Professional Documents

Culture Documents

0%(1)0% found this document useful (1 vote)

234 viewsDebt-To-Income Ratio Calculator

Debt-To-Income Ratio Calculator

Uploaded by

Karan VishwakarmaThis document contains a debt-to-income ratio calculator that allows a user to input their monthly income and debt payments to calculate their debt-to-income ratio. The user's monthly income is $8,300 and total monthly debt payments are $3,550, resulting in a debt-to-income ratio of 42.77%. The calculator indicates that a debt-to-income ratio above 40% is considered unhealthy.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Consumer CreditDocument45 pagesConsumer CreditJan Francine AbanteNo ratings yet

- Credit Repair Guide: How to Fix Credit Score and Remove Negatives From Credit ReportFrom EverandCredit Repair Guide: How to Fix Credit Score and Remove Negatives From Credit ReportRating: 5 out of 5 stars5/5 (5)

- Creating Your Financial GenogramDocument2 pagesCreating Your Financial Genogramdininja100% (1)

- Early Morning ReidDocument2 pagesEarly Morning ReidCrodole0% (1)

- Decasa, Erica J. CBET 01 401E The Philippine Finacial SystemDocument4 pagesDecasa, Erica J. CBET 01 401E The Philippine Finacial SystemErica DecasaNo ratings yet

- Aml/Cft Checklist Anti-Money Laundering and Countering Financing of Terrorism Act 2009 ("AML/CFT Act")Document9 pagesAml/Cft Checklist Anti-Money Laundering and Countering Financing of Terrorism Act 2009 ("AML/CFT Act")rajsalgyanNo ratings yet

- How Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentDocument2 pagesHow Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentbootybethathangNo ratings yet

- VA Loans Guidebook Ebook SummaryDocument8 pagesVA Loans Guidebook Ebook Summaryangel montanez100% (1)

- Unit 3 - 1 The Three C's of Credit: Nine Different Credit CardsDocument8 pagesUnit 3 - 1 The Three C's of Credit: Nine Different Credit CardsSSANo ratings yet

- Module 13Document17 pagesModule 13abhishek gautamNo ratings yet

- CBA HomeLoan Key Fact SheetDocument2 pagesCBA HomeLoan Key Fact Sheet3zarez14No ratings yet

- Home Equity Loans and Lines of Credit: Mini-LessonDocument35 pagesHome Equity Loans and Lines of Credit: Mini-Lessonkusha010No ratings yet

- Investment Planning Workbook: Getting StartedDocument8 pagesInvestment Planning Workbook: Getting StartedshanpiePLNo ratings yet

- Are You: Credit WiseDocument32 pagesAre You: Credit Wisebesis111No ratings yet

- Print - AamirDocument19 pagesPrint - AamirAamir BasraiNo ratings yet

- esignPdfDocument13 pagesesignPdfrenab70No ratings yet

- DoE Lesson Plan 11 Interest The Cost of Borrowing MoneyDocument20 pagesDoE Lesson Plan 11 Interest The Cost of Borrowing MoneyHoney Grace BicarNo ratings yet

- Credit and CollectionDocument17 pagesCredit and CollectionDia Cessianne VillarolaNo ratings yet

- Loan Rates & Estimated Total Costs: Private Education Loan Approval DisclosureDocument2 pagesLoan Rates & Estimated Total Costs: Private Education Loan Approval DisclosureKeith GruberNo ratings yet

- Understanding Personal LoansDocument10 pagesUnderstanding Personal Loansapi-255112727No ratings yet

- Credit DisputeDocument15 pagesCredit Disputeedward julius67% (3)

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Personal Loan PDFDocument3 pagesPersonal Loan PDFbusiness loanNo ratings yet

- MOCKTEST Personal and Family Financial ManagementDocument2 pagesMOCKTEST Personal and Family Financial ManagementyoshinokurukoNo ratings yet

- Consumer CreditDocument3 pagesConsumer CreditHAIFA DAYANA BT DAZUKINo ratings yet

- Module 4 Credit TransactionsDocument27 pagesModule 4 Credit Transactionslord kwantoniumNo ratings yet

