Professional Documents

Culture Documents

Task 3 Acc

Task 3 Acc

Uploaded by

bbang bbyCopyright:

Available Formats

You might also like

- Solution Manual For Operations Management Creating Value Along The Supply Chain 7th Edition by RussellDocument9 pagesSolution Manual For Operations Management Creating Value Along The Supply Chain 7th Edition by Russella3601376750% (3)

- Chapter 7 The Business Plan: Creating andDocument9 pagesChapter 7 The Business Plan: Creating andbeargreat100% (4)

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- AmazonDocument14 pagesAmazonTauhid Uddin MahmoodNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Empire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMDocument3 pagesEmpire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMJasmin JimmyNo ratings yet

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- Pioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesDocument4 pagesPioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesPrajwal PaiNo ratings yet

- Question 2 - EDWIN JOSES (GROUP ASSIGNMENT)Document3 pagesQuestion 2 - EDWIN JOSES (GROUP ASSIGNMENT)Hareen JuniorNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- SEMINAR QUESTION IAS 1,Document1 pageSEMINAR QUESTION IAS 1,Brian AbrahamNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Renee WongNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- SQA Accounting Assignment 1 02000759Document4 pagesSQA Accounting Assignment 1 02000759SENITH J100% (1)

- Final AccountsDocument15 pagesFinal AccountsHammadNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Also Solve The Problems Provided/mentioned Below:: AssignmentDocument5 pagesAlso Solve The Problems Provided/mentioned Below:: AssignmentUmer NawazNo ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- Ap - Ap 2.1Document19 pagesAp - Ap 2.1viethoangduongkhanhNo ratings yet

- Group 5Document8 pagesGroup 5Doreen OngNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Statement of CFDocument1 pageStatement of CFnr1520122No ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- 2021 Tutorial 9 Nov26 Problem SheetDocument7 pages2021 Tutorial 9 Nov26 Problem SheetdsfghNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Answer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Document9 pagesAnswer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Abul Ala Daniyal QaziNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- HW Chap 5Document9 pagesHW Chap 5uong huonglyNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- A222 Tutorial 1QDocument4 pagesA222 Tutorial 1Qchong huisinNo ratings yet

- RM RM RM Net Sales: Less: Cost of Goods SoldDocument2 pagesRM RM RM Net Sales: Less: Cost of Goods SoldDESIREE DESSY MAIDI STUDENTNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Individual AssignmentDocument22 pagesIndividual AssignmentEda LimNo ratings yet

- Acc140 PresentationDocument8 pagesAcc140 PresentationnyararaitatendaNo ratings yet

- HW 1 Preparing Income Statement Balance SheetDocument5 pagesHW 1 Preparing Income Statement Balance SheetDeepak KapoorNo ratings yet

- CashFlow Smart CompanyDocument1 pageCashFlow Smart CompanyCheyenne CariasNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1Puteri Noor SyahiraNo ratings yet

- LCCI Level One Final AcctDocument2 pagesLCCI Level One Final AcctStpmTutorialClassNo ratings yet

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidNo ratings yet

- Close LTDDocument5 pagesClose LTDXianFa WongNo ratings yet

- Acc117 - Assessment - Project 2 (Q)Document5 pagesAcc117 - Assessment - Project 2 (Q)SHARIFAH NOORAZREEN WAN JAMURINo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- FS Q.2Document4 pagesFS Q.2bsaf2247195No ratings yet

- TK 2 Accounting Nomer 3Document6 pagesTK 2 Accounting Nomer 3Dwi PutriNo ratings yet

- December 2007 Exam - Case 1 - AcmeGameDocument3 pagesDecember 2007 Exam - Case 1 - AcmeGamesherif_awadNo ratings yet

- Additional Case K17409 - Ias 7Document2 pagesAdditional Case K17409 - Ias 7Vy DangNo ratings yet

- Suggested Solutions June 2008Document11 pagesSuggested Solutions June 2008kalowekamoNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- IT Excel Financial StatementDocument17 pagesIT Excel Financial StatementMadelline San PedroNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 11. VatDocument56 pagesChapter 11. VatAmanda RuseirNo ratings yet

- Core Execution: Introduction To Order FlowDocument13 pagesCore Execution: Introduction To Order FlowBala SubramanianNo ratings yet

