Professional Documents

Culture Documents

Job Costing

Job Costing

Uploaded by

Sujay SinghviCopyright:

Available Formats

You might also like

- CAPA Form ExampleDocument1 pageCAPA Form ExampleBharath78% (9)

- Oral Defense ScriptDocument31 pagesOral Defense ScriptFernan Enad82% (17)

- Quiz 2 Problem - SolutionDocument9 pagesQuiz 2 Problem - SolutionCharice Anne VillamarinNo ratings yet

- Green Supply Chain ManagementDocument40 pagesGreen Supply Chain ManagementAnil Kumar SharmaNo ratings yet

- Harsh Electricals: Analyzing Cost in Search of ProfitDocument11 pagesHarsh Electricals: Analyzing Cost in Search of ProfitSanJana NahataNo ratings yet

- 5 Job CostingDocument22 pages5 Job CostingAbimanyu Shenil0% (1)

- Problem 2-14 Product Cost Sunk Cost Direct LaborDocument8 pagesProblem 2-14 Product Cost Sunk Cost Direct LaborarijitmajeeNo ratings yet

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- Costing Systems - Lessons ExamplesDocument15 pagesCosting Systems - Lessons ExamplesNicolasNo ratings yet

- Cost Accounting - ABC Vs Variable CostingDocument3 pagesCost Accounting - ABC Vs Variable CostingJaycel Yam-Yam VerancesNo ratings yet

- UntitledDocument6 pagesUntitledAravind P RNo ratings yet

- Unit 1 - ch.2 OverheadDocument9 pagesUnit 1 - ch.2 Overheadaayushgiri21No ratings yet

- SampleproblemsDocument5 pagesSampleproblemsCristine Joy BenitezNo ratings yet

- Predetermined Factory OverheadDocument5 pagesPredetermined Factory OverheadCharléNo ratings yet

- P1 Question Bank - CH 1 and 2Document29 pagesP1 Question Bank - CH 1 and 2prudencemaake120No ratings yet

- Tutorial 1 - Topic 4 - OAR - QDocument6 pagesTutorial 1 - Topic 4 - OAR - QJong HannahNo ratings yet

- Overhead CostingDocument8 pagesOverhead Costingarmansafi761No ratings yet

- Sno Description Cost in Rs Cost in RsDocument8 pagesSno Description Cost in Rs Cost in RsCH NAIRNo ratings yet

- 03122020055228-Job Costing Problems & Solutions NotesDocument4 pages03122020055228-Job Costing Problems & Solutions NotesRohit RanaNo ratings yet

- Management Advisory Services: BudgetedDocument26 pagesManagement Advisory Services: Budgetedi hate youtubersNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing Decisionschintan desaiNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- The Other: Cost AccowntingDocument7 pagesThe Other: Cost AccowntingLakshmi SNo ratings yet

- JobDocument4 pagesJobNeha SmritiNo ratings yet

- Cost AccountingDocument53 pagesCost Accountingpritika mishraNo ratings yet

- Accounting For Production LossesDocument6 pagesAccounting For Production LossesMary Ann NatividadNo ratings yet

- Manufacturing A LevelDocument21 pagesManufacturing A LevelSheraz AhmadNo ratings yet

- 9 Job Costing & Batch Costing PDFDocument7 pages9 Job Costing & Batch Costing PDFgracel angela tolejano100% (1)

- Tuto 11Document3 pagesTuto 11WEI QUAN LEENo ratings yet

- Mumbai University - TYBCOM - Sem 5 - Cost AccountingDocument19 pagesMumbai University - TYBCOM - Sem 5 - Cost Accountingpritika mishraNo ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Overheads - IBADocument6 pagesOverheads - IBAZehra HussainNo ratings yet

- Bacc232 .309 Management Accounting Assignment 1Document13 pagesBacc232 .309 Management Accounting Assignment 1TarusengaNo ratings yet