- Module 6B CreditDocument41 pagesModule 6B CreditLorejhen VillanuevaNo ratings yet

- Description: Tags: EntrcoborrDocument25 pagesDescription: Tags: Entrcoborranon-446848No ratings yet

- Personal Finacial Literacy NotesDocument64 pagesPersonal Finacial Literacy Notesmpontier123100% (1)

- Types of LoansDocument9 pagesTypes of LoansSanjay VaruteNo ratings yet

- IntroductionDocument2 pagesIntroductionXin YongNo ratings yet

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2No ratings yet

- Budget Basics For Modular Home Buyers - How Much Home Can I Afford?Document3 pagesBudget Basics For Modular Home Buyers - How Much Home Can I Afford?SEAN NNo ratings yet

- Lesson 14 PathwaysDocument7 pagesLesson 14 Pathwaysapi-608672339No ratings yet

- Individual Money LendersDocument5 pagesIndividual Money LendersMa. Kristine Laurice AmancioNo ratings yet

- Risks and Benefits of Borrowing FinalDocument3 pagesRisks and Benefits of Borrowing Finalsun mmerNo ratings yet

- Chapter 6 & 7 - Kapoor: Consumer CreditDocument24 pagesChapter 6 & 7 - Kapoor: Consumer CreditPaulo Lucas Guillot100% (1)

- Research Papers On Reverse Mortgage LoanDocument5 pagesResearch Papers On Reverse Mortgage Loanafmcuafnh100% (1)

- 1 Credit and CollectionDocument51 pages1 Credit and CollectionGigiNo ratings yet

- All About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Document10 pagesAll About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Biswa Prakash NayakNo ratings yet

- CFPB Loan-EstimateDocument3 pagesCFPB Loan-EstimateRichard VetsteinNo ratings yet

- Credit CardsDocument8 pagesCredit Cardsasmat ullah khanNo ratings yet

- Entrance Counseling Guide For Direct Loan Borrowers: WWW - Dl.ed - GovDocument5 pagesEntrance Counseling Guide For Direct Loan Borrowers: WWW - Dl.ed - Govanon-417085No ratings yet

- DIY Credit Repair And Building Guide: Financial Free VictoryFrom EverandDIY Credit Repair And Building Guide: Financial Free VictoryNo ratings yet

- Budgeting Worksheet: Non-Monthly Expenses Annual ResourcesDocument2 pagesBudgeting Worksheet: Non-Monthly Expenses Annual ResourcesDavid GreeneNo ratings yet

- UntitledDocument24 pagesUntitledEric JohnsonNo ratings yet

- Installment Loans - Borrow Money and Repay With Ease!Document2 pagesInstallment Loans - Borrow Money and Repay With Ease!PhamWheeler9No ratings yet

- Credit Management: Adeel Nasir Lecturer (Commerce) Punjab University Jhelum CampusDocument34 pagesCredit Management: Adeel Nasir Lecturer (Commerce) Punjab University Jhelum CampusZindgiKiKhatirNo ratings yet

- Is Credit Wealth: Negative Aspects of CreditDocument4 pagesIs Credit Wealth: Negative Aspects of CreditFrederick PatacsilNo ratings yet

- Chapter 7 Choosing A Source of Credit The Costs of Credit AlternativesDocument40 pagesChapter 7 Choosing A Source of Credit The Costs of Credit Alternativesgyanprakashdeb302No ratings yet

- 07 PFM Chapter 6 Establishing Consumer CreditDocument4 pages07 PFM Chapter 6 Establishing Consumer CreditLee K.No ratings yet

- Define and Explain Thoroughly What Is CREDITDocument4 pagesDefine and Explain Thoroughly What Is CREDITAngelika SinguranNo ratings yet

- Credit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.From EverandCredit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.No ratings yet

- MATH +what Is Investment and LoanDocument11 pagesMATH +what Is Investment and LoanJhoana MaeNo ratings yet

- Fall 2012Document12 pagesFall 2012api-309082881No ratings yet

- Topic 2 Practice QuestionDocument4 pagesTopic 2 Practice Questionaarzu dangiNo ratings yet

