Professional Documents

Culture Documents

CH 1 Notes

CH 1 Notes

Uploaded by

ahsanCopyright:

Available Formats

You might also like

- CMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionDocument7 pagesCMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionGANESH KUNJAPPA POOJARINo ratings yet

- Topic 8 - Measuring Financial PerformanceDocument60 pagesTopic 8 - Measuring Financial PerformanceThabo ChuchuNo ratings yet

- Cost of Capital: - Importance From The Capital Budgeting DecisionsDocument37 pagesCost of Capital: - Importance From The Capital Budgeting DecisionsCrocsNo ratings yet

- Formulas FinanceDocument1 pageFormulas FinanceLeire BegoñaNo ratings yet

- Class 27 - Depreciation and Income Taxes Contd..Document33 pagesClass 27 - Depreciation and Income Taxes Contd..SwastikNo ratings yet

- CVP Analysis Formula Cheat SheetDocument1 pageCVP Analysis Formula Cheat SheetRaj SinghNo ratings yet

- Cma Formula SheetDocument7 pagesCma Formula Sheetanushkamohanan0No ratings yet

- Comparing Quantities - NotesDocument23 pagesComparing Quantities - NotesVENKATESH PRABHUNo ratings yet

- Topic 7 - Cost of CapitalDocument26 pagesTopic 7 - Cost of CapitalKSNo ratings yet

- Corporate FinanceDocument88 pagesCorporate Financepgdm23antaspNo ratings yet

- Formula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDocument10 pagesFormula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDilip KumarNo ratings yet

- Interest, Commission, and DiscountsDocument3 pagesInterest, Commission, and DiscountsJulius Caesar ColladoNo ratings yet

- Adjusted Gross Revenue (AGR) : What's in It For You?Document47 pagesAdjusted Gross Revenue (AGR) : What's in It For You?Priti VaidyaNo ratings yet

- Year 11 BUSINESS UNIT 6 Formula SheetDocument3 pagesYear 11 BUSINESS UNIT 6 Formula SheetNana Barnett QuaicooNo ratings yet

- Ielm7016 Lecture2 2018 PDFDocument39 pagesIelm7016 Lecture2 2018 PDFKA LOK CHANNo ratings yet

- Factors Affecting Cost of CapitalDocument40 pagesFactors Affecting Cost of CapitalKartik AroraNo ratings yet

- Formula Sheet PDFDocument1 pageFormula Sheet PDFIsneha DussaramNo ratings yet

- Presentation 9 - Cost Concepts and Design EconomicsDocument18 pagesPresentation 9 - Cost Concepts and Design EconomicsafzalNo ratings yet

- BEC CPA Formulas November 2015 Becker CPA Review PDFDocument20 pagesBEC CPA Formulas November 2015 Becker CPA Review PDFsasyedaNo ratings yet

- GSFSD 2 SDocument32 pagesGSFSD 2 SJay SmithNo ratings yet

- Advanced Performance Management: Useful Formulas and EquationsDocument3 pagesAdvanced Performance Management: Useful Formulas and Equationstaxathon thaneNo ratings yet

- Abm FormulasDocument39 pagesAbm FormulasYogambica Pilladi0% (1)

- Summary 2Document9 pagesSummary 2Eman El-kholyNo ratings yet

- Increase in Demand and SupplyDocument9 pagesIncrease in Demand and SupplyJon LeinsNo ratings yet

- Dividend ModelsDocument40 pagesDividend ModelsRahul sardanaNo ratings yet

- Costs: Costs Are Different From ExpensesDocument26 pagesCosts: Costs Are Different From Expensesnuwany2kNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalVincitta MuthappanNo ratings yet

- RatiosDocument4 pagesRatiospoorva9096No ratings yet

- Finance T3 2017 - w51Document47 pagesFinance T3 2017 - w51aabubNo ratings yet

- Fringe Benefit TaxDocument9 pagesFringe Benefit Taxsteven belenNo ratings yet

- FormulaDocument4 pagesFormulaZIKIE CHOYNo ratings yet

- Ratio Analysis - Converted - by - AbcdpdfDocument3 pagesRatio Analysis - Converted - by - AbcdpdfSerendipity 16No ratings yet