- Suggested Answer of November 2019 ExamDocument21 pagesSuggested Answer of November 2019 ExamRakshitha VarshaNo ratings yet

- Cost & Management AccountingDocument3 pagesCost & Management AccountingAnurag AwasthiNo ratings yet

- Excel Practise Questions and SolutionsDocument18 pagesExcel Practise Questions and SolutionsFahad NadeemNo ratings yet

- MAE - Pratice - Cost Sheet. - QuestionDocument6 pagesMAE - Pratice - Cost Sheet. - QuestionDhairya Mudgal0% (1)

- Process Costing-306Document4 pagesProcess Costing-306dbadhon2021No ratings yet

- Manufacturing AccountsDocument2 pagesManufacturing AccountsMohamed IrshaNo ratings yet

- OBE - COST QB With ANSWERS - FINALDocument92 pagesOBE - COST QB With ANSWERS - FINALPavi NishaNo ratings yet

- SEM-II-Cost & Management Accounting-I Overhead CostingDocument8 pagesSEM-II-Cost & Management Accounting-I Overhead CostingTanishq KambojNo ratings yet

- Manufacturing Account (With Answers) : Advanced LevelDocument15 pagesManufacturing Account (With Answers) : Advanced LevelMomoh Kebiru0% (1)

- ActivityDocument7 pagesActivityTrina Mae BarrogaNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- 4 - Sample Problems - Standard Costing and Variance AnalysisDocument8 pages4 - Sample Problems - Standard Costing and Variance AnalysisJustin AciertoNo ratings yet

- Basic Costing PrinciplesDocument5 pagesBasic Costing Principlescaleahmarshall03No ratings yet

- Alka 25-7-2015 OverheadDocument9 pagesAlka 25-7-2015 OverheadShubhamNo ratings yet

- Exercise 1 Requirement 1 SummaryDocument19 pagesExercise 1 Requirement 1 SummaryMonique VillaNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- Activity Based CostingDocument55 pagesActivity Based CostingCeline Marie AntonioNo ratings yet

- Cost Revision Sheets For Students Chapter 1 2Document21 pagesCost Revision Sheets For Students Chapter 1 2abdelrahman redaNo ratings yet

- Cost HeetDocument4 pagesCost HeetYuvnesh KumarNo ratings yet

- Overheads Revision PDFDocument9 pagesOverheads Revision PDFSurajNo ratings yet

- Income Statement Under Job Order and Activity-Based CostingDocument10 pagesIncome Statement Under Job Order and Activity-Based CostingSadhna MaharjanNo ratings yet

- Question No-1-Solution Traditional Costing Method: Overhead Rate Per Machine HoursDocument3 pagesQuestion No-1-Solution Traditional Costing Method: Overhead Rate Per Machine HoursRiya SharmaNo ratings yet

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- Q&A On Cost AccountingDocument55 pagesQ&A On Cost AccountingAbdulmalik LawalNo ratings yet

- AmountDocument3 pagesAmountJudy TotoNo ratings yet

- See Zhao Wei U2003083Document5 pagesSee Zhao Wei U2003083zhaoweiNo ratings yet

- Acc 803Document2 pagesAcc 803Tasfia NahiyanNo ratings yet

- Investment in Financial Literacy and Saving Decisions PDFDocument45 pagesInvestment in Financial Literacy and Saving Decisions PDFSujay SinghviNo ratings yet

- The Solution To The Financial Literacy Problem - What Is The Answe PDFDocument22 pagesThe Solution To The Financial Literacy Problem - What Is The Answe PDFSujay SinghviNo ratings yet

- IOT and ERP SYSTEMDocument10 pagesIOT and ERP SYSTEMSujay SinghviNo ratings yet

- Analyzing Factors Affecting Financial Literacy and Its Impact On Investment Behavior Among Adults in India PDFDocument25 pagesAnalyzing Factors Affecting Financial Literacy and Its Impact On Investment Behavior Among Adults in India PDFSujay SinghviNo ratings yet