- RYPKEMA Quotes PDFDocument5 pagesRYPKEMA Quotes PDFNicholas BradleyNo ratings yet

- l5 - Credit and Debt 4Document14 pagesl5 - Credit and Debt 4api-290878974No ratings yet

- Consumer Credit: Submitted By: Aayush Behal Shashank Singh Manik MittalDocument61 pagesConsumer Credit: Submitted By: Aayush Behal Shashank Singh Manik Mittalmanik_mittal30% (1)

- Just The Faqs:: Answers Common Questions About Reverse MortgagesDocument16 pagesJust The Faqs:: Answers Common Questions About Reverse MortgagesValerie VanBooven RN BSNNo ratings yet

- Countries and Currencies - GK Notes in PDFDocument7 pagesCountries and Currencies - GK Notes in PDFhelldelosbendersNo ratings yet

- Aud ReconDocument8 pagesAud ReconShaine PacsonNo ratings yet

- Risk Management in BanksDocument100 pagesRisk Management in BanksAditJoshiNo ratings yet

- What Is The Purpose of PDIC Law? 4. Define A. DepositDocument5 pagesWhat Is The Purpose of PDIC Law? 4. Define A. DepositJoshel MaeNo ratings yet

- FDP On Tax Planning, Financial Planning & Filing of ItrDocument4 pagesFDP On Tax Planning, Financial Planning & Filing of ItrAman KumarNo ratings yet

- Analysis of Cryptocurrency, People and FutureDocument7 pagesAnalysis of Cryptocurrency, People and FutureIJRASETPublicationsNo ratings yet

- Quiz 7 - CH 13 & 14 ACC563Document14 pagesQuiz 7 - CH 13 & 14 ACC563scokni1973_130667106No ratings yet

- Mid-Term Exam Review REE 6200 FIU Fall 2018: Important Concepts/topicsDocument2 pagesMid-Term Exam Review REE 6200 FIU Fall 2018: Important Concepts/topicsJoel Christian MascariñaNo ratings yet

- Exchange-Rate Determination: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityDocument56 pagesExchange-Rate Determination: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityRahul AnandNo ratings yet

- Chapter 1055Document17 pagesChapter 1055MohitAhujaNo ratings yet

- What Is An Automated Teller MachineDocument7 pagesWhat Is An Automated Teller MachineNeha SoningraNo ratings yet

- International Financial Institutions: 1. World BankDocument9 pagesInternational Financial Institutions: 1. World BankTabish AhmedNo ratings yet

- Tax 1Document43 pagesTax 1opep77No ratings yet

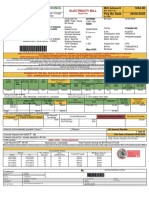

- New Delhi Municipal Council: Electricity BillDocument1 pageNew Delhi Municipal Council: Electricity BillMayank Subhash Balodi0% (1)

- Day 3 Class Work SPCCDocument6 pagesDay 3 Class Work SPCCkawaljeetsingh121666No ratings yet

- Islami Bank Bangladesh LimitedDocument9 pagesIslami Bank Bangladesh LimitedrounakjuiNo ratings yet

- Chapter-1 Indian Banking System PDFDocument53 pagesChapter-1 Indian Banking System PDFbhuvaneswarimpNo ratings yet

- GM Insights - Asymmetry - 9-20Document16 pagesGM Insights - Asymmetry - 9-20richardck61No ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Private Credit - Time To Consider Special Situations - (J.P. Morgan Asset Management)Document4 pagesPrivate Credit - Time To Consider Special Situations - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- Is India Ready For Cashless EconomyDocument1 pageIs India Ready For Cashless Economyharsh sainiNo ratings yet

- Francisco Partners CaseDocument32 pagesFrancisco Partners CaseJose M Terrés-NícoliNo ratings yet

- Chap 003Document31 pagesChap 003NazifahNo ratings yet

- NPVDocument5 pagesNPVMian UmarNo ratings yet

- UP 2008 Commercial Law (Banking Law)Document52 pagesUP 2008 Commercial Law (Banking Law)Adalie NageauNo ratings yet