- BA Case StudyDocument2 pagesBA Case StudyRishi MitraNo ratings yet

- Culinarian CookwareDocument8 pagesCulinarian CookwarePratip BeraNo ratings yet

- Group 10 - Siemens CerberusEco in ChinaDocument9 pagesGroup 10 - Siemens CerberusEco in Chinaronitr209No ratings yet

- BA291-1 Robin Co Case StudyDocument7 pagesBA291-1 Robin Co Case StudyJed EstanislaoNo ratings yet

- Project Report ON Growth of Retail Sector in IndiaDocument57 pagesProject Report ON Growth of Retail Sector in IndiaDiksha PrajapatiNo ratings yet

- Question No.1 Is Compulsory. Answer Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument8 pagesQuestion No.1 Is Compulsory. Answer Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKv kNo ratings yet

- Jeunesse GlobalDocument4 pagesJeunesse GlobalJeunesse Global IndonesiaNo ratings yet

- Efficiency RatioDocument21 pagesEfficiency Ratiomushiechan888No ratings yet

- Ch.10 Branch AccountingDocument30 pagesCh.10 Branch AccountingMalayaranjan PanigrahiNo ratings yet

- 3 DiscountDocument16 pages3 Discountclear conceptsNo ratings yet

- The Value ChainDocument3 pagesThe Value ChainRICARDO PRADA OSPINANo ratings yet

- Exercise B2C AnswerDocument5 pagesExercise B2C AnswerNabilah Musri98No ratings yet

- Standby Letter of CreditDocument1 pageStandby Letter of Creditheenasaluja89No ratings yet

- Material Control: Ashim Bhatta (CA, MBS, ISA)Document49 pagesMaterial Control: Ashim Bhatta (CA, MBS, ISA)Safal BhandariNo ratings yet

- How To Increase Margins and Profitability in DistributionDocument4 pagesHow To Increase Margins and Profitability in Distributionطه احمدNo ratings yet

- Multi-Level Marketing Businesses and Pyramid Schemes Consumer AdviceDocument4 pagesMulti-Level Marketing Businesses and Pyramid Schemes Consumer AdviceelainelingaNo ratings yet

- Narrative Description Expenditure Cycle I: Purchase Order Person ActivityDocument3 pagesNarrative Description Expenditure Cycle I: Purchase Order Person ActivityKristine ApaleNo ratings yet

- Kama Company ProfileDocument4 pagesKama Company ProfileRahil JainNo ratings yet

- Managing Demand and CapacityDocument7 pagesManaging Demand and CapacityHeavy Gunner100% (2)

- Jay Abraham ChecklistDocument10 pagesJay Abraham ChecklistKiranNo ratings yet

- Chapter 5: The Franchising Market ProcessDocument5 pagesChapter 5: The Franchising Market ProcessRosalie RosalesNo ratings yet

- Branding and Packaging Decisions of The ProductDocument34 pagesBranding and Packaging Decisions of The ProductPraveen Prasoon100% (1)

- Syeda Samia Ali - Case Study - National Mayonnaise - CBDocument6 pagesSyeda Samia Ali - Case Study - National Mayonnaise - CBSyédà Sámiá AlìNo ratings yet

- How Is The Contract Perfected? 2. Who Are Capacitated and Incapacitated To Enter Into A Contract? How Is Consent Manifested?Document3 pagesHow Is The Contract Perfected? 2. Who Are Capacitated and Incapacitated To Enter Into A Contract? How Is Consent Manifested?Ilonah HizonNo ratings yet

- Answer Unit 5 Nur Widyastuti (207010006)Document2 pagesAnswer Unit 5 Nur Widyastuti (207010006)yerico shauqiNo ratings yet

Task 3 Acc

Task 3 Acc

Uploaded by

bbang bbyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Task 3 Acc

Task 3 Acc

Uploaded by

bbang bbyCopyright:

Available Formats

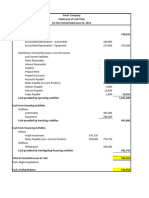

c.