- All The Formulas For BusinessDocument2 pagesAll The Formulas For BusinessyaaseenkhalifaNo ratings yet

- Finance BECDocument8 pagesFinance BECJon LeinsNo ratings yet

- Garrison/Libby/Webb Managerial Accounting 11 Edition Formula SummaryDocument4 pagesGarrison/Libby/Webb Managerial Accounting 11 Edition Formula Summaryمنیر ساداتNo ratings yet

- Inventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv TurnoverDocument3 pagesInventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv Turnoverjoe91bmwNo ratings yet

- RE Notes 6a Fall2023Document15 pagesRE Notes 6a Fall2023p4rfmdxpndNo ratings yet

- Online 2.3 - Yield To MaturityDocument7 pagesOnline 2.3 - Yield To MaturityPhilippNo ratings yet

- Chapter 9EDocument16 pagesChapter 9EMandarin English CentreNo ratings yet

- Formula Sheet PDFDocument3 pagesFormula Sheet PDFmadhav1111No ratings yet

- Topic 5 - Budget For Maximum Profit - Part 1Document40 pagesTopic 5 - Budget For Maximum Profit - Part 1arif fikriNo ratings yet

- Taxation - Quick Notes - FinalsDocument17 pagesTaxation - Quick Notes - FinalsRoseanneNo ratings yet

- Strategic Cost ManagementDocument7 pagesStrategic Cost ManagementIris FenelleNo ratings yet

- Cost of CapitalDocument30 pagesCost of CapitalShafaq NigarNo ratings yet

- RecipeDocument4 pagesRecipesasyedaNo ratings yet

- APM_5Document16 pagesAPM_5Vidu ShanNo ratings yet

- Balance Sheet, Revenue Statement and Combined RatiosDocument27 pagesBalance Sheet, Revenue Statement and Combined Ratioskharatss.dcNo ratings yet

- Fringe BenefitsDocument22 pagesFringe BenefitsMariel BerdigayNo ratings yet

- Deffereed Tax Asset and LiabilitiesDocument8 pagesDeffereed Tax Asset and LiabilitiesRimissha Udenia 2No ratings yet

- Federal Urdu University Islamabad Faculty of Management SciencesDocument14 pagesFederal Urdu University Islamabad Faculty of Management SciencesVampyy GalNo ratings yet

- Be AnalysisDocument32 pagesBe AnalysisMuskan GoyalNo ratings yet

- Estimation Of: Different Farm IncomeDocument42 pagesEstimation Of: Different Farm IncomeOmprakash MishraNo ratings yet

- Lesson-6 Cost ZeniaDocument10 pagesLesson-6 Cost Zeniazeniashaheen2007No ratings yet

- 9.the Cost of ProductionnewDocument25 pages9.the Cost of ProductionnewAgANo ratings yet

- Formula SheetDocument4 pagesFormula SheetAdil AliNo ratings yet

- 13 Cost of Capital-R2Document14 pages13 Cost of Capital-R2Jay JayNo ratings yet

- النسب المالية - إنجليزىDocument5 pagesالنسب المالية - إنجليزىMohamed Ahmed YassinNo ratings yet

- FINA 210 Topic 4 ValuationDocument26 pagesFINA 210 Topic 4 ValuationrawanelayusNo ratings yet

- Robert Conrad Mozambique GW2012Document12 pagesRobert Conrad Mozambique GW2012Mochammad AdamNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Geo Assignment 2Document1 pageGeo Assignment 2ahsanNo ratings yet

- COMP6Document3 pagesCOMP6ahsanNo ratings yet

- English Literature 2Document4 pagesEnglish Literature 2ahsanNo ratings yet

- Army Public School & College System Revision Plan November-December 2022 Week 1 Date Subjects SyllabusDocument1 pageArmy Public School & College System Revision Plan November-December 2022 Week 1 Date Subjects SyllabusahsanNo ratings yet