- Phil Mosley and Rolando Shannon Financial RatiosDocument12 pagesPhil Mosley and Rolando Shannon Financial Ratiosapi-282888108No ratings yet

Debt-To-Income Ratio Calculator

Debt-To-Income Ratio Calculator

Uploaded by

Karan Vishwakarma0%(1)0% found this document useful (1 vote)

234 views3 pagesThis document contains a debt-to-income ratio calculator that allows a user to input their monthly income and debt payments to calculate their debt-to-income ratio. The user's monthly income is $8,300 and total monthly debt payments are $3,550, resulting in a debt-to-income ratio of 42.77%. The calculator indicates that a debt-to-income ratio above 40% is considered unhealthy.

Original Description:

A ratio calculator for debt to income.

Original Title

Debt-To-Income_Ratio_Calculator

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a debt-to-income ratio calculator that allows a user to input their monthly income and debt payments to calculate their debt-to-income ratio. The user's monthly income is $8,300 and total monthly debt payments are $3,550, resulting in a debt-to-income ratio of 42.77%. The calculator indicates that a debt-to-income ratio above 40% is considered unhealthy.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0%(1)0% found this document useful (1 vote)

234 views3 pagesDebt-To-Income Ratio Calculator

Debt-To-Income Ratio Calculator

Uploaded by

Karan VishwakarmaThis document contains a debt-to-income ratio calculator that allows a user to input their monthly income and debt payments to calculate their debt-to-income ratio. The user's monthly income is $8,300 and total monthly debt payments are $3,550, resulting in a debt-to-income ratio of 42.77%. The calculator indicates that a debt-to-income ratio above 40% is considered unhealthy.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

DEBT TO INCOME RATIO CALCULATOR

Monthly Income $8,300.00

Rent/Mortgage $2,000.00

Car Loan $300.00

Credit Card Payments $150.00

Student Loans $0.00 To use the debt-to-income ratio

Personal Loans $150.00 calculator spreadsheet, input your

Medical Debt $0.00 monthly income in cell B4 and debt

Tax Debt $0.00 payments in the appropriate cells to

Payday Loans $0.00 calculate your debt-to-income ratio.

Line of Credit $0.00 Check if it's healthy or not by

Child Support or Alimony $450.00 checking the color of the cell and the

Collection Accounts $0.00 statement in cell C20.

Utilities $350.00

Other Loans $0.00

Retail Credit Card $150.00

Total Monthly Debt $3,550.00

Debt-to-Income Ratio (%) 42.77 Healthy DTI Ratio

Type of Debt

Rent/Mortgage

Car Loan

Credit Card Payments

Student Loans

Personal Loans

Medical Debt

Tax Debt

Payday Loans

Line of Credit

Child Support or Alimony

Collection Accounts

Utilities

Other Loans

Retail Credit Card

You can add or remove rows accordingly, depending on the types of debt you have. It is important to

include all your debts in order to have an accurate picture of your overall debt-to-income ratio.

Explanation

Monthly payment made for the housing, whether it is for renting an apartment or

Monthly payment madehouse or for

for a loan a mortgage

taken on a home.

out to purchase a vehicle. This can include

Monthly payment made to pay off the balance on a credit

the principal and interest payments on the card. This can include the

loan.

minimum payment required by the credit card issuer as

tuition, room and board, and other education-related expenses. Thesewell as anycan

additional

be federal

payments made to pay off the balance more

student loans or private student loans. quickly.

Any loans taken out for personal expenses, such as home renovations, vacations, or

weddings.

Any outstanding bills or payments related to medical expenses, such as hospital

stays, doctor visits, or prescription drugs.

Any unpaid taxes owed to the government, including federal, state, or local taxes.

Small, short-term loans that are typically due on the borrower's next payday.

A revolving line of credit that can be used for various expenses, such as home repairs

or emergency expenses.

Any payments made for child support or alimony as a result of a divorce or separation.

Any outstanding debts that have been turned over to a collection agency.

Any unpaid bills for services such as electricity, water, internet, and telephone.