Statement Of Profit Or Loss

STATEMENT OF PROFIT OR LOSS

FOR THE YEAR ENDED 31st DECEMBER 2022

RM RM RM

Sales 220,000

( 2,500 )

( - ) Sales Return and Allowances

( 950 )

( - ) Sales Discount

Net Sales 216,550

( - ) Cost Of Goods Sold

Beginning Inventory 24,800

Purchase 145,000

( - ) Purchase Return and Allowances ( 1,300 )

( - ) Purchase Discount ( 1,250 )

Net Purchase 142,450 142,450

Cost Of Goods Available for sale 167,250

( - ) Ending Inventory ( 18,000 )

Cost Of Goods Sold ( 149,250 )

Gross Profit 67,300

( + ) Other Revenue

Commission Revenue ( 3,300 – 700 ) 2,600

69,900

( - ) Operating Expenses

Bad Debts Expenses ( 800 + 760 ) 1,550

Salaries Expense ( 25,800 ) 25,800

Miscellaneous Expense ( 6,600 + 850 ) 7,450

Rental Expense ( 800 – 8,200 ) 7,400

Depreciation Expense - Vehicles 7,000

Depriciation Expense - Office Equipment 3,750 ( 52,950 )

Net Profit 16,950

d. Financial Position Statement

THE STATEMENT OF FINANCIAL POSITION

AS AT 31st DECEMBER 2022

RM RM RM

Current Assets

Inventory 18,000

Cash 1,600

Accounts Receivable 42,050

Prepaid Shop Rental 800

Total Current Assets 62,450

Non- Current Assets

Vehicles 70,000

( - ) Accumulated Depreciation - Vehicles ( 21,000 ) 49,000

Office Equipments 25,000

( - ) Accumulated Depreciation – Office Equipments ( 8,750 ) 16,250

Total Non-Current Assets 65,250

Total Assets 127,700

Owner`s Equity

Beginning Capital 100,000

( + ) Net Profit 16,950

( - ) Drawings ( 4,300 ) 112,650

Ending Capital

Current Liabilities

Accounts Payable 13,500

Unearned Revenue 700

Expenses Payable 850

Total Current Liabilities 15,050

Total Liabilities and Owner`s Equity 127,700

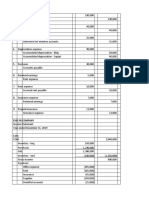

a. Adjustment Records

GENERAL JOURNAL

Date Account Explanation Debit ( RM ) Credit ( RM )

Dec 31 Inventories 31 December 18,000

Capital 18,000

( To record capital )

31 Commission Revenue 700

Unearned Commission 700

( To record adjustment unearned commission )

31 Prepaid ShopRental 800

Shop Rental 800

( To record prepaid rental )

31 Drawings 1,300

Cash 1,300

( To record drawings )

31 Bad Debts Expense 750

Accounts Receivable 750

( To record bad debts expense )

31 Expenses 850

Expenses Payable 850

( To record adjustment expense payable )

31 Depreciation Expense - Vehicles 7,000

Accumulated Depreciation - Vehicles 7,000

( To record depreciation expense of vehicles )

31 Depreciation Expense – Office Equipment 3,750

Accumulated Depreciation – Office Equipment 3,750

( To record depreciation expense of office

equipment )

b. Adjusted Trial Balance

Debit ( RM ) Credit ( RM

Capital ( 100,000 ) 100,000

Vehicles ( 70,000 ) 70,000

Accumulated Depreciation – Vehicles ( 14,000 + 7,000 ) 21,000

Office Equipments ( 25,000 ) 25,000

Accumulated Depreciation – Office Equipments (5000 + 3,750) 8,750

Inventories 1st January ( 24,800 ) 24,800

Cash ( 2,900 – 1,300 ) 1,600

Purchases ( 145,000 ) 145,000

Sales ( 220,000 ) 220,000

Bad Debts Expense ( 750 + 800 ) 1,550

Accounts Receivable ( 42,800 – 750 ) 42,050

Accounts Payable ( 13,500 ) 13,500

Purchases Discount ( 1,250 ) 1,250

Sales Discount ( 950 ) 950

Salaries Expense ( 25,800 ) 25,800

Sales Returns and Allowances ( 2,500 ) 2,500

Miscellaneous Expense ( 6,600 + 850 ) 7,450

Purchase Returns and Allowances ( 1,300 ) 1,300

Rental Expense ( 8,200 – 800 ) 7,400

Commission Revenue ( 3,300 – 700 ) 2,600

Drawings ( 3,000 + 1,300 ) 4,300

Unearned Revenue ( 700 ) 700

Shop Prepaid Rental ( 800 ) 800

Expenses Payable ( 850 ) 850

Depreciation Expense- Vehicles ( 7,000 ) 7,000

Depreciation Expense- Office Equipment ( 3750 ) 3,750

Total 369,950 369,950

ADJUSTED TRIAL BALANCE AS AT 31st DECEMBER 2022

You might also like

- Solution Manual For Operations Management Creating Value Along The Supply Chain 7th Edition by RussellDocument9 pagesSolution Manual For Operations Management Creating Value Along The Supply Chain 7th Edition by Russella3601376750% (3)