- Geo Assignment 3Document1 pageGeo Assignment 3ahsanNo ratings yet

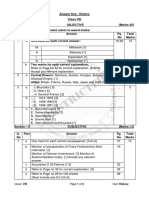

- Subject: History Class: VIII Worksheet Q-1: Fill in The BlanksDocument4 pagesSubject: History Class: VIII Worksheet Q-1: Fill in The BlanksahsanNo ratings yet

- Class: Viii Page 1 of 3 Subject: HistoryDocument2 pagesClass: Viii Page 1 of 3 Subject: HistoryahsanNo ratings yet

- Chapter 7 Electricty & EnergyDocument3 pagesChapter 7 Electricty & EnergyahsanNo ratings yet

- Subject: History Class: VIII Worksheet Q-1: Fill in The BlanksDocument3 pagesSubject: History Class: VIII Worksheet Q-1: Fill in The BlanksahsanNo ratings yet

- COMPUTER5Document3 pagesCOMPUTER5ahsanNo ratings yet

- Class: Viii Page 1 of 1Document1 pageClass: Viii Page 1 of 1ahsanNo ratings yet

- His Rtest 2 Ans KeyDocument1 pageHis Rtest 2 Ans KeyahsanNo ratings yet

- Answer Key CompDocument1 pageAnswer Key CompahsanNo ratings yet

- His Rtest 2 Ans KeyDocument2 pagesHis Rtest 2 Ans KeyahsanNo ratings yet

- Phy 2Document6 pagesPhy 2ahsanNo ratings yet

- His Rtest 1Document4 pagesHis Rtest 1ahsanNo ratings yet

- His Rtest 2Document3 pagesHis Rtest 2ahsanNo ratings yet

- His Rtest 1 Ans Key UpdatedDocument2 pagesHis Rtest 1 Ans Key UpdatedahsanNo ratings yet

- Geo Rtest 3 Ans KeyDocument1 pageGeo Rtest 3 Ans KeyahsanNo ratings yet

- His Rtest 1Document4 pagesHis Rtest 1ahsanNo ratings yet

- Geo Rtest 3Document3 pagesGeo Rtest 3ahsanNo ratings yet

- Geo Rtest 2 Ans KeyDocument1 pageGeo Rtest 2 Ans KeyahsanNo ratings yet

- Mathematicscp 2Document2 pagesMathematicscp 2ahsanNo ratings yet

- Geo Rtest 1 Ans KeyDocument2 pagesGeo Rtest 1 Ans KeyahsanNo ratings yet

- Chapter 9 SaltsDocument1 pageChapter 9 SaltsahsanNo ratings yet

- Geo Rtest 2Document3 pagesGeo Rtest 2ahsanNo ratings yet

- Chapter 10 Pressure and MomentsDocument2 pagesChapter 10 Pressure and MomentsahsanNo ratings yet

- Window To World History - Sample PaperDocument3 pagesWindow To World History - Sample PaperahsanNo ratings yet

- History The Modern World: Age of Exploration WorksheetDocument2 pagesHistory The Modern World: Age of Exploration WorksheetahsanNo ratings yet

- Ch4 Coastal Feautures and Formation Answer KeyDocument1 pageCh4 Coastal Feautures and Formation Answer KeyahsanNo ratings yet

CH 1 Notes

CH 1 Notes

Uploaded by

ahsanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 1 Notes

CH 1 Notes

Uploaded by

ahsanCopyright:

Available Formats

Chapter 1: Applications of Mathematics in Practical Situations

Key Formulas

• Profit = selling price – cost price − GST payable = GST (in %) x

• Loss = cost price – selling price (marked price – discount + service

• Profit% = Profit/C.P x 100% charge)

• Loss% = Loss/C.P x 100% • Chargeable income = Total income –

• Discount = marked price – sale price Reliefs

• Discount% = Discount/marked price x • Amount of zakat = 2.5% of the total yearly

100% savings

• Total amount payable = marked price – • If land is irrigated by natural sources then,

discount + service charge + GST payable ushr = 10%

− Service charge = service charge (in • If land is irrigated by artificial means then,

%) x (marked price – discount) ushr = 5%

Key Notes

• GST is paid in addition to goods and services.