Any other types of loans, such as boat loans, motorcycle loans, or RV loans.

Any credit card debt from retail stores, such as department stores or clothing stores.

or remove rows accordingly, depending on the types of debt you have. It is important to

l your debts in order to have an accurate picture of your overall debt-to-income ratio.

You might also like

- Consumer CreditDocument45 pagesConsumer CreditJan Francine AbanteNo ratings yet

- Credit Repair Guide: How to Fix Credit Score and Remove Negatives From Credit ReportFrom EverandCredit Repair Guide: How to Fix Credit Score and Remove Negatives From Credit ReportRating: 5 out of 5 stars5/5 (5)

- Creating Your Financial GenogramDocument2 pagesCreating Your Financial Genogramdininja100% (1)

- Early Morning ReidDocument2 pagesEarly Morning ReidCrodole0% (1)

- Decasa, Erica J. CBET 01 401E The Philippine Finacial SystemDocument4 pagesDecasa, Erica J. CBET 01 401E The Philippine Finacial SystemErica DecasaNo ratings yet

- Aml/Cft Checklist Anti-Money Laundering and Countering Financing of Terrorism Act 2009 ("AML/CFT Act")Document9 pagesAml/Cft Checklist Anti-Money Laundering and Countering Financing of Terrorism Act 2009 ("AML/CFT Act")rajsalgyanNo ratings yet

- How Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentDocument2 pagesHow Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentbootybethathangNo ratings yet

- VA Loans Guidebook Ebook SummaryDocument8 pagesVA Loans Guidebook Ebook Summaryangel montanez100% (1)

- Unit 3 - 1 The Three C's of Credit: Nine Different Credit CardsDocument8 pagesUnit 3 - 1 The Three C's of Credit: Nine Different Credit CardsSSANo ratings yet

- Module 13Document17 pagesModule 13abhishek gautamNo ratings yet

- CBA HomeLoan Key Fact SheetDocument2 pagesCBA HomeLoan Key Fact Sheet3zarez14No ratings yet

- Home Equity Loans and Lines of Credit: Mini-LessonDocument35 pagesHome Equity Loans and Lines of Credit: Mini-Lessonkusha010No ratings yet

- Investment Planning Workbook: Getting StartedDocument8 pagesInvestment Planning Workbook: Getting StartedshanpiePLNo ratings yet

- Are You: Credit WiseDocument32 pagesAre You: Credit Wisebesis111No ratings yet

- Print - AamirDocument19 pagesPrint - AamirAamir BasraiNo ratings yet

- esignPdfDocument13 pagesesignPdfrenab70No ratings yet

- DoE Lesson Plan 11 Interest The Cost of Borrowing MoneyDocument20 pagesDoE Lesson Plan 11 Interest The Cost of Borrowing MoneyHoney Grace BicarNo ratings yet

- Credit and CollectionDocument17 pagesCredit and CollectionDia Cessianne VillarolaNo ratings yet

- Loan Rates & Estimated Total Costs: Private Education Loan Approval DisclosureDocument2 pagesLoan Rates & Estimated Total Costs: Private Education Loan Approval DisclosureKeith GruberNo ratings yet

- Understanding Personal LoansDocument10 pagesUnderstanding Personal Loansapi-255112727No ratings yet

- Credit DisputeDocument15 pagesCredit Disputeedward julius67% (3)

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Personal Loan PDFDocument3 pagesPersonal Loan PDFbusiness loanNo ratings yet

- MOCKTEST Personal and Family Financial ManagementDocument2 pagesMOCKTEST Personal and Family Financial ManagementyoshinokurukoNo ratings yet

- Consumer CreditDocument3 pagesConsumer CreditHAIFA DAYANA BT DAZUKINo ratings yet

- Module 4 Credit TransactionsDocument27 pagesModule 4 Credit Transactionslord kwantoniumNo ratings yet

- Module 6B CreditDocument41 pagesModule 6B CreditLorejhen VillanuevaNo ratings yet

- Description: Tags: EntrcoborrDocument25 pagesDescription: Tags: Entrcoborranon-446848No ratings yet