- Chapter 7 The Business Plan: Creating andDocument9 pagesChapter 7 The Business Plan: Creating andbeargreat100% (4)

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- Exercise Financial Statements Without AdjustmentsDocument3 pagesExercise Financial Statements Without AdjustmentsShahrillNo ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- AmazonDocument14 pagesAmazonTauhid Uddin MahmoodNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Empire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMDocument3 pagesEmpire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMJasmin JimmyNo ratings yet

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- Pioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesDocument4 pagesPioma Plastics Company Cash Flow Statement For The Year Ended July 31 Amount in Rs. Amount in Rs. Cash Flow From Operating ActivitiesPrajwal PaiNo ratings yet

- Question 2 - EDWIN JOSES (GROUP ASSIGNMENT)Document3 pagesQuestion 2 - EDWIN JOSES (GROUP ASSIGNMENT)Hareen JuniorNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- SEMINAR QUESTION IAS 1,Document1 pageSEMINAR QUESTION IAS 1,Brian AbrahamNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Document5 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 2 (Part 2)Renee WongNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- SQA Accounting Assignment 1 02000759Document4 pagesSQA Accounting Assignment 1 02000759SENITH J100% (1)

- Final AccountsDocument15 pagesFinal AccountsHammadNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Also Solve The Problems Provided/mentioned Below:: AssignmentDocument5 pagesAlso Solve The Problems Provided/mentioned Below:: AssignmentUmer NawazNo ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- Ap - Ap 2.1Document19 pagesAp - Ap 2.1viethoangduongkhanhNo ratings yet

- Group 5Document8 pagesGroup 5Doreen OngNo ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Statement of CFDocument1 pageStatement of CFnr1520122No ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- 2021 Tutorial 9 Nov26 Problem SheetDocument7 pages2021 Tutorial 9 Nov26 Problem SheetdsfghNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- Answer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Document9 pagesAnswer #1: Total Current Liabilities 58709 Equipment Total Liabilities 68709Abul Ala Daniyal QaziNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- HW Chap 5Document9 pagesHW Chap 5uong huonglyNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- A222 Tutorial 1QDocument4 pagesA222 Tutorial 1Qchong huisinNo ratings yet

- RM RM RM Net Sales: Less: Cost of Goods SoldDocument2 pagesRM RM RM Net Sales: Less: Cost of Goods SoldDESIREE DESSY MAIDI STUDENTNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Individual AssignmentDocument22 pagesIndividual AssignmentEda LimNo ratings yet

- Acc140 PresentationDocument8 pagesAcc140 PresentationnyararaitatendaNo ratings yet

- HW 1 Preparing Income Statement Balance SheetDocument5 pagesHW 1 Preparing Income Statement Balance SheetDeepak KapoorNo ratings yet

- CashFlow Smart CompanyDocument1 pageCashFlow Smart CompanyCheyenne CariasNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1Puteri Noor SyahiraNo ratings yet

- LCCI Level One Final AcctDocument2 pagesLCCI Level One Final AcctStpmTutorialClassNo ratings yet

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidNo ratings yet

- Close LTDDocument5 pagesClose LTDXianFa WongNo ratings yet

- Acc117 - Assessment - Project 2 (Q)Document5 pagesAcc117 - Assessment - Project 2 (Q)SHARIFAH NOORAZREEN WAN JAMURINo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- FS Q.2Document4 pagesFS Q.2bsaf2247195No ratings yet

- TK 2 Accounting Nomer 3Document6 pagesTK 2 Accounting Nomer 3Dwi PutriNo ratings yet

- December 2007 Exam - Case 1 - AcmeGameDocument3 pagesDecember 2007 Exam - Case 1 - AcmeGamesherif_awadNo ratings yet