- Ratio AnalysisDocument18 pagesRatio AnalysisSujay SinghviNo ratings yet

- Outlook Sip ReportDocument80 pagesOutlook Sip ReportSujay SinghviNo ratings yet

- Process CostingDocument11 pagesProcess CostingSujay SinghviNo ratings yet

- Company Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Document14 pagesCompany Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Sujay SinghviNo ratings yet

- Session 070Document8 pagesSession 070Sujay SinghviNo ratings yet

- Session 3 Effort EstimationDocument2 pagesSession 3 Effort EstimationSujay SinghviNo ratings yet

- Chapter 5 Break Even AnalysisDocument19 pagesChapter 5 Break Even AnalysisAbdullahNo ratings yet

- CH 05Document30 pagesCH 05thekman2015No ratings yet

- Entrepreneurship11 12 - q2 - Clas1 - 4ms of Oepration Materials - v1 (1) Joseph AurelloDocument11 pagesEntrepreneurship11 12 - q2 - Clas1 - 4ms of Oepration Materials - v1 (1) Joseph AurelloaraNo ratings yet

- Software Development MethodologyDocument7 pagesSoftware Development MethodologyRajasekar VelswamyNo ratings yet

- College of Business and Economics Department of Management: Salale UniversityDocument48 pagesCollege of Business and Economics Department of Management: Salale UniversityTemuNo ratings yet

- Lecture#08 - Web Project ManagementDocument15 pagesLecture#08 - Web Project ManagementMalik SalmanNo ratings yet

- Audit Risks and MaterialityDocument19 pagesAudit Risks and MaterialityRemah PaudacNo ratings yet

- Explain The Performance Appraisal ProcessDocument2 pagesExplain The Performance Appraisal ProcessLetsogile BaloiNo ratings yet

- Chapter 5Document16 pagesChapter 5jaydenNo ratings yet

- Impact of Digital Marketing On Small Scale Startup Business With Special Reference To Madhya PradeshDocument7 pagesImpact of Digital Marketing On Small Scale Startup Business With Special Reference To Madhya PradeshIJRASETPublicationsNo ratings yet

- Automotive Functional Safety Compliance Intland SoftwareDocument23 pagesAutomotive Functional Safety Compliance Intland SoftwaresafakeemNo ratings yet

- Krispy Kreme Doughnuts-ProjectDocument18 pagesKrispy Kreme Doughnuts-ProjectHarun Kaya0% (1)

- Strategic Managemnt - Swot Matrix AnalysisDocument1 pageStrategic Managemnt - Swot Matrix AnalysisAdmer TandogNo ratings yet

- Questonaries Prepare To Be Fill by The CompanyDocument6 pagesQuestonaries Prepare To Be Fill by The Companyambrita88No ratings yet

- Accounting Policies Changes in Accounting Estimates and Errors - IAS 8Document6 pagesAccounting Policies Changes in Accounting Estimates and Errors - IAS 8Anonymous P1xUTHstHTNo ratings yet

- Online Examination Instruction:: Format & Sample Question Paper For ETE, December, 2015Document20 pagesOnline Examination Instruction:: Format & Sample Question Paper For ETE, December, 2015Abdullah HolifNo ratings yet

- SOP-HR-01 (Recruitment Process)Document2 pagesSOP-HR-01 (Recruitment Process)M CNo ratings yet

- Case Report: WebvanDocument11 pagesCase Report: Webvanapi-301978530No ratings yet

- Gantt Chart: Task Title Task Owner Work BKDN StructureDocument8 pagesGantt Chart: Task Title Task Owner Work BKDN StructureTrần Xuân QuýNo ratings yet

- Organizing Technical Activities Micahael Angelo de LeonDocument38 pagesOrganizing Technical Activities Micahael Angelo de Leonangelo100% (5)