- Personal Finacial Literacy NotesDocument64 pagesPersonal Finacial Literacy Notesmpontier123100% (1)

- Types of LoansDocument9 pagesTypes of LoansSanjay VaruteNo ratings yet

- IntroductionDocument2 pagesIntroductionXin YongNo ratings yet

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2No ratings yet

- Budget Basics For Modular Home Buyers - How Much Home Can I Afford?Document3 pagesBudget Basics For Modular Home Buyers - How Much Home Can I Afford?SEAN NNo ratings yet

- Lesson 14 PathwaysDocument7 pagesLesson 14 Pathwaysapi-608672339No ratings yet

- Individual Money LendersDocument5 pagesIndividual Money LendersMa. Kristine Laurice AmancioNo ratings yet

- Risks and Benefits of Borrowing FinalDocument3 pagesRisks and Benefits of Borrowing Finalsun mmerNo ratings yet

- Chapter 6 & 7 - Kapoor: Consumer CreditDocument24 pagesChapter 6 & 7 - Kapoor: Consumer CreditPaulo Lucas Guillot100% (1)

- Research Papers On Reverse Mortgage LoanDocument5 pagesResearch Papers On Reverse Mortgage Loanafmcuafnh100% (1)

- 1 Credit and CollectionDocument51 pages1 Credit and CollectionGigiNo ratings yet

- All About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Document10 pagesAll About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Biswa Prakash NayakNo ratings yet

- CFPB Loan-EstimateDocument3 pagesCFPB Loan-EstimateRichard VetsteinNo ratings yet

- Credit CardsDocument8 pagesCredit Cardsasmat ullah khanNo ratings yet

- Entrance Counseling Guide For Direct Loan Borrowers: WWW - Dl.ed - GovDocument5 pagesEntrance Counseling Guide For Direct Loan Borrowers: WWW - Dl.ed - Govanon-417085No ratings yet

- DIY Credit Repair And Building Guide: Financial Free VictoryFrom EverandDIY Credit Repair And Building Guide: Financial Free VictoryNo ratings yet

- Budgeting Worksheet: Non-Monthly Expenses Annual ResourcesDocument2 pagesBudgeting Worksheet: Non-Monthly Expenses Annual ResourcesDavid GreeneNo ratings yet

- UntitledDocument24 pagesUntitledEric JohnsonNo ratings yet

- Installment Loans - Borrow Money and Repay With Ease!Document2 pagesInstallment Loans - Borrow Money and Repay With Ease!PhamWheeler9No ratings yet

- Credit Management: Adeel Nasir Lecturer (Commerce) Punjab University Jhelum CampusDocument34 pagesCredit Management: Adeel Nasir Lecturer (Commerce) Punjab University Jhelum CampusZindgiKiKhatirNo ratings yet

- Is Credit Wealth: Negative Aspects of CreditDocument4 pagesIs Credit Wealth: Negative Aspects of CreditFrederick PatacsilNo ratings yet

- Chapter 7 Choosing A Source of Credit The Costs of Credit AlternativesDocument40 pagesChapter 7 Choosing A Source of Credit The Costs of Credit Alternativesgyanprakashdeb302No ratings yet

- 07 PFM Chapter 6 Establishing Consumer CreditDocument4 pages07 PFM Chapter 6 Establishing Consumer CreditLee K.No ratings yet

- Define and Explain Thoroughly What Is CREDITDocument4 pagesDefine and Explain Thoroughly What Is CREDITAngelika SinguranNo ratings yet

- Credit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.From EverandCredit Score: The Beginners Guide for Building, Repairing, Raising and Maintaining a Good Credit Score. Includes a Step-by-Step Program to Improve and Boost Your Bank Rating.No ratings yet

- MATH +what Is Investment and LoanDocument11 pagesMATH +what Is Investment and LoanJhoana MaeNo ratings yet

- Fall 2012Document12 pagesFall 2012api-309082881No ratings yet

- Topic 2 Practice QuestionDocument4 pagesTopic 2 Practice Questionaarzu dangiNo ratings yet