- Additional Case K17409 - Ias 7Document2 pagesAdditional Case K17409 - Ias 7Vy DangNo ratings yet

- Suggested Solutions June 2008Document11 pagesSuggested Solutions June 2008kalowekamoNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- IT Excel Financial StatementDocument17 pagesIT Excel Financial StatementMadelline San PedroNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 11. VatDocument56 pagesChapter 11. VatAmanda RuseirNo ratings yet

- Core Execution: Introduction To Order FlowDocument13 pagesCore Execution: Introduction To Order FlowBala SubramanianNo ratings yet

- BA Case StudyDocument2 pagesBA Case StudyRishi MitraNo ratings yet

- Culinarian CookwareDocument8 pagesCulinarian CookwarePratip BeraNo ratings yet

- Group 10 - Siemens CerberusEco in ChinaDocument9 pagesGroup 10 - Siemens CerberusEco in Chinaronitr209No ratings yet

- BA291-1 Robin Co Case StudyDocument7 pagesBA291-1 Robin Co Case StudyJed EstanislaoNo ratings yet

- Project Report ON Growth of Retail Sector in IndiaDocument57 pagesProject Report ON Growth of Retail Sector in IndiaDiksha PrajapatiNo ratings yet

- Question No.1 Is Compulsory. Answer Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument8 pagesQuestion No.1 Is Compulsory. Answer Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKv kNo ratings yet

- Jeunesse GlobalDocument4 pagesJeunesse GlobalJeunesse Global IndonesiaNo ratings yet

- Efficiency RatioDocument21 pagesEfficiency Ratiomushiechan888No ratings yet

- Ch.10 Branch AccountingDocument30 pagesCh.10 Branch AccountingMalayaranjan PanigrahiNo ratings yet

- 3 DiscountDocument16 pages3 Discountclear conceptsNo ratings yet

- The Value ChainDocument3 pagesThe Value ChainRICARDO PRADA OSPINANo ratings yet

- Exercise B2C AnswerDocument5 pagesExercise B2C AnswerNabilah Musri98No ratings yet

- Standby Letter of CreditDocument1 pageStandby Letter of Creditheenasaluja89No ratings yet

- Material Control: Ashim Bhatta (CA, MBS, ISA)Document49 pagesMaterial Control: Ashim Bhatta (CA, MBS, ISA)Safal BhandariNo ratings yet

- How To Increase Margins and Profitability in DistributionDocument4 pagesHow To Increase Margins and Profitability in Distributionطه احمدNo ratings yet

- Multi-Level Marketing Businesses and Pyramid Schemes Consumer AdviceDocument4 pagesMulti-Level Marketing Businesses and Pyramid Schemes Consumer AdviceelainelingaNo ratings yet

- Narrative Description Expenditure Cycle I: Purchase Order Person ActivityDocument3 pagesNarrative Description Expenditure Cycle I: Purchase Order Person ActivityKristine ApaleNo ratings yet

- Kama Company ProfileDocument4 pagesKama Company ProfileRahil JainNo ratings yet

- Managing Demand and CapacityDocument7 pagesManaging Demand and CapacityHeavy Gunner100% (2)

- Jay Abraham ChecklistDocument10 pagesJay Abraham ChecklistKiranNo ratings yet

- Chapter 5: The Franchising Market ProcessDocument5 pagesChapter 5: The Franchising Market ProcessRosalie RosalesNo ratings yet

- Branding and Packaging Decisions of The ProductDocument34 pagesBranding and Packaging Decisions of The ProductPraveen Prasoon100% (1)

- Syeda Samia Ali - Case Study - National Mayonnaise - CBDocument6 pagesSyeda Samia Ali - Case Study - National Mayonnaise - CBSyédà Sámiá AlìNo ratings yet

- How Is The Contract Perfected? 2. Who Are Capacitated and Incapacitated To Enter Into A Contract? How Is Consent Manifested?Document3 pagesHow Is The Contract Perfected? 2. Who Are Capacitated and Incapacitated To Enter Into A Contract? How Is Consent Manifested?Ilonah HizonNo ratings yet

- Answer Unit 5 Nur Widyastuti (207010006)Document2 pagesAnswer Unit 5 Nur Widyastuti (207010006)yerico shauqiNo ratings yet