- Knowledge Management Systems: Submitted byDocument12 pagesKnowledge Management Systems: Submitted byNimish JoshiNo ratings yet

- Human Resources Planning at Tata Consultancy Services LimitedDocument5 pagesHuman Resources Planning at Tata Consultancy Services LimitedrutujaNo ratings yet

- OEM Solutions: Products. Technology. Services. Delivered GloballyDocument20 pagesOEM Solutions: Products. Technology. Services. Delivered GloballyJosefaNo ratings yet

- Analisis Metode Kanban Dan Metode Junbiki Pada PerDocument18 pagesAnalisis Metode Kanban Dan Metode Junbiki Pada PerIrfan Adi WardanaNo ratings yet

- Autonomy in Higher Education From Affiliation To Self Governing Management - An Indian PerspectiveDocument15 pagesAutonomy in Higher Education From Affiliation To Self Governing Management - An Indian PerspectiveGlobal Research and Development ServicesNo ratings yet

- Consulting Services BrochureDocument4 pagesConsulting Services BrochureS M SHEKAR AND CONo ratings yet

- Comprehensive Exam "Disney Production": Graduate School of Business MBA ProgramDocument13 pagesComprehensive Exam "Disney Production": Graduate School of Business MBA ProgrammenoushNo ratings yet

Job Costing

Job Costing

Uploaded by

Sujay SinghviOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Job Costing

Job Costing

Uploaded by

Sujay SinghviCopyright:

Available Formats

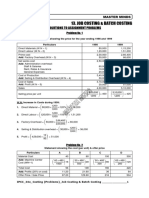

1.

The following direct costs are incurred on job 430

of Classic Radio Company:

Materials – Rs 4010

Wages: Dept A – 60 hrs – Rs3 per hour

Dept B – 40 hrs – Rs. 2 per hour

Dept C – 20hrs – Rs. 5 per hour

Overheads for these three departments were estimated as follows:

Variable overheads:

Dept A – Rs. 5000 for 5000 labour hours

Dept B – Rs 3000 for 1500 labour hours

Dept C – 2000 for 500 labour hours

Fixed overheads: Estimated at Rs20000 for 10000 normal working hours.

You are required to calculate the cost of Job 430 and calculate price to give profit of 25% on selling price.

Job cost sheet to determine cost og the job and profit ?

Working Note : rate per hour = overhead cost/ total labour h

Crossmultiply technique

Dept A 5000

?

Working Note : Overhead cost = Actual labour hours * overh

Dept A 60*1

Dept B 40*2

Working Note : Rate per hour of fixed overhead = overhead

Crossmultiply technique

or

Formulae

20000

?

Overhead cost = Actual labour hours * overh

Cost sheet for Job no. 430

Particulars Amount Amount

Material 4010

Direct wages

Dept A 180

Deep B 80

Deep C 100

360

Prime Cost 4370

Overheads

Variable 220

fit of 25% on selling price. Fixed 240

Total Cost 4830

Profit on Cost 1609.839

Selling Price 6439.839

rate per hour = overhead cost/ total labour hours

or

Crossmultiply technique

5000

1

Overhead cost = Actual labour hours * overhead rate per hour

Rate per hour of fixed overhead = overhead cost/ normal working hours

Crossmultiply technique

10000

1

Overhead cost = Actual labour hours * overhead rate per hour

Working Note :Rate per hour of overhead = overheads/ total labour hour

Dept x 1

Dept y 0.5

z 0.625

Overhead Cost = Actual labour hours*rate per hour

deptx 1000 1 1000

depty 2000 0.5 1000

deptz 5000 0.625 3125

5125

Cost sheet for the job no. 58

Particulars Amount Amount

Material

Department X 8000

Y 1000

Z 500

total 9500

(scrape)

x 1000

y 150

z 100

total -1250

8250

Direct Wages

X 1000

Y 3000

Z 10000

14000

Prime Cost 22250

Overheads 5125

Total Cost 27375

1. A factory uses a job costing system. The following data are available from the books at the year ending 31.3

Particulars Amount (INR)