• Percentage point is defined as the difference between two percentages.

• A commission is the payment an agent receives for selling or buying something on behalf of another

party.

• Every Muslim who owns wealth equivalent of a value of 7.5 tola of gold or 52.5 tola of silver is

obligated to pay zakat.

• Ushr is a tax that is applied on a Muslim’s agricultural assets

You might also like

- CMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionDocument7 pagesCMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionGANESH KUNJAPPA POOJARINo ratings yet

- Topic 8 - Measuring Financial PerformanceDocument60 pagesTopic 8 - Measuring Financial PerformanceThabo ChuchuNo ratings yet

- Cost of Capital: - Importance From The Capital Budgeting DecisionsDocument37 pagesCost of Capital: - Importance From The Capital Budgeting DecisionsCrocsNo ratings yet

- Formulas FinanceDocument1 pageFormulas FinanceLeire BegoñaNo ratings yet

- Class 27 - Depreciation and Income Taxes Contd..Document33 pagesClass 27 - Depreciation and Income Taxes Contd..SwastikNo ratings yet

- CVP Analysis Formula Cheat SheetDocument1 pageCVP Analysis Formula Cheat SheetRaj SinghNo ratings yet

- Cma Formula SheetDocument7 pagesCma Formula Sheetanushkamohanan0No ratings yet

- Comparing Quantities - NotesDocument23 pagesComparing Quantities - NotesVENKATESH PRABHUNo ratings yet

- Topic 7 - Cost of CapitalDocument26 pagesTopic 7 - Cost of CapitalKSNo ratings yet

- Corporate FinanceDocument88 pagesCorporate Financepgdm23antaspNo ratings yet

- Formula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDocument10 pagesFormula Sheet Corporate & Management Accounting: Chapter 1: Introduction To Financial AccountingDilip KumarNo ratings yet

- Interest, Commission, and DiscountsDocument3 pagesInterest, Commission, and DiscountsJulius Caesar ColladoNo ratings yet

- Adjusted Gross Revenue (AGR) : What's in It For You?Document47 pagesAdjusted Gross Revenue (AGR) : What's in It For You?Priti VaidyaNo ratings yet

- Year 11 BUSINESS UNIT 6 Formula SheetDocument3 pagesYear 11 BUSINESS UNIT 6 Formula SheetNana Barnett QuaicooNo ratings yet

- Ielm7016 Lecture2 2018 PDFDocument39 pagesIelm7016 Lecture2 2018 PDFKA LOK CHANNo ratings yet

- Factors Affecting Cost of CapitalDocument40 pagesFactors Affecting Cost of CapitalKartik AroraNo ratings yet

- Formula Sheet PDFDocument1 pageFormula Sheet PDFIsneha DussaramNo ratings yet

- Presentation 9 - Cost Concepts and Design EconomicsDocument18 pagesPresentation 9 - Cost Concepts and Design EconomicsafzalNo ratings yet

- BEC CPA Formulas November 2015 Becker CPA Review PDFDocument20 pagesBEC CPA Formulas November 2015 Becker CPA Review PDFsasyedaNo ratings yet

- GSFSD 2 SDocument32 pagesGSFSD 2 SJay SmithNo ratings yet

- Advanced Performance Management: Useful Formulas and EquationsDocument3 pagesAdvanced Performance Management: Useful Formulas and Equationstaxathon thaneNo ratings yet

- Abm FormulasDocument39 pagesAbm FormulasYogambica Pilladi0% (1)

- Summary 2Document9 pagesSummary 2Eman El-kholyNo ratings yet

- Increase in Demand and SupplyDocument9 pagesIncrease in Demand and SupplyJon LeinsNo ratings yet

