4 pagesTamil Nadu National Law University: Course ObjectivesAgrawal DeekshaNo ratings yet

- Sample Letter To Landlord To Request Rent Relief or Payment PlanDocument3 pagesSample Letter To Landlord To Request Rent Relief or Payment PlanS P JaladharanNo ratings yet

- ISLAMIC MEDICAL EDUCATION RESOURCES PURPOSES AND PRINCIPLES OF MEDICINE, Maqāsid Wa Qawā'id Al - A BībDocument7 pagesISLAMIC MEDICAL EDUCATION RESOURCES PURPOSES AND PRINCIPLES OF MEDICINE, Maqāsid Wa Qawā'id Al - A Bībanis suraya mohamed said100% (1)

- SCDL Financial ManagementDocument3 pagesSCDL Financial Managementnehagupta2537471100% (1)

- SCRIPTDocument9 pagesSCRIPTJesu EbacuadoNo ratings yet

- Columbia County Property Transfers Aug. 29 - Sept. 4Document2 pagesColumbia County Property Transfers Aug. 29 - Sept. 4augustapressNo ratings yet

- St. Peter's College of Ormoc: Claim LetterDocument5 pagesSt. Peter's College of Ormoc: Claim LetterMichael BarceloNo ratings yet

- Traffic Management and Accident InvestigationDocument80 pagesTraffic Management and Accident InvestigationHarold GaraoNo ratings yet

- Affidavit by Parent - StudentDocument2 pagesAffidavit by Parent - Student43045731No ratings yet

- History of Radio in PalestineDocument8 pagesHistory of Radio in PalestineDINA ABUJARADNo ratings yet

- 5187 0103Document141 pages5187 0103Aravind ArjunanNo ratings yet

- Prosys Wireless Receiver: InstallationDocument2 pagesProsys Wireless Receiver: InstallationFabio BolivarNo ratings yet

- Weitzer, Ronald. 2020. Modern Slavery and Human TraffickingDocument12 pagesWeitzer, Ronald. 2020. Modern Slavery and Human TraffickingMaria LitoshNo ratings yet

- Oregon Firearms Federation Lawsuit DocumentsDocument18 pagesOregon Firearms Federation Lawsuit DocumentsJonathan SotoNo ratings yet

- Budgets MCQ - S - Past Exam QuestionsDocument24 pagesBudgets MCQ - S - Past Exam QuestionsAadhitya NarayananNo ratings yet

- Fujitsu Mainboard D3 Mainboard D3162-A ATX: Data SheetDocument3 pagesFujitsu Mainboard D3 Mainboard D3162-A ATX: Data SheetpziolkoNo ratings yet

- Be Programme Final2.0Document4 pagesBe Programme Final2.0Ernal Jovit GavinoNo ratings yet

- Thank You LetterDocument4 pagesThank You LetterCorrosion FactoryNo ratings yet

- Dr. Superintendent Charles Foust Bills - 2023Document2 pagesDr. Superintendent Charles Foust Bills - 2023Ben SchachtmanNo ratings yet

- CPR3701 ExaminationDocument8 pagesCPR3701 Examinationnhlapozanele108No ratings yet