Direct Material 900000

Direct wages 750000

Profit 609000

Selling and distribution

525000

overhead

Administrative

420000

overhead

Factory overhead 450000

Required:

1. Prepare a cost sheet indicating the prime cost, works cost, production cost, cost of sales and sales value

2. In 2010-11, the factory has received an order for a number of jobs. It is estimated that the direct materi

What would be the price for these jobs if the factory intends to earn the same rate of profit on sales,

assuming that the selling and distribution overhead has gone up by 15%.

The factory recovers factory overhead as a percentage of direct wages and administrative and

selling and distribution overhead as a percentage of works cost, based on the cost rates prevalent in the previous year.

Cost sheet for the year 2010

particulars amt

Direct material 900000

direct wages 750000

Prime cost 1650000

factory o/h 450000

factory cost 2100000

admin o/h 420000

cost of production 2520000

selling and distribution 525000

total cost 3045000

profit 609000

sales 3654000

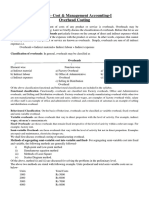

Estimation

factory o/h / Direct wages

450000/2100000*100

60

admin o/h / Works cost

420000/ 2100000*100

20

Selling and distribution/ works cost

525000/2100000*100

25

add 15% of 25% 3.75

28.75

lable from the books at the year ending 31.3.2010.

roduction cost, cost of sales and sales value.

of jobs. It is estimated that the direct materials would be INR 1200000, and direct labour would cost INR 750000.

ate of profit on sales,

inistrative and

ost rates prevalent in the previous year.

Estimated cost sheet

particulars amt

Direct material 1200000

direct wages 750000

Prime cost 1950000

factory o/h 450000

60% of 750000 450000

Factory Cost 2400000

Admin o/s

20%of 2400000 480000

Cost of production 2880000

Selling and distribution

28.75% of 2400000 690000

Total Cost 3570000

Profit (20%) 714000

Sales 4284000

r would cost INR 750000.

Estimated Cost Sheet

Particulars Amount

Direct Material 2000

Direct labour 8000

Prime Cost 10000

Factory o/h

120% of 8000 9600

Factory Cost 19600

Admin o/h

20% of 19600 3920

cost of production 23520

selling and distribtion

15% of 23520 3528

Total Cost 27048

profit 20% on 27048 5409.6

Sales 32457.6

You might also like

- CAPA Form ExampleDocument1 pageCAPA Form ExampleBharath78% (9)

- Oral Defense ScriptDocument31 pagesOral Defense ScriptFernan Enad82% (17)

- Quiz 2 Problem - SolutionDocument9 pagesQuiz 2 Problem - SolutionCharice Anne VillamarinNo ratings yet

- Green Supply Chain ManagementDocument40 pagesGreen Supply Chain ManagementAnil Kumar SharmaNo ratings yet

- Harsh Electricals: Analyzing Cost in Search of ProfitDocument11 pagesHarsh Electricals: Analyzing Cost in Search of ProfitSanJana NahataNo ratings yet

- 5 Job CostingDocument22 pages5 Job CostingAbimanyu Shenil0% (1)

- Problem 2-14 Product Cost Sunk Cost Direct LaborDocument8 pagesProblem 2-14 Product Cost Sunk Cost Direct LaborarijitmajeeNo ratings yet

- Cma ProblemsDocument25 pagesCma ProblemsPridhvi Raj ReddyNo ratings yet

- Costing Systems - Lessons ExamplesDocument15 pagesCosting Systems - Lessons ExamplesNicolasNo ratings yet

- Cost Accounting - ABC Vs Variable CostingDocument3 pagesCost Accounting - ABC Vs Variable CostingJaycel Yam-Yam VerancesNo ratings yet