- Dividend ModelsDocument40 pagesDividend ModelsRahul sardanaNo ratings yet

- Costs: Costs Are Different From ExpensesDocument26 pagesCosts: Costs Are Different From Expensesnuwany2kNo ratings yet

- Cost of CapitalDocument24 pagesCost of CapitalVincitta MuthappanNo ratings yet

- RatiosDocument4 pagesRatiospoorva9096No ratings yet

- Finance T3 2017 - w51Document47 pagesFinance T3 2017 - w51aabubNo ratings yet

- Fringe Benefit TaxDocument9 pagesFringe Benefit Taxsteven belenNo ratings yet

- FormulaDocument4 pagesFormulaZIKIE CHOYNo ratings yet

- Ratio Analysis - Converted - by - AbcdpdfDocument3 pagesRatio Analysis - Converted - by - AbcdpdfSerendipity 16No ratings yet

- All The Formulas For BusinessDocument2 pagesAll The Formulas For BusinessyaaseenkhalifaNo ratings yet

- Finance BECDocument8 pagesFinance BECJon LeinsNo ratings yet

- Garrison/Libby/Webb Managerial Accounting 11 Edition Formula SummaryDocument4 pagesGarrison/Libby/Webb Managerial Accounting 11 Edition Formula Summaryمنیر ساداتNo ratings yet

- Inventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv TurnoverDocument3 pagesInventory Turnover Cost of Sales / Avg Inventory High Is Effective Inv MGMT Days of Inventory On Hand (DOH) 365/inv Turnoverjoe91bmwNo ratings yet

- RE Notes 6a Fall2023Document15 pagesRE Notes 6a Fall2023p4rfmdxpndNo ratings yet

- Online 2.3 - Yield To MaturityDocument7 pagesOnline 2.3 - Yield To MaturityPhilippNo ratings yet

- Chapter 9EDocument16 pagesChapter 9EMandarin English CentreNo ratings yet

- Formula Sheet PDFDocument3 pagesFormula Sheet PDFmadhav1111No ratings yet

- Topic 5 - Budget For Maximum Profit - Part 1Document40 pagesTopic 5 - Budget For Maximum Profit - Part 1arif fikriNo ratings yet

- Taxation - Quick Notes - FinalsDocument17 pagesTaxation - Quick Notes - FinalsRoseanneNo ratings yet

- Strategic Cost ManagementDocument7 pagesStrategic Cost ManagementIris FenelleNo ratings yet

- Cost of CapitalDocument30 pagesCost of CapitalShafaq NigarNo ratings yet

- RecipeDocument4 pagesRecipesasyedaNo ratings yet

- APM_5Document16 pagesAPM_5Vidu ShanNo ratings yet

- Balance Sheet, Revenue Statement and Combined RatiosDocument27 pagesBalance Sheet, Revenue Statement and Combined Ratioskharatss.dcNo ratings yet

- Fringe BenefitsDocument22 pagesFringe BenefitsMariel BerdigayNo ratings yet

- Deffereed Tax Asset and LiabilitiesDocument8 pagesDeffereed Tax Asset and LiabilitiesRimissha Udenia 2No ratings yet

- Federal Urdu University Islamabad Faculty of Management SciencesDocument14 pagesFederal Urdu University Islamabad Faculty of Management SciencesVampyy GalNo ratings yet

- Be AnalysisDocument32 pagesBe AnalysisMuskan GoyalNo ratings yet

- Estimation Of: Different Farm IncomeDocument42 pagesEstimation Of: Different Farm IncomeOmprakash MishraNo ratings yet

- Lesson-6 Cost ZeniaDocument10 pagesLesson-6 Cost Zeniazeniashaheen2007No ratings yet

- 9.the Cost of ProductionnewDocument25 pages9.the Cost of ProductionnewAgANo ratings yet

- Formula SheetDocument4 pagesFormula SheetAdil AliNo ratings yet

- 13 Cost of Capital-R2Document14 pages13 Cost of Capital-R2Jay JayNo ratings yet