- RYPKEMA Quotes PDFDocument5 pagesRYPKEMA Quotes PDFNicholas BradleyNo ratings yet

- l5 - Credit and Debt 4Document14 pagesl5 - Credit and Debt 4api-290878974No ratings yet

- Consumer Credit: Submitted By: Aayush Behal Shashank Singh Manik MittalDocument61 pagesConsumer Credit: Submitted By: Aayush Behal Shashank Singh Manik Mittalmanik_mittal30% (1)

- Just The Faqs:: Answers Common Questions About Reverse MortgagesDocument16 pagesJust The Faqs:: Answers Common Questions About Reverse MortgagesValerie VanBooven RN BSNNo ratings yet

- Countries and Currencies - GK Notes in PDFDocument7 pagesCountries and Currencies - GK Notes in PDFhelldelosbendersNo ratings yet

- Aud ReconDocument8 pagesAud ReconShaine PacsonNo ratings yet

- Risk Management in BanksDocument100 pagesRisk Management in BanksAditJoshiNo ratings yet

- What Is The Purpose of PDIC Law? 4. Define A. DepositDocument5 pagesWhat Is The Purpose of PDIC Law? 4. Define A. DepositJoshel MaeNo ratings yet

- FDP On Tax Planning, Financial Planning & Filing of ItrDocument4 pagesFDP On Tax Planning, Financial Planning & Filing of ItrAman KumarNo ratings yet

- Analysis of Cryptocurrency, People and FutureDocument7 pagesAnalysis of Cryptocurrency, People and FutureIJRASETPublicationsNo ratings yet

- Quiz 7 - CH 13 & 14 ACC563Document14 pagesQuiz 7 - CH 13 & 14 ACC563scokni1973_130667106No ratings yet

- Mid-Term Exam Review REE 6200 FIU Fall 2018: Important Concepts/topicsDocument2 pagesMid-Term Exam Review REE 6200 FIU Fall 2018: Important Concepts/topicsJoel Christian MascariñaNo ratings yet

- Exchange-Rate Determination: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityDocument56 pagesExchange-Rate Determination: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityRahul AnandNo ratings yet

- Chapter 1055Document17 pagesChapter 1055MohitAhujaNo ratings yet

- What Is An Automated Teller MachineDocument7 pagesWhat Is An Automated Teller MachineNeha SoningraNo ratings yet

- International Financial Institutions: 1. World BankDocument9 pagesInternational Financial Institutions: 1. World BankTabish AhmedNo ratings yet

- Tax 1Document43 pagesTax 1opep77No ratings yet

- New Delhi Municipal Council: Electricity BillDocument1 pageNew Delhi Municipal Council: Electricity BillMayank Subhash Balodi0% (1)

- Day 3 Class Work SPCCDocument6 pagesDay 3 Class Work SPCCkawaljeetsingh121666No ratings yet

- Islami Bank Bangladesh LimitedDocument9 pagesIslami Bank Bangladesh LimitedrounakjuiNo ratings yet

- Chapter-1 Indian Banking System PDFDocument53 pagesChapter-1 Indian Banking System PDFbhuvaneswarimpNo ratings yet

- GM Insights - Asymmetry - 9-20Document16 pagesGM Insights - Asymmetry - 9-20richardck61No ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Private Credit - Time To Consider Special Situations - (J.P. Morgan Asset Management)Document4 pagesPrivate Credit - Time To Consider Special Situations - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- Is India Ready For Cashless EconomyDocument1 pageIs India Ready For Cashless Economyharsh sainiNo ratings yet

- Francisco Partners CaseDocument32 pagesFrancisco Partners CaseJose M Terrés-NícoliNo ratings yet

- Chap 003Document31 pagesChap 003NazifahNo ratings yet

- NPVDocument5 pagesNPVMian UmarNo ratings yet

- UP 2008 Commercial Law (Banking Law)Document52 pagesUP 2008 Commercial Law (Banking Law)Adalie NageauNo ratings yet

- Phil Mosley and Rolando Shannon Financial RatiosDocument12 pagesPhil Mosley and Rolando Shannon Financial Ratiosapi-282888108No ratings yet