- UntitledDocument6 pagesUntitledAravind P RNo ratings yet

- Unit 1 - ch.2 OverheadDocument9 pagesUnit 1 - ch.2 Overheadaayushgiri21No ratings yet

- SampleproblemsDocument5 pagesSampleproblemsCristine Joy BenitezNo ratings yet

- Predetermined Factory OverheadDocument5 pagesPredetermined Factory OverheadCharléNo ratings yet

- P1 Question Bank - CH 1 and 2Document29 pagesP1 Question Bank - CH 1 and 2prudencemaake120No ratings yet

- Tutorial 1 - Topic 4 - OAR - QDocument6 pagesTutorial 1 - Topic 4 - OAR - QJong HannahNo ratings yet

- Overhead CostingDocument8 pagesOverhead Costingarmansafi761No ratings yet

- Sno Description Cost in Rs Cost in RsDocument8 pagesSno Description Cost in Rs Cost in RsCH NAIRNo ratings yet

- 03122020055228-Job Costing Problems & Solutions NotesDocument4 pages03122020055228-Job Costing Problems & Solutions NotesRohit RanaNo ratings yet

- Management Advisory Services: BudgetedDocument26 pagesManagement Advisory Services: Budgetedi hate youtubersNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing Decisionschintan desaiNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- The Other: Cost AccowntingDocument7 pagesThe Other: Cost AccowntingLakshmi SNo ratings yet

- JobDocument4 pagesJobNeha SmritiNo ratings yet

- Cost AccountingDocument53 pagesCost Accountingpritika mishraNo ratings yet

- Accounting For Production LossesDocument6 pagesAccounting For Production LossesMary Ann NatividadNo ratings yet

- Manufacturing A LevelDocument21 pagesManufacturing A LevelSheraz AhmadNo ratings yet

- 9 Job Costing & Batch Costing PDFDocument7 pages9 Job Costing & Batch Costing PDFgracel angela tolejano100% (1)

- Tuto 11Document3 pagesTuto 11WEI QUAN LEENo ratings yet

- Mumbai University - TYBCOM - Sem 5 - Cost AccountingDocument19 pagesMumbai University - TYBCOM - Sem 5 - Cost Accountingpritika mishraNo ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- Overheads - IBADocument6 pagesOverheads - IBAZehra HussainNo ratings yet

- Bacc232 .309 Management Accounting Assignment 1Document13 pagesBacc232 .309 Management Accounting Assignment 1TarusengaNo ratings yet

- Suggested Answer of November 2019 ExamDocument21 pagesSuggested Answer of November 2019 ExamRakshitha VarshaNo ratings yet

- Cost & Management AccountingDocument3 pagesCost & Management AccountingAnurag AwasthiNo ratings yet

- Excel Practise Questions and SolutionsDocument18 pagesExcel Practise Questions and SolutionsFahad NadeemNo ratings yet

- MAE - Pratice - Cost Sheet. - QuestionDocument6 pagesMAE - Pratice - Cost Sheet. - QuestionDhairya Mudgal0% (1)

- Process Costing-306Document4 pagesProcess Costing-306dbadhon2021No ratings yet

- Manufacturing AccountsDocument2 pagesManufacturing AccountsMohamed IrshaNo ratings yet

- OBE - COST QB With ANSWERS - FINALDocument92 pagesOBE - COST QB With ANSWERS - FINALPavi NishaNo ratings yet

- SEM-II-Cost & Management Accounting-I Overhead CostingDocument8 pagesSEM-II-Cost & Management Accounting-I Overhead CostingTanishq KambojNo ratings yet

- Manufacturing Account (With Answers) : Advanced LevelDocument15 pagesManufacturing Account (With Answers) : Advanced LevelMomoh Kebiru0% (1)