- النسب المالية - إنجليزىDocument5 pagesالنسب المالية - إنجليزىMohamed Ahmed YassinNo ratings yet

- FINA 210 Topic 4 ValuationDocument26 pagesFINA 210 Topic 4 ValuationrawanelayusNo ratings yet

- Robert Conrad Mozambique GW2012Document12 pagesRobert Conrad Mozambique GW2012Mochammad AdamNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Geo Assignment 2Document1 pageGeo Assignment 2ahsanNo ratings yet

- COMP6Document3 pagesCOMP6ahsanNo ratings yet

- English Literature 2Document4 pagesEnglish Literature 2ahsanNo ratings yet

- Army Public School & College System Revision Plan November-December 2022 Week 1 Date Subjects SyllabusDocument1 pageArmy Public School & College System Revision Plan November-December 2022 Week 1 Date Subjects SyllabusahsanNo ratings yet

- Geo Assignment 3Document1 pageGeo Assignment 3ahsanNo ratings yet

- Subject: History Class: VIII Worksheet Q-1: Fill in The BlanksDocument4 pagesSubject: History Class: VIII Worksheet Q-1: Fill in The BlanksahsanNo ratings yet

- Class: Viii Page 1 of 3 Subject: HistoryDocument2 pagesClass: Viii Page 1 of 3 Subject: HistoryahsanNo ratings yet

- Chapter 7 Electricty & EnergyDocument3 pagesChapter 7 Electricty & EnergyahsanNo ratings yet

- Subject: History Class: VIII Worksheet Q-1: Fill in The BlanksDocument3 pagesSubject: History Class: VIII Worksheet Q-1: Fill in The BlanksahsanNo ratings yet

- COMPUTER5Document3 pagesCOMPUTER5ahsanNo ratings yet

- Class: Viii Page 1 of 1Document1 pageClass: Viii Page 1 of 1ahsanNo ratings yet

- His Rtest 2 Ans KeyDocument1 pageHis Rtest 2 Ans KeyahsanNo ratings yet

- Answer Key CompDocument1 pageAnswer Key CompahsanNo ratings yet

- His Rtest 2 Ans KeyDocument2 pagesHis Rtest 2 Ans KeyahsanNo ratings yet

- Phy 2Document6 pagesPhy 2ahsanNo ratings yet

- His Rtest 1Document4 pagesHis Rtest 1ahsanNo ratings yet

- His Rtest 2Document3 pagesHis Rtest 2ahsanNo ratings yet

- His Rtest 1 Ans Key UpdatedDocument2 pagesHis Rtest 1 Ans Key UpdatedahsanNo ratings yet

- Geo Rtest 3 Ans KeyDocument1 pageGeo Rtest 3 Ans KeyahsanNo ratings yet

- His Rtest 1Document4 pagesHis Rtest 1ahsanNo ratings yet

- Geo Rtest 3Document3 pagesGeo Rtest 3ahsanNo ratings yet

- Geo Rtest 2 Ans KeyDocument1 pageGeo Rtest 2 Ans KeyahsanNo ratings yet

- Mathematicscp 2Document2 pagesMathematicscp 2ahsanNo ratings yet

- Geo Rtest 1 Ans KeyDocument2 pagesGeo Rtest 1 Ans KeyahsanNo ratings yet

- Chapter 9 SaltsDocument1 pageChapter 9 SaltsahsanNo ratings yet

- Geo Rtest 2Document3 pagesGeo Rtest 2ahsanNo ratings yet

- Chapter 10 Pressure and MomentsDocument2 pagesChapter 10 Pressure and MomentsahsanNo ratings yet

- Window To World History - Sample PaperDocument3 pagesWindow To World History - Sample PaperahsanNo ratings yet

- History The Modern World: Age of Exploration WorksheetDocument2 pagesHistory The Modern World: Age of Exploration WorksheetahsanNo ratings yet

- Ch4 Coastal Feautures and Formation Answer KeyDocument1 pageCh4 Coastal Feautures and Formation Answer KeyahsanNo ratings yet