- ActivityDocument7 pagesActivityTrina Mae BarrogaNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- 4 - Sample Problems - Standard Costing and Variance AnalysisDocument8 pages4 - Sample Problems - Standard Costing and Variance AnalysisJustin AciertoNo ratings yet

- Basic Costing PrinciplesDocument5 pagesBasic Costing Principlescaleahmarshall03No ratings yet

- Alka 25-7-2015 OverheadDocument9 pagesAlka 25-7-2015 OverheadShubhamNo ratings yet

- Exercise 1 Requirement 1 SummaryDocument19 pagesExercise 1 Requirement 1 SummaryMonique VillaNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- Activity Based CostingDocument55 pagesActivity Based CostingCeline Marie AntonioNo ratings yet

- Cost Revision Sheets For Students Chapter 1 2Document21 pagesCost Revision Sheets For Students Chapter 1 2abdelrahman redaNo ratings yet

- Cost HeetDocument4 pagesCost HeetYuvnesh KumarNo ratings yet

- Overheads Revision PDFDocument9 pagesOverheads Revision PDFSurajNo ratings yet

- Income Statement Under Job Order and Activity-Based CostingDocument10 pagesIncome Statement Under Job Order and Activity-Based CostingSadhna MaharjanNo ratings yet

- Question No-1-Solution Traditional Costing Method: Overhead Rate Per Machine HoursDocument3 pagesQuestion No-1-Solution Traditional Costing Method: Overhead Rate Per Machine HoursRiya SharmaNo ratings yet

- Job CostingDocument18 pagesJob CostingBiswajeet DashNo ratings yet

- Q&A On Cost AccountingDocument55 pagesQ&A On Cost AccountingAbdulmalik LawalNo ratings yet

- AmountDocument3 pagesAmountJudy TotoNo ratings yet

- See Zhao Wei U2003083Document5 pagesSee Zhao Wei U2003083zhaoweiNo ratings yet

- Acc 803Document2 pagesAcc 803Tasfia NahiyanNo ratings yet

- Investment in Financial Literacy and Saving Decisions PDFDocument45 pagesInvestment in Financial Literacy and Saving Decisions PDFSujay SinghviNo ratings yet

- The Solution To The Financial Literacy Problem - What Is The Answe PDFDocument22 pagesThe Solution To The Financial Literacy Problem - What Is The Answe PDFSujay SinghviNo ratings yet

- IOT and ERP SYSTEMDocument10 pagesIOT and ERP SYSTEMSujay SinghviNo ratings yet

- Analyzing Factors Affecting Financial Literacy and Its Impact On Investment Behavior Among Adults in India PDFDocument25 pagesAnalyzing Factors Affecting Financial Literacy and Its Impact On Investment Behavior Among Adults in India PDFSujay SinghviNo ratings yet

- Ratio AnalysisDocument18 pagesRatio AnalysisSujay SinghviNo ratings yet

- Outlook Sip ReportDocument80 pagesOutlook Sip ReportSujay SinghviNo ratings yet

- Process CostingDocument11 pagesProcess CostingSujay SinghviNo ratings yet

- Company Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Document14 pagesCompany Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Sujay SinghviNo ratings yet

- Session 070Document8 pagesSession 070Sujay SinghviNo ratings yet

- Session 3 Effort EstimationDocument2 pagesSession 3 Effort EstimationSujay SinghviNo ratings yet

- Chapter 5 Break Even AnalysisDocument19 pagesChapter 5 Break Even AnalysisAbdullahNo ratings yet

- CH 05Document30 pagesCH 05thekman2015No ratings yet

- Entrepreneurship11 12 - q2 - Clas1 - 4ms of Oepration Materials - v1 (1) Joseph AurelloDocument11 pagesEntrepreneurship11 12 - q2 - Clas1 - 4ms of Oepration Materials - v1 (1) Joseph AurelloaraNo ratings yet

- Software Development MethodologyDocument7 pagesSoftware Development MethodologyRajasekar VelswamyNo ratings yet

- College of Business and Economics Department of Management: Salale UniversityDocument48 pagesCollege of Business and Economics Department of Management: Salale UniversityTemuNo ratings yet

- Lecture#08 - Web Project ManagementDocument15 pagesLecture#08 - Web Project ManagementMalik SalmanNo ratings yet

- Audit Risks and MaterialityDocument19 pagesAudit Risks and MaterialityRemah PaudacNo ratings yet

- Explain The Performance Appraisal ProcessDocument2 pagesExplain The Performance Appraisal ProcessLetsogile BaloiNo ratings yet

- Chapter 5Document16 pagesChapter 5jaydenNo ratings yet

- Impact of Digital Marketing On Small Scale Startup Business With Special Reference To Madhya PradeshDocument7 pagesImpact of Digital Marketing On Small Scale Startup Business With Special Reference To Madhya PradeshIJRASETPublicationsNo ratings yet

- Automotive Functional Safety Compliance Intland SoftwareDocument23 pagesAutomotive Functional Safety Compliance Intland SoftwaresafakeemNo ratings yet

- Krispy Kreme Doughnuts-ProjectDocument18 pagesKrispy Kreme Doughnuts-ProjectHarun Kaya0% (1)

- Strategic Managemnt - Swot Matrix AnalysisDocument1 pageStrategic Managemnt - Swot Matrix AnalysisAdmer TandogNo ratings yet

- Questonaries Prepare To Be Fill by The CompanyDocument6 pagesQuestonaries Prepare To Be Fill by The Companyambrita88No ratings yet

- Accounting Policies Changes in Accounting Estimates and Errors - IAS 8Document6 pagesAccounting Policies Changes in Accounting Estimates and Errors - IAS 8Anonymous P1xUTHstHTNo ratings yet

- Online Examination Instruction:: Format & Sample Question Paper For ETE, December, 2015Document20 pagesOnline Examination Instruction:: Format & Sample Question Paper For ETE, December, 2015Abdullah HolifNo ratings yet

- SOP-HR-01 (Recruitment Process)Document2 pagesSOP-HR-01 (Recruitment Process)M CNo ratings yet

- Case Report: WebvanDocument11 pagesCase Report: Webvanapi-301978530No ratings yet

- Gantt Chart: Task Title Task Owner Work BKDN StructureDocument8 pagesGantt Chart: Task Title Task Owner Work BKDN StructureTrần Xuân QuýNo ratings yet

- Organizing Technical Activities Micahael Angelo de LeonDocument38 pagesOrganizing Technical Activities Micahael Angelo de Leonangelo100% (5)

- Knowledge Management Systems: Submitted byDocument12 pagesKnowledge Management Systems: Submitted byNimish JoshiNo ratings yet

- Human Resources Planning at Tata Consultancy Services LimitedDocument5 pagesHuman Resources Planning at Tata Consultancy Services LimitedrutujaNo ratings yet

- OEM Solutions: Products. Technology. Services. Delivered GloballyDocument20 pagesOEM Solutions: Products. Technology. Services. Delivered GloballyJosefaNo ratings yet

- Analisis Metode Kanban Dan Metode Junbiki Pada PerDocument18 pagesAnalisis Metode Kanban Dan Metode Junbiki Pada PerIrfan Adi WardanaNo ratings yet

- Autonomy in Higher Education From Affiliation To Self Governing Management - An Indian PerspectiveDocument15 pagesAutonomy in Higher Education From Affiliation To Self Governing Management - An Indian PerspectiveGlobal Research and Development ServicesNo ratings yet

- Consulting Services BrochureDocument4 pagesConsulting Services BrochureS M SHEKAR AND CONo ratings yet

- Comprehensive Exam "Disney Production": Graduate School of Business MBA ProgramDocument13 pagesComprehensive Exam "Disney Production": Graduate School of Business MBA ProgrammenoushNo ratings yet